TradingView Automated Trading

TradingView makes it easier to automate your trading strategies. By using Pine Script, you can create, test, and execute trading strategies directly on the platform. These strategies generate buy and sell signals, which can be executed automatically via alerts, webhooks, or broker integrations.

Key Features:

- Pine Script: A simple coding language to build custom indicators and strategies.

- Backtesting: Test strategies with historical data to evaluate performance.

- Alerts & Webhooks: Automate trading by connecting signals to brokers or bots.

- Supported Brokers: Execute trades directly with brokers like Interactive Brokers and OANDA.

Benefits:

- Reduces emotional decision-making.

- Saves time by monitoring multiple markets.

- Ensures consistent trade execution.

TradingView automation suits all traders, from beginners to professionals, and works for various trading styles like day trading, swing trading, and forex. Advanced users can also integrate AI tools or build custom bots for more complex strategies. Reliable infrastructure, like QuantVPS, ensures smooth execution with low latency.

Quick Overview:

- Setup: Write strategies in Pine Script, backtest, and configure alerts.

- Execution: Use webhooks or broker integrations for live trading.

- Risk Management: Set stop-losses, position sizes, and daily loss limits.

- Performance Tracking: Regularly review metrics like win rate and drawdowns.

TradingView offers a complete solution to automate trading, from strategy creation to execution, making it a practical tool for traders of all levels.

How to AUTOMATE a TradingView STRATEGY Script

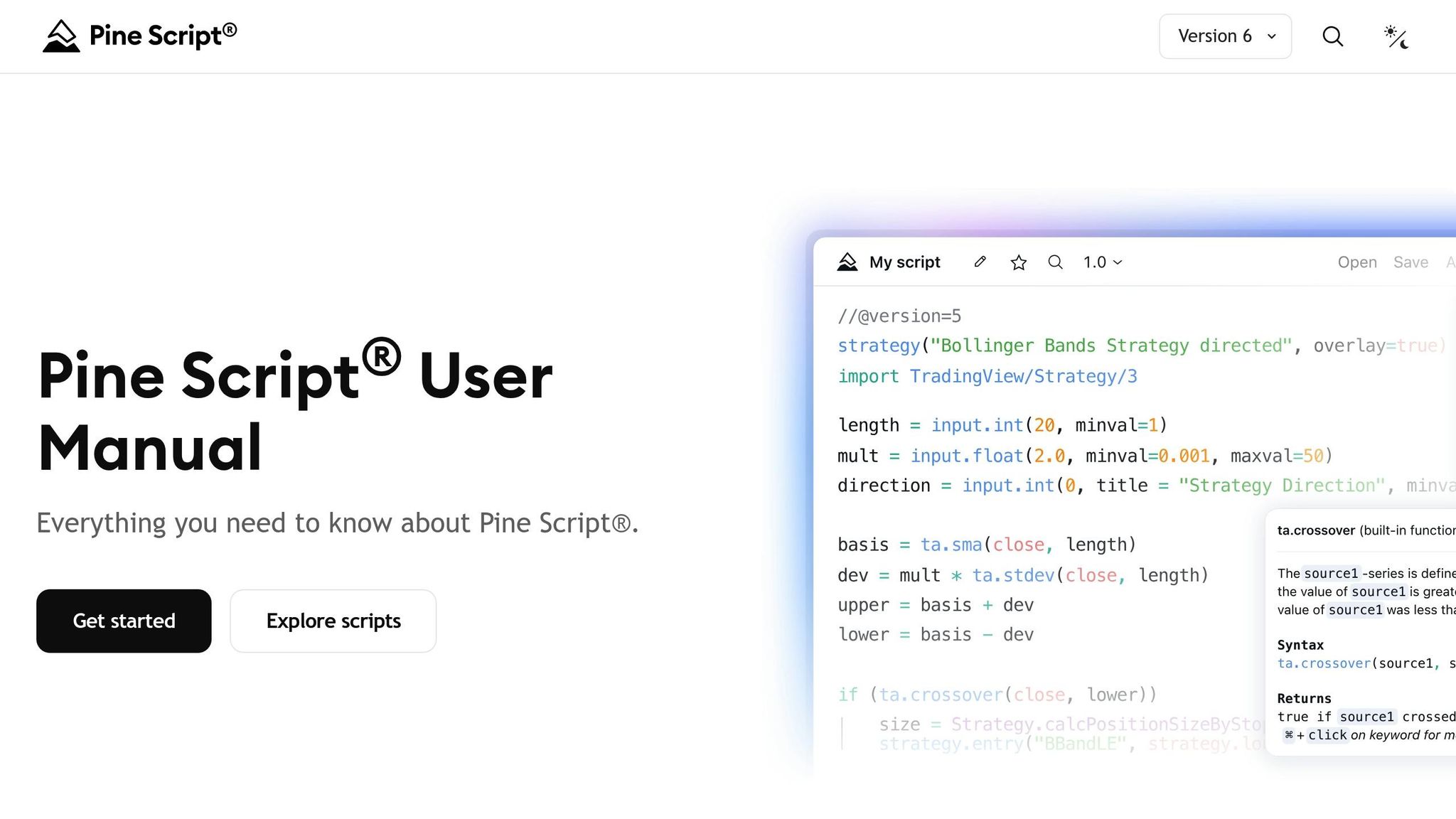

Building Trading Strategies with Pine Script

Pine Script powers TradingView's automated trading tools, turning your trading ideas into actionable strategies. With Pine Script, you can analyze market data, create trading signals, and simulate trades - all directly within TradingView. Let’s dive into how you can write and test these strategies.

Pine Script Basics

Pine Script is designed specifically for working with financial data, processing it one bar at a time and updating as new price bars appear on your chart. Every Pine Script starts with a version declaration. For example, the latest version, Pine Script v6, begins with:

//@version=6

The core of any automated strategy lies in the strategy() function. This function transforms your script from a simple indicator into a fully functional trading system, complete with tools for simulating orders and analyzing performance via the strategy.* namespace. Here's a basic example:

//@version=6

strategy("My First Strategy", overlay=true)

// Your strategy logic goes here

The syntax is straightforward, making it beginner-friendly. You can use comments (// for single lines and /* ... */ for longer notes) to keep your code organized. Variables are declared using the var keyword, and the plot() function lets you display calculations directly on your chart.

Pine Script also provides a suite of built-in functions for technical analysis. For instance, you can calculate simple moving averages with ta.sma(), analyze momentum using ta.rsi(), or detect crossovers with ta.crossover() - all essential tools for crafting trading strategies.

Writing Automated Strategies with Pine Script

To create an automated strategy, you combine technical indicators with conditional logic to generate buy and sell signals. Let’s look at a moving average crossover strategy. This strategy compares a fast (shorter period) moving average with a slow (longer period) one. A buy signal occurs when the fast average crosses above the slow average, and a sell signal happens when it crosses below.

Here’s how it looks in Pine Script:

//@version=6

strategy("MA Crossover Strategy", overlay=true)

// Define input variables

fast_length = input.int(10, title="Fast MA Length")

slow_length = input.int(20, title="Slow MA Length")

// Calculate moving averages

fast_ma = ta.sma(close, fast_length)

slow_ma = ta.sma(close, slow_length)

// Plot the moving averages

plot(fast_ma, color=color.blue, title="Fast MA")

plot(slow_ma, color=color.red, title="Slow MA")

// Define entry conditions

long_condition = ta.crossover(fast_ma, slow_ma)

short_condition = ta.crossunder(fast_ma, slow_ma)

// Execute trades

if long_condition

strategy.entry("Long", strategy.long)

if short_condition

strategy.entry("Short", strategy.short)

In this example, the ta.crossover() and ta.crossunder() functions identify when the moving averages cross, triggering buy or sell signals. Pine Script’s broker emulator then simulates trades based on your chart data, typically executing orders at the open of the bar following the signal.

For more accurate simulations, TradingView offers Bar Magnifier mode (available with Premium+ plans), which uses lower timeframe data to mimic real-world order fills. The strategy.entry() function is used to place orders, with a default setting of one trade per position unless specified otherwise.

Once your strategy is written, it’s time to test it.

Testing Strategies with Historical Data

Backtesting is a crucial step in validating your strategy. It allows you to measure performance using historical price data, providing insights into metrics like total return, win rate, and drawdowns. These metrics help you evaluate how your strategy might perform in real-world scenarios.

When you add a strategy to your chart, TradingView automatically backtests it using the available historical data for the selected timeframe. The Strategy Tester tab displays detailed information, including a trade log with entry and exit prices, trade durations, and profit or loss.

Backtesting also helps uncover patterns or weaknesses you might miss during manual analysis. For example, it can reveal how your strategy behaves in volatile markets or during specific conditions. Drawdown analysis, which highlights the largest peak-to-trough declines, is particularly useful for assessing risk during tough market periods.

For more advanced strategies involving multiple timeframes or complex logic, backtesting can also expose potential execution issues, giving you the chance to refine your approach before going live.

Setting Up TradingView Alerts for Automation

Once you've developed a Pine Script strategy, the next step is to turn those strategy signals into live trading actions using TradingView alerts. These alerts act as the connection between your strategy's signals and actual trade execution, whether through broker integrations or external automation tools. This step bridges your backtested strategy with live trading, opening the door to automation.

How to Configure Alerts in TradingView

Configuring alerts in TradingView transforms your strategy into a real-time signal generator. To start, click the Alert button (⏰) on your chart to access the alert creation window. From the "Condition" dropdown, select your strategy and choose "Order fills only" to ensure alerts are triggered once per completed bar.

The alert message determines the information sent when the signal fires. For simple notifications, you might use messages like "BUY AAPL at $150.25" or "SELL EURUSD at 1.0850." However, if you're automating trades, the message needs to follow the format required by your broker's API or automation system.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

To manage alert frequency, TradingView offers options to avoid overloading you with notifications. Selecting "Once Per Bar Close" ensures alerts fire at regular intervals, while "Once Per Bar" triggers alerts immediately on shorter timeframes.

You can also set expiration settings to control how long alerts remain active. Options include setting an expiration date, limiting the number of triggers, or keeping alerts active indefinitely until you manually disable them.

Once your alerts are set up, you can use webhooks to link them to external systems for trade execution.

Using Webhooks for Trade Execution

Webhooks are the backbone of connecting TradingView alerts to external trading systems. When an alert triggers, TradingView sends an HTTP POST request to a specified URL, enabling instant communication with trading bots, servers, or third-party platforms.

To get started, you'll need a destination URL from your external system. This could be a custom server, a third-party bot, or even a messaging platform like Telegram for notifications. Once you have the URL, go to the "Notifications" tab in the alert settings window and check the "Webhook URL" box.

Paste your webhook URL into the designated field and format the alert message to match your system's requirements. If you're using JSON-based systems, your message might look like this:

{

"symbol": "AAPL",

"action": "buy",

"quantity": 100,

"price": "{{close}}"

}

Use double curly braces (e.g., {{close}}) to include real-time data from TradingView.

Security is a key consideration when using webhooks. TradingView requires two-factor authentication to enable webhook alerts. Avoid including sensitive details like login credentials or API keys in your alert messages. Instead, rely on authentication tokens or configure your receiving system to handle credentials securely.

Connecting with Supported Brokers

TradingView also offers direct integrations with several brokers, simplifying the process of live trading. These connections allow your strategies to execute trades without needing external webhook systems. The functionality of these integrations varies - some support full automation, while others require manual confirmation.

For example, Interactive Brokers (IBKR) provides robust integration, enabling automated order placement directly from TradingView alerts. Once you link your IBKR account through TradingView's broker connection settings, you can set up alerts to automatically trigger market or limit orders based on your strategy.

Similarly, OANDA supports forex trading with real-time execution of currency trades. Their integration allows you to define position sizes based on account equity and risk parameters.

If your broker doesn't integrate directly with TradingView, third-party bridge solutions can fill the gap. These services translate TradingView webhook alerts into API calls for brokers like MetaTrader 4/5, TD Ameritrade, or Alpaca.

When setting up broker connections, pay close attention to order types and timing. Choose order types that strike a balance between speed and control, depending on market conditions.

Position sizing is another critical factor when transitioning from backtesting to live trading. While your Pine Script strategy might use fixed position sizes, live trading requires adjustments based on account size, risk tolerance, and available margin. Many traders opt for percentage-based sizing, risking 1-2% of their account per trade.

To ensure smooth execution, start small. Test your setup with minimal position sizes to identify potential issues, such as delays or formatting errors. Most brokers offer paper trading environments where you can fine-tune your automated system using simulated funds before going live.

Managing and Improving Automated Strategies

Managing automated trading strategies requires constant oversight of risks and performance to keep up with ever-changing market conditions.

Setting Up Risk Management Rules

Effective risk management is the backbone of any automated trading system, especially during periods of market volatility. To minimize losses, consider these key measures:

- Position sizing: Limit individual trades to 1-2% of your account equity.

- Stop-loss orders: Integrate stop-losses into your Pine Script strategy, setting them at 3-5% for swing trades and 0.5-1% for day trades.

- Daily loss limits: Cap losses at 3-5% of your account value to avoid overexposure.

- Time-based filters: Pause trading during high-risk periods, such as major news events.

Using percentage-based sizing instead of fixed dollar amounts ensures consistency across trades. Additionally, setting maximum position limits - such as restricting any single trade to 10% of your account or limiting sector exposure to 25% - helps control risk during turbulent times.

Once these controls are in place, continuous monitoring and fine-tuning of your strategy are essential to maintain long-term performance.

Tracking and Adjusting Strategy Performance

The ability to monitor and adapt is what separates successful automated traders from those who fall behind. Markets are dynamic, and strategies that thrive today may falter tomorrow.

Track metrics like risk-adjusted returns, maximum drawdown, win rate, and trade duration to identify shifts in market behavior. For instance, a strategy with a 40% win rate can still succeed if the profits from winning trades outweigh losses from losing ones.

Weekly performance reviews are crucial. Compare live trading results to your backtested expectations to spot discrepancies. For example, if your strategy’s average trade duration increases from 2 days to 5 days, it may signal a change in market volatility or execution efficiency.

When optimizing parameters, patience is key. Avoid making frequent adjustments based on short-term results. Instead, gather data from at least 30-50 trades before considering changes. Always test new parameters on out-of-sample data to reduce the risk of curve fitting.

Market regime analysis is another valuable tool. Track how your strategy performs under various conditions, such as trending versus sideways markets or high versus low volatility. This insight helps you decide when to increase or reduce position sizes - or even pause trading temporarily.

Finally, slippage and execution tracking is vital for understanding real-world performance. Compare actual fill prices to backtested expectations. If you notice consistent negative slippage, it may indicate liquidity issues or a need to adjust your order types. Document execution delays and their effects on your strategy’s outcomes to identify potential improvements.

Using QuantVPS for Low-Latency Execution

To implement these strategies effectively, robust infrastructure is essential. QuantVPS offers a high-performance solution with 0-1ms latency and 100% uptime, ensuring uninterrupted trade execution.

This low-latency environment is particularly beneficial for strategies requiring rapid entries and exits, such as scalping or momentum-based systems. In fast-moving markets, every millisecond counts.

Here’s what QuantVPS brings to the table:

- 100% uptime guarantee: Keeps your strategies running even if your home computer is offline.

- Dedicated resources: Avoids performance issues caused by shared hosting.

- 24/7 operation: Ensures TradingView alerts and webhook connections stay active around the clock.

- Global accessibility: Allows you to monitor and tweak strategies from anywhere.

- Automatic backups: Safeguards your strategy configurations and trading history.

Plans start at $59.99/month for basic strategies, scaling up to $299.99/month for professional-grade setups. Higher-tier plans include multi-monitor support, enabling you to track multiple timeframes, monitor news feeds, and analyze market conditions - all while your automated strategies execute trades seamlessly.

Advanced TradingView Automation Techniques

Once you've got a solid grasp of automated trading basics and risk management, it's time to take things up a notch. Advanced techniques can help you push the boundaries of TradingView’s capabilities, allowing you to refine and expand your strategies. These methods combine modern technology with time-tested trading principles to build smarter and more responsive systems.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Improving Strategies with AI Tools

Artificial intelligence is changing the game when it comes to strategy development. AI tools can process massive amounts of market data, uncover patterns that might go unnoticed, and suggest tweaks to improve performance.

ChatGPT and Pine Script Development simplify the process of creating strategies. Just explain your trading idea in everyday language, and ChatGPT can generate Pine Script code for you to test. This makes prototyping much faster and easier.

AI also helps pinpoint and fix strategy issues. Instead of spending hours debugging, you can share your Pine Script code with ChatGPT and ask it to highlight potential problems. It can spot common errors like syntax mistakes, logical missteps in conditions, or missing variable declarations.

Market sentiment analysis is another area where AI shines. By processing news headlines, earnings reports, and social media trends, AI can identify shifts in sentiment and send webhook alerts to TradingView. This is especially useful for swing trading strategies tied to earnings announcements or major economic updates.

When it comes to parameter optimization, AI takes the guesswork out of testing. Rather than manually experimenting with settings like moving average periods or RSI thresholds, AI can analyze market volatility, asset behavior, and historical data to recommend optimal ranges. It can even review backtesting results and suggest fine-tuning for better risk-adjusted returns.

Machine learning models enhance regime detection by adapting strategies to current market conditions. For instance, by training models on historical price data, volatility, and economic indicators, you can create systems that adjust parameters on the fly. A momentum strategy might tighten stop-losses during volatile markets and loosen them when things are calmer.

Building and Running Custom Trading Bots

While AI tools are great for designing and optimizing strategies, custom trading bots bring those strategies to life. These bots take automation to the next level, executing multi-asset strategies that go far beyond basic alert setups.

A common approach involves using webhooks to connect TradingView alerts to broker APIs for automated execution. When TradingView sends JSON-formatted alerts, your bot processes them and places trades through the broker's API. This allows for complex decision-making that Pine Script alone can’t handle.

Custom bots can monitor multiple TradingView charts at the same time, each running different strategies across various timeframes and assets. For example, your bot might wait for confirmation from both a 15-minute momentum signal and a 4-hour trend-following strategy before entering a trade.

What sets custom bots apart is their portfolio management and risk control capabilities. They can maintain target allocations across asset classes and rebalance positions automatically when thresholds are exceeded. Beyond simple stop-losses, your bot can use dynamic risk controls, adjusting position sizes in response to real-time portfolio volatility.

With database integration, your bot can log every trade, market condition, and performance metric. This creates a treasure trove of data for analyzing strategy performance and refining parameters. Over time, you’ll gain insights into which strategies work best under specific conditions.

Running custom bots does come with technical demands. You’ll need 24/7 uptime, low-latency connections to TradingView and broker APIs, and enough computing power to handle multiple strategies simultaneously. Downtime or poor connectivity could mean missed trades or execution errors, which can be costly.

That’s where QuantVPS comes in. With 0-1ms latency and a 100% uptime guarantee, you can execute trades with the reliability of institutional systems. Dedicated resources ensure your bots run smoothly without competing for CPU or memory, and automatic backups safeguard your configurations and trading history.

For more complex setups, QuantVPS’s premium plans offer the power to run multiple TradingView instances, perform real-time analysis, and maintain database connections all at once. Features like multi-monitor support let you keep an eye on your bots across different timeframes and assets, ensuring everything runs as planned.

The global accessibility feature is a bonus, giving you the ability to monitor and adjust your bots from anywhere. Whether you’re working remotely or traveling, you’ll always have control over your automated trading system.

TradingView Automated Trading Summary

TradingView takes the complexity of manual chart analysis and turns it into a streamlined, fully automated trading process. From creating strategies to executing trades and managing risk, the platform offers tools to simplify and enhance your trading journey.

At the heart of this automation is Pine Script, which allows you to convert trading ideas into actionable code. Before risking any real money, you can rigorously test your strategies through backtesting. Combine this with real-time alerts, and you have a system ready to execute trades instantly through broker integrations.

Alerts and webhooks are game-changers for hands-free trading. These tools link your strategy signals to real-time execution, removing the need for constant monitoring. TradingView’s webhook functionality communicates directly with broker APIs, ensuring trades are automatically placed whenever your conditions are met.

Risk management is a cornerstone of successful trading automation. By setting rules for position sizing, stop-losses, and portfolio allocation, you can protect your account from unexpected market shifts. Regularly tracking performance and adjusting strategies ensures your approach stays effective as market conditions change.

For those ready to go beyond the basics, advanced tools like AI optimization and custom trading bots can elevate your results. AI can fine-tune strategy parameters and even generate Pine Script code, while custom bots allow for multi-asset management and more sophisticated risk controls than TradingView’s default options.

A reliable infrastructure is critical to avoid costly disruptions. Platforms like QuantVPS provide the stability you need, offering dedicated resources and automatic backups to keep your automated trading system running smoothly.

The key to success with TradingView automation lies in combining well-developed strategies, strong risk management, and dependable execution tools. Start with simple Pine Script strategies, expand into advanced techniques as you gain confidence, and ensure your system is supported by reliable hardware to match your trading ambitions.

FAQs

How do I start creating and testing trading strategies with Pine Script on TradingView?

To get started with creating and testing trading strategies using Pine Script on TradingView, head to the Pine Editor located at the bottom of your chart. From there, you can create a new script by choosing 'Blank indicator script' from the 'New' menu. Pine Script is built specifically for crafting custom strategies, letting you set parameters like moving averages or specific indicator thresholds to suit your trading style.

Once you've written your script, take advantage of TradingView's backtesting tools. These tools allow you to simulate how your strategy would have performed using historical market data. This process is invaluable for refining your approach and ensuring it aligns with your trading objectives before moving to live trades. Backtesting offers a practical way to test and adjust your ideas with confidence.

What are the best ways to manage risk when using automated trading strategies on TradingView?

To handle risk wisely when using automated trading strategies on TradingView, begin by defining strict risk limits - like capping your risk at 1-2% of your total capital per trade. This approach safeguards your account from major setbacks.

Take advantage of tools such as position sizing calculators and risk management indicators that integrate directly with your charts. These tools help you keep a close eye on your exposure. Also, make it a habit to revisit and tweak your strategies regularly to adapt to shifting market conditions or to address any technical glitches. Staying disciplined and proactive plays a crucial role in achieving consistent results with automated trading.

How can TradingView alerts and webhooks automate trades with brokers?

TradingView alerts and webhooks offer a straightforward way to automate trades by linking TradingView's charting features with broker platforms. When an alert is triggered on TradingView, the webhook sends an HTTP request containing the alert details to your broker's system or a connected app.

This setup allows trades to be carried out automatically based on your preset strategies, removing the need for continuous manual oversight. With these tools, traders can save time, avoid emotional decisions, and ensure their strategies are executed quickly and efficiently.

To get started with creating and testing trading strategies using Pine Script on TradingView, head to the Pine Editor located at the bottom of your chart. From there, you can create a new script by choosing 'Blank indicator script' from the 'New' menu. Pine Script is built specifically for crafting custom strategies, letting you set parameters like moving averages or specific indicator thresholds to suit your trading style.

Once you've written your script, take advantage of TradingView's backtesting tools. These tools allow you to simulate how your strategy would have performed using historical market data. This process is invaluable for refining your approach and ensuring it aligns with your trading objectives before moving to live trades. Backtesting offers a practical way to test and adjust your ideas with confidence.

To handle risk wisely when using automated trading strategies on TradingView, begin by defining strict risk limits - like capping your risk at 1-2% of your total capital per trade. This approach safeguards your account from major setbacks.

Take advantage of tools such as position sizing calculators and risk management indicators that integrate directly with your charts. These tools help you keep a close eye on your exposure. Also, make it a habit to revisit and tweak your strategies regularly to adapt to shifting market conditions or to address any technical glitches. Staying disciplined and proactive plays a crucial role in achieving consistent results with automated trading.

TradingView alerts and webhooks offer a straightforward way to automate trades by linking TradingView's charting features with broker platforms. When an alert is triggered on TradingView, the webhook sends an HTTP request containing the alert details to your broker's system or a connected app.

This setup allows trades to be carried out automatically based on your preset strategies, removing the need for continuous manual oversight. With these tools, traders can save time, avoid emotional decisions, and ensure their strategies are executed quickly and efficiently.

"}}]}