Equity Curve Simulator for Strategy Performance

Equity curve simulators let you test trading strategies without risking money. They use metrics like win rate, risk-to-reward ratio, and risk per trade to simulate thousands of possible outcomes. Unlike backtesting, which follows historical data, these simulators shuffle trade sequences using probabilistic methods like Monte Carlo simulations. This approach helps traders understand potential drawdowns, losing streaks, and overall strategy performance under varied market conditions.

Key benefits include:

- Visualizing equity growth and drawdowns over time.

- Preparing for losing streaks and long-term strategy risks.

- Testing adjustments to position sizing and risk management.

While these tools provide valuable insights, they rely on accurate input data and can't account for real-world factors like slippage or trader emotions. Combining simulations with backtesting offers a more complete picture of strategy viability.

How Equity Curve Simulators Work

Equity curve simulators rely on key statistical inputs - like win rate, reward-to-risk ratio, starting capital, and risk per trade - to perform iterative calculations. These inputs act as the foundation for the simulation process, shaping every calculation that follows.

The process begins by defining these parameters. For each trade, the simulator determines whether the outcome is a win or a loss based on the win rate. Profits from winning trades are calculated using the reward-to-risk ratio and the amount of risk allocated per trade. Losses, on the other hand, are directly subtracted. The equity is updated after each trade using the formula:

Final Capital = Starting Capital + (Trade Gains or Losses - Commissions).

One standout feature of these simulators is their ability to repeat this process thousands of times. Each iteration reshuffles the sequence of wins and losses using probability-based methods, emulating the unpredictability of real-world markets. For instance, running 100 iterations generates 100 unique "lifetimes" of a strategy, each with its own sequence of outcomes. Below are the key components that drive this simulation process.

Core Components of a Simulation Engine

Four main inputs dictate the results of an equity curve simulation:

- Win Rate: Determines how often trades result in profits.

- Reward-to-Risk Ratio: Measures the size of wins relative to losses, which can help offset a lower win rate.

- Iterations: Specifies the number of trades simulated per run.

- Risk Per Trade: Defines the amount of capital risked on each trade, influencing both volatility and drawdowns.

For accurate and reliable results, it’s crucial to use real-world data - ideally from at least 100 backtested or live trades. For example, a strategy with a 55% win rate and a 2:1 reward-to-risk ratio will produce vastly different outcomes depending on whether you risk 1% or 2% of your capital per trade.

| Parameter | Description | Impact on Simulation |

|---|---|---|

| Win Rate | Percentage of trades that are winners | Drives overall profitability |

| Reward-to-Risk Ratio | Average win size compared to losses | Can offset lower win rates |

| Iterations | Number of trades in each simulation run | Ensures statistical reliability |

| Risk Per Trade | Capital risked per trade (fixed or % based) | Affects volatility and drawdowns |

In addition to these inputs, simulators incorporate features to replicate the variability of real markets.

Simulating Market Variability

Equity curve simulators aim to reflect the unpredictable nature of markets by generating multiple potential outcomes - from the best-case to the worst-case scenarios. Instead of offering a single definitive result, these simulators present a spectrum of possibilities.

One common method is exact shuffling, where the simulator randomizes the sequence of a fixed set of trades. While the total net profit stays constant across iterations, the drawdowns can vary significantly. For example, one simulation might show a drawdown of 16%, while another shows 26%, simply because losses occur in clusters. Advanced simulators may use resampling (the bootstrap method), which selects trades randomly from a historical dataset. This approach allows for some trades to appear multiple times or be omitted entirely, introducing variability in both net profit and drawdown.

Some simulators even factor in real-world disruptions, such as skipped trades due to internet outages or platform issues. For instance, introducing a 5% probability of missed trades can create more realistic expectations for both profits and drawdowns.

"By simply reshuffling the trades your final profit will stay the same, but your drawdown can change a lot. Instead of drawdown 10% you might end with drawdown 30% just by changing the order of the trades."

- Mark Fric, Founder of StrategyQuant

"By simply reshuffling the trades your final profit will stay the same, but your drawdown can change a lot. Instead of drawdown 10% you might end with drawdown 30% just by changing the order of the trades."

- Mark Fric, Founder of StrategyQuant

To achieve reliable results, aim for at least 100 iterations. This ensures statistical robustness and a 95% confidence level. Additionally, running the same inputs multiple times will produce slightly different equity curves, reflecting the inherent randomness of market conditions.

Key Benefits of Using Equity Curve Simulators

Equity curve simulators bring powerful tools to the table, offering traders a clear lens into the potential outcomes of their strategies. By generating thousands of possible equity paths using the same parameters, these simulators reveal everything from the highest peaks to the deepest drawdowns. This process helps traders grasp what might realistically happen when they put their money on the line [2, 10].

One major advantage is the ability to prepare for the inevitable ups and downs of trading. For instance, a strategy with a 55% win rate and a 1.5:1 reward-to-risk ratio has about a 12% chance of hitting a streak of eight or more consecutive losses over 100 trades. Simulators make these tough scenarios visible before they happen, reducing the risk of emotional decisions that could derail your plan.

"The real value of an equity curve simulator isn't in promising profits - it's in preparing you for the statistical gut-punches of trading, like long drawdowns and brutal losing streaks" - TradeReview

"The real value of an equity curve simulator isn't in promising profits - it's in preparing you for the statistical gut-punches of trading, like long drawdowns and brutal losing streaks" - TradeReview

Visualizing Probable Outcomes

Using Monte Carlo methods, simulators randomize trade sequences, creating a range of possible outcomes instead of a single fixed result [2, 4]. This approach highlights the variability in trading results. For example, even if your average drawdown is 15%, there’s still a 10% chance it could spike to 30% just because of random trade order. Professional traders often aim to keep their Probability of Ruin - the likelihood of a 50% drawdown - below 5%, and simulators calculate this directly based on your strategy’s parameters.

Focusing on drawdowns rather than peak profits is critical. Over 100 trades, even strategies with a 60% win rate are almost certain to encounter at least one five-trade losing streak. Simulators allow you to see and mentally prepare for these scenarios, helping you stay committed to your plan even during tough periods.

Here’s a breakdown of key metrics simulators provide and why they matter:

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

| Metric | What It Shows | Why It Matters |

|---|---|---|

| Max Drawdown | Largest drop from a peak to a trough in equity | Helps gauge if the strategy is financially and emotionally manageable [2, 10] |

| Prob. of Ruin | Likelihood of losing a critical portion of capital (e.g., 50%) | Keeping this below 5% is crucial for long-term success |

| Median Final Equity | The middle point of all simulated outcomes | Offers a realistic expectation of average performance |

| 95th/5th Percentile | Top and bottom 5% of outcomes | Highlights the best- and worst-case scenarios due to variance |

These metrics provide actionable insights, helping traders fine-tune risk management and refine their strategies.

Improving Strategy Performance

Equity curve simulators act as a safe testing ground where you can experiment with adjustments without risking real money. For example, you might explore whether improving your win rate from 55% to 60% through better entry rules significantly impacts long-term equity growth and drawdown levels.

Simulators also make it easy to analyze position sizing. Testing different risk-per-trade percentages, such as 1% versus 2%, often reveals that smaller risks lead to smoother equity curves and shallower drawdowns. To ensure reliable insights, it’s best to simulate 500 to 1,000 trades, with many simulators running at least 1,000 iterations to provide dependable percentile estimates.

Watching how a simulated strategy weathers long losing streaks and still recovers can build the confidence needed to stick with your plan when trading live.

Interpreting Simulation Results

Simulation results provide a window into how effective a trading strategy might be in real-world scenarios. A well-performing equity curve should rise steadily from left to right at about a 45-degree angle. This kind of trajectory reflects consistent performance across different market conditions, rather than relying on a few lucky trades or specific market scenarios. By analyzing these patterns, you can gain insight into your strategy's stability and identify areas for improvement.

Be cautious of equity curves that seem too good to be true. For instance, if the curve has distinct "steps" rather than a smooth progression, it could mean that the strategy's profits hinge on just a few big trades. Similarly, a curve with a sudden spike near the end might indicate overfitting to recent market data, which is a red flag.

"A good equity curve is one that has an even slope, small and short-lived drawdowns, and a good amount of trades to make the observation statistically significant." - Oddmund Groette, Founder, Quantified Strategies

"A good equity curve is one that has an even slope, small and short-lived drawdowns, and a good amount of trades to make the observation statistically significant." - Oddmund Groette, Founder, Quantified Strategies

Pay attention to plateaus and recovery times in the equity curve. Long flat periods often signal that the strategy struggles to recover after losses. Keep in mind how drawdowns compound: a 50% loss requires a 100% gain to recover, while a 75% loss needs a 300% gain just to break even.

Analyzing Equity Curve Patterns

It's important to review Mark-to-Market equity, as it captures all market movements, including those within open trades. Relying only on closed trade equity curves can mask significant intra-trade drawdowns that could jeopardize your account.

Sudden, steep drops in your equity curve are another warning sign. These sharp declines may indicate large, unexpected losses or extreme risk events. Additionally, if your strategy's success depends heavily on a few standout trades, it suggests the system lacks robustness. Removing one or two exceptional trades shouldn't cause the entire equity curve to collapse.

Parameter sensitivity is another critical factor. If small tweaks to your strategy's parameters result in drastic changes to the equity curve, it might be overfitted. Strategies with more than five parameters are particularly prone to this issue. Understanding these patterns and sensitivities lays the groundwork for evaluating key performance metrics.

Key Metrics to Evaluate

When assessing metrics, aim for a balance between profitability and risk. For instance, a Profit Factor between 1.5 and 2.5 is considered strong, while values above 4.0 could indicate overfitting. The Recovery Factor (net profit divided by maximum drawdown) measures how quickly a strategy bounces back from losses. A value above 5.0 is excellent, but anything below 1.0 signals trouble.

The Calmar Ratio (annualized return divided by max drawdown) is helpful for comparing strategies over different time frames. A ratio above 3.0 is generally regarded as strong. Another useful metric is Expectancy, calculated as: (Win% × Average Win) - (Loss% × Average Loss). This provides insight into the average profit per trade.

| Metric | Realistic Range | Warning Sign |

|---|---|---|

| Profit Factor | 1.5 – 2.5 | > 4.0 |

| Sharpe Ratio | 1.0 – 2.0 | > 3.0 |

| Win Rate | 35% – 65% | > 80% |

| Max Drawdown | 15% – 30% | < 5% |

Finally, ensure your Average Profit per Trade is high enough to cover trading costs. For example, if your average profit is $20 but commissions and slippage total $15, the strategy might not be viable in practice. To get reliable metrics, simulate at least 100 trades to reduce the impact of random variations. Also, be aware that live trading drawdowns are often 1.5 to 2 times higher than those seen in simulations due to slippage and other real-world costs.

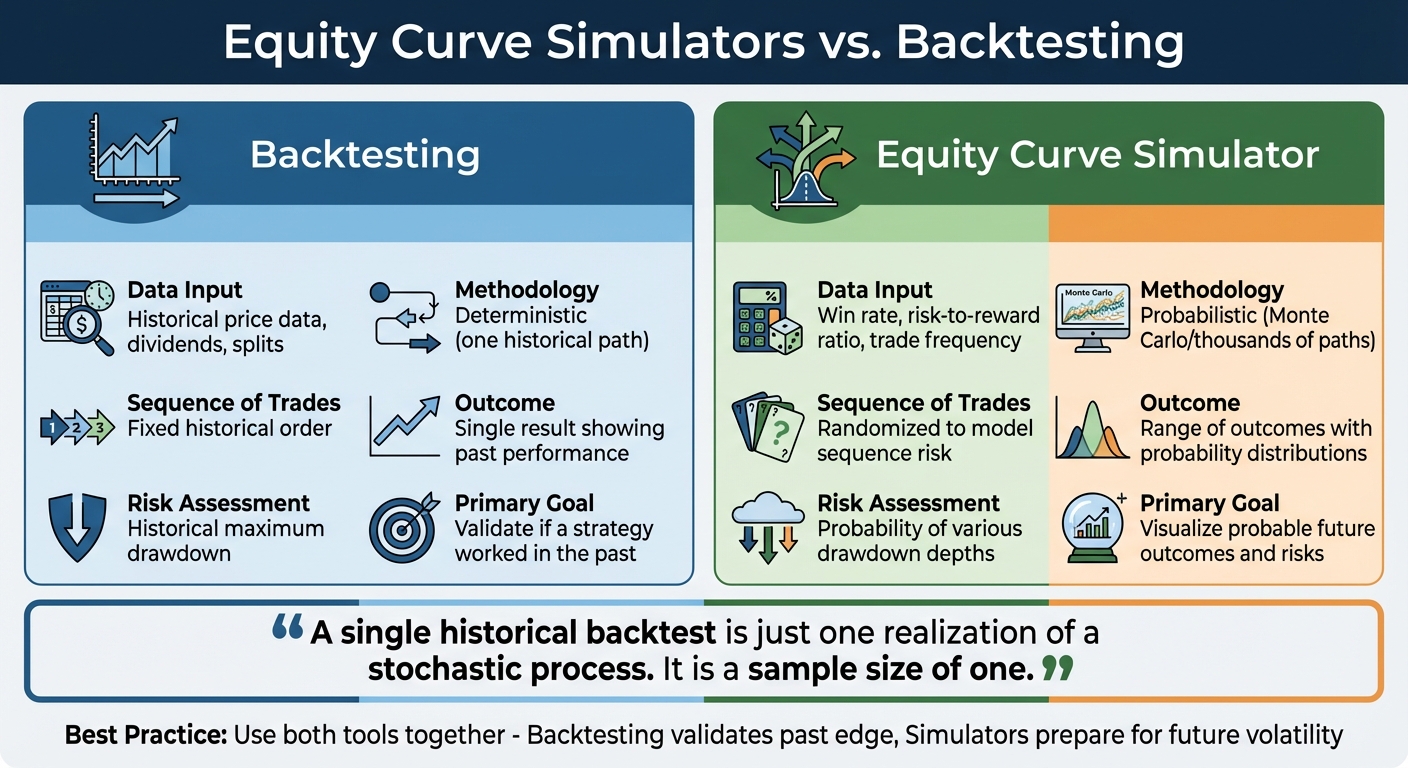

Equity Curve Simulators vs. Backtesting

Equity Curve Simulators vs Backtesting: Key Differences for Traders

Equity Curve Simulators vs Backtesting: Key Differences for Traders

Let’s dive deeper into the roles of equity curve simulators and backtesting, and how they complement each other when evaluating trading strategies.

Backtesting focuses on how a strategy performed during a specific historical period, while equity curve simulators project thousands of potential outcomes. Backtesting applies your strategy to actual price data, helping confirm whether it had an edge in the past. Simulators, on the other hand, use probabilistic methods to model various "lifetimes" of your strategy, offering a broader view of possible results.

The key difference lies in how they handle uncertainty. A backtest represents just one instance of a stochastic process. This is a major limitation because the exact sequence of historical returns you tested is unlikely to repeat in live trading. Simulators tackle this problem by using metrics like win rate, risk-to-reward ratio, and trade frequency to estimate how your strategy might behave across different market scenarios.

"A single historical backtest is just one realization of a stochastic process. It is a sample size of one. Reliance on the specific sequence of historical returns is the primary cause of live trading failure." - Sophie-AI-Finance

"A single historical backtest is just one realization of a stochastic process. It is a sample size of one. Reliance on the specific sequence of historical returns is the primary cause of live trading failure." - Sophie-AI-Finance

Backtesting shows what worked, while simulators prepare you for what might happen. They highlight risks like hitting critical loss thresholds or enduring long losing streaks that may not have appeared in the historical data. For instance, Monte Carlo simulations often reveal that drawdowns can spike to 30% on average.

Comparison Table: Simulators vs. Backtesting

| Feature | Backtesting | Equity Curve Simulator |

|---|---|---|

| Data Input | Historical price data, dividends, splits | Win rate, risk-to-reward ratio, trade frequency |

| Methodology | Deterministic (one historical path) | Probabilistic (Monte Carlo/thousands of paths) |

| Sequence of Trades | Fixed historical order | Randomized to model sequence risk |

| Outcome | Single result showing past performance | Range of outcomes with probability distributions |

| Risk Assessment | Historical maximum drawdown | Probability of various drawdown depths |

| Primary Goal | Validate if a strategy worked in the past | Visualize probable future outcomes and risks |

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

This comparison highlights why using both tools is essential for a well-rounded strategy evaluation.

The ideal approach combines these methods. Backtesting helps identify strategies with positive expectancy, while simulators assess whether you can handle the volatility that comes with them. For example, research shows that survivorship bias can inflate backtested returns by several percentage points annually. Additionally, a test of 1,000 random strategies with no real edge produced a "lucky" one with a Sharpe ratio of 2.367. Simulators help filter out these false positives by stress-testing the statistical foundation of your strategy.

Why Simulators Improve Trading Preparedness

Simulators act as a mental and practical training tool, helping you prepare for the realities of trading. They show that even profitable strategies can experience prolonged losing streaks, which can help you build the discipline to stick to your plan during tough periods. For example, seeing your strategy survive a simulated 15-trade drawdown can make it easier to stay calm during a real-life 5-trade losing streak.

Limitations of Equity Curve Simulators

Understanding Simulator Constraints

Equity curve simulators are tools designed to model potential outcomes based on the historical performance of a trading strategy. However, they are not fortune-telling devices - they can't predict what will happen in live markets [2,6]. These simulators rely on your strategy's characteristics, like win rate, risk-reward ratio, and trade frequency, to create a range of possible scenarios. The key word here is possible - real markets often behave unpredictably.

"A simulator is only as good as the data you feed it. Think of it as a mirror reflecting your trading history, not a promise of future outcomes." - TradeReview

"A simulator is only as good as the data you feed it. Think of it as a mirror reflecting your trading history, not a promise of future outcomes." - TradeReview

The principle of "garbage in, garbage out" applies heavily here. If your input data is limited or overly optimistic - say, based on just 30 trades - the simulation results can be misleading. While simulations with at least 100 trades might give you a rough idea, datasets of 500 to 1,000 trades offer the statistical depth needed to account for random variations. Another major issue is overfitting, where parameters are excessively tailored to past data. This often results in a strategy that looks great in backtests but struggles - or outright fails - when applied to live trading.

On top of these theoretical limitations, real-world trading introduces its own set of challenges.

Accounting for Live Trading Factors

Simulators operate under the assumption of perfect execution - every trade happens instantly at your desired price. Unfortunately, real markets are far messier. Slippage, latency, and limited liquidity can significantly affect your results [6,19]. A strategy that appears profitable in a simulator may falter once transaction costs and slippage are factored in.

Another overlooked aspect is human psychology. Simulators assume traders will stick to their strategies no matter what, but emotions like fear during drawdowns or greed during winning streaks often interfere [2,20]. For instance, recovering from a 50% drawdown requires a 100% gain just to break even. While this is just math in a simulation, it can feel overwhelming - and even paralyzing - in live trading. On top of that, behaviors like revenge trading or deviating from your plan are impossible for simulators to model accurately.

In short, while equity curve simulators are helpful tools, they can't account for the full complexity of live trading.

Conclusion

Equity curve simulators provide a practical way to prepare for the challenges of managing trading risks. By simulating thousands of potential trade scenarios using metrics like win rate, risk-reward ratio, and position sizing, these tools give a glimpse into how your account might perform over time.

The real advantage, however, goes beyond just numbers. It's about preparing mentally and fine-tuning your strategy. As TradeReview explains:

"An equity curve simulator transforms abstract statistics into a felt experience. This mental rehearsal forges the discipline to execute your strategy flawlessly."

"An equity curve simulator transforms abstract statistics into a felt experience. This mental rehearsal forges the discipline to execute your strategy flawlessly."

Simulators also let you experiment with variables in a controlled setting. For example, reducing your risk per trade from 2% to 1% can help smooth out your equity curve while still maintaining potential gains.

To get the most reliable insights, use verified backtesting or live trading data and simulate between 500 and 1,000 trades. This process helps you evaluate key metrics like maximum drawdown and overall profit, ensuring your strategy aligns with both your emotional tolerance and financial goals before putting real money on the line.

FAQs

How many real trades are needed before a simulation is trustworthy?

A simulation is generally deemed reliable after evaluating 200 to 500 trades. This range allows for statistical accuracy while considering different market scenarios, ensuring the strategy is tested thoroughly and can be trusted under diverse conditions.

What risk per trade should I use to keep drawdowns tolerable?

When it comes to managing losses, many traders stick to risking just 1–2% of their capital per trade. Others might go even lower, depending on their personal comfort with risk and their trading approach. Tweaking the amount you risk per trade is a crucial part of smart risk management - it helps safeguard your capital, especially during rough patches when trades don't go as planned.

How do I factor in slippage and commissions in the simulation?

When simulating an equity curve, it's essential to factor in slippage and commissions to keep your results grounded in reality. Slippage can be accounted for by adjusting returns to include a specific basis point (bps) cost. On the other hand, commissions should be subtracted either per trade or as fixed/variable expenses. Including these costs in your model ensures your simulation mirrors actual trading conditions, avoiding overly optimistic projections.

A simulation is generally deemed reliable after evaluating 200 to 500 trades. This range allows for statistical accuracy while considering different market scenarios, ensuring the strategy is tested thoroughly and can be trusted under diverse conditions.

When it comes to managing losses, many traders stick to risking just 1–2% of their capital per trade. Others might go even lower, depending on their personal comfort with risk and their trading approach. Tweaking the amount you risk per trade is a crucial part of smart risk management - it helps safeguard your capital, especially during rough patches when trades don't go as planned.

When simulating an equity curve, it's essential to factor in slippage and commissions to keep your results grounded in reality. Slippage can be accounted for by adjusting returns to include a specific basis point (bps) cost. On the other hand, commissions should be subtracted either per trade or as fixed/variable expenses. Including these costs in your model ensures your simulation mirrors actual trading conditions, avoiding overly optimistic projections.

"}}]}