How To Get Funded For Trading in 2026

Want to trade with someone else's money in 2026? Here's how it works:

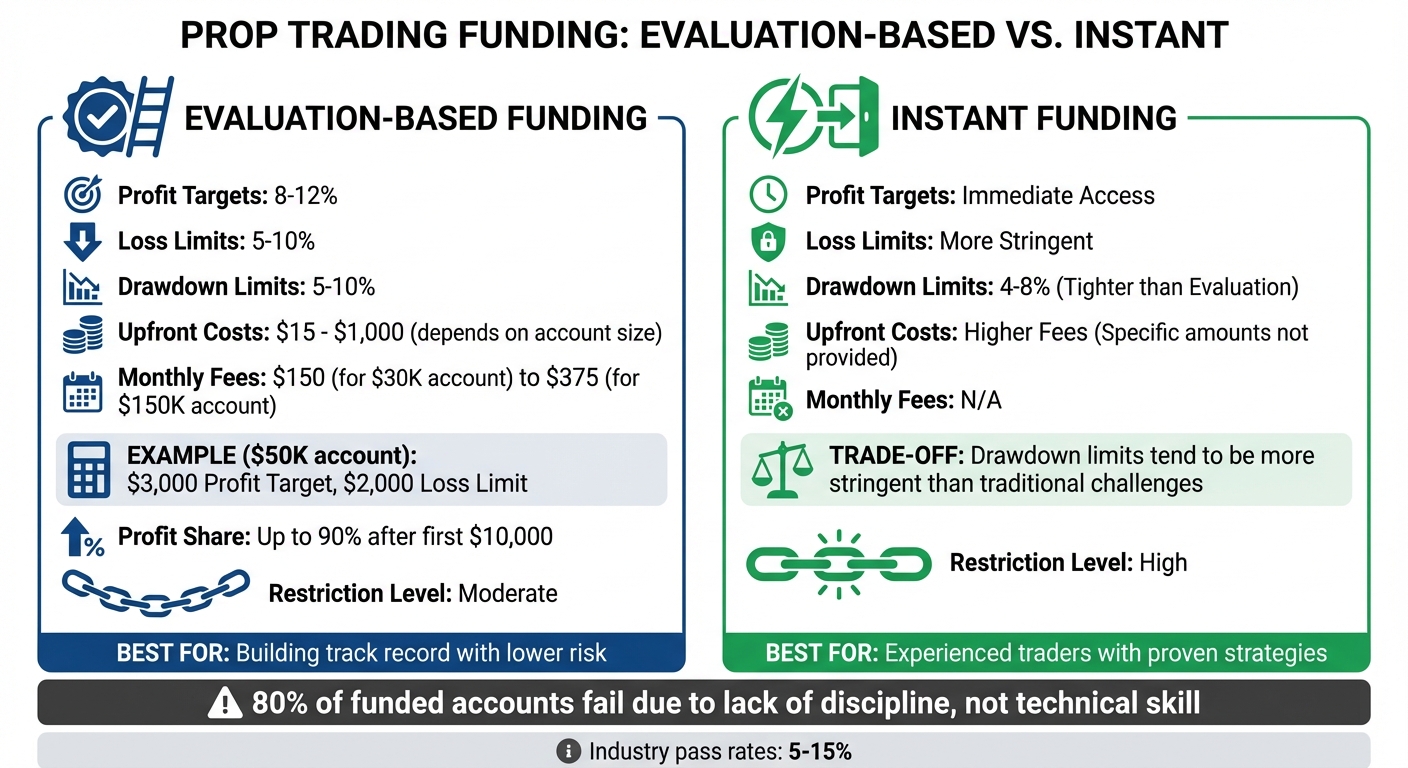

Funded trading lets you trade using capital provided by proprietary firms. You start by proving your skills in a prop firm challenge, hitting profit targets while sticking to strict risk rules. If you pass, you can trade a funded account and keep a large share of the profits (up to 90% after the first $10,000).

Key Points:

- Evaluation Programs: Meet profit targets (8–12%) with loss limits (5–10%) to qualify for funding.

- Instant Funding: Skip evaluations but face stricter drawdown limits and higher fees.

- Rules Matter: Daily loss limits, maximum drawdowns, and consistency rules are strictly enforced.

- Tech Setup: Use a VPS for reliable, fast trading and tools like trade copiers and performance trackers.

- Scaling: Start with one account, then expand to trade multiple accounts simultaneously using trade copiers.

In 2026, firms prioritize consistency and risk management over quick wins. Advanced tools, like behavioral safeguards and AI coaching, help traders stay disciplined. To succeed, focus on a solid trading plan, track your performance, and build reliable infrastructure like QuantVPS for uninterrupted trading.

The Easiest Way To Get Funded in 2026 (Full Guide)

How Prop Firm Funding Programs Work

Evaluation-Based vs Instant Funding Programs Comparison 2026

Evaluation-Based vs Instant Funding Programs Comparison 2026

Evaluation-Based Funding Programs

Evaluation-based programs often involve challenge phases where traders must meet profit targets - typically between 8% and 12% - while adhering to strict loss limits. For example, in a $50,000 combine, traders need to achieve a $3,000 profit target without exceeding a $2,000 loss limit. Successfully completing this phase grants access to an Express Funded Account, where traders can earn real payouts of up to $5,000. Similarly, Vanquish Trader's Basic Options Plan sets a 10% profit target along with a 5% trailing drawdown. Traders must also complete at least 10 trades to qualify. Once funded, they keep 100% of their profits and can request payouts daily.

One advantage of these programs is their lower upfront costs. For instance, Topstep charges monthly subscription fees ranging from $150 for a $30,000 account to $375 for a $150,000 account. Funding Frontier's fees vary from $15 to $1,000, depending on the account size. These relatively affordable entry points make evaluation programs appealing for traders looking to build their track record without risking large sums of personal capital.

Next, let's explore programs that offer immediate access to trading capital.

Instant Funding Programs

Unlike evaluation-based models, instant funding programs provide traders with capital right after paying the required fee. However, this convenience comes with certain trade-offs. As Funding Frontier explains:

"Instant funding comes with significant considerations. Drawdown limits tend to be more stringent than traditional challenges."

"Instant funding comes with significant considerations. Drawdown limits tend to be more stringent than traditional challenges."

Instant funding accounts often impose tighter drawdown limits, typically between 4% and 8%, compared to the 5% to 10% range seen in evaluation accounts. Additionally, the upfront fees for these programs are generally much higher. This model is best suited for experienced traders who already have proven strategies in place.

The differences between these two funding options highlight the importance of following strict trading guidelines, which are outlined below.

Rules You Must Follow

Prop firms enforce a variety of rules to manage risk effectively:

- Daily Loss Limits: Losses are usually capped at 2% to 5% of the account balance. Exceeding this limit often results in immediate account closure.

- Maximum Drawdown: This rule specifies the total allowable loss from either the peak or starting balance. It can be a fixed amount (static) or adjusted as your balance grows (trailing).

- Consistency Rules: To ensure performance isn't based on one lucky trade, firms often cap single-day profits at 40% of the total. Many evaluations also require traders to actively trade for 5 to 10 days to demonstrate consistent strategies.

Proper risk management is crucial. Limit your risk to 1%–2% of your account on any single trade. Additionally, check your firm's economic calendar, as trading during high-impact news events - like Non-Farm Payrolls or CPI releases - is often restricted. Lastly, ensure all positions are closed before the market settlement period (typically 4:45 PM EST for futures) to avoid triggering penalties for rule violations.

How to Pass Evaluation and Get Funded

Creating a Trading Plan That Meets Program Rules

To succeed in a funded trading program, your trading plan must align with the firm's rules. Start by focusing on 2–3 specific instruments, such as EUR/USD, NASDAQ, or Gold. Specializing in a few assets allows you to understand their behavior during market news and volatility, which is crucial for managing strict drawdown limits.

Keep your risk per trade between 0.5% and 1% of your account balance. For example, on a $50,000 account with a $2,000 drawdown limit, risking 1% means $500 per trade. This approach gives you room for about four consecutive losses while staying within the limits. Use a position size calculator to ensure accuracy.

Set personal risk thresholds that are even tighter than the firm's requirements. If the firm permits a 5% daily loss, you might set your own cap at 2% or 3%. Many firms also limit how much of your total profit can come from a single day's wins, typically capping it at 30%–40%.

Always attach a strict stop loss to every trade. Failing to do so could result in an immediate violation of the firm's rules. Additionally, steer clear of prohibited strategies like martingale systems, grid trading without stops, or hedging across multiple accounts.

Once your plan is in place, focus on measuring and refining your performance.

Tracking and Improving Your Performance Numbers

Funded firms look beyond just profits - they evaluate win rates and risk-to-reward ratios. For instance, you can still be profitable with a 40% win rate if your average winning trade is at least twice the size of your average losing trade.

Keep a detailed trade journal that tracks your entry and exit points, as well as your emotional state. This can help you identify patterns like revenge trading or impulsive decisions, which often lead to costly mistakes.

Pay close attention to your trailing drawdown. Unlike a fixed drawdown, a trailing drawdown adjusts as your equity grows. For example, if you start with $50,000 and your account grows to $52,000, the drawdown limit recalculates based on the new peak. Knowing this threshold before placing trades is essential.

In December 2024, a trader named Jayden turned an $80,000 personal loss into over $270,000 in profit using a $250,000 funded account. He achieved this by meticulously tracking his performance and using Enigma risk management software to stick to a structured trading plan.

Effective performance tracking sets the stage for leveraging advanced tools.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

Using Tools to Stay Consistent

Consistency is key to passing evaluations, and the right tools can make all the difference. Trade copiers, for example, allow you to replicate strategies across multiple accounts. One trader mirrored a $2,000 profit trade across 20 accounts, resulting in a $40,000 gain. However, make sure your strategy is solid before scaling up.

Proprietary software like Enigma can enhance your approach by analyzing historical data to fine-tune your risk parameters, improving your chances of meeting evaluation criteria.

Consider adopting the 3-2-1 Strategy: trade three days a week, take two trades per day, and aim for a 1% weekly profit. This helps prevent overtrading, which is one of the most common reasons traders lose funded accounts. As PropFirmCodes explains:

"Fewer trades = Fewer emotional errors. Most funded traders lose their account through overtrading, not lack of skill." – PropFirmCodes

"Fewer trades = Fewer emotional errors. Most funded traders lose their account through overtrading, not lack of skill." – PropFirmCodes

Start each trading day with a pre-trade checklist. Confirm your trailing drawdown, review the economic calendar for major news events, and double-check your position size calculations. Avoid trading 30 minutes before and after significant events like Non-Farm Payrolls or FOMC announcements to reduce the risk of slippage or violating loss limits.

Setting Up Your Trading Infrastructure with QuantVPS

Why Funded Traders Need a VPS

For funded traders, maintaining uninterrupted access to trading platforms is non-negotiable. A Virtual Private Server (VPS) eliminates risks tied to home computer issues - like power outages or unreliable internet - and ensures your trading platform stays operational 24/7. This is especially critical when adhering to strict risk management rules. QuantVPS offers ultra-low latency of just 0.52ms to the CME Group exchange from its Chicago datacenter, reducing slippage during trade entries and exits.

"Ultra-low latency ensures rapid trade execution and reduces slippage." – QuantVPS

"Ultra-low latency ensures rapid trade execution and reduces slippage." – QuantVPS

Beyond latency, a VPS provides a stable environment for running trade copiers and risk management tools without hiccups. With a 99.999% uptime rating, you can trust your software to remain active around the clock. Once you’ve secured a stable, low-latency connection, selecting the right QuantVPS plan is the next step.

Choosing the Right QuantVPS Plan

The best QuantVPS plan for you depends on your trading setup - specifically, the number of charts you monitor and whether you’re using trade copiers. Here’s a breakdown of their offerings:

- VPS Lite: Designed for single-account traders with 1–2 charts. Includes 4 cores, 8GB RAM, and 70GB NVMe storage at $59.99/month (or $41.99/month if billed annually). Perfect for running one trading platform.

- VPS Pro: Ideal for more complex setups, such as managing 3–5 charts or testing strategies across multiple timeframes. It features 6 cores, 16GB RAM, and support for up to 2 monitors at $99.99/month ($69.99/month annually). A great choice for NinjaTrader or MetaTrader users with a single funded account.

- VPS Ultra: Tailored for traders managing multiple prop firm accounts with trade copiers. Boasts 24 cores, 64GB RAM, and support for up to 4 monitors at $189.99/month ($132.99/month annually). This plan can handle the heavy processing demands of running several trading platforms simultaneously.

Not sure which plan fits your needs? QuantVPS provides a 5-question configurator tool to help you align your trading volume and platform requirements with the right resources.

Configuring Your VPS for Prop Trading

Once you’ve chosen your plan, it’s time to set up your VPS. Start by connecting to your pre-configured Windows Server 2022 VPS using Remote Desktop Protocol (RDP).

Next, install your trading platform - whether it’s NinjaTrader, MetaTrader, or TradeStation - and link it to your preferred data feed. QuantVPS supports popular options like Rithmic, CQG, and dxFeed. Thanks to NVMe M.2 SSD storage, platform loading times remain fast, even during high-volatility periods.

If you’re using trade copier software to manage multiple funded accounts, install it on the VPS and configure it to replicate trades from your master account. Test the copier with small positions to confirm accuracy. The VPS’s 1Gbps+ network, with 10Gbps burst capability, ensures smooth data transmission without lag.

Next, set up your risk management software. This tool should run continuously on the VPS to monitor trailing drawdowns in real time, allowing you to stay within the limits set by your prop firm.

"Your VPS environment is set up for efficient, secure trade execution... keeping your futures platform and bots active even when your home computer is off." – QuantVPS

"Your VPS environment is set up for efficient, secure trade execution... keeping your futures platform and bots active even when your home computer is off." – QuantVPS

Finally, verify your connectivity with your prop firm’s servers. Some firms require IP whitelisting, so ensure your QuantVPS IP address is approved. With enterprise-grade DDoS protection and advanced firewalls, QuantVPS meets the security requirements of most prop firms. Once everything is configured, you’re ready to trade with confidence, knowing your infrastructure is built for reliability and performance.

Advanced Strategies for Funded Trading Success

Building on the basics of trading tools and performance tracking, advanced strategies can take your funded trading game to the next level.

Using Data to Improve Your Results

To ensure your trading strategy is reliable, keep a close eye on key metrics like the Sharpe Ratio (aim for above 1.0), win rate (40–60%), and a risk-to-reward ratio of at least 1:2. These numbers help confirm if your approach is solid or if you're just riding on luck.

Avoid relying too heavily on a single trade or day's performance. If one trade or day accounts for more than 30–40% of your total profits, it could lead to failure during evaluations - even if you hit your profit targets. A trading journal is essential here. Use it not just to log trades but also to track your emotional state. This can help you spot patterns like "revenge trading", which often leads to costly mistakes.

"Passing isn't about being perfect. It's about being repeatable. Think like a risk manager first and a trader second." – Vanquish Trader

"Passing isn't about being perfect. It's about being repeatable. Think like a risk manager first and a trader second." – Vanquish Trader

Advanced tools like Enigma can be game-changers. By analyzing your historical data, these tools can optimize your position sizing and risk parameters mathematically, boosting your chances of passing evaluations. The focus should always be on proving your strategy is consistent and repeatable, not random. Traders who stick to a structured process of data tracking often secure funding within 60 to 90 days. Once you’ve validated your strategy, scaling up becomes the logical next step.

Managing Multiple Funded Accounts

When you’ve mastered one account, expanding to multiple accounts can significantly increase your earning potential without adding extra effort. Tools like the best trade copiers, hosted on a VPS, allow you to mirror trades across multiple accounts simultaneously, ensuring identical execution while keeping things efficient.

Scaling should be done gradually. For example, focus on a single account for three months, add a second account in months four through six, and consider a third account between months seven and nine. Rushing this process can lead to mistakes and rule violations across all accounts. For instance, Trader Steph successfully linked 20 funded accounts using trade-copying software. By applying the same high-probability setups across all accounts, a $2,000 payout on one account turned into a $40,000 total payout.

Avoid hedging across accounts - placing a buy on one account and a sell on another to secure profits is not allowed and will lead to immediate disqualification. Before linking accounts, confirm that the firm permits "self-copying" or futures copy trading. While mirroring your own trades is generally accepted, using external EAs or copying other traders is usually prohibited.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

To protect your accounts, implement a three-tier safety system:

- At a 2% drawdown, reduce your position size by 50%.

- At 4%, pause trading for three days.

- At 6%, stop trading for a week and review your strategy.

When withdrawing profits, keep 20% in the account as a buffer. This prevents you from hitting trailing drawdown limits right after a withdrawal.

Building a Daily Trading Routine

A well-structured routine removes guesswork and reinforces discipline. Start each morning by reviewing the economic news calendar and checking your trailing drawdown levels across all accounts. This simple habit can help you avoid accidental rule violations before you even begin trading.

Consistency is key. For example, avoid trading 30 minutes before and after major news events like NFP, FOMC, or CPI announcements. These timeframes are highly volatile, and waiting allows you to analyze market reactions before entering trades with confirmation. Close all positions by 8:00 PM GMT every Friday to avoid the risks of weekend gaps.

Once the market closes, take time to review your trades. Record details like entry and exit points, your reasons for each trade, and your emotional state. This reflective process can help you pinpoint behaviors that lead to losses. Beyond trading, prioritize your mental and physical health - get seven to eight hours of sleep and include daily exercise in your routine. Mental clarity is essential for making sound decisions in high-pressure trading environments.

It’s worth noting that around 80% of funded accounts fail - not due to technical skill, but because of a lack of discipline and poor long-term strategies. A solid routine can make all the difference.

Conclusion

Key Takeaways

As we look ahead to 2026, success in funded trading depends on careful planning, consistency, and a disciplined approach. Prop firms are now prioritizing traders who demonstrate repeatable strategies over those relying on luck or rushed evaluations. This means sticking to your trading plan and maintaining strict risk management. Keep a detailed trade journal, including notes on your emotional state, to spot and eliminate harmful habits like revenge trading.

No single trade or trading day should dominate your overall profits - aim to keep any one trade below 30% of your total earnings. Once funded, focus on preserving capital by building a profit buffer before requesting payouts. If you plan to scale to multiple accounts, take it slow and use VPS-based trade copiers to ensure smooth and consistent execution. Setting personal risk limits tighter than the firm's rules can provide an extra layer of security.

With industry pass rates hovering between 5–15% and failure rates for funded accounts exceeding 80%, achieving success requires a combination of technical skill, disciplined planning, and reliable tools. As discussed earlier, treating funded trading like a professional business is the foundation for consistent payouts.

These principles are not just about strategy - they emphasize the importance of having a reliable infrastructure to support your trading.

Why QuantVPS Is Essential for Traders

To complement disciplined trading practices, a dependable VPS platform is a must for executing your strategy effectively. QuantVPS offers ultra-low latency (0–1ms), near-perfect uptime, and seamless compatibility with platforms like NinjaTrader, MetaTrader, and TradeStation. This helps eliminate technical issues that could lead to rule violations or missed opportunities.

QuantVPS also simplifies the process of scaling. Its platform supports trade copiers that sync trades across 5 to 20 accounts, removing the need for manual effort and ensuring consistent execution. With plans starting at $59.99/month (or $41.99/month annually), QuantVPS offers scalable options, including dedicated servers with DDoS protection, automatic backups, and fast NVMe storage - letting you focus entirely on trading.

Whether you're navigating your first evaluation or managing multiple accounts, QuantVPS provides the infrastructure you need to trade with confidence. By mastering the core principles of disciplined trading and leveraging QuantVPS, you'll be better equipped to succeed in today’s competitive trading landscape.

FAQs

What’s the difference between evaluation-based and instant funding programs for traders?

Evaluation-based funding programs require traders to prove their abilities by meeting specific performance criteria. These can include hitting profit targets, adhering to daily loss limits, and maintaining consistency metrics - such as keeping a maximum daily drawdown between 4-8% or achieving a monthly profit of 8-12%. Typically, these programs operate in a simulated trading environment and may involve completing one or more challenge stages. Only after meeting all the outlined requirements do traders receive funding, ensuring they’ve demonstrated both discipline and profitability.

On the other hand, instant funding programs skip the evaluation phase entirely. Traders gain immediate access to a funded account after paying a fee, without needing to pass any performance tests. However, these accounts often come with stricter position-size limits and higher upfront costs. While instant funding provides quick access to trading capital, it generally offers less flexibility compared to evaluation-based programs.

In short, evaluation-based programs emphasize verifying a trader’s consistency and skill, while instant funding trades verification for immediate access to capital but with tighter restrictions and higher fees.

What steps can I take to follow prop firm rules and avoid losing my funded account?

To keep your funded account in good standing, start by getting a clear grasp of the prop firm's rules. Pay close attention to key guidelines like profit targets, daily loss limits, and maximum drawdown thresholds. These rules act as your framework - your trading strategy should align with them.

Risk management is critical. Aim to keep your per-trade risk low, ideally between 0.25% and 0.5% of your account balance, and never breach the daily loss cap, which is often set at 1%. Focus on steady, consistent results rather than chasing quick gains. For instance, in your first week, take time to observe market trends and limit yourself to just one or two low-risk trades per day.

Keep a close eye on your performance by using tools like a trading journal or equity curve simulator. These can help you ensure you're staying within the firm's boundaries. Additionally, double-check that you're trading on approved platforms and steering clear of banned strategies, such as hedging or unauthorized trade copiers. By sticking to the rules, managing risk wisely, and regularly tracking your progress, you can reduce the chances of disqualification and increase the lifespan of your funded account.

Why is using a VPS crucial for funded trading, and how can I choose the best one?

A Virtual Private Server (VPS) plays a crucial role in funded trading by delivering fast, reliable, and uninterrupted performance - a must for meeting the strict standards of proprietary trading firms. With a high-performance VPS, latency is minimized - often down to just milliseconds - ensuring quicker order execution and lowering the chances of slippage. Plus, features like 99.999% uptime, DDoS protection, and automated backups keep your trading system online and compliant, even during unexpected disruptions.

When choosing a VPS, think about the speed and complexity of your trading strategy. If you're running high-frequency or multi-account setups, look for a plan with multiple CPU cores, at least 8 GB of RAM, and NVMe SSDs to manage large data flows effectively. For slower, discretionary trading, a smaller plan with dependable performance and low latency should work just fine. Ensure your VPS is compatible with your trading platform, such as NinjaTrader, and is located near critical servers like the CME or your broker's data center to further cut down on latency. Matching your VPS plan to your specific trading needs can improve execution quality while keeping costs in check.

Evaluation-based funding programs require traders to prove their abilities by meeting specific performance criteria. These can include hitting profit targets, adhering to daily loss limits, and maintaining consistency metrics - such as keeping a maximum daily drawdown between 4-8% or achieving a monthly profit of 8-12%. Typically, these programs operate in a simulated trading environment and may involve completing one or more challenge stages. Only after meeting all the outlined requirements do traders receive funding, ensuring they’ve demonstrated both discipline and profitability.

On the other hand, instant funding programs skip the evaluation phase entirely. Traders gain immediate access to a funded account after paying a fee, without needing to pass any performance tests. However, these accounts often come with stricter position-size limits and higher upfront costs. While instant funding provides quick access to trading capital, it generally offers less flexibility compared to evaluation-based programs.

In short, evaluation-based programs emphasize verifying a trader’s consistency and skill, while instant funding trades verification for immediate access to capital but with tighter restrictions and higher fees.

To keep your funded account in good standing, start by getting a clear grasp of the prop firm's rules. Pay close attention to key guidelines like profit targets, daily loss limits, and maximum drawdown thresholds. These rules act as your framework - your trading strategy should align with them.

Risk management is critical. Aim to keep your per-trade risk low, ideally between 0.25% and 0.5% of your account balance, and never breach the daily loss cap, which is often set at 1%. Focus on steady, consistent results rather than chasing quick gains. For instance, in your first week, take time to observe market trends and limit yourself to just one or two low-risk trades per day.

Keep a close eye on your performance by using tools like a trading journal or equity curve simulator. These can help you ensure you're staying within the firm's boundaries. Additionally, double-check that you're trading on approved platforms and steering clear of banned strategies, such as hedging or unauthorized trade copiers. By sticking to the rules, managing risk wisely, and regularly tracking your progress, you can reduce the chances of disqualification and increase the lifespan of your funded account.

A Virtual Private Server (VPS) plays a crucial role in funded trading by delivering fast, reliable, and uninterrupted performance - a must for meeting the strict standards of proprietary trading firms. With a high-performance VPS, latency is minimized - often down to just milliseconds - ensuring quicker order execution and lowering the chances of slippage. Plus, features like 99.999% uptime, DDoS protection, and automated backups keep your trading system online and compliant, even during unexpected disruptions.

When choosing a VPS, think about the speed and complexity of your trading strategy. If you're running high-frequency or multi-account setups, look for a plan with multiple CPU cores, at least 8 GB of RAM, and NVMe SSDs to manage large data flows effectively. For slower, discretionary trading, a smaller plan with dependable performance and low latency should work just fine. Ensure your VPS is compatible with your trading platform, such as NinjaTrader, and is located near critical servers like the CME or your broker's data center to further cut down on latency. Matching your VPS plan to your specific trading needs can improve execution quality while keeping costs in check.

"}}]}