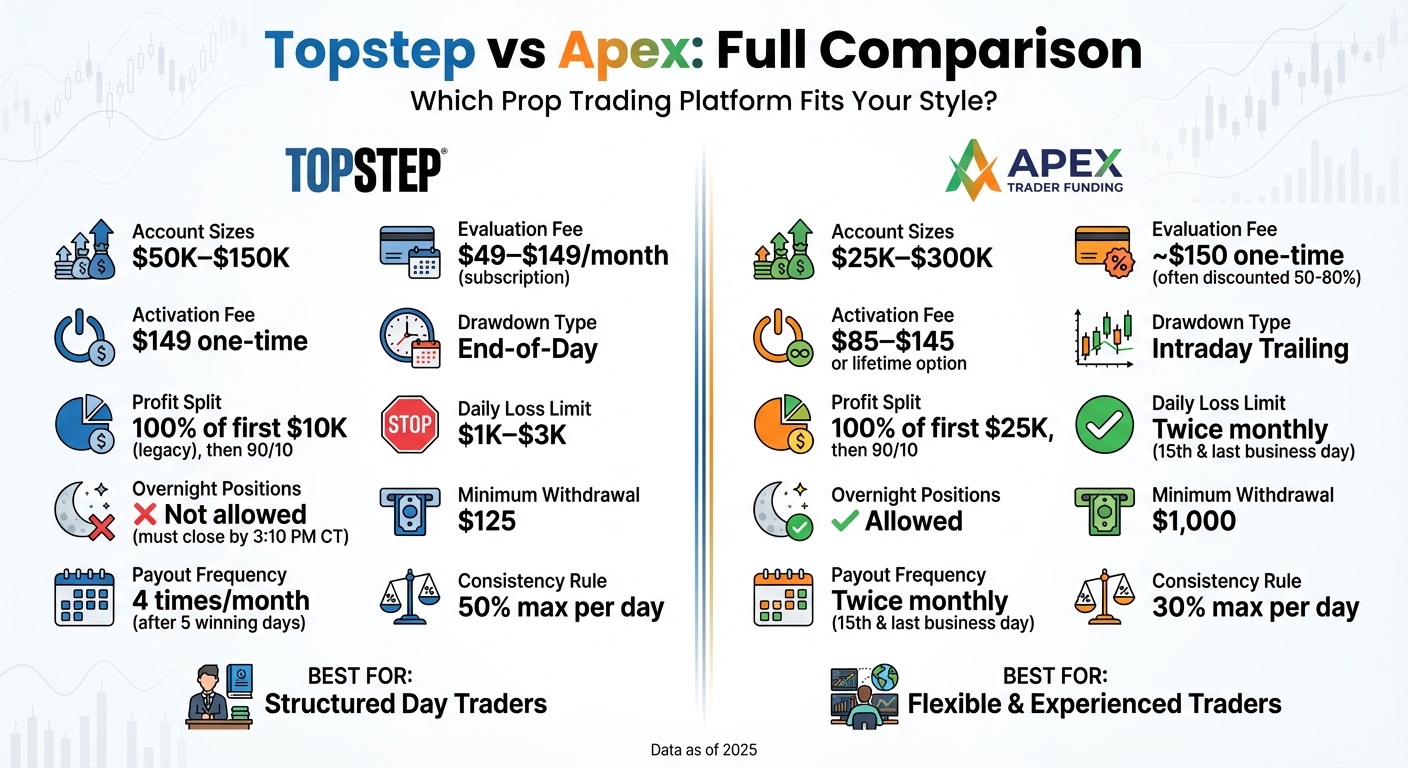

When choosing between Topstep and Apex for futures trading evaluations, your decision depends on your trading style and priorities. Here’s a quick breakdown:

- Topstep: Best for traders who prefer structured rules and day trading. Offers an End-of-Day drawdown, strict daily loss limits, and fast payouts (5 winning days minimum). Monthly fees start at $49 for a $50K account, with a $149 activation fee. You can manage up to 5 funded accounts but cannot hold overnight positions.

- Apex: Designed for experienced traders seeking flexibility. Allows overnight positions, up to 20 funded accounts, and keeps 100% of the first $25K profits per account. Uses an Intraday Trailing drawdown and enforces a 30% consistency rule. Evaluation fees vary but are often heavily discounted, with lifetime fee options available.

Quick Comparison

| Feature | Topstep | Apex Trader Funding |

|---|---|---|

| Account Sizes | $50K–$150K | $25K–$300K |

| Evaluation Fee | $49–$149/month | ~$150 (varies by promo) |

| Activation Fee | $149 one-time | $85–$145 or lifetime option |

| Drawdown Type | End-of-Day | Intraday Trailing |

| Profit Split | 100% of first $10K, then 90/10 | 100% of first $25K, then 90/10 |

| Daily Loss Limit | $1K–$3K | None |

| Overnight Positions | Not allowed | Allowed |

| Max Funded Accounts | 5 | 20 |

| Payout Frequency | 4 times/month | Twice monthly |

| Minimum Withdrawal | $125 | $1,000 |

Topstep is ideal for disciplined day traders, while Apex offers greater flexibility for experienced traders managing multiple accounts or holding positions overnight. Choose based on your trading strategy and risk tolerance.

Topstep vs Apex Trader Funding: Complete Feature Comparison

Topstep vs Apex Trader Funding: Complete Feature Comparison

Topstep Rules and Evaluation Process

Trading Combine Overview

Topstep’s evaluation program, the Trading Combine, gives traders the chance to showcase their abilities and earn an Express Funded Account™. To succeed, traders must hit a profit target, maintain consistency, and stay within the Maximum Loss Limit (MLL).

Profit targets vary based on the account size: $3,000 for a $50,000 account, $6,000 for a $100,000 account, and $9,000 for a $150,000 account. Topstep uses an end-of-day drawdown calculation, meaning the Maximum Loss Limit only updates after the trading day ends, based on the highest account balance. Intraday losses won’t count against you as long as your balance recovers by the close of the market.

The Consistency Target ensures that no single trading day accounts for more than 50% of your total profits. This rule prevents traders from passing the evaluation with a single lucky trade. Interestingly, it’s possible to complete the evaluation in just two trading days if both profit and consistency requirements are met.

Let’s dig into the specific rules and restrictions that traders must follow on Topstep.

Key Rules and Restrictions

Topstep enforces a day trading-only policy, requiring all positions to be closed by 3:10 PM CT or the product’s market close. Holding positions overnight is considered a rule violation and will result in immediate disqualification.

For traders using NinjaTrader or Tradovate, the Daily Loss Limit applies, though it’s not enforced on TopstepX™. These limits are $1,000 for $50,000 accounts, $2,000 for $100,000 accounts, and $3,000 for $150,000 accounts. Exceeding the limit deactivates your account for the rest of the trading session.

Once traders pass the evaluation and receive an Express Funded Account, they must complete at least five "Benchmark Trading Days" – days with $150 or more in profit – before requesting their first payout. While Topstep allows trading during high-impact news events, they don’t provide credits or exceptions for losses caused by volatility or slippage during these times.

Apex Rules and Evaluation Process

Two-Step Evaluation Process

Apex uses a straightforward two-step evaluation process, which stands out as simpler compared to Topstep’s Trading Combine. The first step, called the Evaluation Phase, requires traders to meet a specific profit target – like $3,000 for a $50,000 account – while adhering to an intraday trailing drawdown. This drawdown adjusts in real-time based on your highest profit point and locks at your starting balance plus $100. Once locked, it stays fixed, providing additional margin flexibility.

After successfully completing this phase, traders transition to the Performance Account Phase (PA) by paying an activation fee, which ranges from $85 to $145. In this phase, traders must follow a 30% consistency rule, ensuring that no single trading day accounts for more than 30% of total profits. Apex also offers a Safety Net for the first three payouts, giving traders extra support as they start trading live.

The evaluation process requires a minimum of 7–8 trading days. Apex’s intraday trailing drawdown updates continuously, and since there’s no daily loss limit, traders have the opportunity to recover from early losses as long as they stay above the trailing threshold by the end of the trading day. This streamlined setup sets Apex apart from other platforms.

Flexibility and Trading Options

Apex provides traders with a high level of flexibility. Unlike some competitors, traders aren’t restricted to day trading – they can hold positions overnight. The platform also supports diverse strategies, including dollar-cost averaging and automated trading.

Additionally, traders can manage up to 20 funded accounts simultaneously and even utilize copy trading across multiple accounts. Apex supports integration with 14 platforms via API, including popular options like NinjaTrader, TradingView (through Tradovate), and WealthCharts. The platform has paid out over $598 million to traders, with a single-day payout record of $2.5 million in 2025.

Comparison Table: Rules and Evaluation Processes

| Feature | Topstep | Apex |

|---|---|---|

| Evaluation Steps | Single Trading Combine | Two-Step (Evaluation Phase & Performance Account Phase) |

| Drawdown Type | End-of-Day Trailing | Intraday Trailing (locks at starting balance + $100) |

| Daily Loss Limit | $1K–$3K | None |

| Minimum Trading Days | 2 days possible | 7–8 days required |

| Consistency Rule | 50% max per day | 30% max per day |

| Overnight Positions | Not allowed (must close by 3:10 PM CT) | Allowed |

| News Trading | Allowed (no exceptions for losses) | Allowed (with restrictions) |

| Max Accounts | Up to 5 accounts | Up to 20 accounts |

| Activation Fee | $149 one-time | $85–$145 one-time |

Payout Structures: Topstep vs Apex

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

Topstep’s Payout Structure

Starting January 12, 2026, Topstep implements a 90/10 profit split right from the first payout. However, legacy traders still retain 100% of their first $10,000 in profits before the split kicks in. To request a payout, traders need five winning days, each with at least $150 in profit. For Express Funded Accounts, payouts are capped at 50% of the account balance or $5,000, with a minimum withdrawal of $125. Traders can make up to four payout requests per month, and those who achieve a Live Funded Account with 30 winning days gain access to daily payouts and their full balance.

Let’s now look at Apex’s payout structure for a side-by-side comparison.

Apex’s Payout Structure

Apex allows traders to keep 100% of their first $25,000 in profits per account before moving to the standard 90/10 profit split. This 100% profit tier applies to up to 20 funded accounts. To qualify, traders need 8–10 trading days. The minimum withdrawal amount is $1,000, and payouts are processed twice a month – on the 15th and the last business day. Apex also applies a 30% consistency rule, meaning no single day’s profit can exceed 30% of the total profit at withdrawal. Additionally, for the first three payouts, traders must maintain a buffer equal to the drawdown amount plus $100.

These differences in profit retention, payout frequency, and withdrawal requirements highlight how each prop firm approaches trader compensation.

Comparison Table: Payout Structures

| Feature | Topstep | Apex |

|---|---|---|

| Initial 100% Profit Tier | Legacy traders: first $10,000 are 100% retained | First $25,000 per account |

| Standard Profit Split | 90/10 (Trader/Firm) | 90/10 (Trader/Firm) |

| Min. Winning Days | 5 days (each with at least $150 profit) | 8–10 days |

| Payout Frequency | Up to 4 times per month | Twice monthly (15th & last business day) |

| Minimum Withdrawal | $125 | $1,000 |

| Consistency Rule | None | 30% max per day |

| Payout Buffer | None | Required for first 3 payouts (drawdown + $100) |

| Withdrawal Limit | 50% of balance or $5,000 max (Express Accounts) | Not specified |

Cost Breakdown: Topstep vs Apex

Topstep Costs

Topstep operates on a monthly subscription model, with fees set at $49, $99, and $149 per month for $50K, $100K, and $150K accounts, respectively. These fees continue until you successfully pass the evaluation.

Once you pass, there’s a one-time activation fee of $149. Additionally, traders need to account for market data fees, which cost about $39 per month for advanced access. If you need Level 2 data (Depth of Market), that’s an extra $34.25 per month. Unlike Apex, Topstep does not offer a lifetime fee option.

Apex Costs

Apex takes a different approach with a one-time evaluation fee starting at around $150 for a $25,000 account. However, frequent promotions can significantly lower this fee, sometimes by 50% to 80%. After being funded, you’ll pay a Paid Performance (PA) fee ranging from $85 to $105 per month, depending on the account size. Alternatively, Apex offers a lifetime PA fee option, which requires a one-time payment between $130 and $360. Market data fees are already included in Apex’s pricing.

Comparison Table: Costs

| Feature | Topstep | Apex |

|---|---|---|

| Evaluation Model | Monthly subscription | One-time fee (often discounted) |

| $50K Account Fee | $49/month | ~$150 (varies by promo) |

| $100K Account Fee | $99/month | Varies by account size |

| Activation/PA Fee | $149 one-time | $85–$105/month or $130–$360 lifetime |

| Lifetime Option | Not available | Available |

| Market Data Fees | ~$39/month (advanced) | Included in pricing |

| Level 2 Data | $34.25/month | Included |

This breakdown highlights the key differences in pricing structures between Topstep and Apex, giving traders the details they need to weigh their options effectively.

Trading Flexibility and Asset Differences

Tradable Assets and Market Access

After comparing evaluations and payouts, it’s equally important to look at the trading flexibility and asset range each platform offers. Both Topstep and Apex focus on CME Group futures, but Apex provides a wider selection of tradable assets. Topstep supports Equity Futures (like E-mini S&P 500, Nasdaq 100, and Russell 2000), Foreign Exchange Futures, Agricultural, Energy, Interest Rate, Metals futures, and Micro Bitcoin futures. Apex, on the other hand, extends these options by including broader access to Cryptocurrency futures and even allows trading on weekends and holidays. One key difference is that Topstep requires positions to be closed by 3:10 PM CT, whereas Apex permits extended trading hours. This is a significant advantage for those monitoring NQ and MNQ market hours for overnight opportunities. Differences in platform integration and account scaling also set these two apart.

Platform Compatibility and Scaling Features

As of 2025, Topstep requires all new Trading Combines to use the TopstepX platform. While existing users on NinjaTrader or Tradovate can continue using those platforms, new traders are limited to TopstepX. This platform comes with integrated TradingView charts but does not support custom indicators. Apex, however, offers more flexibility, supporting multiple platforms like NinjaTrader, WealthCharts, and Tradovate through Rithmic, which is particularly appealing for those using automated trading systems and algorithmic strategies.

When it comes to scaling, Apex allows traders to manage up to 20 accounts, significantly more than Topstep’s limit of 5 accounts. For traders who prefer a single account, Topstep’s Dynamic Live Risk Expansion gradually increases contract limits as account balances grow, providing an alternative way to scale within one account.

Which Platform Fits Your Trading Style?

The decision between trading platforms ultimately comes down to matching their features with how you trade.

Topstep: Ideal for Structured Day Traders

Topstep is a great fit for traders who thrive on structure and discipline. With fixed daily loss limits and a requirement to close all positions by the market’s end, it enforces consistent risk management. Plus, its educational tools are designed to help newer traders develop strong habits. One key feature is the End-of-Day drawdown rule, which only factors in realized losses at the close of the trading day. This means normal intraday fluctuations won’t lead to liquidation.

For payouts, you can request one after just five winning days, provided you’ve earned at least $150 in profit. The platform creates a supportive environment, but there are some restrictions: you can manage up to five funded accounts, and holding positions overnight is not allowed.

Apex: Perfect for Flexible and Experienced Traders

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Apex caters to traders who value flexibility and have more experience. It allows you to hold swing and overnight positions, which is beneficial for navigating news events or trading through holidays. The platform also supports up to 20 funded accounts at once, making it an excellent choice for those using algorithmic strategies or trade copiers.

Apex’s payout structure is appealing, letting traders keep 100% of their first $25,000 in profits per account. However, its Intraday Trailing Drawdown tracks unrealized gains in real time, meaning a winning trade that retraces could still trigger liquidation. Additionally, the 30% consistency rule requires at least 8 to 10 winning days before your first payout and limits any single day’s profit to 30% of your total. Frequent discounts – often cutting evaluation fees by 80–90% – make the platform more affordable to start.

QuantVPS Integration for Both Platforms

No matter which platform you choose, a reliable VPS can improve your trading efficiency. QuantVPS offers two plans tailored for traders:

- Pro Plan: Includes 6 cores, 16GB RAM, and dual-monitor support for $99.99/month (or $69.99/month annually).

- Ultra Plan: Features 24 cores, 64GB RAM, and four-monitor support for $189.99/month (or $132.99/month annually).

Both options provide ultra-low latency and 24/7 uptime, crucial for managing trailing drawdowns and executing trades seamlessly on platforms like NinjaTrader and Tradovate.

Conclusion

The comparison above highlights how each platform caters to different trading needs and strategies.

Topstep is tailored for day traders who thrive on structure. Its End-of-Day (EOD) drawdown calculation shields traders from liquidation during typical intraday pullbacks, making it a good fit for those who value clear rules and quick payouts. Traders can qualify for payouts after just five winning days of $150 each, with no consistency restrictions. This structured approach earned Topstep the "Best Rules" award at the 2025 Prop Firm Match Awards. Monthly fees for Topstep accounts start at $49 for a $50,000 account, with a one-time activation fee of $149.

On the other hand, Apex offers flexibility for traders who prefer more freedom in their strategies. With the ability to hold positions overnight, trade during news events, and manage up to 20 funded accounts, Apex appeals to experienced traders seeking scalability. The platform also features a favorable profit split, especially on the first $25,000 earned. However, its Intraday Trailing Drawdown can increase the risk of liquidation during routine pullbacks, and the 30% consistency rule limits the profit potential from the best trading days. Apex’s fees range from $147 to $167 before discounts, with lifetime fee options available.

Key Takeaways

- Topstep: Best for disciplined day traders who value structured rules, quick payouts, and educational resources like TopstepTV. Its EOD drawdown provides added security during intraday fluctuations.

- Apex: Ideal for experienced traders looking for flexibility with overnight positions, news trading, and account scaling. While its profit split and discounted evaluation fees are appealing, traders need to carefully manage risks tied to the Intraday Trailing Drawdown and consistency rule.

Both platforms integrate with popular trading tools like NinjaTrader and Tradovate, ensuring compatibility with low-latency VPS hosting for smoother execution and better management of trailing drawdowns. Selecting the right platform depends on your trading style and priorities.

FAQs

What are the key differences between Topstep and Apex in managing trading accounts?

The main contrasts between Topstep and Apex come down to their drawdown rules, evaluation processes, and payout structures.

Drawdown Rules

Topstep uses an end-of-day trailing drawdown. This means your risk limits are based on the account balance at the close of each trading day, giving traders clear boundaries to work within daily. On the other hand, Apex applies a trailing drawdown based on the account’s peak equity. While this offers more flexibility during the trading day, it requires traders to monitor their equity highs closely to avoid breaching the rules.

Evaluation Process

Topstep employs a two-step evaluation process with set profit targets and risk rules. In contrast, Apex offers a faster, one-step evaluation model, which can appeal to traders who want quicker access to funded accounts. Apex also typically provides higher initial funding amounts and allows for more flexible profit splits. Topstep, however, focuses on structured risk management and gradual progression.

Ultimately, both platforms are designed for different trading approaches. The right choice will depend on what aligns best with your trading goals and style.

What are the differences in payout structures between Topstep and Apex for new traders?

When it comes to payout structures, Topstep and Apex cater to different trading styles and goals.

- Topstep lets traders keep 100% of their profits up to $10,000. After hitting that mark, profits are split 90/10, with the trader receiving the larger share.

- Apex offers a higher cap, allowing traders to retain 100% of profits up to $25,000. Beyond that, the same 90/10 split applies.

For those focusing on steady, smaller gains, Topstep’s lower cap might feel more approachable. On the flip side, Apex’s higher threshold is appealing for traders aiming to maximize larger profits. Ultimately, the right platform depends on your trading strategy and how much profit you plan to target.

What should I consider when deciding between Topstep and Apex for my trading needs?

When choosing between Topstep and Apex, it’s crucial to weigh factors like their rules, payout structures, fees, and overall trading approach.

Topstep uses a multi-step evaluation process that focuses heavily on risk management and trader discipline. This structured approach makes it a solid pick for traders who want a guided learning experience. On the flip side, Apex offers a faster, one-step evaluation process with more flexible trading rules. This can be particularly attractive to those looking for quicker funding or traders who rely on automation.

Their payout policies also differ. With Topstep, traders keep 100% of the first $10,000 in profits, after which it shifts to a 90/10 split. Apex, however, allows traders to keep 100% of the first $25,000 before moving to the same 90/10 split. As for costs, Topstep generally has lower monthly fees, while Apex may offer advantages like more contracts and higher initial balances, depending on your trading style and budget.

Ultimately, your decision should align with your trading goals, risk tolerance, and budget, as well as the features you value most in a trading platform.