In futures trading, every microsecond counts. Accurate timestamps ensure trades are executed in the correct order, prevent missed opportunities, and comply with strict regulations. Systems that fail to maintain precise synchronization risk financial losses, data inconsistencies, and audit issues. Here’s the key takeaway: sub-millisecond accuracy is critical for low latency futures trading success.

- What is NTP? A protocol that synchronizes clocks to Coordinated Universal Time (UTC), ensuring precision in trading operations.

- Why it matters: Even a millisecond of clock drift can disrupt order execution, create unreliable data, and lead to regulatory non-compliance.

- How to achieve it: Use Stratum 1 or 2 servers, configure systems for local network synchronization, and monitor for network latency issues.

For traders, maintaining this level of accuracy is essential to stay competitive, meet regulatory standards, and operate efficiently.

How NTP Achieves Sub-Millisecond Synchronization

NTP Stratum Hierarchy and Time Synchronization Levels for Trading Systems

NTP Stratum Hierarchy and Time Synchronization Levels for Trading Systems

NTP Stratum Levels and Time Servers

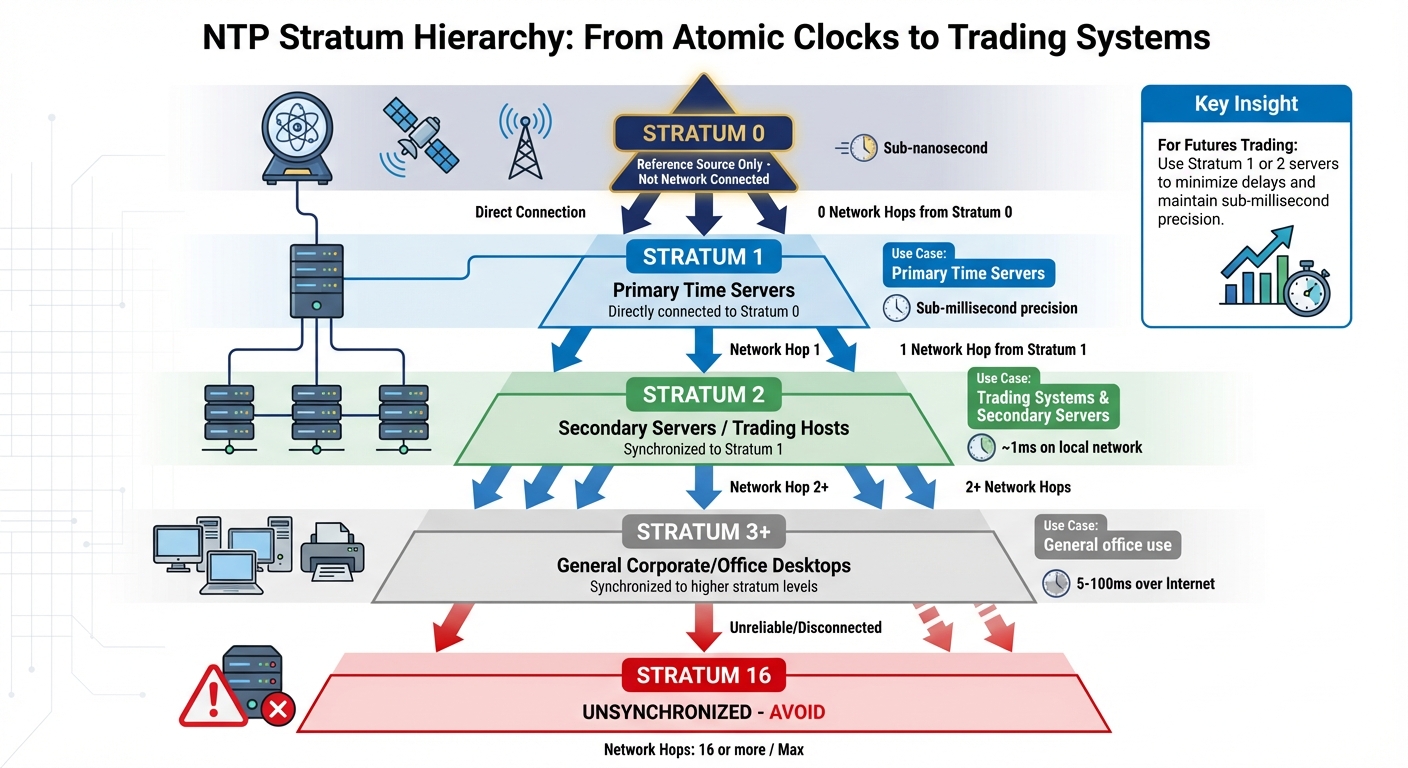

NTP’s ability to achieve sub-millisecond precision heavily relies on its hierarchical structure, known as stratum levels. These levels indicate how far a time source is from the most authoritative reference. At the top of this hierarchy is Stratum 0, which includes atomic clocks, GPS receivers, and cesium clocks. These devices serve as the ultimate time references but are not directly network-connected.

Stratum 1 servers, connected directly to Stratum 0 devices, act as primary time sources. Below them, Stratum 2 servers synchronize with Stratum 1 servers. As you move further down the hierarchy (Stratum 3 and beyond), additional network hops are introduced, which can increase delays and errors. For time-sensitive applications like futures trading, systems typically synchronize with Stratum 1 or Stratum 2 servers to reduce these delays and maintain sub-millisecond precision.

This hierarchy also prevents timing loops by ensuring that servers prioritize sources with lower stratum numbers, creating an acyclic network. Any server reporting as Stratum 16 is considered unsynchronized and should be avoided.

| Stratum Level | Description | Typical Use Case |

|---|---|---|

| Stratum 0 | Atomic Clocks, GPS, Radio | Reference source only; not on network |

| Stratum 1 | Directly connected to Stratum 0 | Primary Time Servers |

| Stratum 2 | Synchronized to Stratum 1 | Secondary Servers / Trading Hosts |

| Stratum 3+ | Synchronized to higher stratum levels | General Corporate/Office Desktops |

The closer a server is to Stratum 0, the more accurate its timekeeping. For trading systems, using Stratum 1 or 2 servers is essential to minimize delays and ensure precise order execution.

How Network Latency Affects Time Synchronization

While the stratum hierarchy is key to accuracy, network conditions also play a critical role in achieving precise synchronization. NTP uses a four-timestamp exchange to calculate both time offset and roundtrip delay. The client logs the request (T1) and reply (T4) times, while the server records receipt (T2) and transmission (T3) times.

This process assumes symmetric network delays, but in practice, asymmetry – caused by factors like inconsistent routing or bandwidth congestion – can lead to errors. Wide Area Networks (WANs) are particularly prone to such asymmetry, making it the primary source of synchronization inaccuracies.

To address these issues, NTP incorporates a Clock Filter Algorithm. This algorithm collects multiple samples (usually eight) and selects the one with the lowest roundtrip delay as the most reliable estimate of the true time offset. On a quiet local network, this method can achieve accuracy within 1 millisecond. However, over the public Internet, accuracy typically ranges from 5ms to 100ms.

For systems like futures trading that demand sub-millisecond precision, placing the NTP server on the same local subnet can significantly reduce routing asymmetry. This setup ensures tighter synchronization, which is critical for maintaining the reliability and precision required in high-stakes trading environments.

When Time Synchronization Matters in Futures Trading

Order Execution and Market Timing

In the fast-paced world of futures trading, even the smallest clock drift can wreak havoc. It can mess up the order sequencing, leading to trades being executed at less favorable prices. If different trading systems record the same event with inconsistent timestamps, the order book can become unreliable. This inconsistency can confuse automated trading strategies, which depend on precise timing to interpret market signals and make decisions.

Clock discrepancies can also contribute to market fragmentation. Without accurate sequencing, trade pricing becomes less efficient, and maintaining reliable data logs and audit trails becomes challenging.

Data Integrity and Transaction Auditing

Accurate timestamps are more than just a technical detail – they’re essential for regulatory compliance and reliable audit trails. For example, in the U.S., automated trading systems must keep their clocks synchronized within 50 milliseconds of UTC, as provided by NIST. In Europe, high-volume trading systems face even stricter requirements, needing to maintain accuracy within 100 microseconds. FINRA, on the other hand, mandates a one-second tolerance for business clocks to align with the NIST standard.

As NIST explains:

"To ensure that trades are executed in the correct order, each one must be recorded and time-stamped. Time-stamping also creates an audit trail ensuring that each player in the stock market gets the correct value for the stock they’re buying or selling." – NIST

"To ensure that trades are executed in the correct order, each one must be recorded and time-stamped. Time-stamping also creates an audit trail ensuring that each player in the stock market gets the correct value for the stock they’re buying or selling." – NIST

Beyond compliance, accurate time data is a cornerstone of effective risk management. It helps track trading exposure and flags unusual activity before it spirals into a bigger issue.

| Region/Regulation | Required Accuracy | Reference Source |

|---|---|---|

| U.S. Automated Trades | 50 milliseconds | UTC (NIST) |

| European High-Volume Trading | 100 microseconds | Atomic Clock (UTC) |

| FINRA (OATS/Rule 7430) | 1 second | NIST Standard |

Reducing Latency in Algorithmic Trading

For algorithmic trading, where speed is everything, clock accuracy is a game-changer. Systems synchronized to microsecond precision can better measure network delays and optimize routing decisions, giving traders an edge in execution speed.

Clock drift, however, introduces hidden latency. For instance, an oscillator’s frequency can shift by about 1 PPM due to temperature changes. This might not sound like much, but over time, it can lead to errors of several milliseconds if left unchecked. In high-frequency trading environments, where algorithms execute thousands of trades per second, these seemingly tiny delays can snowball into significant performance hits. Accurate synchronization is the key to avoiding these pitfalls and staying competitive.

Setting Up NTP Synchronization on QuantVPS Servers

Configuring NTP on Windows Server 2022

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

QuantVPS servers operate on Windows Server 2022, which supports highly precise time synchronization – down to sub-millisecond accuracy – when configured correctly. To start, you’ll need to adjust the Windows Time service (W32Time) for more frequent polling and faster corrections.

First, open Command Prompt as an Administrator and set the Windows Time service to start automatically:

sc config w32time start= auto This ensures the service stays active, even after server restarts. Next, configure your server to use a reliable time source by entering:

w32tm /config /manualpeerlist:"pool.ntp.org,0x8" /syncfromflags:manual /update The 0x8 flag tells Windows to treat this as a special interval peer, which is essential for achieving high accuracy.

To enhance your trading server performance through sub-millisecond synchronization, modify specific registry settings under:

HKLM\SYSTEM\CurrentControlSet\Services\W32Time\Config

Adjust the following parameters:

- Set both

MinPollIntervalandMaxPollIntervalto 6 (corresponding to a 64-second polling interval). - Change

UpdateIntervalto 100 ticks for faster phase corrections. - Set

SpecialPollIntervalto 64 seconds. - Disable Secure Time Seeding by setting

UtilizeSslTimeDatato 0, as it can interfere with precision.

Once the registry changes are made, apply them by running:

w32tm /config /update net stop w32time && net start w32time Here’s a quick reference for the recommended registry settings:

| Registry Setting | Recommended Value | Purpose |

|---|---|---|

| MinPollInterval | 6 | Minimum polling interval (64 seconds) |

| MaxPollInterval | 6 | Maximum polling interval (64 seconds) |

| UpdateInterval | 100 | Phase corrections applied every 100 ticks |

| SpecialPollInterval | 64 | Interval for special polling mode |

| UtilizeSslTimeData | 0 | Disables SSL time seeding for precision |

For optimal results, maintain network latency below 0.1 milliseconds, ensure no more than four network hops, and keep CPU usage under 80%. QuantVPS’s infrastructure is designed to meet these criteria with ultra-low latency connections and access to high-quality time servers.

Once you’ve completed these steps, you can move on to verifying the synchronization accuracy.

Testing and Verifying Time Synchronization

After configuring the settings, it’s important to confirm everything is working as expected. Start by running:

w32tm /query /status /verbose This command provides details about your current time source, stratum level, polling interval, and the last successful synchronization. Ideally, you should see a stratum level of 2 or 3, with polling intervals matching your registry configuration.

To check the actual accuracy, use the stripchart command:

w32tm /stripchart /computer:pool.ntp.org /samples:450 /rdtsc This tool measures real-time offset between your server and the reference clock. Consistent offsets under 1 millisecond indicate proper synchronization. If you notice larger variations, investigate potential issues like network latency spikes or asymmetry in the path. Microsoft emphasizes:

"Time accuracy entails the end-to-end distribution of accurate time from the authoritative time source to the end device. Anything that adds asymmetry in measurements along this path negatively influences the accuracy."

"Time accuracy entails the end-to-end distribution of accurate time from the authoritative time source to the end device. Anything that adds asymmetry in measurements along this path negatively influences the accuracy."

For ongoing monitoring, periodically run:

w32tm /query /configuration This ensures your registry settings remain intact. If you need an immediate resynchronization – say, after network maintenance or when timestamp discrepancies arise – use:

w32tm /resync /nowait This clears accumulated error statistics and forces a fresh synchronization, keeping your server’s clock accurate and reliable.

Best Practices for Maintaining Time Accuracy

Selecting Reliable NTP Servers

The accuracy of your time synchronization hinges on choosing the right servers. Stratum 1 servers, which sync directly with atomic clocks or GPS satellites, provide the precision needed for activities like futures trading. These servers bypass intermediate network hops by connecting directly to national time services, reducing latency.

To ensure reliability, configure at least four independent time sources. This redundancy, as highlighted by Professor David L. Mills, allows the NTP algorithm to detect and eliminate unreliable servers automatically.

It’s also wise to diversify your time sources. Use servers from different providers and hardware setups to avoid systemic issues, such as shared chipset vulnerabilities or firmware bugs. For added security, enable symmetric key authentication (AES-128-CMAC) to protect against man-in-the-middle attacks that could introduce false time data.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

For those adhering to regulations like MiFID II or SEC Rule 613, avoid using "leap smearing" servers. As RFC 8633 explains:

"Operators who have legal obligations or other strong requirements to be synchronized with UTC or civil time SHOULD NOT use leap smearing."

"Operators who have legal obligations or other strong requirements to be synchronized with UTC or civil time SHOULD NOT use leap smearing."

This is because smeared time can deviate from UTC by up to a full second during the smear window, potentially causing audit trail discrepancies.

Monitoring and Troubleshooting NTP Performance

Ongoing monitoring is crucial to prevent timing issues from disrupting trading operations. Running the command w32tm /query /status /verbose provides key details about your synchronization status, including offset, stratum level, and the last successful sync. For futures trading, aim to keep your offset below 1.0 millisecond.

Key metrics to track daily include:

- Offset: The difference between your server’s time and the reference clock.

- Jitter: A measure of network stability; high jitter may indicate congestion or routing issues.

- Reach: Represented as an octal value (ideally 377), this shows the success rate of the last eight polling attempts. A reach value of zero may suggest that UDP port 123 is blocked by your firewall.

To verify offsets remain under 1 millisecond, use the stripchart tool periodically. If you notice significant variations, investigate potential network asymmetry – when request and response packets take different routes, timing errors can increase.

Check system logs for warnings about "insane" servers or frequent clock adjustments, as these can signal poor reference sources or severe network congestion . If synchronization issues arise after updates or maintenance, use the following command to force an immediate resync:

w32tm /resync /nowait This clears accumulated error statistics and helps restore accurate synchronization.

With a solid monitoring system in place, let’s explore how QuantVPS takes time accuracy to the next level for ultra-low-latency trading.

Using QuantVPS for Ultra-Low-Latency Trading

QuantVPS complements strong NTP practices with infrastructure designed for sub-millisecond accuracy. Its strategically placed datacenters and optimized network connections ensure minimal latency. For example, the Chicago datacenter achieves 0.52 millisecond latency to CME Globex and Tradovate, ensuring your trades are executed with speed and precision.

All QuantVPS servers run Windows Server 2022, which supports advanced time synchronization when properly configured. Combined with high-quality time servers and proactive monitoring tools, this setup detects and resolves synchronization issues before they can affect your trading. The result is a robust environment where accurate timestamps are guaranteed for every trade.

Conclusion

Key Takeaways for Traders

In futures trading, sub-millisecond accuracy isn’t just a technical detail – it’s a necessity. It ensures precise timestamps and reliable order execution, which are critical in a world where high-frequency trading makes up over 50% of all stock trades in the U.S.. Even a few microseconds can separate profit from loss. As Michael A. Lombardi from NIST puts it:

"The world’s financial markets now operate as high performance distributed systems where the time stamp of any particular trade can have a huge influence on the financial fortunes of both large and small investors."

"The world’s financial markets now operate as high performance distributed systems where the time stamp of any particular trade can have a huge influence on the financial fortunes of both large and small investors."

- NIST

This highlights the importance of strong synchronization practices in trading operations.

Using proper NTP synchronization safeguards your trading activities by ensuring orders execute in the correct sequence, maintaining accurate audit trails, and adhering to regulatory requirements. It also plays a vital role in measuring and reducing latency, giving traders a competitive edge.

For best results, establish redundancy by relying on multiple time sources, perform daily synchronization checks, and aim to keep offsets below 1.0 millisecond. These steps can help you avoid costly mistakes and stay ahead in the fast-paced trading environment.

FAQs

How does NTP help achieve precise timing for trading systems?

NTP, or Network Time Protocol, plays a crucial role in keeping trading systems on the same page by synchronizing clocks across networks with incredible precision. It adjusts for network delays, smooths out inconsistencies, and aligns systems with highly accurate time references like atomic clocks or national time standards.

With its ability to maintain sub-millisecond precision, NTP helps minimize timing errors. This level of accuracy is essential for tasks like order execution, reducing latency, and safeguarding data integrity in the fast-moving world of trading.

Why is precise time synchronization crucial for futures trading?

Accurate time synchronization plays a critical role in futures trading. Even the smallest timing discrepancies can lead to costly mistakes. For instance, if order execution is delayed or processed out of sequence, it can directly affect profitability. Similarly, data inaccuracies caused by poor synchronization make it harder to analyze market trends or fulfill regulatory reporting obligations.

Beyond financial impacts, poor timekeeping can heighten operational risks. It might even expose trading systems to compliance issues or allegations of unfair practices. Achieving sub-millisecond accuracy is key to maintaining data integrity, minimizing latency, and ensuring the reliability of high-speed trading operations.

Why should high-frequency trading systems rely on Stratum 1 or 2 NTP servers for time synchronization?

High-frequency trading systems rely on Stratum 1 or 2 NTP servers for their ability to deliver highly accurate and dependable time synchronization. These servers are directly connected to national or global time standards, making them essential for ensuring precise timing in trading operations.

This level of accuracy is crucial for minimizing latency, avoiding errors, and preserving data integrity during trades. Timing discrepancies can result in costly issues, like missed trading opportunities or executing trades at incorrect prices. By syncing your system’s clock with these trusted servers, you can achieve the sub-millisecond precision needed to perform effectively in high-speed trading environments.