Topstep is a well-known futures prop trading firm that evaluates and funds retail traders. It uses a two-step process: the Trading Combine® and the Express Funded Account™. Plans range from $50,000 to $150,000 accounts, with monthly fees of $49–$149. Traders keep 100% of their first $10,000 in profits, followed by a 90/10 split. However, only 22% of participants secure funding. A $149 activation fee applies after passing the evaluation, though a no-fee option exists with a $129 payment.

For smooth trading, QuantVPS offers high-performance VPS hosting with ultra-low latency (0–1ms) and 100% uptime. Plans start at $59.99/month and are tailored to various trading needs, ensuring uninterrupted performance during evaluations.

Key Takeaways:

- Topstep focuses on futures trading only (no spot Forex or equities).

- Profit withdrawals are allowed daily after meeting minimum requirements.

- QuantVPS ensures reliable technical infrastructure for trading platforms.

Both Topstep and QuantVPS cater to traders aiming for funding and consistent execution, but costs and features should align with your goals.

Topstep Trading Combine Plans Comparison: Pricing, Account Sizes, and Features

Topstep Trading Combine Plans Comparison: Pricing, Account Sizes, and Features

1. Topstep

Trading Programs

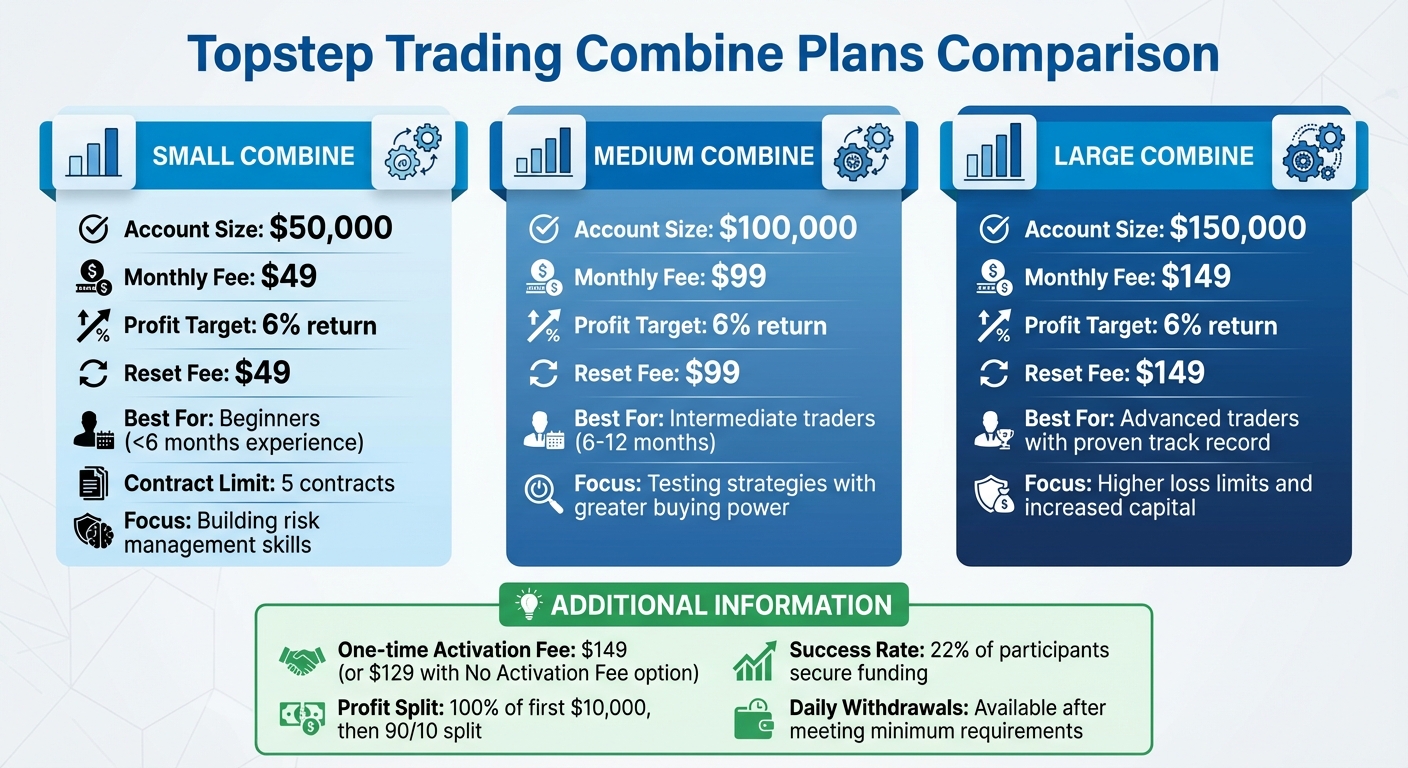

Topstep offers a structured path to funding through its Trading Combine®, a program designed to evaluate traders in a simulated environment before granting access to real capital. This program is available in three tiers: the Small Combine ($50,000 account for $49/month), the Medium Combine ($100,000 account for $99/month), and the Large Combine ($150,000 account for $149/month). To progress, traders must achieve a 6% return on their account size. After passing the Trading Combine, participants move to an Express Funded Account™, with the potential to later access a Live Funded Account™.

For those just starting out (less than six months of experience), the Small Combine is a great option as it allows beginners to focus on building sound risk management skills without taking on too much financial pressure. Traders with intermediate experience (6–12 months) who have shown consistent profitability may find the Medium Combine more suitable, offering greater buying power to test different strategies. Meanwhile, seasoned traders with advanced strategies and a proven track record can benefit from the Large Combine, which provides higher loss limits and increased capital.

Once the program structure is clear, the next priority is mastering risk management.

Risk Management

Topstep places a strong emphasis on disciplined risk management, which is a cornerstone of successful trading. This is enforced through its Maximum Loss Limit (MLL), a trailing drawdown calculated based on the highest end-of-day balance. This approach ensures traders develop disciplined habits before transitioning to real-money accounts. The evaluation focuses on three key areas: managing risk, maintaining discipline, and achieving profit targets.

The single-phase evaluation process makes it easy for traders to understand what’s required to advance. If a trader violates any rules during the Trading Combine, they can restart the evaluation by paying a reset fee – $49 for $50K accounts, $99 for $100K accounts, or $149 for $150K accounts. Additionally, Topstep offers a free reset with the renewal of the monthly subscription if an account becomes ineligible.

While risk management is crucial, understanding the associated costs is equally important.

Fees and Costs

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

In addition to the monthly subscription fees, traders must pay a one-time activation fee of $149 after successfully passing the Trading Combine and securing funding. Alternatively, traders can opt for a "No Activation Fee" route, which requires a $129 payment upon passing.

Topstep’s profit-sharing model is designed to benefit traders, though the exact split depends on the account type and performance stage. When choosing a plan, aim to keep monthly fees below 15% of your trading budget to maintain financial flexibility.

Platform and Infrastructure Support

Topstep supports a wide range of trading platforms and provides access to 32 futures markets, including forex, equity indices, oil and gas, metals, and agricultural commodities. This broad compatibility ensures traders can execute cross-asset strategies consistently.

For those using automated strategies or trading in volatile markets, platform stability is critical. Day traders employing quick scalping techniques might find the Small Combine’s 5-contract limit somewhat restrictive, while swing traders generally find it sufficient for their needs. Reliable platform support is essential for maintaining trading discipline and managing risk throughout the evaluation process. Choosing the right plan for your trading style and ensuring dependable technical infrastructure can significantly improve your chances of passing the evaluation and succeeding as a funded trader.

I Traded on TopstepX EVERY DAY for 12 Months… (My Full Review)

2. QuantVPS: High-Performance VPS for Futures Trading

QuantVPS complements Topstep’s focus on reliable trading tools by delivering the technical backbone traders need to perform at their best.

Platform and Infrastructure Support

In trading, platform stability isn’t just important – it’s non-negotiable. A single disconnect could mean restarting your Trading Combine and racking up extra fees. QuantVPS addresses this with ultra-low latency (0–1ms) and a 100% uptime guarantee, ensuring your trading platform stays online 24/7. This level of reliability is especially critical during Topstep’s rigorous evaluation process.

Whether you’re using automated systems or manual strategies, QuantVPS supports popular trading platforms seamlessly. Plus, features like DDoS protection and automatic backups safeguard your trading environment during unpredictable market swings.

Fees and Costs

QuantVPS plans are tailored to meet different trading needs. The VPS Lite plan starts at $59.99/month (or $41.99/month with annual billing) and is built for traders running 1–2 charts. It comes with 4 cores, 8GB RAM, and 70GB NVMe storage. If you’re managing multiple markets or strategies, the VPS Pro plan offers more power at $99.99/month (or $69.99/month annually), supporting 3–5 charts with 6 cores, 16GB RAM, and up to 2 monitors.

For those with advanced needs, such as high-frequency trading or complex algorithmic setups, QuantVPS also offers Performance Plans (+) with enhanced specs. And with annual billing cutting monthly costs by about 30%, it’s a smart choice for traders who value both performance and affordability.

Pros and Cons

Here’s a breakdown of the strengths and weaknesses of Topstep and QuantVPS, based on their key features:

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

| Aspect | Pros | Cons |

|---|---|---|

| Topstep | • Flexible one-phase evaluation with no time limits, letting you move at your own pace • Daily profit withdrawals with up to four requests per month • Earn 100% of your first $10,000 in profits, followed by a 90/10 split in your favor • Payouts available after just five winning trading days (minimum $200 net profit per day) |

• $149 activation fee required after completing the Trading Combine • Focused exclusively on futures – no spot Forex, equities, or CFDs • Forex traders need to adapt to trading Foreign Exchange Futures on centralized exchanges |

| QuantVPS | • Ultra-low latency (0–1ms) for fast trade execution • 100% uptime guarantee ensures minimal interruptions • Dedicated resources with DDoS protection and automatic backups • Compatible with popular platforms like NinjaTrader, MetaTrader, and TradeStation |

• Higher costs for premium plans (VPS Ultra at $189.99/month and Dedicated Server at $299.99/month) • Performance upgrades add $10–$100/month for improved specs |

Topstep offers a straightforward evaluation process and an attractive profit-sharing model, making it easier to access funded accounts. The ability to withdraw profits daily and the generous 100% earnings on the first $10,000 are standout features. However, the $149 activation fee and its exclusive focus on futures trading may limit its appeal for some traders.

On the other hand, QuantVPS excels in technical reliability, offering ultra-low latency and guaranteed uptime – critical for traders who need fast and uninterrupted execution. While entry-level plans are affordable, the higher-tier options provide better performance but come at a premium. Whether you prioritize funding opportunities, technical performance, or a combination of both will guide your decision.

Conclusion

Topstep continues to stand out as a solid choice for futures traders in 2026, especially if you’re looking for a straightforward evaluation process and a competitive profit-sharing model. With the Trading Combine, traders can progress easily and keep 100% of their first $10,000 in profits.

To make the most of what Topstep offers, having a reliable trading setup is crucial. For those using platforms like Quantower – one of the free options provided by Topstep – ensuring dependable connectivity is key. Quantower integrates with the Rithmic data feed, known for its ultra-low latency and real-time market data. Running Quantower on a high-performance VPS can help avoid issues caused by local internet outages or computer failures, which is essential for complying with Topstep’s strict trading rules. QuantVPS provides the reliability traders need, offering ultra-low latency, guaranteed uptime, and compatibility with various platforms across its plans.

Ultimately, whether Topstep is the right futures prop firm for you depends on your goals. If you prioritize a clear evaluation process, attractive profit splits, and strong trader support, it’s worth considering – especially when paired with dependable tools like QuantVPS to maintain smooth and consistent trading operations.

FAQs

What is Topstep’s Trading Combine® and how does it work?

The Trading Combine® by Topstep is a two-phase evaluation designed to test traders’ abilities in a simulated setting. By hitting profit goals and sticking to strict risk management guidelines, traders showcase their discipline and potential for success.

Those who pass the Trading Combine® gain access to a funded account, enabling them to trade with real capital and share in the profits. This program aims to help traders grow their confidence while maintaining professional trading practices.

How does Topstep’s profit-sharing model work?

Topstep has a simple and rewarding profit-sharing system for traders. You get to keep 100% of the first $10,000 you make in profits. Beyond that, you take home 90% of any additional profits. This setup gives traders the opportunity to maximize their income while leveraging Topstep’s funding and resources.

What are the technical requirements for using QuantVPS with Topstep?

To get started with QuantVPS and Topstep, you’ll need a stable internet connection and a trading platform that works seamlessly with the service. Compatible platforms include TradingView, NinjaTrader, Tradovate, and Quantower. Make sure your VPS is equipped with adequate processing power, RAM, and storage to run your trading software without any hiccups.

Equally important is access to precise market data feeds, as they play a crucial role in supporting your trading decisions. Meeting these technical requirements ensures a smooth and efficient trading experience with QuantVPS and Topstep.