Funded Trading Challenges: Everything You Need to Know in 2026

Funded trading challenges let you trade with firm capital (up to $2 million) after passing evaluations. Here's what you need to know:

- Entry Fees: Range from $15 to $1,000. Some firms refund fees after your first profit withdrawal.

- Profit Targets: Typically 6%-12%, with strict drawdown limits (4%-10%).

-

Evaluation Models:

- One-Step: Single profit target, faster to complete.

- Two-Step: Two phases with reduced targets in the second phase.

- Three-Step: Gradual, lower targets over three phases, ideal for cautious traders.

- Rules: Loss limits, minimum trading days, and restrictions like no weekend positions or news trading.

- Profit Splits: Keep 70%-90% of profits; some firms offer 100% on initial withdrawals.

- Scaling: Consistent traders can grow accounts to $2 million. Many firms, such as Top One Futures, offer specific pathways for this growth.

- One-Step: Single profit target, faster to complete.

- Two-Step: Two phases with reduced targets in the second phase.

- Three-Step: Gradual, lower targets over three phases, ideal for cautious traders.

Key to success? Risk management, sticking to rules, and using tools like QuantVPS for reliable trade execution. Most traders fail due to emotional decisions, over-leveraging, or breaking rules - not bad strategies. Funded accounts are a low-risk way to access significant capital and grow as a trader.

How to Pass ANY Prop Firm Challenge (and Actually Get Paid Out) | The Trader's Edge

How Funded Trading Challenges Work

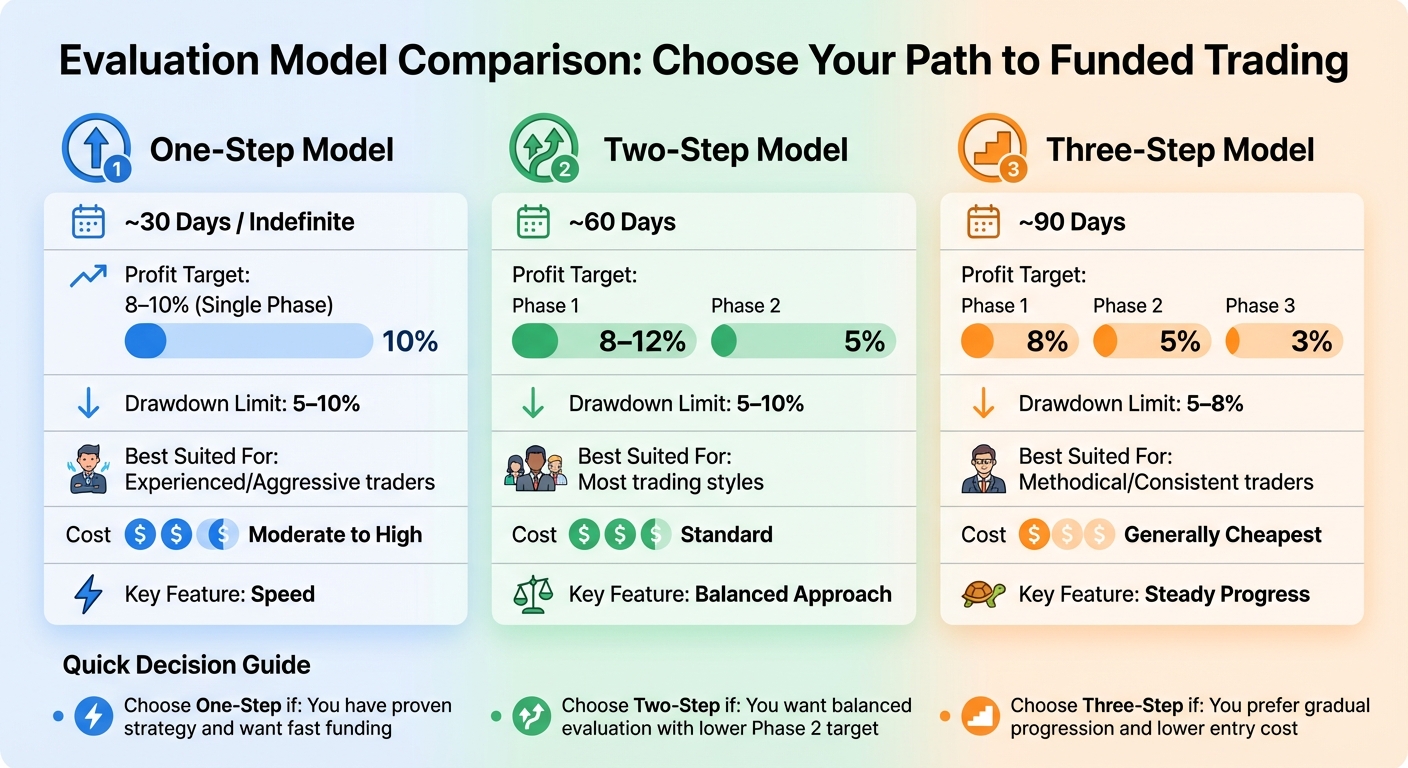

Funded Trading Challenge Evaluation Models Comparison: One-Step vs Two-Step vs Three-Step

Funded Trading Challenge Evaluation Models Comparison: One-Step vs Two-Step vs Three-Step

Funded trading challenges are structured programs designed to assess your ability to generate profits while managing risk. These challenges take place in a simulated trading environment using real market data, allowing you to showcase your skills without putting the firm's capital at risk.

The evaluation process revolves around two main metrics: profit targets and drawdown limits. Profit targets typically range from 6% to 10% of your account balance, while drawdown limits act as safeguards against excessive losses. For example, most firms set a maximum daily loss between 2% and 5% to prevent significant one-day declines, and a maximum overall loss (usually 4% to 10%) to cap how much you can lose in total. Some companies also implement a trailing drawdown, which adjusts upward as your account grows, requiring you to stay vigilant about your loss limits.

To ensure consistency, many programs enforce a minimum number of trading days - usually between 4 and 10. For instance, FTMO requires at least 4 active trading days during the evaluation phase, while Alfa Prop Traders mandates 10 days. However, several firms, including FTMO, Funding Pips, and Blueberry Trading, now allow unlimited time to complete challenges, giving traders the flexibility to proceed at their own pace.

"The FTMO Challenge stage has reasonable rules, where the Profit Target is in balance with the drawdown we allow you to take."

– FTMO

"The FTMO Challenge stage has reasonable rules, where the Profit Target is in balance with the drawdown we allow you to take."

– FTMO

Once you successfully pass the evaluation, you'll need to complete identity verification (KYC) and sign a professional agreement. Afterward, you gain access to a funded account or rewards account, with profit splits typically ranging between 80% and 90%. However, you must continue to follow the firm's risk management rules.

One-Step vs. Two-Step Evaluation Models

Evaluation models vary in structure, with distinct profit targets and risk parameters.

Two-step models are the most common. These include a Challenge phase followed by a Verification phase. In the first phase, you might need to hit a profit target of 8% to 12%, while the second phase lowers the target to around 5%, ensuring your performance wasn't based on luck. For example, a $100,000 challenge might require $10,000 in the first phase and $5,000 in the second.

One-step evaluations offer a faster alternative, often achievable in 30 days. These require a single profit target of 8% to 10%. Some firms, like Vanquish Trader, have removed time limits altogether, letting traders focus on quality rather than speed. However, these programs often impose stricter consistency rules, such as limiting any single trade or day's contribution to 30% to 40% of your total profits.

Three-step models take a more gradual approach, with profit targets decreasing at each stage - for example, 8% in Phase 1, 5% in Phase 2, and 3% in Phase 3. These models tend to be more affordable and cater to traders who prefer a slower-paced evaluation.

| Feature | One-Step Model | Two-Step Model | Three-Step Model |

|---|---|---|---|

| Typical Duration | ~30 Days / Indefinite | ~60 Days | ~90 Days |

| Profit Target | 8–10% (Single Phase) | P1: 8–12%, P2: 5% | P1: 8%, P2: 5%, P3: 3% |

| Drawdown Limit | 5–10% | 5–10% | 5–8% |

| Best Suited For | Experienced/Aggressive | Most trading styles | Methodical/Consistent |

| Cost | Moderate to High | Standard | Generally Cheapest |

If you’re an experienced trader with a confident strategy and want quick access to capital, a one-step model might be ideal. The two-step approach, on the other hand, offers a balanced path with a lower second-phase target that rewards disciplined risk management. Three-step models are great for traders who value affordability and prefer a slower, more deliberate evaluation process.

Profit Targets and Drawdown Limits

Profit targets and drawdown limits are the backbone of these challenges, ensuring a balance between risk and reward.

Profit targets are usually expressed as a percentage of your account balance, ranging from 6% to 12% in the initial phases. For instance, FTMO sets a 10% target for Phase 1, while The 5%ers offer more conservative targets of 6% for Phase 1 and 4% for Phase 2. Topstep's $150,000 account challenge requires a $9,000 profit target, equivalent to 6%.

Drawdown limits can be static or trailing. A static drawdown stays fixed based on your starting balance. For example, if you begin with $100,000 and have a 10% drawdown limit, your equity cannot fall below $90,000. Trailing drawdowns, however, adjust upward as your account grows. If your balance increases to $105,000, a 10% trailing drawdown would raise your equity floor to about $94,500.

Daily loss limits typically range from 2% to 5% of your starting balance. FTMO sets this limit at 5%, while Topstep uses 2% for certain account sizes, and Alfa Prop Traders enforces a 4% cap. Exceeding this limit results in immediate account termination, often referred to as a "hard breach".

"Lower targets encourage risk-averse, consistent strategies instead of high-leverage bursts."

– E8 Funding

"Lower targets encourage risk-averse, consistent strategies instead of high-leverage bursts."

– E8 Funding

Before starting, confirm whether your chosen firm uses static or trailing drawdowns. Keeping track of your drawdown limit in real time is crucial, especially with trailing models where the allowable loss tightens as your account grows. Many traders fail by breaching drawdown limits rather than missing profit targets, so protecting your capital should always take precedence over chasing aggressive gains.

Requirements for Joining Funded Challenges

Joining a funded trading challenge doesn’t require formal certifications - your trading performance is what matters. As outlined earlier, these programs use specific evaluation metrics to ensure only dedicated traders advance. To participate, you’ll need to pay an entry fee, complete a KYC (Know Your Customer) process, and meet the legal age requirement in your area. With these basics covered, you’ll be ready to dive into the fee structures and trading rules that come next.

Account Sizes and Entry Fees

Funded trading programs provide access to simulated capital, typically ranging from $10,000 to $200,000. Some firms even offer scaling opportunities for traders who consistently perform well, with potential account sizes reaching up to $2 million. Entry fees for these programs fall into two main categories: one-time payments or monthly subscriptions.

- One-time challenge fees: Many firms, like Maven Trading, charge a single fee to enter. For example, mini challenges may cost as little as $13 to $15, while standard two-step evaluations range from $19 to $88 or more. Some firms sweeten the deal by refunding your fee after your first or third profit withdrawal, making the initial expense recoverable upon success.

- Monthly subscriptions: Other programs, such as Topstep, require ongoing payments during the evaluation period. For instance, Topstep charges $150 per month for a $30,000 account, $165 for $50,000, $325 for $100,000, and $375 for $150,000.

Lark Funding offers a variety of account sizes, including $10,000, $25,000, $50,000, $100,000, and $200,000 options. Understanding these financial commitments is essential before moving on to the specific trading rules.

Trading Rules and Restrictions

Funded challenges enforce strict trading rules to ensure participants adhere to professional standards. These rules focus on risk management, consistency, and proper trade execution.

- Loss limits: Programs enforce daily loss limits, typically between 3% and 5% of your starting balance, and maximum drawdown limits of 5% to 10%. These limits include realized and unrealized profit and loss, as well as fees and commissions. Breaching these thresholds results in immediate account termination.

- Minimum trading days: To prevent reliance on a few lucky trades, firms require a minimum number of active trading days. FTMO, for example, mandates at least 4 active days, while others may require up to 10. Topstep adds another layer by defining "Benchmark Trading Days", where traders must earn at least $150 in a day for it to count toward payout eligibility.

- Trade management rules: Some firms require stop-loss orders on every trade, while others enforce rules like closing all positions before market close. For example, Topstep requires traders to close positions by 3:10 PM CT, and it prohibits holding positions over the weekend. In contrast, ATFunded allows weekend holdings.

- News trading restrictions: Many programs restrict trading around high-impact economic events. Traders are often barred from placing trades 2 to 3 minutes before or after significant news releases. ATFunded completely bans news trading, while firms like Topstep allow it but caution against the heightened volatility.

- Leverage caps: Leverage limits vary by firm and asset type. For instance, Alfa Prop Traders allows up to 1:50 leverage for major forex pairs, 1:20 for indices and commodities, and 1:10 for cryptocurrencies. ATFunded, on the other hand, caps leverage at 1:30 for forex and 1:2 for crypto.

- Consistency rules: To discourage risky trading behavior, many firms implement consistency requirements. ATFunded, for example, mandates that "Core Trades" must be at least 50% of the lot size of your largest trade during the payout period. Maven Trading uses a "Consistency Score" of 20% to ensure profits aren’t derived from a single high-risk trade.

"A Core Trade must be at least 50% of the size (lot size only) of your largest trade during the current pay period."

– ATFunded

"A Core Trade must be at least 50% of the size (lot size only) of your largest trade during the current pay period."

– ATFunded

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

- Inactivity policies: Accounts may be closed if no trades are placed within a specified period, which can range from 14 to 90 days. Additionally, daily loss calculations reset at specific times - FTMO resets at midnight Prague time, while Topstep resets at 5:00 PM CT.

Before you join a program, carefully review the rulebook. Some strategies, like latency arbitrage, martingale systems, high-frequency trading, or reverse trading between accounts, are strictly prohibited and can lead to disqualification. If you plan to use Expert Advisors, confirm that your strategy complies with the firm’s guidelines and isn’t flagged as overused.

How to Pass Funded Trading Challenges

Succeeding in a funded trading challenge boils down to consistent execution and disciplined risk management. These challenges typically require hitting specific profit targets, with daily loss limits often set at around 5% of your starting balance. Successful traders treat these evaluations like running a business, not gambling. The main goal is to show that you can protect your capital while steadily achieving profit targets. To do this, your trading plan needs to be thoroughly tested and ready before you even pay the entry fee. A solid, risk-controlled trading plan is your foundation for success.

Building Risk-Controlled Trading Plans

A good trading plan starts with strategy validation. You’ll need to backtest and forward-test your strategy with at least 100 trades to ensure your drawdowns stay well within the firm’s limits.

Define clear rules for entering and exiting trades - guesswork and relying on reversals won’t cut it. Stick to a risk-to-reward ratio of at least 1:2. This means you can remain profitable even with a 40% win rate. For example, if you risk 1% per trade and maintain a 1:2 ratio, you’ll still come out ahead even with less-than-perfect accuracy.

Position sizing is a common pitfall for many traders. Limit your risk to 0.5% to 1% of your account per trade. Use a position size calculator to determine the exact lot size based on your stop-loss distance - manual calculations during live trading can lead to costly errors. Every trade must have an automatic stop-loss in place. Relying on manual exits is risky and often leads to emotional decisions, which one industry expert calls "a dangerous gamble".

Set a personal daily loss limit that’s more conservative than the firm’s rule. For instance, if the firm allows a 5% daily loss, stop trading at 2% or 3% to create a buffer against unexpected market volatility. Many firms also enforce consistency rules, which prevent a single trade from accounting for more than 30% of your total profit. This means you’ll need a steady stream of smaller wins rather than relying on one big trade to hit your target.

"Passing isn't about being perfect. It's about being repeatable. Think like a risk manager first and a trader second." – Vanquish Trader

"Passing isn't about being perfect. It's about being repeatable. Think like a risk manager first and a trader second." – Vanquish Trader

If your firm uses a trailing drawdown model, track it daily. Unlike a static drawdown, which is fixed at your starting balance, a trailing drawdown moves upward as your equity grows. This tightens your risk management as you become more profitable. Calculate your liquidation threshold daily to stay on top of your position. These practices help build the discipline needed to pass evaluations and secure funding.

Choosing Instruments and Trading Sessions

Picking the right instruments and trading sessions is just as important as having a solid plan. Base your choices on data, not guesswork. Review your trading journal to identify which assets - such as Forex pairs, indices, or stocks - yield the best results for your strategy. Forex and indices are popular in prop challenges due to their high liquidity and tight spreads, often starting from 0.0 pips. Stocks, on the other hand, require more patience and a higher tolerance for lower volatility. Options accounts often come with stricter risk controls and higher profit targets, sometimes as high as 10%.

Trade during high-volume sessions like the London or New York open, but only if these times align with your peak mental performance. For example, if you’re not at your best during the New York session, trading then could hurt your results despite the market activity. Focus on sessions where your strategy finds the most setups and where you’re mentally sharp.

Stick to established market timing rules to manage volatility. If your strategy involves scalping or high-frequency trading, check the firm’s policies - some explicitly prohibit these methods. Also, confirm whether you’re allowed to hold positions overnight or over the weekend. Policies vary; some firms permit overnight holds during evaluations but require all positions to be closed before the weekend to avoid gap risk.

| Component | Recommended Parameter | Purpose |

|---|---|---|

| Risk Per Trade | 0.5% - 1.0% | Preserves capital during losing streaks |

| Risk-to-Reward | Minimum 1:2 | Ensures profitability even with a lower win rate |

| Daily Loss Limit | 2% - 3% (Self-imposed) | Protects against breaching the firm’s 5% limit |

| Profit Target | 8% - 10% | Standard goal for Phase 1 evaluations |

| Trading Days | Minimum 4 - 10 days | Demonstrates consistency over time |

Focus on process over outcome. Profit should be the result of executing quality setups, not the primary goal of every trade. Aim for small, consistent gains of 0.5% to 1% per day rather than chasing large, volatile wins. This approach keeps emotions in check and helps you meet the firm’s consistency requirements. Most traders fail these challenges due to behavioral mistakes - like overleveraging, ignoring trailing drawdowns, or revenge trading - rather than flawed strategies. Combining a disciplined plan with smart instrument and session choices can significantly improve your chances of passing the challenge.

Technical Setup: Using QuantVPS for Funded Challenges

A solid technical setup is the backbone of any successful attempt at meeting funded challenge metrics. When you combine disciplined risk management with reliable technology, you create the conditions for better performance. A single delayed order or system hiccup can push you over risk limits, potentially costing you the challenge fee. Here's how QuantVPS ensures fast, reliable execution to keep you in the game.

Fast Execution for Meeting Performance Metrics

In funded challenges, slippage can be a silent killer. When you're working toward an 8% profit target with a 5% maximum drawdown, even small delays can add up across multiple trades, eating into your limits. QuantVPS solves this issue by hosting servers in Chicago, right next to CME Group's matching engines. This setup enables ultra-low latency - less than 0.52 milliseconds - via direct fiber-optic cross-connects.

The platform's infrastructure uses enterprise-grade AMD EPYC and Ryzen processors, paired with NVMe M.2 SSD storage and high-speed DDR4/5 RAM. This combination ensures smooth processing even during heavy market activity. The network provides a steady 1Gbps connection with bursts up to 10Gbps, a critical feature for challenges that involve trailing drawdown models. A delayed exit during a losing trade could otherwise end your challenge instantly.

"Ultra-low latency is critical for rapid futures trade execution and minimizing slippage." – QuantVPS

"Ultra-low latency is critical for rapid futures trade execution and minimizing slippage." – QuantVPS

QuantVPS also delivers reliability, boasting a 99.999% uptime rating. This means your automated trading bots and trade copiers can run 24/7, even if your home computer is offline. To put its capacity into perspective, over $10.92 billion in trades were processed through QuantVPS servers within a single 24-hour period as of January 14, 2026.

Platform Compatibility and Performance

Speed is essential, but compatibility matters too. QuantVPS supports all major trading platforms commonly used in funded challenges, including NinjaTrader, MetaTrader 4/5, TradeStation, Quantower, Tradovate, Rithmic, Sierra Chart, and Trading Technologies. The servers come pre-installed with Windows Server 2022, optimized specifically for trading applications to save you setup time and enhance platform stability.

The system is also fully compatible with leading futures data feeds like Rithmic, CQG, dxFeed, TT, and IQFeed. This ensures your charts and order flow tools receive real-time data without interruptions. For added convenience, you can access your setup remotely through a secure Remote Desktop (RDP) gateway that supports multi-monitor configurations. This allows you to maintain a professional trading workspace, mirroring the experience of using a high-performance local machine.

"QuantVPS is ideal for running trade copier software reliably 24/7. Our stable environment is perfect for managing multiple accounts or prop firm setups." – QuantVPS

"QuantVPS is ideal for running trade copier software reliably 24/7. Our stable environment is perfect for managing multiple accounts or prop firm setups." – QuantVPS

On top of that, the platform meets the strict security and performance standards of many prop firms that allow copy trading. Features like enterprise-grade DDoS protection, advanced firewall configurations, and 24/7 U.S.-based technical support ensure any issues are resolved quickly and efficiently.

QuantVPS Plan Comparison

Selecting the right QuantVPS plan depends on your trading needs, such as the number of charts you run, the use of automated bots, and the accounts you manage. QuantVPS offers a configurator tool to help you choose.

| Plan | Monthly Cost | Annual Cost | CPU Cores | RAM | Storage | Network | Multi-Monitor | Best For |

|---|---|---|---|---|---|---|---|---|

| VPS Lite | $59.99 | $41.99/mo | 4 | 8GB | 70GB NVMe | 1Gbps+ | No | 1–2 charts; single account |

| VPS Pro | $99.99 | $69.99/mo | 6 | 16GB | 150GB NVMe | 1Gbps+ | Up to 2 | 3–5 charts; multiple accounts |

| VPS Ultra | $189.99 | $132.99/mo | 24 | 64GB | 500GB NVMe | 1Gbps+ | Up to 4 | 5–7 charts; trade copiers |

| Dedicated Server | $299.99 | $209.99/mo | 16+ | 128GB | 2TB+ NVMe | 10Gbps+ | Up to 6 | 7+ charts; heavy workloads |

For traders focused on funded challenges, the VPS Lite plan is a good starting point if you're running 1–2 charts. However, if you need multi-monitor support or manage multiple accounts with trade copier software, the VPS Pro or VPS Ultra plans provide the additional CPU power and RAM needed for smooth operations.

All plans include unmetered bandwidth, a pre-configured Windows Server 2022 installation, and access to the Chicago datacenter. Opting for an annual subscription can cut your monthly costs by about 30%, which can help offset the fees for your funded challenges over time.

Advantages of Getting a Funded Trading Account

Funded trading accounts have become a game-changer in modern prop trading, giving traders the opportunity to use firm capital to aim for larger profits. Instead of risking your own money, these accounts allow you to control substantial sums for a fraction of the cost. For example, rather than depositing $50,000 of your own funds, you could pay a challenge fee ranging from $165 to $375 and gain access to accounts worth $50,000 to $200,000. The best part? Your financial risk is capped at the challenge fee, creating an appealing balance between risk and reward.

This setup opens the door to significant profit potential. Say you achieve a 10% return on a $200,000 funded account - that’s a $20,000 gain. With many programs offering traders 80% of the profits, you’d walk away with $16,000. And even if things don’t go as planned, your loss is limited to the initial fee.

"Trading with Maven gives you access to higher funds (and profits). Instead of a $1000 investment, imagine $200,000. Now you've got a $20,000 profit with $16,000 in your pocket." – Maven Trading

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

"Trading with Maven gives you access to higher funds (and profits). Instead of a $1000 investment, imagine $200,000. Now you've got a $20,000 profit with $16,000 in your pocket." – Maven Trading

Profit-sharing structures and payout models are another draw. Most firms let traders keep 80% to 90% of their gains, and some even offer 100% on the first $10,000 before reverting to the usual split. But the benefits don’t stop there - funded accounts often come with opportunities to grow your trading capital.

Many programs reward successful traders by increasing account sizes by 25% every four months, provided profit targets are met. In some cases, traders can scale their accounts up to $2 million. This means your earning potential can grow significantly without additional personal investment. The initial challenge fee remains your only risk while your access to capital - and potential profits - keeps expanding.

Common Mistakes and How to Avoid Them

Many traders who stumble during funded challenges aren't lacking in skill - they're often tripped up by avoidable mistakes under pressure. One of the biggest pitfalls is misinterpreting trailing drawdowns. A trailing drawdown adjusts upward as your account grows, reducing your margin for error. For instance, even if you hit a 10% profit target, the trailing drawdown moves with your equity. This means one bad trade could push you over the limit. Before you start trading, double-check whether your firm uses a static or trailing drawdown system.

Another common issue is poor leverage management. Over-leveraging is a surefire way to blow up an account, even faster than a flawed strategy. Traders often miscalculate position sizes or use excessive leverage, especially when under pressure, leading to breaches like the 5% daily loss limit. The solution? Use a position size calculator and keep risk per trade between 0.5% and 1%. Set a personal daily loss cap of 2% to 3%, staying well below the firm's 5% threshold. If you hit your limit, close your platform immediately to avoid revenge trading.

"Success in these prop firm challenges is built on consistent habits, not on shortcuts or secret indicators." – OneFunded

"Success in these prop firm challenges is built on consistent habits, not on shortcuts or secret indicators." – OneFunded

Chasing profit targets is another trap. The pressure to quickly reach a 10% goal often tempts traders to take trades outside their strategy. Statistics show that fewer than 15% of traders pass prop firm evaluations, largely because they abandon their proven methods after a few losses. Stick to your tested strategy and remember, many challenges don’t have a time limit. Rushing only increases risk without improving outcomes.

Lastly, ignoring specific challenge rules can lead to unnecessary disqualifications. Violations like trading during restricted news events, breaking consistency rules (e.g., no single day can account for more than 30% to 40% of total profit), or holding positions over the weekend can all result in failure. To avoid these mistakes, read your firm's rulebook thoroughly - twice if needed. Keep a detailed trade journal, noting not just your trades but also your emotional state. This can help you identify patterns like impatience or overtrading. Remember, the goal isn’t just to prove your strategy works - it’s to execute it consistently enough for your edge to shine.

New Developments in Funded Trading Programs for 2026

The funded trading landscape in 2026 has seen a noticeable shift in evaluation models. Companies like Vanquish Trader have streamlined the process with one-step evaluations, eliminating the verification phase entirely to fund traders more quickly. On the other hand, Alfa Prop Traders has introduced a more detailed three-stage institutional model, which includes: The Challenge (initial evaluation), The Incubator (a mentorship phase lasting over six months), and The Prop Fund, where traders earn a base salary plus commission instead of relying solely on profit splits.

"The Incubator should be considered a consolidation and mentoring stage... to guide you through the process to working for The Prop Fund." – Alfa Prop Traders

"The Incubator should be considered a consolidation and mentoring stage... to guide you through the process to working for The Prop Fund." – Alfa Prop Traders

Another major change is the removal of time limits in many programs, giving traders the freedom to progress at their own pace. This approach prioritizes quality execution over hurried performance. For instance, Alfa Prop Traders now requires participants to maintain a Sharpe Ratio above 1.0 before accessing real capital. Additionally, many firms have introduced consistency rules, ensuring no single trading day accounts for more than 30% to 40% of total profits. These updates highlight a shift toward more flexible and performance-focused evaluations.

Advancements in technology are also reshaping the industry. Firms now use internal algorithms to monitor simulated trades and apply profitable strategies to their own live accounts. FTMO, which has paid out over $500 million in rewards since its inception, offers cutting-edge tools like Account Metrix and Mentor Apps to provide automated performance analytics and real-time risk management.

Payout structures have become more trader-friendly as well. Many programs now offer maximum profit splits at the performance account stage and daily payouts, replacing the traditional monthly schedule. FTMO, for example, provides a 19% discount on their 100K Challenge and refunds the entry fee upon the first withdrawal. The firm also boasts a 4.8/5 rating on Trustpilot from over 35,000 reviews. These updates are designed to better align with traders' needs and the demands of modern markets.

"Many firms structure evaluations as revenue generators. Vanquish structures theirs as skill assessments." – Vanquish Trader Blog

"Many firms structure evaluations as revenue generators. Vanquish structures theirs as skill assessments." – Vanquish Trader Blog

Conclusion

Funded trading challenges in 2026 have evolved into tough evaluations of trading expertise. To succeed, traders need to focus on disciplined risk management and consistent execution rather than relying on aggressive or high-risk strategies. A crucial step is validating your approach with at least 100 backtested trades to ensure you can stay within drawdown limits. It’s also wise to set personal loss limits that are stricter than the firm’s official rules, giving yourself an extra safety net. With the trend shifting toward no-time-limit models, there’s more room to focus on steady, deliberate growth - but sticking to your trading plan remains critical for consistent results.

"Success in these prop firm challenges is built on consistent habits, not on shortcuts or secret indicators." – OneFunded

"Success in these prop firm challenges is built on consistent habits, not on shortcuts or secret indicators." – OneFunded

Even a minor connectivity issue during a key trade can push you over the drawdown limit and lead to disqualification, and most firms don’t offer flexibility for technical problems on the trader’s side. For strategies that require fast execution, QuantVPS provides the reliability you need to safeguard your trades. Their plans start at $59.99/month for the VPS Lite, which supports 1–2 charts with 4 cores and 8GB RAM. Ultimately, sticking to solid risk management principles is essential for navigating these challenges successfully.

FAQs

What’s the difference between one-step, two-step, and three-step evaluation models in funded trading challenges?

Funded trading challenges use various evaluation models to test traders' abilities before offering financial backing. Here's a closer look at the three main approaches:

- One-step evaluations: Traders must meet a profit target while adhering to risk limits in a single phase. Once they succeed, funding is provided right away.

- Two-step evaluations: This method consists of a Challenge phase, where traders aim to achieve profit goals under strict conditions, followed by a shorter Verification phase to confirm consistency before funding is approved.

- Three-step evaluations: In addition to the Challenge and Verification phases, this model includes an extra stage - commonly referred to as a Scaling or Live-Trading phase. Here, traders must hit additional performance or capital-growth targets to secure full funding.

These models progressively increase the level of scrutiny, ensuring traders display both skill and reliability before receiving financial support.

What are trailing drawdown limits, and why do they matter in funded trading challenges?

Trailing drawdown limits are a flexible risk management tool often used in funded trading challenges to keep losses in check. Unlike fixed loss limits, a trailing drawdown adjusts based on your account's highest equity point, which includes unrealized gains. Here’s how it works: as your account grows, the minimum allowable balance rises with it. For instance, if you’re trading a $50,000 account with a $2,000 trailing drawdown and your equity peaks at $51,000, your new minimum balance shifts to $49,000. Once you’ve locked in enough realized profits to cover the drawdown limit - plus a small buffer, say $100 - the trailing drawdown might be removed or switched to a fixed floor.

This approach plays a key role in promoting disciplined trading. By linking the loss limit to your peak performance, it discourages reckless risk-taking after gains. It also pushes traders to secure profits regularly, manage positions wisely, and avoid steep drawdowns - safeguarding both their earnings potential and the firm’s capital.

What are the main advantages of using a funded trading account instead of your own money?

Using a funded trading account means you get to trade with money provided by a proprietary trading firm, eliminating the need to dip into your personal savings. Once you successfully complete their evaluation process, you’re granted access to a live account, often starting at $25,000 and going up to $250,000 or more. This gives you access to far greater buying power than what most individual traders can manage on their own. Plus, since the capital belongs to the firm, your financial exposure is limited to their rules - allowing you to concentrate on perfecting your strategies without the stress of losing your own money.

Another major perk is the high profit-sharing structure that many funded accounts offer. In most cases, traders can keep 80% to 90% of their earnings. On top of that, payouts are typically quicker than with traditional brokerage accounts - some firms even provide daily or instant withdrawals. With reduced personal risk, faster access to profits, and the ability to trade larger amounts, funded trading accounts are an attractive choice for traders aiming to grow without relying on their own capital.

Funded trading challenges use various evaluation models to test traders' abilities before offering financial backing. Here's a closer look at the three main approaches:

- One-step evaluations: Traders must meet a profit target while adhering to risk limits in a single phase. Once they succeed, funding is provided right away.

- Two-step evaluations: This method consists of a Challenge phase, where traders aim to achieve profit goals under strict conditions, followed by a shorter Verification phase to confirm consistency before funding is approved.

- Three-step evaluations: In addition to the Challenge and Verification phases, this model includes an extra stage - commonly referred to as a Scaling or Live-Trading phase. Here, traders must hit additional performance or capital-growth targets to secure full funding.

These models progressively increase the level of scrutiny, ensuring traders display both skill and reliability before receiving financial support.

Trailing drawdown limits are a flexible risk management tool often used in funded trading challenges to keep losses in check. Unlike fixed loss limits, a trailing drawdown adjusts based on your account's highest equity point, which includes unrealized gains. Here’s how it works: as your account grows, the minimum allowable balance rises with it. For instance, if you’re trading a $50,000 account with a $2,000 trailing drawdown and your equity peaks at $51,000, your new minimum balance shifts to $49,000. Once you’ve locked in enough realized profits to cover the drawdown limit - plus a small buffer, say $100 - the trailing drawdown might be removed or switched to a fixed floor.

This approach plays a key role in promoting disciplined trading. By linking the loss limit to your peak performance, it discourages reckless risk-taking after gains. It also pushes traders to secure profits regularly, manage positions wisely, and avoid steep drawdowns - safeguarding both their earnings potential and the firm’s capital.

Using a funded trading account means you get to trade with money provided by a proprietary trading firm, eliminating the need to dip into your personal savings. Once you successfully complete their evaluation process, you’re granted access to a live account, often starting at $25,000 and going up to $250,000 or more. This gives you access to far greater buying power than what most individual traders can manage on their own. Plus, since the capital belongs to the firm, your financial exposure is limited to their rules - allowing you to concentrate on perfecting your strategies without the stress of losing your own money.

Another major perk is the high profit-sharing structure that many funded accounts offer. In most cases, traders can keep 80% to 90% of their earnings. On top of that, payouts are typically quicker than with traditional brokerage accounts - some firms even provide daily or instant withdrawals. With reduced personal risk, faster access to profits, and the ability to trade larger amounts, funded trading accounts are an attractive choice for traders aiming to grow without relying on their own capital.

"}}]}