In fast-moving prediction markets like Polymarket and Kalshi, speed is everything. Prices shift instantly based on breaking news, and even a delay of milliseconds can mean the difference between profit and loss. Using a Virtual Private Server (VPS) gives traders a critical advantage by reducing latency, ensuring faster order execution, and maintaining uninterrupted performance.

Key Points:

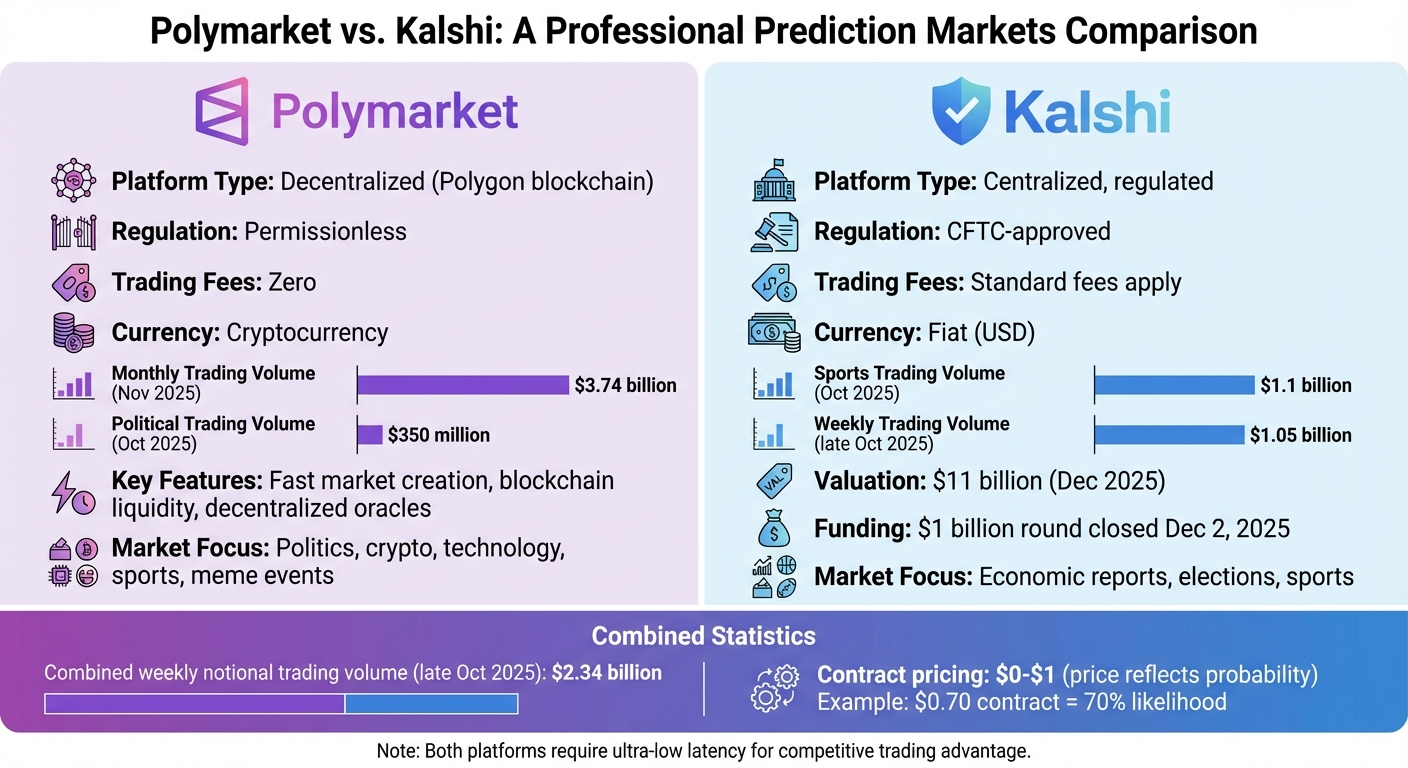

- Polymarket: A decentralized platform on the Polygon blockchain, handling $3.74 billion in monthly trading volume (Nov 2025).

- Kalshi: A regulated U.S.-based market approved by the CFTC, with $1.1 billion in sports-related trading volume (Oct 2025).

- Why Speed Matters: Faster execution captures better prices and exploits arbitrage opportunities before they disappear.

- VPS Benefits: Low latency, 24/7 uptime, and proximity to servers improve trading performance, especially during volatile events like elections or economic reports.

By hosting trading bots and strategies on a VPS, traders gain the infrastructure needed to stay ahead in these competitive markets.

Get a trading VPS! Step by step tutorial

What Are Polymarket and Kalshi?

Polymarket vs Kalshi: Platform Comparison and Trading Volume Statistics

Polymarket vs Kalshi: Platform Comparison and Trading Volume Statistics

To understand how a VPS can improve speed, it’s important to first get a clear picture of Polymarket and Kalshi and what makes them stand out.

Prediction markets allow people to trade contracts based on real-world events. Instead of traditional betting, these platforms let traders speculate on outcomes like elections, inflation data, interest rate changes, sports results, and cryptocurrency milestones. Contracts are priced between $0 and $1, with the price reflecting the probability of the event happening.

What Is Polymarket?

Polymarket is a decentralized prediction market built on the Polygon blockchain. It lets users trade outcomes on a wide range of topics, including politics, cryptocurrency, technology, sports, and even meme-related events. The platform has zero trading fees and operates in a permissionless way, which means it can quickly create liquid markets for trending topics. In November 2025, Polymarket handled an impressive $3.74 billion in monthly trading volume. Prices on the platform are influenced by real-time internet chatter, blockchain liquidity, and decentralized oracles, making it highly responsive to breaking news and fast-moving trends.

What Is Kalshi?

Kalshi, on the other hand, is a regulated U.S.-based prediction market that’s approved by the Commodity Futures Trading Commission (CFTC). It allows users to trade event contracts using fiat currency on topics like economic reports, elections, and sports. Its regulated status makes it a trusted platform for large-scale trading, with liquidity focused on high-volume markets. On December 2, 2025, Kalshi closed a $1 billion funding round, securing an $11 billion valuation. In October 2025, Kalshi led sports-related trading with $1.1 billion in volume, while Polymarket dominated political markets with $350 million. During election seasons and major geopolitical events, Kalshi’s political markets have seen huge spikes in trading activity, often aligning with periods of intense political uncertainty.

Both platforms rely heavily on speed and reliability, which is where advanced VPS infrastructure comes into play.

Why Speed Matters on These Platforms

Speed isn’t just a nice-to-have on platforms like Polymarket and Kalshi – it’s a necessity.

Market prices on these platforms shift instantly based on breaking news and updates. For instance, a contract priced at $0.70 reflects a 70% likelihood of an event happening – if that event occurs, a "Yes" contract pays $1. As money flows into a particular outcome, prices adjust immediately, much like how traditional order-driven markets work. In just one week in late October 2025, prediction markets saw a combined notional trading volume of $2.34 billion, with Kalshi alone contributing $1.05 billion.

This kind of rapid price movement means traders competing against advanced algorithms need infrastructure that minimizes latency. Every millisecond counts when it comes to capturing profitable trades before the market adjusts. This is why low-latency VPS hosting is so crucial for staying ahead in these fast-paced markets.

Why Latency Determines Trading Outcomes

Latency – the tiny delay between sending a request and receiving a response – plays a critical role in trading. It directly impacts how fast you can process data and execute orders. In high-speed trading environments, even a millisecond can make or break your success. This is especially true in prediction markets, where price dynamics shift rapidly.

How Prices Move in Prediction Markets

Prediction markets function like micro-futures markets, with contract prices shifting within milliseconds after major news events. A poll update, an election result, or an economic announcement can spark immediate price changes on platforms like Polymarket and Kalshi. Just like in cryptocurrency or traditional futures markets, the first traders to act often secure the best prices. Even the slightest delay can leave you chasing less favorable terms as the market adjusts to new information.

The Cost of High Latency

High latency doesn’t just slow you down – it can cost you money. Consider this: an experiment comparing trading performance found that a VPS with under 1 millisecond of latency achieved a gain of +0.20 pips, while a VPS with 75 milliseconds of latency suffered cumulative slippage of –1.50 pips over 120 trades. That’s a difference of 1.70 pips. For a 1-lot trade (where 1 pip equals $10), this translates to a monthly loss of about $1,700 and a yearly loss of $20,400 if 100 lots are traded per month. On the flip side, the low-latency VPS setup generated an annual gain of $2,400, compared to an $18,000 loss with the high-latency setup.

Beyond the numbers, high latency means missed opportunities. Markets often experience brief price imbalances that can offer nearly risk-free arbitrage. However, when orders are delayed, those chances slip away. During volatile periods, the problem worsens as orders may not fill at the intended price. Additionally, market makers, wary of latency risks, often widen bid-ask spreads, increasing transaction costs for everyone.

Prediction Markets and High-Frequency Trading

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

Prediction markets are increasingly dominated by the need for speed, much like high-frequency trading in futures or cryptocurrency markets. A delay of just a few milliseconds can lead to worse entry prices or missed arbitrage opportunities. Traders who invest in low-latency infrastructure – like high-speed VPS hosting – gain a critical edge. By minimizing every possible delay between market-moving news and order execution, these traders position themselves for success in this fast-paced environment.

How a VPS Improves Trading Performance

What Is a VPS?

A Virtual Private Server (VPS) is a remote server hosted in a professional data center that operates continuously, 24/7. Unlike your home computer, it’s immune to interruptions like power outages, internet disconnections, or system updates. For prediction market traders, this means trading strategies, bots, and monitoring tools can keep running without a hitch. This uninterrupted performance is crucial in a world where milliseconds can make or break a trade.

VPS Benefits for Prediction Market Traders

Prediction markets move fast, and every split second can impact profitability. A VPS eliminates the latency issues common with home networks. By reducing network hops, it shortens ping times and ensures orders are executed almost instantly.

This constant connectivity becomes even more critical during periods of market volatility. A VPS ensures your orders go through without being affected by home-network disruptions. For instance, when breaking news or unexpected data releases cause sudden market shifts, a VPS keeps executing trades smoothly, avoiding delays caused by competing traffic on residential networks.

Location also plays a big role. Polymarket’s decentralized platform depends on blockchain nodes and oracles for real-time price updates and settlements. Similarly, being near Kalshi’s centralized servers can significantly speed up order confirmations. This matters a lot when arbitrage opportunities arise, as price differences between events can disappear in seconds.

Why Location and Hardware Matter

The closer your VPS is to the platform’s servers, the lower your latency. Data centers strategically located near financial hubs, Polygon blockchain nodes, or Kalshi’s servers can drastically reduce ping times, giving traders a competitive edge.

Hardware is just as important. QuantVPS, for example, uses AMD Ryzen and EPYC processors designed for real-time trading, paired with NVMe storage for lightning-fast data handling. High-speed, unmetered connections ensure trades are never interrupted. When Polymarket markets rely on instant updates powered by blockchain liquidity, your hardware needs to keep up. By combining ultra-low latency connections with top-tier processors, traders gain the infrastructure advantage needed to stay ahead of the competition and capitalize on fleeting opportunities.

Real-World VPS Use Cases for Prediction Markets

Election Traders Reacting to Live Results

Election markets are incredibly dynamic, with conditions changing in seconds as new information becomes available. During the 2024 US Presidential Election, some traders turned to VPS-hosted systems to execute trades within milliseconds of spotting early signals on platforms like Twitter or local news outlets. By deploying NLP models on their VPS, these traders could scan social media and act faster than most retail participants.

"The core assets here are low-latency information and automated decision engines." – political-market tech builder

"The core assets here are low-latency information and automated decision engines." – political-market tech builder

In the final moments before markets close, even the smallest price discrepancies can offer valuable arbitrage opportunities. This same need for speed applies to traders in other markets, where rapid price shifts demand equally fast responses.

Crypto-Arbitrage Traders

Arbitrage traders in the crypto world rely heavily on VPS technology to seize fleeting price differences across platforms. For example, price disparities between Polymarket and major crypto exchanges like Binance or GMX can vanish in under a second. Using a VPS, traders monitor multiple platforms simultaneously and execute trades quickly enough to capitalize on these short-lived spreads.

"Speed is often the difference between a successful arbitrage trade and a missed opportunity." – J.R. Gutierrez

"Speed is often the difference between a successful arbitrage trade and a missed opportunity." – J.R. Gutierrez

Even a 1-millisecond delay can lead to millions in lost profits annually. For individual traders, such delays can mean missing out on arbitrage windows entirely. By hosting their VPS near exchange servers, traders improve their chances of completing trades before price gaps close.

This same high-speed execution is critical for traders dealing with economic data platforms like Kalshi.

Economic Data Traders on Kalshi

For those trading on economic data events, VPS hosting offers a distinct advantage. Kalshi provides markets tied to key economic indicators like CPI, NFP, or Fed rate decisions, where prices can shift the instant data is released. With 27.2% of trades executed within just half a second of order posting, a VPS is indispensable for staying competitive. Additionally, Kalshi’s 24/7 trading hours during high-stakes events make continuous operation crucial. A VPS ensures traders remain active and responsive, even while they sleep.

Automated Trading Bots and Algorithms

Algorithmic trading strategies also depend on the reliability of VPS hosting. Quantitative traders running probability models and aggregating real-time data need uninterrupted operation to stay ahead. VPS-hosted automated systems can monitor hundreds of markets at once and respond faster than manual efforts. With 99.9% uptime, a VPS ensures trading bots remain operational through power outages, internet issues, or local hardware failures.

"Arbitrage is a race against time. These professionals don’t just react faster than retail traders – they also deploy bots and scripts to detect inefficiencies within seconds." – CoinRank

"Arbitrage is a race against time. These professionals don’t just react faster than retail traders – they also deploy bots and scripts to detect inefficiencies within seconds." – CoinRank

This level of reliability is crucial for maintaining consistent, high-speed trading performance.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Selecting a VPS for Prediction Market Trading

Required Features for a Trading VPS

Not all VPS options are built to handle the demands of prediction market trading. The right server setup can make the difference between seizing a profitable opportunity or missing it entirely due to delays.

The most critical factor? Ultra-low latency. In prediction markets, prices can shift within milliseconds of breaking news. To stay ahead, you need latency in the sub-millisecond range – ideally between 0-1ms to major financial hubs like the CME Group. Standard VPS solutions often deliver latency in the 50-100ms range, which can lead to slippage and missed trades.

Data center location is equally important. The closer your VPS is to the trading platform’s servers, the faster your orders can travel. For U.S.-based markets, a Chicago data center is ideal because it provides the shortest path to key exchanges and liquidity providers. Cutting down physical distance is essential for achieving sub-millisecond latency.

Performance hardware also plays a huge role. High-speed CPUs and NVMe storage are necessary for running trading algorithms, processing live data feeds, and executing complex probability models without delays. To keep up with market demands, DDR4/DDR5 ECC RAM ensures your processor has quick access to the data it needs. Additionally, unmetered 1 Gbps+ network connections with 99.9% uptime guarantee consistent performance, even during periods of market volatility.

These features are non-negotiable for a VPS that can handle the unique challenges of prediction market trading.

Why QuantVPS Works for Polymarket and Kalshi

For traders on platforms like Polymarket and Kalshi, having a VPS optimized for speed and reliability is critical. QuantVPS is specifically designed to meet these needs, delivering 0.52ms latency to CME infrastructure and ensuring 99.999% uptime. This level of performance keeps your systems running smoothly, even during high-stakes market events.

Prediction markets are all about timing, and every millisecond matters. QuantVPS uses AMD Ryzen and EPYC processors to handle demanding tasks like running multiple trading bots, processing real-time data feeds, and executing algorithmic strategies – all at the same time. These processors are built to handle the intense computational workload that prediction market trading requires.

Each plan includes Windows Server 2022, ensuring compatibility with the most popular trading platforms and development tools. The infrastructure is tailored to the workflows prediction market traders depend on, such as hosting bots that react instantly to oracle updates, execute arbitrage opportunities, and place orders in real time. Whether it’s Kalshi releasing economic data or Polymarket adjusting prices after breaking news, your competitive edge lies in the speed and reliability of your VPS – not just the accuracy of your predictions.

Conclusion

Key Takeaways

In prediction markets like Polymarket and Kalshi, every millisecond counts. Success often hinges on how quickly you act – those with faster execution secure profitable trades, while slower participants can miss out entirely.

A low-latency VPS addresses the key challenges traders face. By reducing delays, it ensures better fill prices, minimizes slippage, and maintains uninterrupted execution – advantages that high-frequency traders depend on daily. This infrastructure helps avoid network congestion and transaction delays, which can cost traders valuable opportunities during critical moments.

With ultra-low latency, trades are executed at the intended price, avoiding unfavorable shifts caused by transmission delays. For those engaging in high-frequency trading or arbitrage across platforms, this speed can mean the difference between locking in profits or losing out entirely. Simply put, running your trading setup from a home computer can’t compete with the sub-millisecond performance institutional traders already enjoy.

The message is clear: speed and reliability are non-negotiable in these fast-paced markets.

Next Steps

If you’re trading on Polymarket or Kalshi – or using automated strategies – your edge starts with having the right trading infrastructure. It’s not just about making accurate predictions; it’s about acting on them faster than the competition.

QuantVPS provides the tools prediction market traders need: 0.52ms latency to CME infrastructure, 99.999% uptime, and cutting-edge AMD Ryzen and EPYC processors built for real-time trading. Whether you’re reacting to breaking election results, seizing arbitrage opportunities, or running automated bots to track oracle updates, the right VPS setup gives you a critical advantage in these fast-moving markets. Learn more about how QuantVPS can elevate your trading at quantvps.com/polymarket-vps.

FAQs

How does using a VPS improve trading speed on prediction markets?

Using a VPS can significantly boost your trading speed by hosting your trading environment closer to Polymarket’s servers. This shortens the distance your data needs to travel, reducing latency. The result? Faster order execution, which can be a game-changer during fast-moving markets or breaking news events.

A VPS also ensures a more stable connection by cutting down on signal interruptions. This means fewer disconnects and delays, even during periods of intense market volatility. For dedicated traders, this reliability can be the key to seizing the best prices instead of watching opportunities slip away.

Why is low latency important for trading on Polymarket and Kalshi?

Low latency plays a crucial role when trading on platforms like Polymarket and Kalshi. These prediction markets respond immediately to breaking news, live events, and market shifts. The faster you can react, the better your chances of locking in favorable entry prices, seizing arbitrage opportunities, and steering clear of unfavorable price swings.

In the fast-paced world of trading, even milliseconds matter. Low latency keeps you competitive by enabling swift and dependable trade execution – especially during high-volatility moments or when dealing with real-time data updates.

What features should you prioritize in a VPS for trading on platforms like Polymarket?

When choosing a VPS for trading, focus on low latency and high reliability to guarantee quick and stable execution, especially during volatile market swings. Opt for features such as minimal ping times, 24/7 uptime, and optimized network routing to keep performance steady. A dedicated or partitioned environment is crucial if you’re running bots or automated strategies, as it helps avoid disruptions. Also, make sure the VPS provides scalable resources to meet your trading demands and includes strong security measures to safeguard your data and transactions.