Algorithmic Trading Strategies: Types, Examples & How to Build Profitable Systems

Algorithmic trading uses computer programs to execute trades based on predefined rules. It eliminates emotions, allowing for faster and more consistent execution. As of 2023, the market was valued at $15.76 billion, with over 70% of global equity trading volume driven by automated systems.

Key strategies include:

- Trend-Following: Focuses on market momentum using indicators like moving averages.

- Mean Reversion: Assumes prices revert to their average, using tools like RSI and Bollinger Bands.

- Arbitrage: Exploits price differences across markets or securities.

To build a profitable system:

- Define Rules: Clear, specific conditions for trade execution.

- Backtest: Test strategies on historical data to ensure viability.

- Risk Management: Limit exposure with stop-losses and position sizing.

- Infrastructure: Use VPS services like QuantVPS for low-latency, reliable execution.

Automated trading requires discipline, thorough testing, and robust infrastructure to succeed.

Types of Algorithmic Trading Strategies

Algorithmic trading strategies generally fall into three main categories: trend-following, mean reversion, and arbitrage. Each serves as a cornerstone for creating systems aimed at generating profits. Trend-following focuses on capturing momentum in rising or falling markets, mean reversion capitalizes on price fluctuations within a range, and arbitrage takes advantage of inefficiencies between markets or exchanges. As of 2025, automated systems account for over 90% of foreign exchange transactions and contribute to more than 70% of daily global equity trading volume. Let’s break down these strategies in more detail.

Trend-Following Strategies

Trend-following algorithms aim to identify and ride ongoing market trends. They rely on technical indicators like moving averages, MACD, and ADX to pinpoint opportunities. For instance, an uptrend signal occurs when a 50-day moving average crosses above a 200-day moving average. These algorithms often target instruments like E-mini S&P 500 futures during primary cash sessions, using volume spikes to confirm breakouts.

The key risk here lies in "whipsaws" - sudden price reversals in choppy markets that trigger false signals. To mitigate this, safeguards like trailing stops are essential to lock in gains. Trend-following strategies excel in markets with clear directional movement but can struggle in sideways or volatile conditions.

Mean Reversion Strategies

Mean reversion strategies operate on the idea that asset prices will eventually revert to their historical average. Indicators such as Bollinger Bands, RSI, and Z-scores help detect extremes - where, for example, a Z-score above 2 might suggest a reversal. In forex trading, pairs trading is a common approach. Traders take opposing positions on highly correlated currency pairs, like EUR/USD and GBP/USD, when their spread deviates significantly.

These strategies work best in range-bound markets but can face significant risks during strong trends. A continued downtrend, often referred to as "catching a falling knife", can lead to compounding losses. It’s critical to apply these strategies cautiously, especially during periods of high directional momentum or shifting market dynamics.

Arbitrage Strategies

Arbitrage strategies aim to profit from price differences by simultaneously buying and selling an asset in different markets. Spatial arbitrage exploits price discrepancies across exchanges, while triangular arbitrage focuses on mismatches among currency pairs. Another example includes identifying price gaps between dual-listed stocks or an ETF and its underlying basket, then executing simultaneous trades to capture the spread.

Statistical arbitrage takes a more advanced approach, using mathematical models to identify pricing inefficiencies between correlated securities. By balancing long and short positions based on volatility and beta, traders maintain market neutrality. However, these strategies face challenges like execution latency and slippage. With high-frequency trading now operating in nanoseconds, maintaining ultra-low latency systems and robust connectivity is critical to success.

How to Build Profitable Trading Systems

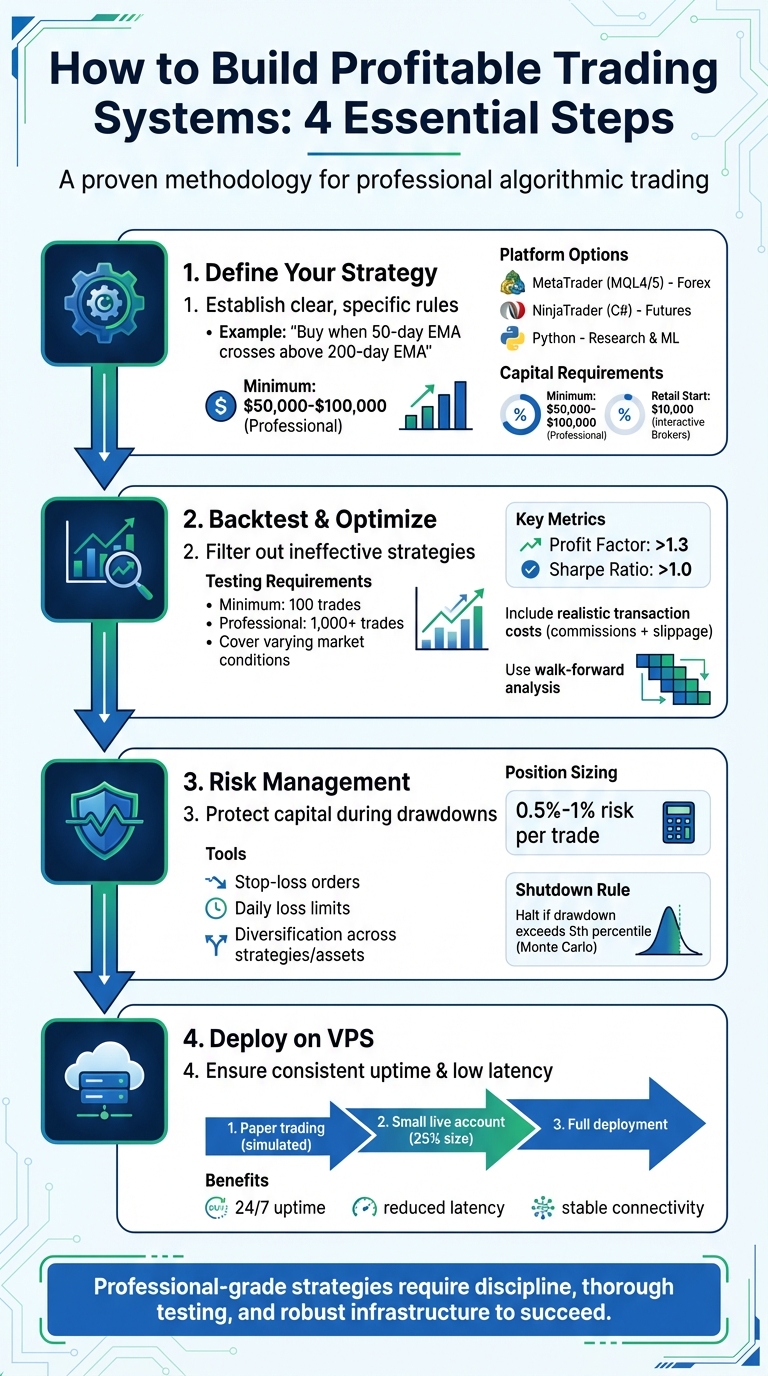

4-Step Process to Build Profitable Algorithmic Trading Systems

4-Step Process to Build Profitable Algorithmic Trading Systems

Creating a profitable trading system involves turning well-defined, repeatable rules into consistent execution. As QuantStart emphasizes, this process requires disciplined research and patience. Algorithmic trading, in particular, demands a detailed approach to transform an edge into reliable, automated performance.

Defining Your Strategy

Start by establishing clear, specific rules. As MooreTechLLC explains:

Automation is about turning repeatable edge into repeatable execution.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

Automation is about turning repeatable edge into repeatable execution.

For instance, instead of vaguely stating, "buy when momentum looks strong", you might specify, "Buy when the 50-day EMA crosses above the 200-day EMA."

Your choice of platform will depend on your asset class and coding expertise. MetaTrader, with its MQL4/5 language, is widely used for forex trading. NinjaTrader supports futures trading with its C# integration, while Python is favored for research and machine learning due to its flexibility and rapid development capabilities.

In terms of capital, quantitative strategies often require a minimum of $50,000 to $100,000 to account for transaction costs and potential drawdowns. However, brokers like Interactive Brokers allow retail traders to start with as little as $10,000. Once your rules are defined, rigorous testing is essential before transitioning to live trading.

Backtesting and Optimization

Backtesting is the cornerstone of filtering out ineffective strategies. A robust backtest should cover at least 100 trades across varying market conditions, with professional-grade tests often exceeding 1,000 trades. Be sure to incorporate realistic transaction costs, including commissions and slippage - your strategy should remain viable even if these costs are doubled.

To avoid look-ahead bias, always lag high and low values by at least one period, as extreme price points are only confirmed at the end of a bar. Walk-forward analysis is another critical step, where you optimize your strategy on one period and test it on the next. This ensures your system can adapt to changing market environments.

Keep your strategy as simple as possible - too many parameters can make it fragile when exposed to new data. For a professional-grade strategy, aim for a Profit Factor above 1.3 and a Sharpe Ratio greater than 1.0. Tools like QuantVPS, which offer NVMe storage and high-performance CPUs, can significantly speed up the processing of large historical datasets. Once your strategy demonstrates consistent performance, focus on preserving your gains through effective risk management.

Risk Management Techniques

Risk management is critical for protecting your capital during inevitable drawdowns. Proper position sizing is a fundamental step - limit your risk to 0.5% to 1% of your equity per trade. Use stop-loss orders to cap losses on individual trades and set daily loss limits to prevent severe portfolio damage. Diversification, whether across different strategies or asset classes, can also help reduce overall volatility.

Before going live, establish clear shutdown rules. For example, halt your system if the current drawdown exceeds the 5th percentile of outcomes predicted by Monte Carlo simulations. Transitioning to live trading should be gradual: start with paper trading using simulated data, then move to a small live account at 25% of your intended size before scaling up fully.

Keep in mind that even profitable strategies can experience extended losing streaks. Maintaining psychological resilience during these periods is just as important as the technical aspects of your system.

Deploying Strategies with QuantVPS

Once you've completed backtesting and assessed risks, it's time to deploy your strategy. Running it from a home computer can expose you to potential issues like power outages, internet disruptions, or hardware failures, all of which can interfere with trade execution. A professional VPS (Virtual Private Server) addresses these risks by ensuring consistent uptime and stable connectivity. Plus, it enhances performance by reducing the distance between your server and your broker's servers. Choosing QuantVPS for deployment guarantees the low-latency performance essential for successful algorithmic trading.

The next step? Picking a QuantVPS plan that aligns with your strategy's complexity and resource needs.

Choosing the Right QuantVPS Plan

Your VPS hardware should be tailored to your strategy's requirements. QuantVPS offers several plans to meet different needs:

- VPS Lite: Priced at $59.99/month (or $41.99/month with annual billing), this plan is perfect for running simple Expert Advisors (EAs) on one or two charts. It includes 4 cores, 8GB RAM, and 70GB NVMe storage.

- VPS Pro: For traders managing up to five charts or using multi-monitor setups, this plan costs $99.99/month (or $69.99/month annually). It provides 6 cores, 16GB RAM, and supports up to two monitors.

- VPS Ultra: Designed for resource-intensive tasks such as NinjaTrader optimizations or processing heavy tick data, this plan is $189.99/month (or $132.99/month annually). It features 24 cores, 64GB RAM, and supports up to four monitors.

- Dedicated Server: High-frequency traders or those running multiple strategies simultaneously will benefit from this option. Priced at $299.99/month (or $209.99/month annually), it includes 16+ dedicated cores, 128GB RAM, 2TB+ NVMe storage, and 10Gbps+ network speeds.

Server location is just as critical as hardware. Forex traders should opt for NY4 or LD4 data centers to reduce latency to major FX brokers, while CME futures traders should choose Chicago-based servers. For example, an NY4 Forex VPS can achieve a ping as low as 0.8 ms - compared to 62 ms on home fiber - resulting in slippage of approximately 0.1 pip and a dramatic reduction in order errors (from 11 per 100 orders to just 0–1 per 100 orders).

Once you’ve selected the right plan, the next step is setting up your trading environment.

Setting Up Your Trading Environment

Begin by installing your trading platform directly onto the VPS. QuantVPS supports popular platforms like MetaTrader 4/5, NinjaTrader 8, TradeStation, Quantower, and Sierra Chart. As Thomas Vasilyev, a full-time EA developer, explains:

Hosting MT4/5, NinjaTrader, or Quantower on a low-latency Forex VPS... removes the last-mile bottleneck and keeps sessions alive 24/5.

Hosting MT4/5, NinjaTrader, or Quantower on a low-latency Forex VPS... removes the last-mile bottleneck and keeps sessions alive 24/5.

Security should be a priority during setup. Avoid exposing the Remote Desktop Protocol (RDP) port 3389 directly to the internet. Instead, use Zero-Trust tools like Cloudflare Access to secure remote access. MetaTrader users should also normalize volume and price values in their Expert Advisors to avoid execution errors (Error 129/131) during volatile markets.

Finally, configure performance monitoring tools to ensure smooth operations. Continuously track latency, fill ratios, and error counts using a broker latency checker to verify server placement. For more advanced setups, explore automation tools like n8n or FastAPI for signal routing, and use dashboards like Grafana to monitor spreads and fill rates in real time. As Vasilyev points out:

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Reliability comes from a well-placed VPS, clean data, robust automation, and constant observability.

Reliability comes from a well-placed VPS, clean data, robust automation, and constant observability.

Wrapping It Up

Building a successful algorithmic trading system comes down to a few key elements: strategy, testing, risk management, and reliable infrastructure. Strategy selection gives you the competitive edge, grounded in sound economic reasoning. Backtesting helps confirm that logic by using historical data to weed out ideas that don’t hold up. Risk management ensures your capital is protected with smart position sizing and stop-loss techniques. And finally, infrastructure guarantees smooth, uninterrupted execution, which is critical in this fast-paced world.

As Michael Brenndoerfer, a Quantitative Finance Researcher, wisely states:

A well-executed process on a simple idea will always outperform a sloppy process on a clever one.

A well-executed process on a simple idea will always outperform a sloppy process on a clever one.

Algorithmic trading is not for the faint of heart. As QuantStart bluntly puts it:

Algo trading is NOT a get-rich-quick scheme - if anything it can be a become-poor-quick scheme. It takes significant discipline, research, diligence and patience.

Algo trading is NOT a get-rich-quick scheme - if anything it can be a become-poor-quick scheme. It takes significant discipline, research, diligence and patience.

Having the right infrastructure can make or break your system. Local setups can face delays and outages, but services like QuantVPS promise 100% uptime and ultra-low latency - down to 0.8 ms. Whether you’re using the VPS Lite plan for $41.99/month (billed annually) to run simple strategies or managing high-frequency trading on a Dedicated Server at $209.99/month (billed annually), the infrastructure adapts to your needs.

To thrive in algorithmic trading, focus on creating strategies with solid economic rationale, validate them rigorously through backtesting (at least 100 trades), safeguard your funds with disciplined risk management, and execute on infrastructure where every millisecond counts.

FAQs

How do I know which strategy type fits my market?

Choosing the right algorithmic trading strategy hinges on your trading objectives, market behavior, and personal preferences. For instance, trend-following strategies are ideal for markets that show clear directional movement, while mean reversion strategies are better suited for markets that fluctuate around an average price. Key considerations include your risk tolerance, the type and quality of data you have access to, and the assets you plan to trade. Conducting thorough analysis and backtesting can help ensure your chosen strategy aligns with the specific market conditions you aim to navigate.

What data quality do I need for reliable backtests?

High-quality data is the backbone of reliable backtests in algorithmic trading. To ensure accuracy, the data must be clean, detailed, and free of gaps or errors. It should also span the relevant time periods and include all necessary instruments to provide a complete picture.

When running backtests, it's important to factor in realistic transaction costs, bid-ask spreads, and slippage. Ignoring these can lead to overly optimistic results. Also, be cautious of look-ahead bias, which occurs when future information is unintentionally included in the backtest. To avoid overfitting, make sure your data is out-of-sample, meaning it hasn't been used during the strategy development phase.

By addressing these elements, backtest results are more likely to reflect actual market conditions, providing a stronger sense of how robust your strategy truly is.

When should I use a VPS for algo trading?

A VPS is a great choice for algorithmic trading because it offers a dependable, low-latency setup that ensures your automated strategies run smoothly without interruptions. Even during power outages or internet disruptions, your algorithms stay active. This reliability is especially important for high-frequency trading, where every millisecond counts. Plus, a VPS provides a secure and stable environment, protecting against local hardware failures and delivering consistent performance in fast-paced markets.

Choosing the right algorithmic trading strategy hinges on your trading objectives, market behavior, and personal preferences. For instance, trend-following strategies are ideal for markets that show clear directional movement, while mean reversion strategies are better suited for markets that fluctuate around an average price. Key considerations include your risk tolerance, the type and quality of data you have access to, and the assets you plan to trade. Conducting thorough analysis and backtesting can help ensure your chosen strategy aligns with the specific market conditions you aim to navigate.

High-quality data is the backbone of reliable backtests in algorithmic trading. To ensure accuracy, the data must be clean, detailed, and free of gaps or errors. It should also span the relevant time periods and include all necessary instruments to provide a complete picture.

When running backtests, it's important to factor in realistic transaction costs, bid-ask spreads, and slippage. Ignoring these can lead to overly optimistic results. Also, be cautious of look-ahead bias, which occurs when future information is unintentionally included in the backtest. To avoid overfitting, make sure your data is out-of-sample, meaning it hasn't been used during the strategy development phase.

By addressing these elements, backtest results are more likely to reflect actual market conditions, providing a stronger sense of how robust your strategy truly is.

A VPS is a great choice for algorithmic trading because it offers a dependable, low-latency setup that ensures your automated strategies run smoothly without interruptions. Even during power outages or internet disruptions, your algorithms stay active. This reliability is especially important for high-frequency trading, where every millisecond counts. Plus, a VPS provides a secure and stable environment, protecting against local hardware failures and delivering consistent performance in fast-paced markets.

"}}]}