Best AI For Stock Trading

Looking for the best AI tools for stock trading in 2025? Here’s what you need to know: AI has transformed trading, offering tools that analyze markets, predict trends, and execute trades faster than ever. Three standout platforms in the U.S. are Trade Ideas, Tickeron, and Kavout. Each caters to different trading styles and goals.

Key Takeaways:

- Trade Ideas: Best for day and swing traders. Features include Holly AI for trade signals, real-time market scanning, and backtesting tools. Pricing starts at $118/month.

- Tickeron: Ideal for data-driven strategies. Offers AI modules with up to 80% prediction accuracy and tools for stocks, ETFs, forex, and crypto. Pricing starts at $125/month annually.

- Kavout: Great for diverse trading needs. InvestGPT provides stock analysis, pattern recognition, and portfolio tools. Pricing starts at $19 for the first month, then $49/month.

Quick Comparison:

| Feature | Trade Ideas | Tickeron | Kavout |

|---|---|---|---|

| Best For | Day and swing traders | Quantitative strategy enthusiasts | Diverse trading styles |

| Key Tool | Holly AI | AI Robots | InvestGPT |

| Pricing | $118-$228/month | $125-$250/month | $19-$49/month |

| Integration | Direct broker integration | Works with major brokerages | API access, U.S. stocks only |

These platforms bring AI-powered insights to retail traders, helping them make faster, more informed decisions. Choose based on your trading style, budget, and goals.

Best AI Trading Tools - This is CRAZY!

1. Trade Ideas

Trade Ideas is a cutting-edge stock scanner and charting tool designed for active U.S. traders. It tracks over 8,000 U.S. stocks in real time, offering insights into market trends and identifying potential trading opportunities. Here's a closer look at what makes Trade Ideas a go-to platform for traders.

Features

At the heart of Trade Ideas is Holly AI, an advanced system that analyzes market data to provide actionable entry and exit signals. Holly AI uses a variety of strategies, each based on algorithms crafted to spot patterns, anomalies, and market conditions that have historically led to profitable trades.

The platform also includes built-in scans and a customizable interface, giving traders the freedom to develop and refine their strategies. Key features include:

- AI-powered trade signals

- Real-time market scanning

- Customizable alerts

- Backtesting tools to evaluate strategies using historical data

Holly AI boasts a strategy success rate exceeding 60%, consistently outperforming the market. These results have earned the platform an overall rating of 4.5/5, with scores as high as 4.8/5 for accuracy and reliability.

Barry D. Moore, a Certified Financial Technician, highlighted the platform's strengths:

"Trade Ideas impressed me with its advanced stock scanner and trade signals powered by smart AI algorithms. It is designed for active day and swing traders, not long-term investors."

"Trade Ideas impressed me with its advanced stock scanner and trade signals powered by smart AI algorithms. It is designed for active day and swing traders, not long-term investors."

One notable success story took place in March 2024, when the platform flagged AMD as a swing-trade opportunity. Traders who acted on this alert saw significant profits.

Automation

Holly AI takes the guesswork out of trading by automating market monitoring. It generates quick, actionable trade suggestions, allowing users to respond to market changes without delay.

Integration

Trade Ideas integrates smoothly with popular brokers like Interactive Brokers and TradeZero, enabling users to execute trades directly from the platform. This feature eliminates the hassle of manually transferring trade ideas, making the trading process more efficient.

Infrastructure Requirements

To run Trade Ideas effectively, certain system requirements must be met. While the platform is optimized for Windows operating systems, Mac users can access it through options like Bootcamp, Fusion, Parallels, AWS, Windows 365, or a web version (though the latter has limited functionality).

Here’s a breakdown of system requirements:

| Requirement Level | System Bus | CPU | RAM |

|---|---|---|---|

| Minimum | 32-bit | 1.5 GHz (dual/quad core) | 4 GB |

| Preferred | 64-bit | 2.0 GHz (dual/quad core) | 8 GB |

| Ideal | 64-bit | 2.5 GHz (dual/quad core) | 16 GB |

For the best experience, an SSD, a stable internet connection, and multiple monitors (e.g., one 4K screen or two 1080P screens) are recommended.

Pricing and Support

Trade Ideas offers two pricing options: the Standard Plan at $118 per month and the Premium Plan at $228 per month. To help new users get started, the platform provides "Getting Started" videos, tutorials, and daily support sessions. Beginners are encouraged to start with paper trading to practice and fine-tune their strategies before committing real money.

2. Tickeron

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

Tickeron is an AI-powered trading assistant designed for stocks, ETFs, forex, and crypto. It provides traders with advanced market analysis tools that are on par with those used by major Wall Street firms.

Features

Tickeron stands out with its six AI modules, including the impressive AI Robots module, which boasts an 80% accuracy rate in its predictions. Tools like the AI Pattern Search Engine and AI Trend Prediction Engine assist traders in spotting lucrative opportunities across various markets. For instance, Tickeron's Swing Trader AI robot delivered a 4.51% return for Cloudflare, Inc. (NET) in a single week in 2025, while a Tesla-focused AI bot achieved a 4.40% gain within the same period. Backtesting has shown success rates of up to 83.33% in closed trades for specific tickers.

Here are some key features:

- AI-powered buy/sell signals with real-time pattern recognition

- Customizable AI algorithms tailored to individual trading styles

- Portfolio optimization tools featuring Diversification Score analysis

- Market scanners with adjustable filtering options

- Educational resources, including webcasts, blogs, and an investment terms library

Tickeron has earned a 4.4 out of 5 rating on the Google Play Store, reflecting users' appreciation for its advanced AI tools and real-time market scanning features. These capabilities enhance trade execution through precise automation.

Automation

Tickeron takes automation to the next level by generating trade signals that respond quickly to market changes. The platform's AI Trading Agents have been upgraded to analyze market data at shorter intervals - reduced from 60 minutes to just 15 or even 5 minutes. This improvement ensures faster and more accurate trade signals, as the AI continuously evaluates market trends and patterns.

Integration

Tickeron supports trade execution through users' preferred brokerage services. The platform is working on integrations with major brokerages, including Binance, Alpaca, Kraken, TD Ameritrade, and Interactive Brokers. However, trades must be executed on the connected brokerage platform since Tickeron itself does not handle direct trade execution. The platform is accessible via both mobile and web applications, allowing users to manage their portfolios from virtually anywhere.

Infrastructure Needs

To make the most of Tickeron's features, a reliable computer setup is essential. The platform's AI tools demand a system capable of efficiently handling charting, data feeds, and trade execution. With the adoption of shorter machine learning intervals, having the right hardware is even more critical. Here’s a quick overview of the recommended setup:

| Component | Minimum Requirement | Recommended |

|---|---|---|

| Operating System | Windows (best for trading apps) | Windows 10/11 |

| RAM | 8 GB | 16 GB or higher |

| CPU | Quad-core 2.8 GHz 64-bit | Multi-core 3.0+ GHz |

| Storage | 250 GB SSD | 500 GB+ SSD |

| Monitors | Single display | 2-3 monitors (24"-27") |

While mobile and web access are available, a desktop setup with multiple monitors is ideal for active day traders. Windows remains the preferred operating system for trading applications due to its compatibility.

Tickeron offers a free Beginner Membership, while the Expert Membership costs $250 per month (or $125 per month when billed annually).

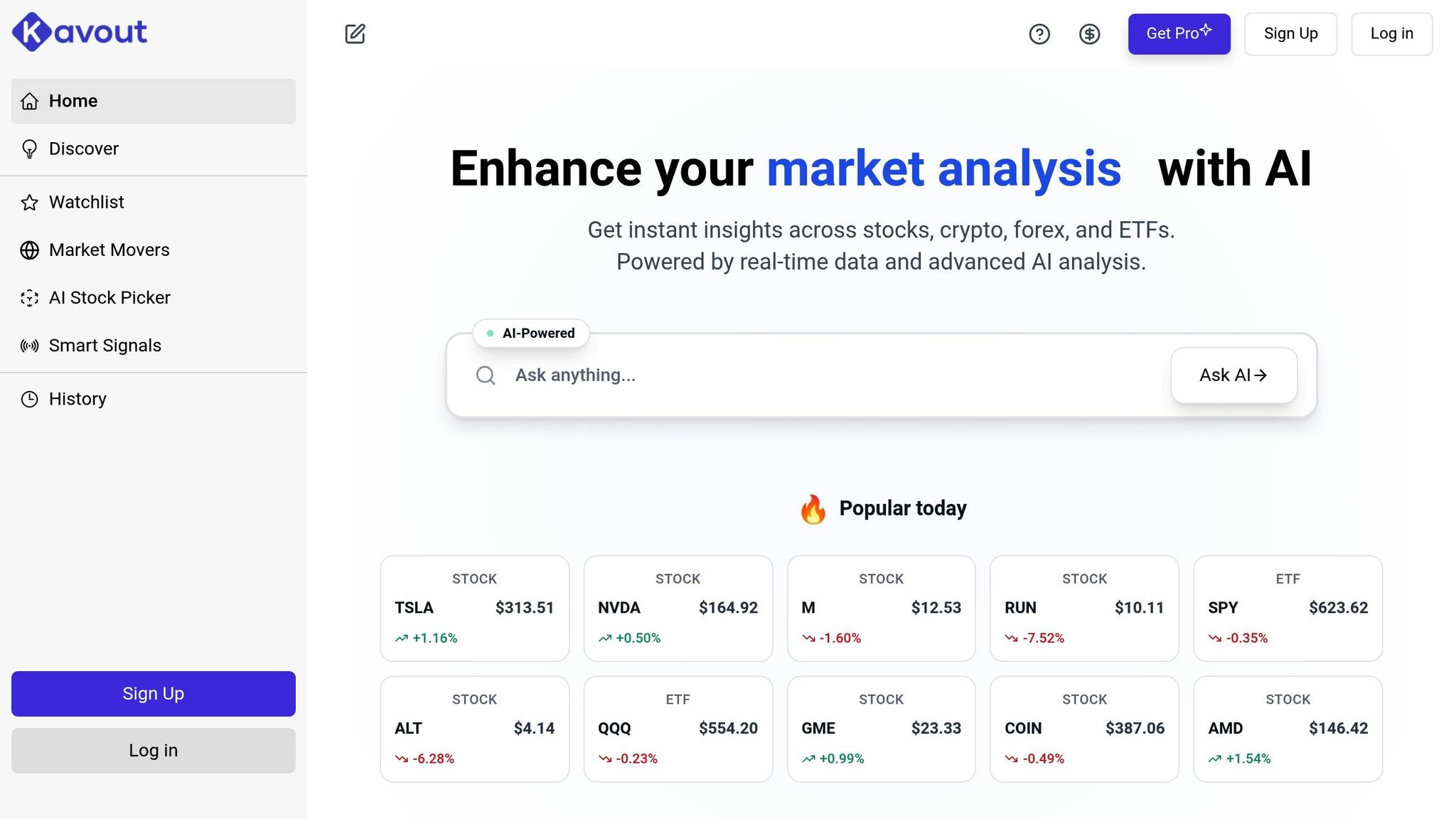

3. Kavout

Kavout is an AI-driven investment platform that evaluates over 9,000 U.S. stocks every day. At the heart of its offerings is InvestGPT, a tool equipped with smart query capabilities, AI-powered stock pattern recognition, and a robust portfolio toolbox.

Features

Kavout's standout feature is its ability to provide real-time signals and in-depth analysis across various assets. With custom live scans and instant alerts, traders can stay on top of market movements without delay.

InvestGPT enhances this by enabling smart queries for financial data, identifying stock patterns, and offering tools tailored to both long-term investors and active day traders. Whether you're looking for fundamental analysis to guide long-term decisions or momentum indicators for short-term trades, Kavout has you covered.

Automation

Kavout simplifies trading by automatically monitoring market data and updating custom lists. This ensures traders are alerted to significant market changes without needing to manually track them. Its automated signals and momentum indicators cater to both day and swing trading strategies, delivering actionable insights in real time.

The platform continuously processes data from thousands of stocks, eliminating the need for manual scanning. This allows users to focus on strategy while the AI handles the heavy lifting of data analysis.

Integration

Kavout is designed to integrate smoothly into various trading workflows. As the company explains:

"Whether you're trading, investing, or advising, Kavout adapts to your workflow".

"Whether you're trading, investing, or advising, Kavout adapts to your workflow".

Active traders benefit from real-time signals, long-term investors can leverage its fundamental analysis tools, and financial advisors gain access to client-ready reports and portfolio optimization features.

For advanced users, Kavout offers API access, enabling quantitative funds and individual investors to incorporate its predictive analytics into their trading systems, research platforms, or algorithmic strategies. Research analysts can also use the platform for deep-dive analysis and alternative data insights, making it a versatile tool for institutional-grade research.

Pricing

Kavout operates on a subscription model. The Portfolio Toolbox is available for $19 during the first month and $49 per month afterward. For those seeking advanced features, Kavout Pro is priced at $20 per month.

Advantages and Disadvantages

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Looking at the platforms side by side, it's clear each brings its own strengths and challenges to the table.

Trade Ideas stands out for its AI-powered tools tailored for day trading and real-time scanning. Its algorithms have a proven track record of outperforming the market. However, it falls short with an outdated interface and the absence of a mobile app, which can be a dealbreaker for some traders.

Tickeron offers cutting-edge quantitative tools and actively managed AI portfolios, making it appealing to users who enjoy data-driven strategies. That said, its steep learning curve can be daunting for beginners unfamiliar with quantitative analysis.

Kavout strikes a balance with its InvestGPT technology and robust stock analysis features. It caters to a wide audience, including active traders, long-term investors, and financial advisors. Additionally, its API access allows seamless integration with advanced trading systems.

| Feature | Trade Ideas | Tickeron | Kavout |

|---|---|---|---|

| Best For | Day and swing traders | Quantitative strategy enthusiasts | Diverse trading styles |

| Key Strength | AI algorithms that have outperformed the market | Advanced quantitative analysis tools | AI-driven stock analysis and scoring |

| Major Weakness | Outdated interface; no mobile app | Steep learning curve for beginners | Not specified |

| User Rating | 4.7/5 | 4.4/5 | Not specified |

These comparisons shed light on what each platform excels at and where they might fall short, helping users make more informed decisions.

When it comes to technical requirements, Trade Ideas is built for Windows users, while Tickeron and Kavout are cloud-based and can run on any operating system, as long as there's a stable internet connection.

Pricing and user experience also vary significantly. Trade Ideas is on the pricier side and limited to Windows, while Tickeron offers flexible subscription plans but demands a certain level of expertise to navigate. Kavout, on the other hand, is more budget-friendly and offers API access for advanced users. However, Tickeron has faced criticism for issues like inaccurate predictions despite high confidence scores, mobile app glitches, and challenges with subscription cancellations. These user experiences highlight the importance of thoroughly testing a platform before committing to a long-term subscription.

Final Thoughts

Choosing the right AI trading platform comes down to finding one that matches your experience, trading style, and personal goals.

Trade Ideas is a standout for seasoned day and swing traders who thrive on analyzing intricate market data. With its machine learning tools testing and fine-tuning thousands of strategies daily, it’s a go-to for traders looking for consistent and proven results.

Tickeron offers a balanced approach, providing powerful quantitative tools and AI-driven signals with clear success rates. It’s particularly useful for traders who appreciate community-driven insights, though beginners might need some time to get comfortable with its features.

For those seeking a platform that blends education with comprehensive market analysis, Kavout delivers on multiple fronts. By combining fundamental, technical, and behavioral data, it’s an excellent option for professionals and investors focused on long-term strategies.

If you’re trading within U.S. markets, both Trade Ideas and Tickeron integrate seamlessly with U.S. brokerage accounts and trading hours. Kavout, on the other hand, specializes exclusively in U.S. stock market data.

In short, Trade Ideas is perfect for traders aiming for peak performance, Tickeron offers dependable AI signals at a competitive price, and Kavout stands out for its focus on investment insights. To find the best fit, consider exploring free trials and see which platform aligns with your trading style and goals.

FAQs

How do Trade Ideas, Tickeron, and Kavout differ in their AI features and target users?

Trade Ideas caters to active traders and professional investors, offering tools to keep up with fast-paced markets. With its Virtual Trade Assistant, Holly AI, users get real-time stock suggestions and precise entry and exit signals. This makes it a go-to platform for those who rely on quick, data-backed decisions.

Tickeron is aimed at retail investors and traders, delivering AI-powered analytics and adaptive buy/sell signals. These features are designed to simplify trading strategies while aiming to outperform market benchmarks, making it an appealing option for those seeking automated tools.

Kavout serves both retail and professional investors, providing sophisticated AI tools like the AI Stock Picker and Kai Score. These tools offer in-depth stock and crypto analysis, making it a strong choice for anyone in need of detailed, data-driven insights.

What are the costs of AI trading platforms, and how do they deliver value for traders?

AI trading platforms generally operate on a subscription model, with basic plans starting at around $90 per month. These platforms come packed with features such as automated trading, real-time market analysis, and tools to fine-tune trading strategies - all aimed at helping traders act quickly and make better-informed decisions.

What sets these platforms apart is their capability to handle and analyze vast amounts of market data with remarkable speed and accuracy. By pinpointing trends, uncovering opportunities, and managing risks effectively, they can play a key role in boosting both trading efficiency and profitability for their users.

What technical factors should I evaluate when selecting an AI trading platform, and how do they affect performance?

When picking an AI trading platform, you should focus on three key factors: scalability, computational performance, and data security. Scalability allows the platform to handle massive amounts of real-time market data and adjust as your trading requirements expand. High computational performance is crucial for executing advanced algorithms swiftly, enabling you to act on time-sensitive opportunities. Meanwhile, strong data security ensures your financial information and trading activities stay safe.

These elements play a critical role in delivering precise, timely, and dependable trading insights - essentials for refining your strategies and boosting profitability.

Trade Ideas caters to active traders and professional investors, offering tools to keep up with fast-paced markets. With its Virtual Trade Assistant, Holly AI, users get real-time stock suggestions and precise entry and exit signals. This makes it a go-to platform for those who rely on quick, data-backed decisions.

Tickeron is aimed at retail investors and traders, delivering AI-powered analytics and adaptive buy/sell signals. These features are designed to simplify trading strategies while aiming to outperform market benchmarks, making it an appealing option for those seeking automated tools.

Kavout serves both retail and professional investors, providing sophisticated AI tools like the AI Stock Picker and Kai Score. These tools offer in-depth stock and crypto analysis, making it a strong choice for anyone in need of detailed, data-driven insights.

AI trading platforms generally operate on a subscription model, with basic plans starting at around $90 per month. These platforms come packed with features such as automated trading, real-time market analysis, and tools to fine-tune trading strategies - all aimed at helping traders act quickly and make better-informed decisions.

What sets these platforms apart is their capability to handle and analyze vast amounts of market data with remarkable speed and accuracy. By pinpointing trends, uncovering opportunities, and managing risks effectively, they can play a key role in boosting both trading efficiency and profitability for their users.

When picking an AI trading platform, you should focus on three key factors: scalability, computational performance, and data security. Scalability allows the platform to handle massive amounts of real-time market data and adjust as your trading requirements expand. High computational performance is crucial for executing advanced algorithms swiftly, enabling you to act on time-sensitive opportunities. Meanwhile, strong data security ensures your financial information and trading activities stay safe.

These elements play a critical role in delivering precise, timely, and dependable trading insights - essentials for refining your strategies and boosting profitability.

"}}]}