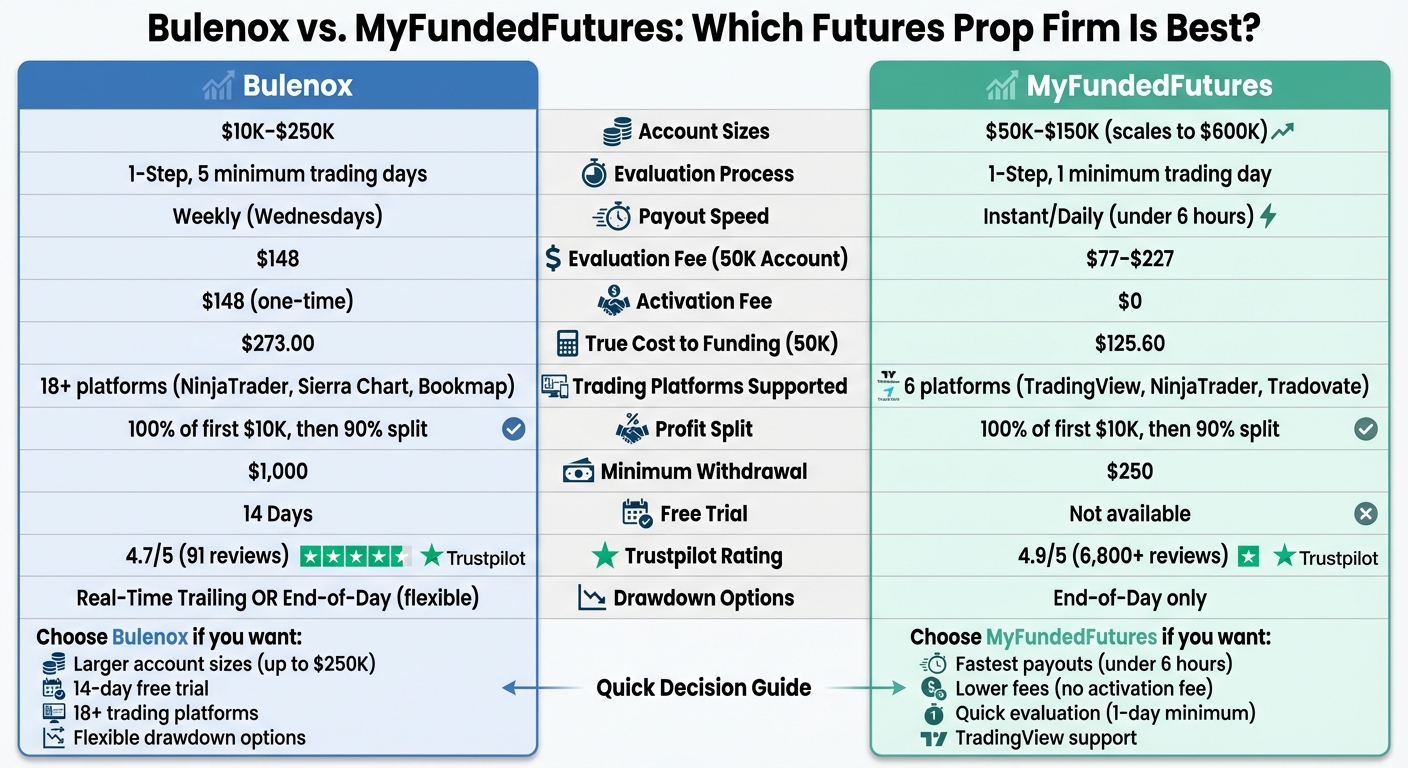

If you’re deciding between Bulenox and MyFundedFutures, here’s what you need to know:

- Bulenox offers flexible evaluation models, larger account sizes (up to $250K), and support for over 18 trading platforms like NinjaTrader and Sierra Chart. It includes a 14-day free trial, but you’ll pay higher fees overall, and withdrawals are processed weekly.

- MyFundedFutures focuses on speed and simplicity, with payouts processed in under 6 hours and evaluations that can be completed in one day. It supports fewer platforms (6, including TradingView) but has lower fees and no activation charges.

Quick Comparison

| Feature | Bulenox | MyFundedFutures |

|---|---|---|

| Account Sizes | $10K–$250K | $50K–$150K (up to $600K scale) |

| Evaluation Steps | 1-Step | 1-Step (faster options) |

| Min. Trading Days | 5 | 1 |

| Payout Speed | Weekly | Instant (daily on some plans) |

| Evaluation Fee (50K) | $148 | $77–$227 |

| Platforms Supported | 18+ (e.g., Sierra Chart) | 6 (e.g., TradingView) |

| Trustpilot Rating | 4.7/5 (91 reviews) | 4.9/5 (6,800+ reviews) |

Choose Bulenox if you want larger accounts, a free trial, or access to advanced trading tools.

Choose MyFundedFutures if you prefer faster payouts, lower fees, or a streamlined evaluation process.

Both firms are excellent choices for different trading needs – pick the one that aligns with your strategy and priorities.

Bulenox vs MyFundedFutures: Complete Feature Comparison Chart

Bulenox vs MyFundedFutures: Complete Feature Comparison Chart

Funding Programs and Account Options

Bulenox Funding Programs

Bulenox offers a straightforward one-step evaluation process that transitions traders from Qualification Accounts to Master Accounts. Account sizes range from $10K to $250K, with specific profit targets and drawdown limits based on the account size. For instance, a $10K account requires a $1,000 profit target and has a $1,000 maximum drawdown, costing $98 per month. On the other hand, a $250K account comes with a $15,000 profit target, a $5,500 max drawdown, and a monthly fee of $898.

A notable feature is the flexibility in drawdown options. Traders can choose between Real-Time Trailing Drawdown, which suits scalpers, or End-of-Day (EOD) Drawdown with scaling options, better suited for swing traders. Once funded, traders keep 100% of the first $10,000 in profits, followed by a 90% split on additional earnings. Bulenox allows up to 11 Master Accounts per trader, with a maximum of three active accounts at a time under a single Rithmic ID. Additionally, they offer a 14-day free trial to help traders get started.

These features make Bulenox a strong contender when comparing funding programs, particularly against MyFundedFutures.

MyFundedFutures Funding Programs

MyFundedFutures focuses on speed and simplicity, offering a streamlined evaluation process. Standard account sizes include $50K, $100K, and $150K, with a "Milestone" plan that scales accounts to as much as $600K. Traders can complete the evaluation in as little as one day, significantly faster than Bulenox’s five-day minimum.

All MyFundedFutures programs use the End-of-Day (EOD) drawdown approach, which helps traders manage intraday volatility. Most plans also eliminate daily loss limits, providing more flexibility. The profit-sharing model is similar to Bulenox: traders keep 100% of the first $10,000 in profits, followed by either a 90% or 80% split, depending on the plan. MyFundedFutures is also known for quick payouts, with most requests approved instantly, and the Rapid plan even offers daily payouts. The company highlights this feature:

My Funded Futures is proud to announce that most payout requests are approved instantly!

My Funded Futures is proud to announce that most payout requests are approved instantly!

For seasoned traders on the Pro Plan, MyFundedFutures offers a structured Live Account Transition after achieving three consecutive payouts or reaching specific profit milestones.

Comparison Table: Funding Programs

| Feature | Bulenox | MyFundedFutures |

|---|---|---|

| Evaluation Steps | 1-Step | 1-Step (2-Step option available) |

| Account Sizes | $10K–$250K | $50K–$150K (up to $600K on Milestone) |

| Min. Trading Days | 5 Days | 1 Day |

| Drawdown Type | Choice: Trailing or EOD | EOD (End-of-Day) |

| Daily Loss Limit | Only on EOD accounts | None (on most plans) |

| Profit Split | 100% first $10K, then 90% | 100% first $10K, then 90% (or 80%) |

| Payout Frequency | Weekly (Wednesdays) | Instant approvals; Daily on Rapid plan |

| Free Trial | 14 Days | Not specified |

| Max Active Accounts | 3 (11 total allowed) | Not specified |

Fee Structures and Costs

The two firms approach fees in distinct ways, which impacts the overall cost of accessing funded accounts.

Bulenox Fees

Bulenox operates on a monthly subscription model for evaluation accounts. Fees range from $98 for a $10K account to $898 for a $250K account. Once you pass the evaluation, there’s a one-time activation fee equal to the evaluation fee. For example, if you’re working with a $50K account, you’d pay $148 for both the evaluation and activation fees combined [5, 13, 16].

New traders can take advantage of a 14-day free trial if they haven’t registered with Rithmic before. However, if you break a rule and need to reset your account, a $78 reset fee applies – unless it coincides with your monthly billing date [5, 16].

For professional traders, exchange data feeds (CME, CBOT, NYMEX, and COMEX) cost $116 per month, while these fees are included for non-professional traders. Additionally, Bulenox enforces a "Safety Threshold" reserve in funded accounts. For example, a $50,000 account requires a $2,600 reserve, meaning you can’t withdraw the full account balance immediately.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

MyFundedFutures Fees

MyFundedFutures takes a different approach by not charging activation fees for its Core, Scale, and Pro plans. For a $50,000 account, evaluation fees start at $77 for the Core plan, $127 for the Scale plan, and $227 for the Pro plan. This structure leads to a "True Cost to Funding" of roughly $125.60 for a $50,000 account, which is considerably lower than Bulenox’s equivalent cost.

Another advantage is the lower minimum withdrawal threshold – just $250, allowing traders quicker access to their profits.

Comparison Table: Fees and Costs

| Feature | Bulenox | MyFundedFutures |

|---|---|---|

| $50K Evaluation Fee | $148 | $77–$227 (plan dependent) |

| Activation Fee | $148 (one-time) | $0 |

| Reset Fee | $78 | Varies by plan |

| Free Trial | 14 Days | Not specified |

| Professional Data Fee | $116/month | Included |

| Minimum Withdrawal | $1,000 | $250 |

| True Cost to Funding (50K) | $273.00 | $125.60 |

| First $10K Profit Split | 100% to trader | 100% to trader |

| Subsequent Split | 90/10 | 90/10 |

Trading Platforms and Technology

Both firms provide support for automated trading and multiple platforms, but their approaches differ significantly in scope and specialization. Here’s a closer look at their trading technology and platform offerings.

Bulenox Trading Platforms

Bulenox stands out with its support for over 18 futures trading platforms. These include professional-grade tools like NinjaTrader, Tradovate, Sierra Chart, Bookmap X-Ray, ATAS, Quantower, and Jigsaw Daytradr. The firm leverages Rithmic data feeds, which integrate seamlessly with advanced order flow analysis tools – a feature that appeals to traders using platforms like Bookmap and Sierra Chart.

For those interested in automation, Bulenox allows the use of bots, algorithms, and trade copiers. Traders can manage up to 3 Master Accounts simultaneously under a single Rithmic ID, with a total of 11 accounts permitted.

MyFundedFutures Trading Platforms

MyFundedFutures takes a more focused approach, offering support for 6 primary platforms, with a strong emphasis on TradingView integration. This feature enables traders to execute trades directly from charts, making it particularly appealing for those who prefer a visual, streamlined interface. Supported platforms also include NinjaTrader, Tradovate, ATAS, Quantower, Volumetrica, and Jigsaw Daytradr.

The firm’s technology infrastructure is designed for reliability, featuring data centers in Chicago, New York, London, and Amsterdam. This setup ensures 99.999% uptime and sub-millisecond execution speeds. While MyFundedFutures supports copy trading for up to 10 accounts simultaneously, it prohibits fully automated bots, requiring active trader involvement.

Comparison Table: Trading Platforms

| Feature | Bulenox | MyFundedFutures |

|---|---|---|

| Number of Platforms | 18+ | 6 |

| TradingView Support | No | Yes |

| Sierra Chart Support | Yes | No |

| Bookmap X-Ray Support | Yes | No |

| Algo/Bot Support | Yes | Yes |

| Trade Copier Support | Allowed | Up to 10 accounts |

| Infrastructure Uptime | Not specified | 99.999% |

| Data Feed | Rithmic, Tradovate | Tradovate, NinjaTrader |

| Trustpilot Rating | 4.7/5 | 4.9/5 |

These platform offerings highlight how each firm tailors its services to meet different trading styles and technical needs. Whether you prioritize a broad range of tools or a streamlined, chart-focused experience, both options cater to distinct trader preferences.

Support, Resources, and Community

Both companies provide extensive support systems, but their approaches to trader education and community involvement set them apart.

Bulenox Support and Resources

Bulenox offers a comprehensive Help Center that covers topics like trading rules, account transitions, drawdown mechanics, and technical requirements. Traders receive automated email updates for account resets and status changes, ensuring they stay informed. The Help Center also dives into specific details, such as qualification account rules, master account transitions, and end-of-day drawdown logic.

For technical issues with third-party platforms like Rithmic or NinjaTrader, Bulenox directs traders to the respective software developers. Master Account holders benefit from a free NinjaTrader 8 license, adding value to their trading experience. However, Bulenox does not include educational content for skill-building and, while it permits algorithmic trading tools like bots and trade copiers, it does not supply these tools directly.

The firm has earned a 4.7/5.0 rating on Trustpilot from 91 reviews, highlighting positive feedback about its support system.

MyFundedFutures Support and Resources

MyFundedFutures has a more prominent community presence, reflected in its 4.8/5.0 Trustpilot rating from 399 reviews. This larger review base indicates higher community involvement and more verified feedback. Serving over 70,000 traders as of early 2026, the company fosters a strong network for knowledge-sharing.

Support is available through email, live chat, and a Help Center filled with detailed articles and policy documentation. While the platform does not offer formal trading education, it features an automated payout approval system that processes most requests instantly, minimizing delays for funded traders. Additionally, the company encourages community-driven discussions on topics like rapid evaluation paths and scaling options, reinforcing trader confidence.

These support features, combined with earlier insights on pricing and technology, provide a clearer picture of how each firm operates.

Comparison Table: Support and Resources

| Feature | Bulenox | MyFundedFutures |

|---|---|---|

| Trustpilot Rating | 4.7/5.0 | 4.8/5.0 |

| Number of Reviews | 91 | 399 |

| Support Channels | Email, Help Center | Email, Live Chat, Help Center |

| Educational Content | No built-in education | No formal education |

| Community Size | Not specified | 70,000+ traders |

| Automated Notifications | Yes (email) | Not specified |

| Payout Processing | Not specified | Mostly instant |

Pros and Cons of Each Firm

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Here’s a breakdown of the strengths and drawbacks of each firm, highlighting their unique features and trade-offs.

Pros and Cons of Bulenox

Bulenox stands out with its 14-day free trial and flexible evaluation models, tailored to different trading styles. It offers two distinct options: Real-Time Trailing Drawdown for scalpers and End-of-Day (EOD) Drawdown with scaling for swing traders. Another plus is its trader-friendly policy that allows pausing trading after hitting the daily loss limit. On the flip side, Bulenox enforces a "Safety Threshold" reserve, which reduces the amount of capital traders can actively use.

Pros and Cons of MyFundedFutures

MyFundedFutures simplifies the evaluation process with streamlined one-step plans designed to meet various trading needs. However, its sole reliance on EOD drawdown might not align with every trading strategy, making it less versatile for some traders. These factors make it essential for traders to weigh their preferences and risk tolerance when choosing this option.

Comparison Table: Pros and Cons

| Aspect | Bulenox | MyFundedFutures |

|---|---|---|

| Key Advantages | 14-day free trial; 100% of first $10,000 profits; flexible evaluation models; trader-friendly loss policy | Multiple one-step evaluation plans |

| Key Disadvantages | Enforced Safety Threshold reserve limits active capital deployment | Primarily limited to EOD drawdown logic |

| Best For | Traders seeking trial periods and varied evaluation styles | Traders preferring a straightforward one-step evaluation process with clear risk management |

Conclusion and Recommendation

Key Takeaways

Both firms offer a 90% profit split once traders earn their first $10,000. Bulenox provides larger account sizes, going up to $250,000, compared to MyFundedFutures’ maximum of $150,000. However, MyFundedFutures stands out with payouts processed within 6–12 hours for Starter plans, while Bulenox handles withdrawals on a weekly basis, typically on Wednesdays. When it comes to trading platforms, MyFundedFutures supports popular choices like TradingView and Tradovate, while Bulenox offers access to more specialized platforms such as Sierra Chart and Bookmap. These differences highlight how each firm caters to different trader needs.

Which Firm Is Best for You?

Looking at the comparisons:

- Choose Bulenox if you need access to larger capital, a 14-day trial, and a variety of specialized platforms. Their $78 reset fee is helpful for traders needing multiple attempts at evaluation. The two-step evaluation program is ideal for those who prefer a more measured qualification process.

- Choose MyFundedFutures for faster profit access, compatibility with platforms like TradingView or Tradovate, and a streamlined evaluation process. Their one-step evaluation can be completed in as little as two trading days. The Expert plans remove daily loss limits entirely, offering greater flexibility. Additionally, MyFundedFutures boasts a 4.8/5.0 Trustpilot rating from 399 reviews, compared to Bulenox’s 4.7/5.0 rating from 91 reviews, reflecting a broader user base.

For cost-conscious beginners, Bulenox’s low entry fees and free trial minimize financial risks. On the other hand, MyFundedFutures’ quick payouts and simplified process make it a better fit for traders looking to access capital more quickly. Both firms, based in the U.S. and operating since 2022, provide solid options depending on your trading priorities.

FAQs

How do the evaluation processes of Bulenox and MyFundedFutures differ?

Bulenox and MyFundedFutures take different paths when it comes to evaluating traders.

Bulenox operates with a one-time activation fee, which depends on the account size you choose. This fee grants you access to trading platforms, real-time market data, and account maintenance. To transition into live trading, traders must adhere to specific risk management guidelines and trading rules.

MyFundedFutures opts for a quicker, more straightforward process, often using a single-step challenge. This allows traders to showcase their skills and qualify for funding without delay. The firm emphasizes efficiency, clear processes, and simple profit-sharing setups.

In essence, Bulenox offers a more structured, fee-based approach, while MyFundedFutures leans into speed and simplicity, appealing to different trading styles and goals.

What are the differences in trading platform options between Bulenox and MyFundedFutures?

Bulenox and MyFundedFutures take different routes when it comes to trading platforms, each catering to distinct trader preferences.

Bulenox provides a proprietary platform tailored specifically for its evaluation and funded trading programs. The platform is designed with simplicity in mind and includes built-in risk management tools that align with Bulenox’s trading rules.

In contrast, MyFundedFutures offers more flexibility by supporting popular third-party platforms like TradingView, NinjaTrader, and Tradovate. This gives traders access to familiar tools, advanced charting capabilities, and customizable interfaces, making it easier to adapt the platform to their trading style.

The decision boils down to what you value more: the streamlined, rule-specific setup of Bulenox’s platform or the versatility and familiarity that MyFundedFutures provides through its third-party integrations.

Which firm lets traders access profits faster, and why?

Bulenox gives traders the chance to access profits faster through its straightforward two-step evaluation process that comes with fewer restrictions. This setup allows traders to transition quickly from qualification to trading on live funded accounts.

On top of that, Bulenox provides clear payout terms and affordable reset fees, ensuring traders can earn and withdraw their profits without unnecessary hold-ups. With flexible account choices and rules that are easy to navigate, even for beginners, Bulenox lowers the barriers to entry, helping traders start earning faster compared to firms with more rigid evaluation or scaling processes.