Polymarket, the largest prediction market platform, has officially returned to the U.S. after a four-year absence due to regulatory challenges. The platform now operates under full approval from the Commodity Futures Trading Commission (CFTC), ensuring compliance with federal laws. Key updates include:

- Regulatory Approval: Polymarket acquired QCEX, a licensed derivatives exchange, and implemented strict compliance protocols.

- Platform Features: U.S. users can trade event-based markets via registered brokerages using USDC (USD Coin) for stability.

- Market Highlights: Covers topics like politics, cryptocurrency, sports, and more, with $2.76 billion in monthly trading volume as of October 2025.

- Trading Tools: Offers real-time data, API access, and automation options for advanced strategies.

The platform’s return provides U.S. traders with a legal, regulated way to speculate on future events, integrating seamlessly with professional trading systems.

What Are Polymarket and Prediction Markets?

Polymarket’s History and Regulatory Changes

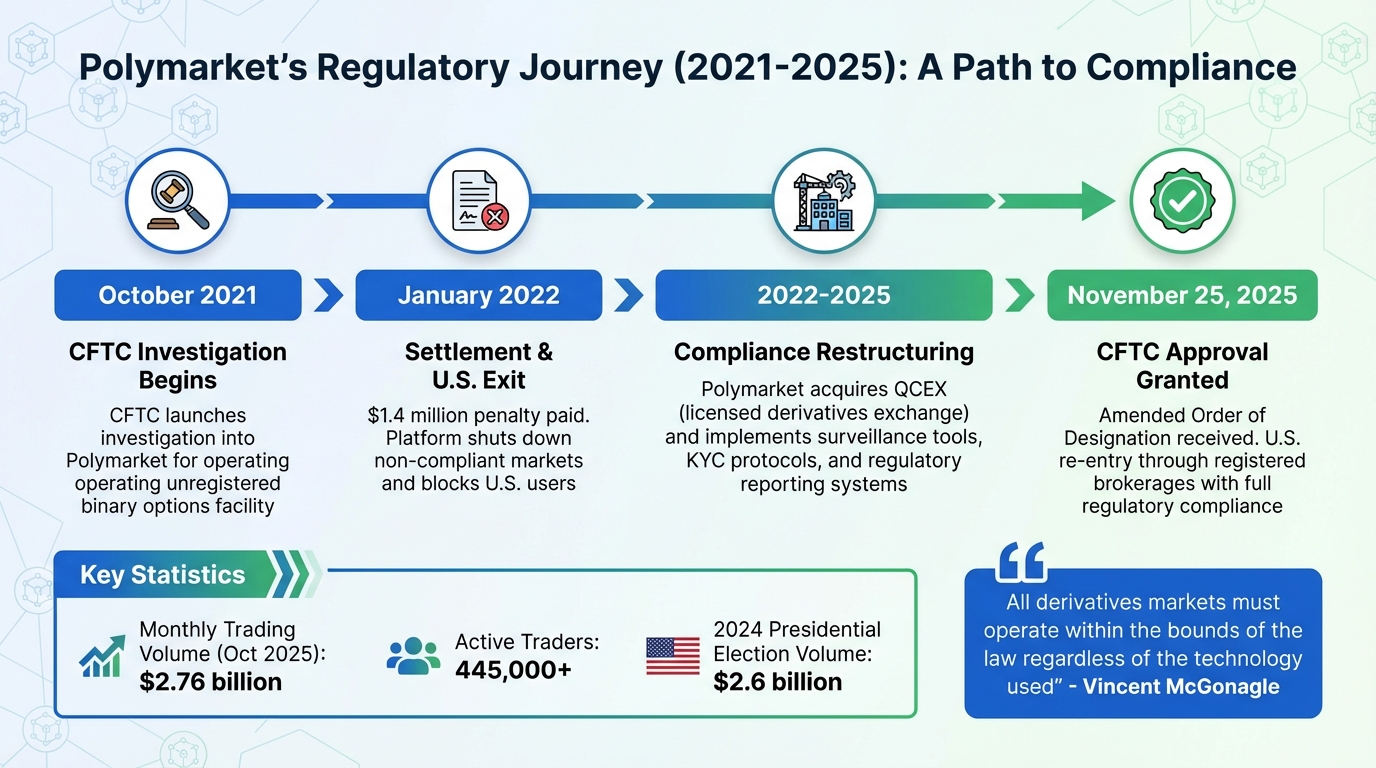

Polymarket’s Regulatory Journey: From CFTC Investigation to U.S. Re-Entry (2021-2025)

Polymarket’s Regulatory Journey: From CFTC Investigation to U.S. Re-Entry (2021-2025)

How Polymarket Started and Grew

Polymarket began as a decentralized prediction platform built on blockchain technology. It allowed users to engage in peer-to-peer transactions on binary options tied to real-world events, such as political elections or economic trends. While this approach gained attention, it also attracted regulatory scrutiny early on.

Regulatory Problems and Solutions

In October 2021, the Commodity Futures Trading Commission (CFTC) launched an investigation into Polymarket. The agency argued that the platform was operating an unregistered facility for binary options, categorizing its trades as illegal swaps instead of properly registered contracts. By January 2022, Polymarket settled the case with the CFTC, agreeing to pay a $1.4 million civil monetary penalty. The settlement also required the platform to shut down non-compliant markets, effectively barring U.S. users while the company reconsidered its business strategy.

"All derivatives markets must operate within the bounds of the law regardless of the technology used, and particularly including those in the so‐called decentralized finance or ‘DeFi’ space."

"All derivatives markets must operate within the bounds of the law regardless of the technology used, and particularly including those in the so‐called decentralized finance or ‘DeFi’ space."

This statement came from Acting Director of Enforcement Vincent McGonagle after the settlement.

To address these challenges, Polymarket took significant steps to align with regulatory expectations. The company acquired QCX (also referred to as QCEX), a firm already holding the necessary CFTC licenses for derivatives exchange and clearinghouse operations. This acquisition provided a compliant foundation for Polymarket’s return to the market. On November 25, 2025, the CFTC granted Polymarket an Amended Order of Designation, enabling it to operate an intermediated trading platform through registered brokerages and futures commission merchants. The company also implemented advanced surveillance tools, refined its clearing processes, and strengthened its regulatory reporting systems to meet federal standards.

"This approval allows us to operate in a way that reflects the maturity and transparency that the U.S. regulatory framework demands."

"This approval allows us to operate in a way that reflects the maturity and transparency that the U.S. regulatory framework demands."

This was highlighted by Shayne Coplan, Polymarket’s Founder and CEO.

Requirements for U.S. Traders

As part of its compliance efforts, Polymarket restructured its platform to meet U.S. regulatory requirements. U.S.-based traders are now required to access the platform via registered brokerages and futures commission merchants. This intermediated model ensures federal oversight through stringent reporting, surveillance, and Know Your Customer (KYC) protocols, creating a compliant and secure environment for U.S. users.

How Polymarket Works

Trading System Basics

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

Polymarket operates as a decentralized prediction market built on the Polygon blockchain, with a focus on transparency and efficiency through blockchain technology. It uses USDC (USD Coin) to minimize price volatility, ensuring a more stable trading experience. The markets are structured around binary YES/NO contracts, where share prices range from $0.00 to $1.00, reflecting the market’s view on the likelihood of an event happening. A key feature is that the combined value of one YES share and one NO share always equals $1.00, allowing for seamless order inversion.

When a market resolves, correct predictions are rewarded with shares valued at $1.00 each, while incorrect ones lose all value. Polymarket employs a hybrid Central Limit Order Book (CLOB) system: trades are matched off-chain for speed, while settlements occur on-chain via smart contracts to ensure security. Users can connect a Web3 wallet, deposit USDC, and activate a Polygon proxy wallet with a one-time setup transaction, enabling gas-free trading.

The platform doesn’t charge direct trading fees; users only incur gas fees and liquidity provider spreads. For U.S. traders using QCEX, fees are minimal – around 0.01%. By October 2025, Polymarket had achieved impressive growth, with $2.76 billion in monthly trading volume and more than 445,000 active traders.

Available Market Types

Polymarket offers a wide range of markets, covering topics like Politics, Economics, Cryptocurrency, Sports, Pop Culture, Science, Business, Weather, Awards, and Legislative outcomes. One of its standout moments came during the 2024 U.S. Presidential Election, which saw over $2.6 billion in bets, making it the platform’s most active market to date.

Beyond politics, cryptocurrency markets are a major draw. Traders speculate on events like Ethereum ETF approvals or Bitcoin price fluctuations. For instance, one Bitcoin price prediction market surpassed $4 billion in trading volume. Other notable markets have included predictions on the Guatemalan presidential election, whether Twitter would sue Meta, and the likelihood of Russia deploying nuclear weapons. Additionally, Polymarket provides opportunities to trade in areas like economic indicators, weather events, entertainment awards, and legislative decisions, catering to a wide variety of interests and expertise levels.

How Outcomes Are Determined

Polymarket relies on UMA‘s Optimistic Oracle to resolve market outcomes. This system follows a request–propose–dispute cycle. When a market closes, an asserter posts a USDC bond to propose an outcome. If the outcome is verified, the bond is returned along with a reward. However, if the outcome is disputed and found to be incorrect, the bond is forfeited. This process encourages honest reporting and gives the community a structured way to challenge outcomes, ensuring fairness and reliability.

Trading Strategies for Polymarket

Reading and Using Market Probabilities

On Polymarket, probabilities are displayed as percentages next to each question, reflecting the collective judgment of participants about the likelihood of an event. These percentages are derived from a mix of participant knowledge, private research, and financial decisions. In many cases, these markets can provide insights into real-world probabilities faster and more accurately than traditional polls or even expert opinions.

Unlike polls, which measure voter sentiment, Polymarket odds represent the probabilities of specific outcomes. For example, during the 2024 U.S. Presidential Election, Polymarket showed a 70%-30% split favoring President Trump in early October, while most polls suggested a much closer race. This highlights how prediction markets focus on pricing the likelihood of outcomes rather than gauging preferences.

However, the efficiency of these markets depends on factors like liquidity and the diversity of participants. Thin markets, with fewer participants or less trading activity, are more prone to price distortions and manipulation. For instance, on October 7, 2024, Polymarket’s odds for Donald Trump rose to 53.3%, while Kamala Harris’s odds fell to 46.1%. It was later revealed that these shifts were heavily influenced by a single French trader using four accounts to place significant wagers.

Before trading, it’s crucial to review the specific contract rules and understand the resolution source for each market. Also, be cautious of large trades or wash trading, as these can temporarily skew probabilities, particularly in less liquid markets. A critical eye is essential when interpreting market movements in these scenarios.

These probability insights lay the groundwork for various trading strategies.

Common Trading Methods

Traders use Polymarket’s probability data to implement strategies like directional bets, arbitrage, and hedging.

- Directional betting involves taking a position based on solid research and a strong belief about an event’s outcome. Success here depends on conducting in-depth analysis to gain an edge over other participants.

- Arbitrage exploits pricing inefficiencies, offering a way to earn consistent, low-risk profits. For example, if the combined probabilities of mutually exclusive outcomes don’t add up to 100%, traders can place bets on both sides to secure a guaranteed return.

- Hedging is used by advanced traders to protect against potential losses in other investments. By integrating prediction market positions into their portfolios, they can offset risks tied to traditional markets. These strategies require a systematic, rules-based approach and a deep understanding of market dynamics.

For traders looking to execute these strategies continuously, automation through VPS hosting becomes a game-changer.

Automated Trading with VPS

Virtual Private Server (VPS) hosting allows traders to run algorithmic strategies around the clock, ensuring uninterrupted API connections for automated trading. This is especially critical for arbitrage strategies, where quick execution is key to capitalizing on pricing inefficiencies.

QuantVPS offers plans tailored for prediction market trading, delivering ultra-low latency (0–1 ms) and 100% uptime. Their VPS Pro plan includes 6 cores and 16 GB of RAM for $99.99/month (or $69.99/month with an annual plan). For higher performance, the VPS Ultra plan provides 24 cores and 64 GB of RAM at $189.99/month (or $132.99/month annually).

Automated trading systems can continuously monitor market probabilities, compare them against external benchmarks, and execute trades when specific conditions are met. VPS hosting ensures your algorithms stay active even during local power outages or internet disruptions, giving you a competitive edge in fast-moving prediction markets.

Building a Professional Trading Setup

Connecting Tools and Platforms

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Polymarket equips traders with technical tools designed to integrate its prediction market data with professional trading systems. One standout feature is the Real-Time Data Socket (RTDS), which streams live market data through WebSocket. This allows traders to track probability shifts as they happen. Additionally, the platform offers an API for executing trades, retrieving market and event metadata, and seamlessly incorporating prediction market data into existing trading setups. For those looking to automate their strategies, Polymarket also provides the "Polymarket Agents" framework, which enables AI-driven trading.

Using VPS hosting, traders can link Polymarket data with analysis tools via custom scripts. This setup makes it possible to monitor multiple markets at once, execute trades based on pre-set conditions, and maintain continuous connectivity without relying on a local machine. These tools work best when paired with a reliable VPS solution, which we’ll explore in the next section.

Choosing the Right QuantVPS Plan

Your choice of VPS plan should align with your trading needs, whether you’re performing basic monitoring or running advanced, automated systems.

- VPS Lite plan: At $59.99/month (or $41.99/month when billed annually), this plan includes 4 cores and 8 GB of RAM. It’s ideal for traders who need basic API connections and real-time data streaming for occasional trades or simple monitoring.

- VPS Pro plan: Designed for traders managing multiple automated strategies or monitoring several markets simultaneously, this plan offers enhanced performance.

- VPS Ultra plan: Tailored for high-volume operations, this plan is perfect for handling complex algorithms or AI-driven trading agents, ensuring smooth execution without performance drops.

All QuantVPS plans come with a 100% uptime guarantee and ultra-low latency (0–1 ms), ensuring your trading systems stay active – even during local power outages or internet disruptions. A well-optimized VPS not only enhances performance but also provides a layer of security, which is crucial for professional trading.

Security and Risk Management

For U.S.-based traders, tax considerations are a key factor when trading Polymarket contracts. The classification of CFTC-regulated event contracts as a "wager" under 26 U.S.C. § 4421 could subject them to federal excise taxes under 26 U.S.C. § 4401. Additionally, traders should be mindful of state-level tax regulations and reporting requirements, as these can vary.

Protecting your wallet is essential in prediction market trading. VPS hosting ensures secure, encrypted connections to trading accounts and incorporates automatic backup procedures. QuantVPS enhances security further with built-in DDoS protection and system monitoring, which are critical for maintaining uninterrupted operations.

It’s also important to steer clear of using material non-public information (MNPI). Misusing such information can lead to market distortion and potential regulatory penalties, as financial service firms have flagged these concerns. Traders should be vigilant against manipulative practices, such as placing large orders or engaging in wash trading to influence market probabilities – especially in less liquid markets.

For contracts tied to non-public events, settlement often depends on external data sources, known as oracles. Any inaccuracies or tampering with these inputs could lead to incorrect settlements and financial losses.

Conclusion

Polymarket’s return to the U.S. marks a new chapter for prediction market trading. After a four-year hiatus, the platform now operates with full approval from the CFTC, providing traders with the regulatory clarity and legal certainty they need to confidently engage in this market. This development opens up opportunities to combine traditional trading approaches with cutting-edge, tech-driven strategies.

For traders looking to maximize their efficiency, investing in reliable VPS hosting can make all the difference. A strong VPS setup ensures continuous connectivity, supports automated trading, and enables real-time monitoring. QuantVPS, for instance, offers solutions with 0–1 ms latency and 100% uptime, helping traders maintain seamless access to markets and react instantly to changes. Selecting the right VPS plan tailored to your trading volume can significantly enhance your ability to navigate market shifts effectively.

Polymarket’s integration into existing financial systems through intermediated access further enhances its appeal, allowing traders to incorporate prediction markets into their broader strategies. For U.S. traders, this platform now offers a compliant and reliable avenue for event-based speculation.

FAQs

What steps does Polymarket take to comply with U.S. regulations?

Polymarket operates within U.S. regulations by strictly following the guidelines established by the Commodity Futures Trading Commission (CFTC). This involves maintaining thorough reporting systems, conducting market surveillance, and adhering to detailed recordkeeping practices. These measures are designed to promote transparency and ensure accountability.

Additionally, the platform places a strong emphasis on protecting its users. By adopting practices similar to those found in other regulated derivatives markets, Polymarket creates a secure and compliant environment for its customers.

What advantages does using USDC on Polymarket provide for traders?

Using USDC on Polymarket brings several benefits to traders. First, transactions are completed more quickly and with lower fees compared to traditional payment methods, making the trading process smoother and more cost-effective. Additionally, USDC works seamlessly with blockchain technology, offering improved security and transparency for every transaction. These qualities make it a dependable and user-friendly option for both beginners and seasoned traders on the platform.

What is the Optimistic Oracle, and how does it resolve market outcomes?

The Optimistic Oracle is a mechanism designed to decide the outcomes of market events. It starts with an oracle provider suggesting a specific outcome for a given market. This proposed result is open for review and can be contested by other participants if disagreements arise.

When a challenge occurs, the system triggers a decentralized voting process. Participants in this process collaborate to reach a consensus, ultimately finalizing the outcome. Once the dispute is settled, the agreed-upon result is used to conclude the market. This method relies on community participation to validate results, promoting both openness and accountability.