Where Are Polymarket Servers Located? Polymarket Infrastructure, Latency & Geo-Restrictions Explained

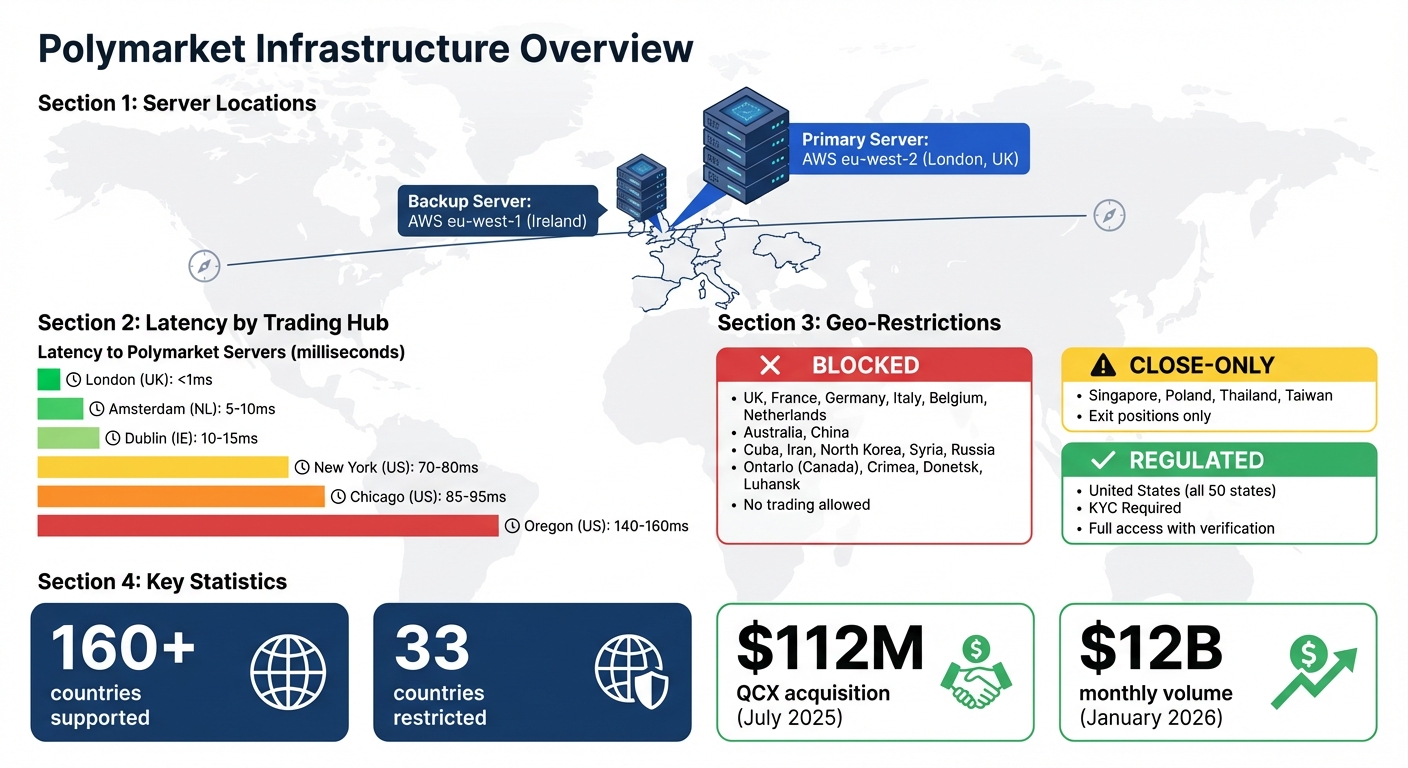

Polymarket operates its primary servers through AWS in London (eu-west-2), with a backup in Ireland (eu-west-1). These server locations ensure fast order execution but also enforce strict geo-restrictions, blocking access from 33 countries and limiting new trades in "close-only" regions. Traders in Dublin benefit from low latency (5–10ms), while U.S.-based traders face higher delays (70–160ms).

Key points:

- Server Locations: London (primary), Ireland (backup).

- Latency: Lowest in Europe (5–15ms); higher in the U.S. (70–160ms).

- Geo-Restrictions: Blocks 33 countries, including the UK, France, and Germany. Close-only rules apply to regions like Singapore and Poland.

- Compliance: U.S. users must complete KYC due to regulatory requirements.

- Trading APIs: Core APIs include Gamma (market data), CLOB (order management), and Data (user info).

For traders, selecting a Dublin VPS near compliant regions or Ireland can reduce latency while adhering to restrictions. Avoid using VPNs, as Polymarket strictly enforces its Terms of Use.

Polymarket Server Latency and Geo-Restrictions by Region

Polymarket Server Latency and Geo-Restrictions by Region

Polymarket Server Locations

Primary Server Regions

Polymarket's core trading infrastructure is centered in AWS eu-west-2 (London). This region powers the platform's Central Limit Order Book (CLOB), which is responsible for matching buy and sell orders in real time. London was selected as the primary location due to its position within major financial data networks, offering the low-latency environment essential for high-frequency trading.

In addition to London, Polymarket leverages AWS eu-west-1 (Ireland) as a secondary region. This setup provides a backup route to maintain performance and adhere to regulatory standards. The dual-region approach ensures fast order execution while meeting compliance needs. These strategically chosen server locations support Polymarket's API-driven and geoblocked trading framework.

Interestingly, although the servers are based in the United Kingdom, UK residents are not permitted to access Polymarket. The decision to place servers in specific locations is driven by technical performance requirements rather than user accessibility or legal trading eligibility.

To further optimize performance, Polymarket's architecture also extends to additional global locations.

Global Server Distribution

Expanding on its European base, Polymarket has developed a global infrastructure. In July 2025, the company acquired QCX LLC, a CFTC-licensed derivatives exchange, for $112 million. By November 2025, Polymarket secured an Amended Order of Designation from the CFTC, enabling the launch of a regulated U.S. platform. This U.S. entity operates under strict regulatory oversight and enforces mandatory KYC verification for users across all 50 states.

Today, Polymarket supports traders in over 160 countries while maintaining compliance with regulations in 33 restricted jurisdictions. This global setup directly impacts latency for traders in key regions. For example, European users benefit from latencies as low as 5–15 milliseconds, while U.S.-based traders experience latencies ranging from 70–160 milliseconds. These variations in latency can significantly influence algorithmic strategies that depend on precise, split-second execution.

Polymarket Infrastructure Details

API Endpoints and Their Functions

Polymarket's infrastructure is built around three REST APIs, each serving a specific purpose. Here's a closer look:

-

Gamma API: Found at

https://gamma-api.polymarket.com, this API acts as the discovery layer. It provides market metadata, event listings, and category tags. Data indexing here has a latency of about 1 second. -

CLOB API: Accessible at

https://clob.polymarket.com, this is the backbone of Polymarket's trading engine. It handles order placements, cancellations, real-time orderbooks, and price quotes. Supporting this API are two WebSocket services:-

CLOB WebSocket (

wss://ws-subscriptions-clob.polymarket.com/ws/): Offers real-time updates for orderbooks and order statuses. -

RTDS WebSocket (

wss://ws-live-data.polymarket.com): Delivers low-latency cryptocurrency price feeds with a delay of about 100ms.

-

CLOB WebSocket (

-

Data API: Found at

https://data-api.polymarket.com, this API manages user-specific data, such as positions, trade history, and analytics on on-chain activities. While most endpoints are publicly accessible, active trading requires HMAC-SHA256 authentication.

-

CLOB WebSocket (

wss://ws-subscriptions-clob.polymarket.com/ws/): Offers real-time updates for orderbooks and order statuses. -

RTDS WebSocket (

wss://ws-live-data.polymarket.com): Delivers low-latency cryptocurrency price feeds with a delay of about 100ms.

| Component | Base URL / Endpoint | Primary Function |

|---|---|---|

| Gamma API | https://gamma-api.polymarket.com | Market discovery, metadata, and event listings |

| CLOB API | https://clob.polymarket.com | Order management, price quotes, and orderbook data |

| Data API | https://data-api.polymarket.com | User positions, trade history, and analytics |

| CLOB WebSocket | wss://ws-subscriptions-clob.polymarket.com/ws/ | Real-time updates for orderbooks and order statuses |

| RTDS WebSocket | wss://ws-live-data.polymarket.com | Low-latency cryptocurrency price feeds |

These APIs and WebSocket services form the core of Polymarket's trading operations. Next, let's dive into how the infrastructure is deployed and secured.

AWS Regions and IP-Based Geoblocking

Polymarket's infrastructure is hosted on AWS in the eu-west-2 region (London). This setup ensures low-latency VPS options for efficient trade execution. While the CLOB handles matching off-chain for speed, all trades are settled atomically on the Polygon blockchain through a thoroughly audited Exchange contract. This guarantees that unauthorized trades cannot be executed by the operator.

To maintain compliance with international regulations, Polymarket enforces geographic restrictions. A dedicated endpoint, https://polymarket.com/api/geoblock, checks IP addresses against a list of 33 restricted countries. This system operates under two main rules:

- Adherence to U.S. Office of Foreign Assets Control (OFAC) sanctions.

- Compliance with local regulatory requirements.

If an order originates from a restricted region, it is automatically rejected by the API. Developers are advised to integrate geoblock checks into their applications to provide users with immediate feedback before any trading attempt. Additionally, Polymarket employs advanced methods to detect and block circumvention efforts.

This layered approach ensures both smooth operations and strict regulatory compliance.

How Latency Affects Polymarket Trading

Latency - the time it takes for data to travel between your system and Polymarket’s servers - can range from 50 to 100 milliseconds, significantly impacting trade execution. For algorithmic traders and arbitrageurs, even a few milliseconds can make or break their strategies, as they rely on lightning-fast responses to price discrepancies.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

Latency Measurements from Major Trading Hubs

Polymarket’s servers run on AWS infrastructure located in the eu-west-2 region (London). This means your physical distance from London plays a key role in determining your baseline latency. For example, traders in Dublin enjoy an advantage with latencies of just 5–10ms, matching previously recorded data. Dublin, another nearby hub in the eu-west-1 region, follows closely with latencies of 10–15ms.

However, for traders in the United States, the numbers tell a different story. A connection from New York typically results in a latency of 70–80ms, while Chicago sees slightly higher delays at 85–95ms. On the West Coast, locations like Oregon face even greater challenges, with latencies reaching 140–160ms. These transatlantic delays are significant for those engaged in high-frequency trading or real-time market monitoring.

This disparity in latency highlights how physical distance and network infrastructure can shape trading dynamics.

Regional Latency Comparison

Here’s a summary of typical latency values when connecting to Polymarket’s London servers:

| Trading Hub | Typical Latency to Polymarket (London) | Status |

|---|---|---|

| London (UK) | <1ms | Primary (eu-west-2) |

| Dublin (IE) | 10–15ms | Closest Non-Restricted (eu-west-1) |

| New York (US) | 70–80ms | Transatlantic |

| Chicago (US) | 85–95ms | Major Financial Hub |

| Oregon (US) | 140–160ms | West Coast |

For traders employing automated systems or monitoring several markets at once, these latency differences can become a critical factor. Residential internet connections often add further delays due to ISP routing inefficiencies, pushing response times well above the baseline of 70ms. In contrast, dedicated trading infrastructure can minimize these delays, achieving performance measured in milliseconds.

The impact of latency becomes even more noticeable during periods of high market volatility, where rapid order execution is crucial. These metrics also shed light on how geo-restrictions can further influence trading outcomes.

Polymarket Geo-Restrictions

Polymarket's geo-restrictions play a crucial role in its operations, affecting both who can use the platform and how trading is conducted, often requiring a unified order management system for efficient execution. These restrictions, covering 33 countries, are designed to comply with international sanctions, local gambling laws, and anti-money laundering (AML) regulations. The limitations vary by region - some countries face total bans, while others allow users to close existing positions but block them from opening new ones.

Restricted Countries and Regions

Polymarket enforces complete bans in several key European countries, including France, Germany, Italy, Belgium, the United Kingdom, and the Netherlands, to meet regulatory standards. Similarly, full restrictions apply in parts of the Asia-Pacific region, such as Australia and China, due to gambling laws and internet regulations.

In other areas, Polymarket operates under a "close-only" policy. This means users can finalize existing trades but cannot initiate new ones. Countries like Singapore, Poland, Thailand, and Taiwan fall under this category. Notably, in January 2025, Singapore's Gambling Regulatory Authority (GRA) mandated geoblocking for Polymarket, enforcing the close-only rule. Violating gambling laws in Singapore can result in penalties of up to SGD $10,000 or six months in jail.

The United States has had its own unique journey with Polymarket. After paying a $1.4 million fine to the CFTC in 2022 for running an unregistered trading facility, Polymarket purchased QCX LLC - a CFTC-licensed derivatives exchange - for $112 million in July 2025. This acquisition allowed the platform to relaunch across all 50 U.S. states by November 2025 as a fully regulated exchange requiring complete KYC verification. Additionally, Polymarket blocks access to OFAC-sanctioned regions like Cuba, Iran, North Korea, Syria, and Russia, as well as specific areas such as Ontario in Canada and parts of Ukraine, including Crimea, Donetsk, and Luhansk.

These restrictions are strictly enforced and carefully monitored.

How Restrictions Are Enforced

Polymarket uses advanced IP detection systems to enforce these regional rules, operating through the eu-west-2 (London) AWS region. Trades from restricted locations are automatically denied.

The platform employs multiple layers of verification, including IP reputation analysis, browser fingerprinting, and time zone checks, to prevent circumvention attempts. Compliance executive David Ackerman highlighted this approach:

"Geo-fencing is one thing, but it isn't very easy. Everyone has to KYC. So if there is a discrepancy between the information provided in the KYC and the IP address that is being used, that is a very easy monitor".

"Geo-fencing is one thing, but it isn't very easy. Everyone has to KYC. So if there is a discrepancy between the information provided in the KYC and the IP address that is being used, that is a very easy monitor".

Using a VPN to bypass these restrictions violates Polymarket's Terms of Use and can lead to account suspension or frozen funds. The platform explicitly warns:

"Use of a virtual private network ('VPN') or any similar tool to attempt to or to circumvent the restrictions set forth herein is strictly prohibited".

"Use of a virtual private network ('VPN') or any similar tool to attempt to or to circumvent the restrictions set forth herein is strictly prohibited".

Even if a VPN is used successfully, Polymarket can still trace on-chain activity back to restricted regions.

Best VPS Locations for Polymarket Trading

When trading on Polymarket, choosing the right VPS location for low latency is crucial and adhering to the platform's geo-restrictions. Since Polymarket's core infrastructure is based in eu-west-2 (London), UK users face restrictions, making it vital to select VPS locations that balance speed and compliance.

Top VPS Locations by Region

For traders in Europe and beyond, Dublin is an excellent choice. The Netherlands offers a favorable regulatory environment compared to some nearby countries facing stricter oversight. Dublin also boasts efficient routing to Polymarket's Central Limit Order Book (CLOB) and serves as a key financial hub within the EU.

In the United States, New York is the go-to location for traders. With ultra-low latency, New York-based VPS providers like QuantVPS can achieve just 0.52ms latency to major equity exchanges, ensuring swift trade execution for U.S. users.

It’s important to avoid VPS hosting in restricted countries such as France, Germany, Italy, and the United Kingdom. For traders seeking proximity to Polymarket’s infrastructure without violating geo-restrictions, eu-west-1 (Ireland) is the closest alternative to London-based servers.

By selecting one of these optimal locations, traders can maintain high performance while staying compliant with Polymarket's access rules.

QuantVPS Plans for Polymarket Traders

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

QuantVPS offers tailored plans specifically designed for algorithmic traders, ensuring 24/7 uptime, smooth performance, and robust features. Each plan includes Windows Server 2022, NVMe storage, unmetered bandwidth, and a 99.999% uptime guarantee.

| Plan | Monthly Price | Annual Price | Cores | RAM | Best For |

|---|---|---|---|---|---|

| VPS Lite | $59.99 | $41.99/month | 4 | 8GB | Basic bot operations |

| VPS Pro | $99.99 | $69.99/month | 6 | 16GB | Multi-strategy trading, 3–5 charts |

| VPS Ultra | $189.99 | $132.99/month | 24 | 64GB | High-frequency trading, 5–7 charts |

| Dedicated Server | $299.99 | $209.99/month | 16+ | 128GB | Professional arbitrage, 7+ charts |

The VPS Pro plan is ideal for most traders running automated strategies, offering a balance of cost and performance. For those engaged in high-frequency trading, the VPS Ultra plan provides the computational power needed for demanding operations. All plans can be deployed in Dublin for European traders or New York for those based in the U.S., ensuring optimal performance tailored to your trading needs.

Trading Implications and Compliance Guidelines

Effects on Algorithmic Trading and Arbitrage

Polymarket's primary servers, located in the eu-west-2 (London) AWS region, present both opportunities and challenges for algorithmic traders. Latency is a key factor for high-frequency trading strategies. To put it into perspective, while a typical home internet connection might have a latency of 50–200 ms, a dedicated trading VPS can reduce this to as low as 1–10 ms. This reduction in delay can make a significant difference. For example, between April 2024 and April 2025, Polymarket's leading arbitrageur executed 4,049 trades, earning over $2 million - an average of about $496 per trade.

For traders in restricted regions like the UK, France, Germany, and Italy, the nearest compliant AWS region is eu-west-1 (Ireland). Setting up trading infrastructure closer to these servers can help reduce latency and improve execution speeds. However, while optimizing for latency is important, maintaining compliance is equally critical for long-term success.

Compliance Strategies for Restricted Regions

Reducing latency with VPS deployment is only part of the equation. Traders must also adhere to Polymarket's compliance rules to avoid penalties. Polymarket enforces compliance by categorizing jurisdictions into fully blocked, close-only, and regulated markets. Using tools like VPNs to bypass these restrictions is a clear violation of the Terms of Service and can result in wallets being restricted to close-only mode or even permanent bans.

To stay compliant, traders can use automated IP checks via the /api/geoblock endpoint to prevent unintentional violations. Additionally, traders in restricted regions should host their trading systems in compliant locations, such as the Netherlands or Ireland, to minimize both latency and regulatory risks.

In the United States, compliance takes a different route. After Polymarket acquired QCX LLC for $112 million in July 2025, the platform obtained CFTC approval to operate legally across all 50 states by November 2025. U.S. users are required to complete a Know Your Customer (KYC) process, which includes submitting a government-issued photo ID, Social Security Number, and proof of residency. Once verified, users gain full trading access. This regulated version of Polymarket quickly gained traction, achieving record monthly volumes of $12 billion by January 2026.

| Status | Countries/Regions | Trading Permissions |

|---|---|---|

| Blocked | United Kingdom, France, Germany, Italy, Australia, Ontario (CA) | No trading; content access only |

| Close‑Only | Singapore, Poland, Thailand, Taiwan | Can close positions only |

| Regulated | United States (all 50 states) | Full trading access (KYC required) |

| Unrestricted | Japan, South Korea, India, Brazil, Spain | Full trading with permissionless onboarding |

Why QuantVPS Works for Polymarket Workloads

QuantVPS leverages Amsterdam's strategic connectivity to London and Ireland, ensuring reliable and low-latency access to Polymarket's matching engine. This setup avoids the compliance risks tied to operating in restricted jurisdictions. Unlike VPNs, which can trigger detection systems and risk account freezes, QuantVPS offers a static IP from a permitted location, ensuring uninterrupted access.

For developers building automated trading systems, QuantVPS supports performance-heavy languages like Rust, enables connections via dedicated Polygon RPC nodes, and ensures consistent order submission speeds. This infrastructure is fully compliant with Polymarket's geo-blocking rules. To confirm your VPS IP is unrestricted, use the GET https://polymarket.com/api/geoblock endpoint before deployment.

Conclusion

Polymarket's server infrastructure plays a key role in maintaining low latency and adhering to regulatory requirements. The platform's main servers operate in the eu-west-2 (London) AWS region, with eu-west-1 (Ireland) serving as the nearest alternative for traders in restricted areas. As the platform continues to grow, having an optimized infrastructure setup becomes even more critical.

For algorithmic traders and arbitrageurs, using one of the low latency trading VPS options can significantly cut down connection delays, providing an edge in executing orders quickly. However, geographic restrictions introduce added complexity. Traders should carefully review the geoblock verification process outlined earlier in this guide before initiating trades. Polymarket enforces these restrictions across multiple jurisdictions, each with its own access rules.

U.S.-based traders are required to use the CFTC-regulated platform, which mandates KYC verification, including a government-issued photo ID and Social Security Number. For traders in restricted countries like the UK, France, and Germany, hosting infrastructure in compliant locations such as Ireland or the Netherlands is key to minimizing latency and avoiding regulatory issues. In regions with "close-only" status - such as Singapore, Poland, Thailand, and Taiwan - users can only exit existing positions but cannot open new ones.

FAQs

How do I check if my country is blocked or close-only on Polymarket?

To find out if your country is restricted or limited to close-only access on Polymarket, you can use their geolocation tools or API. Polymarket determines your location based on your IP address. By sending a GET request to their API endpoint, you’ll receive details indicating whether your IP is blocked ("blocked": true) and information about your country and region. If your location is restricted, you’ll only be able to close existing positions, not open new ones.

What’s the safest way to reduce latency without breaking Polymarket’s rules?

To minimize latency while staying compliant with Polymarket’s rules, consider using a VPS located in Dublin. This region offers fast access to London servers while adhering to geo-restrictions. Make sure to confirm your geographic eligibility before trading to ensure you’re following all regulations.

Which Polymarket API should I use for trading vs. market data?

The Polymarket platform provides two distinct APIs tailored to different needs:

- REST API: Ideal for handling trading-related tasks. You can use it to place orders, cancel them, or query existing orders with ease.

- Data API: Best suited for accessing market data and staying updated with real-time information.

Each API is built for specific operations, ensuring smooth integration and efficient performance for your trading and data needs.

To find out if your country is restricted or limited to close-only access on Polymarket, you can use their geolocation tools or API. Polymarket determines your location based on your IP address. By sending a GET request to their API endpoint, you’ll receive details indicating whether your IP is blocked ("blocked": true) and information about your country and region. If your location is restricted, you’ll only be able to close existing positions, not open new ones.

To minimize latency while staying compliant with Polymarket’s rules, consider using a VPS located in Dublin. This region offers fast access to London servers while adhering to geo-restrictions. Make sure to confirm your geographic eligibility before trading to ensure you’re following all regulations.

The Polymarket platform provides two distinct APIs tailored to different needs:

- REST API: Ideal for handling trading-related tasks. You can use it to place orders, cancel them, or query existing orders with ease.

- Data API: Best suited for accessing market data and staying updated with real-time information.

Each API is built for specific operations, ensuring smooth integration and efficient performance for your trading and data needs.

"}}]}