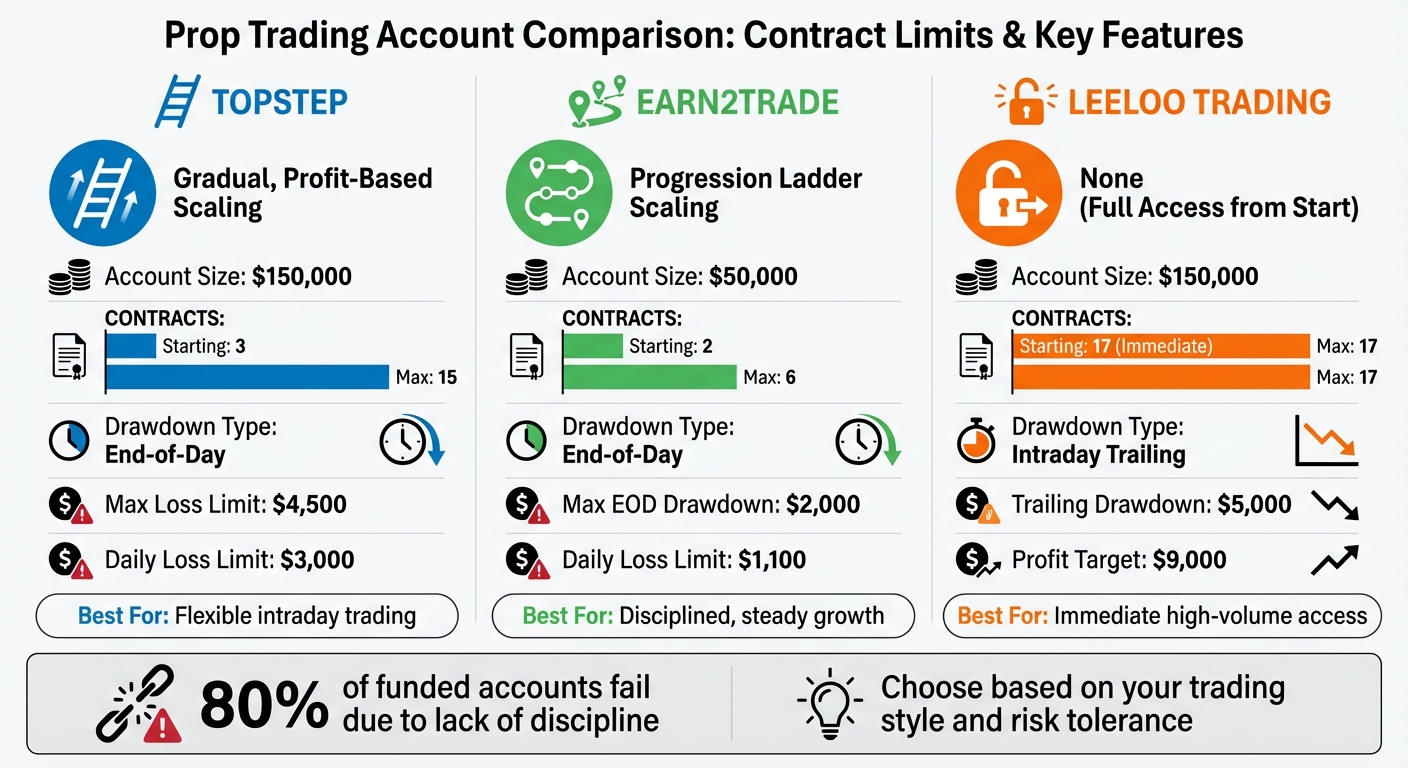

Prop trading accounts let you trade ES and NQ futures contracts without risking personal funds. However, the number of contracts you can trade depends on the account size, firm-specific rules, and your performance. Here’s a quick breakdown:

- Topstep: Gradual scaling based on account balance. A $150,000 account starts with 3 contracts and increases to 15 as profits grow.

- Earn2Trade: Uses a "Progression Ladder." Contract limits grow as you hit profit milestones. A $50,000 account starts with 2 contracts, scaling to 6 with $2,000 in profits.

- Leeloo Trading: Offers immediate access to full contract limits. A $150,000 account allows up to 17 contracts from the start but uses a trailing drawdown system.

Each firm has unique risk rules, such as daily loss limits, drawdowns, and scaling plans. Choose the one that aligns with your trading style and risk tolerance.

Quick Comparison:

| Firm | Account Size | Starting Contracts | Max Contracts | Scaling Plan | Trailing Drawdown |

|---|---|---|---|---|---|

| Topstep | $150,000 | 3 | 15 | Gradual, profit-based | End-of-Day |

| Earn2Trade | $50,000 | 2 | 6 | Progression Ladder | End-of-Day |

| Leeloo Trading | $150,000 | 17 | 17 | None (full access) | Intraday |

The right choice depends on how much flexibility and risk management you need. Always align contract sizes with your trading plan to avoid overleveraging.

Prop Trading Firms Contract Limits Comparison: Topstep vs Earn2Trade vs Leeloo Trading

Prop Trading Firms Contract Limits Comparison: Topstep vs Earn2Trade vs Leeloo Trading

1. Topstep

Topstep offers three account options: $50,000, $100,000, and $150,000. The largest account allows trading up to 15 ES or NQ contracts, but this is unlocked gradually through a scaling plan.

Risk Limits

Each account size comes with specific risk limits:

- $50,000 account: Maximum Loss Limit of $2,000 and Daily Loss Limit of $1,000.

- $100,000 account: Maximum Loss Limit of $3,000 and Daily Loss Limit of $2,000.

- $150,000 account: Maximum Loss Limit of $4,500 and Daily Loss Limit of $3,000.

These limits apply to both realized and unrealized P&L. All positions must be closed by 3:10 PM CT or at market close. If you briefly exceed the contract limit (within 10 seconds), it won’t result in penalties .

Scaling Plans

Topstep’s scaling plan aligns contract allowances with your account balance. For Express Funded Accounts, contract limits are tied to the end-of-day balance. For example, in a $150,000 account:

- When the balance is between $150,000 and $151,499, the contract limit is 3 contracts.

- Once the balance reaches $154,500, the limit increases to 15 contracts.

Session profits update the next day, as limits refresh at 5:00 PM CT.

On TopstepX, a 10:1 ratio applies to Micro contracts – 15 standard contracts translate to 150 MES or MNQ contracts . However, third-party platforms like NinjaTrader or Tradovate count 1 Micro as 1 contract, which reduces the number of contracts you can trade .

2. Earn2Trade

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

Earn2Trade takes a different approach by using a Progression Ladder instead of traditional margin requirements. Unlike fixed margin systems used by other firms, this ladder adjusts contract limits based on your account balance and profit milestones, rewarding strong performance with greater trading capacity.

Risk Limits

Earn2Trade provides two main programs: Trader Career Path (TCP) and Gauntlet Mini. Each account size comes with its own set of risk parameters:

| Account Size | Daily Loss Limit | Max EOD Drawdown | Profit Target | Initial Contracts |

|---|---|---|---|---|

| $25,000 | $550 | $1,500 | $1,750 | 3 Contracts |

| $50,000 | $1,100 | $2,000 | $3,000 | 2 Contracts |

| $100,000 | $2,200 | $3,500 | $6,000 | 6 Contracts |

| $150,000 | $3,300 | $4,500 | $9,000 | 15 Contracts |

| $200,000 | $4,400 | $6,000 | $11,000 | 16-20 Contracts |

During evaluations, Earn2Trade uses an End-of-Day (EOD) trailing drawdown, which updates only at market close. Additionally, all positions must be closed by 3:50 PM CT. To maintain balance, the firm enforces a rule that no single trading day can account for more than 30% of the total profit.

This system naturally transitions into a profit-based scaling plan, where contract limits increase as you achieve specific profit levels.

Scaling Plans

The Progression Ladder ties contract limits directly to your profits. For example, with a $50,000 account, you start with 2 contracts. Reaching a $1,500 profit increases the limit to 4 contracts, and hitting $2,000 allows for 6 contracts.

For traders using Micro contracts, 10 MES or MNQ contracts are equivalent to 1 standard ES or NQ contract within the contract limit. The TCP program provides a clear progression path, starting from a $50,000 account and scaling up to $400,000, with a fixed drawdown at the top tier.

In 2024, Earn2Trade reported a 10.42% pass rate for its programs. Among the successful traders, 94.77% opted for LiveSim accounts over Live accounts.

3. Leeloo Trading

Leeloo Trading stands out from competitors like Topstep and Earn2Trade by offering traders immediate access to full buying power and a unique set of risk rules. Unlike other firms that require traders to hit profit milestones to unlock capacity, Leeloo allows full contract usage right from the start. Each account size comes with fixed contract limits, ensuring traders have access to the maximum allowed contracts within predefined risk parameters. This setup eliminates the need for gradual unlocking, which is common in other proprietary trading accounts.

Risk Limits

Leeloo employs a Rising Trailing Max Drawdown system, also known as the Auto Liquidate Threshold Value (ALTV). This system tracks the highest unrealized profit during a trade, adjusting the drawdown floor as profits increase. However, the floor remains fixed if the trade retraces. For instance, if your NQ position gains $2,000 but then pulls back significantly without being closed, your account could still hit the liquidation threshold – even if you initially had a sufficient buffer.

Another key rule is the 30% consistency requirement for Performance Accounts. This means no single trading day can account for more than 30% of your total profit when requesting a payout. Additionally, traders must close all standard ES and NQ positions 15 minutes before market close (4:45 PM ET). However, up to 3 micro contracts (MES/MNQ) can be held overnight without prior approval.

| Account Size | Max Contracts | Trailing Drawdown (ALTV) | Profit Target |

|---|---|---|---|

| $25,000 | 3 | $1,500 | $1,500 |

| $50,000 | 8 | $2,500 | $3,000 |

| $100,000 | 12 | $3,000 | $6,000 |

| $150,000 | 17 | $5,000 | $9,000 |

| $250,000 | 27 | $6,500 | $15,000 |

| $300,000 | 30 | $7,500 | $20,000 |

Scaling Plans

Leeloo offers two account types with different approaches to scaling. The Investor Account provides immediate access to the full contract limit, with no restrictions on scaling. On the other hand, the Accelerator Account follows a mandatory scaling plan. Traders in this account start with just 2 contracts and gradually increase their limits by hitting specific profit milestones.

In terms of payouts, traders keep 100% of their first $8,000 in profits. After that, profits are split 80/20 for the first year and shift to a 90/10 split thereafter. This payout structure adds flexibility and rewards long-term performance.

Pros and Cons

When evaluating the trading constraints of different proprietary firms, it’s important to weigh their distinct advantages and drawbacks. Here’s a closer look at how Topstep, Earn2Trade, and Leeloo Trading approach key aspects like contract limits, risk rules, and scaling methods.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Topstep stands out with its End-of-Day (EOD) updates, which provide traders more flexibility during volatile sessions. This feature helps reduce the risk of prematurely hitting the maximum loss. However, the mandatory scaling plan can feel limiting, as it initially caps traders at just 2 mini contracts on a $50,000 account.

Earn2Trade introduces a Progression Ladder that increases contract limits as traders achieve profit milestones. This setup rewards consistent performance and enforces discipline, but it may frustrate traders who prefer faster access to higher contract exposure, as the system requires a gradual, step-by-step progression.

Leeloo Trading, on the other hand, offers immediate access to full contract limits, skipping the gradual unlocking process entirely. While this provides upfront freedom, its risk management system includes an intraday trailing drawdown rule. This rule adjusts the liquidation threshold based on unrealized profits, which can lead to automatic liquidation if a profitable position experiences a sharp pullback – even if the trade remains viable overall.

Each firm’s approach caters to different trading styles. Topstep’s EOD drawdown is more forgiving for intraday traders seeking flexibility. Leeloo Trading appeals to those comfortable managing dynamic risks with greater initial freedom. Meanwhile, Earn2Trade’s ladder system suits traders who value a methodical and disciplined path to scaling. These differences highlight the importance of matching a firm’s features to your personal trading strategy and risk tolerance.

Conclusion

Our breakdown of Topstep, Earn2Trade, and Leeloo Trading highlights how each firm structures its contract limits and risk controls to cater to different trading approaches. Topstep’s End-of-Day updates offer more flexibility during volatile trading sessions, though its conservative scaling plan requires traders to start small. Earn2Trade’s Progression Ladder gradually increases contract limits for consistent traders, making it a solid choice for those who thrive on steady growth. On the other hand, Leeloo Trading provides immediate access to full contract limits but uses an intraday trailing drawdown, which calls for precise risk management.

Selecting the right funded account comes down to how well the firm’s rules align with your trading style and tolerance for risk. If you value flexibility within the trading day, an End-of-Day drawdown structure might suit you best. Alternatively, if you’re confident in managing real-time risk, immediate access to larger contract limits could be more appealing. Scaling plans, while sometimes restrictive, are designed to prevent overleveraging – something newer traders often struggle with.

Your contract size should always align with your risk management plan. With around 80% of funded accounts failing due to a lack of discipline, it’s better to choose an account size that keeps evaluation fees manageable rather than chasing high contract limits. Success in funded prop trading ultimately depends on finding a firm whose parameters fit your trading habits and risk tolerance.

FAQs

What determines how many ES and NQ contracts I can trade with a funded prop account?

The number of ES (E-mini S&P 500) and NQ (E-mini Nasdaq 100) contracts you can trade with a funded prop account depends on several factors. These include your account’s buying power, margin requirements, risk limits, and the scaling plans established by the prop firm.

Margin requirements determine the minimum capital needed to hold a certain number of contracts. At the same time, risk limits – like maximum drawdowns – set boundaries on potential losses and directly affect how many contracts you can trade. On top of that, scaling plans allow traders to gradually increase their position sizes as they demonstrate steady performance and responsible risk management.

These elements work together to align trading activities with the firm’s risk management rules, while still giving traders the opportunity to grow as they prove their abilities.

How do scaling plans work in funded prop trading accounts?

Scaling plans in funded prop trading accounts are all about helping traders grow their trading size responsibly. These plans let traders gradually access more contracts or increased buying power as they prove they can trade profitably and manage risk effectively.

For instance, some firms tie the number of contracts a trader can use to their daily performance, setting limits to keep things under control. Others follow milestone-based systems, where traders unlock additional trading capacity after hitting specific profit targets. The idea is simple: promote disciplined trading habits, reward consistent success, and keep risk in check.

What risk management strategies do funded prop trading firms use?

Funded prop trading firms rely on risk management strategies to safeguard their capital and protect traders’ accounts. Some of the most common methods include:

- Daily loss limits: Caps on how much a trader can lose in a single day.

- Trailing drawdowns: These adjust dynamically as the account equity grows, limiting potential losses.

- Maximum risk per trade: Often set between 0.25% and 0.5% of the account balance, keeping individual trades under control.

These measures are designed to keep losses in check and ensure traders can continue operating without jeopardizing their accounts.

Firms also promote disciplined trading by enforcing strict rules. Traders are expected to avoid overtrading, stick to profit targets, and close positions by certain times to limit overnight exposure. By following these guidelines, traders build responsible habits, reduce unnecessary risks, and increase their chances of long-term success in funded accounts.