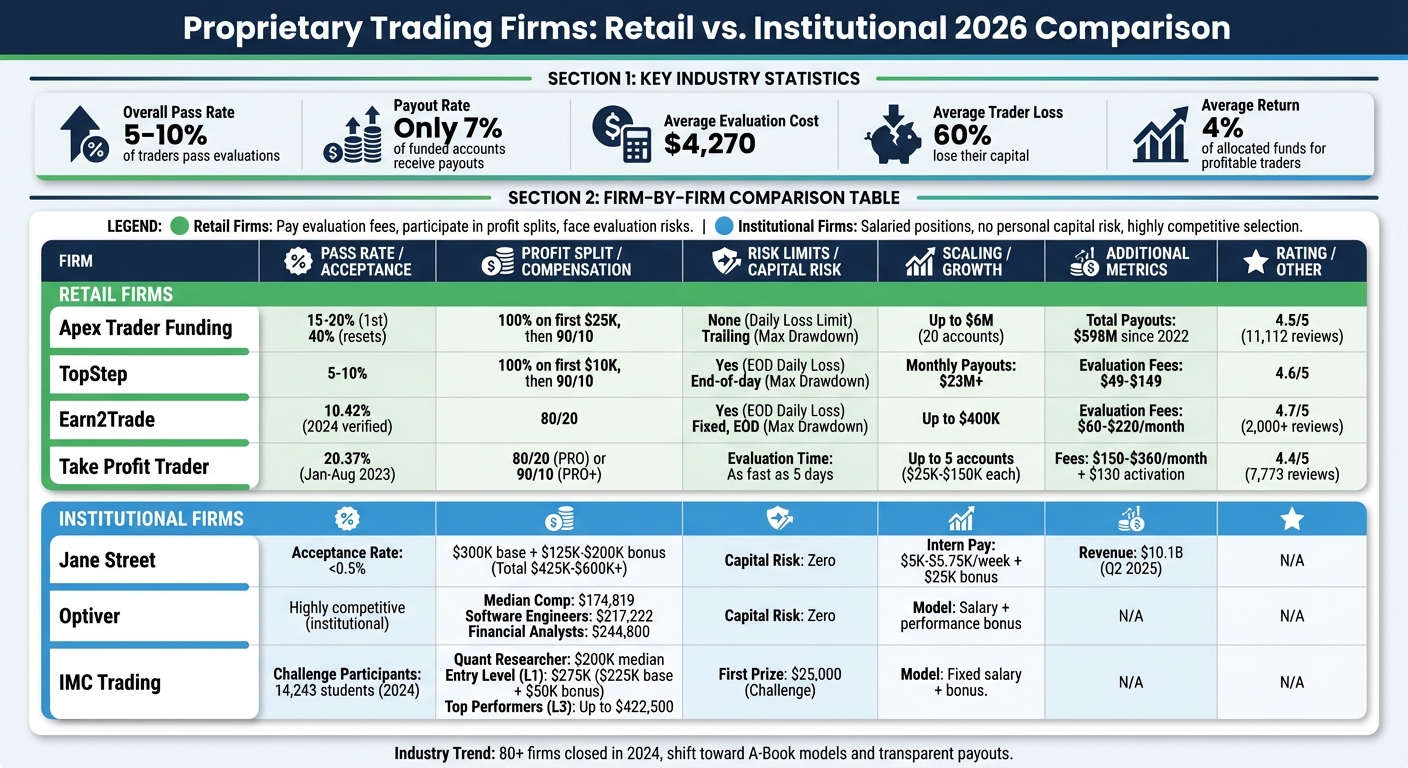

Proprietary trading firms (prop firms) allow traders to use company capital in exchange for a share of profits. However, success rates are low – only 5–10% of traders pass evaluations, and just 7% of funded accounts receive payouts. With evaluation fees averaging $4,270, choosing the right firm is critical. Many traders look for prop firm discounts to lower these initial costs.

Key takeaways:

- Pass Rates: Most firms see pass rates between 5–10%, though a few, like Apex Trader Funding, report higher rates with resets.

- Payouts: Retail firms offer profit splits up to 100% for early payouts, but institutional firms like Jane Street provide salaries and bonuses.

- Scaling: Retail firms cap account sizes; institutional firms offer larger capital with no personal risk.

- Risk Requirements: Daily loss limits typically range from 3–5%, with stricter rules for retail firms.

- Industry Trends: Prop firms are transitioning to more transparent and sustainable models after the 2024 closures of over 80 firms.

Retail firms like Apex Trader Funding, TopStep, and Earn2Trade cater to independent traders with flexible account models, while institutional firms like Jane Street and Optiver focus on hiring top-tier talent with guaranteed salaries. Each has pros and cons depending on your goals, skill level, and risk tolerance.

Prop Firm Comparison: Pass Rates, Profit Splits, and Loss Limits 2026

Prop Firm Comparison: Pass Rates, Profit Splits, and Loss Limits 2026

1. Apex Trader Funding

Evaluation Pass Rates

Apex Trader Funding sets itself apart with a first-attempt pass rate of 15% to 20%, which is about double the industry average of 5% to 10%. For traders who opt for account resets, this rate increases significantly to 40%. The introduction of "Apex 3.0" updates in late 2025 brought in more flexible rules, including on-demand payout requests and the elimination of rigid payout windows. These changes led to a 10% to 15% increase in user-reported pass rates.

Since 2022, Apex has distributed over $598 million in payouts, with an average monthly payout of $15.4 million as of late 2025. In the 90 days leading up to 2026, traders received $56 million in payouts. Notably, in April 2025, one trader secured a single-day payout of $2,552,800.50, verified via bank wire – one of the largest single-day payouts on record. Similarly, in December 2024, trader Patrick Wieland received an approved payout of $608,000, with bank documentation confirming the transaction.

Next, let’s break down how these pass rates align with Apex’s payout structures.

Payout Structures

Apex offers a 100% profit split on the first $25,000 earned per account. Beyond that, the split adjusts to 90/10 in favor of the trader. The minimum withdrawal is $500, and traders must complete 8 to 10 trading days before requesting their first payout. Once requested, payouts are typically received within 8 days and processed in 1 to 4 days.

"Getting my first payout took less than a week from request to money in my bank account. Apex is the fastest prop firm payout I’ve seen." – Chris T., Funded Trader

"Getting my first payout took less than a week from request to money in my bank account. Apex is the fastest prop firm payout I’ve seen." – Chris T., Funded Trader

Apex enforces a 30% Consistency Rule, which means no single trade or trading day can account for more than 30% of total profits at the time of payout. For the first three payouts, traders must maintain a "safety net" in their account equal to the drawdown amount plus $100. Additionally, there are withdrawal caps for the first five payouts based on account size – for instance, a $50,000 account has a maximum withdrawal limit of $2,000. These caps are lifted starting with the sixth payout.

Scaling Potential

Apex provides traders with the ability to manage up to 20 active Performance Accounts simultaneously, allowing total capital scaling of up to $6 million (20 accounts at $300,000 each). Unlike many competitors, Apex doesn’t impose restrictions on contract sizes based on account balance. This means traders can trade the maximum allowable position size right from the start. Using trade copiers, traders can execute the same strategy across multiple accounts, amplifying their profit potential. For example, in 2024, trader Carlos V. leveraged multiple accounts and automation tools to generate over $400,000 in total payouts.

This scaling flexibility pairs well with Apex’s advanced performance tools, which we’ll explore next.

Performance Features

Apex uses a real-time trailing drawdown system based on peak intraday balance, including unrealized gains. This differs from the end-of-day drawdown calculations many competitors use, which are often considered more forgiving for swing traders. Apex also stands out by having no daily loss limit and allowing trading during news events and holidays, as long as traders steer clear of high-risk directional news scalping strategies.

The firm’s reputation is solid, with a 4.5/5 rating on Trustpilot from over 11,112 reviews as of late 2025. Users frequently praise the speed of withdrawals, though occasional delays have been reported in non-U.S. regions.

2. TopStep

Evaluation Pass Rates

TopStep evaluates traders through its Trading Combine, which measures their ability to hit profit targets while staying within a Maximum Loss Limit. According to industry data from 2025, the pass rates for such evaluations typically range between 5% and 10%. One feature that sets TopStep apart is its end-of-day drawdown calculation, which gives traders more breathing room during volatile trading sessions.

"Verified public sources consistently show low pass rates. Roughly 5 to 10% pass evaluations, and a smaller share maintain accounts long enough to withdraw profits." – FunderPro

"Verified public sources consistently show low pass rates. Roughly 5 to 10% pass evaluations, and a smaller share maintain accounts long enough to withdraw profits." – FunderPro

In a recent month, TopStep paid out over $23 million, with one trader earning an impressive $346,000. That said, reaching the payout stage is no easy feat – only about 7% of traders who pass the evaluation eventually make withdrawals. To qualify for your first payout, traders need five winning days with at least $150 in net profit and loss (PNL).

Payout Structures

TopStep offers a generous profit-sharing model. Traders keep 100% of their profits on the first $10,000 of cumulative payouts. After that, the split changes to 90/10, with traders keeping the larger portion. This structure is considered more favorable than what many competitors offer.

"Topstep offers one of the most competitive profit splits in the industry: you keep up to 90% of your profits, for the traders who don’t need the smoke and mirrors." – Team Topstep

"Topstep offers one of the most competitive profit splits in the industry: you keep up to 90% of your profits, for the traders who don’t need the smoke and mirrors." – Team Topstep

Payout requests are processed within 24–48 hours, and there’s a $20 fee for ACH and wire transfers. For those using Express Funded Accounts, payouts are capped at the lesser of $5,000 or 50% of the account balance per request. Once traders transition to a Live Funded Account and achieve 30 non-consecutive winning days, they unlock daily payouts, allowing them to withdraw up to 100% of their balance. It’s worth noting that after the first payout, the Maximum Loss Limit resets to $0, so the account balance cannot fall below the starting capital.

Scaling Potential

TopStep provides a clear scaling path for traders. After securing five successful payouts, traders can move from an Express Funded Account to a Live Funded Account. Live accounts remove the $5,000 payout cap and introduce the option for daily withdrawals after 30 winning days. The proprietary TopstepX platform supports traders on this journey, offering commission-free trading and tools like the Tilt Indicator, which helps traders recognize and manage emotional trading patterns before they lead to rule violations.

For those interested in getting started, evaluation fees are priced at $49 for a $50,000 account, $99 for a $100,000 account, and $149 for a $150,000 account. Additionally, there’s a one-time activation fee of $149 for funded accounts.

Performance Features

One of TopStep’s standout features is its end-of-day Maximum Loss Limit. Unlike intraday drawdowns, which can penalize traders for temporary price swings, this approach adjusts only at the market close. This flexibility is especially valuable for swing traders and those managing positions in volatile markets.

The firm has earned a strong reputation, boasting a 4.6/5 rating and recognition for having the "Best Payout Policy in the Industry". To avoid breaching the daily loss limits during evaluations, it’s recommended to keep risk per trade between 0.5% and 1.0%. TopStep’s Consistency Target and Daily Loss Limit are designed to encourage disciplined trading habits rather than act as rigid constraints.

3. Earn2Trade

Evaluation Pass Rates

Earn2Trade has a verified evaluation pass rate of 10.42% in 2024, which places it on the higher end of the industry range (most proprietary trading firms report pass rates between 5% and 10%). The firm provides two main evaluation options: the Trader Career Path, designed for structured scaling, and the Gauntlet Mini, a faster route to funding. Both programs focus exclusively on futures trading across major exchanges like CME, COMEX, NYMEX, and CBOT. Among traders who successfully passed their evaluations, 89.96% opted for a LiveSim account, while 10.04% chose a Live account.

Payout Structures

Earn2Trade offers an 80/20 profit split, allowing traders to keep 80% of their earnings. Withdrawals have a $100 minimum, with a $10 processing fee waived for amounts over $500. The payout setup varies depending on the account type:

- LiveSim Accounts: These accounts are activated within two business days after approval. A one-time $139 activation fee is deducted from the first profits.

- Live Accounts: These require more detailed brokerage paperwork and verification, which can delay the setup process. However, Live accounts do not have an activation fee, though traders are responsible for approximately $135 per month in exchange data fees.

These payout structures provide traders with clear terms and flexibility as they grow their accounts.

Scaling Potential

The Trader Career Path offers a structured scaling system, allowing traders to grow their accounts up to $400,000 under a fixed drawdown model. Meeting the profit target at each tier automatically upgrades the account to the next level. For instance, hitting the target on a $50,000 account advances it to $100,000. Evaluation pricing starts at $60 per month for a $25,000 account and goes up to $220 per month for a $200,000 Gauntlet Mini account.

The Trader Career Path includes one free reset with each renewal, while Gauntlet Mini resets cost $100. Once traders are funded, they can request the removal of the daily loss limit once their account balance grows sufficiently beyond the starting capital. Unlike dynamic trailing drawdowns used by firms like Apex Trader Funding, Earn2Trade’s fixed drawdown provides a more stable and predictable risk management approach.

Performance Features

Earn2Trade emphasizes trader protection and performance during evaluations. The firm uses an end-of-day (EOD) trailing drawdown, which only considers the closing balance, offering more flexibility compared to intraday drawdowns. This method is also employed by other firms like TopStep. To ensure consistency, traders must close all positions by 3:50 PM CT, as overnight and swing trading are not permitted.

A 30% consistency rule is enforced during the evaluation phase, ensuring no single trading day contributes more than 30% of the total profit. This rule is lifted once traders secure funding. Additionally, Earn2Trade provides access to professional tools like NinjaTrader, Finamark Systems, and Journalytix for trade journaling and performance tracking. The firm also boasts a strong reputation, with a Trustpilot rating of 4.7/5 based on over 2,000 reviews.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

4. Bulenox

Evaluation Pass Rates

Bulenox keeps its evaluation pass rates under wraps. However, industry statistics reveal that only about 5% to 10% of traders pass proprietary firm evaluations, and just 7% of traders typically receive a payout. Bulenox operates on a subscription-based model, with fees ranging from $115 per month for a $10,000 account to $535 per month for a $250,000 account. This pricing structure encourages traders to complete evaluations quickly to avoid racking up monthly fees.

Now, let’s dive into how Bulenox structures its payouts.

Payout Structures

Bulenox offers traders a generous profit split: 100% of the first $10,000 in profits and 90% of profits beyond that.

Payouts are processed weekly on Wednesdays, but traders must meet a few conditions. They need to complete 10 trading days on their Master Account, adhere to a 40% consistency rule (which limits profits from any single day), and abide by initial withdrawal caps. For example, on a $25,000 account, the first three payouts are capped at $1,000 each. After these initial payouts, the limits are removed, allowing traders to make unlimited withdrawals every 10 trading days. Additionally, to qualify for withdrawals, traders must maintain a safety threshold reserve – for instance, $2,600 on a $50,000 account.

Scaling Potential

When it comes to scaling, Bulenox requires traders to upgrade to larger account sizes as their profitability grows. Account sizes go up to $250,000, with contract limits increasing accordingly – from 5 micro contracts on a $10,000 account to 25 standard contracts on a $250,000 account.

Traders can choose between two account models: Trailing Drawdown (TD) and End of Day (EOD). The EOD model calculates risk based only on closed daily balances, giving traders more flexibility compared to intraday drawdown methods. On Trustpilot, Bulenox has received glowing feedback, with around 90% of its 500 reviews rated 5 stars. However, some users have pointed out the absence of live chat or phone support as a drawback.

5. Take Profit Trader

Evaluation Pass Rates

Between January and August 2023, Take Profit Trader recorded a 20.37% pass rate for its evaluation process. This is higher than the industry average and is achieved through their straightforward one-step evaluation system. Traders can qualify for a funded PRO account in as little as five days. Compared to multi-phase evaluations that can stretch up to 60 days, this streamlined approach saves both time and money. It also sets the stage for a payout structure that many traders find appealing.

Payout Structures

Take Profit Trader provides two payout options: the PRO account and the PRO+ account. The PRO account offers an 80/20 profit split, but traders must meet a buffer requirement (e.g., a $50,000 account needs to grow to $52,000 for full withdrawals). On the other hand, the PRO+ account features a 90/10 profit split without any buffer and uses end-of-day drawdown calculations. A key benefit is that PRO account holders can start withdrawing profits from day one. These payout terms align well with the firm’s efficient scaling options.

Scaling Potential

Traders can manage up to five PRO accounts, with account sizes ranging from $25,000 to $150,000. Subscription fees are tiered, starting at $150 per month for a $25,000 account and going up to $360 per month for a $150,000 account. Additionally, there’s a one-time $130 activation fee upon passing the evaluation. During 2024, 16.86% of Trading Tests led to traders securing a PRO account. Take Profit Trader has also earned a solid reputation, boasting a 4.4/5 star rating on Trustpilot from 7,773 reviews.

6. Jane Street

Evaluation Pass Rates

Jane Street takes a different approach to evaluating candidates, relying on a distinctive interview process that emphasizes mathematical reasoning, probability skills, and teachability rather than paid evaluation challenges. With an acceptance rate of less than 0.5% for the 2025/2026 cycle, the firm is far more selective compared to retail proprietary trading firms like TopStep or FTMO, where pass rates generally fall between 5% and 10%. Once interns secure a spot, about 85% are offered full-time positions.

"If even one interviewer says ‘They were arrogant’ or ‘They didn’t listen to my hint,’ you are rejected. Consensus is key." – GetSmartResume

"If even one interviewer says ‘They were arrogant’ or ‘They didn’t listen to my hint,’ you are rejected. Consensus is key." – GetSmartResume

Jane Street places a premium on teachability over raw speed in solving problems. Candidates who demonstrate intellectual humility and an ability to incorporate feedback are the ones who succeed. This stringent selection process lays the groundwork for the firm’s unique compensation system.

Payout Structures

Unlike many retail prop firms, Jane Street follows a salaried compensation model. New graduate traders start with a base salary of $300,000, accompanied by a guaranteed bonus of $125,000 to $200,000. This brings their total compensation to somewhere between $425,000 and over $600,000. Interns are also well-compensated, earning $5,000 to $5,750 per week (around $21,000 to $25,000 per month) along with a $25,000 sign-on bonus.

"All employees are paid based on the firm’s collective profits, not personal trading gains." – eFinancialCareers

"All employees are paid based on the firm’s collective profits, not personal trading gains." – eFinancialCareers

This profit-sharing model stands in stark contrast to retail prop firms, which often offer traders 80–90% of their individual profits but provide no guaranteed income. At Jane Street, traders typically receive 10% to 30% of their book’s P&L, while taking on zero capital risk and avoiding evaluation fees.

Performance Features

Jane Street’s trading infrastructure is built on OCaml, a programming language that connects traders and engineers seamlessly. The firm has also been expanding its use of Python for machine learning applications. Financially, Jane Street reported $10.1 billion in net trading revenue and $6.9 billion in net profit during the second quarter of 2025. In 2024, the firm averaged $2 trillion in equity trading volumes per month and dominated 41% of bond ETF trading volume.

Traders at Jane Street typically work 50–55 hours per week, which is less demanding compared to the 60+ hours common at other firms. The company also operates with a flat hierarchy, avoiding traditional titles like "VP" or "Associate." Instead, respect and status are earned through peer recognition rather than formal promotions.

7. Optiver

Evaluation Pass Rates

Optiver operates as an institutional market maker, which sets it apart from fee-based retail proprietary trading firms. The company focuses on recruiting top-tier STEM talent through initiatives like "FutureFocus" and quantitative trading internships, aiming to fill roles in high-frequency and systematic trading. These recruitment programs also double as rigorous evaluation processes for full-time employment and career-track positions.

Although Optiver doesn’t disclose its acceptance rates, the selection process is known to be extremely competitive. For comparison, retail proprietary trading firms typically have pass rates ranging between 5% and 10%. Now, let’s take a closer look at how Optiver’s compensation structure differs from the fee-based models found in retail firms.

Payout Structures

Optiver moves away from the profit-split models commonly seen in retail proprietary firms, instead offering employees guaranteed base salaries and performance-based bonuses. The median annual compensation across all roles at Optiver is $174,819.

Here’s a breakdown of some roles:

- Hardware Engineers: Up to $391,781 annually

- Software Engineers: Around $217,222 in total compensation

- Financial Analysts: Median pay of $244,800

- Investment Bankers: Approximately $258,700

These figures include base salaries, bonuses, and stock-based incentives. Traders at Optiver don’t receive individual profit splits. Instead, their bonuses are tied to the firm’s overall trading performance, which removes the risk of using personal capital. This structure aligns employee incentives with the firm’s collective success.

Performance Features

Optiver places a strong emphasis on innovation, leveraging cutting-edge tools and processes to stay ahead. Their "Research at Scale" initiative utilizes machine learning and streamlined continuous integration workflows, achieving a 30% improvement in build speeds and reducing onboarding times to just minutes. Additionally, the firm has enhanced its infrastructure by adopting CPython 3.13 with free threading, which eliminates the Global Interpreter Lock and boosts efficiency. These advancements contribute to Optiver’s ability to maintain its competitive edge in the market.

8. IMC Trading

Evaluation Pass Rates

IMC Trading stands apart from retail proprietary firms that charge evaluation fees. Instead, it hosts the Prosperity Global Trading Challenge, a free market simulation designed for STEM university students. In 2024, this event attracted 14,243 students from over 400 universities.

The competition spans five rounds, blending algorithmic trading bots and manual trading exercises that mimic real-world market conditions. Participants vie for cash prizes and the chance to join IMC’s Graduate Traineeship program, which offers specialized training in areas like Trading, Development, FPGA, and Analysis. With thousands competing for just a few top spots, IMC’s selection process is far more selective than the 5–10% pass rates typical at retail proprietary firms.

"Reaching Prosperity will require strategic thinking and fast problem-solving – just like a career at IMC." – Jade Olsson, Head of Core HR, IMC

"Reaching Prosperity will require strategic thinking and fast problem-solving – just like a career at IMC." – Jade Olsson, Head of Core HR, IMC

An impressive 96% of participants in the 2024 Prosperity challenge reported considering a trading career after the event. This competitive evaluation process sets the stage for a distinct approach to payouts, which is explored next.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Payout Structures

Instead of profit-split arrangements common in retail trading, IMC awards fixed cash prizes. In the Prosperity challenge, prizes are determined by final account rankings, with $25,000 awarded to the first-place winner. Winners are announced two weeks after the final round, and prize payments are distributed within three months. Tax obligations fall on the winners, with U.S. residents required to submit IRS Form W-9.

For those who transition to full-time roles, IMC offers competitive salaries rather than profit splits. In the United States, the median annual compensation for a Quantitative Researcher is $200,000. Entry-level (L1) roles start at approximately $275,000, which includes a $225,000 base salary and a $50,000 bonus. High-performing L3-level researchers have reported earning up to $324,000. Beyond the contest, full-time positions at IMC provide substantial, performance-driven compensation.

Scaling Potential

IMC’s career progression follows a structured path (L1–L4), with compensation increasing based on performance. Top-tier performers can earn packages up to $422,500. This growth is supported by IMC’s 6-week Trading School, which delivers in-depth training on options theory and the firm’s proprietary systems. Unlike retail firms that scale through phased account sizes, IMC offers institutional-grade capital and infrastructure from the very beginning, enabling employees to focus on high-level trading strategies without limitations.

9. Flow Traders

Evaluation Pass Rates

Flow Traders takes a different approach to hiring compared to many other firms. Instead of relying on challenge-based evaluations – which typically see a pass rate of just 5–10% – they focus on candidates’ academic and technical qualifications. This method allows them to sidestep the need for generating revenue through evaluation fees.

Payout Structures

When it comes to compensation, Flow Traders opts for a more structured setup. They provide fixed salaries paired with performance bonuses, offering traders a stable and predictable income. This is a departure from the profit-split models that are more common among retail proprietary trading firms.

Scaling Potential

Career growth at Flow Traders aligns with their institutional framework. Traders can advance by demonstrating strong performance and effective risk management, which leads to increased capital allocations. From the very beginning, traders have access to institutional-grade capital, with further growth tied to their ability to deliver consistent results.

10. DRW Trading

Evaluation Pass Rates

DRW stands apart from retail proprietary trading firms by skipping the typical pay-to-play challenges. Instead, candidates apply directly for trading roles through a multi-stage recruitment process. This process includes a technical challenge – focused on either quantitative analysis or coding – a Zoom interview with developers or researchers, and a two-day final round that evaluates both technical expertise and behavioral traits.

While retail firms often have pass rates as low as 5–10%, DRW’s selection process is even tougher. The firm specifically seeks candidates who excel in solving complex quantitative and coding problems. This intense screening ensures that only the most capable individuals join the team, aligning with DRW’s focus on fostering a stable and rewarding trading career.

Payout Structures

At DRW, traders receive a traditional salary along with performance-based bonuses, offering a steady income without the pressure of meeting profit targets. The company emphasizes that its traders are employees building a professional career, with compensation tied to their contributions and roles within the organization.

Scaling Potential

DRW doesn’t just offer competitive pay – it also prioritizes long-term career development. The firm provides personalized learning programs, mentorship from experts, and opportunities to work on diverse projects. This hands-on approach helps employees develop and refine their skills across various trading products.

"Learning is a core value here and we’re committed to making learning opportunities easily accessible so all employees can build their skills and develop their careers"

"Learning is a core value here and we’re committed to making learning opportunities easily accessible so all employees can build their skills and develop their careers"

Career advancement at DRW is based on individual performance rather than simply growing account size, ensuring that growth is earned and meaningful.

What Percentage Actually Pass Prop Firm Challenges? (The Results Will Shock You)

Advantages and Disadvantages

When evaluating prop firms, it’s important to weigh the pros and cons of different types. Retail firms like Apex Trader Funding, TopStep, and Earn2Trade are known for their relatively low barriers to entry. However, the evaluation pass rates are typically between 5% and 10%. These firms offer enticing benefits, such as flexibility and profit splits that can go as high as 95%. On the downside, they enforce strict risk limits – usually around 5% daily and 10% maximum – which can result in accounts being closed prematurely.

Institutional firms, such as Jane Street, Optiver, and DRW Trading, take a completely different approach. They focus on hiring top-tier talent in quantitative analysis and coding through highly selective recruitment processes. Instead of profit splits, these firms provide stable salaries with performance bonuses. This structure removes the pressure of hitting arbitrary profit targets and includes opportunities for mentorship and career development. That said, these positions are extremely competitive, with acceptance rates significantly lower than those of retail-focused firms.

On average, traders spend about $4,270 on evaluations, with 60% losing their capital. For those who do turn a profit, the average return is just 4% of their allocated funds.

Another factor to consider is payout speed, which varies widely across firms. Some firms promise payouts within 24 hours, while others may take up to 14 days, potentially disrupting trading momentum and cash flow. In many cases, faster payouts can be more beneficial than slightly higher profit splits, especially for maintaining operational flow.

Here’s a breakdown of the key metrics across different firm types:

| Firm Type | Pass Rate | Profit Split | Daily Loss Limit | Max Loss Limit | Key Advantage | Key Disadvantage |

|---|---|---|---|---|---|---|

| Retail (Apex, TopStep) | 5–10% | 80–95% | 3–5% | 6–14% | Low entry cost, flexibility | Strict risk limits, low payout rates (7%) |

| Institutional (Jane Street, DRW) | <5% (estimated) | Salary + Bonus | N/A | N/A | Stable income, career growth | Extremely competitive, limited spots |

| Hybrid/Instant Funding | Varies | 80–100% | 3–7% | 6–14% | Fast access to capital | Tighter constraints, higher fees |

Recognizing these trade-offs is essential for choosing a firm that aligns with your trading goals and risk tolerance.

Conclusion

The prop trading scene in 2026 is anything but easy. Only about 5% to 10% of traders manage to pass the initial evaluations, and just 7% actually see payouts. The competition is fierce, and firms maintain strict standards. Recent closures of trading firms further underscore the importance of financial stability and transparent payout practices. These challenges paint a clear picture of what traders are up against.

For beginners, it’s wise to start small. Look for retail firms with lower entry costs, and spend time practicing on demo accounts before committing real money. Managing risk is key – keeping it between 0.5% and 1.0% per trade can help you stay within the typical daily drawdown limits of 3% to 5%. On average, traders can expect to spend around $4,270 on evaluations before reaching profitability.

For seasoned traders, the focus should shift to firms offering favorable profit splits and fast payout systems. Diversifying across two or three firms can reduce risk, and it’s crucial to verify payout histories to ensure transparency.

The industry itself is evolving, with a noticeable move toward A-Book execution models and futures trading. Interest in these areas has skyrocketed, with a 5,556% increase in search activity since 2020. Firms that rely heavily on evaluation fees – up to 80% to 95% of their revenue – are proving unsustainable. A glaring example is the 2024 collapse of My Forex Funds, which had collected $310 million in fees before shutting down.

"The 2024 bloodbath exposed the unsustainability of pure challenge-fee models. Long-term winners will adopt A-Book or hybrid models so trades hit real markets." – Prop Fintech

"The 2024 bloodbath exposed the unsustainability of pure challenge-fee models. Long-term winners will adopt A-Book or hybrid models so trades hit real markets." – Prop Fintech

As demonstrated by top-performing retail and institutional firms, having strong payout structures and clear risk management strategies is non-negotiable. Success in prop trading hinges on finding a firm that matches your trading style, offers transparent execution and payouts, and has a proven financial track record. With fewer than 15% of traders achieving consistent annual profits, both skill and careful firm selection are critical to thriving in this highly competitive space.

FAQs

What should I look for when choosing a proprietary trading firm?

When choosing a proprietary trading firm, it’s crucial to start by examining their success rates and evaluation process. Industry data shows that only 5%–10% of traders pass the initial challenges, with roughly 7% eventually receiving payouts. Opt for a firm that has transparent rules, realistic pass rates, and clearly defined risk limits. These factors can make a big difference in improving your chances of success.

Next, take a close look at the firm’s financial terms. Profit splits are a key consideration – most firms offer an 80/20 split, but some go as high as 90/10 or even 100% for top-tier performers. Pay attention to fee refund policies and initial capital allocations. Many firms offer starting balances ranging from $50,000 to $640,000, with opportunities to scale up to multi-million-dollar accounts if you show consistent performance.

Finally, evaluate the firm’s technology and support. Features like low-latency VPS hosting, multiple withdrawal options, and access to various trading platforms – such as MetaTrader 4/5 or proprietary software – can simplify your trading experience. Additional perks, including mentorship programs, evaluations without time limits, and strong fund security policies, can further enhance your journey. By prioritizing these aspects, you can find a firm that matches your trading approach and financial objectives.

What are the differences in payout structures between retail and institutional prop firms?

Retail proprietary trading firms operate on a profit-split model, where traders typically keep 70–80% of their net profits, while the firm takes the remaining share. Payouts are usually processed on a regular schedule – monthly or bi-weekly – but many firms now offer daily payout options. With this flexibility, traders can request withdrawals every business day, as long as they adhere to drawdown limits and maintain the required minimum account balance.

On the other hand, institutional proprietary trading firms are less transparent about their payout structures. They rarely share specific details publicly, making direct comparisons difficult. Their compensation packages often include a mix of base salaries, performance bonuses, and profit-sharing arrangements, which are usually designed for seasoned traders with a proven track record.

What are the major trends shaping the prop trading industry in 2026?

The proprietary trading industry is undergoing a transformation in 2026, fueled by AI-driven strategies and cloud-based execution platforms. These technologies are opening doors to high-frequency trading and complex algorithms that were out of reach just a few years ago. Alongside this, many firms are shifting to hybrid funding models. By blending traditional capital allocation with performance-based revenue sharing, they’re moving away from hefty challenge fees and building stronger, trust-based relationships with traders.

Attracting top talent has become a fierce competition. To stand out, firms are offering highly attractive profit splits – ranging from 80–90% and sometimes even conditional 100% – to lure skilled traders. However, the path to joining these firms remains tough, with evaluation program pass rates hovering around just 5–10%. To tackle this, companies are leaning into data-driven tools to refine their assessment processes and are branching out into various asset classes, including forex, crypto, and equities.

The industry’s momentum is undeniable. Its valuation has climbed to an impressive $20 billion, supporting over 2,000 firms, the majority of which are headquartered in the U.S. This rapid growth underscores a future shaped by technology, offering exciting opportunities but also presenting unique challenges for traders navigating this competitive landscape.