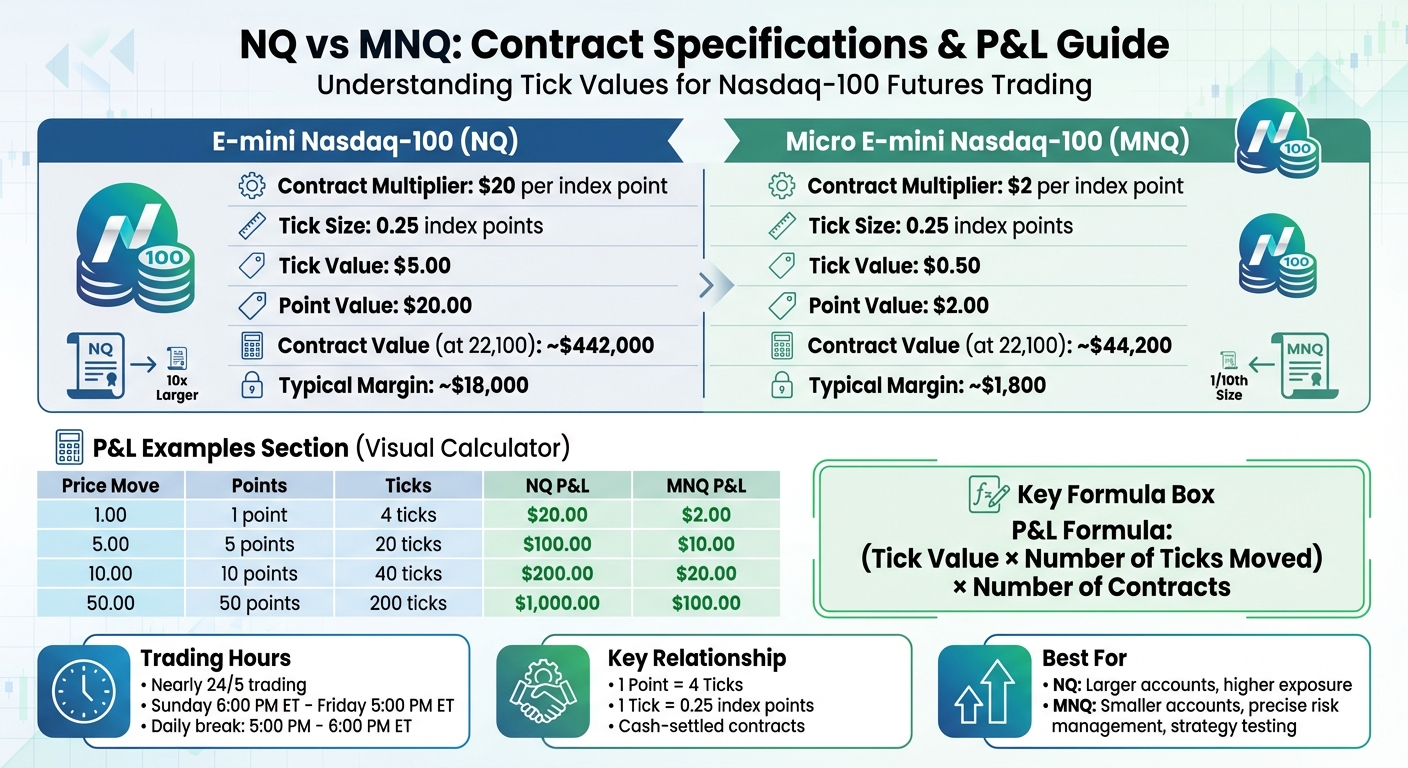

Calculating profit and loss (P&L) in Nasdaq futures (NQ and MNQ) boils down to understanding tick values. A tick is the smallest price movement in these contracts, set at 0.25 index points. Each tick has a specific dollar value: $5.00 for NQ and $0.50 for MNQ. Here’s the key formula you need:

- P&L Formula:

(Tick Value × Number of Ticks Moved) × Number of Contracts

For example:

- If NQ moves 10 points (40 ticks), the P&L for one contract is $200 (40 × $5.00).

- For MNQ, the same move would result in $20 (40 × $0.50).

The difference between NQ and MNQ lies in their contract size:

- NQ: $20 per index point, higher exposure per tick.

- MNQ: $2 per index point, lower exposure per tick, making it better for smaller accounts.

Both contracts trade almost 24/5 and are cash-settled. By mastering tick calculations, you can set accurate stop-loss levels, position sizes, and profit targets to manage risk effectively.

Nasdaq Futures Contracts: NQ and MNQ

NQ vs MNQ Nasdaq Futures: Contract Specifications and P&L Comparison

NQ vs MNQ Nasdaq Futures: Contract Specifications and P&L Comparison

The NQ and MNQ futures contracts follow the Nasdaq-100 index, which represents the 100 largest non-financial companies listed on Nasdaq. The NQ was introduced in 1999, while the MNQ debuted in May 2019 to make trading this index more accessible to a broader audience.

Contract Specifications: NQ vs. MNQ

The key difference between NQ and MNQ lies in their contract multipliers. The NQ has a multiplier of $20 per index point, while the MNQ is one-tenth its size, with a multiplier of $2 per index point. For example, at an index level of 22,100:

- NQ: A single contract represents approximately $442,000.

- MNQ: A single contract represents about $44,200.

Both contracts share the same minimum price fluctuation (tick size) of 0.25 index points, but the tick values differ:

- NQ: Each tick is worth $5.00.

- MNQ: Each tick is worth $0.50.

This means a $1,000 move in the NQ equates to a $100 move in the MNQ.

| Specification | E-mini Nasdaq-100 (NQ) | Micro E-mini Nasdaq-100 (MNQ) |

|---|---|---|

| Contract Unit | $20 × Nasdaq-100 Index | $2 × Nasdaq-100 Index |

| Tick Size | 0.25 index points | 0.25 index points |

| Tick Value | $5.00 | $0.50 |

| Point Value | $20.00 | $2.00 |

Both contracts are traded nearly 24 hours a day, starting Sunday at 6:00 p.m. ET and ending Friday at 5:00 p.m. ET, with a daily maintenance break from 5:00 p.m. to 6:00 p.m. ET. They are cash-settled, meaning no physical delivery of the underlying index occurs.

Why Tick Values Matter

Tick values are crucial because they determine the dollar amount gained or lost with each price movement. Since one full index point equals four ticks (0.25 × 4 = 1.00), you can calculate profit or loss by multiplying the total ticks by the tick value. For example:

- If the NQ price moves from 15,000 to 15,005 (a 5-point change, or 20 ticks):

- NQ: The profit would be $100 (20 × $5.00).

- MNQ: The profit would be $10 (20 × $0.50).

- NQ: The profit would be $100 (20 × $5.00).

- MNQ: The profit would be $10 (20 × $0.50).

The smaller tick value of the MNQ offers greater flexibility for risk management. For instance, instead of trading one full NQ contract, a trader could use 15 MNQ contracts, which is roughly equivalent to 1.5 NQ contracts. This approach allows traders to fine-tune their risk exposure, making it particularly appealing for those with smaller accounts or for testing strategies with less financial risk. For those just starting out, following a roadmap for beginners can help navigate these complexities.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

How to Calculate Tick Values and Point Values

Let’s dive deeper into converting ticks and points into dollar values, building on the earlier concepts.

What Is a Tick?

A tick is the smallest possible price change, fixed at 0.25 index points. This means prices move in increments of 0.25 – you won’t encounter prices like 15,000.13 or 15,000.47 on the order book. Traders often use a Chicago VPS for futures trading to ensure these price changes are captured with minimal latency.

A point, on the other hand, represents a full unit of price movement, such as moving from 15,000.00 to 15,001.00. Since a tick is 0.25, there are exactly 4 ticks in a single point. This relationship is crucial for calculating how price changes affect profits or losses.

Now, let’s see how these movements translate into dollar values.

Converting Tick Movement to Dollar Value

To determine the dollar value of a tick, you multiply 0.25 by the contract’s multiplier. For example:

- NQ (E-mini Nasdaq-100): The contract multiplier is $20 per index point. Each tick is worth $5.00 (0.25 × $20 = $5.00).

- MNQ (Micro E-mini Nasdaq-100): The multiplier is $2 per index point. Each tick is worth $0.50 (0.25 × $2 = $0.50).

Since each point equals 4 ticks, the point values are:

- NQ: $20.00 per point (4 × $5.00).

- MNQ: $2.00 per point (4 × $0.50).

For example, if the NQ moves from 15,000 to 15,005, that’s a 5-point move (or 20 ticks). On a single contract, this results in a profit or loss of $100 (20 ticks × $5.00).

| Price Move | Points | Ticks | NQ Profit/Loss | MNQ Profit/Loss |

|---|---|---|---|---|

| 1.00 | 1 | 4 | $20.00 | $2.00 |

| 5.00 | 5 | 20 | $100.00 | $10.00 |

| 10.00 | 10 | 40 | $200.00 | $20.00 |

| 50.00 | 50 | 200 | $1,000.00 | $100.00 |

Step-by-Step P&L Calculations

Now that you know how tick and point values work, let’s break down the profit and loss (P&L) calculations for both contract types. The formula is simple: (Tick Value × Number of Ticks Moved) × Number of Contracts.

Calculating P&L for NQ Contracts

Let’s say you enter an NQ contract at 15,000.00 and exit at 15,010.00. That’s a 10-point move. Since each point equals 4 ticks (10 ÷ 0.25 = 40 ticks), the calculation is 40 ticks × $5.00 = $200 per contract. Whether you calculate it as 40 ticks × $5.00 or 10 points × $20.00, the result is the same.

Now, if you held three contracts instead of one, you’d multiply the result by three: $200 × 3 = $600 total profit. Keep in mind, the same math applies if the market moves against you – a 10-point loss would mean $200 lost per contract.

Calculating P&L for MNQ Contracts

For an MNQ contract, the same entry at 15,000.00 and exit at 15,010.00 results in a 10-point move. Since each tick is worth $0.50, and there are 40 ticks in a 10-point move, the profit per contract is 40 × $0.50 = $20.

If you traded five MNQ contracts, your total profit would be $20 × 5 = $100. Alternatively, using the point value method, you’d calculate 10 points × $2.00 per point, which also equals $20 per contract.

These exact calculations are essential for managing risk effectively using futures trading strategies, a topic we’ll dive into next.

Using P&L Calculations for Risk Management

Risk management becomes much more practical when you integrate P&L calculations into your trading decisions. Knowing exactly how much you’re risking per tick or point allows you to make smarter choices about position sizes, stop-loss levels, and profit targets. Let’s break this down further by exploring how to set clear profit targets, define stop-loss levels, and understand the role leverage plays in these calculations.

Setting Profit Targets and Stop-Loss Levels

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

A key part of risk management is translating index movements into dollar values. For example, if you’re trading one NQ contract and want to risk $400, you could place a stop-loss 20 points away (20 points × $20 = $400).

Many traders also rely on the Average True Range (ATR) to align their targets with market volatility. Suppose the Nasdaq-100’s ATR suggests typical daily moves of about 150 points. You might aim for a 60-point profit target paired with a 20-point stop-loss, creating a 3:1 risk-to-reward ratio. In dollar terms, this setup means a $1,200 profit on an NQ contract or $120 on an MNQ contract, making it easier for smaller accounts to participate with proportionate risk.

To avoid emotional decision-making during volatile periods, consider automating your exits. Using stop-market or stop-limit orders tied to your predetermined P&L thresholds can help you stick to your plan.

How Leverage Affects P&L

Leverage amplifies both potential gains and losses, making it a critical factor in futures trading. With margin, you can control large notional values using a relatively small deposit. For instance, at an index level of 16,000, a single NQ contract represents about $320,000 in notional value (16,000 × $20) but requires only around $18,000 in margin. This results in leverage of roughly 17.7:1, meaning even small index moves can significantly affect your capital.

Here’s an example: A 50-point move in the Nasdaq-100 index equals just 0.31% of a 16,000 index level. However, it translates to a $1,000 swing in your NQ position, which is about 5.6% of an $18,000 margin deposit. For MNQ contracts, the same 50-point move results in a $100 change, maintaining a similar percentage impact on a typical $1,800 margin requirement.

To gauge leverage’s impact, calculate the notional value by multiplying the index level by the contract multiplier. During high-volatility events like CPI releases or FOMC announcements, consider reducing your position size or widening stop-loss levels to manage risk and account for potential slippage. If you’re testing new strategies or working with a smaller account, MNQ contracts offer the same percentage exposure as NQ contracts but require only 1/10th of the capital.

These principles are essential for building a disciplined and effective trading approach.

Conclusion

Mastering these calculation methods plays a key role in maintaining discipline when trading Nasdaq futures. Every tick and point movement translates into real dollar amounts, directly affecting your profit and loss (P&L).

The National Futures Association highlights the importance of understanding minimum price fluctuations and their impact on contract values. CME Group also reminds traders: "The size of the contract can have a considerable multiplying effect on the profit and loss of a specific futures contract". These insights underline the need for precision and careful planning and automated trading strategies in every trade.

Always use the established formula to manually confirm your P&L both before and after executing a trade. This habit allows you to set accurate stop-loss levels, choose appropriate position sizes, and approach your trades with greater confidence. If you’re working with a smaller account, MNQ contracts offer the same percentage exposure as NQ but require only one-tenth of the capital, providing more flexibility to manage your risk effectively.

FAQs

Why is the MNQ a better choice than the NQ for traders with smaller accounts?

The Micro E-mini Nasdaq 100 (MNQ) is a great option for traders with smaller accounts, primarily because of its lower tick value. Each tick is worth $0.50, compared to the $5.00 per tick of the standard Nasdaq 100 (NQ) contract. This smaller tick value makes it easier to manage risk, allowing traders to take smaller position sizes and better control potential losses.

For those with limited capital, the MNQ offers an accessible way to trade Nasdaq futures while still capturing the same market movements as the NQ. It’s an ideal choice for newer or smaller-scale traders looking to gain experience, refine their strategies, and build confidence – all without taking on too much financial risk.

How does leverage affect profit and loss in Nasdaq futures trading?

Leverage in Nasdaq futures trading can significantly amplify your results – both positive and negative. Even minor price fluctuations can lead to notable changes in your account balance.

For instance, every tick in the Nasdaq futures market carries a set dollar value. When trading with leverage, the effect of each tick is multiplied. This means you could see higher profits if the market moves in your favor. However, the same leverage also increases the potential for larger losses if the market turns against you.

Understanding how leverage operates and using it wisely is crucial. A responsible approach to leverage can help you manage risk effectively while navigating the market.

What are the best ways to manage risk when trading Nasdaq futures (NQ and MNQ)?

Effectively managing risk in Nasdaq futures trading requires a solid grasp of tick size and tick value for each contract. For instance, the tick value is $5 per tick for standard NQ futures and $0.50 per tick for micro NQ (MNQ). Understanding these values helps you set precise stop-loss and take-profit levels that align with your risk tolerance.

Another essential component is position sizing. This means adjusting the number of contracts you trade based on your account size and the market’s volatility. It’s crucial to keep margin requirements in mind and avoid overleveraging, as this can expose you to significant losses.

Lastly, using stop-loss orders is a smart way to limit potential losses. Staying informed about market-moving events, such as earnings reports or major economic announcements, is also critical. By combining these strategies, you can manage risk more effectively and enhance your trading performance.