Want to trade smarter and faster? TradeStation, combined with Advantage Trading tools, delivers professional-grade features for automated trading and market analysis. Here’s what you get:

- Advanced Indicators: Tools like Trend Colors, Reversal Dots, and Volume Waves simplify market trends and signals.

- Automation: Use EasyLanguage to turn strategies into automated systems for hands-free trading.

- Risk Management: Tools for position sizing, stop-loss adjustments, and daily loss limits.

- VPS Hosting: QuantVPS ensures ultra-low latency (0-1ms) for seamless 24/7 trading.

Quick Overview:

- TradeStation Features: Real-time data, strategy automation, multi-asset trading.

- Advantage Trading Tools: Trend analysis, signal generation, risk management.

- VPS Options: Scalable plans for optimized trading performance.

With this setup, you can automate strategies, minimize risk, and trade with precision across stocks, forex, options, and futures.

The Art of TradeStation: The Strategy Automation Process

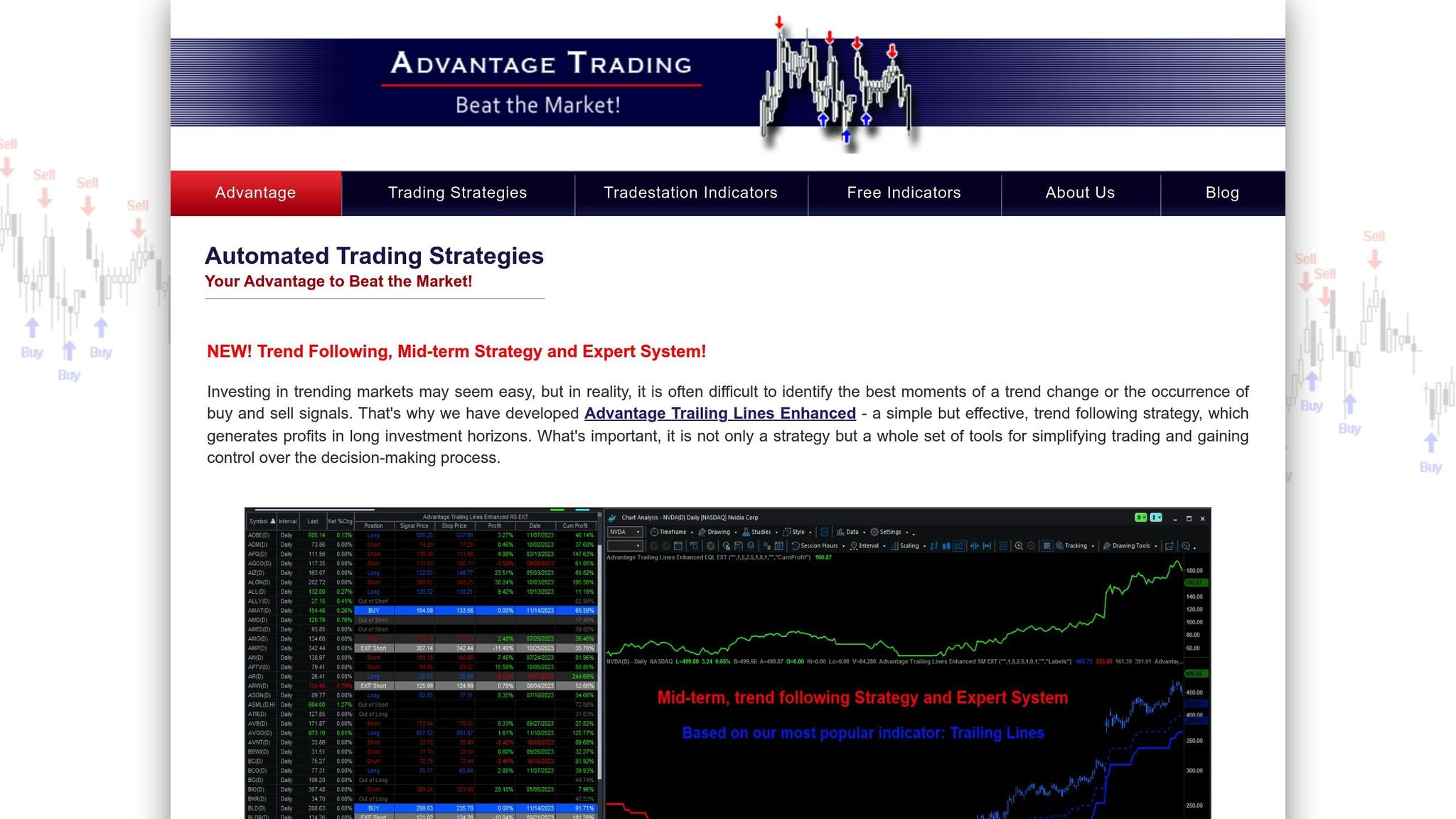

Advantage Trading Indicators

Advantage Trading provides a set of tools for TradeStation that help traders identify opportunities and manage risk effectively.

Trend Colors Indicator

The Trend Colors indicator simplifies market analysis by using colors to indicate market direction:

- Green: Shows upward momentum in bullish trends.

- Red: Indicates downward pressure in bearish trends.

- Neutral tones: Highlight consolidation periods when the market lacks direction.

Color changes act as early warnings of potential trend shifts, giving traders time to adjust their positions.

| Signal Type | Color | Trading Implication |

|---|---|---|

| Strong Uptrend | Dark Green | Consider entering long positions |

| Weak Uptrend | Light Green | Monitor for possible continuation |

| Strong Downtrend | Dark Red | Consider entering short positions |

| Consolidation | Gray | Wait for a clear market direction |

Reversal Dots Indicator

This indicator places markers at key support and resistance levels, helping traders:

- Recognize potential trend reversals.

- Pinpoint optimal entry and exit points.

- Confirm changes in market trends.

Trailing Lines Indicator

The Trailing Lines indicator dynamically adjusts stop-loss levels as trades progress:

- Dynamic Protection: Stop-loss levels shift in line with the trend.

- Risk Management: Automatically adapts to market volatility.

- Visual Aid: Provides a clear view of stop-loss adjustments.

Volume Waves Indicator

Volume Waves highlights volume patterns to offer deeper market insights:

- Validate Breakouts: Confirms price breakouts with volume data.

- Spot False Moves: Identifies low-volume breakouts that might fail.

- Assess Market Activity: Gauges overall market participation.

| Volume Pattern | Signal Strength | Trading Action |

|---|---|---|

| Rising Volume + Rising Price | Strong | Consider entering a position |

| Falling Volume + Rising Price | Weak | Exercise caution |

| High Volume + Price Reversal | Strong | Watch for a potential trend change |

| Low Volume + Sideways Price | Weak | Wait for further confirmation |

These tools not only support profitable strategies but also reinforce disciplined risk management. They provide a solid foundation for building and testing automated trading strategies.

Building Automated Trading Strategies

Once you’ve identified clear market signals, the next step is automating your trading strategy. This section focuses on turning specialized indicators into actionable, automated strategies.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

EasyLanguage Programming Basics

EasyLanguage is a tool designed for creating custom trading strategies. It simplifies the process of translating trading logic into executable code with market-specific commands.

Here are the core components of EasyLanguage:

- Inputs: Define parameters like price thresholds or time periods.

- Variables: Store calculated values, such as moving averages or indicator outputs.

- Conditions: Set the rules for entering or exiting trades based on market signals.

- Orders: Execute trades, whether they’re market orders or limit orders.

This programming foundation is essential for building and testing strategies effectively.

Strategy Testing Methods

Testing your strategy with historical data allows you to simulate various market conditions and evaluate its performance. Focus on metrics like profit factor, drawdown, win rate, and average trade returns. These numbers help you judge how well your strategy performs and whether it’s consistent.

To ensure reliability, conduct walk-forward analysis using out-of-sample data. This process helps confirm that your strategy works in different scenarios and reduces the risk of overfitting. After testing, implement strict risk controls to protect your capital.

Risk Management Guidelines

Effective risk management is key to preserving your capital and maintaining discipline. Here are some essential practices to follow:

- Position Sizing: Risk only a small percentage of your capital on each trade.

- Stop-Loss Orders: Limit potential losses by setting predefined exit points.

- Daily Loss Limits: Establish a maximum loss threshold to stop trading on tough days.

- Diversification Filters: Spread risk across different assets or strategies.

For more advanced risk management, consider:

- Dynamic Position Sizing: Adjust trade sizes based on account volatility.

- Time-Based Filters: Avoid trading during periods of high market uncertainty.

- Market Condition Filters: Tailor strategy parameters to align with current market trends.

TradeStation Pro Tools

TradeStation offers a suite of tools designed to elevate market analysis and streamline strategy execution. These tools go beyond basic indicators and automated strategies, offering deeper insights for traders.

Market Scanning with RadarScreen

RadarScreen allows you to monitor hundreds of symbols in real time. Here’s what it offers:

- Custom Scanning Rules: Build filters using technical indicators, fundamental data, or price trends.

- Dynamic Alerts: Get audio and visual notifications for specific market conditions.

- Real-Time Strategy Tracking: Keep tabs on how your strategies are performing live.

- Multi-Market Monitoring: Analyze stocks, futures, forex, and options – all from one dashboard.

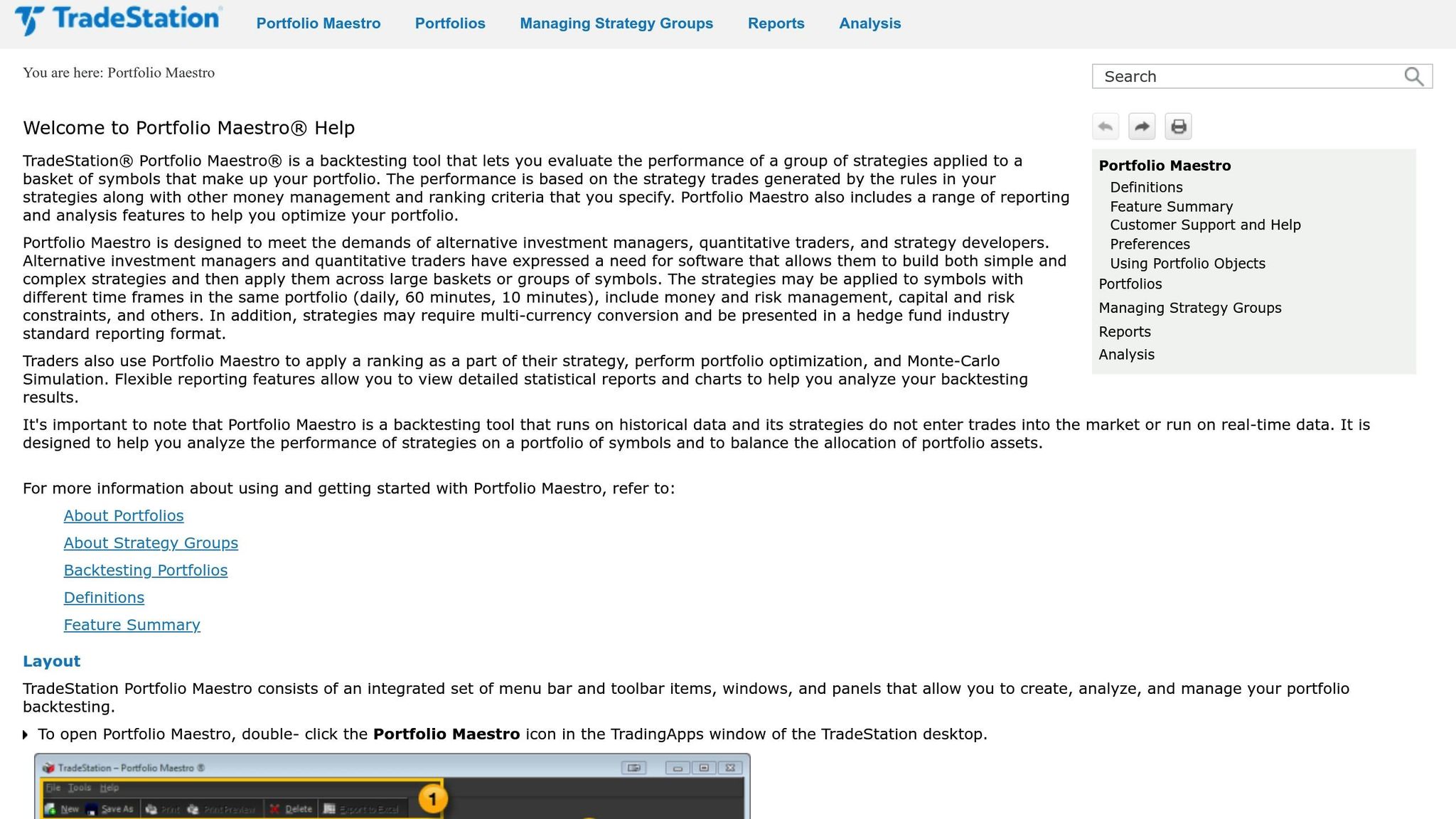

Portfolio Maestro Strategy Tools

Portfolio Maestro helps traders manage strategies with detailed portfolio analysis. Key features include:

- Portfolio Construction: Build and manage diversified portfolios.

- Correlation Analysis: Examine how different trading systems interact.

- Position Sizing: Optimize position sizes across various strategies.

- Performance Reports: Generate in-depth reports to evaluate results.

This tool allows traders to test different parameters across multiple symbols, helping identify the most effective settings.

Custom Indicator Setup

TradeStation lets you tailor indicators to suit your needs. Here’s how you can set them up effectively:

- Parameter Configuration

Adjust settings like look-back periods for moving averages, sensitivity for momentum indicators, and color schemes for better visibility. - Visual Settings

Use distinct colors for different signals, tweak line thickness for clarity, and configure alerts to match your trading style. - Performance Optimization

Simplify calculations, write efficient code, and use data caching to improve performance.

For traders managing complex setups, having reliable hardware is essential. QuantVPS’s Ultra plan, featuring 24 cores and 64 GB RAM, ensures seamless performance even with demanding indicator combinations.

QuantVPS Setup for TradeStation

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Setting up TradeStation on QuantVPS involves a few key steps to ensure efficient and reliable trading operations.

Low-Latency Trading Setup

Minimizing execution delays is critical for automated trading success. QuantVPS offers ultra-low latency of 0-1ms, making it ideal for high-frequency trading strategies. Here’s how to optimize your setup:

- Allocate memory: Adjust TradeStation’s memory settings to fully utilize available RAM.

- Enable NVMe acceleration: Use NVMe storage for faster data processing.

- Tweak server settings: Optimize Windows Server 2022 for better performance.

- Direct data feed: Set TradeStation’s data feed to direct connection mode for faster access.

For best results, use the VPS Ultra plan (24 cores, 64GB RAM) to handle multiple strategies with minimal latency. Once configured, your system will be ready for seamless, around-the-clock trading.

24/7 Trading Operations

To ensure uninterrupted trading, configure your system for continuous operation:

- Automatically log in to TradeStation during system startup.

- Schedule data downloads during non-trading hours.

- Enable automatic recovery of strategies after disconnections.

- Set up system monitoring alerts for real-time updates.

- Run 3-5 charts on the VPS Pro plan (6 cores, 16GB RAM).

- Run up to 7 charts on the VPS Ultra plan (24 cores, 64GB RAM).

- Perform system maintenance during off-market hours.

- Optimize network settings to maintain stable connectivity.

These steps will keep your trading system running smoothly and consistently.

Backup and Recovery Systems

To safeguard your trading operations, implement a reliable backup and recovery plan:

Automated Backup Schedule

| Backup Type | Frequency | Retention Period |

|---|---|---|

| Strategy Files | Daily | 30 days |

| Historical Data | Weekly | 90 days |

| System Config | Monthly | 12 months |

The backup system includes:

- Daily backups of trading strategies and indicators.

- Regular system snapshots to capture the current state.

- Weekly archiving of historical data.

- Monthly backups of configuration files.

QuantVPS’s automated backup system runs quietly in the background, ensuring your data is secure without compromising performance.

For more demanding setups, consider the Dedicated Server option with 128GB RAM and 2TB+ NVMe storage. This option provides the space and reliability needed for managing extensive historical data and backups while maintaining consistent performance for complex trading systems.

Summary

TradeStation’s integration with Advantage Trading indicators and QuantVPS hosting offers a seamless solution for automated trading and secure data handling. This setup combines advanced technical analysis tools with lightning-fast execution speeds.

Key Features of the System:

- Execution Speed: Ultra-low latency of 0-1ms for precise trades

- Automation: Deploy automated strategies with 24/7 operational capabilities

- Data Security: Reliable backup systems to safeguard trading data

- Market Analysis: Professional-grade indicators for better insights

Advantage Trading provides tools like Trend Colors, Reversal Dots, and Volume Waves, giving traders a structured way to analyze market trends.

"A strictly defined trading strategy is a key to success on the stock market. It overrides emotions and ensures sound investment decisions." – Advantage Trading

"A strictly defined trading strategy is a key to success on the stock market. It overrides emotions and ensures sound investment decisions." – Advantage Trading

With this integration, traders can:

- Operate multiple automated strategies simultaneously

- Process real-time market data efficiently

- Maintain consistent strategy performance

- Apply effective risk management procedures

For optimal performance, match your trading setup with these VPS resources:

- VPS Pro: 6 cores, 16GB RAM, suitable for 3-5 active charts

- VPS Ultra: 24 cores, 64GB RAM, ideal for 5-7 charts with indicators

- Dedicated Server: Designed for 7+ charts, perfect for professional trading setups