Polymarket Banned in Amsterdam, Netherlands over 'Illegal Gambling'

The Dutch Gaming Authority (KSA) has officially banned Polymarket, a decentralized prediction market, from operating in the Netherlands. The platform, which lets users trade on future events using cryptocurrency, was classified as illegal gambling under Dutch law. This decision affects Dutch traders and Amsterdam-based VPS users, who must now migrate to New York servers to comply with regulations.

Key points:

- Ban Details: Polymarket was ordered to cease operations for Dutch users by January 20, 2026, or face fines of €420,000 per week.

- Reason for Ban: Betting on uncertain events, including political outcomes, is prohibited in the Netherlands.

- Impact: Amsterdam VPS servers can no longer support Polymarket. Traders must switch to using New York-based VPS and the US API.

- US API Limitations: The new API does not support CLOB trading, requiring traders to adjust their strategies.

Polymarket's case highlights the challenges of navigating international gambling and trading regulations. Dutch users should avoid workarounds like VPNs, as these violate platform rules and could lead to account penalties.

Changes to QuantVPS Services

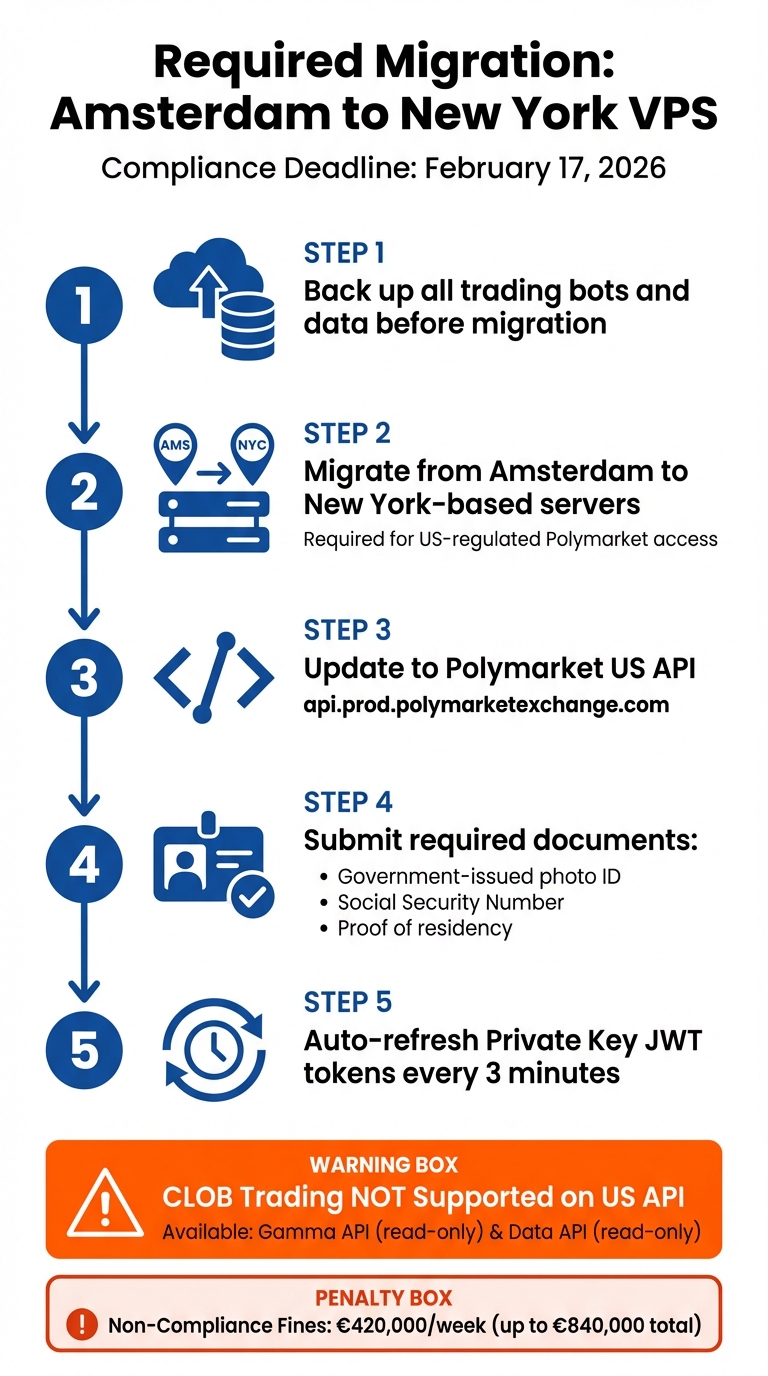

Polymarket Migration Guide: Amsterdam to New York VPS Transition Steps

Polymarket Migration Guide: Amsterdam to New York VPS Transition Steps

Amsterdam VPS Location No Longer Available

Due to new regulations set by Dutch authorities, Amsterdam-based VPS instances can no longer be used to access Polymarket. This restriction, effective by February 17, 2026, includes strict IP geoblocking measures and potential fines reaching up to €840,000 per week for non-compliance. As a result, customers must transition to New York-based servers without delay.

Moving to New York VPS Locations

To maintain access to the U.S.-regulated version of Polymarket, QuantVPS customers are required to migrate their operations to New York-based servers. Ensure that all trading bots and data are backed up before starting the migration process. Acting swiftly will help prevent any service disruptions.

Required: Use the Polymarket US API

All users must now operate through the Polymarket US API, available at: https://api.prod.polymarketexchange.com. This API introduces several key requirements:

- JWT Token Updates: Private Key JWT tokens must be refreshed automatically every 3 minutes.

- Identity Verification: Users must complete KYC procedures, including submitting government-issued photo IDs, Social Security Numbers, and proof of residency. These steps align with U.S. anti-money laundering laws.

- Trading Limitations: Note that CLOB (Central Limit Order Book) trading is not supported through this API.

Meeting these technical and regulatory requirements is essential for uninterrupted trading on Polymarket.

Technical Changes and Workarounds

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

CLOB Trading Not Supported with US API

With the enforced switch to the Polymarket US API, traders should note that CLOB trading is no longer available. This restriction applies specifically to users operating from US-based IP addresses. The US-regulated version of Polymarket blocks these functions to comply with regulatory requirements. As stated in Polymarket's documentation:

"Polymarket restricts order placement from certain geographic locations due to regulatory requirements and compliance with international sanctions".

"Polymarket restricts order placement from certain geographic locations due to regulatory requirements and compliance with international sanctions".

What’s still functional? The Gamma API (for market discovery and browsing) and the Data API (for viewing user positions and analytics) remain accessible. However, they are strictly read-only, meaning they cannot be used for executing trades. This represents a substantial limitation for traders who rely on automated systems for rapid order execution.

In addition to API changes, the shift to a New York-based VPS brings another challenge: increased latency.

How to Maintain Performance on US-Based VPS

Switching your VPS location from Amsterdam to New York introduces latency issues. Polymarket's server infrastructure is based in the eu-west-2 region (London), meaning trading requests now need to travel across the Atlantic rather than staying within Europe. This added distance can slow down execution times, especially for high-frequency trading systems.

To counteract this, optimizing your VPS hardware and network setup becomes critical. Look for VPS plans with the following features:

- AMD Ryzen 9 9950X processors for high-speed processing

- DDR5 RAM to handle intensive tasks

- NVMe SSDs for faster data access

Additionally, ensure your VPS provider offers a 99.99% uptime guarantee and DDoS protection to minimize disruptions in these always-active markets.

Before initiating trades, confirm that your IP address is not blocked. You can do this by sending a GET request to https://polymarket.com/api/geoblock and checking that the blocked field is false. Implementing heartbeat signals to monitor connectivity can further help maintain uninterrupted operations.

Legal and Compliance Requirements

Dutch Gambling Laws and Polymarket

In January 2026, the Dutch Gaming Authority (Kansspelautoriteit, or KSA) issued a penalty order against Adventure One QSS, the operator of Polymarket. This action was grounded in the Betting and Gaming Act (Wet op de kansspelen) and the Remote Gambling Act (Wet kansspelen op afstand). According to Article 1(a) of the Betting and Gaming Act, any game where outcomes depend on chance rather than skill is classified as a game of chance. Dutch regulators use a "chance vs. skill" test to determine whether platforms fall under gambling regulations.

Polymarket was instructed to cease operations in the Netherlands by January 20, 2026, or face weekly fines of €420,000, up to a cap of €840,000. The KSA dismissed Polymarket's argument that it functioned as a "prediction market" rather than a gambling platform. Even licensed operators in the Netherlands are not allowed to offer bets on non-sporting events, such as elections. Operating without a KSA-issued license violates the Betting and Gaming Act, with potential administrative fines reaching €1,030,000 or 10% of the operator's prior-year revenue.

To comply with these regulations, Polymarket users must transition to a New York-based VPS and utilize the Polymarket US API. These strict Dutch laws highlight the necessity of adhering to local compliance standards, especially when engaging in international trading.

Staying Compliant When Trading Internationally

Regulatory definitions differ significantly across countries. For instance, while the U.S. Commodity Futures Trading Commission views prediction markets as financial instruments, many other jurisdictions - such as the U.K., Italy, Portugal, Singapore, and the Netherlands - classify them as gambling.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Under the Dutch Gambling Act, participating in unlicensed games of chance is prohibited. Dutch residents using workarounds like VPNs to access Polymarket may face legal consequences. The KSA closely monitors "passive accessibility", which includes platforms allowing access from Dutch IP addresses or accepting local payment methods. Such actions are treated as illegal market targeting. Regulators can also direct payment processors and internet service providers to block access to unlicensed operators.

For traders using QuantVPS services, it's crucial to ensure you're operating from a jurisdiction where Polymarket is permitted. With the Amsterdam VPS location no longer available, setting up a New York-based VPS and using the Polymarket US API is essential to remain compliant with U.S. regulations. Avoid using methods to bypass geo-blocking, as this violates platform terms and could lead to frozen accounts or voided trades.

Stay updated on regulatory changes both in your physical location and with your VPS provider. In some cases, such as in Tennessee, authorities have mandated platforms to cancel contracts and issue refunds, which can disrupt trading strategies. Keeping an eye on regulatory updates is critical for adapting to shifting compliance landscapes.

Conclusion

The Dutch Gaming Authority's ban on Polymarket marks a major shift in regulations, directly affecting traders relying on VPS setups in Amsterdam. Starting February 2026, Amsterdam servers will no longer be a compliant option. All QuantVPS customers must migrate to New York-based servers and integrate the Polymarket US API to continue operating within legal boundaries. This transition isn’t optional - KSA enforcement now tracks local IP addresses and Dutch payment methods, making Amsterdam-based infrastructure non-compliant. Ignoring this mandate could result in fines as steep as €840,000 per week.

It’s important to note that the US API does not support CLOB trading. Traders will need to adapt their strategies to align with this limitation. While this adjustment may be inconvenient, it ensures operations remain within a legally protected framework, avoiding risks like account suspensions or hefty weekly fines of roughly €420,000 ($497,073).

Regulatory compliance is non-negotiable in this evolving landscape. The legal divide between Europe, where prediction markets are classified as illegal gambling, and the United States, where they are treated as legitimate event contracts, provides a clear path forward. Using VPNs or proxies to bypass geo-restrictions is a violation of platform rules and puts your capital at risk. Instead, migrating to New York-based infrastructure ensures compliance and operational security.

Despite increasing regulatory restrictions - Polymarket access is now limited in over 30 countries - the platform remains robust. For instance, it recorded an impressive $701.7 million in single-day trading volume in January 2026. This highlights the market's resilience for traders operating in compliant jurisdictions. QuantVPS is prepared to support this transition, offering the low-latency infrastructure needed for high-performance trading from US-based servers.

To avoid disruptions, traders must act immediately: migrate from Amsterdam to New York VPS and update API integrations. Staying on top of regulatory changes in both your physical location and VPS jurisdiction is critical for maintaining long-term stability in this dynamic trading environment.

FAQs

Am I allowed to use Polymarket from the Netherlands now?

No, Polymarket is no longer available in the Netherlands because of regulatory restrictions. Users now need to operate through the New York location and utilize the Polymarket US API. The Amsterdam location has been discontinued.

How do I migrate my Polymarket setup from Amsterdam to New York VPS?

To move your Polymarket setup, start by ordering a New York VPS. Once you have it, configure the server and transfer all your data and settings. Update your application to connect to the Polymarket US API, as support for the Amsterdam location has ended. After completing the setup, thoroughly test everything to confirm it's working as expected. Finally, deactivate your Amsterdam VPS to stay compliant with regulations. This process ensures smooth access while adhering to Polymarket's regional guidelines.

What can’t I do with the Polymarket US API (like CLOB trading)?

The Polymarket US API does not currently support CLOB (Central Limit Order Book) trading. For a detailed overview of the features and functionalities available, check out the official Polymarket documentation.

No, Polymarket is no longer available in the Netherlands because of regulatory restrictions. Users now need to operate through the New York location and utilize the Polymarket US API. The Amsterdam location has been discontinued.

To move your Polymarket setup, start by ordering a New York VPS. Once you have it, configure the server and transfer all your data and settings. Update your application to connect to the Polymarket US API, as support for the Amsterdam location has ended. After completing the setup, thoroughly test everything to confirm it's working as expected. Finally, deactivate your Amsterdam VPS to stay compliant with regulations. This process ensures smooth access while adhering to Polymarket's regional guidelines.

The Polymarket US API does not currently support CLOB (Central Limit Order Book) trading. For a detailed overview of the features and functionalities available, check out the official Polymarket documentation.

"}}]}