Starting a proprietary trading firm has never been easier, thanks to white-label solutions that simplify the process. These platforms allow you to launch a fully functional firm in days, offering tools for branding, risk management, and trader onboarding. Whether you’re an educator, entrepreneur, or influencer, there’s a solution tailored to your needs. Here’s a quick summary of the top providers:

- PropAccount: Full-stack white-label platform with a one-time $3,000 fee. Ideal for educators and influencers.

- YourPropFirm: Turnkey solution with fast setup and no revenue sharing.

- FPFX Technologies: Enterprise-level platform for global growth and multi-asset support.

- Quadcode WL Prop: Integrated trading and CRM system with mobile apps.

- Axcera PropTech: Automation-focused platform for startups, with customizable trading rules.

- Eightcap Partners: White-label broker solution with MT4/MT5 integration.

- Match-Trader: Scalable trading platform with mobile-first design.

- DXtrade: Multi-asset platform for enterprise-level firms.

Key Takeaway: Choose a platform based on your goals – quick launch, scalability, or customization. Pairing these tools with reliable VPS hosting ensures fast, reliable operations for traders.

How to set up a White Label Prop Firm

1. PropAccount

PropAccount is tailored for educators, influencers, and affiliate marketers who want to launch their own prop trading firm quickly and efficiently. With FPFX Tech powering it, this full-stack white-label platform can have your firm up and running in just one week.

Type

PropAccount functions as a full-stack white-label provider, taking care of everything from the core technology infrastructure to capital provision. It offers a complete system for backend operations, so you can focus on building your brand and growing your audience.

Assets Supported

The platform supports FX/CFDs, futures, and cryptocurrencies, with access to over 20 front-end trading platforms.

Core Features

PropAccount offers a range of features designed to streamline operations and enhance user experience. These include a branded checkout page, a unified trader dashboard, and an automated payout system. These tools make it easier to transition into running a tech-driven trading brand.

"Our licensees access a comprehensive CRM, branded trader dashboard, automated payouts, and tools for managing affiliates, competitions, and KYC, all supported by the FPFX Tech Prop Trading Tech Kit."

"Our licensees access a comprehensive CRM, branded trader dashboard, automated payouts, and tools for managing affiliates, competitions, and KYC, all supported by the FPFX Tech Prop Trading Tech Kit."

The admin/CRM portal provides complete control for prop firm owners. It enables them to monitor trader performance, manage risk parameters, and address customer service needs. Additional features include affiliate program management, trader leaderboards, KYC document processing, legal agreement signing, trading competitions, and multi-language support. The platform also handles all risk management tasks and offers assistance from a dedicated support team.

Pricing Model

PropAccount keeps things straightforward with a one-time fee of $3,000, avoiding any recurring costs. This pricing model is particularly appealing for those who want to focus on acquiring traders without worrying about ongoing expenses.

"All of the above for a One Time Fee of $3K. No monthly or hidden fees"

"All of the above for a One Time Fee of $3K. No monthly or hidden fees"

Ideal For

This platform is perfect for trading educators, influencers, and affiliate marketers who already have an audience but lack the technical know-how or capital to start a traditional prop firm. PropAccount is designed for those who want to monetize their following by offering trading capital while building a branded trading community. It’s an ideal solution for individuals who prefer to focus on marketing and trader acquisition, leaving the complexities of technology, risk management, and capital allocation to the platform.

2. YourPropFirm

YourPropFirm provides a streamlined, all-in-one solution for entrepreneurs looking to break into prop trading. With over $45 million in revenue generated for its clients, it has established itself as a key player in the competitive world of proprietary trading.

Type

This platform offers a fully managed turnkey approach, handling everything from technology infrastructure and payment systems to brand control – all under one umbrella.

Assets Supported

YourPropFirm supports FX and CFDs, and as of April 2025, it has expanded to include futures trading via Rithmic. This addition opens up more earning possibilities while maintaining seamless integration with its robust suite of management tools.

Core Features

YourPropFirm brings a range of tools and services designed to simplify operations and attract top trading talent:

- Centralized dashboard and CRM for real-time monitoring and management

- Customizable branding and website development options

- Integrated payment processing, supporting cryptocurrencies, credit cards, and bank transfers

- Automated subscription billing and real-time webhooks

- Advanced rule enforcement and integration updates introduced in May 2025

The platform also connects users with broker partners and liquidity providers, while offering marketing and lead generation services to help firms attract skilled traders and manage them effectively.

Pricing Model

YourPropFirm follows a no revenue sharing model, allowing firms to keep 100% of their profits. Specific pricing details are provided during a consultation.

Ideal For

This platform is perfect for entrepreneurs aiming for a fast launch – YourPropFirm can get a new prop trading firm up and running in as little as four weeks.

3. FPFX Technologies

FPFX Technologies builds on earlier integrated solutions to cater to firms aiming for global growth. This enterprise-level white-label solution is specifically designed for proprietary firms looking to expand quickly across international markets. It supports a wide range of assets, including FX/CFDs, futures, and cryptocurrencies, offering firms the ability to reach broader markets and diversify their trading options. This extensive asset coverage not only attracts a wider audience but also aligns with the industry’s demand for fast and scalable trading operations.

Up next, we’ll dive into Quadcode WL Prop and its focus on unified platform solutions.

4. Quadcode WL Prop

Quadcode WL Prop brings together cutting-edge trading technology and efficient back-office management in a single, integrated system.

Type

This platform operates as a White-Label provider, combining a next-generation trading platform with a marketing-oriented CRM to simplify and streamline operations.

Assets Supported

The platform caters to both forex (FX) and cryptocurrency trading, allowing prop firms to meet the needs of traditional forex traders and crypto enthusiasts alike.

Core Features

Quadcode WL Prop offers a range of features designed for seamless trading and management:

- Trading Features: Includes one-click trading, leverage options, support for up to 9 charts, and access to over 100 technical indicators.

- Back Office Tools: Simplifies management of customers, administrators, and Introducing Brokers (IBs). It integrates with global KYC providers and includes a ticket-based support system.

- CRM Integration: Helps manage broker-affiliate relationships effectively.

- Accessibility: Dedicated apps for iOS and Android, along with a web-mobile traderoom, provide flexibility and customization.

- Liquidity and Execution: Pre-connected liquidity and ultra-fast execution ensure a smooth trading experience.

Pricing Model

The platform operates on a monthly license fee structure.

Ideal For

Quadcode WL Prop is an excellent fit for firms aiming to streamline both trading and administrative tasks. Its advanced trading tools, comprehensive back-office management, and CRM capabilities make it a strong choice for prop firms focused on growing their trader base and building their brand. Firms looking to offer both forex and cryptocurrency trading will especially appreciate its dual-asset support and high-speed execution.

For firms seeking even more automation and rule customization, Axcera PropTech provides tailored solutions for evolving needs.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.9% uptime • Chicago & NY data centers • From $59.99/mo

FUTURES — 60% off first month

5. Axcera PropTech

Axcera PropTech combines technology and CRM solutions to deliver automated trading systems with customizable rule settings.

Type

Axcera serves as a Tech + CRM provider, offering tools tailored for proprietary trading firms. With the Match-Trader platform at its core, the company delivers trading solutions designed to optimize operations.

Assets Supported

Through the Match-Trader platform, Axcera PropTech supports trading in forex (FX) and CFDs. Its integration with Match-Prime Liquidity ensures access to deep liquidity across a range of multi-asset instruments.

Core Features

Axcera PropTech emphasizes automation and CRM functionality, helping proprietary trading firms streamline their processes:

- Automated Challenge Management: Simplifies the evaluation process and transitions traders to funded accounts.

- Custom Rule Engine: Lets firms define specific trading rules, risk controls, and evaluation criteria.

- CRM Integration: Enhances trader onboarding, performance tracking, and relationship management.

- API Connectivity: Ensures seamless integration with existing systems.

This technology-driven approach positions firms to scale operations efficiently.

Herman Shalo, Co-Founder and CTO of Axcera, shares his perspective on the platform’s performance:

"Match-Trader has checked all the boxes for our mutual clients, and it has been a pleasure working with their team to continue raising the bar".

"Match-Trader has checked all the boxes for our mutual clients, and it has been a pleasure working with their team to continue raising the bar".

Pricing Model

Axcera PropTech uses a setup fee plus a monthly subscription model, offering an affordable way for firms to explore its automation features before committing to larger-scale operations.

Ideal For

Axcera PropTech is an excellent choice for smaller proprietary trading firms and startups seeking dependable automation and streamlined workflows. Up next, learn about Trade Tech Solutions’ lean and risk-focused white-label option.

6. Trade Tech Solutions

Currently, there’s no public confirmation that Trade Tech Solutions operates as a white-label provider specifically for proprietary trading. Important aspects like the range of tradable assets, availability of risk management tools, trader dashboards, and pricing structures are not clearly documented. For firms considering this vendor, it’s crucial to independently verify whether their offerings align with proprietary trading requirements.

With these uncertainties in mind, let’s explore vendors with more clearly defined trading solutions.

7. PropTradeTech (PTT)

PropTradeTech remains a mystery due to ongoing issues with accessing its website.

Type

The type of white-label solution offered by PropTradeTech is unclear because its online details are unavailable.

Core Features

Details about PropTradeTech’s core features are unknown, as the website (proptradetech.com) is inaccessible due to a Cloudflare SSL connection error.

Pricing Model

Pricing information for PropTradeTech cannot be determined, as no documentation is accessible.

Ideal For

Without any accessible information, it’s impossible to identify which proprietary trading firms might find PropTradeTech’s solutions useful. This lack of clarity stands in stark contrast to the well-defined offerings provided by other vendors.

8. Eightcap Partners

Eightcap Partners provides a white-label broker solution designed to offer all the trading infrastructure you need while keeping your brand front and center. This service eliminates the hassle of building your own platform, making it easier to integrate with your current operations and focus on growing your business.

Type

Eightcap Partners is specifically crafted as a white-label broker solution for proprietary trading firms.

Assets Supported

The platform supports trading in Forex (FX) and Contracts for Difference (CFDs).

Core Features

Eightcap Partners integrates seamlessly with widely-used trading platforms like MT4 and MT5, ensuring a familiar and reliable experience for traders. It also provides access to strong liquidity through trusted institutional channels. Additionally, the platform includes funding integrations, simplifying the process of managing trader funds.

Ideal For

This solution is perfect for proprietary trading firms aiming to utilize broker-level infrastructure. It allows firms to concentrate on recruiting traders and building their brand, without the added burden of handling technical development.

9. Match-Trader

Match-Trader is a fully in-house trading solution designed to meet the needs of both Forex brokers and proprietary trading firms.

Type

Match-Trader is a white-label trading platform that offers flexibility in how it’s used. It can operate as a standalone platform with its own CRM system or as backend technology that allows brokers to design custom front-ends. Additionally, it integrates smoothly with external systems, offering firms a range of deployment options – all built by industry professionals.

Assets Supported

The platform supports Forex (FX) and Contracts for Difference (CFDs). By connecting with Match-Prime Liquidity, it provides access to deep liquidity across multiple asset classes, ensuring strong trading capabilities for proprietary trading firms.

Core Features

Match-Trader’s Prop Trading Platform module comes equipped with essential tools like built-in challenges, account dashboards, and a Prop CRM tailored for managing funded accounts.

The platform is designed to handle high-capacity operations, efficiently managing up to 100,000 accounts. Its mobile-first approach ensures full functionality, whether accessed through downloadable apps or browser shortcuts.

For firms needing integration, Match-Trader offers extensive API access, enabling seamless connections with CRMs, payment providers, liquidity sources, and regulatory reporting tools.

"Match-Trader is one of the easiest platforms we’ve integrated into our CRM. The API is clean, setup is smooth, and it’s rock-solid once live. The new UI is genuinely slick, big step up from older versions. For prop firms, the setup removes a ton of launch friction. Fast to deploy, easy to scale, and plays well with our system. Solid choice all around." – Ryan Beasley, Founder & CEO, Propriotec

"Match-Trader is one of the easiest platforms we’ve integrated into our CRM. The API is clean, setup is smooth, and it’s rock-solid once live. The new UI is genuinely slick, big step up from older versions. For prop firms, the setup removes a ton of launch friction. Fast to deploy, easy to scale, and plays well with our system. Solid choice all around." – Ryan Beasley, Founder & CEO, Propriotec

These features are offered under a flexible, account-based licensing model.

Pricing Model

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

FUTURES — 60% off first month

Match-Trader uses an account-based licensing model. TradingView charts are included at no additional cost, helping firms cut down on licensing expenses. For businesses managing both Forex and proprietary trading operations, Match-Trader allows both platforms to operate on a single server, streamlining costs and operations.

Ideal For

Match-Trader is well-suited for growing proprietary trading firms looking for advanced charting tools and a mobile-focused trading experience. Its scalability and reliability make it a standout choice for firms aiming to expand. The platform has received accolades at the Finance Feeds Awards 2024, winning titles like ‘Outstanding Proprietary Trading Platform’ and ‘Exceptional Technology and Infrastructure in Proprietary Trading’.

"Match‑Trader’s platform delivers the speed, stability, and flexibility Equityedge needs to grow our prop‑trading community with confidence. It’s become the backbone of our operation, freeing us to focus on empowering traders rather than managing tech." – Berkay Gurlek, Co-Founder, Equity Edge

"Match‑Trader’s platform delivers the speed, stability, and flexibility Equityedge needs to grow our prop‑trading community with confidence. It’s become the backbone of our operation, freeing us to focus on empowering traders rather than managing tech." – Berkay Gurlek, Co-Founder, Equity Edge

To further support firms, Match-Trader offers 24/7 live technical support via messengers and provides step-by-step guidance for integration. Recent updates, such as the October 2025 release of the Trailing Stop Loss feature, highlight the platform’s dedication to ongoing development and trader-focused enhancements.

10. DXtrade (Devexperts)

DXtrade, developed by Devexperts, has earned recognition as the "Best Software for Trading Cryptocurrency". This platform is a multi-asset, broker-agnostic solution designed for flexibility and customization, offering white-label services tailored to specific business needs.

Type

DXtrade is built as a broker-agnostic, multi-asset platform with a flexible architecture. It integrates seamlessly with various liquidity sources and can be adjusted to meet the unique requirements of different firms.

Assets Supported

This platform supports a broad range of assets, including stocks, derivatives like futures, forex (FX), contracts for difference (CFDs), spread betting, and cryptocurrencies. With such extensive asset coverage, prop trading firms can diversify their strategies and tap into new and growing markets.

Core Features

DXtrade is designed to handle trading operations with precision and scalability. It includes features like "Optimizing a Prop Trading Firm’s Client Journey and Experience", ensuring it can adapt to the evolving needs of firms as they expand their asset offerings and operational scope.

Pricing Model

DXtrade offers custom pricing based on the specific needs of the client. Firms interested in the platform can schedule a consultation to discuss their project requirements.

Ideal For

This platform is best suited for enterprise-level proprietary trading firms that need a scalable, customizable, and versatile solution to manage multi-asset trading.

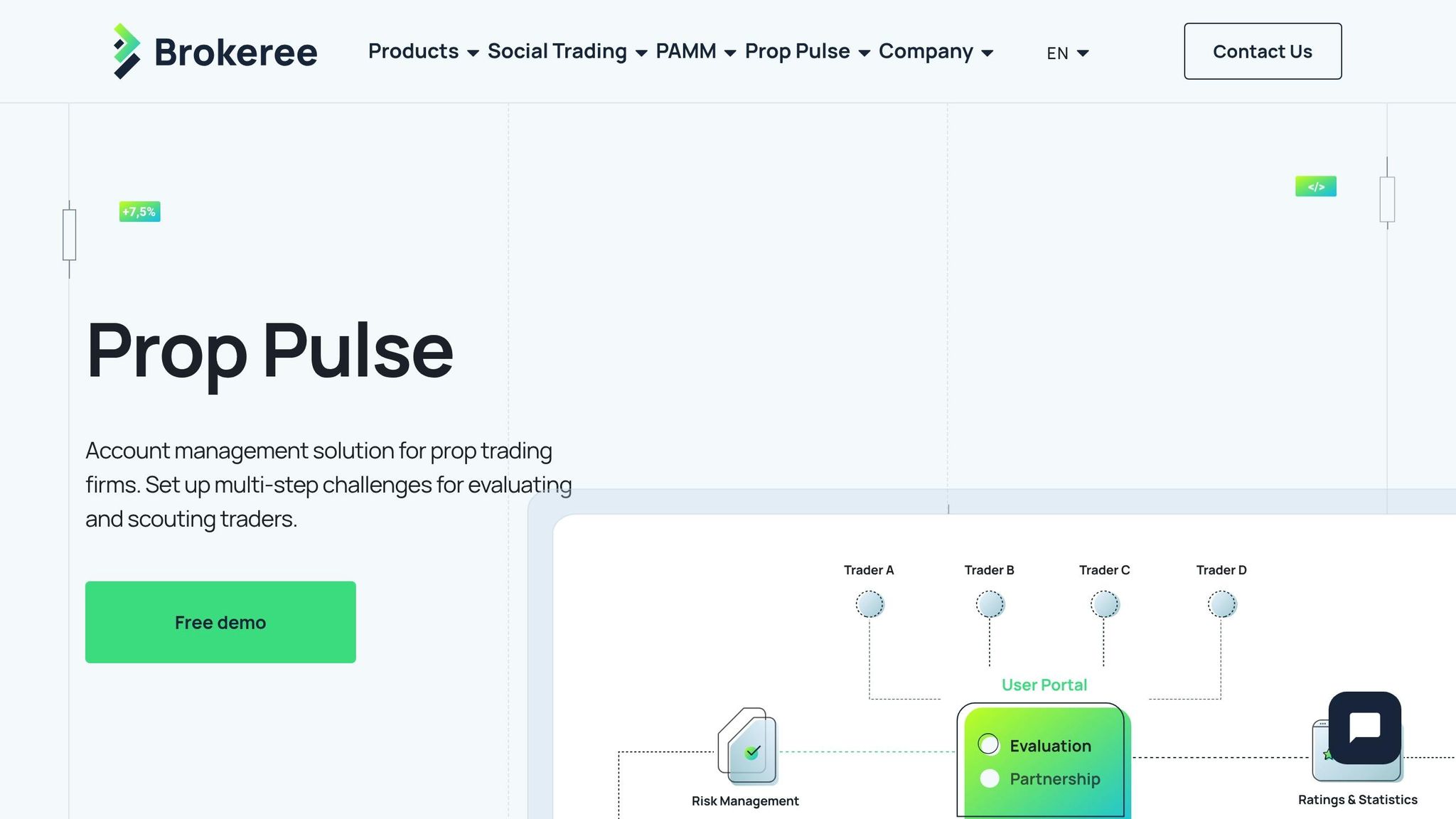

11. Brokeree Prop Pulse

Details about Brokeree Prop Pulse remain scarce, apart from its mention as a vendor focusing on challenge engine functionality. For the most accurate and up-to-date information, check out their official website at brokeree.com.

12. UpTrader CRM

UpTrader CRM takes a different route compared to integrated white-label and platform-level solutions. It offers a modular, component-based design that can seamlessly fit into your existing tech stack.

Type

This isn’t a full-fledged, turnkey platform. Instead, UpTrader CRM serves as a modular component, making it an excellent choice for firms looking to enhance their custom-built systems with specific operational tools.

Assets Supported

The solution supports FX and CFD trading, though further details about additional asset classes remain unspecified.

Core Features

The available information highlights only basic operational management tools, with no extensive feature set disclosed.

Pricing Model

Pricing information isn’t publicly available. You’ll need to reach out to the vendor directly for a quote.

Ideal For

This solution is tailored for proprietary trading firms that already have a robust tech stack in place but need a flexible, customizable addition. To determine if it aligns with your requirements, it’s best to consult the vendor directly.

Advantages and Disadvantages

Every prop firm technology solution comes with its own set of strengths and limitations, which can significantly impact your trading business. Knowing these trade-offs allows you to make decisions that align with your needs, budget, and future plans.

Full-stack solutions, like PropAccount and YourPropFirm, offer the quickest way to get your business up and running. For example, PropAccount charges a one-time setup fee of $3,000, eliminating ongoing monthly costs. However, these solutions often lack flexibility for customization, which can be a hurdle as your business grows and evolves.

Enterprise platforms, such as FPFX Technologies and DXtrade, are designed for scalability and offer extensive customization options. They can handle high trading volumes and support multiple asset classes, including futures and crypto. The trade-off? These systems are more complex to implement, require technical expertise, and take longer to set up.

Modular components, like Brokeree Prop Pulse and UpTrader CRM, provide the ultimate flexibility, allowing you to create a custom tech stack by integrating specific features. While this gives you greater control, it demands advanced technical resources. The performance of these platforms also heavily depends on hosting infrastructure, with solutions like QuantVPS offering low-latency servers to maintain responsive trader dashboards.

Here’s a quick comparison of the key advantages and disadvantages of different providers:

| Provider | Main Advantages | Key Disadvantages |

|---|---|---|

| PropAccount | One-time setup fee, no monthly costs, includes capital provision | Limited customization, less control over platform changes |

| YourPropFirm | Fast deployment, branding options, turnkey solution | Monthly fees, reliance on vendor for updates |

| FPFX Technologies | Scalable for large operations, supports multiple assets, extensive API access | Complex to implement, higher costs, requires technical expertise |

| Quadcode WL Prop | Unified platform with mobile apps, modern interface, built-in CRM | Monthly licensing fees, limited customization |

| Axcera PropTech | Customizable rules, automation, affordable for startups | Limited asset class support, smaller vendor presence |

| Trade Tech Solutions | Simple setup, revenue-share model reduces upfront costs | Basic features, less scalable for rapid growth |

| PropTradeTech (PTT) | Focus on brand building, handles capital and risk management | Revenue-share model, reduced control over trading operations |

| Eightcap Partners | Established broker infrastructure, MT4/MT5 integration, strong liquidity | Volume-based pricing can get expensive, limited to FX/CFD |

| Match-Trader | Modern charting, mobile app support, prop-specific modules | Account-based pricing structure |

| DXtrade | Enterprise-grade platform, US futures support, contest modules | High licensing fees, complex implementation |

| Brokeree Prop Pulse | Specialized challenge engine, cTrader integration, modular design | Limited functionality without additional systems |

| UpTrader CRM | Flexible integrations, works with custom tech stacks | Requires extra integration efforts |

Conclusion

The landscape offers a variety of options tailored to different needs, from full-stack solutions for quick launches to enterprise platforms designed for large-scale growth, and modular components that provide fine-tuned control. For educators and influencers looking for a straightforward way to enter the market, PropAccount is a standout choice. Its $3,000 one-time setup fee eliminates the hassle of ongoing monthly charges, making it an attractive option for those seeking simplicity. If speed is your top priority, YourPropFirm provides turnkey solutions capable of getting your branded prop firm up and running in just a few days.

For firms with ambitious scaling goals, enterprise platforms like FPFX Technologies and DXtrade offer robust solutions for handling the complexities of multi-asset trading, including futures and crypto. However, these platforms require a more substantial upfront investment and significant technical expertise to manage effectively.

Your hosting infrastructure is another critical piece of the puzzle. Modular solutions like Brokeree Prop Pulse and UpTrader CRM allow for maximum flexibility when building custom tech stacks. That said, their success hinges on the capabilities of your technical team and the strength of your underlying infrastructure.

Reliable hosting is non-negotiable. Even the most advanced technology can falter without the right support. Pairing these platforms with low-latency VPS hosting ensures smooth operation and fast execution. Providers like QuantVPS, with servers in key locations such as Chicago, New York, and London, deliver the performance needed to handle high trading volumes effectively.

Ultimately, your decision comes down to three key factors: speed to launch, customization needs, and scaling plans. Full-stack solutions are ideal for getting started quickly, enterprise platforms excel at managing growth, and modular components give you the most control. Whichever path you choose, combining cutting-edge technology with reliable, low-latency hosting ensures you’re equipped to meet the high expectations of modern traders.

FAQs

What should I consider when choosing a white-label solution to start a proprietary trading firm?

When you’re choosing a white-label solution to launch your proprietary trading firm, it’s important to identify the type of solution that aligns with your specific needs. Options typically include full-stack, platform-integrated, or modular setups. You’ll also want to check which asset classes are supported – whether that’s FX, CFDs, futures, or crypto – and assess the core features available. These could range from CRM tools and risk management systems to trader dashboards and payout automation.

Pricing models are another key factor. Does the provider’s structure fit your budget and growth plans? For instance, some companies, like PropAccount, offer a one-time setup fee for a turnkey solution, which can be a great fit for influencers or educators. On the other hand, providers like FPFX Technologies cater to scalable institutional firms, offering advanced automation and support for multiple asset classes. Aligning these factors with your business goals is essential for a smooth and successful launch.

How do platforms like PropAccount and YourPropFirm help educators and influencers create and monetize their own trading brands?

Platforms like PropAccount and YourPropFirm make it easier than ever for educators and influencers to create their own proprietary trading brands. These platforms offer white-label solutions packed with must-have features like custom branding, trader dashboards, CRM systems, and payout automation. This means users can spend less time worrying about the technical setup and more time growing and monetizing their audience.

PropAccount provides a hassle-free, turnkey solution with a one-time setup fee, perfect for those who value simplicity and speed. Meanwhile, YourPropFirm delivers a full-service package designed for quick brand launches, complete with tools for evaluation management and payment processing. Both platforms give educators and influencers the tools they need to turn their expertise into a scalable and profitable trading venture.

Why is VPS hosting essential for ensuring speed and reliability in a new proprietary trading firm?

VPS hosting plays a key role for proprietary trading firms by offering low-latency servers that enable lightning-fast trade execution and real-time risk management. In an industry where every millisecond counts, this speed and reliability are crucial for staying ahead of the competition.

With VPS hosting, trading platforms can run efficiently, even during the busiest market conditions. This ensures traders experience uninterrupted performance, helping firms maintain smooth operations and optimize their overall efficiency.