A funded trading account lets you trade with a firm’s money instead of your own. You keep most of the profits – usually 70%–95% – while the firm covers losses. To qualify, you need to pass an evaluation by meeting profit targets (8%–12%) and staying within strict loss limits (e.g., 5% daily, 10% total drawdown). Fees for the evaluation typically range from $100 to $300 for accounts starting at $50,000.

Here’s how it works:

- Evaluation Phase: Prove you can trade profitably within risk limits.

- Profit Split: Once funded, you keep most of the earnings (up to 95%).

- Account Types: Options include one-phase, two-phase, or instant funding prop firms.

- Risk Management: Strict rules ensure disciplined trading.

Funded accounts help traders overcome capital limitations while minimizing personal financial risk. Programs often include tools, platforms, and scaling opportunities for consistent performers.

How Funded Trading Accounts Work

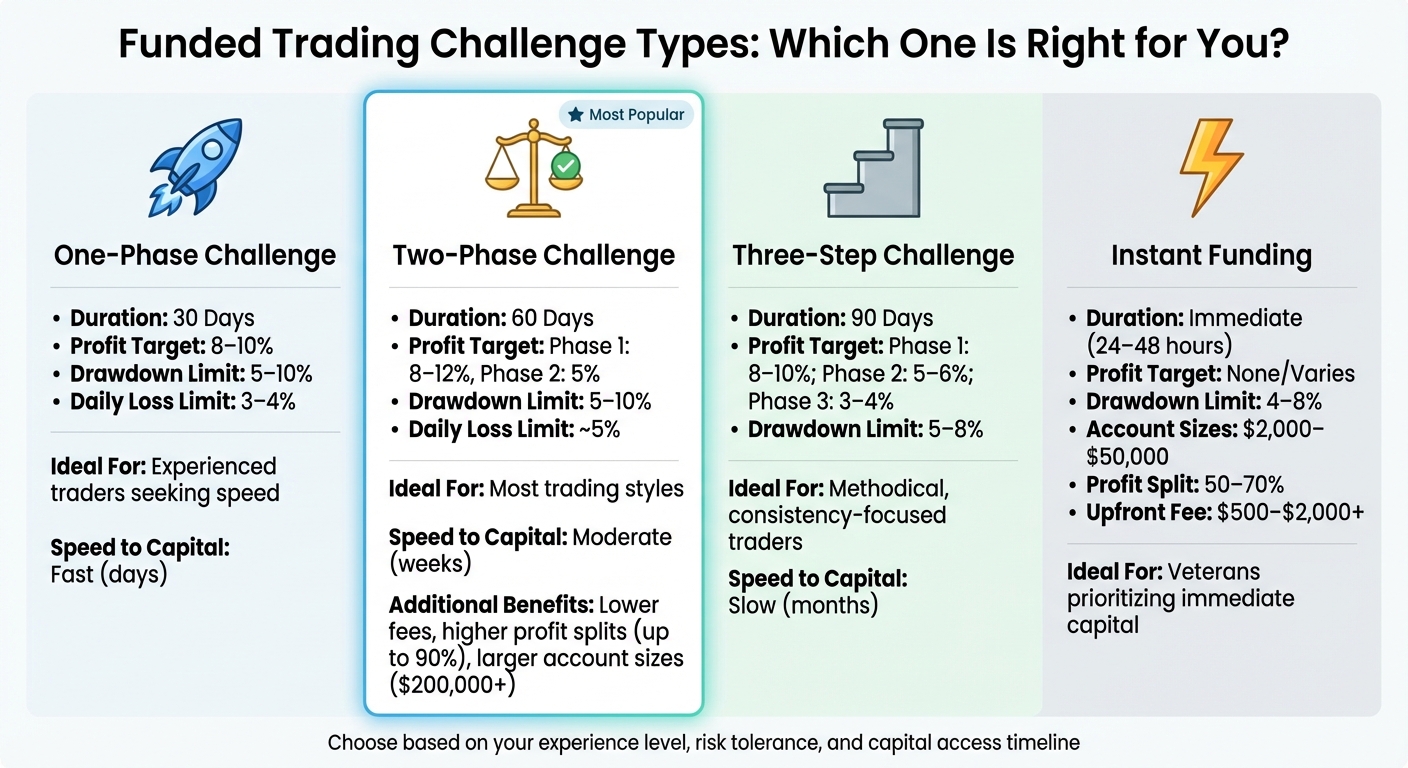

Funded Trading Account Challenge Types Comparison Chart

Funded Trading Account Challenge Types Comparison Chart

Funded trading accounts operate on a system where traders demonstrate their skills before they gain access to a firm’s capital. This starts with an upfront fee, which grants entry to a simulated trading environment designed for evaluation. Essentially, it’s a test to identify traders who can consistently make profits while managing risk effectively.

During this evaluation, every trade is monitored closely. To pass, you need to hit profit targets – usually between 8% and 12% of the account balance – while staying within strict loss limits. These loss limits include a drawdown range of 4%–10% and daily loss caps of 2%–5%.

"The Trading Combine is a rules-based trading evaluation in a simulated futures market… to enforce focus and discipline." – Team Topstep

"The Trading Combine is a rules-based trading evaluation in a simulated futures market… to enforce focus and discipline." – Team Topstep

Once you successfully complete the evaluation, the profit-sharing model begins. Most firms offer traders a share of the profits, typically ranging from 70/30 to 90/10 in favor of the trader. Some programs even allow traders to keep 100% of their first $5,000–$10,000 in profits. In this setup, the firm takes on all the financial risk for losses, while traders keep the bulk of their earnings.

Now, let’s dive into how the evaluation process is structured and what it entails.

The Challenge Evaluation Process

The evaluation phase is designed to test your ability to trade profitably under strict conditions. Many programs follow a two-phase approach that spans around 60 days. In Phase 1, you’re tasked with hitting a profit target of 8%–12%. Phase 2 focuses on verifying your consistency with a smaller target of around 5%.

These evaluations come with non-negotiable rules. You’ll face a maximum drawdown limit, which tracks your total losses from the starting balance. There’s also a daily loss limit to cap single-session losses, and consistency rules to ensure no single trade accounts for more than 50% of your total profits. These guidelines promote disciplined trading rather than risky, high-stakes bets.

Before taking on a challenge, it’s wise to test your strategy thoroughly. Backtesting over at least 100 trades can help ensure your typical drawdown stays well within the firm’s limits. Additionally, following the "2% rule" – risking no more than 2% of your account balance on a single trade – can help manage risk effectively.

| Challenge Type | Duration | Profit Target | Drawdown Limit | Ideal For |

|---|---|---|---|---|

| One-Phase | 30 Days | 8–10% | 5–10% | Experienced traders seeking speed |

| Two-Phase | 60 Days | Phase 1: 8–12%, Phase 2: 5% | 5–10% | Most trading styles |

| Three-Step | 90 Days | Phase 1: 8–10%; Phase 2: 5–6%; Phase 3: 3–4% | 5–8% | Methodical, consistency-focused traders |

| Instant Funding | Immediate | None/Varies | 4–8% | Veterans prioritizing immediate capital |

Profit Split Arrangements

Once you pass the evaluation, profit-sharing kicks in as a reward for your performance.

This model benefits both the trader and the funding firm. You bring the trading expertise and strategy, while the firm provides the capital and absorbs the financial risks. In return, the firm takes a percentage of your profits – usually between 10% and 30% – leaving you with the majority.

Some programs offer progressive splits, where your share increases as you hit performance milestones. For example, your profit share might start at 80% and grow to 90%–95% over time. Additionally, some firms allow you to pay an extra fee during the evaluation to boost your base split right away. Payouts are typically processed either biweekly or monthly. For instance, FTMO refunds 100% of your evaluation fee with your first profit withdrawal, and Topstep has funded over 10,000 accounts while paying millions to traders.

This structure ensures mutual success. While individual traders may face losing streaks, the firm spreads its risk across many traders, ensuring profitability as long as enough succeed. To support this, firms often invest in trader education and resources, as your success directly impacts their bottom line.

The following sections will break down the different challenge types and qualification criteria, helping you decide if these programs align with your trading goals.

Types of Funded Trading Programs

Funded trading programs differ in their evaluation phases, speed of capital access, fee structures, and profit-sharing arrangements.

One-phase challenges are designed for traders seeking quick access to capital, often within just a few days. These programs typically require hitting a single profit target of 10%, but they come with stricter risk controls, including lower daily loss limits (generally 3%–4%).

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

Two-phase challenges are the most common format in the industry. These programs involve two stages: an initial "Challenge" phase requiring an 8%–10% profit target, followed by a "Verification" phase with a 5% target to demonstrate consistency. While this process can take weeks or even months, it offers several perks, such as lower entry fees, higher profit splits (up to 90%), and access to larger account sizes – sometimes exceeding $200,000. Additionally, the daily loss limits are more lenient, typically around 5%, such as the Tradeify daily loss limit.

Instant funding options skip the evaluation process entirely, providing capital within 24–48 hours. These programs charge an upfront fee ranging from $500 to over $2,000 and offer smaller account sizes ($2,000–$50,000) with profit splits of 50%–70%. Instant funding is ideal for experienced traders who can handle the higher costs and want to avoid traditional evaluations. However, it’s crucial to confirm whether the account is a true live trading environment or a "demo-live" setup, as this can impact trade execution and withdrawal processes.

Choosing the right program depends on your trading experience, risk tolerance, and how quickly you want access to capital. Two-phase challenges are often the best all-around option for most traders, while one-phase challenges cater to those prioritizing speed, and instant funding suits professionals looking to bypass evaluations entirely.

Benefits of Funded Trading Accounts

Access to Large Trading Capital

One of the biggest perks of funded trading accounts is the access they provide to significant trading capital. Instead of being limited by your personal savings, you can trade with the financial backing of a proprietary firm. This opens the door to larger positions and the ability to scale strategies that would be out of reach for most retail traders.

"When your account is too small, every trade feels capped and every mistake feels costly. Becoming a funded trader changes everything." – Team Topstep

"When your account is too small, every trade feels capped and every mistake feels costly. Becoming a funded trader changes everything." – Team Topstep

Funded traders typically keep 70%–90% of their profits, with some programs offering up to 95% depending on the plan. For example, FTMO has distributed over $500 million in rewards to traders globally since it started. Additionally, traders who demonstrate consistent performance can have their capital allocation increased over time, potentially managing six-figure portfolios without risking more of their own money.

Lower Personal Financial Risk

Another major advantage is the reduced financial risk. Your liability is limited to an initial fee, which usually ranges from $100 to $300 for a $50,000 account. Beyond this fee, the proprietary firm absorbs any trading losses, so you’re not personally responsible if a trade doesn’t go as planned.

Some firms, like FTMO, even refund the evaluation fee after your first profit withdrawal, making it a win-win situation. Additionally, these firms enforce strict risk management rules, such as a 5% daily loss cap and a 10% maximum drawdown. These measures not only protect the firm’s capital but also help traders develop disciplined habits and maintain a healthy trading mindset.

Professional Trading Platforms and Tools

Funded trading programs often provide access to high-end trading platforms, such as NinjaTrader, MetaTrader 5, Tradovate, cTrader, and Sterling Trader Pro. These platforms, which can be expensive for individual traders, come equipped with advanced features and tools. They also include real-time market data for major exchanges like NYSE, NASDAQ, and AMEX, ensuring you’re trading on live prices instead of delayed quotes.

Many programs go beyond just platforms, offering performance dashboards to track key metrics like win rates, average trade size, and risk-adjusted returns. These tools are invaluable for identifying strengths and areas for improvement. Some firms even provide educational resources, strategy guides, and access to exclusive communities. For instance, SeacrestFunded’s Discord server boasts over 124,000 members, providing a space for traders to learn and connect in real time.

"The benefits of funded accounts are clear – access to global markets and the potential to earn returns, while limiting exposure of personal funds." – Research Team, Seacrest Markets

"The benefits of funded accounts are clear – access to global markets and the potential to earn returns, while limiting exposure of personal funds." – Research Team, Seacrest Markets

How to Qualify for a Funded Account

Standard Evaluation Rules and Targets

To qualify for a funded account, traders must complete a two-phase evaluation process. In Phase 1, the goal is to achieve an 8–10% profit, while Phase 2 requires a 5% profit. All of this must be done while keeping daily losses between 2–5% and maintaining a total drawdown of 8–10%.

Take FTMO as an example: traders aiming for a $100,000 account need to hit a $10,000 profit target in Phase 1 (10%) and $5,000 in Phase 2 (5%). On the other hand, Topstep’s $50,000 account comes with a $3,000 profit target and a $2,000 loss limit. Additionally, Topstep has a unique rule – your best trading day cannot account for more than 50% of your total profits.

Most firms also require active trading over 5–10 days to ensure performance isn’t reliant on a single trade. Strategies like high-frequency trading, copy trading, or holding positions during major news events or weekends are often restricted.

Risk Management Requirements

Meeting profit targets is essential, but staying within risk limits is just as important. A staggering 80% of traders failed Phase 1 at FundedNext in 2023, underscoring the importance of risk management. Many firms follow the "2% rule", which advises traders to never risk more than 2% of their account on a single trade.

"The 2% rule in funding traders means never risking more than 2% of your total capital or account size on a single trade. This helps manage risk, protect your funded account, and stay within drawdown limits."

– Alyaziah Hayat, Blog Author, Defcofx

"The 2% rule in funding traders means never risking more than 2% of your total capital or account size on a single trade. This helps manage risk, protect your funded account, and stay within drawdown limits."

– Alyaziah Hayat, Blog Author, Defcofx

To manage this effectively, use mandatory stop-loss orders and position sizing to ensure that a single trade never risks more than 1–2% of your balance. Some firms, like Topstep, implement a "soft breach" system. If you hit your daily loss limit, your account is locked for the day. However, exceeding the maximum loss limit results in permanent account closure.

Once you’ve mastered risk management on individual trades, you’ll be better prepared to explore payout schedules and account scaling.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Account Scaling and Payout Processes

After passing the evaluation phases and demonstrating consistent risk management, traders gain access to payout and scaling options. Payouts can typically be requested biweekly or monthly, with some firms offering on-demand withdrawals after your first successful month. Profit splits usually range from 70% to 90%, with certain plans reaching up to 95%.

For traders showing consistent profitability over 2–3 months, firms often scale up account sizes. For instance, a $50,000 account could grow to $100,000 or more. Some programs even offer access to as much as $20 million in buying power for traders with a proven track record of long-term consistency. Before your first payout, you’ll need to verify your identity and meet minimum activity requirements, such as trading for at least 5 days and earning a minimum of $150 profit.

Using QuantVPS for Funded Trading

Why VPS Hosting Improves Trading Performance

When you’re trying to pass a funded account evaluation, every fraction of a second can make a difference. Relying on a home setup introduces risks like power outages, internet disruptions, or hardware issues – any of which could interrupt your trading. A Virtual Private Server (VPS) eliminates these risks by hosting your trading environment in a secure, always-on datacenter.

A VPS also helps minimize slippage. QuantVPS, for instance, operates from a Chicago-based datacenter with direct fiber-optic connections to the CME Group exchange. This setup achieves latency as low as 0.52ms. Being so close to the exchange’s matching engines allows your orders to execute faster, which can lead to better entry and exit prices – something crucial when working with tight profit targets and drawdown limits during evaluations.

For traders who use automated strategies or manage multiple accounts, QuantVPS offers 99.999% uptime, meaning less than 52 minutes of downtime per year. This reliability ensures your systems stay operational during critical market sessions, giving you an edge in performance.

QuantVPS Features for Funded Traders

QuantVPS doesn’t just stop at low latency and high uptime – it offers features specifically designed for the high demands of funded traders. It supports key trading platforms like NinjaTrader, MetaTrader 4/5, TradeStation, Quantower, and Sierra Chart, as well as data feeds such as Rithmic, CQG, and dxFeed. Powered by high-performance AMD EPYC and Ryzen processors paired with NVMe M.2 SSD storage, QuantVPS ensures smooth operation of even the most complex strategies during periods of high volatility.

To enhance productivity, QuantVPS supports RDP setups for one to six monitors, allowing you to monitor multiple metrics simultaneously. Network connections offer 1Gbps speeds with a 10Gbps burst capability, ensuring fast and reliable performance during major market-moving events. Security is also a priority, with enterprise-grade DDoS protection and advanced firewall configurations to keep your funded account credentials safe.

| Plan | Monthly Price | Annual Price | CPU Cores | RAM | Storage | Best For |

|---|---|---|---|---|---|---|

| VPS Lite | $59.99 | $41.99/mo billed annually | 4 | 8GB | 70GB NVMe | 1–2 charts, single monitor |

| VPS Pro | $99.99 | $69.99/mo billed annually | 6 | 16GB | 150GB NVMe | 3–5 charts, up to 2 monitors |

| VPS Ultra | $189.99 | $132.99/mo billed annually | 24 | 64GB | 500GB NVMe | 5–7 charts, up to 4 monitors |

| Dedicated Server | $299.99 | $209.99/mo billed annually | 16+ | 128GB | 2TB+ NVMe | 7+ charts, up to 6 monitors |

For traders with more demanding needs, QuantVPS offers Performance Plans like VPS Pro+ at $129.99/month ($90.99/month annually) and VPS Ultra+ at $199.99/month ($139.99/month annually). These plans come with upgraded specifications to handle more resource-intensive strategies. All plans include Windows Server 2022 pre-configured for trading and 24/7 expert technical support to resolve any issues quickly.

Conclusion

Funded trading accounts offer a way for skilled traders to access significant capital without risking their own savings. By paying a fee, traders gain access to these accounts, with the prop firm covering losses and sharing profits with successful participants. This setup eliminates the challenge of limited personal funds while promoting professional risk management through strict drawdown limits and consistency rules. It’s a structure designed to encourage disciplined and methodical trading.

However, success in this model demands discipline and preparation. Statistics show that over 90% of traders fail prop firm challenges due to common pitfalls like overtrading, emotional decisions, or inadequate preparation. To improve your chances, it’s essential to test your strategy on a demo account under the specific rules and drawdown limits of the firm you plan to work with.

Investing in a VPS can also make a difference. A VPS ensures uninterrupted evaluations by eliminating risks from power outages or internet issues. For example, QuantVPS offers 99.999% uptime and ultra-low latency, keeping your systems running smoothly during critical trading sessions. With reliable infrastructure in place, you can focus entirely on executing your strategy.

FAQs

What fees and profit splits can you expect with funded trading accounts?

Funded trading accounts often come with associated costs, such as monthly subscription fees or one-time activation charges. These fees typically fall between $50 and $189 per month, depending on the size of the account and the specific program’s setup. In some cases, programs may require a one-time payment after you successfully complete their evaluation process.

When it comes to profit sharing, many programs offer traders a high percentage of their earnings – sometimes up to 90%. However, this usually hinges on meeting the program’s profit targets and adhering to its risk management guidelines. Since profit splits and fee structures differ across programs, it’s crucial to carefully review the terms before committing.

What is the evaluation process for earning a funded trading account?

The evaluation process for a funded trading account is designed to test a trader’s skills, discipline, and risk management abilities. To qualify, traders typically need to complete a challenge or assessment phase that includes meeting specific objectives. These often involve hitting a profit target, staying within daily loss limits, and following strict trading rules.

If a trader successfully passes this evaluation, they are granted access to a funded account, allowing them to trade using the firm’s capital. Profits from successful trades are then shared based on a pre-agreed structure, benefiting both the trader and the funding firm. This system ensures that only traders who demonstrate consistency and discipline gain access to these valuable resources.

What are the advantages of using a funded trading account instead of trading with your own money?

A funded trading account comes with some clear advantages for traders. One of the biggest perks? You don’t have to put your own money on the line. Instead, the trading firm supplies the capital, which means your personal financial risk is significantly reduced. This setup lets you focus on fine-tuning your strategies without the constant worry of losing your own savings.

Another major benefit is access to larger trading capital. With more funds at your disposal, you can scale up your strategies and aim for higher profits. Plus, most funded accounts operate on a profit-sharing model. This means you get to keep a portion of the profits you generate, while the firm takes on the financial risk. For traders who want to grow without making a hefty upfront investment, this arrangement can be a game-changer.