Slippage happens when the price you expect for a trade differs from the actual execution price. This can erode profits, especially in fast-moving markets or with large trades. To reduce slippage in automated trading, focus on:

- Order Types: Use limit orders to control execution prices and avoid unexpected outcomes. Stop-limit orders can also help manage risks.

- Smart Order Routing: Connect to multiple exchanges and liquidity pools for better pricing and faster execution.

- Low-Latency VPS Hosting: Hosting your trading platform near financial hubs like Chicago or New York reduces delays, improving execution speed.

- Co-Location and Direct Market Access (DMA): Placing servers close to exchanges and bypassing brokers minimizes latency.

- Execution Algorithms: Tools like VWAP and TWAP split large orders into smaller ones, reducing market impact.

Monitoring market conditions, avoiding high-volatility events, and maintaining robust infrastructure are also key to minimizing slippage. QuantVPS offers plans starting at $59.99/month, providing low-latency solutions tailored for traders. While slippage can’t be eliminated, these strategies help mitigate its impact, protecting your profits.

Trading Slippage: How To Simulate And Minimize It

What Is Slippage and What Causes It

Slippage refers to the difference between the price you expect when placing a trade and the actual price at which the order is executed. In automated trading, this gap can occur when markets move too quickly for your system to keep up, or when there are delays between your trading platform and the broker’s server.

For instance, consider a volatile market scenario where you place a market order for USD/CAD. The trade might experience slippage of 1.05 pips (a difference of 0.00108), which can have a noticeable impact on large positions. While algorithmic trading systems can help reduce the effects of slippage, they can’t eliminate it entirely due to the natural complexities of the market, such as liquidity limitations and price fluctuations.

Positive vs. Negative Slippage

Not all slippage is detrimental. Positive slippage occurs when your order is executed at a more favorable price than expected – for instance, buying at a lower price or selling at a higher price than anticipated. On the flip side, negative slippage happens when the execution price is worse than expected, leading to higher trading costs and potentially turning profitable trades into losses.

This distinction is especially important for managing risk. Negative slippage can disrupt your risk-to-reward ratio. For example, if a stop-loss order is executed at a much worse price than planned, it can lead to losses larger than initially calculated.

Main Factors That Cause Slippage

Several factors contribute to slippage in automated trading:

- Market Volatility: Rapid price changes during major news events, such as Non-Farm Payroll announcements or interest rate decisions, can make it difficult to execute orders at a fixed price.

- Liquidity Issues: When there aren’t enough buyers or sellers at a given price, your order may need to "walk the book", filling at progressively less favorable prices.

- Execution Speed: Delays between your trading platform, broker, and liquidity providers give the market time to shift before your order is fully executed.

Market orders are particularly prone to slippage since they aim to execute as quickly as possible, regardless of price. Similarly, stop-loss orders can experience slippage because they turn into market orders once triggered. Large trades can also cause slippage by impacting the market directly. For example, a large order might widen the bid-ask spread, shifting it from $24.50/$24.53 to $24.50/$24.65.

How to Improve Order Execution

The way you structure your trades can significantly influence the slippage you encounter. Market orders, while convenient due to their instant execution, expose you to price fluctuations. On the other hand, limit orders ensure trades are executed only at your specified price or better, effectively removing the risk of negative slippage. However, if the market doesn’t hit your target price, the order will remain unfilled.

Select the Right Order Types

Limit orders are your go-to tool for reducing slippage, especially in automated trading systems. As Advanced AutoTrades puts it:

"At Advanced AutoTrades, we use limit orders only. In other words, every trade is placed at a specific price, so you’re never filled above or below the target. No surprises."

"At Advanced AutoTrades, we use limit orders only. In other words, every trade is placed at a specific price, so you’re never filled above or below the target. No surprises."

For larger trades, using algorithms like VWAP (Volume-Weighted Average Price) and TWAP (Time-Weighted Average Price) becomes crucial. VWAP breaks orders into smaller chunks based on trading volume patterns, while TWAP spreads them evenly over time. These methods help minimize the risk of moving the market against yourself.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

Stop-limit orders add another layer of control. Unlike regular stop-loss orders, which turn into market orders when triggered, stop-limit orders activate a limit order, ensuring a price cap that prevents execution at extreme levels. Many platforms also allow you to set a slippage tolerance, automatically rejecting orders that exceed your threshold.

Choosing the right order types is the first step toward smoother trade execution.

Use Smart Order Routing

Smart Order Routing (SOR) technology scans multiple exchanges, dark pools, and liquidity providers in milliseconds to find the tightest bid-ask spreads available. Instead of relying on a single broker’s liquidity pool, SOR connects to various venues, ensuring your orders are filled at the best possible price. It evaluates real-time factors like order book depth, fees, and execution speed to make the best routing decisions.

Top-tier SOR systems operate with round-trip latencies under 200 microseconds and process market data in less than 10 microseconds. This performance far exceeds what typical retail setups can achieve. When paired with limit orders, SOR offers both price precision and access to deep liquidity, significantly reducing slippage during execution.

How Low-Latency VPS Hosting Reduces Slippage

QuantVPS Trading Plans Comparison: Features, Pricing, and Performance Specs

QuantVPS Trading Plans Comparison: Features, Pricing, and Performance Specs

The speed at which your trades are executed heavily depends on where your trading platform operates. Running your platform on a home internet connection often results in latency exceeding 150ms, which can make fast-paced strategies, like scalping, less effective. Every millisecond of delay between identifying a trading opportunity and executing an order increases the risk of unfavorable price changes. That’s why reducing latency with VPS hosting is so important.

Why Low-Latency Hosting Makes a Difference

The main culprit behind high latency is physical distance. When your trading platform runs from home, data has to travel across multiple networks, adding delays. These delays become even more noticeable during periods of high market volatility.

Low-latency VPS hosting solves this issue by placing your trading platform in data centers located in financial hubs. For example, futures traders benefit from servers in Chicago, where futures algorithms interact with the CME Group matching engine. Here, execution speeds of under 5ms are common, providing the edge needed for competitive algorithmic trading. Top-tier VPS providers ensure faster connections by using direct fiber-optic links to bypass the congestion of public internet networks.

Additionally, optimized hardware plays a key role. Enterprise-grade AMD EPYC and Ryzen processors, combined with NVMe SSD storage, reduce internal delays and maximize the benefits of being close to the exchange.

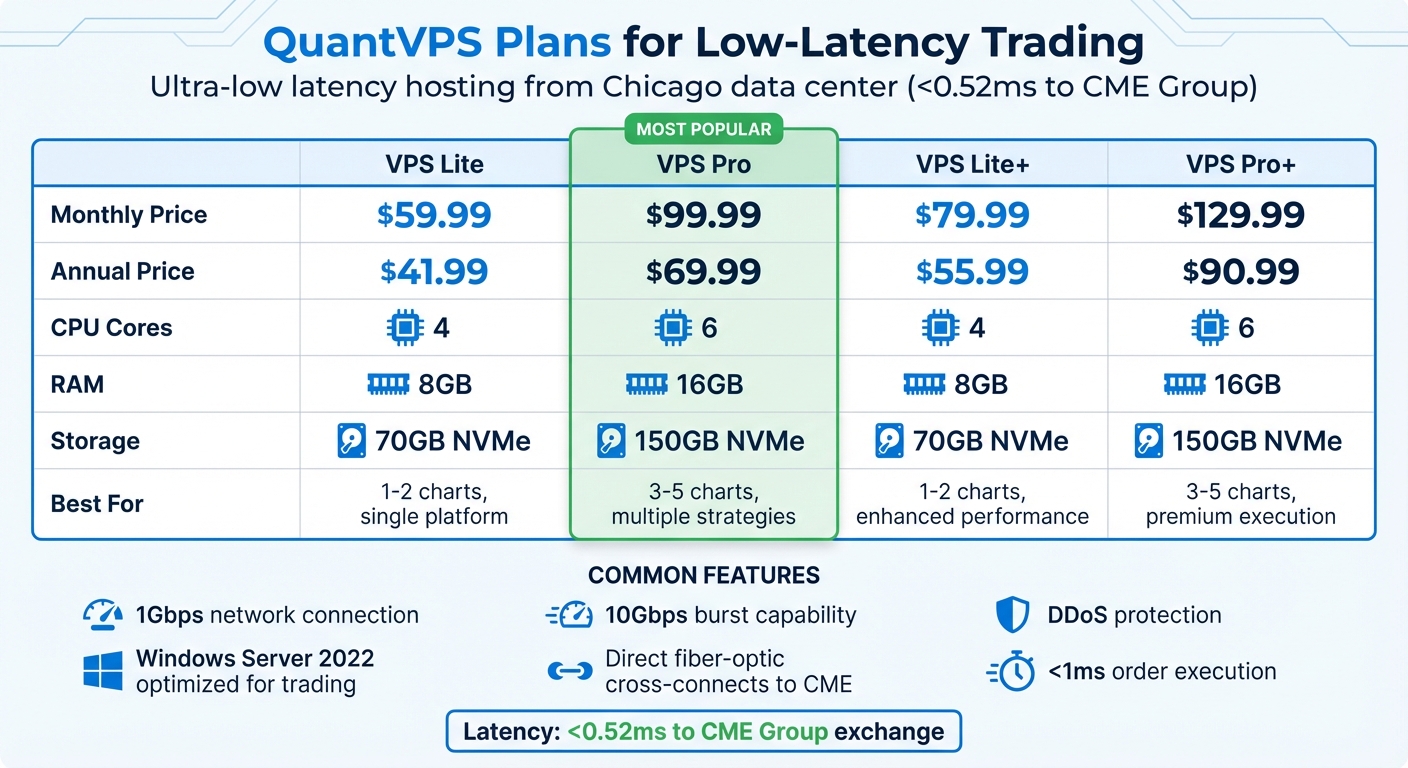

QuantVPS Plans for Reducing Slippage

QuantVPS offers specialized plans designed to enhance execution speed by leveraging low-latency infrastructure. Operating from a Chicago data center, QuantVPS provides ultra-low latency of less than 0.52ms to the CME Group exchange. Its direct fiber-optic cross-connects to CME’s matching engines ensure order transmission and execution occur in under 1 millisecond. This setup is ideal for high-frequency trading strategies that demand lightning-fast performance. Achieving ultra-low latency is critical for maintaining a competitive edge in these environments.

| Plan | Monthly Price | Annual Price | Cores | RAM | Storage | Best For |

|---|---|---|---|---|---|---|

| VPS Lite | $59.99 | $41.99 | 4 | 8GB | 70GB NVMe | 1–2 charts, single platform |

| VPS Pro | $99.99 | $69.99 | 6 | 16GB | 150GB NVMe | 3–5 charts, multiple strategies |

| VPS Lite+ | $79.99 | $55.99 | 4 | 8GB | 70GB NVMe | 1–2 charts, enhanced performance |

| VPS Pro+ | $129.99 | $90.99 | 6 | 16GB | 150GB NVMe | 3–5 charts, premium execution |

For traders using a single automated strategy on platforms like NinjaTrader or MetaTrader, the VPS Lite plan offers sufficient resources, with 4 cores and 8GB of RAM. Meanwhile, the VPS Pro plan is better suited for running multiple platforms or handling complex algorithmic systems that require additional memory. All plans come with a 1Gbps network connection, 10Gbps burst capability, DDoS protection, and Windows Server 2022 optimized for trading.

Advanced Infrastructure Solutions

Co-Location and Direct Market Access

Co-location involves placing your trading servers as close as possible to exchange data centers, such as Equinix or the NYSE facility in Mahwah, New Jersey. This reduces the physical distance your orders need to travel, enabling them to reach the exchange’s matching engine in microseconds instead of milliseconds. For context, a round-trip signal between New York and London takes about 65 milliseconds due to the limitations of light speed in fiber optic cables.

Direct Market Access (DMA) complements co-location by allowing orders to bypass intermediate brokers and go straight to the exchange’s order book. This direct connection eliminates delays caused by intermediaries, significantly cutting latency. While retail trading setups typically experience latencies ranging from 10 to 100 milliseconds, professional-grade high-frequency trading systems using co-location and DMA can achieve execution speeds in the sub-millisecond range.

To further reduce delays, advanced setups often include ultra-low latency network cards (NICs) and PCIe-based SSDs, which minimize internal processing times. Technologies like Solarflare or DPDK use kernel bypass techniques to avoid the operating system kernel altogether, shaving off additional microseconds from execution time. These hardware and software optimizations, paired with continuous monitoring, ensure that infrastructure improvements directly enhance trade execution efficiency.

Monitor Markets and Backtest Your Strategies

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Improving hardware is only part of the equation – keeping a close eye on market conditions is equally critical. Monitoring slippage, fill rates, and average trade performance helps identify discrepancies between backtested results and live trading outcomes. Tools like heartbeat pings for your VPS, traceroute commands to check broker API connectivity, and realistic slippage models during backtesting provide deeper insights into system performance. For example, conducting 24 to 48 hours of ping monitoring during high-volume trading periods, such as the overlap of London and New York markets, can reveal latency patterns. Using traceroute, you can measure connection speeds to broker data centers in key locations like London LD4 or New York NY4.

Be mindful of market regime changes. Shifts in volatility, tracked through indicators like the VIX, and reduced liquidity during holidays or major news events can significantly increase slippage risks. High-impact announcements, such as Non-Farm Payroll (NFP) or Federal Open Market Committee (FOMC) releases, can cause CPU loads to spike by 300% to 500%. Ensuring your infrastructure can handle these spikes is crucial. By monitoring these factors, you can proactively adjust position sizes or even pause trading temporarily when slippage risks exceed acceptable thresholds.

Conclusion

Reducing slippage in automated trading boils down to merging the right technology with effective execution strategies. Tools like low-latency VPS hosting, smart order routing, and Direct Market Access (DMA) work together to ensure your orders hit the best liquidity pools quickly, bypassing unnecessary delays or intermediaries. Pairing these tools with techniques like limit orders and execution algorithms (e.g., VWAP or TWAP) gives you both speed and control – two critical factors for safeguarding your trading profits.

Your trading infrastructure plays a pivotal role in maintaining a competitive edge. For instance, using a VPS with latency under 5 milliseconds to your broker’s data center can mean the difference between securing a profitable trade and missing out entirely. As Finance Monthly highlights:

"Every millisecond of delay between your automated trading strategies and your broker’s trading servers can mean the difference between capturing profitable opportunities and watching them slip away".

"Every millisecond of delay between your automated trading strategies and your broker’s trading servers can mean the difference between capturing profitable opportunities and watching them slip away".

QuantVPS offers plans designed for traders, starting at $59.99/month for the VPS Lite and scaling to dedicated servers at $299.99/month. These plans include features like dedicated CPU cores, NVMe storage, and Tier-1 network connectivity, ensuring your system can handle even the most demanding market conditions.

But speed isn’t the only factor. Staying aware of the market in real time is just as important. Trading during periods of peak liquidity and steering clear of high-impact news events can significantly reduce the risk of slippage. Regularly monitoring system performance with tools like ping tests, traceroute commands, and thorough backtesting helps you stay prepared, even during volatile market conditions.

While slippage can never be entirely eliminated, the strategies outlined in this article offer a strong defense. As Switch Markets aptly states:

"knowing when it’s most likely to happen gives you the power to trade smarter and reduce unnecessary losses".

"knowing when it’s most likely to happen gives you the power to trade smarter and reduce unnecessary losses".

FAQs

How can limit orders help reduce slippage in automated trading?

Limit orders offer a smart way to minimize slippage by letting you set a specific price for your trade. This means your trade will only go through at your chosen price or better, keeping you safe from less favorable price levels.

They’re especially helpful in fast-moving markets where prices can shift in the blink of an eye. With limit orders, you maintain greater control over your trades, cutting down on unexpected costs that could hurt your strategy’s bottom line. Adding this feature to your automated trading system can sharpen execution accuracy and boost overall performance.

How does low-latency VPS hosting reduce slippage in automated trading?

Low-latency VPS hosting boosts the performance of automated trading systems by hosting them on servers near major financial exchanges. This close proximity allows orders to be executed and market data to be received within milliseconds, cutting down delays and reducing slippage.

With a low-latency VPS, traders benefit from faster execution, more precise pricing, and better trade results. It’s a critical resource for maximizing the efficiency and effectiveness of automated trading strategies.

Why is monitoring market conditions crucial for reducing slippage in automated trading?

Monitoring market conditions is crucial for traders because elements like high volatility, low liquidity, and unexpected news events can cause orders to be executed at prices that differ from what was anticipated. Staying informed allows traders to tweak their strategies – whether that means adjusting the timing of orders or changing execution methods – to help minimize slippage.

Keeping a close eye on market trends also ensures that your automated trading system runs more smoothly, safeguarding profitability and lessening the effects of price fluctuations.