Jim Simons Trading Strategy Explained: Inside Renaissance Technologies

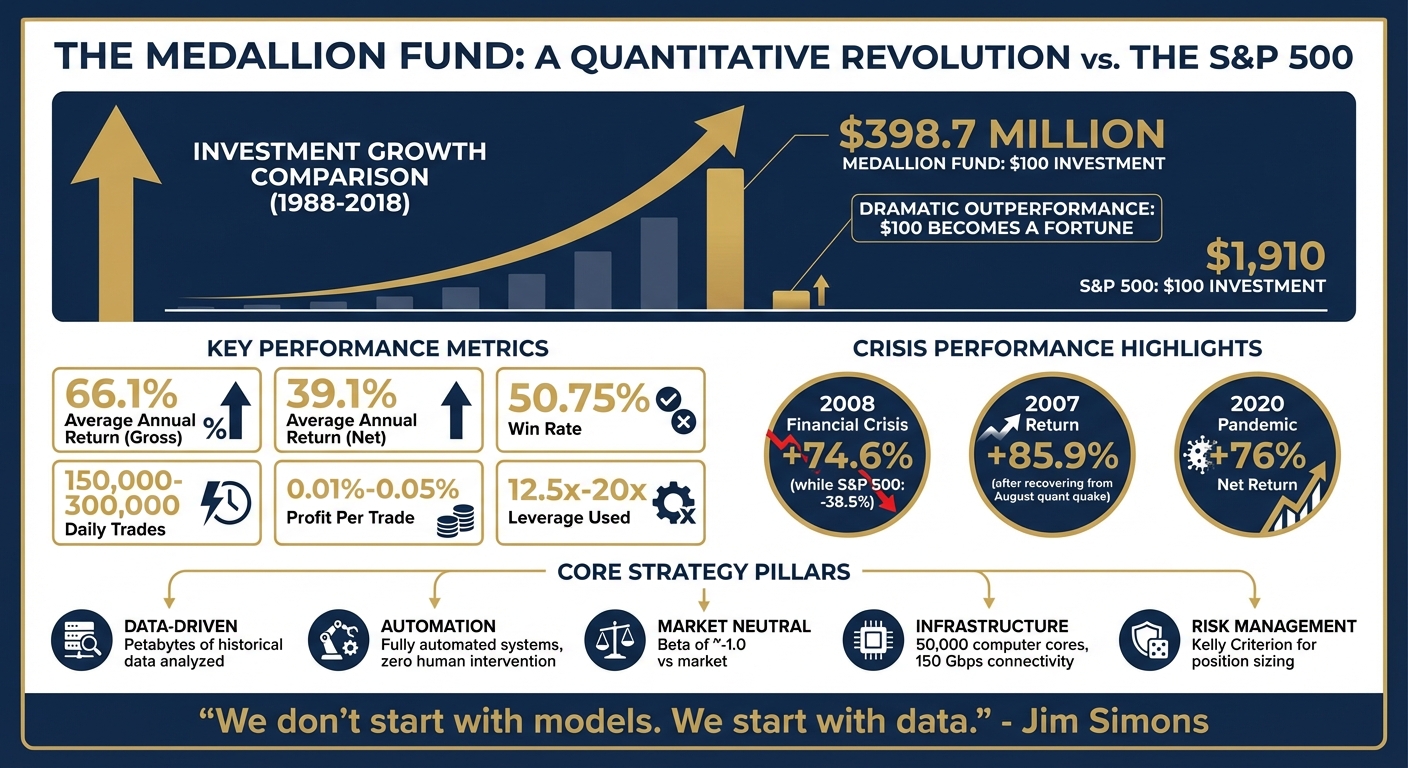

Jim Simons, a brilliant mathematician, revolutionized trading by applying mathematical models and data analysis to financial markets. His hedge fund, Renaissance Technologies, and its flagship Medallion Fund, achieved unparalleled success with an average annual return of 66.1% (39.1% net) from 1988 to 2018. Simons' approach relied on identifying patterns in market data, using advanced statistical models, machine learning, and automated systems to execute trades without human intervention.

Key takeaways from Simons' strategy:

- Data-Driven Approach: Renaissance focused on raw data, analyzing petabytes of historical and real-time market information to uncover patterns.

- Quantitative Models: The firm used statistical arbitrage and market-neutral strategies to profit from inefficiencies while minimizing risk.

- Automation: Fully automated systems executed 150,000–300,000 trades daily, eliminating emotional biases.

- Risk Management: Techniques like the Kelly Criterion and balanced portfolios helped control risk and maintain consistent returns.

- Infrastructure: Renaissance leveraged powerful computing systems and low-latency networks for rapid execution and analysis.

Simons' success demonstrates the power of systematic, disciplined trading, driven by data and technology, rather than traditional market intuition.

Jim Simons Medallion Fund Performance vs S&P 500 (1988-2018)

Jim Simons Medallion Fund Performance vs S&P 500 (1988-2018)

How Renaissance Technologies Uses Quantitative Trading

Renaissance Technologies has redefined the way trading works by moving away from the traditional Wall Street reliance on economic theories or gut feelings. Instead, the firm focuses on raw data to uncover patterns. This data-driven approach, combined with a team of PhDs in fields like mathematics, physics, statistics, and computer science, forms the backbone of their strategy.

At its core, the firm identifies non-random, unusual patterns in the price movements of thousands of securities. Their analysis goes beyond standard financial data, diving into historical records that date back to the 1700s, sourced from places like the World Bank and Federal Reserve. Renaissance even incorporates unconventional signals like weather trends, shipping data, and lunar cycles to uncover statistical advantages.

What sets Renaissance apart is its rigorous testing process. Most signals they identify are discarded unless they prove statistically valid and scalable through extensive backtesting. Their powerful computing systems analyze petabytes of data in real time, allowing models to adapt to changing market conditions. This relentless focus on data and testing forms the foundation of their advanced quantitative methods.

Data Collection and Historical Analysis

Renaissance maintains one of the most comprehensive financial datasets in the world. Their data warehouse, measured in petabytes, includes not just standard price and volume data but also order book depth, alternative data sources, and indicators that most traders wouldn't even consider. Every piece of data undergoes strict validation to eliminate errors that could lead to costly mistakes.

Interestingly, the firm has borrowed techniques from unexpected areas. For example, they adapted methods from IBM's speech recognition technology - designed to predict the next sound based on prior ones - to forecast price movements based on historical sequences.

This validated data feeds into fully automated trading systems that execute strategies in real time.

Algorithmic Trading and Automation

Renaissance's trading algorithms handle 150,000 to 300,000 trades per day across various asset classes. These trades capitalize on tiny statistical edges of just 0.01% to 0.05% per trade, which add up significantly when executed at such high volumes.

The entire system operates without any human intervention. As Jim Simons, the founder, famously said:

"I want models that will make money while I sleep. A pure system without humans interfering."

"I want models that will make money while I sleep. A pure system without humans interfering."

This automation eliminates emotional biases like fear during market downturns or greed during rallies.

Former co-CEO Robert Mercer summed up their edge perfectly:

"We're right 50.75 percent of the time... but we're 100 percent right 50.75 percent of the time. You can make billions that way."

"We're right 50.75 percent of the time... but we're 100 percent right 50.75 percent of the time. You can make billions that way."

Renaissance employs a single unified model, meaning improvements in one area - like currency trading - benefit other areas such as equities, bonds, and commodities. This unified system creates a compounding advantage that fragmented models can't replicate.

| Aspect | Quantitative Trading (Renaissance) | Manual Trading |

|---|---|---|

| Decision Process | Algorithms and statistical models | Human judgment and intuition |

| Execution Speed | Milliseconds | 10+ seconds per trade |

| Emotional Impact | Eliminated by systematic rules | Prone to fear and greed |

| Data Volume | Petabytes of historical/real-time data | Limited by human capacity |

Statistical Arbitrage and Market Neutral Strategies

Renaissance Technologies built its reputation on two tightly linked strategies: statistical arbitrage and market neutrality. These approaches are central to the firm's data-driven, risk-conscious trading model. Together, they allow Renaissance to profit from market inefficiencies while shielding its portfolio from broader market fluctuations. The result? A portfolio that performs well whether the S&P 500 is soaring or sinking.

What Is Statistical Arbitrage

Statistical arbitrage is a quantitative trading strategy that capitalizes on temporary pricing misalignments between related securities. Unlike traditional investing, Renaissance doesn’t make directional bets on the market’s rise or fall. Instead, they focus on identifying pairs or groups of securities whose prices historically move in sync, then act when those relationships temporarily diverge.

What began as basic pairs trading has evolved into a highly advanced system. Renaissance now manages diversified portfolios with hundreds or even thousands of securities, carefully matched by sector and region to reduce exposure to systemic risks. Their holding periods are short - ranging from seconds to days - aimed at capturing small, fleeting advantages before the market self-corrects.

Here’s how it works: when Renaissance’s models detect that one security is undervalued relative to another, they take a long position in the cheaper asset and a short position in the pricier one. As Jim Simons put it:

"Patterns of price movement are not random. However, they're close enough to random so that getting some excess, some edge out of it, is not easy and not so obvious."

"Patterns of price movement are not random. However, they're close enough to random so that getting some excess, some edge out of it, is not easy and not so obvious."

To uncover these patterns, Renaissance employs stochastic differential equations - the same tools meteorologists use to predict weather. Their non-linear models go beyond what linear regressions can detect, factoring in variables like market sentiment and macroeconomic changes. Additionally, the firm applies a machine learning method called the "kernel method", which maps data into higher-dimensional spaces, revealing subtle patterns that would otherwise remain hidden.

This statistical precision sets the foundation for their market-neutral strategy, which balances risk while exploiting inefficiencies.

Market Neutral Strategies

Market neutrality acts as Renaissance’s safeguard against broad market trends. By maintaining balanced long and short positions in related securities, the firm ensures its portfolio remains unaffected by whether the market is climbing or falling.

The Medallion Fund exemplifies this approach, with a beta of approximately -1.0 against the CRSP market index - meaning it often moves in the opposite direction of the broader market.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

Here’s a snapshot of the Medallion Fund’s performance:

| Metric | Medallion Fund (1988–2018) |

|---|---|

| Average Annual Return (Gross) | 66.1% |

| Average Annual Return (Net) | 39.1% |

| Win Rate | 50.75% |

| Typical Leverage | 12.5x – 20x |

| Beta (vs CRSP Index) | ~ -1.0 |

Renaissance amplifies its market-neutral positions with high leverage, transforming small statistical edges into significant returns. Despite this, each trade carries minimal exposure to market direction.

The resilience of this strategy shone during the August 2007 "quant quake", when collapsing mortgage markets caused the Medallion Fund to lose $1 billion - 20% of its value - in just three days. Instead of intervening, Renaissance let its automated models run. By the end of 2007, the fund posted an 85.9% return. In 2008, amidst a global financial meltdown, it achieved 74.6% net returns.

This blend of statistical arbitrage and market neutrality enables Renaissance to profit from inefficiencies without relying on market trends. It’s a rare accomplishment that sets the firm apart from nearly every other investment company.

Mathematical Models and Machine Learning

Renaissance Technologies sets itself apart from traditional investment firms by taking a distinctly data-driven approach. Instead of relying on economic theories or gut instincts, the firm begins with vast amounts of raw data. As Jim Simons famously explained:

"We don't start with models. We start with data. We don't have any preconceived notions. We look for things that can be replicated thousands of times."

"We don't start with models. We start with data. We don't have any preconceived notions. We look for things that can be replicated thousands of times."

This philosophy forms the backbone of Renaissance's strategy. Their systems process a staggering 40 terabytes of data daily across roughly 50,000 computer cores, all linked by a global network with speeds of 150 gigabits per second. Rather than attempting to explain why markets move, the focus is on uncovering recurring, non-random patterns that can be turned into profitable opportunities.

Predictive Modeling for Market Trends

To forecast market trends, Renaissance employs stochastic processes - mathematical tools that estimate probabilities in uncertain conditions. These models are designed to handle the complexity of market behavior, capturing intricate relationships influenced by factors like investor sentiment and global economic shifts. Notably, the firm achieved a breakthrough by applying speech recognition techniques, such as Hidden Markov Models, to financial data. These models, typically used to predict the next word in a sentence, help Renaissance identify and forecast market "states." As Simons once remarked:

"I don't know why planets orbit the sun. That doesn't mean I can't predict them."

"I don't know why planets orbit the sun. That doesn't mean I can't predict them."

Another key tool in their arsenal is the kernel method, a machine learning technique that maps data to expose hidden correlations. What makes Renaissance's approach especially powerful is their use of a single, unified model. Improvements in one area - like currency trading - automatically enhance performance across all asset classes. This holistic strategy has led to remarkable results. For example, during the 2008 financial crisis, while the S&P 500 plummeted by 38%, the Medallion Fund delivered a 74.6% return. Similarly, in 2020, amid intense market volatility, the fund achieved a staggering 149% gross return. These results highlight how their advanced modeling and machine learning systems work in tandem to deliver exceptional outcomes.

Machine Learning Applications

Machine learning plays a crucial role in refining Renaissance's predictive models. Their algorithms are designed to evolve continuously, processing new market data in real time and updating trading rules without human intervention. This adaptability allows the firm to execute between 150,000 and 300,000 trades daily through fully automated systems. To maintain consistency and eliminate emotional bias, Renaissance enforces a strict policy: "never override the computer." This ensures that decisions remain entirely data-driven, free from human interference.

High-Frequency Trading and Execution

Renaissance Technologies takes its data-driven approach to the next level with high-frequency trading. Using fully automated systems capable of executing up to 300,000 trades daily, the firm capitalizes on tiny, short-lived price discrepancies. Interestingly, the Medallion Fund's success hinges on a hit rate of just 50.75%. While this might seem modest, the sheer volume of trades transforms this slim margin into substantial profits. On average, each trade yields a profit of only 0.01% to 0.05%, but Renaissance amplifies these small gains with leverage ranging from 10x to 20x. This meticulous execution bridges the gap between theoretical models and tangible financial returns.

Why Low Latency Matters

In high-frequency trading, speed isn't just an advantage - it's essential. To stay ahead, Renaissance places its servers directly within exchange data centers, a strategy known as co-location, reducing the time it takes for orders to hit the market. The firm has even patented a system that uses atomic clocks calibrated to cesium vibrations, ensuring global order synchronization down to billionths of a second. This level of precision prevents competitors from front-running trades, a critical safeguard in a fiercely competitive environment.

Speed is crucial in the high-frequency trading world, often described as "winner-take-most." Even the slightest edge can secure the majority of fleeting profit opportunities. With high-frequency trading making up an estimated 50% to 73% of U.S. equity trading volume, the race for speed is intense. Renaissance thrives in this environment, achieving transaction costs as low as 0.002% to 0.003% per trade - far below the standard institutional cost of 0.01% or higher. These low-latency strategies are seamlessly integrated with Renaissance’s execution techniques.

Execution Strategies for Speed and Price

Renaissance employs advanced methods to ensure trades are executed quickly and at the best possible prices. One key tactic is order slicing, where large trades are divided into smaller, strategically timed pieces across multiple exchanges to minimize price slippage. To avoid tipping off competitors, the firm actively masks its trading intentions. For example, if an unusual market movement occurs at 11:00 AM, Renaissance might deliberately pause trading at that time to avoid detection. Additionally, the firm often matches buy and sell orders internally, bypassing external markets entirely and eliminating transaction costs.

Peter Brown, CEO of Renaissance Technologies, summed up the company’s philosophy:

"There's a danger that comes with success, and to avoid this we try to remember that we know how to build large mathematical models and that is all we know. We don't know any economics, don't have any insights into the markets, and just don't interfere with our trading systems."

"There's a danger that comes with success, and to avoid this we try to remember that we know how to build large mathematical models and that is all we know. We don't know any economics, don't have any insights into the markets, and just don't interfere with our trading systems."

This disciplined, hands-off approach proved invaluable during the market upheavals of 2020. While many struggled with the pandemic-induced volatility, the Medallion Fund’s high-frequency models thrived, delivering an extraordinary 76% return for the year.

The Medallion Fund's Performance and Risk Management

Medallion Fund Returns

The Medallion Fund stands as a legend in the hedge fund world. Between 1988 and 2018, it achieved an astounding annualized gross return of about 66% before fees. Even after factoring in Renaissance Technologies' hefty fees - a 5% management fee and a 44% performance fee - the fund still managed to deliver net annual returns of roughly 39%. To put this into perspective, a $100 investment in the Medallion Fund in 1988 would have grown to an eye-popping ~$398.7 million by 2018. In comparison, the same investment in the S&P 500 would have only reached $1,910.

What makes this performance even more extraordinary is how the fund thrived during market downturns. In 2008, when the S&P 500 plummeted by 38.5%, the Medallion Fund soared with a 98.2% return. During the dot-com crash from 2000 to 2002, it posted gross returns of 128.1%, 56.6%, and 51.1% in consecutive years. Since its launch in 1988, the fund has reportedly had only one losing year and just 17 losing months between 1993 and 2005. Such consistency is no accident - it’s the result of a rigorous approach to risk management.

Risk Management Framework

The Medallion Fund’s success isn’t just about generating returns; it’s also about managing risk with precision. Renaissance Technologies employs a market-neutral strategy, balancing long and short positions to reduce vulnerability to overall market fluctuations. This approach ensures that the fund’s performance isn’t overly tied to broader market trends.

Another cornerstone of its risk management is position sizing. The firm uses the Kelly Criterion, a formula originally developed for gambling, to calculate optimal position sizes based on its statistical advantage. This disciplined sizing helps control risk while maximizing growth potential.

Capacity limits are also key to the fund’s strategy. To avoid negatively impacting the markets it trades in, the fund is capped at around $10–15 billion. Additionally, profits are distributed to employees every six months, ensuring that the fund remains agile and maintains its trading edge.

One of the most striking examples of Renaissance’s risk management discipline came during the August 2007 "quant quake." Over just three days, the Medallion Fund lost $1 billion - roughly 20% of its value. Despite the turmoil, Renaissance relied on its automated trading systems, refraining from human intervention. This trust in their systems paid off, as the fund ended 2007 with an impressive 85.9% gain.

These strategies showcase how the Medallion Fund combines cutting-edge technology with disciplined risk management to achieve unparalleled results.

Infrastructure Requirements for Quantitative Trading

Renaissance Technologies' remarkable success is built on a foundation of immense computational power, scalable data systems, and lightning-fast connectivity. The firm operates with approximately 50,000 computer cores and 150 gigabits per second of global connectivity, enabling it to process real-time market data at staggering speeds. Its data warehouse, which spans petabytes and grows by about 40 terabytes daily, stores tick-by-tick historical data (dating back to the 1960s) along with alternative datasets like weather trends and satellite imagery. This infrastructure serves as the backbone for the split-second decisions made by its trading algorithms.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

"And you provide the best infrastructure, the best computers and so on. That was the model that we used in Renaissance."

"And you provide the best infrastructure, the best computers and so on. That was the model that we used in Renaissance."

Such a robust setup is vital for the advanced algorithms that power Renaissance's market dominance. While individual traders may not operate on this scale, reliable and high-performance computing remains critical for quantitative trading. Algorithms analyzing thousands of data points and making split-second decisions demand systems with minimal latency and zero downtime. Even a slight delay can significantly affect profitability. With algorithmic trading driving 60–73% of U.S. equity trades, having fast and dependable infrastructure can make all the difference.

For traders aiming to replicate even a fraction of this capability, dedicated trading VPS solutions provide a practical way to access high-performance infrastructure.

QuantVPS Plans for Quantitative Trading

QuantVPS offers tailored solutions designed for data-intensive trading strategies. Featuring NVMe storage, unmetered bandwidth, and a 100% uptime guarantee, these plans ensure your trading algorithms stay operational and responsive to market shifts.

The choice between Standard and Performance Plans depends on the computational needs of your trading strategy. Standard Plans are ideal for most algorithmic models, while Performance Plans cater to more demanding strategies. Here's a quick breakdown:

| Plan Type | Best For | CPU Cores | RAM | Storage | Network | Price (Annual) |

|---|---|---|---|---|---|---|

| VPS Pro (Standard) | 3–5 charts, moderate algorithms | 6 cores | 16GB | 150GB NVMe | 1Gbps+ | $69.99/month |

| VPS Pro+ (Performance) | 3–5 charts, complex models | 6 cores | 16GB | 150GB NVMe | 1Gbps+ | $90.99/month |

| VPS Ultra (Standard) | 5–7 charts, advanced strategies | 24 cores | 64GB | 500GB NVMe | 1Gbps+ | $132.99/month |

| VPS Ultra+ (Performance) | 5–7 charts, intensive backtesting | 24 cores | 64GB | 500GB NVMe | 1Gbps+ | $139.99/month |

| Dedicated+ Server (Performance) | Heavy workloads, multiple strategies | 16+ dedicated | 128GB | 2TB+ NVMe | 10Gbps+ | $279.99/month |

Each plan includes Windows Server 2022, DDoS protection, automatic backups, and compatibility with popular trading platforms like NinjaTrader, MetaTrader, and TradeStation. This infrastructure gives traders a solid foundation to refine and execute their strategies with confidence.

How to Apply Jim Simons' Principles to Your Trading

Jim Simons' extraordinary success at Renaissance Technologies wasn't a stroke of luck or gut instinct - it was the result of disciplined, data-driven strategies. While most traders don't have access to the massive computing power or vast data resources that Renaissance used, the core principles behind the Medallion Fund's 66.1% average annual return from 1988 to 2018 can still guide individual trading efforts. By adopting these methods, you can bring elements of Renaissance's winning formula into your own trading.

Building Scalable Algorithmic Trading Systems

At the heart of Simons' strategy is a straightforward yet profound idea: let the data lead the way. As Simons famously put it:

"We don't start with models. We start with data. We don't have any preconceived notions. We look for things that can be replicated thousands of times."

"We don't start with models. We start with data. We don't have any preconceived notions. We look for things that can be replicated thousands of times."

This approach begins with collecting clean, historical data and analyzing it for patterns that occur consistently. The goal is to identify short-term statistical edges that, when applied repeatedly and at scale, can generate meaningful returns. It's essential to avoid overfitting your models - relying too heavily on patterns that only work in specific datasets - by using ensemble methods that combine signals from multiple models.

Automation is key. Program your trading rules for entries and exits to remove emotional decision-making and ensure consistency. This is what separates systematic trading from discretionary approaches. A strong system is only as good as its execution, so reliable hardware and software are non-negotiable.

Using VPS Hosting for Better Performance

Once you’ve built a scalable trading system, you need the right infrastructure to execute your strategy without interruptions. Simons envisioned a system that could generate profits even while he slept. For individual traders, this means having infrastructure that operates around the clock. Relying on a personal computer introduces risks like outages and hardware failures, which can disrupt trades.

A dedicated VPS (Virtual Private Server) solves these issues by running in professional data centers with redundant power and internet connections. Beyond reliability, a VPS also reduces latency - the delay between receiving market data and executing an order. In a world where algorithmic trading accounts for 60% to 73% of U.S. equity trades, even a few milliseconds can make a difference. Hosting your VPS near exchange servers creates the low-latency environment needed for strategies like high-frequency trading and statistical arbitrage to succeed before opportunities vanish.

A solid infrastructure also ensures consistent execution. Your risk management rules and position sizing calculations will run exactly as designed, free from human hesitation that can lead to costly mistakes during volatile markets. Pair this discipline with ongoing model improvements, and you’ll be well on your way to narrowing the gap between individual trading systems and the institutional-grade methods pioneered by Simons.

Conclusion

Jim Simons and Renaissance Technologies have shown the world that data-driven decisions can outperform gut instincts. Their Medallion Fund's staggering 66.1% average annual return from 1988 to 2018 wasn't a stroke of luck. It was the outcome of precise mathematical models, automated systems, and a philosophy rooted in raw data rather than traditional market theories. With a 50.75% hit rate across millions of trades, they turned small statistical advantages into massive profits over time.

The takeaway? Strip away emotional biases with automation, focus on uncovering repeatable patterns in clean historical data, and stick to your model - even in volatile markets. As Jim Simons put it:

"We don't start with models. We start with data. We don't have any preconceived notions. We look for things that can be replicated thousands of times."

"We don't start with models. We start with data. We don't have any preconceived notions. We look for things that can be replicated thousands of times."

This mindset transforms trading into a science, not just an art. However, even the most brilliant strategies rely on technical stability.

No algorithm, no matter how advanced, can thrive without robust, reliable infrastructure. Renaissance Technologies' dominance was built on institutional-grade systems that operated 24/7 with low latency. For individual traders, professional hosting solutions are critical to avoid catastrophic failures - like the one that cost Knight Capital Group $440 million in just 45 minutes due to a technical glitch in 2012. Your mathematical edge is only as strong as the infrastructure supporting it.

As technology advances, the gap between retail traders and institutional quant funds is shrinking. Tools previously reserved for elite firms - like alternative data sources and low-latency execution platforms - are becoming more accessible. By committing to a disciplined, data-first approach and investing in reliable systems, traders can consistently exploit market inefficiencies.

FAQs

Can retail traders copy the Medallion Fund strategy?

Retail traders can't imitate the Medallion Fund's approach because it depends on proprietary algorithmic models created by Renaissance Technologies. These models aren't publicly accessible and demand a high level of expertise in fields like mathematics, computer science, and quantitative analysis.

What data do you need for statistical arbitrage?

Statistical arbitrage depends heavily on extensive historical data - covering prices, returns, and trading volumes across a wide range of securities. This data is crucial for spotting patterns, understanding mean reversion, and identifying statistical relationships. Traders use high-quality, high-frequency data to build and test models that generate actionable signals, allowing them to capitalize on market inefficiencies.

Firms like Renaissance Technologies illustrate the power of this approach. They leverage advanced algorithms and enormous datasets to detect subtle market patterns. This highlights how comprehensive and accurate data forms the backbone of successful statistical arbitrage strategies.

Why is low-latency execution so important?

Low-latency execution plays a critical role in enabling traders to capitalize on short-lived market inefficiencies. It allows algorithms to react almost instantly to sudden price movements, which can help boost profits while keeping risks in check. Faster trade execution ensures traders remain competitive in high-speed markets and seize opportunities that might only last for a moment.

Retail traders can't imitate the Medallion Fund's approach because it depends on proprietary algorithmic models created by Renaissance Technologies. These models aren't publicly accessible and demand a high level of expertise in fields like mathematics, computer science, and quantitative analysis.

Statistical arbitrage depends heavily on extensive historical data - covering prices, returns, and trading volumes across a wide range of securities. This data is crucial for spotting patterns, understanding mean reversion, and identifying statistical relationships. Traders use high-quality, high-frequency data to build and test models that generate actionable signals, allowing them to capitalize on market inefficiencies.

Firms like Renaissance Technologies illustrate the power of this approach. They leverage advanced algorithms and enormous datasets to detect subtle market patterns. This highlights how comprehensive and accurate data forms the backbone of successful statistical arbitrage strategies.

Low-latency execution plays a critical role in enabling traders to capitalize on short-lived market inefficiencies. It allows algorithms to react almost instantly to sudden price movements, which can help boost profits while keeping risks in check. Faster trade execution ensures traders remain competitive in high-speed markets and seize opportunities that might only last for a moment.

"}}]}