Running Polymarket Bots on a VPS: Why Low Latency Matters

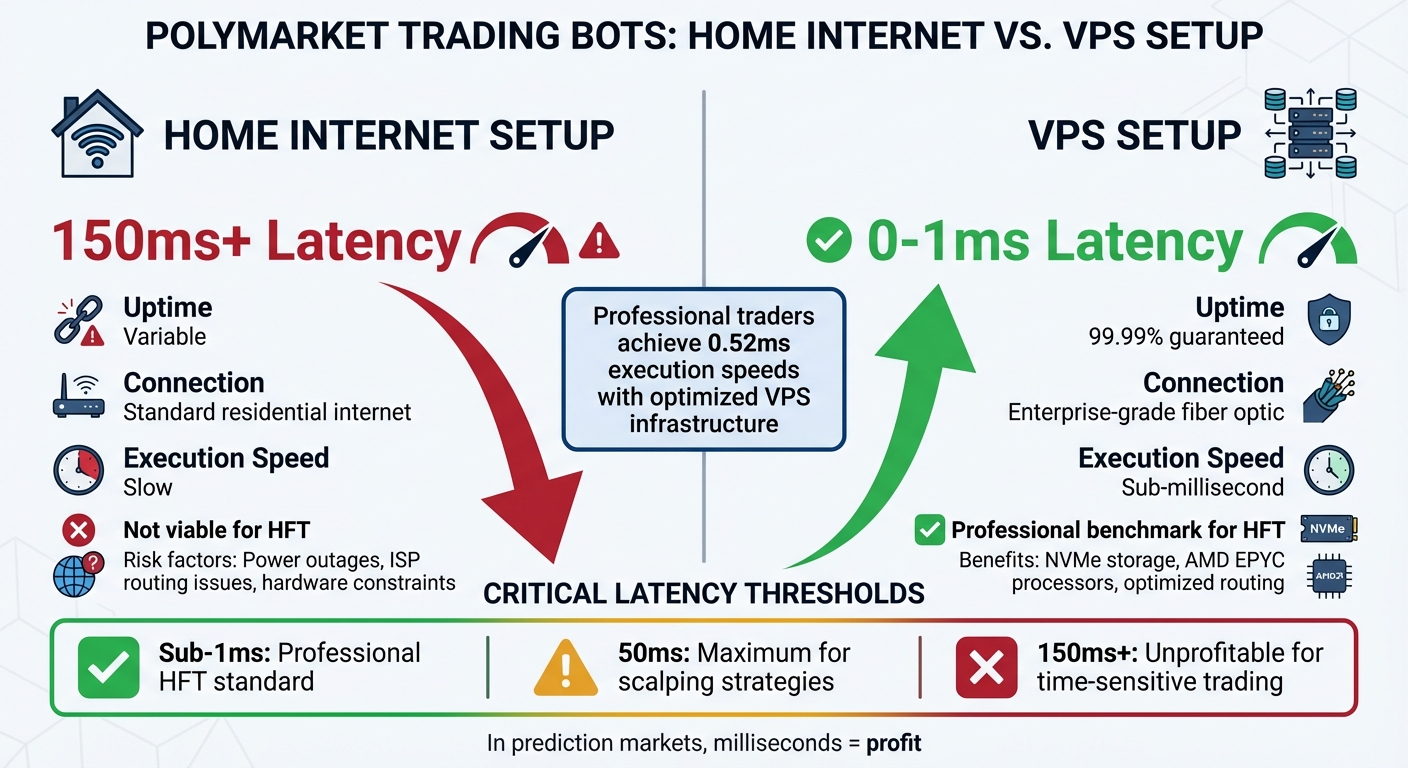

Running Polymarket bots on a VPS can drastically improve your trading performance by reducing latency. In fast-moving prediction markets, even a 50-millisecond delay can result in missed opportunities or less favorable trade prices. Here's why low latency is critical:

- Home setups are slow: Typical home internet connections have delays of 150ms or more, which isn't viable for high-frequency trading strategies like arbitrage or scalping.

- VPS advantages: A Virtual Private Server (VPS) offers faster execution (as low as 0–1ms), 99.99% uptime, and proximity to major financial hubs like Polymarket orderbooks, ensuring your bot stays online and responsive.

- Hardware and network: Enterprise-grade processors, NVMe storage, and optimized network routing on a VPS reduce processing time and data transmission delays.

For Polymarket trading, choosing the right VPS plan, location, and configuration can make all the difference. This article explains how to set up a VPS, optimize bot performance, and monitor latency to stay ahead in competitive markets.

VPS vs Home Internet Latency Comparison for Polymarket Trading

VPS vs Home Internet Latency Comparison for Polymarket Trading

How Latency Affects Polymarket Trading

What Is Trading Latency?

Trading latency refers to the delay between when your bot decides to place a trade and when that trade is actually executed on Polymarket. Essentially, it's the time gap between recognizing an opportunity and acting on it. In prediction markets, this measures the response time between your trading bot and the exchange infrastructure.

Every millisecond matters. The total time it takes for this process determines whether you secure the price you aimed for or experience slippage - where the market shifts, and your trade executes at a less favorable price.

For high-frequency trading (HFT) and scalping strategies, achieving sub-1ms latency is considered the professional benchmark. This isn't just a luxury - it’s what separates profitable trades from constant losses. In contrast, standard home internet connections, which often deliver latency of 150ms or more, can make time-sensitive strategies completely unviable.

These delays have a direct impact on trading outcomes.

Latency Impact on Polymarket Strategies

Latency challenges affect all trading strategies, but some are hit harder than others.

For arbitrage bots, the goal is to capitalize on price differences between markets before those discrepancies vanish - often in mere seconds. Even a slight delay can mean competitors beat you to the trade, leaving you stuck with only part of the transaction completed and an undesirable position.

Market making strategies are also highly sensitive to latency. These bots constantly update their quotes based on market activity. If latency is high, faster traders can exploit your bot by reacting to price changes before your bot can adjust its orders. Poorly optimized VPS setups can lead to execution delays, causing slippage losses of 2–10 pips.

Scalping strategies, which rely on capturing small price movements over short periods, are particularly vulnerable. Scalpers often hold positions for just seconds or minutes, and when latency exceeds 50ms, these strategies can quickly turn unprofitable. This is why professional Polymarket traders often use specialized VPS solutions that deliver 0–1ms latency, typically located in financial data centers.

The Complete Latency Path in Polymarket

Latency in Polymarket trading can be broken down into four key stages:

- Data Ingress: This is when market data flows from Polymarket to your VPS. Bots receive this information via the Gamma API (for market metadata and resolution data) or the CLOB API and WebSocket (for real-time pricing and orderbook updates). Market makers often rely on the RTDS (Real-Time Data Stream) for optimized, low-latency data delivery. The network travel time from Polymarket to your VPS is the first potential bottleneck.

- Decision Processing: Once the data reaches your VPS, your bot analyzes it and decides whether to execute a trade. This stage depends on the computational power of your VPS. If your VPS lacks sufficient resources, delays can occur, particularly during periods of high market volatility.

- Order Routing: After making a decision, your bot sends the trade instruction back to Polymarket through the network. This involves interacting with Polymarket's CLOB API, which processes the trade and communicates with the Polygon blockchain. The geographical distance and quality of the network routing play a significant role here.

- Settlement: The final stage happens on the Polygon blockchain, where the transaction is confirmed. The block time and on-chain processing add another layer of latency before the trade is fully completed.

QuantVPS infrastructure addresses these latency challenges by offering direct fiber-optic connections to major financial matching engines, achieving execution speeds as low as 0.52ms. This ensures your bot can operate efficiently across the entire trading process.

Selecting a VPS for Low-Latency Polymarket Bots

Required VPS Features for Polymarket Bots

If you're aiming for sub-millisecond response times, the right VPS hardware is non-negotiable. Start with enterprise-grade processors like the AMD Ryzen 9 9950X or AMD EPYC. These CPUs, with dedicated cores, ensure rapid data processing without the delays common in shared hosting, where resource contention can wreak havoc on execution speed.

When it comes to memory, a minimum of 4GB RAM suffices for a single trading terminal. But if you're running complex algorithmic bots or managing multiple instances, 8GB or more is a safer bet. High-speed DDR5 RAM further ensures smooth and efficient market data handling.

For storage, NVMe M.2 SSDs are a must. They not only speed up application loading but also handle rapid data logging seamlessly. In high-frequency trading, where every millisecond counts, storage slowdowns can mean missed opportunities.

Network infrastructure is another critical piece. Look for a 1Gbps connection with the ability to burst up to 10Gbps. This ensures you can process high-volume data feeds without throttling. Professional-grade VPS providers often back their services with uptime guarantees of 99.99% to 99.999%. Also, don’t overlook DDoS protection - cyber attacks during volatile trading periods can be catastrophic if your connection is disrupted.

Once you’ve secured the right hardware, you can further enhance your trading server performance by focusing on your VPS’s location and network routing to minimize latency.

Location and Network Performance

The physical distance between your VPS and Polymarket’s infrastructure directly affects latency. New York has become the primary location for Polymarket trading, particularly following expanded U.S. API availability. As a major financial and internet hub, New York offers strong peering, direct fiber connectivity, and proximity to key U.S. exchange infrastructure.

Beyond performance, New York also provides a regulatory advantage. With Polymarket operating under U.S. oversight, including CFTC-related compliance frameworks, the U.S. environment is currently more stable compared to certain European jurisdictions where regulatory scrutiny around prediction markets has increased.

“In markets where prices shift in milliseconds, latency - the time it takes for your order to reach the exchange’s servers - matters.” – TradingVPS

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

“In markets where prices shift in milliseconds, latency - the time it takes for your order to reach the exchange’s servers - matters.” – TradingVPS

Keep in mind that network quality can sometimes outweigh raw geographic proximity. Providers utilizing Tier-1 carriers such as Level3 (Lumen) or Cogent can optimize routing paths, reducing latency even further. Poor routing, however, can introduce execution delays and increase slippage risk, which can be costly in fast-moving prediction markets.

By carefully selecting both the right region and a provider with optimized routing, you can materially reduce latency and give your Polymarket bots the performance edge they require.

QuantVPS Plans for Polymarket Trading

The right VPS plan depends on the complexity of your trading strategy and the resources your bots require.

- For basic arbitrage or market-making bots, the VPS Lite plan ($59.99/month or $41.99/month billed annually) is a solid starting point. It offers 4 cores, 8GB RAM, and 70GB of NVMe storage - enough to handle a single bot instance effectively.

- If you're running scalping strategies or more advanced bots monitoring multiple markets, the VPS Pro plan ($99.99/month or $69.99/month billed annually) is a better fit. With 6 cores, 16GB RAM, and 150GB NVMe storage, this plan supports 3–5 concurrent chart analyses and up to 2 monitors for real-time oversight. The additional memory allows for faster data caching and quicker decision-making during market volatility.

- For high-frequency trading or bots employing machine learning models, the VPS Ultra plan ($189.99/month or $132.99/month billed annually) offers 24 cores, 64GB RAM, and 500GB NVMe storage. This setup is ideal for running multiple bot instances while simultaneously backtesting strategies. It supports 5–7 charts and handles the heavy computational demands of advanced trading.

- Professional traders managing large portfolios or deploying multiple strategies across Polymarket categories should consider the Dedicated Server plan ($299.99/month or $209.99/month billed annually). This plan includes 16+ dedicated cores, 128GB RAM, and 2TB+ NVMe storage, along with 10Gbps+ network connectivity for peak performance.

All QuantVPS plans come with unmetered bandwidth, Windows Server 2022, and infrastructure optimized for execution speeds as low as 0–1ms for Chicago-based financial gateways. For traders seeking even lower latency and priority support, the Performance Plans (Lite+, Pro+, Ultra+, Dedicated+) offer enhanced routing and additional features tailored for high-stakes trading environments.

Configuring Polymarket Bots for Low Latency

Choosing Your Software Stack

Polymarket offers official SDKs for Python (py-clob-client) and TypeScript/Node.js (@polymarket/clob-client), allowing you to customize your trading bot to fit your needs. If your strategy involves machine learning models or advanced statistical analysis, Python is a great choice. On the other hand, Node.js is built to handle asynchronous operations efficiently, making it ideal for managing multiple WebSocket connections simultaneously.

With QuantVPS plans, you get access to Windows Server 2022, which supports both Python and Node.js environments seamlessly. To optimize performance, ensure you're running the latest stable versions of your chosen language and reduce background processes. Additionally, batch logging and data writes to the NVMe drive to avoid I/O bottlenecks. These measures help create a solid foundation for achieving lower latency.

Low-Latency Configuration Techniques

The wss://ws-subscriptions-clob.polymarket.com/ws/ endpoint provides orderbook updates with a latency of about 100ms, which is significantly faster than the Gamma API's 1-second delay. For those needing even quicker updates, the Real-Time Data Stream (RTDS) at wss://ws-live-data.polymarket.com offers near-instantaneous crypto price updates and comment streams.

To maximize responsiveness, implement asynchronous I/O. This approach ensures that multiple operations can run without blocking your bot's main trading logic. For example, in Python, you can use the asyncio library or threading to manage the required 10-second "PING" heartbeat messages while simultaneously processing incoming market data. This keeps your connection active without disrupting order execution.

Instead of repeatedly querying the full orderbook via REST calls, maintain a local orderbook. Use incremental WebSocket updates and monitor sequence numbers to avoid any data gaps. Additionally, set up automatic reconnection with exponential backoff to handle disconnections effectively.

Polygon Network Optimization

Optimizing your network connection is just as important as configuring your bot's software. Since Polymarket operates on the Polygon network (Chain ID 137), the RPC endpoint you select can greatly influence transaction speed. Providers like Alchemy, QuickNode, and Infura offer dedicated nodes that reduce query latency for onchain data such as token balances and resolution events.

To simplify transactions during periods of network congestion, use the Polymarket Relayer Client. This enables gasless transactions, eliminating the need to monitor gas prices and reducing the risk of order submission failures during volatile market conditions.

For real-time order updates, authenticate your WebSocket connection immediately using your API key, secret, and passphrase. This grants access to the user channel, allowing you to receive fill confirmations in milliseconds instead of waiting on polling. Reserve onchain queries for tasks like settlement and position tracking, as these are tied to block time, while relying on WebSockets for time-sensitive operations.

Monitoring and Managing Latency

Measuring End-to-End Latency

When it comes to latency, don’t just rely on network ping times - dig deeper. Track both wall clock time (the total time from start to finish) and CPU time (the time your code actively spends on the processor). This helps pinpoint whether delays are caused by computation or waiting on I/O processes.

"This is the problem with averages: they hide the disasters." - Quant Engineering

"This is the problem with averages: they hide the disasters." - Quant Engineering

Relying on average latency can be misleading. For instance, a 10ms average might mask spikes of 200ms during peak trading hours. To avoid this pitfall, monitor p95, p99, and p99.9 latency during periods of volatility.

For Python-based bots, tools like py-spy can be invaluable. They allow you to profile wall-clock time in production environments without adding significant overhead. If you spot high wall time but low CPU usage, it likely points to I/O or network bottlenecks. On the other hand, high CPU usage with steady wall time suggests inefficient code or loops that need optimization.

Platforms like Prometheus can help you track request durations across predefined buckets, and you can visualize these metrics in Grafana to keep an eye on live quantiles over time.

For a quick check, use Command Prompt to ping endpoints like Polymarket and verify latency. QuantVPS servers in Chicago typically offer lightning-fast connections: 0–1ms to major trading networks like Rithmic and Tradovate, and 0–3ms to Interactive Brokers.

Accurate latency tracking is critical - it ensures you can adjust resources or upgrade your VPS before latency impacts your trading performance.

Monitoring VPS and Bot Performance

Keeping an eye on your VPS and trading bot’s performance is crucial to avoid slowdowns that could disrupt trades. Regularly monitor CPU, RAM, and I/O usage to ensure your VPS isn’t maxing out its resources. Resource bottlenecks can lead to thread starvation, which mimics poor network latency. Running multiple bot instances or using resource-heavy indicators without adequate hardware can also create delays.

WebSocket connections demand constant attention. Add a heartbeat function that sends “PING” messages every 10 seconds to keep the connection alive and monitor its stability. For disconnections, use an automatic reconnection system with exponential backoff (e.g., 1s, 2s, 4s) to prevent overwhelming the server. Be on the lookout for "429 Too Many Requests" errors, which indicate you’ve exceeded the platform’s rate limits - these typically range from 200 to 1,200 requests per minute.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

"In performance engineering, the first optimizer is visibility." - Quant Engineering

"In performance engineering, the first optimizer is visibility." - Quant Engineering

Track trading-specific metrics like order fill rates and failed transactions. If you notice a spike in failures during volatile market periods, your VPS might lack the single-thread CPU performance required for quick execution. Since most trading bots are single-threaded, a high single-core clock speed (4.3 GHz or higher) is more important than having multiple cores.

Run 24–48 hour monitoring sessions during peak market activity or major news events to document latency patterns. If performance metrics show strain, it’s time to consider upgrading your VPS plan.

Upgrading Your QuantVPS Plan

As your trading strategy becomes more complex, you’ll eventually need to scale your VPS to keep up with growing demands. If your CPU usage consistently exceeds 80% or order execution times increase despite normal network conditions, it’s a clear sign you need more resources. Other red flags include frequent memory warnings, rising p99 latency, and delays during routine operations. These issues often indicate hardware limitations rather than network problems.

For simpler setups - like single-strategy bots monitoring 1–2 markets - entry-level plans are usually sufficient. But as you scale up with multiple bot instances, machine learning models, or 3–5 concurrent strategies, mid-tier plans are better suited to handle the workload. More advanced operations, such as multi-strategy setups processing large datasets or running 7+ concurrent strategies, require high-performance configurations. In these cases, dedicated server resources with upgraded specifications become essential.

QuantVPS’s Performance Plans (+) cater specifically to traders who need maximum reliability and speed, especially during high-frequency trading scenarios.

Accurately determining the latency to your broker.

Conclusion

Low latency isn't just a technical perk - it's the backbone of profitable Polymarket bot trading. Similar principles apply when setting up futures trading bots to automate market strategies. By aligning your VPS resources with your trading strategy, you gain a critical edge. A reliable VPS minimizes latency compared to a home setup, eliminating risks like local power outages, ISP routing hiccups, and hardware constraints.

As outlined earlier, QuantVPS offers infrastructure designed specifically for low-latency Polymarket trading. Their servers deliver sub-millisecond execution speeds and maintain enterprise-grade uptime. With high-performance processors, NVMe storage, and fine-tuned network connections, your bot can process market data and execute trades seamlessly, free from hardware slowdowns.

QuantVPS also simplifies the setup process. Their Polymarket VPS solutions come pre-configured with Windows Server 2022 and optimized network settings, saving you the hassle of manual configuration.

Beyond the initial setup, ongoing performance monitoring is key. Keep an eye on p99 latency during peak volatility, track CPU and RAM usage, and upgrade your VPS when performance metrics show signs of strain. Matching your VPS resources to the complexity of your trading strategy ensures consistent performance. With the right infrastructure, you’re not just speeding up execution - you’re enhancing the reliability and profitability of your Polymarket bots in real-world conditions.

FAQs

Why is low latency important for running Polymarket trading bots?

Low latency plays a crucial role for Polymarket trading bots, as it allows them to react swiftly to rapid price changes in the market. Quicker response times mean bots can execute trades with greater precision, cutting down on slippage and boosting the chances of securing profitable trades.

In prediction markets like Polymarket, prices can change in the blink of an eye - sometimes within milliseconds. A low-latency system ensures that your bot can make decisions and act faster than competitors, giving you a clear advantage in high-frequency trading. By reducing delays, your bot can operate with more accuracy and efficiency, helping you stay ahead in these fast-paced markets.

What VPS features are essential for running Polymarket bots effectively?

For Polymarket bots to function effectively, a VPS needs to deliver ultra-low latency, ideally with sub-millisecond round-trip times. This capability allows bots to respond instantly to market fluctuations. QuantVPS ensures this level of performance by operating servers in financial-grade data centers located near major trading hubs like Chicago and New York, giving users a clear edge in real-time decision-making.

Equally critical are reliability and performance. A top-tier VPS should offer near-perfect uptime (e.g., 99.999%) to keep your bot running during crucial market events. Features like high-throughput processing, multi-core CPUs, sufficient RAM, and fast SSD storage are essential for managing AI models and processing real-time data without bottlenecks. On top of that, strong security measures, such as DDoS protection and regular backups, are key to ensuring smooth and secure operations.

Lastly, the VPS must be fully compatible with the Polymarket API and Python environments to guarantee seamless integration and peak performance for your trading bot.

How can I effectively monitor and manage latency for my Polymarket bots on a VPS?

To ensure your Polymarket bots run smoothly and respond quickly, start by setting up a low-latency VPS in locations close to major trading hubs like Chicago or New York. Proximity to these gateways minimizes the time it takes for your bot to interact with the Polymarket API.

Use tools like ping or traceroute to regularly measure round-trip times to the API endpoint. Keep an eye on these metrics over time to spot any inconsistencies. For ongoing monitoring, take advantage of your VPS's performance tracking features and set up alerts to catch any latency spikes as they happen.

Optimize your VPS environment by keeping software up to date, disabling unnecessary services, and ensuring it’s connected to a high-speed network. Whenever you make changes - like upgrading the VPS or tweaking your bot - recheck latency to ensure it stays within the acceptable range. These practices will help your bots stay competitive in the fast-moving prediction market.

Low latency plays a crucial role for Polymarket trading bots, as it allows them to react swiftly to rapid price changes in the market. Quicker response times mean bots can execute trades with greater precision, cutting down on slippage and boosting the chances of securing profitable trades.

In prediction markets like Polymarket, prices can change in the blink of an eye - sometimes within milliseconds. A low-latency system ensures that your bot can make decisions and act faster than competitors, giving you a clear advantage in high-frequency trading. By reducing delays, your bot can operate with more accuracy and efficiency, helping you stay ahead in these fast-paced markets.

For Polymarket bots to function effectively, a VPS needs to deliver ultra-low latency, ideally with sub-millisecond round-trip times. This capability allows bots to respond instantly to market fluctuations. QuantVPS ensures this level of performance by operating servers in financial-grade data centers located near major trading hubs like Chicago and New York, giving users a clear edge in real-time decision-making.

Equally critical are reliability and performance. A top-tier VPS should offer near-perfect uptime (e.g., 99.999%) to keep your bot running during crucial market events. Features like high-throughput processing, multi-core CPUs, sufficient RAM, and fast SSD storage are essential for managing AI models and processing real-time data without bottlenecks. On top of that, strong security measures, such as DDoS protection and regular backups, are key to ensuring smooth and secure operations.

Lastly, the VPS must be fully compatible with the Polymarket API and Python environments to guarantee seamless integration and peak performance for your trading bot.

To ensure your Polymarket bots run smoothly and respond quickly, start by setting up a low-latency VPS in locations close to major trading hubs like Chicago or New York. Proximity to these gateways minimizes the time it takes for your bot to interact with the Polymarket API.

Use tools like ping or traceroute to regularly measure round-trip times to the API endpoint. Keep an eye on these metrics over time to spot any inconsistencies. For ongoing monitoring, take advantage of your VPS's performance tracking features and set up alerts to catch any latency spikes as they happen.

Optimize your VPS environment by keeping software up to date, disabling unnecessary services, and ensuring it’s connected to a high-speed network. Whenever you make changes - like upgrading the VPS or tweaking your bot - recheck latency to ensure it stays within the acceptable range. These practices will help your bots stay competitive in the fast-moving prediction market.

"}}]}