Best Platforms for DOM Trading: NinjaTrader, Bookmap, Quantower & More

- NinjaTrader: Known for its customizable SuperDOM, it offers fast order execution and real-time analytics. Ideal for futures and forex traders but has API limitations for multiple accounts.

- Bookmap: Offers a visual approach with heatmaps and volume bubbles, making it easy to monitor liquidity and order flow. Pricing starts at $39/month for advanced features.

- Quantower: Combines a user-friendly DOM interface with fast order execution and multi-broker support. Offers flexible pricing and supports various markets.

Each platform has unique strengths, whether you value speed, visualization, or flexibility. Below is a quick comparison to help you choose:

| Platform | Key Features | Starting Price | Best For |

|---|---|---|---|

| NinjaTrader | Customizable SuperDOM, fast execution | Varies by broker | Futures and forex traders |

| Bookmap | Heatmaps, historical liquidity | $39/month | Visualizing order flow |

| Quantower | User-friendly DOM, multi-market support | Free (basic) | Multi-asset traders |

Choose the one that fits your trading needs and style.

🎯Best Order Flow Trading Software ✨ Top Picks for Traders in 2025

1. NinjaTrader

NinjaTrader operates through its affiliated NinjaTrader Brokerage (NTB), an NFA-registered introducing broker (NFA #0339976), offering access to futures and foreign exchange products. The platform is particularly appealing to active traders using the Depth of Market (DOM) feature, as it allows simultaneous connections to multiple supported broker technologies. However, there are some limitations tied to specific APIs.

Certain broker APIs come with restrictions. As NinjaTrader Customer Service representative Ray explains:

"All other supported broker technologies you can connect to simultaneously. No matrix exists at this time."

"All other supported broker technologies you can connect to simultaneously. No matrix exists at this time."

"Zen-Fire API does not allow two simultaneous unique logons from one NinjaTrader instance. What they do allow is to have one logon with multiple accounts."

"Zen-Fire API does not allow two simultaneous unique logons from one NinjaTrader instance. What they do allow is to have one logon with multiple accounts."

These compatibility issues are important for traders to keep in mind when managing multiple accounts on the platform.

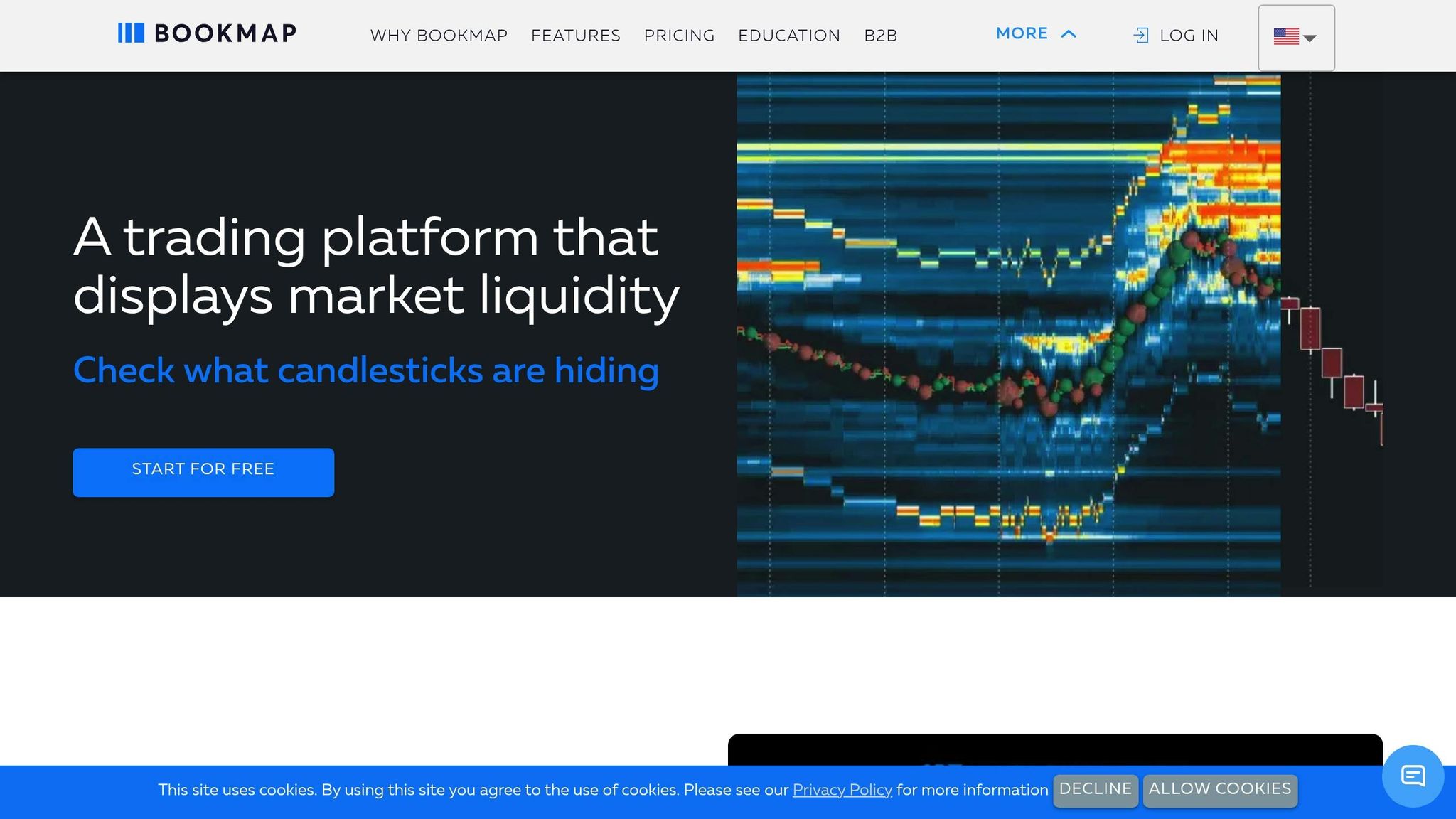

2. Bookmap

Bookmap takes a different approach from platforms that rely on traditional numeric DOM displays. It turns order book data into visual heatmaps and volume bubbles, offering traders a more dynamic view of market activity. Instead of static numbers, Bookmap lets you watch liquidity and order flow patterns evolve over time through color-coded visuals.

Visualization Tools

One of Bookmap's standout features is its heatmap visualization, which uses color blocks to show historical liquidity data. Large institutional orders are easy to spot as bright, concentrated areas, making it clear where significant volume clusters are happening. Meanwhile, volume bubbles provide a real-time look at aggressive buying and selling. These bubbles expand or contract based on the intensity of market participation, making sudden shifts in sentiment instantly visible.

By combining elements of traditional DOM, Footprint charts, and Volume Profile into a single interface, Bookmap offers a clear and fast way to analyze executed trades and liquidity dynamics. This streamlined view is particularly useful for traders who rely on DOM trading strategies.

Market/Broker Compatibility

Bookmap works with both futures and stock markets. However, real-time market data requires an additional fee, which is separate from the software subscription. This allows traders to tailor their data feeds to the specific markets they trade, avoiding unnecessary costs for data they don’t need.

For those looking for advanced tools, higher-tier packages include features like "DOM Pro", "Multibook", and "Stops & Icebergs" indicators, which are designed to help traders better understand institutional order flow.

Pricing

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

Bookmap offers several pricing tiers to match different trading needs. The Digital package is free and provides basic functionality, while real-time trading tools start with the Global package, priced at $39/month when billed annually or $49/month for monthly billing. The Digital+ package is available for $16/month annually or $19/month for monthly billing, and the premium Global+ tier includes all advanced features.

| Package | Monthly Price | Annual Price | Key DOM Features |

|---|---|---|---|

| Digital | Free | Free | Basic visualization |

| Digital+ | $19 | $16/month | Enhanced tools |

| Global | $49 | $39/month | Real-time trading, DOM Pro |

| Global+ | Higher tier | Higher tier | Full feature set |

One feature that gets consistent praise from users is the market replay mode. This tool allows traders to revisit past market sessions tick-by-tick, giving them the chance to analyze liquidity patterns as they developed. It’s an excellent way to practice and refine trading skills without putting real money on the line.

3. Quantower

Quantower stands out in the world of DOM trading, offering traders a user-friendly interface with clear visuals and efficient tools for managing orders. Its DOM Trader panel simplifies the complexities of the order book, enabling traders to spot opportunities and execute trades with precision.

Visualization Tools

Quantower’s DOM Trader panel presents buy and sell orders at various price levels in a way that’s easy to understand. This clear, graphical display helps traders quickly identify clusters of large orders, which often act as short-term support or resistance levels.

One of its strengths is the ability to visually track volume patterns. For instance:

- Large bid volumes at a certain price level can signal strong buying interest and potential support.

- High ask volumes may indicate selling pressure and possible resistance.

The platform also shows the depth of the order book. A "fat" order book suggests good liquidity, while a "light" order book might point to higher volatility. These insights help traders adjust their position sizes and manage risk effectively. For added flexibility, users can customize their display through features like "View Settings" and "DOM Trader Columns", tailoring the interface to suit their trading style.

“In Quantower's DOM Trader, an active trader can visually identify a large block of 5,000 buy shares at a price level of $99.80, indicating a strong support level. This visual cue helps the trader anticipate a price floor and refine their buy orders or stop-loss placements.” (Source: Wright Blogs, 2025)

“In Quantower's DOM Trader, an active trader can visually identify a large block of 5,000 buy shares at a price level of $99.80, indicating a strong support level. This visual cue helps the trader anticipate a price floor and refine their buy orders or stop-loss placements.” (Source: Wright Blogs, 2025)

These visualization tools work seamlessly with the platform’s advanced execution features, making it a reliable choice for active traders.

Order Execution Speed

Quantower’s Mouse Trading mode speeds up the process of placing and managing orders. A left-click in the left column instantly places a Buy Limit order, while a left-click in the right column does the same for a Sell Limit order. For stop orders, holding the Shift key and clicking at the desired price level allows for quick placement. Need to adjust or cancel an order? The drag-and-drop functionality on the DOM interface makes it easy to modify or remove orders in seconds.

Market/Broker Compatibility

Beyond its visual and execution capabilities, Quantower supports a wide range of markets and connects seamlessly to multiple brokers and data providers. This broad compatibility ensures traders have the flexibility they need to operate effectively across different markets.

Platform Advantages and Drawbacks

Each DOM trading platform has its own set of strengths and limitations, making the choice highly dependent on your trading needs. Let’s take a closer look at how these platforms compare in terms of features and execution.

NinjaTrader's SuperDOM is a standout for its point-and-click order entry and extensive customization options. It offers a real-time market depth display, allowing traders to tailor their interface to their preferences. However, the platform's focus on current liquidity means it doesn’t provide historical context, which could be a limitation for traders seeking a broader market view.

Bookmap, on the other hand, takes a unique approach to DOM analysis with its heatmap visualization. This feature records and displays historical liquidity changes, offering insights that extend beyond the immediate market snapshot. Additionally, Bookmap integrates executed volume through volume bubbles and split volume profiles directly on the ladder, giving traders an edge in understanding market dynamics.

Gary Norden, a seasoned market maker and hedge fund strategist with over 35 years of experience, praises Bookmap DOM Pro for its "accuracy" and "low latency." According to Norden, the platform allows traders to "see the path of price, not just the endpoint", highlighting its reliability and depth.

The differences between these platforms become especially evident during volatile market conditions. Bookmap DOM Pro shines in these scenarios with its high refresh rates and smooth updates, capturing both market behavior and aggressive trades in real time. In contrast, traditional DOM platforms like NinjaTrader may struggle with slower updates or inconsistent performance during high-volatility periods.

Here’s a quick comparison of the two platforms:

| Platform | Order Execution | Visualization Strength | Market Compatibility | Starting Price |

|---|---|---|---|---|

| NinjaTrader | Point-and-click; highly customizable | Real-time market depth; focuses on current liquidity | Futures and forex | Varies by broker |

| Bookmap | High-frequency updates; smooth execution | Historical liquidity heatmaps; volume integration | Crypto (free real-time), stocks/futures | Free (limited), $39/month+ |

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Bookmap’s pricing structure is designed to be accessible, starting with a free tier for crypto traders and scaling up to $39 per month for advanced features.

What sets Bookmap apart is its ability to combine executed trade data with detailed liquidity dynamics, offering a comprehensive market view. This level of insight goes beyond what traditional DOMs or even Footprint charts can provide, making it a powerful tool for traders.

Conclusion

Selecting the right DOM trading platform hinges on understanding your trading style and priorities. For traders prioritizing speed and customization, NinjaTrader's SuperDOM offers point-and-click order entry and real-time analytics. Its $489.00 Series add-on provides tools geared for precision and professional-grade performance.

If visualization is your focus, Bookmap stands out with its advanced heatmap display, offering a unique way to view market liquidity and order flow. This approach uncovers insights that traditional DOM interfaces might miss.

For those mindful of costs, Quantower offers flexible pricing and multi-asset support, making it an appealing option. However, choosing the right platform is just the beginning.

To translate platform features into trading success, reliable backend support is critical. Even the most advanced platform can falter without robust infrastructure. Services like QuantVPS provide ultra-low latency (0-1ms) and a 100% uptime guarantee, ensuring platforms like NinjaTrader, Bookmap, and Quantower perform seamlessly - an essential advantage in fast-moving markets.

Pairing platforms with high-performance data engines like Rithmic and stable VPS hosting creates an environment where every millisecond counts. Whether you're leveraging automated strategies or executing manual trades, combining the right platform with dependable infrastructure lays the groundwork for successful DOM trading.

FAQs

How do NinjaTrader, Bookmap, and Quantower differ in terms of order execution and market visualization?

NinjaTrader is well-regarded for its speed and accuracy in order execution, making it an excellent option for traders focused on scalping or high-frequency strategies. It also includes advanced tools to analyze order flow, allowing traders to make quick, informed decisions as markets move.

Bookmap is known for its heatmap visualization, which provides a detailed, real-time look at market depth and liquidity. This tool is especially valuable for traders who depend on visual data to predict market trends and movements.

Quantower shines with its support for multiple connections and highly customizable trading strategies. This flexibility allows traders to configure the platform to suit their specific needs, making it a great fit for those trading across different markets or requiring personalized setups.

What advantages does Bookmap's heatmap visualization offer for analyzing market liquidity and order flow?

Bookmap's heatmap visualization gives traders a real-time snapshot of market liquidity and order flow, making complex data easier to interpret. It uses color-coded areas to represent limit orders in the order book - red indicates high liquidity zones, while darker shades signal areas with lower liquidity. This visual approach helps pinpoint large order clusters and critical price levels at a glance.

This tool isn't just about aesthetics; it provides actionable insights. By highlighting liquidity zones and revealing market behavior, traders can better anticipate price movements. Unlike traditional charts, the heatmap delivers a clearer view of market depth, offering a practical advantage for making informed decisions.

Why is Quantower a strong choice for traders focused on DOM trading, especially in terms of market access and pricing?

Quantower is a standout choice for DOM trading, thanks to its broad market connectivity. With support for over 60 brokers, exchanges, and data feeds, it opens the door to a diverse range of markets, including futures, stocks, and cryptocurrencies. Its broker-neutral setup means you can connect to multiple brokers simultaneously, giving you the kind of flexibility and convenience that traders appreciate.

When it comes to pricing, Quantower keeps things simple. It offers an all-inclusive package that provides access to all features without the need for extra subscriptions. This no-nonsense pricing model makes it an appealing option for active traders who want advanced tools without worrying about hidden fees. With its combination of versatility, ease of use, and straightforward pricing, Quantower delivers great value and high performance for traders.

NinjaTrader is well-regarded for its speed and accuracy in order execution, making it an excellent option for traders focused on scalping or high-frequency strategies. It also includes advanced tools to analyze order flow, allowing traders to make quick, informed decisions as markets move.

Bookmap is known for its heatmap visualization, which provides a detailed, real-time look at market depth and liquidity. This tool is especially valuable for traders who depend on visual data to predict market trends and movements.

Quantower shines with its support for multiple connections and highly customizable trading strategies. This flexibility allows traders to configure the platform to suit their specific needs, making it a great fit for those trading across different markets or requiring personalized setups.

Bookmap's heatmap visualization gives traders a real-time snapshot of market liquidity and order flow, making complex data easier to interpret. It uses color-coded areas to represent limit orders in the order book - red indicates high liquidity zones, while darker shades signal areas with lower liquidity. This visual approach helps pinpoint large order clusters and critical price levels at a glance.

This tool isn't just about aesthetics; it provides actionable insights. By highlighting liquidity zones and revealing market behavior, traders can better anticipate price movements. Unlike traditional charts, the heatmap delivers a clearer view of market depth, offering a practical advantage for making informed decisions.

Quantower is a standout choice for DOM trading, thanks to its broad market connectivity. With support for over 60 brokers, exchanges, and data feeds, it opens the door to a diverse range of markets, including futures, stocks, and cryptocurrencies. Its broker-neutral setup means you can connect to multiple brokers simultaneously, giving you the kind of flexibility and convenience that traders appreciate.

When it comes to pricing, Quantower keeps things simple. It offers an all-inclusive package that provides access to all features without the need for extra subscriptions. This no-nonsense pricing model makes it an appealing option for active traders who want advanced tools without worrying about hidden fees. With its combination of versatility, ease of use, and straightforward pricing, Quantower delivers great value and high performance for traders.

"}}]}