Polymarket API Now Available in the U.S.: No Longer Geoblocked (2026 Update)

The Polymarket API is now accessible to U.S. developers without restrictions, thanks to the launch of Polymarket US. Previously blocked due to regulatory issues, U.S. users can now legally interact with prediction markets through a dedicated platform regulated by the CFTC. The API offers 23 REST endpoints and 2 WebSocket endpoints, enabling real-time market data access, automated trading bots, and AI integration. Key features include:

- Real-time data streaming via WebSockets for up to 10 instruments.

- Central Limit Order Book (CLOB) for detailed market depth and order flow analysis.

- Tools for building bots with Python and TypeScript SDKs.

- Regulatory compliance with secure Ed25519 API key authentication.

U.S. traders can now deploy advanced trading strategies, leveraging low-latency infrastructure and legal clarity. This update removes barriers for developers, opening new opportunities in prediction markets.

What the Polymarket API Offers

The Polymarket US Retail API includes 23 REST endpoints and 2 WebSocket endpoints, categorized into five main areas: Markets, Orders, Events, Portfolio management, and Account operations. These endpoints enable a variety of functions, from retrieving market data to executing trades and managing portfolios. Let’s dive into how these features support real-time trading, automated bots, and AI-driven strategies.

Real-Time CLOB Data Access

The API provides direct access to Polymarket's Central Limit Order Book (CLOB), offering a detailed view of market depth, best bid and offer (BBO) prices, and settlement details. Unlike automated market makers, the CLOB model reveals all pending orders, making it easier to calculate slippage and optimize trades. Public endpoints allow up to 60 requests per minute, but WebSocket connections for live data streaming have virtually no restrictions. Through the /v1/ws/markets endpoint, you can subscribe to real-time updates for up to 10 instruments simultaneously without worrying about rate limits.

For traders using quantitative strategies, this level of access allows you to track order flow, identify liquidity changes, and respond to market shifts in milliseconds.

Building Automated Trading Bots

With real-time data at your fingertips, the API is well-suited for developing automated trading bots. It supports MARKET orders (executed immediately at current prices) and LIMIT orders (executed only at a specified price). These features enable both simple event-driven trades and more complex market-making strategies. SDKs for Python 3.10+ and TypeScript (Node 18+) streamline tasks like Ed25519 authentication and error handling.

To begin, you'll need to generate API keys via the developer portal after completing identity verification through the iOS app. Keep in mind that the private key is displayed only once, so storing it securely is crucial. Once authenticated, your bot can place orders, cancel them (individually or in bulk), and preview the potential impact of orders before execution.

Connecting AI and Quantitative Models

The API's WebSocket data can seamlessly integrate with machine learning frameworks, allowing AI models to process live updates, spot pricing irregularities, and execute trades in real time. You can also filter, paginate, and sort market queries to tailor the data for your specific needs.

For larger players like independent software vendors (ISVs) or futures commission merchants (FCMs), Polymarket offers an Exchange Gateway with expanded management tools. However, the Retail API already provides individual developers and smaller trading teams with everything needed to implement advanced strategies, from arbitrage to trend-following algorithms. By combining the API's robust data feed with stable, low-latency infrastructure, you can execute trades around the clock without interruptions. This setup represents a significant step forward for U.S. developers working in prediction markets.

Where to Deploy Your Trading Infrastructure

Amsterdam vs New York Server Deployment Comparison for Polymarket Trading

Amsterdam vs New York Server Deployment Comparison for Polymarket Trading

Choosing the right server location is a game-changer for automated trading. For U.S. traders, access to the Polymarket API has reshaped how deployment strategies are planned.

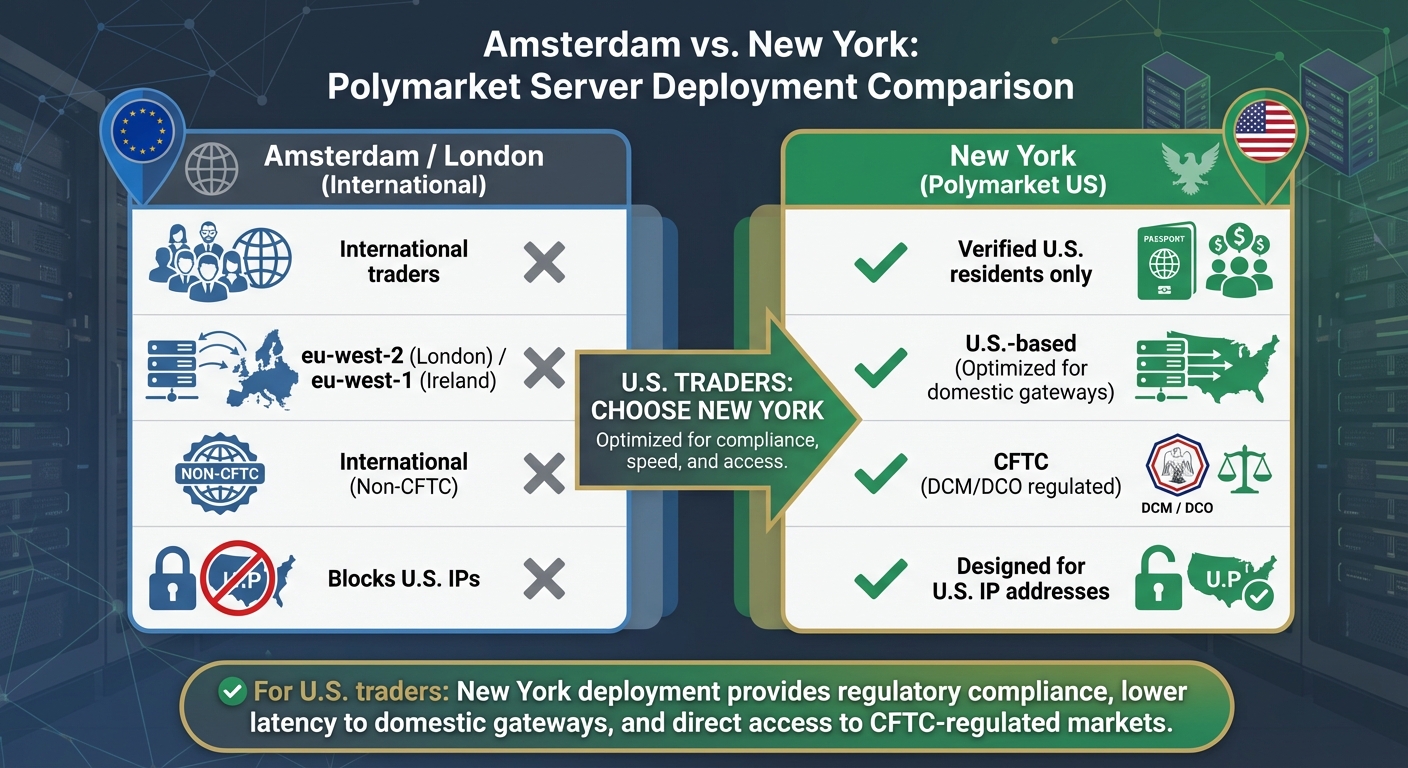

Amsterdam vs. New York: Location Comparison

In the past, Amsterdam and London were the preferred hubs for prediction market infrastructure. Polymarket's international platform (polymarket.com) operates its primary servers in the eu-west-2 (London) region, with eu-west-1 (Ireland) as the nearest alternative outside georestricted zones. Naturally, traders targeting the international order book leaned toward European data centers to reduce latency.

Now, Polymarket has split its infrastructure into two distinct platforms: one for international users and another for U.S. traders. The international platform blocks U.S. IPs along with those from 32 other countries. Meanwhile, the U.S. platform (polymarket.us) is regulated by the CFTC as a Designated Contract Market (DCM) and Derivatives Clearing Organization (DCO). These platforms cater to separate user bases, each operating under different regulations and optimized for their respective regions. Here's a quick breakdown:

| Feature | Amsterdam / London (International) | New York (Polymarket US) |

|---|---|---|

| Primary Users | International traders | Verified U.S. residents only |

| Server Region | eu-west-2 (London) / eu-west-1 (Ireland) | U.S.-based (Optimized for domestic gateways) |

| Regulatory Body | International vs. CFTC-regulated | CFTC (DCM/DCO regulated) |

| Geoblocking | Blocks U.S. IPs | Designed for U.S. IP addresses |

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

This comparison highlights why New York is the clear choice for U.S. traders.

Why New York Works for U.S. Traders

New York hosting aligns perfectly with U.S. regulatory standards and latency requirements, giving traders a significant edge. By deploying in New York, U.S. traders gain access to a direct domestic exchange gateway. This eliminates the need to rely on European routing or navigate the complexities of EU regulatory changes. Plus, identity verification through the Polymarket US iOS app ensures your infrastructure is fully integrated with the domestic platform.

Another key advantage is proximity to U.S. financial data centers. For strategies that combine Polymarket data with other market feeds, being closer to these centers can make all the difference. While the international platform imposes a 60 requests per minute cap on public endpoints, WebSocket connections for real-time data remain virtually unlimited. Hosting in New York ensures stable WebSocket streams to endpoints like /v1/ws/markets and /v1/ws/private, without the latency issues caused by transatlantic routing.

Regulatory clarity is also a major benefit. Operating under CFTC oversight provides a well-defined compliance framework, sparing you from the uncertainties of international regulations. For traders building automated systems, this stability is just as important as achieving low latency.

How to Run a Polymarket Bot in the U.S.

Ready to dive into running a Polymarket bot in the U.S.? Here’s a breakdown of the essential steps to get started and keep your bot running smoothly.

First, make sure your identity is verified through the Polymarket US iOS app. This step is crucial for generating your Ed25519 API keys, which are the foundation for accessing the API securely. Once verified, you can use Polymarket’s comprehensive API endpoints to implement your trading strategies.

Why Use Low-Latency VPS Infrastructure?

Running a bot from your home setup just won’t cut it. Issues like network interruptions, power outages, and system updates can cause downtime, which will hurt your bot’s performance. A low-latency VPS ensures stable connectivity and dedicated resources. For U.S. traders, hosting your VPS in New York is ideal - it provides quick access to domestic gateways and keeps latency low when connecting to Polymarket’s servers.

Your VPS should be equipped with Python 3.10+ or Node.js 18+, as these versions are compatible with the official SDKs. These SDKs simplify tasks like Ed25519 request signing and automating authentication. Also, don’t overlook time synchronization. The API relies on precise timestamps to prevent replay attacks, so even a minor time mismatch can cause authentication errors.

Leveraging WebSockets for Real-Time Data

Forget about polling REST endpoints - it’s inefficient and will quickly hit the API’s rate limit of 60 requests per minute. Instead, use WebSocket connections for real-time data streaming. Polymarket’s US Retail API offers two WebSocket endpoints:

-

/v1/ws/markets: Streams live market data for up to 10 instruments. -

/v1/ws/private: Provides updates on orders, positions, and balances.

WebSockets allow unlimited real-time data, making them essential for latency-sensitive strategies. The official Python and TypeScript SDKs also support asynchronous operations, so you can manage multiple WebSocket streams without slowing down your bot.

Keeping Your Bot Running 24/7

Prediction markets are always active, so your bot needs to operate continuously. To ensure reliable 24/7 performance, your infrastructure should include:

- Error handling for network interruptions.

- Typed exceptions for API-specific issues.

- Exponential backoff logic for retries during high-traffic periods.

- Heartbeat and reconnection mechanisms to recover quickly from network drops.

Logging all API interactions is a smart move - it helps with debugging and monitoring performance. Before risking real money, take advantage of the sandbox environment. This is where you can test your bot’s integration, confirm it follows exchange rules, and handle edge cases effectively.

Trading Opportunities in Prediction Markets

The introduction of unrestricted API access has opened up new doors for U.S. traders in prediction markets. Unlike the highly efficient futures exchanges, prediction markets often leave room for mispricings - creating opportunities for algorithmic traders to step in. This regulatory change allows U.S. traders to deploy advanced, real-time strategies that were previously out of reach due to limited access.

Spotting Market Inefficiencies

Prediction markets present unique advantages for identifying inefficiencies. Through the Central Limit Order Book (CLOB) API, traders gain access to real-time order book data, including midpoints, spreads, and price history. This data can reveal outcomes that are mispriced compared to actual probabilities. For instance, if breaking news alters the likelihood of a political event but the market hasn’t caught up, an automated bot can act faster than manual traders to capitalize on the gap.

Another powerful tool is public wallet tracking. The Data API provides programmatic access to user positions, activity, and leaderboard rankings. This allows traders to monitor "smart money" - those high-volume or historically successful traders. Additionally, markets tagged as "Negative Risk" can offer numerical or hedging advantages. Together, these insights pave the way for arbitrage opportunities and strategies that enhance liquidity.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Developing Arbitrage and Liquidity Tools

Cross-venue arbitrage becomes a practical strategy when comparing Polymarket’s real-time prices with external sources like sportsbooks, financial exchanges, or live news feeds . The API’s WebSocket streams provide the speed needed to execute these strategies effectively. Liquidity detection is just as important. Using endpoints like get_open_interest and get_live_volume, traders can identify markets with enough depth to handle larger trades without causing significant price slippage.

Market-making strategies also come into play here. By taking advantage of Maker Rebates and Liquidity Rewards programs, traders can address inefficiencies in market depth. Tools like the book and bbo (Best Bid Offer) methods allow you to analyze the order book before committing capital .

Event-Driven Trading Strategies

Event-driven strategies build on arbitrage insights by focusing on immediate market reactions to real-world events. With WebSocket endpoints streaming real-time data, bots can respond to breaking news faster than retail traders using traditional web or mobile platforms . The CLOB API supports sub-second reactions, which is critical when an event - like a sports game outcome - becomes clear before the market fully adjusts. Automated stop-loss and take-profit mechanisms further help manage positions in rapidly changing market conditions.

What This Means for U.S. Traders

The removal of API geoblocking marks a major shift for U.S. traders in prediction markets. Instead of relying on manual trading through apps or inefficient workarounds, developers now have direct API access. This opens the door for automated strategies that were previously out of reach for domestic users. Combined with the advanced features mentioned earlier, this change allows traders to implement more efficient and responsive strategies.

Main Benefits of API Access

Real-time execution: With dedicated WebSocket streams, traders receive real-time updates on up to 10 instruments, enabling responses to market changes in under a second. This real-time infrastructure is essential for reacting quickly to breaking news or fast-moving events.

Comprehensive order management: The API includes six endpoints to handle orders - creating, canceling (individually or in bulk), modifying, and querying. To simplify the process, official SDKs for Python 3.10+ and TypeScript (Node 18+) handle Ed25519 request signing, so developers can focus on building their strategies.

Regulatory compliance: The domestic API complies fully with U.S. regulations, offering a clear and secure framework for automated trading.

Next Steps for Traders and Developers

To take full advantage of these new tools, U.S. traders should follow these steps:

- Complete identity verification: Download the Polymarket US iOS app, go through the KYC process, and generate API keys via the developer portal. Be sure to save the private key immediately, as it will only be displayed once. Use the same authentication method (Apple, Google, or email) across both the app and portal to avoid access issues.

- Fund your wallet: Load your wallet with USDC.e for purchasing outcome tokens and POL for gas fees if you're using an EOA wallet.

-

Prioritize WebSocket connections: Instead of relying on REST polling, use the

/v1/ws/marketsand/v1/ws/privateendpoints for real-time data. This approach also helps you stay within the 60 requests-per-minute limit on public endpoints. For high-volume needs, such as those of ISVs, FCMs, or institutional traders, contact onboarding@qcex.com to apply for the Exchange Gateway, which offers advanced account management and FIX support.

FAQs

Do I need a U.S. Polymarket account to use the API?

Yes, you'll need to log in using a Polymarket US account to create API keys for programmatic trading. This step is essential for accessing the API, whether you're automating trades or integrating it with other tools.

How do I create and secure my Ed25519 API keys?

To set up and protect your Ed25519 API keys for Polymarket, start by creating an account and completing identity verification using the Polymarket US iOS app. Once verified, generate your keys through the developer portal. Keep in mind, the private key will only appear once during this process, so make sure to store it in a safe place.

Should I deploy my bot in New York or Europe for best latency?

Deploying in New York often results in better latency because it reduces the need to rely on European routing policies. This location also benefits from fewer regulatory uncertainties and is geographically closer to U.S.-based infrastructure. On top of that, New York provides efficient, low-latency routing to cloud regions, sidestepping potential regulatory hurdles that might arise in Europe.

Yes, you'll need to log in using a Polymarket US account to create API keys for programmatic trading. This step is essential for accessing the API, whether you're automating trades or integrating it with other tools.

To set up and protect your Ed25519 API keys for Polymarket, start by creating an account and completing identity verification using the Polymarket US iOS app. Once verified, generate your keys through the developer portal. Keep in mind, the private key will only appear once during this process, so make sure to store it in a safe place.

Deploying in New York often results in better latency because it reduces the need to rely on European routing policies. This location also benefits from fewer regulatory uncertainties and is geographically closer to U.S.-based infrastructure. On top of that, New York provides efficient, low-latency routing to cloud regions, sidestepping potential regulatory hurdles that might arise in Europe.

"}}]}