dxFeed vs Rithmic: Which Market Data Feed Should You Choose?

When deciding between dxFeed and Rithmic, the choice depends on your trading priorities. Here's a quick breakdown:

- dxFeed: Best for traders focused on data accuracy, historical analysis, and analytics. It offers access to over 2.5 million instruments, including equities, futures, options, forex, and crypto, with historical tick-level data dating back to 2009 (some as far as 1991). Pricing starts at $19/month, but it’s a data-only provider, meaning you’ll need a separate broker for trade execution. It’s ideal for equity traders and those who rely on detailed market insights but lacks Market by Order (MBO) data and macOS compatibility.

- Rithmic: Perfect for futures traders who prioritize low-latency execution and real-time order flow transparency. It combines data delivery with Direct Market Access (DMA), offering unfiltered tick-by-tick data and MBO for granular insights. Pricing includes a $25 monthly connection fee plus $0.10 per contract per side. Rithmic supports both data and execution, making it the go-to choice for high-frequency trading and scalping strategies.

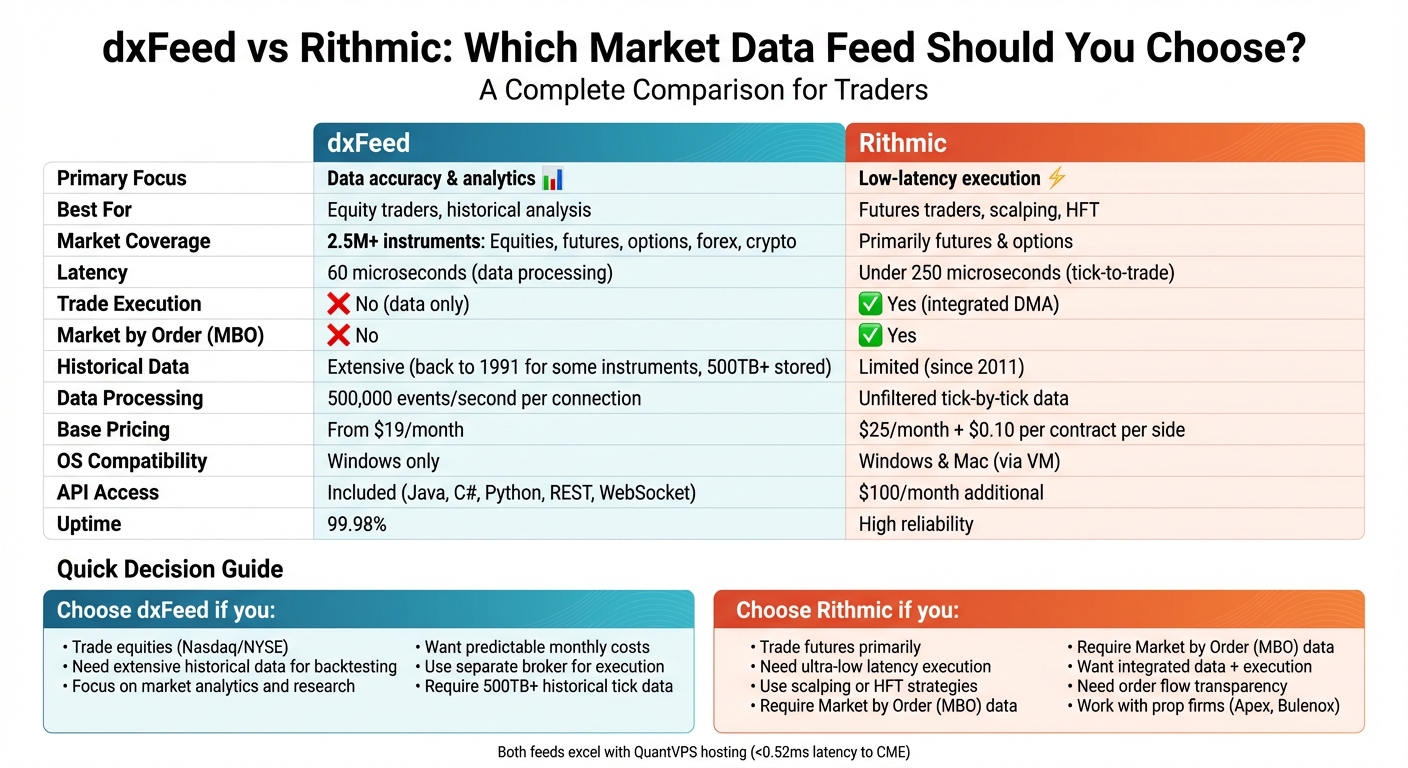

Quick Comparison

| Feature | dxFeed | Rithmic |

|---|---|---|

| Focus | Data accuracy & analytics | Low-latency execution |

| Market Coverage | Equities, futures, forex, crypto | Primarily futures & options |

| Latency | 60 microseconds (data focus) | Under 250 microseconds |

| Execution | No (data only) | Yes |

| MBO Data | No | Yes |

| Pricing | From $19/month | $25/month + $0.10 per side |

| OS Compatibility | Windows only | Windows & Mac (via VM) |

| Historical Data | Extensive (up to 1991) | Limited (since 2011) |

Key Takeaway: Choose dxFeed for deep market analytics and historical data, especially if you’re trading equities. Opt for Rithmic if you need ultra-low latency, integrated execution, and advanced order flow tools for futures trading.

dxFeed vs Rithmic Market Data Feed Comparison Chart

dxFeed vs Rithmic Market Data Feed Comparison Chart

dxFeed: Institutional-Grade Data Provider

Key Features of dxFeed

dxFeed offers two distinct data models: "Ticker" (a bandwidth-efficient, conflated option) and "Stream" (a lossless, uncompressed option). This dual approach gives traders the flexibility to prioritize either speed or complete data accuracy, depending on their trading strategies.

From a technical perspective, dxFeed boasts an average latency of just 60 microseconds and maintains an impressive repository of tick-level historical data. It stores over 500 terabytes of compressed tick-level data, with most records dating back to 2009 and, for some instruments, as far back as 1991. A single dxLink connection is capable of handling approximately 500,000 events per second.

"dxFeed is parsing, indexing and storing up to 10Tb of raw data every day and makes it available for users."

- dxFeed

"dxFeed is parsing, indexing and storing up to 10Tb of raw data every day and makes it available for users."

- dxFeed

The platform also supports a variety of integration options, including Java, C/C#, Python, FIX, REST, and WebSocket APIs. For options traders, dxFeed calculates Greeks using Black-Scholes and Bjerksund-Stensland models, offering theoretical pricing and implied volatility. Additionally, its proprietary "Inforider" terminal enables real-time market rewind and tick-level replay, making it a powerful tool for analyzing market activity.

These features make dxFeed a strong choice for both institutional and retail traders who demand precision and reliability.

Benefits for Traders

dxFeed's advanced infrastructure delivers tailored benefits for both institutional and retail algorithmic trading platforms.

Institutional traders gain from the platform's "Data Lake" infrastructure, which provides fast access to historical data and scalable cloud-based solutions for algorithmic strategies. dxFeed is widely used in institutional trading environments, supporting up to 200,000 simultaneous streaming clients.

Retail algorithmic traders also benefit from dxFeed's integration with popular platforms like ATAS, Quantower, and Bookmap. Subscription plans start at an accessible $19/month. With coverage spanning 2.5 million instruments, traders can access equities, futures, options, forex, and crypto - all from a single provider. For those focusing on volume analysis, the "Stream" delivery contract offers non-conflated data, crucial for detailed volume studies.

Drawbacks to Consider

While dxFeed offers a robust array of features, there are some limitations that traders should keep in mind.

First, dxFeed is strictly a data provider and does not support trade execution. This means traders need to pair it with a separate broker to place orders, adding an extra layer of complexity compared to platforms that integrate both data and execution.

Another drawback is the lack of CME futures MBO (Market by Order) data, which can hinder strategies reliant on identifying individual queue positions or iceberg orders - key elements for granular order flow analysis.

macOS users may also face challenges, as dxFeed is not compatible with Mac systems, even when using virtual machines like Parallels. Additionally, while Java, C#, and FIX APIs offer the lowest latency, REST and Python APIs tend to have higher latency. Historical Greeks, a valuable feature for options traders, require direct contact with sales rather than being accessible through standard API integration. Finally, some platforms, such as Bookmap, may impose restrictions on certain strategies and indicators when used with dxFeed.

Rithmic: Low-Latency Execution Feed

Key Features of Rithmic

Rithmic is a Direct Market Access (DMA) execution platform designed with speed as its core focus. It achieves tick-to-trade execution in under 250 microseconds. This impressive performance is possible thanks to its proprietary binary protocol running over TCP/IP and a C++ native core, which avoids the delays caused by garbage collection pauses often seen in other systems.

Unlike retail feeds that typically provide 100ms snapshots, Rithmic delivers unfiltered tick data, capturing every trade and bid/ask update in real time. The platform currently processes about 20% of the daily global futures trading volume.

One of its standout features is Market by Order (MBO) data, which shows individual queue positions and specific order sizes at each price level. This granular insight allows traders to identify synthetic iceberg orders and analyze the complete depth of the order book - details not available in standard Level 2 feeds. Additionally, Rithmic's "Plugin Mode" lets users connect multiple trading platforms to a single data feed simultaneously. The platform’s server-side order management ensures that tools like brackets and trailing stops remain active even if your local machine crashes.

Benefits for Traders

Rithmic's technical capabilities offer clear advantages for traders, particularly those engaged in high-frequency trading or scalping. Its co-located servers in Chicago are located near CME's matching engines, reducing transmission delays. For strategies that depend on cumulative delta or order flow analysis, Rithmic’s precise timestamps and tick-by-tick data provide unmatched accuracy for volume profiles, outperforming aggregated feeds.

The platform supports over 20 third-party applications, including NinjaTrader, Sierra Chart, Bookmap, and Quantower. Its R|Trader Pro tool enables two-way communication with Microsoft Excel, allowing quants to create custom indicators and automate trades directly from spreadsheets. With its broker-neutral setup, traders gain access to multiple exchanges and asset classes, along with historical tick data dating back to 2011.

Futures traders particularly appreciate the auto-liquidate feature, which automatically closes positions and locks the account for the day if a pre-set daily loss limit is reached. This provides a critical layer of risk management for active traders.

Drawbacks to Consider

While Rithmic excels in speed and execution, it does come with some downsides. The platform has a steep learning curve and an outdated user interface, which many users find rigid. R|Trader Pro has received a 1.8/5 rating on Trustpilot from 23 reviews, with frequent complaints about the lack of built-in charting in the basic version and poor functionality in its mobile app.

Compared to platforms like dxFeed, which offer extensive historical data repositories, Rithmic focuses more on real-time execution than analytics. Beginners may find it challenging to get started due to the limited educational resources and tutorials provided. Its market coverage primarily targets futures and forex, making it less ideal for traders who need equities or options data with calculated Greeks.

Connection quality can vary depending on the broker. While brokers like AMP or Optimus Futures deliver reliable performance, traders using lower-tier prop firm setups have reported occasional lags. The system requires a dual-core CPU and 4GB of RAM, and traders are advised to use a wired Ethernet connection instead of Wi-Fi to reduce local latency. Although Rithmic supports multiple operating systems, it is primarily optimized for Windows, which could present challenges for Mac and Linux users.

dxFeed vs Rithmic: Side-by-Side Comparison

Comparison Metrics

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

Choosing between dxFeed and Rithmic depends heavily on your trading needs and priorities. Rithmic is tailored for high-frequency traders, offering ultra-low latency execution to meet the demands of speed-sensitive strategies. On the other hand, dxFeed stands out with its emphasis on data accuracy and advanced analytics, making it ideal for traders focused on detailed market insights.

One notable difference lies in how they handle data delivery. Rithmic streams every trade tick in real time, ensuring unfiltered data precision. Meanwhile, dxFeed provides both tick data and aggregated options, giving traders the flexibility to balance bandwidth usage and analytical depth. For those aiming to analyze order book depth or uncover iceberg orders, Rithmic’s Market by Order (MBO) data is a valuable feature. It offers granular details, such as individual queue positions and order sizes, which are essential for these advanced analyses.

Another key distinction is in execution capabilities. Rithmic combines data and execution into a single, seamless solution, making it a streamlined choice for active traders. In contrast, dxFeed primarily serves as a data-only provider in many retail setups, requiring a separate broker connection for executing trades. This difference makes Rithmic a more convenient option for traders who prefer an all-in-one platform.

"dxFeed offers historical market data and Rithmic focuses on low latency and high throughput trade execution software."

- Andry API support, Bookmap

"dxFeed offers historical market data and Rithmic focuses on low latency and high throughput trade execution software."

- Andry API support, Bookmap

Ultimately, the right choice depends on your trading style and what metrics matter most to you. The table below highlights the primary differences to help you decide.

Comparison Table

| Metric | dxFeed | Rithmic | Winner/Notes |

|---|---|---|---|

| Primary Focus | Data accuracy and analytics | Low-latency execution | Rithmic for speed; dxFeed for analysis |

| Latency | High-speed with an analytical focus | Ultra-low latency, high throughput | Rithmic |

| Data Type | Tick, Aggregated, L1, L2 | Unfiltered Tick, L1, L2, MBO | Rithmic (for unfiltered/MBO) |

| Execution | Data only (requires broker connection) | Integrated data and execution | Rithmic |

| Market Coverage | Equities & Futures | Primarily Futures & Options | dxFeed (for stocks) |

| OS Compatibility | Windows only | Windows & Mac (via virtual machine) | Rithmic |

| Historical Data | Extensive historical data services | Focus on real-time execution | dxFeed |

Both feeds are excellent for professional volume analysis. Platforms like Overcharts recommend Rithmic for futures trading and dxFeed for U.S. equities. However, it’s important to remember that external factors, such as your internet connection or computer performance, can also influence latency and overall trading experience. While choosing the right feed is critical, these external elements shouldn’t be overlooked.

Performance and Reliability

Latency and Speed

Rithmic sets the bar high for ultra-low latency execution, catering to traders who demand speed-critical performance. Designed with high-frequency trading in mind, where every microsecond can make a difference, Rithmic excels when hosted on an Chicago VPS providers near CME servers. In this setup, it achieves latency as low as 0.52 milliseconds. This makes it a favorite among scalpers and proprietary traders who depend on instantaneous market updates.

On the other hand, dxFeed prioritizes data processing speed over execution. It excels in handling event streams with exceptional efficiency, making it ideal for institutional analytics and strategies that require processing vast amounts of market data rapidly. However, since dxFeed functions primarily as a data provider rather than an execution platform, traders need a separate broker connection to place trades.

"Our core technology processes a typical event stream at 60 microseconds on average."

- dxFeed

"Our core technology processes a typical event stream at 60 microseconds on average."

- dxFeed

The distinction between the two lies in their optimization focus. Rithmic is fine-tuned for the entire execution loop, from receiving data to sending orders back to the exchange. Meanwhile, dxFeed emphasizes delivering data and processing analytics efficiently. For traders using dxFeed, Java, C#, or FIX APIs are recommended for the lowest latency, as REST or Python options may introduce delays. Rithmic, with its direct exchange connectivity, reduces network hops to maintain consistently low latency, even during peak trading volumes.

Next, let’s explore how each platform ensures data accuracy and system stability.

Data Accuracy and System Stability

Speed is important, but precision and stability are just as critical, especially in volatile markets. Rithmic provides unfiltered tick-by-tick data, capturing every price movement in real time. This approach ensures traders have a complete view of the market, which is essential for strategies like order flow analysis and cumulative delta during high-volatility sessions.

"Rithmic's infrastructure is known for high reliability and precise time stamps, which are critical for ensuring the accuracy of order flow calculations."

"Rithmic's infrastructure is known for high reliability and precise time stamps, which are critical for ensuring the accuracy of order flow calculations."

dxFeed takes a different approach to stability by leveraging smart bandwidth management. During extreme market activity, it offers two types of data contracts: "Ticker" contracts, which use conflation to reduce bandwidth while keeping the latest values up to date, and "Stream" contracts, which deliver all events without conflation for lossless data transmission. This dual approach helps prevent system overload during data surges, supported by dxFeed's resilient infrastructure.

For traders using cumulative delta strategies, Rithmic’s precise timestamps and unfiltered data ensure accuracy, even under volatile conditions. In contrast, some other feeds might introduce minor discrepancies. Meanwhile, dxFeed boasts over 500 terabytes of compressed tick-level historical data stored in its Compressed Data Format (CDF), ensuring no data loss during storage and retrieval. While Rithmic is laser-focused on execution precision, dxFeed emphasizes consistent data delivery and in-depth historical data access. The choice between the two ultimately depends on whether your priority is real-time execution accuracy or comprehensive analytical capabilities.

Using dxFeed and Rithmic with QuantVPS

Performance Benefits with QuantVPS

QuantVPS, located in Chicago near the CME matching engines, offers lightning-fast latency of under 0.52 milliseconds to the exchange. Built with high-performance AMD processors, NVMe storage, and generous DDR memory, it’s designed to eliminate bottlenecks. This is crucial for platforms like dxFeed, which can handle up to 500,000 events per second through a single dxLink connection, and Rithmic, which requires seamless and rapid order execution. To top it off, QuantVPS guarantees 99.999% uptime, ensuring uninterrupted trading even if your local computer fails.

"Our Chicago datacenter provides ultra-low latency (<0.52ms) directly to the CME exchange, enabling faster futures trade execution and significantly minimizing slippage." - QuantVPS

"Our Chicago datacenter provides ultra-low latency (<0.52ms) directly to the CME exchange, enabling faster futures trade execution and significantly minimizing slippage." - QuantVPS

On January 5, 2026, QuantVPS low-latency servers supported over $10.89 billion in futures volume traded within a single 24-hour period. For Mac users struggling with dxFeed's lack of macOS support - even via virtual machines like Parallels - a Windows-based QuantVPS offers a straightforward solution, removing compatibility headaches. These features make it easy to integrate and maximize platform performance.

Platform Integration

QuantVPS works seamlessly with popular trading platforms like NinjaTrader, Quantower, Sierra Chart, TradeStation, and MetaTrader 4/5. For the best performance when using dxFeed or Rithmic, selecting Chicago-based data endpoints minimizes internal latency.

Since dxFeed is a data-only feed, pairing it with a broker connection on QuantVPS allows traders to access institutional-grade data while executing orders. Rithmic, with its integrated execution capabilities, further simplifies the trading process. This makes it especially appealing for futures traders working with prop firms such as Apex or Bulenox. QuantVPS efficiently handles demanding tasks like processing Rithmic’s MBO data and dxFeed’s high-throughput streams without missing a beat. This tight integration of data and execution ensures smooth workflows, helping traders achieve better results.

Pricing Comparison

Pricing Table

Rithmic charges a $25 monthly connection fee along with $0.10 per contract per side (equivalent to $0.20 per round turn). For users of the Rithmic API, there's an additional $100 monthly fee, plus the same $0.10 routing fee. Professional traders incur even higher costs, with fees set at $111 per exchange per month.

On the other hand, dxFeed's pricing depends on the platform used. It starts at $19 per month when accessed through Quantower, ATAS, or Optimus Flow, and $37 per month via Bookmap.

| Feature | dxFeed | Rithmic |

|---|---|---|

| Base Monthly Fee | From $19 (platform dependent) | $25 (connection fee) |

| Routing Fees | N/A (data only) | $0.10 per contract |

| Professional Fee | Varies by exchange | $111 per exchange |

| API Access | Included | $100/month |

| Trading Capability | No | Yes |

This table highlights the primary cost components, showcasing how each platform's pricing structure aligns with its intended use.

Cost vs. Performance Analysis

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

When comparing costs to performance, Rithmic's price structure reflects its dual purpose as both a data feed and an execution platform. The reduction in routing fees - from $0.25 to $0.10 per contract - translates to a savings of $0.30 per round turn. For traders handling hundreds of contracts daily, these savings can accumulate quickly. Additionally, Rithmic's low-latency vs. ultra-low latency execution is particularly appealing to professional proprietary trading firms that prioritize speed and reliability.

In contrast, dxFeed is better suited for traders focused on market analysis. With monthly fees ranging from $19 to $37 and no per-trade costs, it provides a predictable pricing model for those who need full order depth across thousands of price levels. However, dxFeed lacks trading capabilities, meaning users must rely on separate brokers for execution. The trade-off is straightforward: Rithmic offers an all-in-one solution with higher per-trade costs, while dxFeed keeps monthly expenses steady but requires additional infrastructure for trade execution.

Rithmic vs dxFeed Honest Comparison: Which One Powers Better Trading 2025?

Which Feed Should You Choose?

Deciding on the right feed depends on your trading goals and how you plan to execute your strategies. Here's a breakdown to guide your choice.

When to Choose dxFeed

dxFeed is ideal for equity traders focusing on Nasdaq and NYSE markets. As noted by Overcharts:

"If you are interested in the Nasdaq/NYSE market, the correct choice is dxFeed".

"If you are interested in the Nasdaq/NYSE market, the correct choice is dxFeed".

This feed is particularly useful for those who rely on deep historical data and advanced analytics. It's a go-to option for quantitative traders and portfolio managers who need to backtest strategies or study long-term market trends. If you primarily use charting tools for market analysis, dxFeed delivers top-tier volume data while allowing you to keep your current broker for order execution. It’s a great fit for those prioritizing analytics over execution. However, if your strategy leans heavily on precise execution, you might want to look into Rithmic instead.

When to Choose Rithmic

Rithmic stands out for futures traders who need a tightly integrated solution for both data and execution. Known for its low latency, this feed is designed for high-frequency trading, scalping, and order flow strategies where every millisecond counts.

Its Market by Order (MBO) data is a game-changer for traders using cumulative delta strategies or trying to spot iceberg orders by analyzing individual queue positions. Confluence Trading highlights:

"For cumulative delta-based strategies, Rithmic is typically the better choice due to its: 1. Superior tick-by-tick data. 2. Lower latency. 3. Higher reliability for volume profile and order flow calculations".

"For cumulative delta-based strategies, Rithmic is typically the better choice due to its: 1. Superior tick-by-tick data. 2. Lower latency. 3. Higher reliability for volume profile and order flow calculations".

If you’re working with a proprietary trading firm like Apex or Bulenox, Rithmic is often the default choice because of its compatibility with trade copiers and its ultra-low latency connection to the CME.

Final Recommendation

Key Takeaways

Both Rithmic and dxFeed provide professional-grade market data, but they cater to distinct trading needs. Rithmic is tailored for futures traders who demand ultra-low latency and detailed Market by Order (MBO) data. Its infrastructure delivers unfiltered, tick-by-tick data directly from exchanges, making it a go-to choice for high-frequency trading and order flow strategies.

On the other hand, dxFeed stands out as a data-focused solution for equity traders targeting Nasdaq and NYSE markets. With a 99.98% uptime, over 500 terabytes of historical data, and processing speeds of 60 microseconds, it’s ideal for tasks like backtesting and quantitative analysis. These differences highlight how each provider aligns with specific trading styles.

Pricing structures also reflect their unique approaches. dxFeed operates with higher fixed costs, while Rithmic charges per-trade fees - approximately $0.10 per side when bundled with brokers. Additionally, dxFeed does not natively support Mac systems, whereas Rithmic does.

How to Choose the Right Provider

Your choice should depend on your trading instruments and strategies. Futures traders will likely benefit more from Rithmic, especially if you rely on scalping, cumulative delta methods, or iceberg order detection. Its compatibility with tools like NinjaTrader and Sierra Chart makes it a strong option for automated trading. If you’re trading with a proprietary firm like Apex or Bulenox, Rithmic is often the default choice.

For equity traders focused on U.S. markets, dxFeed is a better fit. Its extensive Nasdaq and NYSE data coverage is particularly useful if you prefer to keep your data provider separate from your execution broker. For instance, you could analyze the market using dxFeed while placing orders through Interactive Brokers.

If you’re using either feed on QuantVPS, the advantages multiply. QuantVPS offers ultra-low latency (0–1ms) and a 100% uptime guarantee, ensuring you get the most out of Rithmic’s speed or dxFeed’s data depth without performance issues. Its compatibility with platforms like NinjaTrader also allows you to adapt and switch between feeds as your trading strategies evolve.

FAQs

What are the main differences between dxFeed and Rithmic for market data?

When it comes to real-time market data, dxFeed and Rithmic serve different purposes depending on factors like latency, asset coverage, and ease of integration. Rithmic is well-known for its ultra-low latency and tick-by-tick data, making it a go-to option for high-frequency and algorithmic traders who primarily focus on futures markets. On the other hand, dxFeed stands out for its wide asset coverage, spanning equities, ETFs, forex, crypto, and futures. It also offers a scalable, cloud-based setup and flexible subscription plans.

If your priority is ultra-fast, sub-millisecond order-flow data, Rithmic is likely the better fit, although it tends to be more expensive and involves a more intricate integration process. However, if you're looking for a solution that supports multiple asset types, provides smoother platform integration, and offers cost-effective options for both retail and institutional traders, dxFeed is the more practical choice.

How does dxFeed's historical data service compare to Rithmic's?

dxFeed offers a comprehensive range of historical data services tailored for traders seeking detailed market insights. With its cloud-based APIs, users can access raw tick-by-tick data, aggregated candlestick charts, and even replay entire market sessions. The platform supports customizable formats like OHLCV and renko, making it adaptable to various trading strategies. Plus, it’s compatible with multiple programming languages, including Python, Java, and JavaScript, ensuring accessibility for developers across different tech stacks.

One standout feature is dxFeed’s market data replay. This tool stores tick data with millisecond-level timestamps, making it a powerful resource for back-testing and conducting thorough market analysis.

On the other hand, Rithmic’s approach to historical data is less transparent, with limited details available. This lack of clarity makes direct comparisons challenging, but dxFeed clearly shines with its broad range of historical data options and user-friendly flexibility.

Why might futures traders choose Rithmic over dxFeed?

Futures traders often turn to Rithmic for its ultra-low-latency, tick-by-tick data streaming directly from exchanges. This data includes detailed order-flow insights, like market-by-order depth, which provides granular details and precise timestamps. These attributes are especially useful for traders employing high-frequency strategies or delta-based analysis.

When stacked against dxFeed, Rithmic’s data feed is frequently regarded as a more dependable choice for those who demand real-time precision and minimal lag in fast-paced trading environments.

When it comes to real-time market data, dxFeed and Rithmic serve different purposes depending on factors like latency, asset coverage, and ease of integration. Rithmic is well-known for its ultra-low latency and tick-by-tick data, making it a go-to option for high-frequency and algorithmic traders who primarily focus on futures markets. On the other hand, dxFeed stands out for its wide asset coverage, spanning equities, ETFs, forex, crypto, and futures. It also offers a scalable, cloud-based setup and flexible subscription plans.

If your priority is ultra-fast, sub-millisecond order-flow data, Rithmic is likely the better fit, although it tends to be more expensive and involves a more intricate integration process. However, if you're looking for a solution that supports multiple asset types, provides smoother platform integration, and offers cost-effective options for both retail and institutional traders, dxFeed is the more practical choice.

dxFeed offers a comprehensive range of historical data services tailored for traders seeking detailed market insights. With its cloud-based APIs, users can access raw tick-by-tick data, aggregated candlestick charts, and even replay entire market sessions. The platform supports customizable formats like OHLCV and renko, making it adaptable to various trading strategies. Plus, it’s compatible with multiple programming languages, including Python, Java, and JavaScript, ensuring accessibility for developers across different tech stacks.

One standout feature is dxFeed’s market data replay. This tool stores tick data with millisecond-level timestamps, making it a powerful resource for back-testing and conducting thorough market analysis.

On the other hand, Rithmic’s approach to historical data is less transparent, with limited details available. This lack of clarity makes direct comparisons challenging, but dxFeed clearly shines with its broad range of historical data options and user-friendly flexibility.

Futures traders often turn to Rithmic for its ultra-low-latency, tick-by-tick data streaming directly from exchanges. This data includes detailed order-flow insights, like market-by-order depth, which provides granular details and precise timestamps. These attributes are especially useful for traders employing high-frequency strategies or delta-based analysis.

When stacked against dxFeed, Rithmic’s data feed is frequently regarded as a more dependable choice for those who demand real-time precision and minimal lag in fast-paced trading environments.

"}}]}