Stock Algorithmic Trading Platforms Compared: What to Look For

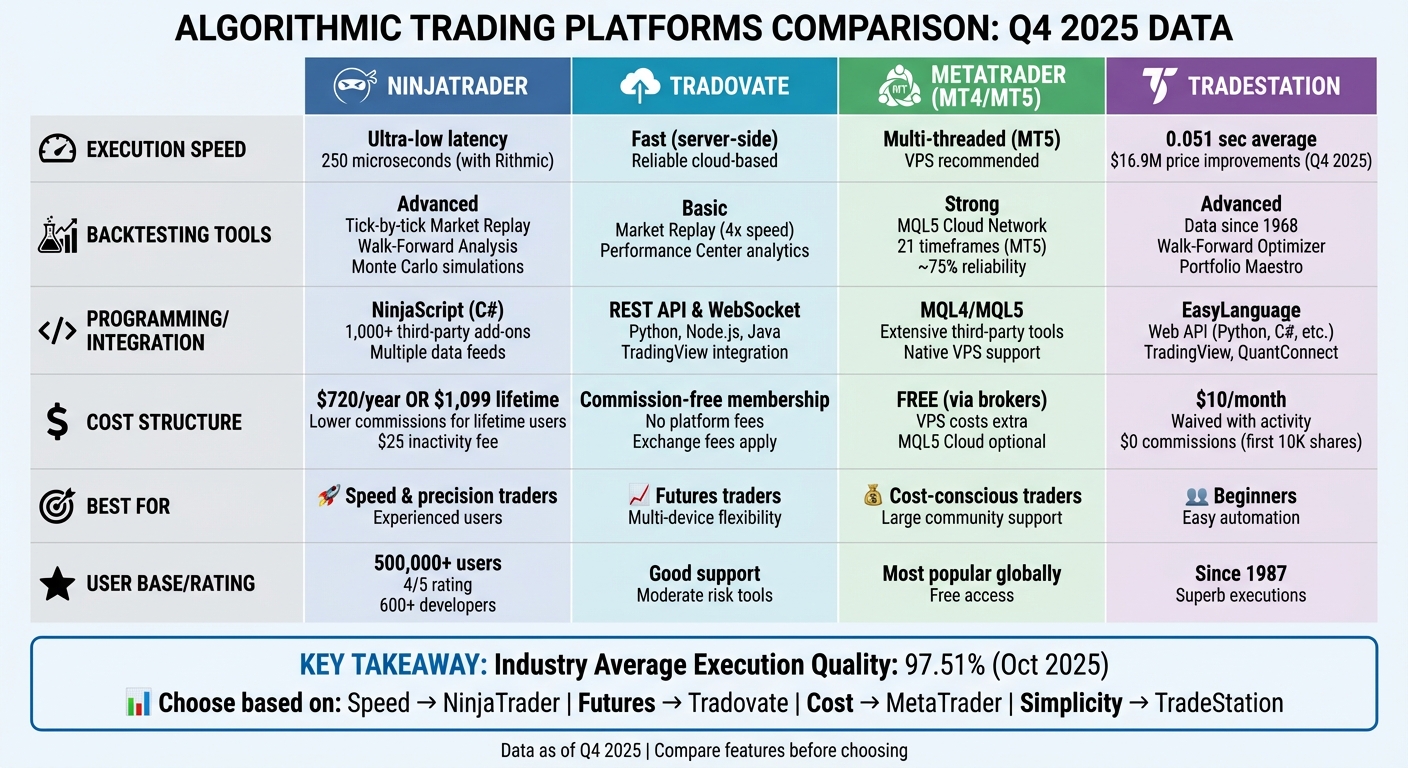

Algorithmic trading platforms are essential for traders looking to execute strategies automatically based on predefined rules. Four key platforms - NinjaTrader, Tradovate, MetaTrader (MT4/MT5), and TradeStation - offer distinct features, strengths, and pricing models. Here’s what you need to know:

- NinjaTrader: Known for ultra-low latency and advanced backtesting tools. Ideal for experienced traders who value precision and customization. Costs include a $1,099 lifetime license or $720 annual fee.

- Tradovate: A cloud-based platform offering commission-free trading and multi-device access. Best for futures traders seeking simplicity, though backtesting features are limited.

- MetaTrader (MT4/MT5): A free, broker-supported platform with extensive third-party tools and robust backtesting via the MQL5 Cloud Network. Requires a VPS for 24/7 automation.

- TradeStation: Offers user-friendly tools like EasyLanguage for strategy automation, fast execution speeds, and access to decades of historical data. Monthly fees start at $10 but can be waived with activity.

Quick Comparison

| Platform | Execution Speed | Backtesting Tools | Integration/Programming | Cost |

|---|---|---|---|---|

| NinjaTrader | Ultra-low latency | Advanced (tick-by-tick) | C# (NinjaScript) | $720/year or $1,099 lifetime |

| Tradovate | Fast (server-side) | Basic (Market Replay) | REST API, WebSocket | Commission-free |

| MetaTrader | Multi-threaded (MT5) | Strong (MQL5 Cloud Network) | MQL4/MQL5, third-party | Free (via brokers) |

| TradeStation | Reliable (0.051 sec avg) | Advanced (Walk-Forward) | EasyLanguage, Web API | $10/month (waived with activity) |

Each platform caters to different needs. Choose NinjaTrader for speed, Tradovate for futures, MetaTrader for cost efficiency, or TradeStation for ease of use. Evaluate your priorities - execution speed, backtesting, integration, or cost - to pick the right fit for your trading goals.

Stock Algorithmic Trading Platforms Comparison: NinjaTrader vs Tradovate vs MetaTrader vs TradeStation

Stock Algorithmic Trading Platforms Comparison: NinjaTrader vs Tradovate vs MetaTrader vs TradeStation

1. NinjaTrader

NinjaTrader has established itself as a trusted platform for futures traders who prioritize precision and control. With a user base exceeding 500,000 and contributions from over 600 developers across 150+ countries, it’s a popular choice among serious algorithmic traders. The platform operates on a desktop-based system and uses NinjaScript - a C#-based framework - offering customization and high-frequency execution that web-based platforms often can’t match.

Execution Speed

In trading, milliseconds can make or break profitability, making execution speed a top priority. NinjaTrader 8 leverages a multi-threaded core, which significantly boosts processing speeds compared to its predecessors. The platform also supports sub-second market data timestamps, a must-have for high-frequency trading strategies. However, execution speeds vary depending on the data provider. For example, traders using Rithmic report tick-to-trade execution times as low as 250 microseconds - just a quarter of a millisecond. On the other hand, CQG/Continuum users experience higher latency.

To safeguard trades, NinjaTrader offers server-side ATM (Advanced Trade Management) strategies. These ensure that stop-loss and profit targets remain active even if your local internet connection fails. When paired with a high-performance VPS offering 0-1ms latency to exchange servers, the platform achieves institutional-grade execution speeds.

Beyond speed, effective backtesting tools are crucial for refining and validating trading strategies.

Backtesting Capabilities

NinjaTrader’s Strategy Analyzer is a powerful backtesting tool that supports multi-objective optimization, allowing traders to test multiple performance metrics simultaneously. A standout feature is the Market Replay tool, which downloads historical data and replays it tick-by-tick under real-time conditions. This provides insights into how strategies would perform, including details like order queue position and bid/ask volume.

"NinjaTrader is an excellent testing platform for validating real market conditions with each backtest so that you can evaluate every trade correctly." - Quant Savvy

"NinjaTrader is an excellent testing platform for validating real market conditions with each backtest so that you can evaluate every trade correctly." - Quant Savvy

The platform also includes Walk-Forward Analysis, which helps avoid curve-fitting by periodically re-optimizing strategies on out-of-sample data. Additionally, Monte Carlo simulations assess risk by running strategies through various historical data distributions. However, users have noted that the Market Analyzer can slow down significantly when scanning more than 100 symbols at once.

Now, let’s look at how NinjaTrader integrates with other tools and platforms.

Integration Options

NinjaTrader offers robust customization options, allowing traders to align the platform with their specific algorithmic strategies. Its NinjaScript framework, built on C# and the .NET framework, supports integration with external DLLs and system-level functions. The platform also supports over 1,000 third-party add-ons, including custom indicators and automated strategies. It connects seamlessly with data feeds such as Kinetick, Rithmic, CQG (Continuum), IQFeed, eSignal, and TradeStation, and works with brokers like NinjaTrader Brokerage, Interactive Brokers, and StoneX.

For traders looking to integrate signals from platforms like TradingView, third-party tools such as CrossTrade can route execution orders directly into NinjaTrader. Since the platform requires a Windows environment, using a dedicated VPS ensures continuous uptime and minimal latency to exchange servers.

Cost Structures

NinjaTrader offers a free version that includes charting, strategy development, and backtesting when linked to a funded account. For live trading, users can choose between a $720 annual lease ($225 quarterly) or a $1,099 lifetime license, which can also be paid in four monthly installments of $329. Lifetime license holders benefit from reduced commission rates: futures contracts start at $0.53 per contract, while Micro contracts cost as little as $0.09. However, inactive accounts incur a $25 monthly fee.

The platform has received an average customer rating of 4/5 on DayTrading.com, with users praising its Market Replay feature and customization options. Common criticisms include a steep learning curve for beginners and the lack of a native mobile app. Evaluating these costs and features can help traders decide if NinjaTrader aligns with their algorithmic trading needs.

2. Tradovate

Tradovate takes a modern approach with its cloud-native platform, designed for traders who value flexibility across multiple devices. Whether you're on the web, desktop, or mobile, Tradovate ensures seamless synchronization of your settings, so you don’t have to deal with the hassle of managing multiple installations or configurations. This multi-device functionality is ideal for traders who need convenience without sacrificing efficiency.

Execution Speed

Tradovate prioritizes reliability with its server-side order management system. This means that even if your internet connection drops, your stop-loss and profit target orders remain active. The platform supports multiple bracket orders with up to 10 target and stop levels, providing precise control over risk management. While Tradovate doesn’t disclose exact latency metrics, its cloud-based architecture is designed more for consistent execution than for high-frequency trading.

Now let’s take a closer look at the tools available for refining trading strategies.

Backtesting Capabilities

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

Tradovate’s backtesting tools might not be as advanced as those of some competitors, but they cover the basics well enough for most algorithmic traders. One standout feature is the Market Replay tool, which lets you revisit historical trading sessions, including major market events, at speeds of up to 4x. The Performance Center adds value by offering real-time analytics, allowing you to filter results by symbol and compare winning and losing trades to spot trends. For strategy development, Tradovate provides unlimited simulated trading with real-time data and advanced charting that includes over 40 technical indicators.

Its integration options further enhance its versatility.

Integration Options

For traders interested in automation, Tradovate offers a REST API and WebSocket endpoints, supporting popular programming languages like Python, Node.js, and Java. The platform also integrates directly with NinjaTrader 8 Desktop, allowing users to pair Tradovate’s pricing structure with NinjaTrader’s advanced charting features. Additionally, Tradovate connects with TradingView and Jigsaw, expanding its analytical and order flow capabilities. You can even route TradingView alerts into Tradovate through third-party middleware.

Cost Structures

Tradovate stands out by offering platform access at no additional cost across web, desktop, and mobile devices when you open an account. It also features a Commission-Free Membership plan, though standard exchange, NFA, and clearing fees still apply. This straightforward pricing model eliminates platform licensing fees, making it appealing for traders who want predictable expenses. While customer feedback highlights "Good" support and "Moderate" risk management tools, some users find the interface and backtesting features less advanced compared to specialized platforms.

3. MetaTrader (MT4/MT5)

MetaTrader has been a cornerstone in algorithmic trading for years. MT4, launched in the early 2000s, became a favorite among retail traders, while MT5 brought updates like multi-threading and new features. Its popularity stems from its accessibility - most brokers provide the platform for free, recouping costs through spreads and commissions. Let’s dive into what makes this platform stand out in terms of execution, testing, and integration.

Execution Speed

One of the key differences between MT4 and MT5 lies in their architecture. MT4 operates on a single-thread system, whereas MT5 uses multi-threading to take full advantage of modern multi-core CPUs. This upgrade significantly boosts performance, especially when running multiple Expert Advisors or handling complex calculations. MT5 also features the MQL5 programming language, which is designed for speed and has a C++-like syntax.

As TradeTheDay puts it:

"Milliseconds matter. Platform choice directly affects your order fill speed and slippage." – TradeTheDay

"Milliseconds matter. Platform choice directly affects your order fill speed and slippage." – TradeTheDay

To further reduce latency, traders can host their platform on a nearby VPS. MT5 also offers advanced order fill policies like Immediate or Cancel and Fill or Kill, giving traders more precision and control over their trades.

Backtesting Capabilities

MT5 takes backtesting to the next level. Its Strategy Tester uses multi-threading, supports 21 timeframes compared to MT4’s 9, and can handle unlimited symbols versus MT4’s 1,024-symbol limit. The inclusion of the MQL5 Cloud Network dramatically speeds up testing, cutting optimization times from months to just hours by distributing tasks across thousands of remote agents.

MetaTrader 5 emphasizes the importance of this tool:

"The Strategy Tester is an extraordinary powerful tool crafted for developers of trading robots. Without the use of the tester, the creation of an efficient and reliable robot is practically impossible."

"The Strategy Tester is an extraordinary powerful tool crafted for developers of trading robots. Without the use of the tester, the creation of an efficient and reliable robot is practically impossible."

MT5 also provides multiple tick generation modes, including one that uses real broker data for highly accurate simulations. Forward testing adds another layer of reliability by dividing historical data into separate periods for optimization and verification, helping traders avoid curve-fitting.

Integration Options

MetaTrader simplifies integration with features like native VPS support for seamless migration of Expert Advisors, indicators, and signal subscriptions. It also offers REST and WebSocket APIs for creating custom applications. The built-in MetaEditor includes profiling tools to ensure your MQL5 code runs efficiently.

Cost Structures

Both MT4 and MT5 are available for free through brokers, who recover their costs via spreads or commissions. The platforms include essential tools like the Strategy Tester and MetaEditor. Additional costs only apply if you choose to use the MQL5 Cloud Network for optimization tasks.

4. TradeStation

TradeStation brings together stocks, ETFs, options, and futures on one platform. One of its standout tools is the EasyLanguage scripting environment, which simplifies strategy automation with plain-English commands like "Buy 100 shares at the market." This feature eliminates the need for advanced programming knowledge, making it accessible for a wide range of traders. Let’s dive into its execution performance.

Execution Speed

TradeStation is known for its fast and reliable execution. In Q4 2025, the platform averaged 0.051 seconds for equity market and marketable limit orders and 0.121 seconds for options market orders. During this period, customers benefited from over $16.9 million in price improvements, with an average of $2.56 per equity order and $17.22 per options order.

The TITAN X desktop platform enhances execution further with a specialized engine designed for speed and advanced order-routing capabilities. By offering direct-market-access and order staging, TradeStation bypasses intermediaries, ensuring faster and more precise execution. As Investopedia highlights:

"TradeStation's executions are superb, even for zero commission customers who can't control their order routing".

"TradeStation's executions are superb, even for zero commission customers who can't control their order routing".

Backtesting Capabilities

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

TradeStation has been a pioneer in backtesting for retail traders since 1987 and continues to lead in this area. Users can access a wealth of historical data, including U.S. stocks dating back to 1968, futures to 1982, and forex to 1971. The Portfolio Maestro tool allows traders to test strategies across entire security baskets.

The Walk-Forward Optimizer helps traders avoid curve-fitting by testing strategies on out-of-sample data under varying market conditions. Backtests can also include realistic trading costs like commissions, slippage, and margin requirements. The Strategy Performance Report provides detailed insights into overall profitability and individual trade performance. Combined with its powerful backtesting tools, TradeStation’s integration options make it a versatile choice for traders.

Integration Options

TradeStation’s integration capabilities expand its functionality even further. Its Web API supports programming languages like Python, C#, C++, PHP, and Ruby, enabling users to build custom applications. It also integrates with popular third-party platforms like TradingView, QuantConnect, and Option Alpha. For traders who prefer automation without keeping their computers running 24/7, services like TradersPost offer webhook-based solutions.

To access the API without subscription fees, traders must open an account using promo code "WAPIAFSG" and maintain a minimum balance of $10,000. Other tools, such as RadarScreen for real-time market monitoring and TipRanks for AI-driven research, further enhance the platform’s offerings.

Cost Structures

TradeStation’s TS Select Plan offers $0 commissions on the first 10,000 shares of exchange-traded stocks or ETFs priced above $1 per share. Options trades cost $0.60 per contract, while futures are priced at $1.50 per standard contract and $0.50 for micro futures. However, a $10 monthly inactivity fee applies unless you maintain a $5,000 average end-of-month balance or execute at least 10 trades every 90 days. These pricing structures, combined with its advanced tools, make TradeStation a strong option for algorithmic traders looking for a comprehensive platform.

Advantages and Disadvantages

Here’s a breakdown of the key strengths and limitations of each platform. Understanding these trade-offs is crucial for traders fine-tuning their algorithmic strategies.

Each platform brings something different to the table. NinjaTrader stands out with its ultra-low latency execution and advanced charting, though its licensing fees can vary depending on your chosen plan. Tradovate caters to futures traders with fast execution and commission-free options, albeit with more limited features. MetaTrader (MT4/MT5) is a free platform with extensive third-party tools and a large library of pre-built Expert Advisors. However, its client-side execution requires either a constantly running computer or a VPS, and its backtesting reliability hovers around 75%.

TradeStation, on the other hand, is beginner-friendly, thanks to its proprietary EasyLanguage, which is simpler to learn than Python. While TradeStation charges a $10 monthly fee, this is often waived with sufficient trading activity.

Here’s a side-by-side comparison to help you weigh your options:

| Platform | Execution Speed | Backtesting Tools | Integration/Programming | Monthly Costs |

|---|---|---|---|---|

| NinjaTrader | Ultra-low latency | Strong historical data libraries | NinjaScript (C#) | $50+ per month or $1,099 lifetime license |

| Tradovate | Very fast | Limited backtesting | API integrations | Commission-free options |

| MetaTrader (MT4/MT5) | Responsive (client-side) | Strategy Tester (~75% reliability) | Extensive third-party support | Free |

| TradeStation | Fast and reliable | Reliable historical data | EasyLanguage | $10/month (waived with activity) |

As of October 15, 2025, major brokers achieved an average execution quality of 97.51%. This means nearly all trades were executed at or better than the National Best Bid and Offer.

Ultimately, your choice depends on your priorities. Opt for MetaTrader if cost efficiency is key, TradeStation for its simplicity, NinjaTrader for unparalleled speed, or Tradovate if you’re focused on futures trading.

Conclusion

Choosing between NinjaTrader, Tradovate, MetaTrader, and TradeStation ultimately comes down to your specific trading needs and priorities.

If execution speed is your top concern, platforms like NinjaTrader stand out with ultra-low latency, achieving tick-to-trade times as fast as 250 microseconds when paired with Rithmic data feeds. Tradovate ensures reliable server-side order management, while MetaTrader's MT5 improves performance with its multi-threading architecture. TradeStation also delivers solid execution speeds, averaging 0.051 seconds for equity orders in Q4 2025.

Cost considerations are equally important, especially with free platforms. While MetaTrader has no upfront fees, reliable 24/7 operation often requires a VPS. TradeStation offers free platform access for many users but may require specific account minimums for API access. NinjaTrader charges $720 annually or $1,099 for a lifetime license, with lower commission rates for lifetime users. Tradovate, on the other hand, simplifies expenses by eliminating platform licensing fees entirely.

For traders without programming experience, platforms like TradeStation offer user-friendly tools such as EasyLanguage, which is simpler to learn compared to languages like Python. However, experienced developers might prefer NinjaTrader’s C#-based NinjaScript or MetaTrader’s MQL5 for greater customization.

Backtesting capabilities can make or break your strategy development. NinjaTrader’s Strategy Analyzer supports multi-objective optimization and tick-by-tick analysis through Market Replay. MetaTrader’s Strategy Tester leverages multi-threading and the MQL5 Cloud Network to speed up optimization times. TradeStation provides historical data for U.S. stocks dating back to 1968 and includes advanced tools like Walk-Forward Optimizer. Tradovate offers basic backtesting with Market Replay at speeds of up to 4x.

Integration features also play a critical role in enhancing platform functionality. NinjaTrader connects with over 1,000 third-party add-ons and multiple data feeds. Tradovate provides REST API and WebSocket endpoints compatible with Python, Node.js, and Java. MetaTrader supports extensive third-party tools and native VPS integration. TradeStation’s Web API works with various programming languages and integrates seamlessly with platforms like TradingView and QuantConnect.

Before committing real funds, take advantage of paper trading simulators to test your chosen platform. With average execution quality among major brokers reaching 97.51% as of October 15, 2025, the technology behind these platforms is robust. By carefully weighing factors such as execution speed, backtesting tools, integration options, and costs, you can select the platform that aligns best with your trading style and technical needs.

FAQs

Do I need a VPS to run my trading bots 24/7?

A VPS (Virtual Private Server) is crucial for keeping trading bots running seamlessly around the clock. It provides fast execution speeds, dependable performance, and eliminates the need for constant manual oversight. With a VPS, your bots can function without disruptions from issues like power outages or unstable internet connections on your local device.

Which platform is best for futures vs stocks and options?

When it comes to futures trading, NinjaTrader is a go-to choice for advanced traders who rely on automation, detailed analytics, and lightning-fast execution - perfect for high-frequency strategies. On the flip side, Tradovate caters to beginners and mobile traders with its user-friendly, cloud-based platform and commission-free trading plans. While NinjaTrader shines with its ability to handle complex futures strategies, Tradovate focuses on simplicity and keeping costs low.

How can I tell if a backtest is realistic and not curve-fit?

To make a backtest reliable and avoid curve-fitting, it's crucial to check its performance on out-of-sample data. Techniques like walk-forward analysis can help ensure the strategy isn't overly optimized for past data. Be mindful of biases - like look-ahead bias, which assumes future knowledge, and survivorship bias, which excludes failed entities from the analysis. Also, factor in transaction costs and slippage, as these real-world elements can significantly impact results. A trustworthy backtest mirrors actual trading conditions and shows consistent performance beyond the dataset used for its creation.

A VPS (Virtual Private Server) is crucial for keeping trading bots running seamlessly around the clock. It provides fast execution speeds, dependable performance, and eliminates the need for constant manual oversight. With a VPS, your bots can function without disruptions from issues like power outages or unstable internet connections on your local device.

When it comes to futures trading, NinjaTrader is a go-to choice for advanced traders who rely on automation, detailed analytics, and lightning-fast execution - perfect for high-frequency strategies. On the flip side, Tradovate caters to beginners and mobile traders with its user-friendly, cloud-based platform and commission-free trading plans. While NinjaTrader shines with its ability to handle complex futures strategies, Tradovate focuses on simplicity and keeping costs low.

To make a backtest reliable and avoid curve-fitting, it's crucial to check its performance on out-of-sample data. Techniques like walk-forward analysis can help ensure the strategy isn't overly optimized for past data. Be mindful of biases - like look-ahead bias, which assumes future knowledge, and survivorship bias, which excludes failed entities from the analysis. Also, factor in transaction costs and slippage, as these real-world elements can significantly impact results. A trustworthy backtest mirrors actual trading conditions and shows consistent performance beyond the dataset used for its creation.

"}}]}