QuantVue ATS is an automated trading systems designed for experienced futures traders. It uses AI-driven strategies to execute trades quickly, with speeds under 40 milliseconds. While some traders report significant profits, such as over $100,000 in 2025 using the qZeus strategy, others highlight challenges like a steep learning curve and risks from overleveraging. The platform costs $8,500–$9,500 for lifetime access and is not beginner-friendly. Key features include automated trading, multi-account integration, and a supportive community of over 20,000 members. Testing strategies in simulation mode is highly recommended before live trading. Success depends on disciplined risk management and a solid understanding of trading fundamentals.

Main Features of QuantVue ATS

Automated Trading Without Manual Intervention

QuantVue ATS takes the hassle out of trading by executing trades automatically based on pre-set rules and automated futures trading strategies. Among these are three proprietary algorithms – Qice, Qzeus, and Qkronos_EVO – designed to handle entries, exits, and risk management seamlessly. This eliminates the need for constant chart monitoring and removes emotional decision-making from the equation.

The platform also includes QuantLynk, which automates multi-account signal replication. This allows traders to implement strategies across both cash and proprietary firm accounts simultaneously. Over 1,000 clients actively share strategies and insights in exclusive Discord channels, creating a collaborative trading environment.

Speed plays a pivotal role in QuantVue’s effectiveness, as detailed in the following section on execution and latency.

Fast Execution and Low Latency

Speed is everything in futures trading, and QuantVue ATS delivers with execution times under 40 milliseconds. This level of performance is made possible through direct data feeds and a fully customized in-house automation platform, bypassing the delays often introduced by third-party connectors. For context, specialized third-party connectors like AlertDragon typically operate at around 300 milliseconds, while more generic solutions can lag by 2–3 seconds, leading to costly slippage.

The platform’s Python-based infrastructure ensures this low-latency performance remains consistent, which is especially critical when trading fast-moving instruments like Nasdaq futures or Crude Oil.

With execution speed covered, the platform’s streamlined setup process further enhances its appeal to experienced traders.

Setup and Integration Process

QuantVue ATS offers a "Done-For-You" setup, completed in most cases within 24 hours. Each new client gets a dedicated one-on-one onboarding session, where the QuantVue team configures the system directly within the trader’s account. Integration with platforms like TradingView and NinjaTrader is straightforward, with pre-designed chart layouts and training videos provided to simplify the process.

This system is intentionally designed for seasoned traders. As QuantVue explicitly states:

"Our core system is designed for those with baseline trading knowledge and live-trading experience. Do not sign up if you’re a beginner trader".

Most users will need a paid TradingView plan (often the Premium tier) and real-time data subscriptions tailored to the instruments they trade. The program is offered with lifetime access for a one-time fee of $9,500 via credit card or $8,500 if paid via wire transfer or cryptocurrency.

What Futures Traders Say About QuantVue ATS

Profits Using Default Settings

In January 2026, a trader named Chris shared his success using the qZeus strategy with QuantVue’s default settings, reporting over $100,000 in payouts during 2025.

"I made just over 100k in payouts in 2025 trading with qZeus and a manual setup from their qPro indicator. The first profitable trading year I’ve ever had." – Chris, Verified Trader

"I made just over 100k in payouts in 2025 trading with qZeus and a manual setup from their qPro indicator. The first profitable trading year I’ve ever had." – Chris, Verified Trader

Other traders highlighted the importance of gradually scaling their investments. Many noted that the system could pay for itself within six months when trading MNQ futures with 3–5 contracts, achieving success rates of 85–90% with disciplined use.

The underlying message here is clear: patience is key. Even high win-rate strategies come with periods of drawdown, and traders looking for instant wealth often found themselves disappointed. These examples naturally lead into the system’s performance in handling trades automatically, which we’ll explore next.

Hands-Off Trade Execution

For traders with packed schedules, the ATS has been a game-changer. Jennifer, for instance, appreciated how the system executed trades automatically based on pre-set rules, helping to eliminate emotional decision-making – even during technical hiccups.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

"If you have a busy lifestyle but real knowledge of the market you will be able to really put these tools and strategies to work." – Jennifer, Verified Trader

"If you have a busy lifestyle but real knowledge of the market you will be able to really put these tools and strategies to work." – Jennifer, Verified Trader

One standout example of the system’s reliability came in January 2026, when a trader successfully passed a $50,000 prop evaluation in just three days despite a Tradovate platform breakdown. Remarkably, the same trader was simultaneously halfway through five additional evaluations. This level of automation is especially useful for those who can’t monitor charts during work hours or want to avoid the psychological strain of manual trading.

Common Problems and Restrictions

Some traders faced challenges, such as accidental changes to settings causing bot malfunctions. Managing multiple accounts was another hurdle until Quantlynk’s release in late 2025 simplified the process.

Overleveraging also proved risky. Running 20+ accounts with aggressive sizing often led to failure, and non-technical users found the learning curve steep despite the "Done For You" setup.

"Automation has been a learning curve for me, but QuantVue through the community and the automation specialists have continued to educate me and improve their algos." – GogglesTv, Verified Trader

"Automation has been a learning curve for me, but QuantVue through the community and the automation specialists have continued to educate me and improve their algos." – GogglesTv, Verified Trader

It’s worth noting that the 30-day money-back guarantee does not apply to the ATS program, which costs $9,500 – a significant investment. Those who ignored conservative guidelines or treated the system as a "money machine" rather than a tool for learning often faced poor results.

Understanding these common issues provides a clearer perspective as we move toward evaluating the system’s real-world performance in upcoming tests.

Testing QuantVue ATS Performance

As shared by experienced traders, thorough testing is a must before diving into live trading. Before putting real money on the line, seasoned traders subject QuantVue ATS to detailed testing phases. This process ensures the system performs effectively using real market data, minimizing risks. Typically, testing involves two key phases: backtesting to analyze past performance and forward testing to validate the strategy in current market conditions.

How Backtesting Works

Backtesting involves running a strategy against historical market data to see how it would have performed in the past. This step helps traders evaluate profitability and calculate the capital buffer needed to endure potential drawdowns. It’s not just about spotting winning trades – it’s about understanding how much capital is necessary to weather inevitable losing streaks.

For example, the Qzeus strategy has undergone over a year of backtesting using its default settings. This extensive testing gives traders confidence in its long-term reliability. However, backtesting has its limits. It doesn’t account for real-world factors like execution speed, latency, or slippage, making forward testing an essential next step.

Why Forward Testing Matters

Forward testing builds on backtesting by verifying a strategy’s performance in live market conditions. It involves running the ATS in a simulated environment with real-time data. QuantVue recommends using demo accounts for 1 to 2 months to fully understand how the system operates and how strategies respond to different market conditions. This phase acts as a reality check, ensuring that backtested results align with current market dynamics.

"The best automated traders are those who test extensively and in an orderly manner. They take notes and record things." – QuantVue Elite Plan Setup Guide

"The best automated traders are those who test extensively and in an orderly manner. They take notes and record things." – QuantVue Elite Plan Setup Guide

Here’s a practical tip: use a dedicated simulation account, such as Tradovate (available for $12.95/month), to test strategies before committing to costly prop firm evaluations. This risk-free phase allows traders to see how the ATS handles economic reports, news events, and fluctuating market volatility. It’s also a great way to build confidence for live trading. Stick with one strategy during this period and test it consistently for at least a month – frequent switching can lead to unreliable results.

Advantages and Disadvantages of QuantVue ATS

QuantVue ATS Pros and Cons Comparison for Futures Traders

QuantVue ATS Pros and Cons Comparison for Futures Traders

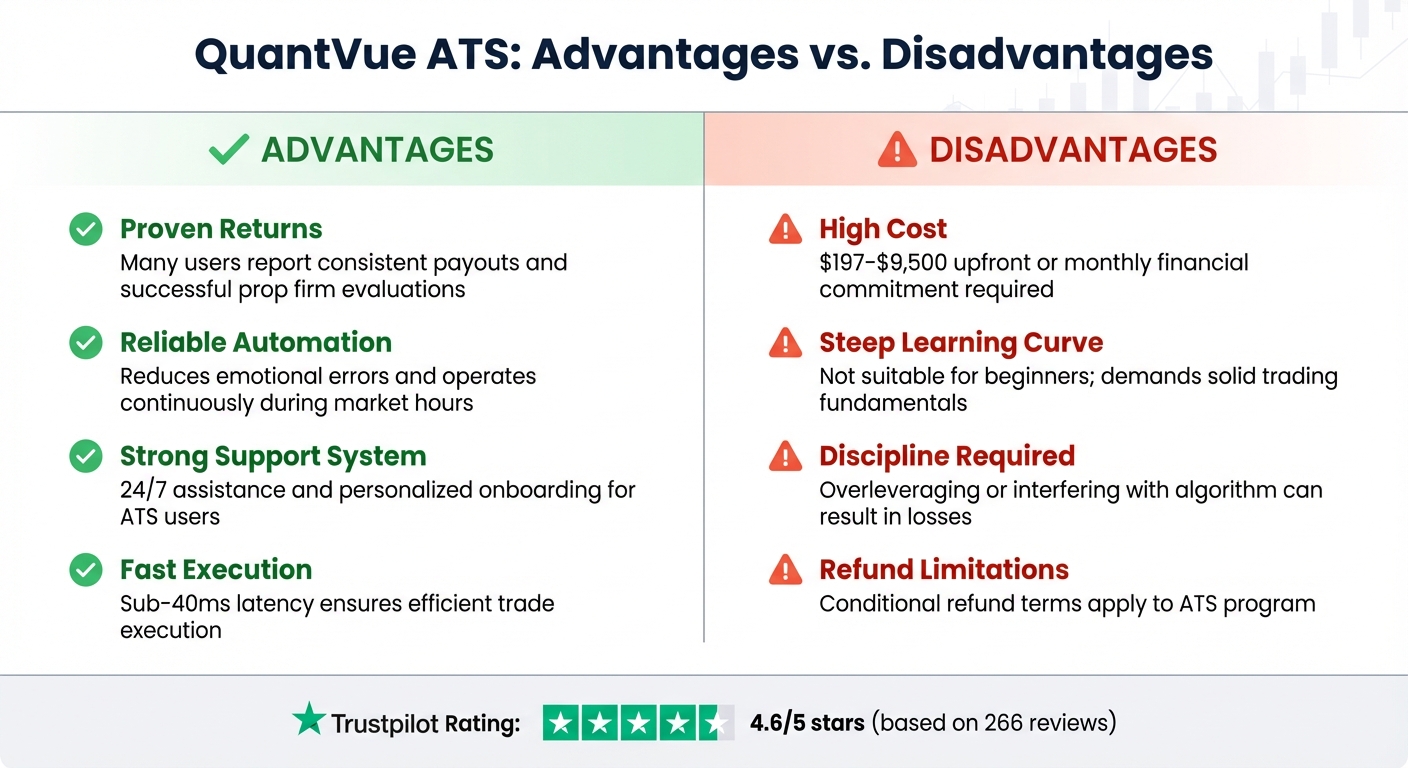

QuantVue ATS comes with a mix of benefits and challenges that traders need to weigh carefully. One of its standout advantages is the elimination of emotional bias, enabling trades to be executed without the influence of human emotions. The platform also boasts impressive speed, with execution times under 40 milliseconds, and offers round-the-clock support from a community of 20,000 traders – a clear technical advantage. Many users have reported significant payouts, particularly when using the qZeus strategy, which adds to its appeal.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

That said, these benefits come with some notable drawbacks. The cost is a major consideration, with monthly plans ranging from $197 to $447, and the full ATS program priced between $8,500 and $9,500. Additionally, this platform isn’t beginner-friendly – it requires a solid understanding of futures trading and risk management to use effectively. Even though the system is automated, users still need to exercise discipline; overleveraging or trying to micromanage the algorithm can lead to significant losses.

Pros and Cons Comparison

| Advantages (Strengths) | Disadvantages (Weaknesses) |

|---|---|

| Proven Returns: Many users report consistent payouts and successful evaluations with top futures prop firms. | High Cost: Requires a substantial upfront or monthly financial commitment ($197–$9,500). |

| Reliable Automation: Reduces emotional errors and operates continuously during market hours. | Steep Learning Curve: Not suitable for beginners; demands a solid understanding of trading fundamentals. |

| Strong Support System: 24/7 assistance and personalized onboarding for ATS users. | Discipline Required: Overleveraging or interfering with the algorithm can result in losses. |

| Fast Execution: Sub-40ms latency ensures efficient trade execution. | Refund Limitations: Conditional refund terms apply to the ATS program, unlike other plans. |

With a Trustpilot score of 4.6 out of 5 based on 266 reviews, QuantVue ATS garners praise for its fast execution and supportive community. However, concerns about its high costs and complexity remain. Success with the platform hinges on following conservative trading practices and avoiding the temptation to chase quick profits.

Should You Use QuantVue ATS?

QuantVue ATS is designed for intermediate to advanced futures traders who already have a solid grasp of market mechanics and risk management. If you’re just starting out, this platform might feel overwhelming, as it’s not intended to teach trading basics.

As Axel Ligman, a trader and reviewer, puts it:

"It’s not a beginner-friendly ‘learn trading from scratch’ course – it’s a set of advanced tools to sharpen strategies you already know."

"It’s not a beginner-friendly ‘learn trading from scratch’ course – it’s a set of advanced tools to sharpen strategies you already know."

The system focuses on short-term scalping, with trades typically lasting between 10 seconds and 5 minutes. It’s not suitable for swing or long-term trading and works exclusively with platforms like TradingView, NinjaTrader, or Sierra Chart. This level of specialization comes at a cost, with monthly plans ranging from $197 to $447, and the full ATS Program priced between $8,500 and $9,500.

Despite the steep price, some users have reported impressive results. For example, one trader claimed over $100,000 in payouts in 2025 using the qZeus strategy, while another reported a 100% return on investment within three to four weeks, even after accounting for fees.

To succeed with QuantVue ATS, disciplined risk management is non-negotiable. Overleveraging or managing more than 20 accounts often leads to losses. The platform recommends testing strategies in simulation mode first, using the settings provided by the QuantVue team, and keeping a capital buffer to handle inevitable losing days.

The platform is supported by a vibrant Discord community of over 20,000 members and offers 24/7 support. With an impressive Trustpilot rating of 4.6 from 266 reviews, users often praise its institutional-grade technology and responsive customer service.

If you have the experience, financial resources, and patience to follow its guidelines, QuantVue ATS can deliver consistent results. However, for beginners or those unwilling to commit to proper testing and disciplined risk management, it may not be the right choice.

FAQs

What automated trading strategies are available with QuantVue ATS?

QuantVue ATS offers pre-built automated trading strategies specifically crafted for U.S.-regulated futures markets. These strategies come with fully configured setups that can be up and running in as little as 24 hours, making the process fast and straightforward.

The platform is designed to provide dependable and user-friendly tools for futures trading, catering to traders across all skill levels while prioritizing both performance and simplicity.

How does QuantVue ATS deliver fast execution speeds for futures trading?

QuantVue ATS delivers lightning-fast execution speeds in futures trading, thanks to its ultra-low latency automated trading system. With the ability to execute trades in under 40 milliseconds, the platform ensures traders can act on market opportunities almost instantly.

This level of performance is achieved through state-of-the-art technology and a solid infrastructure designed for reliability. It’s a go-to option for traders who prioritize speed and accuracy in their trading strategies.

What challenges and risks should I consider before using QuantVue ATS?

Using QuantVue ATS isn’t without its hurdles, and traders should carefully weigh these before diving in. For one, the platform’s advanced tools and features can be expensive, making it less appealing for beginners or those working with tighter budgets. On top of that, its complexity is better suited for seasoned traders. If you’re new to trading, the automation and custom indicators might feel a bit overwhelming, especially without a solid grasp of high-frequency trading strategies.

Another important factor is the platform’s reliance on automation. While automation can boost efficiency, it’s not a magic bullet. To use it effectively, you’ll need a strong understanding of market behavior and a disciplined approach to risk management. QuantVue isn’t a "set-it-and-forget-it" tool – success demands active oversight and well-thought-out strategies. These challenges make it essential for traders to assess whether QuantVue matches their skill level and trading objectives.