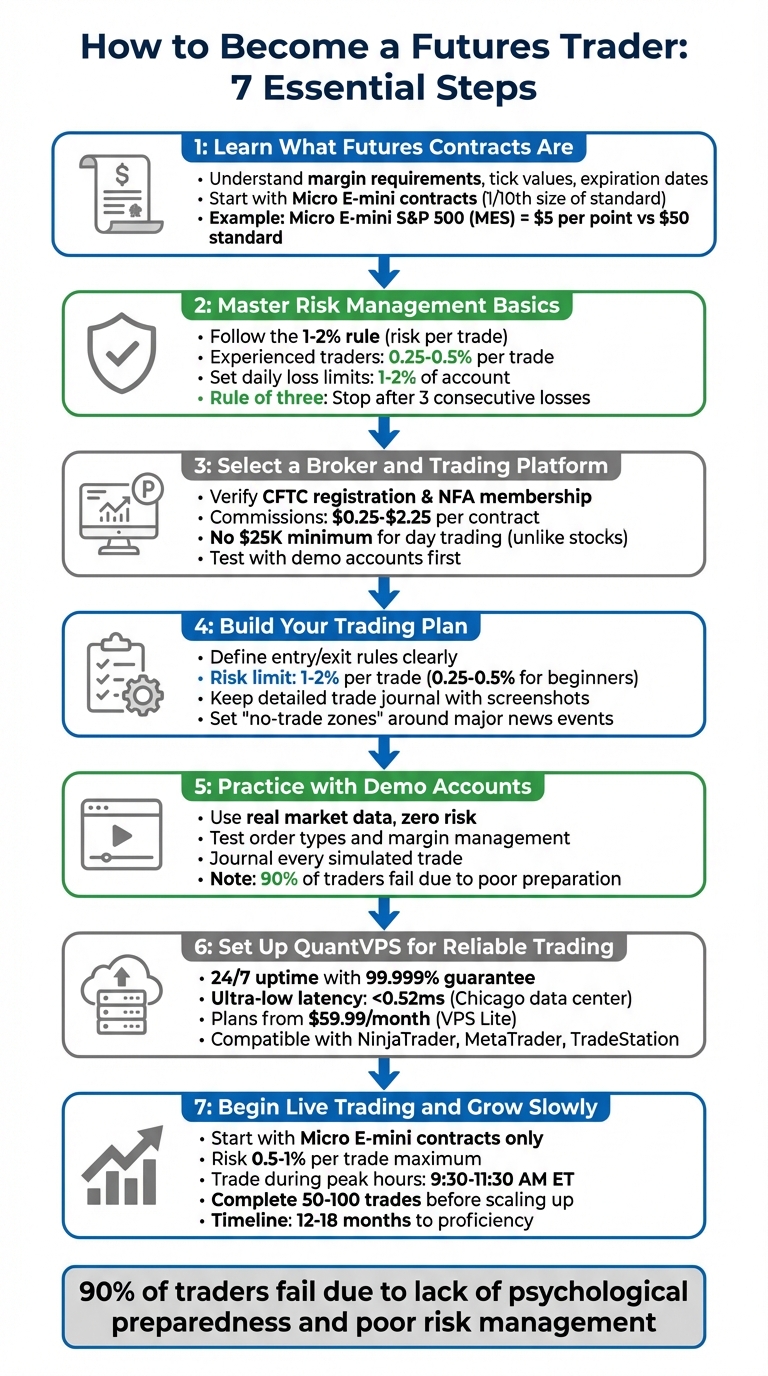

How to Become a Futures Trader: 7 Essential Steps for Beginners

Futures trading can be a profitable venture, but it requires preparation, discipline, and a clear strategy. Here's what you need to know to get started:

- Understand Futures Contracts: Learn how they work, including margin requirements, tick values, and expiration dates. Start with Micro E-mini contracts to limit risk.

- Master Risk Management: Stick to the 1–2% rule for risk per trade, use stop-loss orders, and set daily loss limits to protect your capital.

- Choose the Right Broker: Pick a regulated broker with a trading platform that fits your needs. Test with demo accounts to familiarize yourself with order types and tools.

- Create a Trading Plan: Define your strategy, entry/exit rules, and risk tolerance. Keep a detailed trading journal to refine your approach.

- Practice with Demo Accounts: Simulate trades in a risk-free environment to build confidence and test strategies.

- Set Up a VPS: Use a reliable Virtual Private Server (like QuantVPS) for stable, low-latency trading, especially during volatile market conditions.

- Start Small with Live Trading: Begin with Micro contracts, focus on disciplined execution, and track your performance. Scale up only after consistent success.

Futures trading offers opportunities but comes with significant risks. Success depends on preparation, risk management, and ongoing learning.

7 Steps to Become a Futures Trader: Complete Beginner's Roadmap

7 Steps to Become a Futures Trader: Complete Beginner's Roadmap

ULTIMATE Futures Trading Course (Step-by-Step)

This course covers the fundamentals, but you will also need to evaluate the top futures trading platforms to find the right execution environment for your strategy.

Step 1: Learn What Futures Contracts Are

A futures contract is a legally binding agreement between two parties to buy or sell a specific asset at a set price on a predetermined future date. Essentially, one party agrees to deliver the asset, while the other agrees to pay the agreed-upon price. These contracts are standardized by major exchanges like CME or ICE, which define details such as quantity, quality, and delivery terms to ensure smooth trading and liquidity.

Futures contracts cover a wide range of underlying assets. On the commodities side, you’ll find crude oil (1,000 barrels per contract), gold (100 troy ounces), and corn. On the financial side, contracts are based on indices like the S&P 500 and Nasdaq 100, currencies, Treasury bond interest rates, and even cryptocurrencies. Each contract has a defined minimum price increment, known as the tick size, along with its dollar value. For example, a standard gold futures contract usually has a tick size of 0.10, which translates to a tick value of $10.

When you open a futures position - whether long (expecting prices to rise) or short (expecting prices to fall) - you’ll need to post an initial margin. This is a fraction of the contract’s total value, and you’ll also need to maintain a minimum balance to avoid margin calls. For instance, controlling an E-mini S&P 500 contract, valued at $225,000, might require an initial margin of $12,000.

Futures contracts come with expiration dates, which means traders often close or roll over their positions before expiry to avoid dealing with the complexities of physical or cash settlement. Additionally, futures accounts are marked-to-market daily, meaning profits and losses are recalculated at the end of each trading session.

For beginners, Micro E-mini contracts are a great way to get started with futures trading. These smaller contracts are one-tenth the size of standard contracts, requiring less capital and margin. For example, a Micro E-mini S&P 500 (/MES) moves $5 per index point compared to $50 for the standard version. Similarly, a Micro E-mini Nasdaq 100 (/MNQ) moves $2 per point instead of $20. This scaled-down format lets you gain hands-on experience in real market conditions while limiting your financial exposure. Understanding these basics is a key step toward mastering risk management as you progress in your trading journey.

Step 2: Master Risk Management Basics

Once you grasp the concept of futures contracts, the next priority is safeguarding your capital. Smart risk management is what keeps you in the game, even when losses are inevitable. It lays the groundwork for proper position sizing and disciplined order execution.

Stick to the 1–2% rule. This means never risking more than 1%–2% of your total account balance on a single trade. Seasoned traders often go even lower, risking just 0.25%–0.5% per trade. For example, if you have a $10,000 account and follow the 0.5% rule, you'd limit your risk to $50 per trade. This ensures that even a series of losses won't drain your account.

Position sizing is key to controlling risk. Determining the right number of contracts to trade aligns your risk with market conditions. Here's a simple formula to guide you:

Contracts = (Max Cash Risk per Trade) / (Stop Loss in Ticks × Tick Value).

For instance, trading Micro E-mini S&P 500 (MES) futures with a $10,000 account and risking 0.5% ($50), you set a stop-loss 8 ticks from your entry. Since each tick on MES is worth each tick on MES is worth $1.25.25, your risk per contract is $10 (8 ticks × $1.25). Divide $50 by $10, and you get 5 contracts. Always round down to stay within your risk limits.

Stop-loss orders are non-negotiable. These orders automatically close your position once a specific loss is reached, helping you avoid emotionally driven decisions. A good rule of thumb: place your stop-loss 1–2 ticks below a recent swing low rather than relying on arbitrary levels. Bracket orders can also be helpful, as they let you set both stop-loss and profit targets at the same time.

Set a daily loss limit to stay disciplined. Limit your daily losses to 1%–2% of your account balance, and stop trading once you hit that threshold.

"No revenge trading. No 'double size to win it back.' This one rule can save your year".

"No revenge trading. No 'double size to win it back.' This one rule can save your year".

Another helpful strategy is the "rule of three": stop trading for the day after three consecutive losing trades. This gives you a chance to reset mentally and avoid spiraling into emotional decisions. By sticking to these boundaries, you protect your capital and prepare yourself for the next steps in building a solid trading plan.

Step 3: Select a Broker and Trading Platform

Once you've established your risk management plan, the next step is to choose a broker and trading platform that align with your trading goals. As an individual trader, you'll need to work with a registered intermediary - either a Futures Commission Merchant (FCM) or an Introducing Broker (IB) - to execute your trades.

Start by ensuring your broker is properly regulated. Check their registration with the Commodity Futures Trading Commission (CFTC) and confirm they are a member of the National Futures Association (NFA). These credentials help ensure your funds are kept separate and secure. Then, explore the broker's website, particularly the "Software" or "Technology" section, to see if they support platforms like NinjaTrader, MetaTrader, or TradeStation. For instance, NinjaTrader, recognized as the top Futures Broker for 2026 by BrokerChooser.com, provides free tools for charting, backtesting, and simulation.

Understand the Costs: Commissions generally range from $0.25 to $2.25 per contract, but you may also face platform or data fees. Additionally, accessing real-time market data from exchanges like CME or ICE often comes with monthly data feed charges. While some brokers offer $0 account minimums, you'll still need enough capital to meet margin requirements, which are typically $2,000 or more for standard contracts. If you're starting with less capital, Micro E-mini contracts - 1/10th the size of standard contracts - can be a more accessible option. However, keeping a higher balance is recommended to provide a financial cushion.

Take advantage of free demo accounts to test the platform. Practice placing different order types, such as Market, Limit, Stop-Limit, and OCO orders, and explore features like DoM (Depth of Market) ladders and technical analysis tools. Demo accounts not only help you refine your trading strategy but also give you hands-on experience with real-time market conditions. During this phase, evaluate the broker's customer service and ensure they provide access to the specific markets you're interested in trading.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

Once you're confident the broker meets your requirements, you can move forward with the application process. You'll need to provide details about your net worth, annual income, and trading experience. After signing the necessary risk disclosure agreements, deposit your "risk capital" - money you can afford to lose - and confirm that your account is set up for futures trading. Unlike stock trading, futures trading doesn't require a $25,000 minimum balance for day trading, giving you more flexibility as you begin.

Step 4: Build Your Trading Plan

Now that you’ve chosen a broker, it’s time to organize your trading approach. A written trading plan is essential - it removes guesswork and keeps you disciplined. As Winston Churchill famously said, "He who fails to plan is planning to fail". Your plan should clearly outline what you’ll trade, your entry and exit strategies, and how much risk you’re willing to take on each position.

Start by choosing your target market and futures trading strategies. For instance, if you’re trading the E-mini S&P 500 (ES), decide whether you’ll focus on trend following - entering during pullbacks in strong market moves - or range trading. Day traders close all positions before the market ends to avoid overnight exposure, while scalpers aim to profit from small price movements and need lightning-fast execution. Make sure your strategy aligns with your schedule and personality.

"Trade smarter, not more".

"Trade smarter, not more".

Set clear entry and exit rules. For example, you might only enter a trend trade when the price is above both the 20-EMA and VWAP on a 15-minute chart. Exit half your position at 1.5 times your risk, and manage the rest by trailing your stop under higher lows. Define your stop-loss placement carefully: use the formula (Maximum Dollar Risk) / (Stop Distance [ticks] × Tick Value). To protect your account, limit your risk to 1% to 2% of your total balance per trade - and if you’re new to trading, consider reducing this to 0.25% to 0.5%.

"The most important rule of trading is to play great defense, not great offense".

"The most important rule of trading is to play great defense, not great offense".

Keep a detailed trade journal to monitor your progress. Record every trade, including entry and exit points, contract size, your reasoning, and even your emotional state. Add chart snapshots to make reviewing your strategies easier. Implement safeguards like a "circuit breaker" rule: stop trading after three consecutive losses or if you hit your daily loss limit. Identify "no-trade zones", such as the five minutes before or after high-impact news events like CPI or FOMC announcements. At the end of each week, review your journal to detect patterns, but avoid overhauling your plan based on just one bad day.

Step 5: Practice with Demo Accounts

Before diving in with real money, it’s smart to start in a demo environment. Demo accounts allow you to place trades using actual market data - but without risking your hard-earned cash. This is your chance to get comfortable with order placement, setting stop-losses, managing margins, and testing your trading plan under realistic market conditions.

"Futures trading isn't about predicting the market - it's about preparing for it with structure, tools, and discipline." - Apex Trader Funding

"Futures trading isn't about predicting the market - it's about preparing for it with structure, tools, and discipline." - Apex Trader Funding

Many top online futures trading platforms offer free demo accounts. For example, NinjaTrader provides a 14-day live data trial, while CME Group offers a free simulator. Some platforms also include market replay features, where you can pause, rewind, and analyze historical tick-by-tick data. This lets you experiment with different timeframes and contract sizes - like standard, E-mini, and Micro contracts - to see how leverage impacts your account.

Keep a detailed journal of every simulated trade. Record your entry and exit points, your thought process, your emotional state, and the results. This habit will help you spot mistakes and fine-tune your strategy. Only transition to live trading after you’ve consistently shown disciplined, reliable performance in the demo environment. It’s worth noting that around 90% of traders lose money due to poor risk management and lack of preparation.

That said, demo accounts can’t fully mimic the psychological pressure of trading real money. Even if you excel in simulations, your behavior might shift when your own capital is on the line. Use your demo experience to hone both your technical skills and mental discipline. Once you’ve mastered risk management and built confidence, you can move forward with setting up QuantVPS for stable live trading.

Step 6: Set Up QuantVPS for Reliable Trading

After gaining confidence with demo trading, the next step is ensuring your live trades execute smoothly and without interruptions. Relying on home internet during key market moments can be risky - it might fail at the worst possible time. That’s where a Virtual Private Server (VPS) comes in. A VPS allows your trading platform to run 24/7 from a professional data center, completely separate from your local computer. This constant, reliable connectivity is essential as you move into live trading.

QuantVPS is specifically built for futures traders who need low latency and high performance. Its main data center is located in Chicago, close to the CME Group's matching engines, and uses direct fiber-optic cross-connects to achieve lightning-fast latency of less than 0.52 milliseconds. With powerful processors, NVMe SSD storage, and a 99.999% uptime guarantee, QuantVPS ensures a fast and dependable trading experience.

QuantVPS is compatible with popular futures trading platforms, including NinjaTrader, Sierra Chart, TradeStation, Quantower, and MetaTrader 4/5. It also supports leading data feeds like Rithmic, CQG, and dxFeed. You can access your VPS using Windows Remote Desktop (RDP) from any device with an internet connection. Pricing is flexible: the VPS Lite plan starts at $59.99/month (offering 4 cores, 8GB RAM, and 70GB NVMe storage) for traders running 1–2 charts. For more demanding setups, the VPS Pro ($99.99/month) and VPS Ultra ($189.99/month) plans offer additional resources and multi-monitor support. If you’re handling heavy workloads, the Dedicated Server plan at $299.99/month provides even greater capacity.

Setting up QuantVPS is straightforward. Use the website’s configurator to select your plan, complete your purchase, and then use your RDP credentials to install your trading platform and data feed. QuantVPS includes built-in DDoS protection, advanced firewall settings, and 24/7 U.S.-based technical support, ensuring a secure and stable trading environment.

This setup is especially crucial if you’re working with proprietary trading firms like Apex or Topstep, which require a stable, low-latency connection to meet their strict evaluation standards. With QuantVPS, you’ll have the reliable infrastructure trusted by professional traders, allowing you to confidently transition to live trading.

Step 7: Begin Live Trading and Grow Slowly

With your demo practice and VPS setup in place, it's time to step into live trading. Start small by trading Micro E-mini contracts. These smaller contracts, like MES or MNQ, are perfect for beginners - they let you gain valuable live trading experience while keeping financial risks manageable.

For your first trade, focus on the basics:

- Choose a Micro contract (MES or MNQ).

- Decide your trade direction: Long (buying) or Short (selling).

- Use an order type that fits your strategy - limit, market, or stop.

To protect your account, limit your risk per trade to just 0.5%–1% of your total balance and set a stop-loss immediately. Aim to trade during peak market hours, typically 9:30 AM to 11:30 AM ET, when liquidity is high, and spreads are tighter.

As you transition to live trading, stick to the strong risk management principles you’ve already practiced. Keep a detailed trading journal to track every move. For each trade, note the date, entry and exit prices, profit or loss, and even your emotional state. This journal isn’t just a record - it’s a tool for improvement. Review it weekly to spot patterns and refine your approach.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

"Risk management separates professional traders from beginners, as poor risk control can lead to rapid losses no matter how accurate the strategy is." – EBC Financial Group

"Risk management separates professional traders from beginners, as poor risk control can lead to rapid losses no matter how accurate the strategy is." – EBC Financial Group

Don’t rush to scale up. Wait until you’ve completed 50–100 trades with consistent profitability and a proven edge. When you're ready to increase your position size, do it gradually - add just one additional Micro contract at a time. Avoid jumping straight to standard contracts. As your trading activity grows, consider upgrading your QuantVPS plan to handle the increased processing needs, ensuring smooth and efficient trade execution.

Conclusion

Becoming a successful futures trader isn’t about chasing quick wins - it’s about building a strong foundation through education, practice, and discipline. Let’s recap the key steps: understanding futures contracts, mastering risk management, choosing the right broker, creating a detailed trading plan, practicing with demo accounts, setting up QuantVPS, and transitioning to live trading. Each of these steps lays the groundwork for disciplined and effective trading.

It’s worth noting that 90% of traders fail due to a lack of psychological preparedness. Developing mental resilience is just as crucial as honing technical skills or implementing automated futures trading systems. The markets are ever-changing, influenced by factors like geopolitical events, Federal Reserve policies, and commodity supply shifts. This dynamic environment demands ongoing education and adaptability. Most traders take 12 to 18 months - or longer - to achieve real proficiency.

"Trading is definitely one of those undertakings where one has to constantly study, evolve and grow." – Cannon Trading

"Trading is definitely one of those undertakings where one has to constantly study, evolve and grow." – Cannon Trading

Risk management should always remain a top priority. Keep a trading journal to track your performance and identify patterns in your decision-making. And as you progress, consider upgrading your QuantVPS plan to ensure your execution speed keeps up with the fast-paced demands of the market. Trading success comes from consistent learning, disciplined execution, and a commitment to growth.

FAQs

Why are Micro E-mini contracts a good starting point for new futures traders?

Micro E-mini contracts are a great starting point for beginners because they are 1/10 the size of standard E-mini contracts. This smaller scale comes with key benefits: lower margin requirements, reduced capital investment, and smaller tick values. Together, these factors help limit financial risk, making it easier for new traders to dip their toes into the market without putting too much on the line.

Another advantage is the ability to fine-tune position sizing. The smaller contract size offers traders more flexibility to experiment with strategies and manage trades more precisely. For those just learning the ropes of the futures market, Micro E-mini contracts provide a practical way to gain hands-on experience while building confidence and honing their trading skills.

How can I keep my trading platform stable during volatile markets?

To keep your trading platform running smoothly during periods of market turbulence, start by opting for a dedicated, ultra-low-latency VPS. This ensures you have a fast and stable connection, even when prices are changing rapidly. Look for one with guaranteed uptime and top-tier hardware to minimize disruptions.

Protect your platform by enabling DDoS protection to handle unexpected traffic spikes that could otherwise cause interruptions. Regular updates to your operating system and trading software are also essential to address bugs or vulnerabilities that might surface under pressure. It's a good idea to test your setup with a demo account during simulated periods of high volatility to confirm that everything works as expected.

Lastly, combine your VPS with a reliable internet connection and a backup power solution, like an uninterruptible power supply (UPS). This way, you’re covered against local outages and can keep your platform responsive even during the most chaotic market conditions.

What are the essential elements of a successful futures trading plan?

A solid futures trading plan hinges on a few essential elements to maintain consistency and discipline in your trading approach. Start by establishing clear entry and exit rules. For instance, outline the specific conditions for entering a trade - whether it’s based on price levels, trading volume, or even the time of day. On the exit side, set predefined strategies like stop-loss levels or profit targets to sidestep emotional decision-making during volatile moments.

Another critical piece is position sizing, which plays a big role in managing risk. A popular tactic is to cap your risk at a fixed percentage of your account balance - say, 1% per trade - and adjust the number of contracts you trade accordingly. It’s also wise to concentrate on a few specific futures markets and trading sessions where you’ve historically performed well, rather than spreading your efforts across too many areas.

Finally, implement risk management limits to safeguard your capital. This could include setting a maximum daily loss or an overall drawdown threshold. Make it a habit to document every trade, evaluate your performance, and tweak your strategy as needed. A well-thought-out plan not only keeps you disciplined but also allows you to adapt as market dynamics evolve.

Micro E-mini contracts are a great starting point for beginners because they are 1/10 the size of standard E-mini contracts. This smaller scale comes with key benefits: lower margin requirements, reduced capital investment, and smaller tick values. Together, these factors help limit financial risk, making it easier for new traders to dip their toes into the market without putting too much on the line.

Another advantage is the ability to fine-tune position sizing. The smaller contract size offers traders more flexibility to experiment with strategies and manage trades more precisely. For those just learning the ropes of the futures market, Micro E-mini contracts provide a practical way to gain hands-on experience while building confidence and honing their trading skills.

To keep your trading platform running smoothly during periods of market turbulence, start by opting for a dedicated, ultra-low-latency VPS. This ensures you have a fast and stable connection, even when prices are changing rapidly. Look for one with guaranteed uptime and top-tier hardware to minimize disruptions.

Protect your platform by enabling DDoS protection to handle unexpected traffic spikes that could otherwise cause interruptions. Regular updates to your operating system and trading software are also essential to address bugs or vulnerabilities that might surface under pressure. It's a good idea to test your setup with a demo account during simulated periods of high volatility to confirm that everything works as expected.

Lastly, combine your VPS with a reliable internet connection and a backup power solution, like an uninterruptible power supply (UPS). This way, you’re covered against local outages and can keep your platform responsive even during the most chaotic market conditions.

A solid futures trading plan hinges on a few essential elements to maintain consistency and discipline in your trading approach. Start by establishing clear entry and exit rules. For instance, outline the specific conditions for entering a trade - whether it’s based on price levels, trading volume, or even the time of day. On the exit side, set predefined strategies like stop-loss levels or profit targets to sidestep emotional decision-making during volatile moments.

Another critical piece is position sizing, which plays a big role in managing risk. A popular tactic is to cap your risk at a fixed percentage of your account balance - say, 1% per trade - and adjust the number of contracts you trade accordingly. It’s also wise to concentrate on a few specific futures markets and trading sessions where you’ve historically performed well, rather than spreading your efforts across too many areas.

Finally, implement risk management limits to safeguard your capital. This could include setting a maximum daily loss or an overall drawdown threshold. Make it a habit to document every trade, evaluate your performance, and tweak your strategy as needed. A well-thought-out plan not only keeps you disciplined but also allows you to adapt as market dynamics evolve.

"}}]}