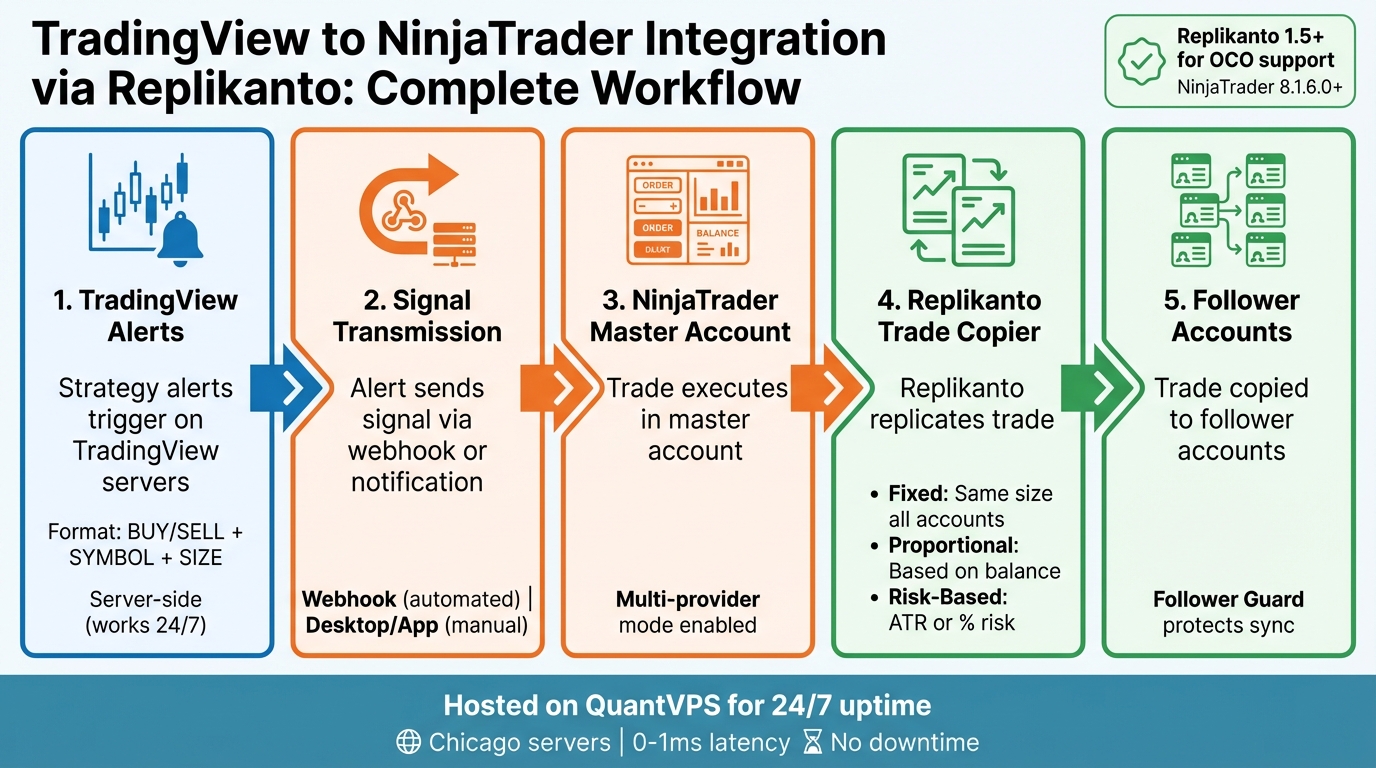

If you want to analyze charts on TradingView and execute trades via NinjaTrader, this guide shows you how to link the two platforms using Replikanto, a NinjaTrader add-on for copying trades across accounts. Here’s what you’ll learn:

- TradingView Alerts: Set up alerts to trigger trades based on your strategies.

- NinjaTrader Setup: Configure accounts for trade execution and enable multi-provider mode.

- Replikanto Installation: Install and set up the tool to copy trades from a master account to follower accounts.

- VPS Hosting: Use one of the best VPS for futures trading for uninterrupted trading and reduced latency, especially for CME futures.

This process isn’t a direct API link but rather a system where TradingView signals trigger trades in NinjaTrader, and Replikanto mirrors them across accounts. Follow these steps to build a reliable setup for multi-account trading.

TradingView to NinjaTrader Integration Workflow with Replikanto

TradingView to NinjaTrader Integration Workflow with Replikanto

Setting Up TradingView Alerts

TradingView alerts are a handy tool to notify you when specific market conditions are met, allowing you to execute trades through NinjaTrader. These alerts can be applied to data series (like price levels), indicator plots, strategy orders, or even drawing objects. You can set them up for manual or semi-automated execution, depending on your trading style.

How to Create Alerts in TradingView

Creating alerts in TradingView is straightforward. You can use the toolbar, Alert Manager, right-click menu, drawing panel, price-scale button, or hotkeys (ALT + A on Windows; ⌥ + A on Mac). Once the alert window pops up, you’ll need to configure the trigger, frequency, and duration. Keep in mind that standard alerts expire after two months, but if you’re a Premium or Ultimate user, you can set alerts with no expiration.

For NinjaTrader integration, it’s best to focus on strategy alerts rather than basic price alerts. Why? Strategy alerts operate on TradingView’s servers, meaning they remain active even if your browser is closed or your computer is off. This server-side functionality ensures you won’t miss critical signals due to connectivity issues.

Formatting Alert Messages

The alert message tells NinjaTrader what action to take. For manual or semi-automated trading, a typical message format might look like this:

BUY / MNQ / SIZE=1

This structure specifies the action (BUY or SELL), the symbol (e.g., MNQ), and the trade size. If you’re using TradingView’s Pine Script, you can automate this process by adding placeholders like {{strategy.order.action}}, {{ticker}}, or {{strategy.order.contracts}} to the message box. These placeholders dynamically pull live data from your chart, ensuring the message stays accurate and up-to-date.

Once you’ve standardized your alert messages, the next step is to decide on the best notification method for triggering trade execution.

Selecting Alert Notification Methods

TradingView offers a variety of notification options, including app notifications, desktop pop-ups, emails, Webhook URLs, sounds, and plain text (email-to-SMS). For manual execution, app or desktop notifications are ideal. They provide you with instant alerts, so you can quickly place trades in NinjaTrader. If you choose desktop notifications, make sure your browser settings allow TradingView to display pop-ups.

For semi-automated or fully automated execution, webhooks are the most efficient option. A webhook sends a POST request to a specific URL whenever an alert triggers, enabling you to send trade signals directly to NinjaTrader or a NinjaTrader trade copier comparison like Replikanto. As TradingView Support explains:

Webhooks allow you to send a POST request to a certain URL every time the alert is triggered.

Webhooks allow you to send a POST request to a certain URL every time the alert is triggered.

Webhooks eliminate the need for manual input, ensuring trades are executed instantly as alerts fire. However, remember that if you adjust an indicator’s settings after creating an alert, you’ll need to recreate the alert, as existing ones will continue using the old parameters.

With your TradingView alerts ready, the next step is configuring NinjaTrader and tools like Replikanto to process these signals effectively.

Setting Up NinjaTrader and Replikanto

Get NinjaTrader and Replikanto configured to ensure trades are mirrored without a hitch.

Configuring Your NinjaTrader Master Account

Before you can start using Replikanto to copy trades, you’ll need to set up a master account in NinjaTrader. Start by enabling Multi-Provider Mode, which allows you to connect multiple broker accounts. To do this, go to Tools > Options > General in NinjaTrader and check the box for Multi-provider mode. This step is crucial if you’re planning to copy trades across different brokerages. Don’t forget to restart NinjaTrader after enabling this setting – otherwise, the "configure" option won’t show up in the Connections menu.

Once NinjaTrader is back up, head to Connections > Configure to add your broker accounts. Enter your login credentials and choose whether you’re operating in Live or Simulated mode. Once your master account is ready, it’s time to install Replikanto.

Installing and Setting Up Replikanto

Download the Replikanto add-on and install it on the same Windows machine or VPS where NinjaTrader 8 is running. Keep in mind, Replikanto doesn’t directly connect to brokers; it works through the accounts already linked to NinjaTrader. So, make sure your broker accounts are properly connected to NinjaTrader beforehand.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

After installation, open Replikanto from the Tools menu in NinjaTrader. From there, select your master account in the dropdown menu and link the follower accounts you want to mirror trades to.

Next, configure allocation rules for the follower accounts. Replikanto provides three main allocation options:

- Fixed Allocation: Assigns the same contract size to each follower account.

- Proportional Allocation: Adjusts the contract size based on each account’s balance.

- Risk-Based Allocation: Determines size using metrics like ATR (Average True Range) or a percentage of risk.

For example, if your master account trades 4 contracts of ES, you could set Follower A to copy 2 contracts and Follower B to copy 1 contract. These rules are especially helpful for staying within prop firm drawdown limits and aligning with your risk management plan.

Once everything is configured, it’s time to test the setup.

Running a Test Trade

Start by running a test trade with a single micro contract. QuantVPS advises:

"Verify the connections by checking account balances or placing a small test trade."

"Verify the connections by checking account balances or placing a small test trade."

Use the NinjaTrader Desktop interface to monitor follower accounts in real time. Look for the same symbol, trade direction (long or short), and allocation to appear in each linked account. If you’re using TradingView to initiate trades, ensure you have Replikanto version 1.5 or later installed for full support of OCO (One Cancels the Other) orders.

If everything replicates correctly, you’re ready to dive into live trading. If not, revisit your broker connections, allocation settings, and symbol mappings before trying again.

Running Your Setup on a VPS

After setting up NinjaTrader and Replikanto, the next step is to move your system to a VPS. This ensures consistent, uninterrupted trading by maintaining a stable connection and improving both performance and execution speed.

Why Use a VPS for Trading

While local testing is fine for initial setups, live trading demands the reliability of a VPS. A VPS eliminates potential disruptions caused by power outages, internet issues, or automatic system updates. With a VPS, NinjaTrader and Replikanto stay online 24/7, providing a seamless trading experience.

Another key advantage is reduced latency. If you’re trading futures contracts on the CME Group, the physical location of your VPS server matters. For example, a VPS based in Chicago places your NinjaTrader instance closer to the exchange, minimizing delays in trade execution. This can be crucial during high-volatility periods when even a millisecond can impact trade outcomes.

For traders managing multiple accounts, a VPS also provides the necessary CPU and RAM to handle demanding workloads. NinjaTrader and Replikanto require sufficient resources, especially when running multiple charts. Choosing a VPS with the right specifications ensures smooth performance and prevents lag during trade copying.

Configuring QuantVPS for NinjaTrader

To take advantage of consistent uptime and low latency, configure your QuantVPS environment based on your trading needs. QuantVPS offers plans tailored for different workloads:

- VPS Lite: Ideal for lighter use, this plan costs $59.99/month (or $41.99/month with an annual subscription) and includes 4 cores, 8GB RAM, and 70GB NVMe storage.

- VPS Pro: Designed for more active setups, this plan costs $99.99/month (or $69.99/month annually) and provides 6 cores, 16GB RAM, and dual-monitor support.

Once you’ve chosen a plan, access your VPS via Remote Desktop Protocol (RDP). Follow a NinjaTrader VPS setup guide to install NinjaTrader 8 and Replikanto just as you would on your local computer. Use NinjaTrader’s Connections > Configure menu to link your broker accounts, and set up Replikanto with your master and follower accounts.

Before starting live trading, conduct a test. Place a small order – like a micro contract – on your master account and confirm that it copies correctly to the follower accounts. This step ensures the entire system is functioning properly and that your VPS is maintaining a stable connection.

VPS Maintenance Tips

To keep your VPS running smoothly, monitor and maintain its performance regularly. Check CPU and RAM usage to ensure they remain within acceptable limits. If you encounter lag or slow performance, consider upgrading to a higher-tier VPS plan for additional resources.

Keep the system time synchronized on your VPS. An out-of-sync clock can disrupt order execution, especially with brokers like Tradovate, where mismatched times might result in canceled entry orders while exit orders remain active. Although Windows Server generally handles time synchronization automatically, it’s a good idea to double-check.

Use Replikanto’s Follower Guard feature to protect follower accounts. This tool automatically flattens follower positions if they fall out of sync or if an order is rejected, reducing the risk of lingering unintended positions. Additionally, configure Replikanto to block trade copying on inactive workspaces, which can prevent accidental trades from background NinjaTrader tabs.

Lastly, update Replikanto to its latest version. As of November 2025, version 1.6.1.2 supports NinjaTrader 8.1.6.0+ and includes full compatibility with OCO orders placed via TradingView. Staying updated ensures you benefit from bug fixes and new features, enhancing the accuracy and reliability of trade copying.

Troubleshooting and Tips

Common Problems and Solutions

Even with everything set up correctly, you might still run into issues when copying trades from TradingView to NinjaTrader using Replikanto. For instance, if follower accounts aren’t copying trades, the most likely culprits are that Replikanto hasn’t been started or there’s been a connection drop. To fix this, restart both Replikanto and NinjaTrader 8, and double-check that the "Start Copying" button is active.

Symbol mismatches, like ES versus MES, can also cause problems. To address this, enable Replikanto’s Cross Order feature, which allows micro-to-mini contract copying. If you’re trading multiple symbols, it’s a good idea to open a separate Replikanto window or tab for each instrument.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Another common issue involves canceled entry orders while exit orders remain active. This usually points to a time sync problem. Check your VPS clock settings and make sure they match your broker’s server time. This is especially important if you’re using Tradovate.

If you’re connecting multiple broker accounts, you’ll need to enable Multi-provider mode in NinjaTrader. To do this, go to Tools > Options > General and check the "Multi-provider" box. Without this setting, NinjaTrader won’t allow simultaneous connections to multiple brokers.

For follower accounts that fall out of sync – whether due to rejected orders or partial fills – use the Follower Guard feature. This tool automatically flattens follower positions if they deviate from the leader’s position. Make sure you’re running Replikanto version 1.5 or later to take advantage of full OCO (One Cancels Other) compatibility.

Once you’ve applied these fixes, test everything in Simulation mode to ensure it’s working as expected.

Testing with Simulated Trades

After addressing the common issues, it’s time to validate your setup with simulated trades. Before putting real money on the line, use NinjaTrader’s Simulation (Sim) mode to test your workflow. Set up a Sim account as your leader account in Replikanto, and place a small test trade from TradingView – try starting with a single micro contract. Watch how the trade flows from TradingView to your master NinjaTrader account, and confirm that Replikanto copies the trade accurately to your follower accounts with the correct quantity ratios.

Also, check NinjaTrader’s Control Center to ensure account balances update correctly after each test trade. This step is crucial to confirm that your connections are functioning properly. It also gives you a chance to observe how market volatility or latency might cause slight discrepancies between leader and follower accounts.

Monitoring Trade Performance

Once your simulations are successful, it’s time to monitor live trade performance closely. Pay attention to key metrics to catch any issues early. For example, track fill rates to ensure all accounts are executing trades as they should, and keep an eye out for partial fills, especially on follower accounts trading smaller quantities. If you’re using Replikanto version 1.6.1.0 or later, the system will wait for additional fills to meet the minimum tradable quantity before processing partial fills.

Slippage is another factor to monitor, as it can vary across accounts due to latency. If you notice consistently high slippage on micro contracts, consider switching follower accounts to mini contracts using the Cross Order feature. To stay on top of everything, keep the NinjaTrader Desktop platform running on your VPS during active trades. This allows you to monitor follower accounts in real time and quickly address any discrepancies that arise.

Conclusion

This guide has walked you through the entire process – from setting up alerts to replicating trades – providing a clear roadmap for implementing this trading workflow effectively.

How the Workflow Works

The process begins with TradingView generating alerts based on your custom strategy. These alerts trigger trades in your NinjaTrader master account, which can be executed manually or automatically. Once trades are executed in NinjaTrader, Replikanto steps in to replicate them across all your designated follower accounts, adhering to your chosen allocation rules. This seamless integration combines TradingView’s analysis capabilities with NinjaTrader’s execution platform, creating a reliable and efficient trading setup.

How QuantVPS Enhances Reliability

Running your trading system on QuantVPS eliminates the common pitfalls of relying on a local PC. With servers strategically located in Chicago, you gain ultra-[low latency access to CME Group futures markets](https://www.quantvps.com/blog/low-latency-futures-trading), often achieving ping times as low as 0-1ms. This speed is crucial when copying trades across multiple accounts, as even minor delays can lead to price discrepancies between master and follower accounts. QuantVPS ensures uninterrupted operation of NinjaTrader and Replikanto – 24/7 – shielding your system from power outages, internet issues, or unexpected Windows updates. Plus, you can manage everything remotely through TradingView’s mobile app, confident that your VPS-hosted setup will execute trades consistently. For traders juggling multiple funded accounts, this level of uptime and reliability is indispensable.

Transitioning to Live Trading

After confirming that trades replicate accurately in simulation mode, you’re ready to move to live trading. Start by enabling Multi-provider mode in NinjaTrader through Tools > Options > General and configure Replikanto’s Follower Guard for added security. Begin cautiously with one or two follower accounts and closely monitor their performance during the first week. Keep NinjaTrader Desktop running on your VPS during active market hours to quickly address any issues that might arise. These steps ensure your system is prepared for dependable live trading while minimizing risks to your capital.

FAQs

How does Replikanto ensure accurate trade copying across multiple NinjaTrader accounts?

Replikanto guarantees precise trade replication by mirroring every order executed in the master NinjaTrader account directly to follower accounts. It uses detailed allocation methods, including exact-quantity, ratio-based, or percentage-based copying, to ensure trades align perfectly with the master account.

Its Follower Guard plays a crucial role in maintaining synchronization. This feature actively monitors follower accounts to prevent issues like mismatched or rejected orders. Additionally, it ensures that symbol mapping and allocation settings are correctly applied, so trades execute seamlessly and as intended across all connected accounts.

What are the advantages of using a VPS for NinjaTrader and Replikanto?

Using a VPS to run NinjaTrader and Replikanto comes with several advantages that can make a significant difference for traders. One of the biggest perks is 24/7 uptime. This means your trading setup stays online around the clock, even if your local computer is off, the power goes out, or your internet connection drops. For traders, this consistency is crucial for seamless alert processing and uninterrupted trade copying.

Another key benefit is low-latency execution. With lightning-fast response times, a VPS minimizes slippage and ensures your orders are executed with greater accuracy. Plus, thanks to dedicated resources like sufficient CPU and RAM, a VPS can handle multiple follower accounts without performance issues. On top of that, it offers strong cybersecurity measures, including DDoS protection and regular backups, to keep your trading environment secure.

For those using NinjaTrader and Replikanto – especially in futures or prop-firm trading where speed and reliability are non-negotiable – a VPS can be a game-changer.

Why aren’t my trades being copied correctly in NinjaTrader?

If trades from your master NinjaTrader account aren’t being copied to follower accounts, here’s how you can troubleshoot the issue:

- Make sure Replikanto is active: Open NinjaTrader 8, navigate to Tools → Replikanto, and check if the copier is running. If it’s not, restart it and confirm the status indicators show it’s operational.

- Double-check account configuration: Verify that the master account is correctly set as the leader and follower accounts are properly linked. Also, ensure followers have enough buying power to execute trades.

- Confirm symbol mapping: For instruments like futures, check that the symbol used by the leader matches the one used by the follower. Any mismatch will block trades from being copied.

- Validate allocation settings: Review your allocation rules (fixed, proportional, or risk-based) to ensure they calculate valid contract sizes. If the size comes out to zero, the trade won’t go through.

- Consider using a VPS: Hosting NinjaTrader and Replikanto on a low-latency VPS can help avoid issues caused by internet disruptions or power outages, ensuring trades are copied without delays.

Addressing these steps should resolve most trade copying issues, keeping your Replikanto setup running smoothly.