Best FXBlue Alternatives: 9 Trade Copiers for Forex Traders

Forex traders looking for FXBlue alternatives have plenty of options to choose from. Trade copiers are essential tools that automate trade replication, reduce manual errors, and improve efficiency. While FXBlue supports only MT4/MT5 and requires local operation on the same PC or VPS, other tools offer more advanced features, including cloud hosting, multi-platform compatibility, and faster execution speeds.

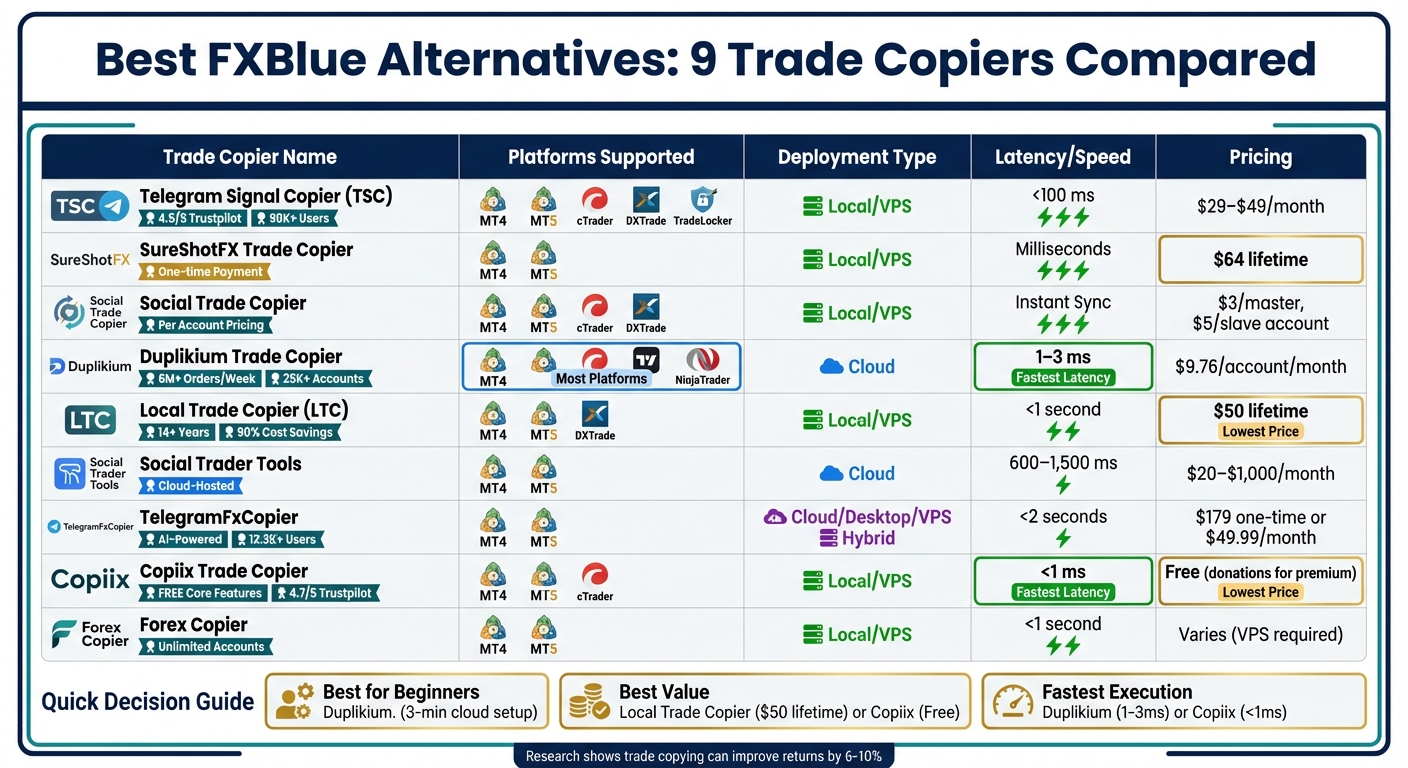

Here’s a quick look at 9 alternatives:

- Telegram Signal Copier (TSC): AI-driven signal automation for MT4, MT5, cTrader, DXTrade, and TradeLocker. Starts at $29/month.

- SureShotFX Trade Copier: Tailored for SureShotFX Telegram signals, exclusive to MT4/MT5. Lifetime license for $64.

- Social Trade Copier: Cross-platform copying for MT4, MT5, cTrader, and DXTrade. $3 per master account, $5 per slave account.

- Duplikium Trade Copier: Cloud-based with 1–3 ms latency, supporting multiple platforms like TradingView and NinjaTrader. Starts at $9.76/account/month.

- Local Trade Copier (LTC): Local solution for MT4, MT5, and DXTrade with a $50 lifetime license.

- Social Trader Tools: Cloud-hosted copying for MT4/MT5 with plans starting at $20/month.

- TelegramFxCopier: AI-powered Telegram signal copier for MT4/MT5. One-time purchase for $179 or subscription starting at $49.99/month.

- Copiix Trade Copier: Free local trade copier for MT4, MT5, and cTrader. Premium features unlocked via donations.

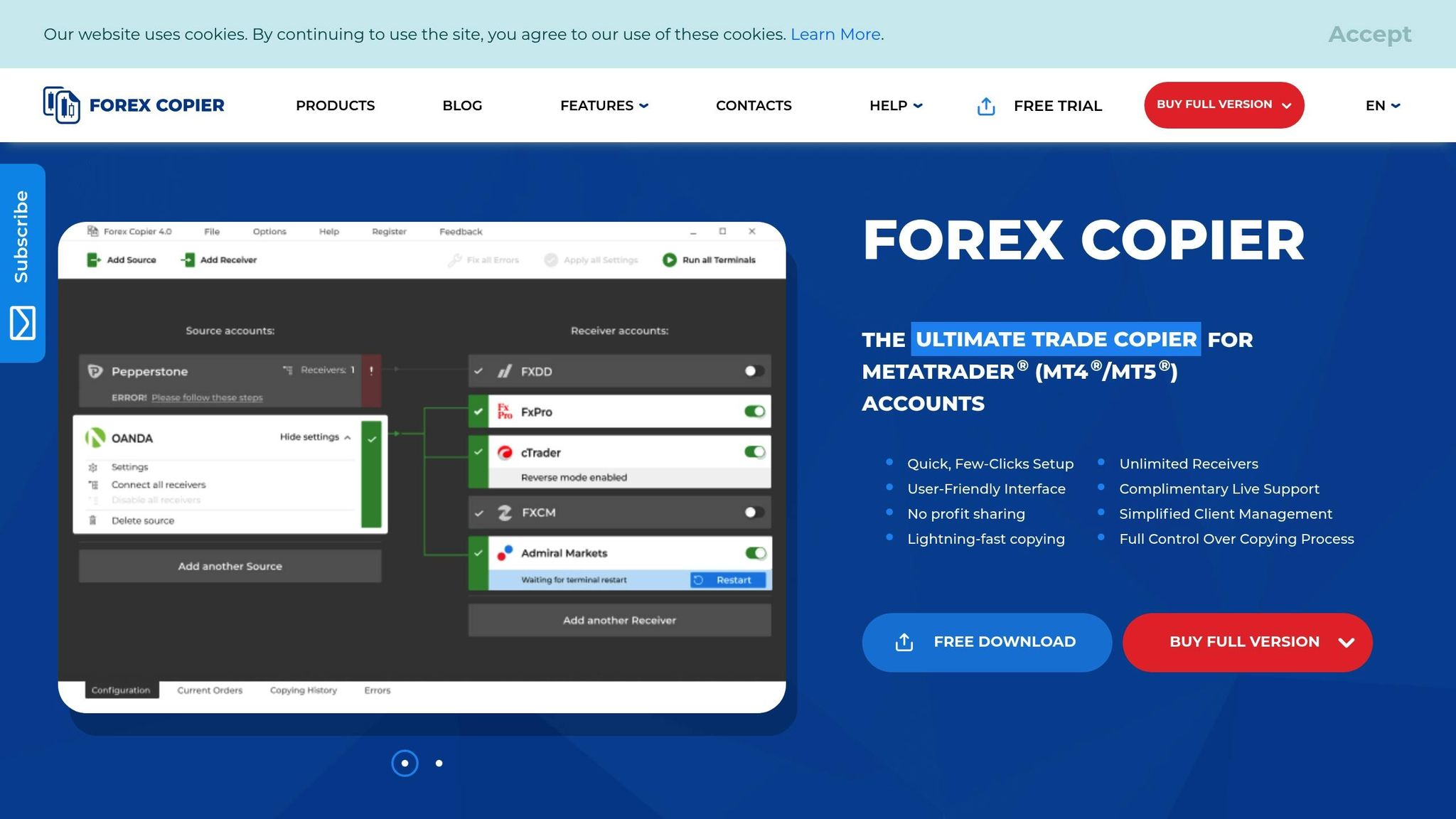

- Forex Copier: MT4/MT5-focused copier with equity scaling and unlimited account syncing. Requires VPS.

Quick Comparison

| Trade Copier | Platforms Supported | Deployment Type | Latency | Pricing |

|---|---|---|---|---|

| Telegram Signal Copier | MT4, MT5, cTrader, DXTrade, TradeLocker | Desktop/VPS | <100 ms | $29–$49/month |

| SureShotFX Trade Copier | MT4, MT5 | Desktop/VPS | Milliseconds | $64 lifetime |

| Social Trade Copier | MT4, MT5, cTrader, DXTrade | Local EA/VPS | Instant Sync | $3/master, $5/slave account |

| Duplikium Trade Copier | MT4, MT5, cTrader, TradingView, NinjaTrader | Cloud | 1–3 ms | $9.76/account/month |

| Local Trade Copier | MT4, MT5, DXTrade | Local/VPS | <1 second | $50 lifetime |

| Social Trader Tools | MT4, MT5 | Cloud | 600–1,500 ms | $20–$1,000/month |

| TelegramFxCopier | MT4, MT5 | Cloud/Desktop/VPS | <2 seconds | $179 one-time or $49.99/month |

| Copiix Trade Copier | MT4, MT5, cTrader | Local/VPS | <1 ms | Free, donations for premium |

| Forex Copier | MT4, MT5 | Local/VPS | <1 second | Requires VPS, pricing varies |

Each tool has unique strengths, so your choice depends on your trading needs, setup, and budget. For cloud-based convenience, Duplikium and Social Trader Tools are great picks. If you prefer a local setup, consider Local Trade Copier or Copiix for cost savings and speed.

FXBlue Alternatives: Trade Copier Comparison Chart for Forex Traders

FXBlue Alternatives: Trade Copier Comparison Chart for Forex Traders

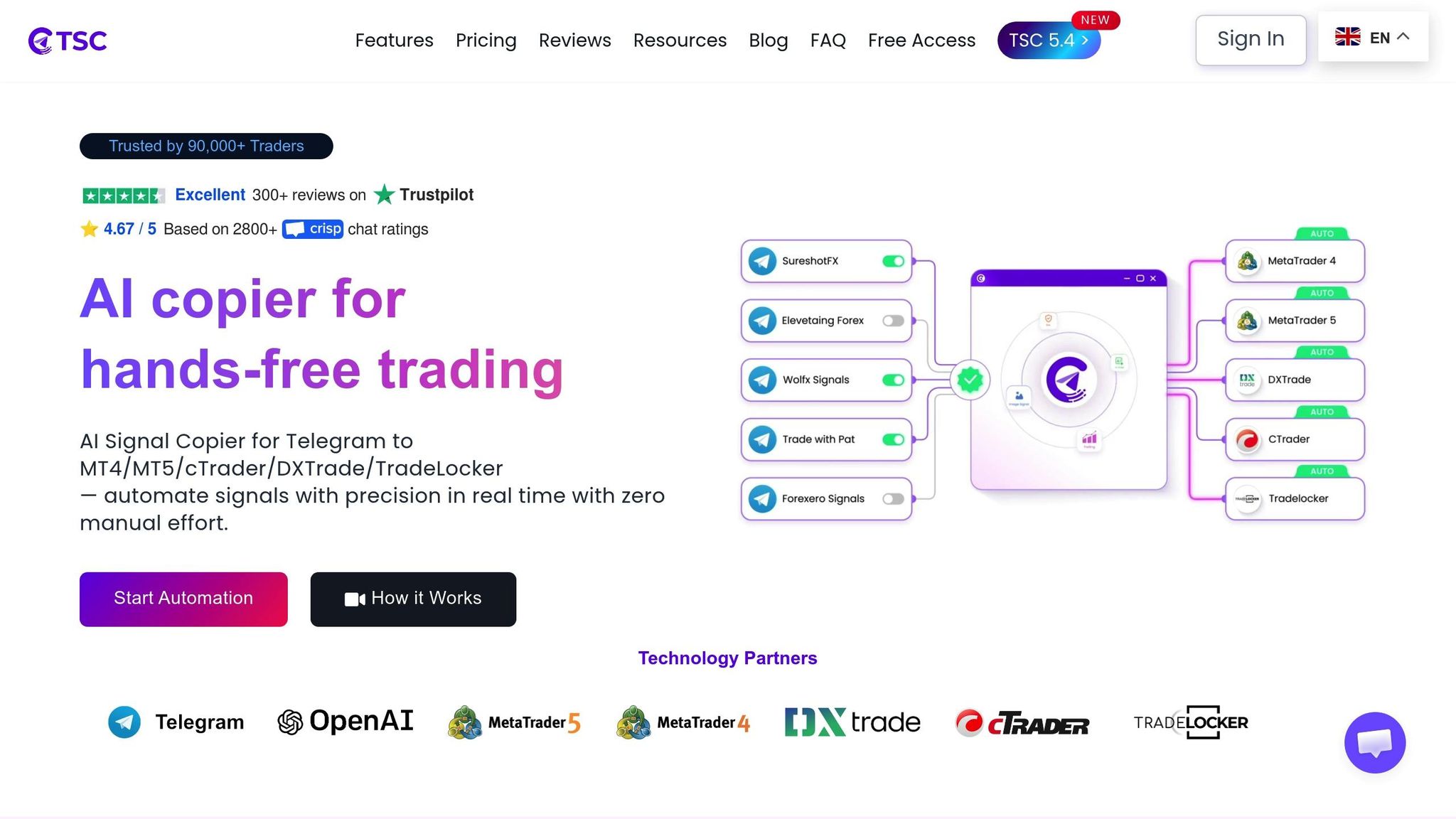

1. Telegram Signal Copier (TSC)

Telegram Signal Copier (TSC) is a desktop application designed to automate trading by converting Telegram signals into executed trades. It leverages Vision AI and Natural Language Processing to interpret signals from text messages, images, and screenshots - eliminating the need for manual input. With a user base exceeding 90,000 traders worldwide and an impressive 4.5/5 rating on Trustpilot from 373 reviews, TSC has gained strong support from its users.

Platform Compatibility

TSC is compatible with multiple trading platforms, including MT4, MT5, cTrader, DXTrade, and TradeLocker. This makes it a flexible choice for U.S. traders who want options beyond MetaTrader. The TSC Copier App integrates seamlessly with supported brokers using platform-specific files, such as MetaTrader Expert Advisors. It also features symbol mapping, ensuring signal provider symbols like "GOLD" align with broker-specific equivalents like "XAUUSD".

Deployment Type

As a Windows-based desktop application, TSC requires continuous connectivity to function effectively. Mac or Linux users, or those seeking uninterrupted 24/7 operation, should consider running it on a Virtual Private Server (VPS). Using a VPS ensures a stable connection between Telegram and the broker's server, reducing the risk of missed trades.

Latency

TSC delivers execution speeds under 100 milliseconds, which helps minimize slippage. Its Force Market Execution feature ensures trades are executed at the current market price, while auto spread calculation adjusts stop-loss and take-profit levels to match the signal provider's intent.

Pricing

TSC offers three subscription plans:

- Starter: $29/month or $14.99/month when billed annually, covering one account.

- Pro: $49/month or $249.99 annually, supporting up to three accounts.

- Advance Lifetime Plan: A one-time payment of $399.99 for three accounts, with lifetime updates included.

All plans come with 24/7 customer support, free setup, and a 15-day free trial (available through Eightcap registration).

Next, we’ll take a closer look at SureShotFX Trade Copier, another excellent tool for Forex traders.

2. SureShotFX Trade Copier

SureShotFX Trade Copier is a tool designed to automatically turn Telegram signals into trades on MT4 or MT5 platforms. Unlike generic trade copiers, this one is tailored specifically for SureShotFX VIP Telegram channels, which boast over 53,000 subscribers as of 2026. Its focused design helps eliminate manual input mistakes and reduces the emotional element of trading.

Platform Compatibility

This copier is exclusively compatible with MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Its tight integration with MetaTrader allows for advanced features like "Auto Move SL", which adjusts your stop-loss to break even after hitting the first take-profit level, and automated partial trade closures. However, it only supports signals from SureShotFX Telegram channels and does not facilitate copying trades between accounts.

Deployment Type

SureShotFX is built for Windows systems and requires constant connectivity. For Mac users, running the copier on one of the top Forex VPS solutions ensures uninterrupted 24/7 functionality. This setup guarantees stable connections and real-time trade execution.

Latency

The copier operates within milliseconds, which is crucial for minimizing slippage in fast-paced markets. According to MIT research, using trade copying effectively can enhance returns by 6–10% compared to manual trading. By replicating signals with high precision, it removes the risk of manual errors.

Pricing

The lifetime license is priced at $64 (regularly $74). Traders who sign up with certain brokers, such as Eightcap, may qualify for a 20% discount along with VIP channel access. This one-time payment model is a cost-effective alternative to the $25–$50 monthly fees charged by other trade copiers. Before using it with real funds, test the copier on a demo account to fine-tune settings like lot sizes and slippage control.

Next, we’ll explore another trade copier that offers distinct features for Forex traders.

3. Social Trade Copier

Social Trade Copier is an EA-based tool designed for seamless trade copying across multiple platforms, including MT4, MT5, cTrader, and DXTrade. Whether you're transferring trades from an MT4 master account to an MT5 slave account or syncing demo and live accounts, this solution offers flexibility for traders working with different brokers. By using a custom Expert Advisor (EA) installed directly on your trading terminal, it eliminates the need for web panels or sharing sensitive account credentials. This setup broadens your trade copying options beyond the usual configurations.

Platform Compatibility

This copier simplifies cross-platform trade mirroring, enabling traders to sync trades from an MT4 master account to an MT5 slave account without hassle. It also addresses broker-specific symbol naming differences by allowing users to add prefixes or suffixes for compatibility. Additionally, a single slave account can follow multiple master accounts at the same time, making it easier to diversify trading strategies.

Deployment Type

Social Trade Copier runs through an EA installed on your local MetaTrader terminal or VPS. A user-friendly dashboard lets you adjust settings, while the EA takes care of executing trades. For uninterrupted performance, especially for 24/7 trading, hosting the EA on a VPS ensures stable connectivity and real-time updates.

Latency

The system’s "Instant Sync" and auto-update features ensure that every change made on the master account - whether opening a new trade, modifying stop-loss or take-profit levels, or closing a position - is reflected immediately on the slave accounts. This is achieved through a high-speed, secure connection, which guarantees quick execution.

Pricing

Social Trade Copier offers a straightforward pricing model: $3 per master account and $5 per slave account. New users can take advantage of a 7-day trial for just $1, which provides full access to all features. Compared to platforms charging monthly fees of $20 or more, this per-account pricing can be a more budget-friendly option. Custom pricing is also available for traders with unique needs.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

4. Duplikium Trade Copier

Duplikium Trade Copier is a cloud-based alternative to FXBlue, designed by Swiss banking engineers to handle high-volume trade copying without the need for software installation. With over 25,000 connected accounts and more than 6,000,000 orders processed weekly, it operates with lightning-fast speeds of 1–3 milliseconds, ensuring trades are replicated almost instantly[17,20]. This level of performance allows for smooth integration across platforms and easy deployment.

Platform Compatibility

Duplikium supports a wide variety of trading platforms, including MT4, MT5, cTrader, TradingView, FXCM, LMAX, DXTrade, and FIX API. Beta support is also available for Tradovate, NinjaTrader, and Fortex. This compatibility enables seamless trade copying between platforms - for example, from a TradingView master account to an MT4 slave account - and connects to over 5,000 broker servers across asset classes like Forex, stocks, indices, crypto, commodities, futures, and synthetic indices. Additionally, it adheres to prop firm requirements by supporting both "Netting" and FIFO account types[17,18,20].

Deployment Type

Duplikium operates entirely in the cloud, eliminating the need for a constantly running PC or a separate VPS. With servers located in major financial hubs such as Frankfurt, London, New York, and Singapore, you can select the server closest to your broker for optimal performance. For traders who need to bypass IP tracking or comply with prop firm restrictions, Static Dedicated IP options are available for $5.42 per month (5 EUR/month) or $0.18 per day (0.17 EUR/day)[17,18].

Latency

Thanks to its strategically placed servers and optimized cloud infrastructure, Duplikium achieves ultra-low latency, with trade copying speeds consistently ranging from 1–3 milliseconds. This ensures every action - whether opening a trade, adjusting stop losses, or closing a position - is mirrored instantly. For those requiring even faster performance, dedicated server options are available starting at $195.48 per month (180 EUR/month, billed annually).

Pricing

Duplikium provides flexible pricing options tailored to different needs:

- Subscription Plan: Starts at $9.76 per account per month for 1–10 accounts, decreasing to $6.51 for users with 1,000+ accounts.

- Prepay Plan: Costs $0.54 per account per day for 1–10 accounts, dropping to $0.22 for high-volume users.

New users receive $32.56 in free prepay credit upon SMS verification. Additional features like Static Shared IP are available for $2.17 per month (2 EUR) or $0.08 per day (0.07 EUR)[17,19,20].

5. Local Trade Copier (LTC)

Local Trade Copier (LTC) provides a privacy-first solution for trade copying, operating directly on your computer or VPS instead of relying on cloud servers. With a history spanning over 14 years and a global user base, LTC can reduce trade copier expenses by up to 90% compared to cloud-based options. The software functions as an Expert Advisor (EA) within MetaTrader terminals, using a "Server EA" for the master account and a "Client EA" for follower accounts, ensuring all data stays local.

Platform Compatibility

LTC works seamlessly with MetaTrader 4 (MT4), MetaTrader 5 (MT5), and DXTrade platforms, allowing cross-platform trade copying - whether it's MT4 to MT5, MT5 to MT4, or within the same platform. It is compatible with any Forex broker offering MetaTrader, such as IC Markets, OANDA, and Pepperstone, and also integrates with DXTrade brokers like SwayMarkets and HeroFX. However, the MT5 version supports only hedging accounts as masters, while MT5 Netting accounts can act as clients.

Deployment Type

Unlike cloud-based solutions, LTC is installed locally on a Windows PC, laptop, or VPS. Mac users will need a Wine simulator or a Windows VPS to run the software. For uninterrupted operation, a top-rated Forex VPS is recommended to avoid disruptions caused by local internet outages. Under the Personal Plan, LTC supports up to 32 MetaTrader accounts on a single PC or VPS, though some traders have reported managing 120–150 accounts on dedicated servers by using specific Windows User Profile configurations. This local setup not only boosts security but also ensures faster trade execution.

Latency

Since all accounts operate on the same machine, LTC achieves trade replication in under one second, depending on broker execution speeds and hardware capabilities. Users can fine-tune the synchronization rate to suit their needs - a slower rate helps manage more accounts by reducing CPU load, while a faster rate enhances trade replication on high-performance systems[24,28].

Pricing

LTC offers flexible pricing plans to meet various trading requirements. The Personal Plan is priced at $31.75 per month for a single PC or VPS, supporting up to 32 accounts. Traders can also opt for the annual plan at $317.50, which includes two months free. For those seeking a one-time purchase, a lifetime license is available for $50, covering 20 activations for either the MT4 or MT5 version. Additionally, rental options are offered at $30 for three months or $40 for six months, both of which include a 7-day free trial. LTC also provides a 30-day conditional money-back guarantee if the software fails to perform as described and support cannot resolve the issue.

6. Social Trader Tools

Social Trader Tools stands out among FXBlue alternatives with its cloud-hosted trade copier designed for MetaTrader users. By hosting trades on its own servers, it removes the need for software installation or a dedicated VPS. This setup is especially appealing to account managers and signal providers who want to focus on trading instead of dealing with technical infrastructure.

Platform Compatibility

This tool is tailored exclusively for MetaTrader 4 and 5, supporting cross-platform copying between these accounts. However, it's worth noting that only hedging accounts are supported for MT5 - netting accounts are not compatible. If you're looking for a solution that works beyond MetaTrader, this platform may not meet your needs.

Its cloud-hosted design prioritizes simplicity and ease of use, making it a great option for those who want to avoid the complexities of locally installed software.

Deployment

Setting up Social Trader Tools is quick and simple, taking about five minutes in the cloud. It offers centralized features like equity monitoring, automatic position closures at set thresholds, and the ability to create public signal pages for marketing your strategies. There's also a free white-label option, giving you the flexibility to rebrand the platform and market signals under your own domain.

Latency

Trades are copied internally within 50 milliseconds, but total latency - including broker execution and server location - can range from 600ms to 1,500ms. Since the platform's servers are mainly located in London, execution speeds will depend on your broker's location. Due to these latency factors, Social Trader Tools is not ideal for high-frequency trading or scalping strategies where speed is critical.

Pricing

Plans start at $20/month for 2 accounts and scale up to $220/month for 20 accounts. For larger setups, rolling plans are available: 40 accounts cost $400/month, and 100 accounts are priced at $1,000/month. While there’s no free trial or cryptocurrency payment option, the cloud-based model eliminates VPS expenses and reduces technical management. This makes it a convenient, though potentially more expensive, choice for traders who prioritize ease of use over upfront cost savings.

7. TelegramFxCopier

TelegramFxCopier stands out by using advanced AI to interpret signals, serving a user base of over 12,300 traders. Unlike many other tools, it utilizes the official Telegram API rather than the Bot API. This means it can access signals directly from your personal Telegram account. Its AI and language model can process signals in text, images, and various languages, without requiring strict formatting.

Platform Compatibility

This tool works seamlessly with MT4/MT5 and any broker that supports these platforms. The AI Edition adds even more flexibility, letting you monitor and execute trades from mobile devices, tablets, or desktops - perfect for traders who need to stay connected while on the move.

Deployment Type

You have two options for deployment. The Classic Edition integrates directly with MT4/MT5 but requires continuous operation on a PC or VPS. Alternatively, the AI Edition offers cloud-based execution via MetaAPI, eliminating the need for a VPS and saving around $25 per month in associated costs.

Latency

For traders who value speed and accuracy, TelegramFxCopier is built for quick order execution. Most trades are executed in under 2 seconds, thanks to its efficient design. The AI Edition is even faster, leveraging cloud-based processing and direct API execution. Its "Dynamic Order Flow System" compares signal entry prices with real-time market data and broker rules, aiming to improve order acceptance rates and reduce rejections. However, actual performance can depend on factors like broker execution speeds and market liquidity.

Pricing

The Classic Edition is available as a one-time purchase:

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

- $179 for 1 MT account

- $249 for 2 accounts

- $499 for 5 accounts

The AI Edition operates on a subscription model, starting at $49.99 per month for a single license. Discounts are available for longer commitments, such as $189.99 for a 12-month subscription. While the AI Edition involves a recurring cost, it offsets this by eliminating VPS expenses. For most users, the Classic Edition typically pays for itself within 5–7 months of use.

Next, we'll explore another trade copier to give you even more options to consider.

8. Copiix Trade Copier

Copiix has gained attention with over 23,801 downloads and a solid 4.7/5 rating on Trustpilot, based on 47 reviews. Its standout feature? The core functionality is completely free - no monthly charges, hidden fees, or account restrictions. For users looking for additional tools like Remote Provider, Webhooks, or the Telegram Copier, these are available through a donation-based model that grants 30 days of enhanced access.

Platform Compatibility

Copiix works smoothly with MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, making it easy to replicate trades across different brokers. The Copiix Console simplifies the process by automatically detecting and installing the required Expert Advisors (EAs) for MetaTrader or cBots for cTrader.

Deployment Type

Unlike cloud-based solutions, Copiix operates locally on your Windows PC or forex trading server. Its portable console runs directly from any folder, ensuring that your account credentials and data stay on your system. The software requires at least 2 GB of RAM (4 GB recommended) and 50 MB of free disk space. However, because it’s not digitally signed by Microsoft, some antivirus programs might flag it as a false positive. If this happens, you can add the Copiix folder to your antivirus exclusions list.

Latency

Thanks to its local execution model, Copiix delivers extremely low latency - typically under 1 millisecond. The setup process is quick, usually taking between 2 to 5 minutes.

Pricing

The core trade copying features are completely free - no subscriptions, no per-account fees, and no limitations on master or follower accounts. Premium features, including Remote Provider, Webhooks, and Telegram Copier, can be unlocked for 30 days with a donation. Higher donation tiers activate the Leader Tier, which supports up to 100 remote users and provides priority support.

"At ClickAlgo, we tested the Free version of Copiix and found it one of the easiest trade copiers available. It's perfect if you're managing multiple accounts or want to share trades." - ClickAlgo

"At ClickAlgo, we tested the Free version of Copiix and found it one of the easiest trade copiers available. It's perfect if you're managing multiple accounts or want to share trades." - ClickAlgo

Continue to the next section to explore another top trade copier option.

9. Forex Copier

Forex Copier is designed for traders who need a dependable way to replicate trades across multiple accounts. It prioritizes synchronization and reliability, with built-in auto-resolution tools to address execution problems and ensure seamless syncing of unlimited accounts.

Platform Compatibility

This software is exclusively compatible with MetaTrader 4 (MT4) and MetaTrader 5 (MT5). It allows traders to copy trades between different brokers, whether for managing personal accounts or providing trading signals.

Pricing

Forex Copier includes features like equity and balance scaling, enabling traders to adjust position sizes to account for differences between accounts. This helps maintain consistent risk management. To get a clearer picture, compare its strengths and weaknesses against other NinjaTrader trade copiers and similar tools.

Pros and Cons Comparison

Every trade copier comes with its own set of advantages and drawbacks, making it essential to weigh your options based on your trading style and requirements.

Local solutions like Local Trade Copier and Forex Copier are known for their low latency since they run directly on your machine. However, to ensure 24/7 operation, you’ll need a dedicated Forex VPS, which typically costs around $59.99 per month. On the other hand, cloud-based tools like Duplikium and Social Trader Tools spare you the hassle of hardware management, though they may experience slightly higher latency during peak times.

When it comes to platform compatibility, Duplikium stands out by supporting MT4, MT5, cTrader, DXTrade, TradingView, and NinjaTrader, handling over 6,000,000 orders weekly across 25,000+ accounts. Meanwhile, tools like SureShotFX and Forex Copier focus solely on MetaTrader platforms, offering deeper integration but limiting versatility.

Pricing structures also vary significantly. One-time license options, such as Local Trade Copier ($50 lifetime) and SureShotFX ($64), are ideal for traders who already maintain a VPS, providing long-term cost savings. Subscription-based services like Duplikium (starting at €9 per account per month) and Social Trader Tools (ranging from $20 to $1,000 per month, depending on account volume) offer lower upfront costs but can become more expensive over time.

Here’s a quick breakdown of the pros and cons of popular trade copiers:

| Trade Copier | Pros | Cons |

|---|---|---|

| Telegram Signal Copier | AI-powered signal parsing; supports MT4, MT5, cTrader, DXTrade, and TradeLocker; rated 4.5/5 on Trustpilot | Requires active Telegram channels; $29–$49/month subscription |

| SureShotFX Trade Copier | Ultra-low millisecond latency; $64 lifetime license; easy plug-and-play setup | Limited to MT4 and MT5; best for current SureShotFX users |

| Social Trade Copier | Low-latency remote copying; EA-based installation; supports MT4, MT5, cTrader, and DXTrade | May need a VPS for uninterrupted use; monthly subscription required |

| Duplikium Trade Copier | Wide platform compatibility; 1–3 ms latency; cloud-based with a free €30 trial credit | Per-account pricing can add up; extra fees for static IPs (≈€2–€5/month) |

| Local Trade Copier | Extremely low local latency; $50 lifetime license; great for managing multiple MT4/MT5/DXTrade accounts | Requires a dedicated VPS; setup can be moderately complex |

| Social Trader Tools | Cloud-based simplicity; medium latency (~50 ms); scalable from 2 to 100+ accounts | Costs can escalate at higher scales (up to $1,000/month for 100 accounts); limited to MT4/MT5 |

| TelegramFxCopier | AI-powered signal interpretation; supports MT4/MT5; one-time purchase option available | Classic Edition needs VPS; AI Edition involves recurring subscription fees |

| Copiix Trade Copier | Free core features; supports MT4, MT5, and cTrader; ultra-low latency (<1 ms) | Runs locally, requiring a VPS; premium features tied to a donation model |

| Forex Copier | Offers equity and balance scaling; unlimited account syncing; auto-resolution tools included | Limited to MT4/MT5; requires a VPS; advanced settings may be challenging |

This comparison highlights the trade-offs between cost, latency, platform support, and ease of use, helping you identify the tool that aligns best with your trading needs.

Conclusion

Choosing the right trade copier hinges on factors like your experience, trading style, and budget. For beginners, Duplikium stands out with its quick 3-minute cloud setup, making it easy to get started. If you're looking for a highly rated option, Telegram Signal Copier boasts a 4.4/5 Trustpilot rating and even offers a free version through select brokers.

For professional fund managers who prioritize speed and precision, Social Trade Copier delivers real-time trade replication. If ultra-low latency is your goal, local solutions like Local Trade Copier, Copiix, and SureShotFX execute trades in just milliseconds, ensuring minimal delays.

Traders who need multi-platform compatibility will appreciate Duplikium, which supports MT4, MT5, cTrader, DXTrade, TradingView, and NinjaTrader. Impressively, it processes over 6 million orders weekly across more than 25,000 accounts. Meanwhile, MetaTrader users seeking cost-effective options can consider one-time licenses like Local Trade Copier ($50) or SureShotFX ($64), avoiding recurring fees.

Research shows that trade copying can enhance returns by 6–10%. With so many active traders leveraging these tools, selecting the right trade copier can have a noticeable impact on your performance. Focus on what matters most to you - whether it's ease of setup, execution speed, or platform compatibility - and choose the copier that aligns with your trading approach.

FAQs

Do I need a VPS to run a trade copier 24/7?

Using a VPS can be a game-changer for running a trade copier around the clock. It guarantees uninterrupted operation, shielding your trading from disruptions like power outages, internet failures, or unexpected computer shutdowns. In the world of Forex trading, where reliability and low latency are critical, a VPS offers a stable and efficient solution. Although it's not a strict requirement, a VPS helps ensure smoother automation of trades and can be particularly beneficial for high-frequency or professional trading strategies.

Which trade copiers work without MT4 or MT5?

Several trade copiers function without relying on MetaTrader 4 (MT4) or MetaTrader 5 (MT5). For instance, tools such as Replikanto and Replikanto - FlowBots are specifically built for NinjaTrader, operating entirely independently of MT4/MT5. Moreover, NinjaTrader’s Trade Copier, along with platforms like Tradovate and TradingView, are compatible with Replikanto, providing options for traders who prefer alternatives to MT4 or MT5.

How do I prevent lot-size and risk mismatches when copying trades?

To prevent mismatches in lot sizes and risk when copying trades, take advantage of the trade copier's risk management settings. These tools let you fine-tune aspects like adjusting lot sizes according to your account balance, equity, or preferred risk percentage. You can also set specific parameters, such as maximum lot sizes, stop-loss levels, and risk per trade. By configuring these options, you can ensure that trades are better aligned with your account size and risk tolerance, helping to reduce potential losses and mismatches.

Using a VPS can be a game-changer for running a trade copier around the clock. It guarantees uninterrupted operation, shielding your trading from disruptions like power outages, internet failures, or unexpected computer shutdowns. In the world of Forex trading, where reliability and low latency are critical, a VPS offers a stable and efficient solution. Although it's not a strict requirement, a VPS helps ensure smoother automation of trades and can be particularly beneficial for high-frequency or professional trading strategies.

Several trade copiers function without relying on MetaTrader 4 (MT4) or MetaTrader 5 (MT5). For instance, tools such as Replikanto and Replikanto - FlowBots are specifically built for NinjaTrader, operating entirely independently of MT4/MT5. Moreover, NinjaTrader’s Trade Copier, along with platforms like Tradovate and TradingView, are compatible with Replikanto, providing options for traders who prefer alternatives to MT4 or MT5.

To prevent mismatches in lot sizes and risk when copying trades, take advantage of the trade copier's risk management settings. These tools let you fine-tune aspects like adjusting lot sizes according to your account balance, equity, or preferred risk percentage. You can also set specific parameters, such as maximum lot sizes, stop-loss levels, and risk per trade. By configuring these options, you can ensure that trades are better aligned with your account size and risk tolerance, helping to reduce potential losses and mismatches.

"}}]}