Binance to Polymarket Arbitrage Strategies: Finding Edge Across Crypto & Prediction Markets

Arbitrage trading between Binance and Polymarket offers traders a way to profit from price differences across platforms. Binance, with its fast-paced crypto markets, often updates prices more quickly than Polymarket, which relies on user-driven odds. This creates brief opportunities to exploit mismatched prices. Successful strategies require speed, automation, and low-latency infrastructure to act within milliseconds.

Key Takeaways:

- Arbitrage Basics: Profits arise from price gaps between Binance's crypto prices and Polymarket's prediction market odds.

- Why It Works: Polymarket lags behind Binance by 30–90 seconds, creating exploitable inefficiencies.

- Tools Needed: Automated trading scripts, low-latency VPS, and API integration with Binance and Polymarket.

- Profitable Examples: Traders have earned millions using methods like 15-minute price lag arbitrage, Yes/No sum arbitrage, and cross-event manipulation.

Quick Summary of Strategies:

- 15-Minute Price Lag Arbitrage: Exploits delays in Polymarket's odds adjusting to Binance price changes.

- Yes/No Sum Arbitrage: Identifies mismatched YES and NO prices on Polymarket for risk-free profits.

- Cross-Event Manipulation: Uses large trades on Binance to influence Polymarket outcomes.

Speed and precision are critical. Low-latency VPS services like QuantVPS help traders execute faster than competitors, turning fleeting opportunities into profits.

Setting Up Your Arbitrage Infrastructure

To seize fleeting arbitrage opportunities, you'll need to set up accounts, fund them, and deploy low-latency infrastructure that can handle the fast-paced nature of these trades.

Account Setup and Funding

For Binance, the process is straightforward:

- Register and complete the KYC verification.

- Enable API access, ensuring you set trading permissions and restrict withdrawals for added security.

- Fund your account with USDC or another stablecoin to get started.

For Polymarket, you can either sign up using an email (via Magic Link) or connect a Web3 wallet like MetaMask. Keep in mind, Polymarket operates exclusively with USDCe (bridged USDC on the Polygon network). To fund your account:

- Transfer USDC from an exchange that supports direct Polygon network deposits.

- Alternatively, use a cross-chain bridge to move funds.

When automating trades on Polymarket, note the two-tier system:

- L1 automation uses your wallet's private key.

- L2 automation requires API credentials (key, secret, and passphrase) for execution.

Before running automated strategies, you'll need to approve Polymarket's exchange contracts to spend your USDCe and outcome tokens. This can be done through the platform’s interface or programmatically using the setApprovalForAll() method.

Once your accounts are ready, ensure you have the speed advantage by choosing the right VPS solution.

Choosing the Right QuantVPS Plan

Speed is everything in arbitrage. A home internet connection introduces delays that can ruin your chances of profiting. To stay competitive, you’ll need a low-latency VPS.

- VPS Pro: At $99.99/month (or $69.99/month annually), this plan includes 6 cores and 16GB of RAM. It’s ideal for monitoring 3-5 markets simultaneously, making it a good fit for multi-market arbitrage strategies.

- VPS Ultra: For $189.99/month (or $132.99/month annually), this plan offers 24 cores and 64GB of RAM. It’s designed for traders scanning dozens of markets or running high-frequency strategies. Sub-millisecond latency ensures you can execute trades before competitors have a chance to react.

With the right VPS plan in place, the next step is setting up the technical tools you’ll need to automate your trades.

Technical Tools and Prerequisites

Automating your strategies requires programming skills in Python or Node.js. Both Binance and Polymarket provide APIs to help you interact with their platforms:

-

Polymarket APIs:

-

Gamma API (

https://gamma-api.polymarket.com) for discovering markets. -

CLOB API (

https://clob.polymarket.com) for managing orders. -

CLOB WebSocket (

wss://ws-subscriptions-clob.polymarket.com/ws/) for real-time updates.

-

Gamma API (

-

Binance APIs:

- REST and WebSocket APIs for both spot and futures trading.

-

Gamma API (

https://gamma-api.polymarket.com) for discovering markets. -

CLOB API (

https://clob.polymarket.com) for managing orders. -

CLOB WebSocket (

wss://ws-subscriptions-clob.polymarket.com/ws/) for real-time updates.

- REST and WebSocket APIs for both spot and futures trading.

To streamline API integration, install libraries like ccxt and py-clob-client. Run continuous monitoring scripts on your VPS to compare prices across platforms and trigger trades when profitable opportunities arise - factoring in fees. This setup enables you to quickly detect and act on price discrepancies across cryptocurrency and prediction markets, giving you the edge you need in arbitrage trading.

3 Arbitrage Strategies Between Binance and Polymarket

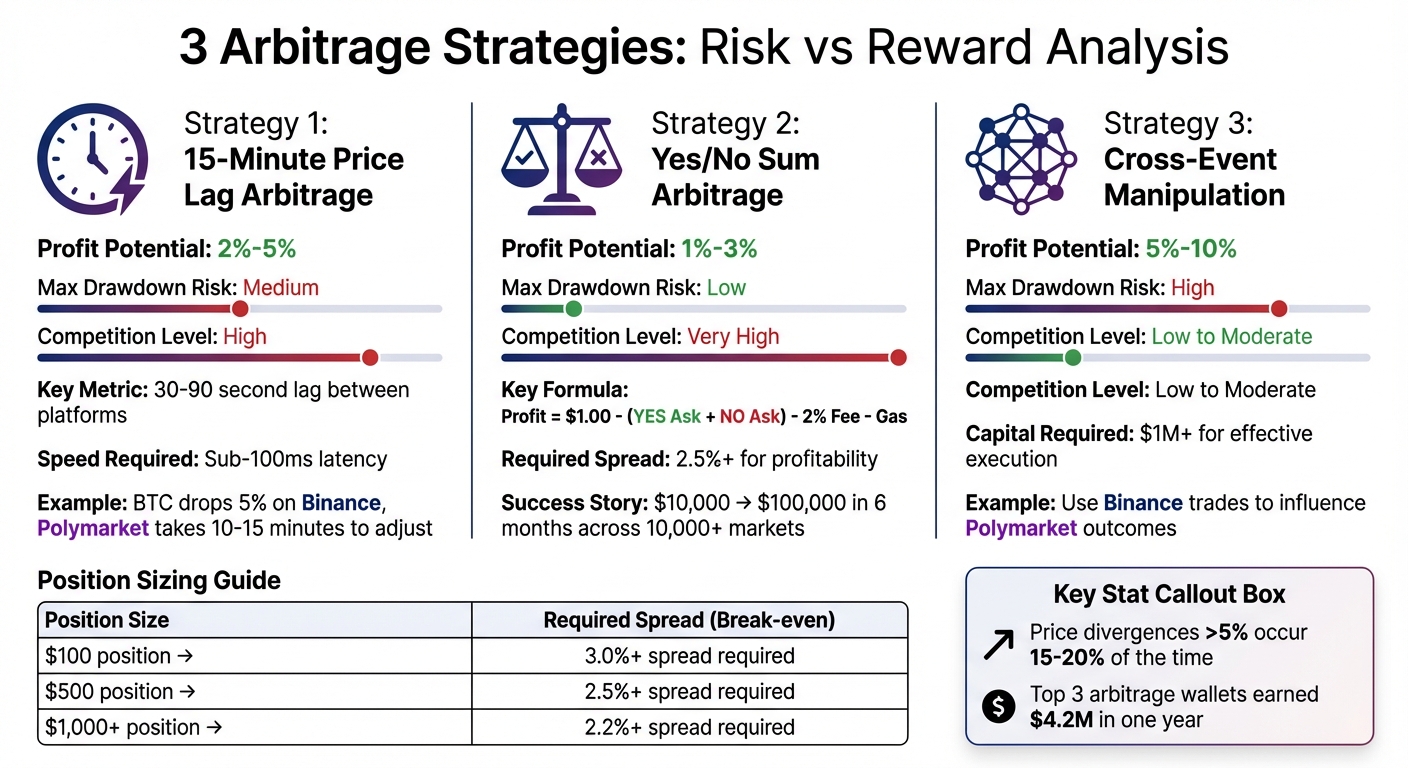

Binance-Polymarket Arbitrage Strategies Comparison: Risk vs Profit Potential

Binance-Polymarket Arbitrage Strategies Comparison: Risk vs Profit Potential

With the right setup, you can take advantage of pricing gaps between Binance's crypto markets and Polymarket's prediction markets. Here are three strategies that focus on these inefficiencies.

15-Minute Price Lag Arbitrage

This approach exploits a time delay where Binance reacts faster to price changes or news compared to Polymarket. For example, if Bitcoin drops 5% on Binance in minutes, Polymarket's "Will BTC close above $X today?" market might take 10–15 minutes to adjust.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

To make this work, set up real-time monitoring via WebSocket connections for Binance and Polymarket. When you spot a 3%+ price move on Binance, check Polymarket for mismatched odds. For instance, if Bitcoin falls from $50,000 to $48,500 on Binance but Polymarket's "BTC above $49,000" market still prices YES shares at $0.60, buying NO shares could be profitable once the odds catch up.

Speed is everything here. Use a VPS with sub-100ms latency and host your scripts near Polygon nodes for faster execution. Many top traders on Polymarket have earned millions by leveraging similar strategies.

Yes/No Sum Arbitrage

In Polymarket's binary markets, the prices of YES and NO shares should always add up to $1.00. If they don’t, there’s an opportunity for risk-free profit.

Here’s how it works: Profit = $1.00 - (YES Ask + NO Ask) - (2% Winner Fee) - Gas Costs. For example, if YES shares are trading at $0.48 and NO shares at $0.49, their combined price is $0.97. After subtracting the 2% fee and Polygon gas costs (around $0.001 to $0.01 per trade), you’re left with a small but guaranteed profit.

One trader reportedly turned $10,000 into $100,000 in just six months by targeting inefficiencies in over 10,000 markets. Automation is crucial since these opportunities disappear fast. Program your scripts to monitor YES and NO prices constantly and act when the spread exceeds 2.5%.

Cross-Event Manipulation Arbitrage

This advanced strategy involves creating predictable price movements by trading across Binance and Polymarket. For example, a trader once used $1 million on Binance to push XRP prices higher while holding "up" positions on Polymarket's 15-minute XRP markets.

To execute this, focus on highly liquid crypto pairs on Binance that have corresponding short-term prediction markets on Polymarket. First, secure your position on Polymarket. Then, execute a large enough trade on Binance to influence the spot price in your favor. The goal is for your Polymarket profits to exceed the slippage costs on Binance.

This method is riskier than pure arbitrage since it requires significant capital and involves market manipulation. Make sure to calculate your break-even point, accounting for Binance's 0.1% trading fees, Polymarket fees, and potential slippage.

These strategies highlight how precise execution and low latency can turn pricing mismatches into real profits, showcasing the potential of cross-market arbitrage.

Monitoring Tools and Automation

Staying ahead in arbitrage trading between Binance and Polymarket means having reliable monitoring and automation tools. These tools allow you to track real-time data and act on fleeting opportunities. The CCXT library is a solid choice for connecting to Binance and other crypto exchanges, letting you fetch live bid-ask spreads using Python or JavaScript.

For ultra-fast execution, Probalytics provides sub-10ms streaming through Server-Sent Events (SSE) and automatically matches events across platforms using semantic similarity. Meanwhile, Crypto-Pandas simplifies bid-ask data collection by consolidating it from multiple exchanges into a single DataFrame, making spread calculations a breeze.

Recommended Monitoring Tools

Most traders find success using CCXT for Binance and Polymarket's API layers. Polymarket's API and WebSocket layers are particularly useful for achieving low-latency monitoring, often under 10ms.

For added flexibility, custom Node.js scripts can monitor both platforms simultaneously. These scripts can send notifications via Telegram or Discord webhooks whenever price discrepancies hit your predefined thresholds. Integrating these tools with your automated scripts ensures precise execution when opportunities arise.

Code Example for Lag Detection

Below is a simple Python script that identifies pricing lags between Binance and Polymarket:

import ccxt

import requests

import time

binance = ccxt.binance({'enableRateLimit': True})

polymarket_clob = 'https://clob.polymarket.com'

def get_binance_price(symbol='BTC/USDT'):

ticker = binance.fetch_ticker(symbol)

return ticker['last']

def get_polymarket_odds(token_id):

response = requests.get(f'{polymarket_clob}/prices/{token_id}')

return float(response.json()['price'])

def detect_lag(btc_threshold=49000, polymarket_token='0x123...'):

btc_price = get_binance_price()

pm_yes_price = get_polymarket_odds(polymarket_token)

if btc_price < btc_threshold and pm_yes_price > 0.60:

print(f'ALERT: BTC at ${btc_price:,.2f}, PM YES at ${pm_yes_price:.2f}')

return True

return False

while True:

detect_lag()

time.sleep(5)

This script compares Binance's Bitcoin price with Polymarket's odds for a "BTC above $49,000" market every five seconds. If it detects a mismatch, it sends an alert.

Optimizing Automation with QuantVPS

Running these scripts on a home computer can lead to latency and reliability issues. QuantVPS offers a solution by hosting your automation with 24/7 uptime and ultra-low latency. This is critical since arbitrage opportunities often last just seconds. QuantVPS provides network latency as low as 0.7–1ms, ensuring your monitoring and trading systems are always ready.

The VPS Pro plan ($99.99/month or $69.99/month annually) includes 6 cores and 16GB RAM, making it ideal for monitoring 3–5 markets at once. For single-market bots, the VPS Lite plan ($59.99/month or $41.99/month annually) with 4 cores and 8GB RAM is a cost-effective option. Both plans feature 1Gbps+ network speeds and Windows Server 2022, supporting Python, Node.js, and other automation tools without interruptions.

Polymarket's top arbitrage wallets generated around $4.2 million in profits over a year. Many traders credit their success to dedicated VPS setups, which keep their scripts running even when local machines are offline. This helps avoid connection drops that could otherwise lead to missed trades.

Risk Management and Execution Best Practices

Managing Risks in Arbitrage Trading

Arbitrage trading comes with its fair share of challenges. These include resolution delays (which can tie up your capital for weeks due to disputes or oracle issues), regulatory uncertainties (especially for traders based in the U.S.), and technical disruptions like smart contract bugs or network congestion. To navigate these risks, it’s smart to limit each trade to 1%–5% of the available order book liquidity. This helps minimize slippage and ensures you can act on opportunities even during volatile periods. Another essential step? Double-check that both platforms involved share the same resolution source before committing to a position.

Position sizing also plays a key role. You’ll need to account for the minimum spread required to break even, factoring in Polymarket’s fees. Here’s a quick breakdown:

| Position Size | Required Spread (Break-even) |

|---|---|

| $100 | 3.0%+ (covers 2% fee, gas, and margin) |

| $500 | 2.5%+ (fees amortize better) |

| $1,000+ | 2.2%+ (scale efficiency) |

Another safeguard? Automated kill switches. These are critical for managing losses and avoiding technical mishaps. A "soft" kill switch halts new trades once daily loss limits are hit, while a "hard" kill switch exits all positions immediately if connectivity issues arise. Staying ahead of these risks requires solid planning and precise execution.

Execution Tips for Minimizing Errors

When it comes to arbitrage, speed and reliability are everything. A well-executed trade can mean the difference between profit and loss. That’s why having a reliable setup is crucial. For instance, QuantVPS’s VPS Ultra+ plan ($199.99/month or $139.99/month billed annually) is a solid choice. It offers robust DDoS protection to keep your scripts running smoothly, along with 24 cores and 64GB of RAM. This setup can handle multiple monitoring streams and up to four monitors, making it easier to track activity across platforms.

Strategy Risk Comparison

Each arbitrage strategy carries its own risks and rewards. Understanding these differences can help you tailor your approach:

| Strategy | Max Drawdown Risk | Competition Level | Profit Potential |

|---|---|---|---|

| 15-Minute Price Lag Arbitrage | Medium | High | 2%–5% |

| Yes/No Sum Arbitrage | Low | Very High | 1%–3% |

| Cross-Event Manipulation | High | Low to Moderate | 5%–10% |

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

For example, price divergence between platforms exceeding 5 percentage points happens about 15–20% of the time. Yes/No sum arbitrage is easier to execute since both trades occur on the same platform, but the profit margins are smaller. On the other hand, cross-event strategies can deliver better returns, though they come with added regulatory risks due to differences in participant pools.

Before committing capital, it’s crucial to evaluate whether the opportunity is worth the lockup. Use this formula to calculate the annualized return:

APY = (profit difference ÷ remaining days) × 365.

For instance, a 3% margin on a position resolving in 7 days translates to a 156% annualized return. However, that same 3% margin over 90 days drops to just 12% APY, which often isn’t enough to offset the risks tied to resolution delays.

Conclusion

Arbitrage between Binance and Polymarket has proven to be a reliable strategy for traders aiming to achieve consistent profits. Real-world examples show how automated arbitrage across these platforms can generate substantial returns when executed systematically. These cases highlight the importance of precision and speed in cross-platform trading.

Manual trading simply can't keep up when opportunities vanish in as little as 200 milliseconds. As AL, Founder of PolyTrack, puts it:

Arbitrage opportunities on Polymarket exist for only a few seconds. Today, they are captured not by people but by bots operating on Polygon nodes.

Arbitrage opportunities on Polymarket exist for only a few seconds. Today, they are captured not by people but by bots operating on Polygon nodes.

This is where QuantVPS becomes a game-changer. Offering ultra-low latency (0–1ms to nodes), 99.999% uptime, and the ability to monitor over 100 markets at once, QuantVPS provides the infrastructure needed to capture fleeting opportunities before they disappear.

The success stories of top traders reinforce the principles discussed earlier. Whether it's using 15-minute lag strategies, Yes/No sum approaches, or cross-event manipulation, the key lies in speed, sufficient liquidity, and solid infrastructure. Keep liquid reserves - 60–70% in active trades and 20–30% as backup - and avoid markets with less than $1,000 in liquidity. For perspective, the top three arbitrage wallets reportedly earned around $4.2 million in a single year by adhering to these strategies.

Another essential tactic is exiting early when your market view aligns with the outcome. This improves capital turnover and minimizes settlement risks. Cross-platform arbitrage between Polymarket and Binance often delivers higher margins compared to intra-market strategies, which are largely dominated by bots. With price divergences exceeding 5 percentage points about 15–20% of the time, traders with the right tools and strategies can capitalize on these opportunities.

QuantVPS's VPS Ultra+ plan ($199.99/month or $139.99/month when billed annually) offers 24 cores, 64GB RAM, and DDoS protection, ensuring the computational power and reliability needed for high-frequency trading. In a market where milliseconds make the difference, having dependable, low-latency infrastructure is crucial. By combining these strategies with QuantVPS’s capabilities, traders can consistently seize market inefficiencies and stay ahead of the competition.

FAQs

What’s the safest Binance-to-Polymarket arbitrage setup for beginners?

If you're new to Binance-to-Polymarket arbitrage, it's best to stick with low-risk strategies that emphasize automation and solid risk management. Here's a straightforward approach to get you started:

- Leverage automated tools: Use programming languages like Python alongside Polymarket’s API to track price differences between platforms efficiently. Automation helps you act quickly when opportunities arise.

- Focus on simple setups: A beginner-friendly tactic is watching for scenarios where the combined cost of YES and NO outcomes is less than $1.00. This ensures a risk-free profit margin.

- Test before you commit: Experiment with your strategies in a simulated environment to work out any kinks without risking real money.

- Secure your operations: Protect your APIs with strong security measures and use a dependable VPS (Virtual Private Server) for faster and more reliable execution.

This setup minimizes risks while giving you a hands-on introduction to arbitrage trading.

How do I calculate real profit after fees, gas, and settlement time?

To figure out your actual profit, apply this formula: Net Profit = (Sell Price - Buy Price) - Total Fees - Slippage - Network Costs. Here's what to factor in:

- Trading fees: For instance, platforms like Binance may charge around 0.1% per trade.

- Gas fees: These can range widely, such as $5 to $50 or more on Ethereum transactions.

- Settlement time effects: Delays in processing can lead to price changes that affect your final profit.

By subtracting all these costs, you'll get a clear picture of your true earnings.

What are the biggest risks that can break an “arb” on Polymarket?

Polymarket arbitrage comes with its fair share of challenges. The most pressing risks include market volatility, execution delays, and liquidity problems.

Here's why these factors matter:

- Market Volatility: Sudden news or unexpected events can disrupt price discrepancies, closing arbitrage opportunities almost instantly. Timing is everything here.

- Execution Delays: Even slight delays in executing trades can lead to slippage, where you end up with less favorable prices. Add transaction fees to the mix, and your profits might shrink - or vanish altogether.

- Liquidity Issues: Limited liquidity can mean partial fills or being forced to accept less-than-ideal prices. On top of that, bots and other traders often act quickly to correct price differences, leaving little room for manual execution.

To navigate these risks, speed and effective risk management are non-negotiable. Without them, staying ahead in Polymarket arbitrage is nearly impossible.

If you're new to Binance-to-Polymarket arbitrage, it's best to stick with low-risk strategies that emphasize automation and solid risk management. Here's a straightforward approach to get you started:

- Leverage automated tools: Use programming languages like Python alongside Polymarket’s API to track price differences between platforms efficiently. Automation helps you act quickly when opportunities arise.

- Focus on simple setups: A beginner-friendly tactic is watching for scenarios where the combined cost of YES and NO outcomes is less than $1.00. This ensures a risk-free profit margin.

- Test before you commit: Experiment with your strategies in a simulated environment to work out any kinks without risking real money.

- Secure your operations: Protect your APIs with strong security measures and use a dependable VPS (Virtual Private Server) for faster and more reliable execution.

This setup minimizes risks while giving you a hands-on introduction to arbitrage trading.

To figure out your actual profit, apply this formula: Net Profit = (Sell Price - Buy Price) - Total Fees - Slippage - Network Costs. Here's what to factor in:

- Trading fees: For instance, platforms like Binance may charge around 0.1% per trade.

- Gas fees: These can range widely, such as $5 to $50 or more on Ethereum transactions.

- Settlement time effects: Delays in processing can lead to price changes that affect your final profit.

By subtracting all these costs, you'll get a clear picture of your true earnings.

Polymarket arbitrage comes with its fair share of challenges. The most pressing risks include market volatility, execution delays, and liquidity problems.

Here's why these factors matter:

- Market Volatility: Sudden news or unexpected events can disrupt price discrepancies, closing arbitrage opportunities almost instantly. Timing is everything here.

- Execution Delays: Even slight delays in executing trades can lead to slippage, where you end up with less favorable prices. Add transaction fees to the mix, and your profits might shrink - or vanish altogether.

- Liquidity Issues: Limited liquidity can mean partial fills or being forced to accept less-than-ideal prices. On top of that, bots and other traders often act quickly to correct price differences, leaving little room for manual execution.

To navigate these risks, speed and effective risk management are non-negotiable. Without them, staying ahead in Polymarket arbitrage is nearly impossible.

"}}]}