Top Cross Asset Trading Platforms & Software for Investors

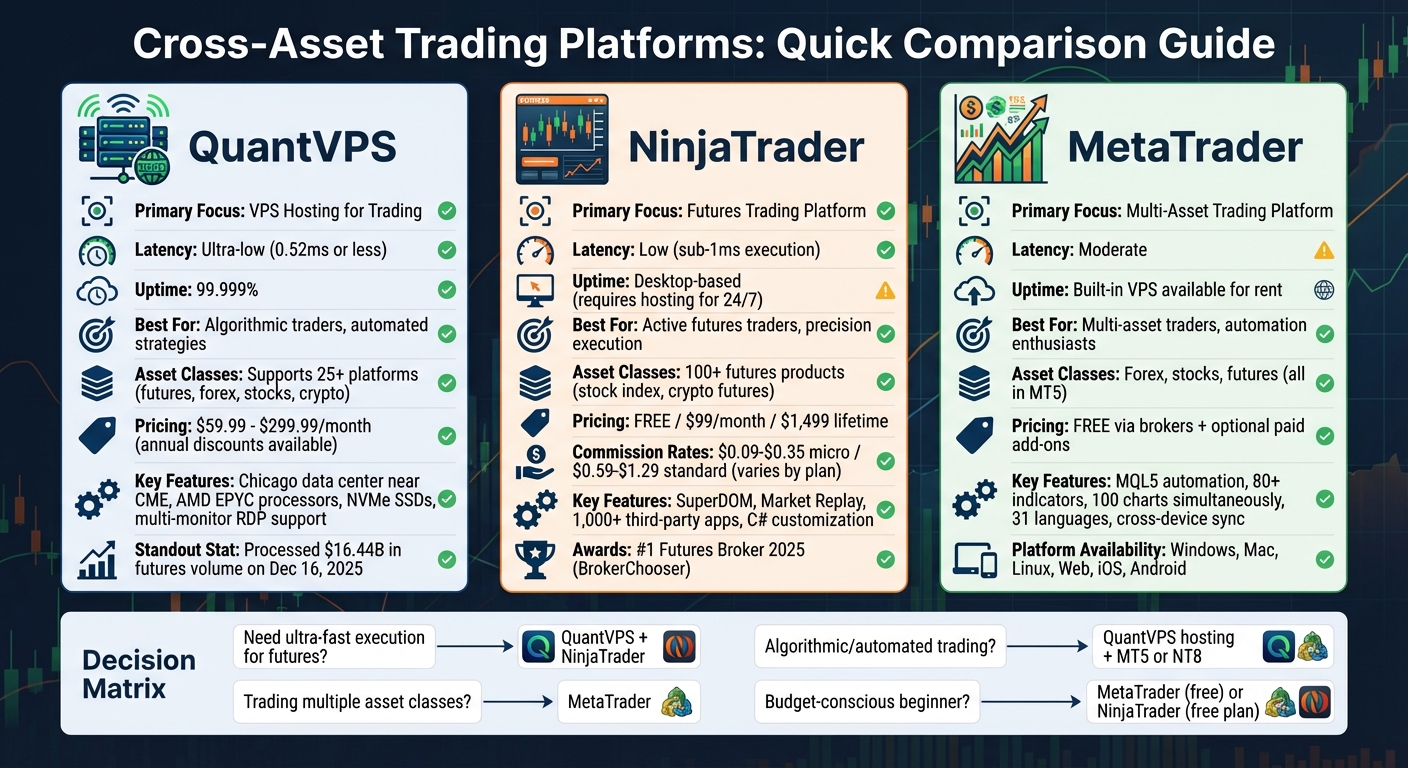

Cross-asset trading platforms let you trade across markets like stocks, futures, forex, and crypto from one system. The key factors to consider are latency (speed of order execution), compatibility (across devices and platforms), and pricing (fees, licenses, and commissions). This article reviews three options:

- QuantVPS: A hosting service offering ultra-low latency (0.52ms or less) for futures trading with 99.999% uptime. Plans start at $59.99/month.

- NinjaTrader: A futures-focused platform with advanced tools like SuperDOM and Market Replay. Pricing includes a free plan, $99/month, or a $1,499 lifetime license.

- MetaTrader: A multi-asset platform (forex, stocks, futures) with automation features. Often free via brokers, with optional paid add-ons.

Each platform caters to different trading styles. For futures, NinjaTrader paired with QuantVPS offers high performance. For multi-asset traders, MetaTrader provides flexibility and broker integration.

Quick Comparison

| Platform | Latency | Focus | Pricing Options | Key Features |

|---|---|---|---|---|

| QuantVPS | Ultra-low | Hosting | $59.99–$299.99/month | VPS with 100% uptime, low delay |

| NinjaTrader | Low | Futures | Free/$99/month/$1,499 lifetime | Advanced tools, low commissions |

| MetaTrader | Moderate | Multi-asset | Free via brokers, paid add-ons | Automation, multi-device support |

Takeaway: Match the platform to your trading goals, whether it's speed for futures or versatility for multiple assets.

Cross-Asset Trading Platforms Comparison: QuantVPS vs NinjaTrader vs MetaTrader

Cross-Asset Trading Platforms Comparison: QuantVPS vs NinjaTrader vs MetaTrader

1. QuantVPS: High-Performance VPS for Futures Trading

QuantVPS serves as a vital backbone for cross-asset trading, offering the ultra-low latency infrastructure that futures traders need for precise and efficient execution.

Latency and Performance

Operating out of a Chicago data center near the CME Group's matching engines, QuantVPS achieves lightning-fast latency of under 0.52ms. It’s powered by AMD EPYC and Ryzen processors, DDR4/5 RAM, and NVMe M.2 SSDs. To ensure consistent execution speeds, it uses direct fiber-optic cross-connects, bypassing unnecessary network hops. With a robust 1Gbps network capacity (capable of 10Gbps bursts) and a 99.999% uptime guarantee, QuantVPS reliably handles automated trading, even during market turbulence. For example, it processed over $16.44 billion in futures volume on December 16, 2025, without any interruptions.

"Latency and slippage can turn a winning NinjaTrader strategy into a losing one. Our rapid execution... minimizes slippage, ensuring your orders are filled closer to your intended price." - QuantVPS

"Latency and slippage can turn a winning NinjaTrader strategy into a losing one. Our rapid execution... minimizes slippage, ensuring your orders are filled closer to your intended price." - QuantVPS

This always-on environment is ideal for running automated trading bots, trade copiers, and algorithmic strategies. It’s particularly valued by proprietary traders working with firms like Apex and Bulenox. Beyond performance, QuantVPS also boasts compatibility with a wide range of trading platforms.

Platform Compatibility

QuantVPS supports more than 25 trading platforms across various asset classes. For futures trading, it works seamlessly with NinjaTrader, Tradovate, Quantower, and Sierra Chart. Forex traders can rely on MetaTrader 4/5 and cTrader, while stock and options traders have access to Interactive Brokers TWS and Thinkorswim. Cryptocurrency traders aren’t left out either, with compatibility for platforms like Coinbase.

The service also includes multi-monitor RDP support, enabling traders to maintain a multi-screen setup while accessing their VPS remotely. Automated backup systems protect custom indicators, workspaces, and historical data, while enterprise-grade DDoS protection and advanced firewalls ensure secure trading operations.

Pricing and Plans

QuantVPS offers a range of plans tailored to different performance needs:

- VPS Lite: 4 cores, 8GB RAM, 70GB NVMe storage for $59.99/month ($41.99/month annually).

- VPS Pro: 6 cores, 16GB RAM, 150GB NVMe storage, and 2-monitor support for $99.99/month ($69.99/month annually).

- VPS Ultra: 24 cores, 64GB RAM, 500GB NVMe storage, and 4-monitor support for $189.99/month ($132.99/month annually).

- Dedicated Server: 16+ dedicated cores, 128GB RAM, 2TB+ NVMe storage, and 10Gbps+ network for $299.99/month ($209.99/month annually).

For those needing even more power, Performance Plans (+) offer upgraded specs at prices ranging from $79.99/month to $399.99/month. A quick 5-question configurator helps traders select the best plan for their strategy. All plans include instant provisioning and credential delivery via email, with payments handled securely through Stripe.

2. NinjaTrader

NinjaTrader stands out as a dedicated futures trading platform, earning recognition as the #1 Futures Broker for 2025 by BrokerChooser.com and winning the 2024 Stocks & Commodities Readers' Choice Award for Best Trading Software. While it occasionally appears in discussions about cross-asset platforms, NinjaTrader’s primary focus is on futures trading. It supports over 100 futures products, including stock index and crypto futures, but does not cater to conventional stocks or spot cryptocurrencies. This specialized focus is reflected in its performance capabilities and compatibility features.

Latency and Performance

NinjaTrader’s desktop platform, built on a modern C# framework, is designed for speed and precision. It utilizes SuperDOM and ATM technology to enable low-level order access with execution speeds under 1 millisecond. For professional traders, such speeds are critical for reducing slippage when connecting to CME Group’s matching engines. To enhance accessibility, the platform integrates a cloud-based infrastructure, ensuring smooth operation across desktop, web, and mobile devices.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

Platform Compatibility

NinjaTrader caters to diverse trading setups with three platform versions. The desktop version, optimized for Windows PCs, supports extensive customization through C# and NinjaScript. For traders on the go, the web platform works seamlessly on any browser, whether on PC or Mac, and includes a mobile app for iOS and Android. With a user base exceeding 1.9 million, NinjaTrader also supports over 1,000 third-party apps and add-ons. Its advanced tools include detailed charting, backtesting capabilities, and unlimited risk-free simulation trading. These features are tailored to meet the demands of precision trading, even in unpredictable market conditions.

Pricing and Plans

NinjaTrader offers flexible pricing options to accommodate various trading needs.

- Free Plan: No monthly fee, with commissions at $0.35 per side for micro contracts and $1.29 for standard contracts.

- Monthly Plan: At $99 per month, this plan lowers commissions to $0.25 for micro and $0.99 for standard contracts.

- Lifetime Plan: For a one-time fee of $1,499, this plan provides the lowest commissions - $0.09 for micro and $0.59 for standard contracts.

Additional costs include market data subscriptions starting at around $48 per year and a $25 monthly inactivity fee (waived if at least one trade is made). Intraday margins can go as low as $50 for Micro E-mini contracts. While NinjaTrader boasts a 4.3/5 rating from NerdWallet, some users have noted that its interface may not be ideal for beginners, and the mobile experience can feel less intuitive.

"NinjaTrader offers a customizable trading platform for experienced futures traders who already have significant know-how and resources to devote to trading."

- Sam Taube, Lead Investing Writer, NerdWallet

"NinjaTrader offers a customizable trading platform for experienced futures traders who already have significant know-how and resources to devote to trading."

- Sam Taube, Lead Investing Writer, NerdWallet

3. MetaTrader

MetaTrader stands out in the world of cross-asset trading platforms by offering a unified solution for Forex, stocks, and futures. Specifically, MetaTrader 5 (MT5) simplifies trading by combining these asset classes into one platform, eliminating the need for multiple applications. Retail traders can access MT5 for free through supported brokers, making it an attractive option without upfront licensing fees. This all-in-one approach sets it apart from platforms that specialize in just one asset class, providing a more streamlined experience.

Latency and Performance

When trading across different asset types, speed and efficiency are critical. MT5, built on the MQL5 programming language, excels in supporting algorithmic trading and precise market analysis. It offers four execution modes - Instant, Request, Market, and Exchange - and includes a built-in VPS for round-the-clock automated trading with minimal delays. For manual traders, features like One Click Trading and an advanced Market Depth tool, complete with tick charts and Time & Sales data, ensure swift execution and detailed market insights.

"Virtualize your platform in a few clicks and run it on a remote server (Forex VPS). Trades of your robots and signal subscriptions will be executed at any time with minimum delay!" - MetaTrader 5

"Virtualize your platform in a few clicks and run it on a remote server (Forex VPS). Trades of your robots and signal subscriptions will be executed at any time with minimum delay!" - MetaTrader 5

Platform Compatibility

MT5 is designed to work seamlessly across various devices and operating systems. It runs on Windows desktops, web browsers, and mobile devices (both Android and iOS). The web-based platform is compatible with Windows, Mac, and Linux, requiring only a browser and internet connection to operate. Mobile apps further enhance flexibility, offering push notifications so traders can stay updated on their automated strategies wherever they are. With support for 31 languages and the ability to open up to 100 charts simultaneously, MT5 caters to a global audience. Its suite of tools - including over 80 built-in indicators and an economic calendar - synchronizes across devices, ensuring a smooth and consistent trading experience.

Pricing and Plans

The core MT5 platform is free when accessed through brokers, but traders can expand its capabilities through optional paid services. These include access to over 2,500 trading robots, technical indicators, and Trading Signals, which are available in both free and paid versions. Many of these tools offer free trials via the Strategy Tester, allowing users to evaluate them before committing. For continuous automated trading, the platform provides a Virtual Hosting (VPS) service available for rent. Additionally, traders can commission custom indicators or robots through the Freelance Service, tailoring the platform to their exact needs. This flexible add-on model lets users choose the features that align with their trading strategies.

Advantages and Disadvantages

Each platform has its own strengths and weaknesses, which play a big role in determining how well it suits different cross-asset trading strategies.

QuantVPS stands out for its ultra-low latency and reliable uptime, making it a go-to option for algorithmic traders using platforms like NinjaTrader or MetaTrader. Its Chicago-based infrastructure reduces delays in executing CME Group futures, but it’s important to note that QuantVPS is strictly a hosting service, not a trading platform.

NinjaTrader is specifically designed for futures trading, offering tools like SuperDOM ladder execution and Market Replay for detailed historical practice. With a lifetime licensing option and commissions starting at just $0.09 per micro contract, it’s a cost-effective choice for active traders. However, the platform has a steep learning curve and is built for Windows, requiring Mac users to rely on solutions like Parallels. Additionally, while it excels in futures trading, stock and options trading require integration with partner brokers rather than being natively supported. These factors make NinjaTrader highly efficient for futures trading but less versatile for other asset classes.

MetaTrader is widely recognized for its automation capabilities and integration of third-party tools. It’s often free when accessed through brokers, making it an accessible choice. MetaTrader 5 works well for multi-asset trading, but it lacks the specialized futures tools found in platforms like NinjaTrader.

To better understand how these platforms measure up, here's a quick comparison:

| Platform | Latency | Strategy Compatibility | Pricing Model |

|---|---|---|---|

| QuantVPS | Ultra-Low (99.999% uptime) | High (Supports NT8, IBKR, etc.) | $59.99–$299.99/mo |

| NinjaTrader | Low (Optimized on VPS) | High (C#, NinjaScript, Backtesting) | Free / $99/mo / $1,499 Lifetime |

| MetaTrader | Moderate | High (MQL4/MQL5, EAs) | Usually Free via Broker |

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools." - Tobias Robinson, Reviewer

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools." - Tobias Robinson, Reviewer

Choosing the right platform depends on your trading priorities. For futures-focused traders, NinjaTrader paired with a hosting service like QuantVPS offers excellent tools and performance. On the other hand, multi-asset traders looking for simplicity and broker integration may find MetaTrader more suitable. Factors like resource needs, ease of use, and long-term costs should all weigh into your decision as you evaluate these options.

Conclusion

Selecting the right cross-asset trading platform boils down to matching your trading objectives with tools that can execute your strategy effectively. For futures traders, NinjaTrader stands out with its precision tools and fast execution, especially when paired with low-latency hosting. Its $1,499 lifetime license offers a cost-effective option for active traders aiming to bypass recurring fees, while intraday margins as low as $50 for Micro E-mini contracts make it accessible for those starting with smaller capital.

This highlights the importance of having a solid infrastructure to support your trading platform. Reliable hosting is crucial for optimal performance across various asset classes. For algorithmic traders relying on automated strategies with platforms like NinjaTrader or MetaTrader, ultra-low-latency hosting is a must to avoid execution delays. Using a VPS with 100% uptime and servers located near exchange hubs ensures minimal round-trip times, which can make a significant difference in fast-moving markets.

"In futures trading, where contracts move fast and leverage magnifies mistakes... the right platform is not just a comfort issue, it is a survival tool." - MyFundedFutures

"In futures trading, where contracts move fast and leverage magnifies mistakes... the right platform is not just a comfort issue, it is a survival tool." - MyFundedFutures

Before committing real money, thorough back-testing is non-negotiable. Use simulation modes or features like NinjaTrader's tick-by-tick Market Replay to practice in conditions that mimic live trading. Many platforms also provide unlimited demo accounts, giving you the chance to refine your strategies without financial risk. Ultimately, the best platform is one that feels "boring in a good way" - stable, consistent, and distraction-free - because in trading, reliability is your greatest ally.

FAQs

What should I look for in a cross-asset trading platform?

When choosing a cross-asset trading platform, it's essential to prioritize performance, tools, and accessibility. A good platform should deliver quick and stable execution, ensuring trades go through without delays - especially in fast-paced markets like forex or futures.

You'll also want a platform that offers robust charting and analysis tools capable of handling multiple asset classes, including stocks, futures, forex, and cryptocurrencies, all within a single interface. Having real-time market data, like order flow and market depth, is equally important for gauging liquidity and understanding market behavior.

Accessibility is another key factor. Whether you're at your desk or on the go, the platform should work seamlessly across desktop, web, and mobile devices, allowing you to manage trades and monitor positions anytime. Lastly, review the platform's cost structure, such as fees and commissions, and see if it supports customization through third-party integrations or programmable features. These options can help you fine-tune the platform to align with your trading strategy. By keeping these elements in mind, you'll be better equipped to choose a platform that fits your trading needs.

How does latency impact trading performance on cross-asset platforms?

Latency - the time lag between placing a trade and its execution - has a significant impact on trading performance, particularly in fast-paced markets like futures or forex. Just a few milliseconds of delay can lead to slippage, missed trades, or less favorable pricing, all of which can cut into profitability.

To combat latency, many trading platforms leverage advanced technologies, including cloud-based infrastructure, direct-market-access (DMA) connections, and low-latency virtual private servers (VPS). These tools are designed to ensure quicker order execution and maintain reliability, even in volatile market conditions.

For traders employing strategies like scalping, algorithmic trading, or high-frequency trading, minimizing latency is critical. It allows for tighter spreads, more precise stop-loss execution, and overall better performance. Even discretionary traders benefit from faster price updates and smoother order fills, which can make a noticeable difference across various asset classes.

What are the benefits of using a VPS for futures trading?

Using a Virtual Private Server (VPS) for futures trading keeps your platform running 24/7, even if your personal computer shuts down or your internet connection fails. VPS setups are housed in professional data centers equipped with dependable power, cooling systems, and network backups. This creates a stable environment for your trading tools, charts, and automated strategies, ensuring uninterrupted access. In fast-paced futures markets, where prices shift in seconds, this reliability is crucial.

Another major advantage of a VPS is its low-latency, high-speed connection to trading exchanges. This means your orders are executed faster, minimizing the risk of slippage. Plus, you can access your trading platform from virtually any device - whether it’s a PC, Mac, or mobile - while taking advantage of the server’s speed and proximity to market gateways. Together, these features enhance both your trading performance and your ability to stay competitive.

When choosing a cross-asset trading platform, it's essential to prioritize performance, tools, and accessibility. A good platform should deliver quick and stable execution, ensuring trades go through without delays - especially in fast-paced markets like forex or futures.

You'll also want a platform that offers robust charting and analysis tools capable of handling multiple asset classes, including stocks, futures, forex, and cryptocurrencies, all within a single interface. Having real-time market data, like order flow and market depth, is equally important for gauging liquidity and understanding market behavior.

Accessibility is another key factor. Whether you're at your desk or on the go, the platform should work seamlessly across desktop, web, and mobile devices, allowing you to manage trades and monitor positions anytime. Lastly, review the platform's cost structure, such as fees and commissions, and see if it supports customization through third-party integrations or programmable features. These options can help you fine-tune the platform to align with your trading strategy. By keeping these elements in mind, you'll be better equipped to choose a platform that fits your trading needs.

Latency - the time lag between placing a trade and its execution - has a significant impact on trading performance, particularly in fast-paced markets like futures or forex. Just a few milliseconds of delay can lead to slippage, missed trades, or less favorable pricing, all of which can cut into profitability.

To combat latency, many trading platforms leverage advanced technologies, including cloud-based infrastructure, direct-market-access (DMA) connections, and low-latency virtual private servers (VPS). These tools are designed to ensure quicker order execution and maintain reliability, even in volatile market conditions.

For traders employing strategies like scalping, algorithmic trading, or high-frequency trading, minimizing latency is critical. It allows for tighter spreads, more precise stop-loss execution, and overall better performance. Even discretionary traders benefit from faster price updates and smoother order fills, which can make a noticeable difference across various asset classes.

Using a Virtual Private Server (VPS) for futures trading keeps your platform running 24/7, even if your personal computer shuts down or your internet connection fails. VPS setups are housed in professional data centers equipped with dependable power, cooling systems, and network backups. This creates a stable environment for your trading tools, charts, and automated strategies, ensuring uninterrupted access. In fast-paced futures markets, where prices shift in seconds, this reliability is crucial.

Another major advantage of a VPS is its low-latency, high-speed connection to trading exchanges. This means your orders are executed faster, minimizing the risk of slippage. Plus, you can access your trading platform from virtually any device - whether it’s a PC, Mac, or mobile - while taking advantage of the server’s speed and proximity to market gateways. Together, these features enhance both your trading performance and your ability to stay competitive.

"}}]}