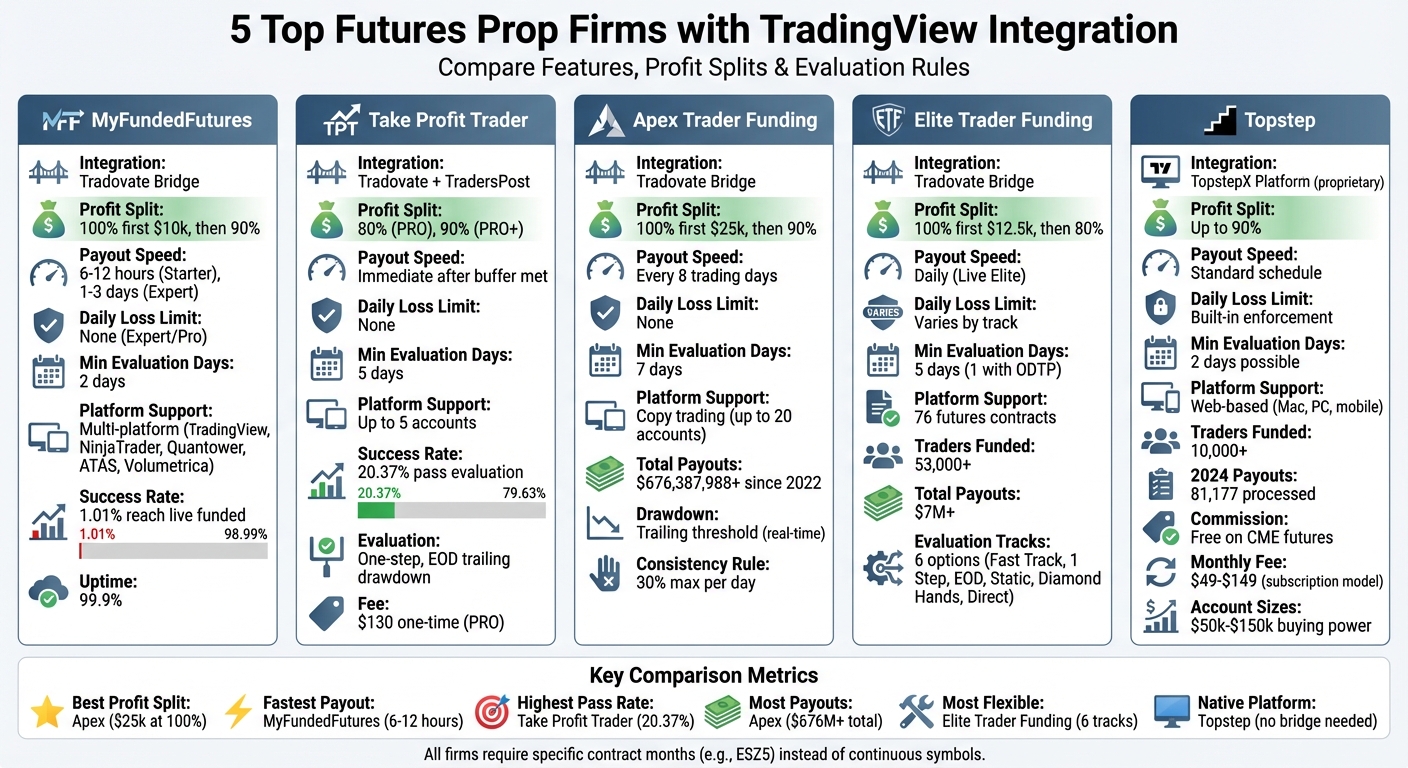

TradingView is a leading platform for futures traders, and many prop firms have integrated it to boost trading efficiency. Here’s what you need to know:

- Top Firms: MyFundedFutures, Take Profit Trader, Apex Trader Funding, Elite Trader Funding, and Topstep all support TradingView, offering varying levels of integration and features.

- Key Benefits: Direct order execution from TradingView charts, access to advanced tools, and seamless broker connections like Tradovate.

- Profit Splits: Firms offer competitive splits, ranging from 80% to 100% on initial profits.

- Evaluation Rules: Flexible rules like no daily loss limits, fast-track evaluations, and trailing drawdowns are common.

- Unique Features: Some firms provide automation tools, same-day payouts, or proprietary platforms like TopstepX.

Quick Comparison:

| Firm | Integration Method | Profit Split | Evaluation Highlights | Platform Support |

|---|---|---|---|---|

| MyFundedFutures | Tradovate bridge | 100% first $10k | No daily loss limits, fast payouts | Multi-platform (TradingView, NinjaTrader, etc.) |

| Take Profit Trader | Tradovate + TradersPost | 80-90% | One-step evaluation, automation | Supports up to 5 accounts |

| Apex Trader Funding | Tradovate bridge | 100% first $25k | Trailing drawdown, discounts | Copy trading for multiple accounts |

| Elite Trader Funding | Tradovate bridge | 100% first $12.5k | Six evaluation tracks, no scaling | Flexible trading styles supported |

| Topstep | TopstepX platform | Up to 90% | Built-in risk rules, fast qualifying | Proprietary platform with TradingView charts |

Choose a firm based on your trading style, evaluation preferences, and desired profit split (see our Topstep vs. MyFundedFutures comparison). Each offers unique advantages tailored to different trader needs.

TradingView Prop Firms Comparison: Features, Profit Splits, and Integration Methods

TradingView Prop Firms Comparison: Features, Profit Splits, and Integration Methods

1. MyFundedFutures

Integration Method

MyFundedFutures (MFFU) connects to TradingView using Tradovate as the primary bridge. To set it up, select Tradovate from the "Trading Panel" in TradingView and use your MFFU dashboard credentials to log in. Once inside Tradovate, enable the TradingView add-on by navigating to Application Settings > Add-Ons. During your first login, you’ll complete a digital Market Data Agreement and select "Non-Professional" status to activate live CME Group data feeds. This integration ensures smooth and efficient order execution.

Order Execution Capabilities

TradingView provides tools for executing Market and Limit orders directly from the chart. With the Long/Short Position Tool, you can visually set entry, stop-loss, and take-profit levels. If you prefer "Quick Market Entry", you can manually add stop-loss and take-profit orders by clicking the "+" at your desired price level. Orders are instantly synchronized across TradingView, Tradovate, and other platforms like NinjaTrader and Quantower.

Platform Support

MFFU offers a unified, single-login setup that works seamlessly across multiple platforms, including TradingView, Tradovate (web, desktop, mobile), NinjaTrader, Quantower, ATAS, and Volumetrica. Thanks to its cloud-based infrastructure, you can manage your positions from desktop, tablet, or mobile devices without losing chart layouts or drawing tools. This streamlined ecosystem enhances TradingView’s role in simplifying trading workflows for prop traders.

Evaluation Rules Flexibility

MFFU’s "Expert" and "Pro" accounts stand out by eliminating daily loss limits, focusing instead on end-of-day drawdown rules. Evaluations can be completed in as little as two days. Between January 2024 and July 2025, 20.35% of evaluation accounts achieved their objectives, with 43.41% advancing to the simulated Funded Stage. However, only 1.01% of traders progressed to Live Funded Accounts. These flexible evaluation rules align with an appealing profit-sharing structure.

Profit Splits

Traders keep 100% of their first $10,000 in profits, with a 90% split applied to any additional earnings. Payouts for Starter plans are processed within 6–12 business hours, while Expert plans are handled bi-weekly within 1–3 days. Notably, as of July 22, 2025, MFFU removed the $149 activation fee for new Core, Scale, and Pro plans.

2. Take Profit Trader

Integration Method

Take Profit Trader (TPT) connects TradingView to Tradovate, enabling direct order routing through your TPT credentials. For those looking to automate their trading, TPT integrates with TradersPost, which converts TradingView alerts into actionable orders. As TradersPost explains:

"Automate your TradingView or TrendSpider strategies directly in Take Profit Trader. Send alerts to us and we’ll send orders to your account!"

"Automate your TradingView or TrendSpider strategies directly in Take Profit Trader. Send alerts to us and we’ll send orders to your account!"

- TradersPost

When using TradingView, it’s important to select specific contract months (e.g., ESZ5) rather than continuous symbols. This ensures accurate synchronization and smooth order execution.

Order Execution Capabilities

TPT offers two account types for traders. PRO Accounts simulate live market conditions, while PRO+ Accounts route orders directly to the exchange. Both accounts support automation tools and trade copiers, and you can manage up to five accounts at once. Between January 1, 2023, and August 31, 2023, 20.37% of users successfully passed the TPT trading test.

Evaluation Rules Flexibility

TPT’s evaluation process is designed for simplicity and quick progression. It features a one-step evaluation with an end-of-day (EOD) trailing drawdown, which only updates at market close, and there’s no daily loss limit. The evaluation requires at least five trading days and includes a consistency rule: no single trading day can contribute more than 50% of the total profit target. For example, a $50,000 account might have a 6% profit target and a 4% drawdown limit.

Profit Splits

TPT offers competitive profit splits: 80/20 for PRO accounts and 90/10 for PRO+ accounts. Once the account’s buffer – equal to the maximum drawdown – is met, traders can withdraw profits immediately. The PRO account has a one-time $130 fee, eliminating recurring monthly charges, which is especially attractive for active TradingView users. Traders can upgrade to a PRO+ (Live) account by consistently withdrawing profits or by earning $10,000 in a single day on a PRO account.

3. Apex Trader Funding

Integration Method

Apex Trader Funding integrates seamlessly with TradingView’s chart-based trading tools, but it does so exclusively through Tradovate. To get started, you’ll need to register with Tradovate and enable the TradingView add-on in its settings. After restarting the platform, you can connect to TradingView directly. This setup ensures that orders are instantly synced across TradingView, Tradovate, and the Apex dashboard. Using TradingView’s visual tools, traders can execute orders directly from charts, adjusting stop-loss and take-profit levels by simply dragging them. To avoid extra fees, select the "Non-Professional" option in the data agreements. Once connected, Apex makes full use of TradingView’s advanced tools for streamlined order management.

Order Execution Capabilities

Apex supports a variety of order types, including market, limit, stop, trailing, and multi-leg orders, all of which can be executed directly from TradingView charts with precision and speed. Thanks to Tradovate’s WebSocket-based infrastructure, execution happens in under a second. Traders can also use TradingView’s Pine Script to create custom indicators that generate buy or sell alerts, which can be executed via webhooks through the Tradovate bridge. For those managing multiple accounts, Apex allows trade multiple accounts simultaneously across up to 20 funded accounts. Since 2022, the firm has paid out over $676,387,988 in total compensation to its traders.

Evaluation Rules Flexibility

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

Apex’s evaluation process is built around a trailing threshold drawdown, which adjusts in real time based on your account’s highest intraday balance, including unrealized profits. To qualify, traders need to complete a minimum of 7 trading days, adhering to a consistency rule that limits any single trading day to no more than 30% of total profits. There are no daily loss limits, giving traders the freedom to operate during news events or volatile market conditions. Once the evaluation is completed – sometimes in as little as 7 days – payouts are processed every eight trading days. This structure emphasizes consistent, disciplined trading.

Profit Splits

Apex offers an attractive profit-sharing model: traders keep 100% of the first $25,000 earned per account, after which profits are split 90/10. Evaluation fees are heavily discounted, and once traders are funded, standard activation fees and commissions apply.

4. Elite Trader Funding

Integration Method

Elite Trader Funding connects to TradingView exclusively through Tradovate. When signing up, make sure to select the TradingView option at checkout – this step can’t be added later. Once your purchase is complete, log in to TradingView’s Trading Panel using your Tradovate credentials to enable chart-based order routing.

One crucial technical point: you’ll need to select specific contract months (like ESZ5 or NQZ5) instead of using continuous rolling tickers (such as ES1! or NQ1!). Rolling tickers are only for charting and don’t support live trading. If your TradingView connection drops, you can still manage active positions directly through Tradovate. This setup enables seamless execution of various order types.

Order Execution Capabilities

After integration, Elite Trader Funding utilizes TradingView’s tools to ensure smooth and efficient order execution. You can place multiple order types directly from TradingView charts, covering 76 popular futures contracts. For those looking to automate their strategies, TradingView alerts can be linked to services like TradersPost, which routes orders through Tradovate.

To avoid login conflicts or delays in execution, it’s best not to run simultaneous sessions on both Tradovate and TradingView.

Evaluation Rules Flexibility

Elite Trader Funding offers six evaluation tracks tailored to different trading styles: Fast Track, 1 Step, EOD (End of Day), Static, Diamond Hands, and Direct to Funded. These options include a variety of drawdown structures, such as intraday trailing, EOD trailing, and static minimum balances. The firm has funded over 53,000 traders and distributed more than $7 million in payouts.

"ETF doesn’t believe in one-size-fits-all. Whether you’re a scalper, swing trader, or day trader, they offer different funding tracks."

– Fred Harrington, Founder of Vetted Prop Firms

"ETF doesn’t believe in one-size-fits-all. Whether you’re a scalper, swing trader, or day trader, they offer different funding tracks."

– Fred Harrington, Founder of Vetted Prop Firms

There are no scaling rules or consistency targets to meet, which offers traders added flexibility. News trading is allowed, and swing traders can hold positions overnight in Live Elite accounts. While standard evaluations require at least five trading days, the One Day To Profit (ODTP) add-on lets you achieve funded status in just one day.

Profit Splits

Elite Trader Funding features a trader-friendly profit structure. Initially, you keep 100% of the first $12,500 earned per account. Beyond that, the profit split adjusts to 80/20 in your favor. For those who reach Live Elite status, daily payouts are available.

"There’s no need to hit unrealistic consistency targets, and most accounts come with no scaling rule after qualification."

– Fred Harrington, Founder of Vetted Prop Firms

"There’s no need to hit unrealistic consistency targets, and most accounts come with no scaling rule after qualification."

– Fred Harrington, Founder of Vetted Prop Firms

Evaluation account sizes range from $10,000 to $300,000, with monthly fees starting around $165 for certain tiers. Standard profit targets are typically set at 6%, paired with a 4% drawdown limit [4,37].

5. Topstep

Integration Method

Topstep takes a dual approach when it comes to integrating TradingView. Traders can access TradingView charts either through Topstep’s proprietary TopstepX platform, which embeds TradingView’s engine, or via the Tradovate bridge for legacy accounts. However, starting July 7, 2025, all new Trading Combines and account resets will exclusively utilize the TopstepX platform.

TopstepX is powered by ProjectX technology, which updates CME market data every 50 milliseconds. Unlike a standalone TradingView setup, TopstepX integrates Topstep’s risk rules directly into its framework. This means features like maximum loss limits and daily lockouts are automatically enforced, ensuring traders don’t accidentally violate evaluation rules.

"TopstepX wasn’t just adapted for prop firm trading; it was built from the ground up for it. This means the risk rules and evaluation parameters are baked directly into the platform’s logic."

– Pineify Blog

"TopstepX wasn’t just adapted for prop firm trading; it was built from the ground up for it. This means the risk rules and evaluation parameters are baked directly into the platform’s logic."

– Pineify Blog

Order Execution Capabilities

TopstepX allows traders to place orders directly from TradingView charts, offering flexibility through Buy/Sell buttons or right-clicking on price action. Adjusting entry, stop-loss, and take-profit levels is as simple as dragging the respective markers. The platform also supports one-click trading and pre-configured bracket or OCO (one-cancels-other) templates to help manage risk efficiently.

With ProjectX technology, order execution is fast, leveraging CME data updates every 50 milliseconds. Risk management is built-in, with features like auto-liquidation, profit-target flattening, and end-of-day position closures. Enabling "Chart Executions" in settings lets you see visual markers for trade entries and exits, while the Symbol Link feature ensures your order card and market depth display sync automatically when switching instruments. Plus, CME futures trading on TopstepX is commission-free.

Platform Support

TopstepX is a web-based platform compatible with Mac, PC, and mobile devices. This is especially helpful for Mac and iOS users, as some alternatives like NinjaTrader only run on Windows. The platform supports up to eight charts on a single screen and includes unique tools like the Tilt™ indicator, which shows real-time sentiment data from over 150,000 traders, and a Daily Levels indicator that plots key levels directly onto your charts.

Evaluation Rules Flexibility

TopstepX enhances TradingView’s functionality by automatically enforcing risk parameters such as daily loss limits and position sizing. Interestingly, TopstepX reportedly doesn’t enforce a daily loss limit (DLL), which might allow traders to complete the evaluation phase faster. For instance, traders can qualify for a funded account in as little as two days if they hit profit targets while following the Trading Combine’s single rule.

Topstep has funded more than 10,000 traders and processed 81,177 payouts in 2024 alone. It operates in over 140 countries, supports 10 currencies, and holds a 4.3-star Trustpilot rating from more than 11,000 reviews.

"TopstepX was built specifically for the Topstep Combine, meaning every rule, from maximum loss limits to trailing drawdowns, is tracked automatically."

– H2T Funding

"TopstepX was built specifically for the Topstep Combine, meaning every rule, from maximum loss limits to trailing drawdowns, is tracked automatically."

– H2T Funding

Profit Splits

Topstep offers traders the chance to retain up to 90% of their profits. Account sizes range from $50,000 to $150,000 in buying power.

| Account Size | Monthly Price (Standard) | Monthly Price (No Activation Fee) | Profit Target | Max Loss Limit |

|---|---|---|---|---|

| $50k Buying Power | $109 | $49 | $3,000 | $2,000 |

| $100k Buying Power | $159 | $99 | $6,000 | $3,000 |

| $150k Buying Power | $209 | $149 | $9,000 | $4,500 |

The standard plan includes a $149 activation fee upon passing, while the no-activation-fee plan eliminates this fee by charging a slightly higher monthly rate.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Pros and Cons

Here’s a breakdown of the strengths and limitations of each prop firm’s integration with TradingView, based on our earlier review.

Each prop firm brings something different to the table. MyFundedFutures, for instance, boasts an impressive 99.9% uptime and offers same-day payouts if requests are made before 11:00 a.m. ET. However, only 1.01% of its participants advance to a live funded account, which might be a consideration for some traders. Apex Trader Funding, on the other hand, allows traders to keep 100% of their first $25,000 in profits and frequently runs discount promotions. That said, some users have reported latency issues during periods of high market volatility.

Take Profit Trader simplifies the process with one-step evaluations and PRO+ payouts, earning it a 4.9/5 rating. Meanwhile, Elite Trader Funding offers fast-track evaluations and allows traders to retain 100% of the first $12,500 in profits before switching to an 80/20 profit split. It holds a solid 4.6/5 rating.

Topstep takes a slightly different route by offering its proprietary TopstepX platform. This eliminates the need for Tradovate bridging and provides commission-free CME futures trading. While it’s funded over 10,000 traders, this platform operates on a subscription model ($49–$149 per month) rather than a one-time evaluation fee.

"Integration quality matters as much as the platform itself. Poor broker integration can lead to connection errors, delayed fills, or missing account data." – MyFundedFutures

"Integration quality matters as much as the platform itself. Poor broker integration can lead to connection errors, delayed fills, or missing account data." – MyFundedFutures

The table below captures the highlights and drawbacks of each firm, helping you decide which one aligns with your trading goals.

| Firm | Key Advantage | Main Drawback | Best For |

|---|---|---|---|

| MyFundedFutures | Same-day payouts, 99.9% uptime | Only 1.01% reach funded stage | Traders prioritizing reliability |

| Take Profit Trader | Simple rules, 4.9/5 rating | 80% profit split | Beginners seeking clarity |

| Apex Trader Funding | 100% first $25k, significant discounts | Potential latency during volatility | Cost-conscious traders |

| Elite Trader Funding | 100% first $12.5k, fast-track evaluations | 80/20 split after initial threshold | Aggressive profit-builders |

| Topstep | Native platform, no bridge needed | Monthly subscription vs. one-time fee | Traders wanting an all-in-one solution |

A couple of things to keep in mind: Selecting the correct contract month is crucial for smooth order execution. Additionally, TradingView’s real-time data requires a paid subscription, and Tradovate bridging might cause slight delays during volatile market conditions (similar to how traders connect TradingView to Interactive Brokers using third-party bridges).

How to Improve TradingView Performance for Prop Trading

In the world of prop trading, even a fraction of a second can make or break a trade. Home internet connections often introduce delays of 50–200ms when connecting to the CME Group exchange, which can be costly in fast-moving markets. A specialized VPS can eliminate this issue.

QuantVPS operates from a Chicago-based data center, directly connected to the CME Group’s matching engines via fiber-optic cross-connects. This setup ensures latency as low as 0.52ms, drastically reducing network hops. The result? Lower slippage and better entry and exit prices. With 99.999% uptime, you can count on uninterrupted performance for TradingView alerts, Pine Script bots, and trade copiers.

"Ultra-low latency is critical for rapid futures trade execution and minimizing slippage." – QuantVPS

"Ultra-low latency is critical for rapid futures trade execution and minimizing slippage." – QuantVPS

This low-latency environment is especially critical for traders managing multiple accounts.

For those handling multiple accounts, QuantVPS supports trade copier software to synchronize orders across all funded accounts seamlessly. Built with AMD Ryzen/EPYC processors, NVMe M.2 SSDs, and high-speed network connections (1Gbps+ with bursts up to 10Gbps), it eliminates the lag often experienced in browser-based trading setups.

QuantVPS offers several pricing tiers to suit different trading needs:

- VPS Lite: $59.99/month (or $41.99/month billed annually) for 1–2 charts.

- VPS Pro: $99.99/month (or $69.99/month billed annually) for 3–5 charts with multi-monitor support.

- VPS Ultra: $189.99/month (or $132.99/month billed annually) for 5–7 charts.

- Dedicated Server: $299.99/month (or $209.99/month billed annually) for professional high-frequency trading with 7+ charts.

For traders needing extra power, Performance Plans (+) are also available.

After completing the checkout process through Stripe, users gain instant access to a Windows Server 2022 environment. From there, simply install TradingView Desktop and configure your Tradovate or NinjaTrader bridge for dependable, high-speed execution.

Conclusion

Different firms integrate TradingView in their own way, so it’s important to pick one that matches your trading approach. MyFundedFutures stands out for its ease of use – you can log in directly through the TradingView Trading Panel using your Tradovate credentials, making it a smooth experience. If quick payouts are a priority, they process most requests the same day if submitted before 11 a.m. ET.

Apex Trader Funding offers a standout deal: you keep 100% of your first $25,000 in profits. Meanwhile, Elite Trader Funding provides 100% on the first $12,500 before moving to an 80/20 split. For those who prefer a simple fee structure, Take Profit Trader offers profit splits ranging from 80% to 100%.

Elite Trader Funding also supports flexibility by allowing you to use the same credentials across multiple platforms, including TradingView, NinjaTrader, Tradovate, and Quantower. On the other hand, Topstep takes a more structured approach with its two-step evaluation process, offering up to 90% profit splits and a reputation for excellent trader coaching.

When choosing a firm, double-check whether they support direct order routing from TradingView and if they have specific symbol requirements, like using ESZ5 instead of continuous symbols such as ES1!, to ensure accurate order fills.

Ultimately, your choice comes down to what matters most to you – whether it’s seamless platform integration, high profit splits, quick payouts, or a structured evaluation process. Align these factors with your trading goals to find the best fit.

FAQs

What are the benefits of using TradingView with futures prop firms?

Using TradingView alongside futures prop firms brings some standout benefits to traders. For starters, TradingView offers top-notch charting tools, fully customizable indicators, and real-time market data. These features make it easier for traders to dive into detailed technical analysis and react to market changes swiftly – something that’s crucial in the fast-moving futures market.

When paired with a prop firm’s system, TradingView takes things up a notch by letting traders execute, adjust, and manage trades directly from the charts. This eliminates the hassle of jumping between platforms and keeps the trading process smooth and efficient. Plus, thanks to its cloud-based setup, traders can access their accounts and charts from virtually any device, whether they’re at home or on the go. This blend of advanced tools and accessibility is why TradingView remains a favorite among futures prop firms and their traders.

What are the profit split options offered by the top futures prop firms that use TradingView?

Profit-sharing arrangements at leading futures prop firms that utilize TradingView often fall between 80% and 100%, influenced by factors such as account size and trader performance. Many firms provide competitive splits, enabling traders to keep 90% or more of their earnings, with a select few offering full profit retention to top-performing traders.

These profit-sharing models aim to reward talented traders, aligning their success with the firm’s goals. They also make these firms an appealing choice for those using TradingView’s advanced tools for market analysis and strategy development.

What should I look for in a futures prop firm that uses TradingView?

When picking a futures prop firm that integrates with TradingView, the first thing to check is how well the platform is connected. Some firms let you fully execute orders directly through TradingView. That means you can place, adjust, or cancel trades without needing to jump between platforms – super convenient for active traders. Make sure the firm doesn’t limit you to just charting or analysis tools; having full functionality is key to getting the most out of your trading.

Beyond platform integration, take a close look at the firm’s policies. Check out their evaluation process, profit-sharing structure, and withdrawal terms. Many firms offer profit splits ranging from 75% to 90%, so see if their terms align with what you’re looking for. Also, explore account scaling options and risk management rules to ensure they match your trading approach.

Lastly, don’t overlook the basics like platform reliability, the variety of instruments available, and the quality of trader support. These details can make or break your experience, so choose a firm that truly fits your needs and goals.