Topstep vs Apex vs Bulenox - Head-to-Head Prop Firm Review

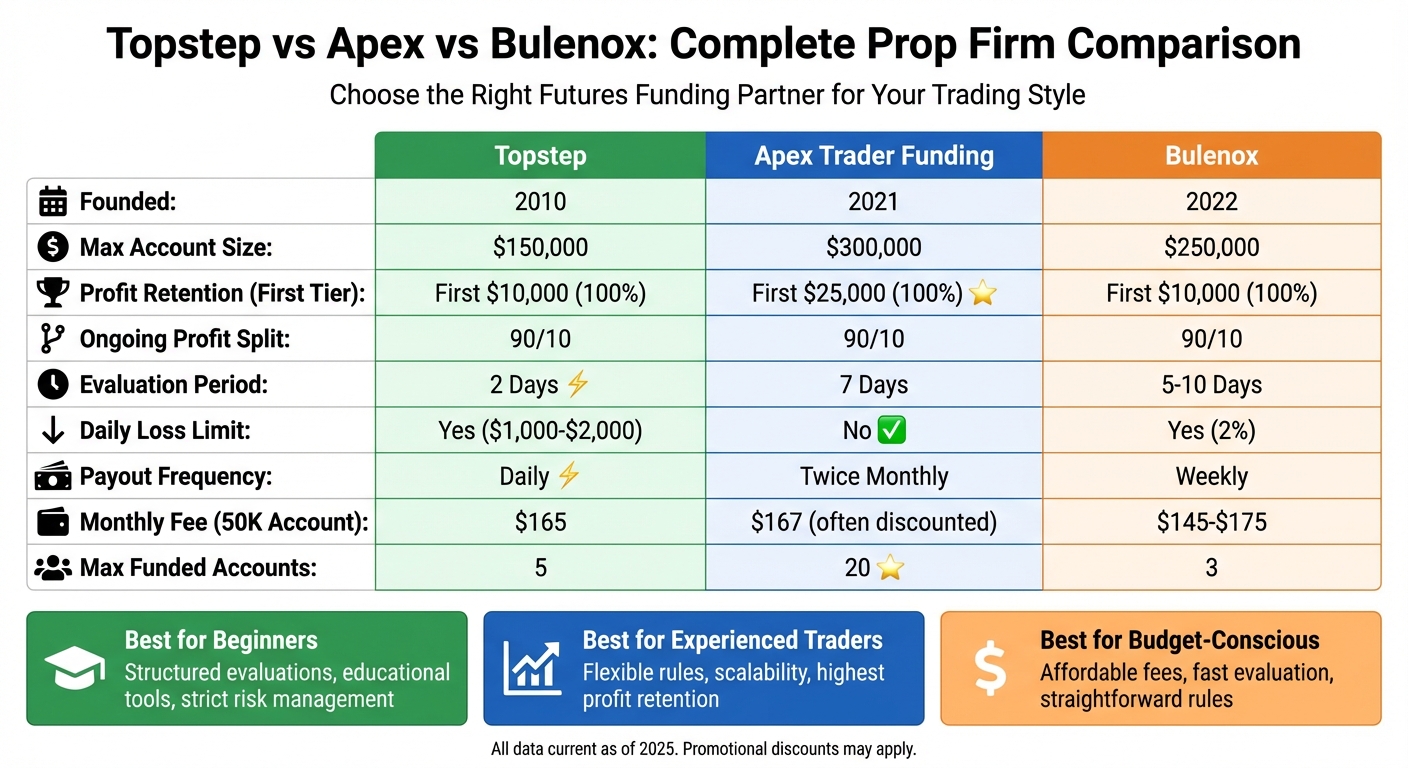

If you're deciding between Topstep, Apex Trader Funding, and Bulenox, here's what you need to know:

- Topstep: Best for beginners with its structured evaluations and educational tools but has strict daily loss limits and higher fees.

- Apex Trader Funding: Ideal for experienced traders due to flexible rules, no daily loss limits, and the ability to manage up to 20 accounts. Offers the highest profit retention on the first $25,000.

- Bulenox: A budget-friendly option with a fast evaluation period and weekly payouts but stricter loss limits and fewer account options.

Quick Comparison

| Feature | Topstep | Apex Trader Funding | Bulenox |

|---|---|---|---|

| Founded | 2010 | 2021 | 2022 |

| Max Account Size | $150,000 | $300,000 | $250,000 |

| Profit Retention | First $10,000 (100%) | First $25,000 (100%) | First $10,000 (100%) |

| Ongoing Profit Split | 90/10 | 90/10 | Up to 90/10 |

| Evaluation Days | 2 | 7 | 5-10 |

| Daily Loss Limit | Yes | No | Yes (2%) |

| Payout Frequency | Daily | Twice Monthly | Weekly |

| Monthly Fee (50K) | $165 | $167 (often discounted) | $145-$175 |

Each futures prop trading firm has its strengths, so your choice will depend on your trading style, experience, and priorities. Topstep is beginner-friendly, Apex offers flexibility and scalability, and Bulenox balances affordability with straightforward rules.

Topstep vs Apex vs Bulenox Prop Firm Comparison Chart

Topstep vs Apex vs Bulenox Prop Firm Comparison Chart

Funding Program Types

Topstep, Apex Trader Funding, and Bulenox all operate with a One-Step evaluation process for their futures funding programs. This approach allows traders to complete a single phase before gaining access to a funded account, making it appealing for those looking for a streamlined path to trading capital. Below, we break down the differences in evaluation timeframes, risk management rules, and profit targets among these programs.

Topstep offers the quickest evaluation, taking just two trading days to complete. Apex requires a seven-day evaluation, whereas Bulenox ranges between five and ten days. If speed is the deciding factor, Topstep's "One-Step/One-Rule" Trading Combine is the fastest option. Risk management policies also differ significantly. Topstep enforces both a daily loss limit and an end-of-day trailing drawdown, which can help traders avoid impulsive decisions but might limit high-frequency trading strategies. Apex, on the other hand, uses only an intraday trailing drawdown, offering greater flexibility during volatile trading sessions. Bulenox adopts a similar approach to Topstep, applying a 2% daily loss limit on most accounts.

When it comes to profit targets, Topstep and Bulenox both set a 6% goal, while Apex uses a dollar-based system, ranging from $1,500 to $20,000, depending on the account size. Speaking of account sizes, Topstep caps at $150,000, Apex offers accounts up to $300,000, and Bulenox provides funding as high as $250,000.

Funding Program Structure Comparison

| Feature | Topstep | Apex Trader Funding | Bulenox |

|---|---|---|---|

| Evaluation Type | One-Step | One-Step | One-Step |

| Account Sizes | $50K - $150K | $25K - $300K | $10K - $250K |

| Trading Days | 2 Days | 7 Days | 5-10 Days |

| Profit Target | 6% | $1,500 - $20,000 | 6% |

| Daily Loss Limit | Yes | No | Yes (2%) |

| Trailing Type | End-of-Day | Intraday | Trailing |

| Max Position Size | 5 to 15 contracts | 4 to 35 contracts | Varies by size |

| News Trading | Allowed | Allowed | Allowed |

| Overnight Holding | Not Allowed | Allowed | Varies by account type |

Evaluation Rules and Metrics

One-Step vs Two-Step Evaluation Requirements

When comparing funding programs, the evaluation rules and metrics play a crucial role in distinguishing these firms. Here's how Topstep, Apex Trader Funding, and Bulenox stack up.

All three firms - Topstep, Apex Trader Funding, and Bulenox - use a one-step evaluation model. This means traders only need to pass a single evaluation to access funded capital. However, the specific rules and metrics differ across these providers.

For standard $50K accounts, Topstep and Bulenox set a 6% profit target ($3,000), while Apex offers two options: a 6% "Full" target or a 2% "Static" target. Bulenox also allows flexibility, offering profit targets that range from 6% to 10%, depending on the account type.

When it comes to drawdowns, the rules vary significantly:

- Topstep enforces a maximum drawdown of 3% to 4% and a daily loss limit of $1,000–$2,000.

- Apex uses only a trailing drawdown (ranging from 2.5% to 6%) and does not impose daily loss limits.

- Bulenox combines both strategies, with a daily loss limit of $500 to $1,250 and a trailing drawdown ranging from 2.2% to 10%.

As noted by OnlyPropFirms:

"Apex offers the most trader-friendly rules, making it the clear winner for those who want to pass quickly and keep more profits".

"Apex offers the most trader-friendly rules, making it the clear winner for those who want to pass quickly and keep more profits".

Requirements for prop firms with no minimum trading days or low requirements also vary:

- Topstep requires a minimum of 2 days.

- Apex typically requires 7 days, although this can drop to just 1 day during promotional periods.

- Bulenox requires traders to trade for at least 5 days.

These requirements ensure traders demonstrate consistent performance and aren't just relying on a single lucky trade.

Here’s a table summarizing the evaluation metrics for a side-by-side comparison:

| Feature | Topstep | Apex Trader Funding | Bulenox |

|---|---|---|---|

| Profit Target | 6% | 2% – 6% | 6% – 10% |

| Max Drawdown | 3% – 4% | 2.5% – 6% (Trailing) | 2.2% – 10% (Trailing) |

| Daily Loss Limit | $1,000 – $2,000 | None | $500 – $1,250 |

| Min. Trading Days | 2 Days | 7 Days (1 Day during promos) | 5 Days |

| Evaluation Steps | One-Step | One-Step | One-Step |

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

These metrics provide traders with a variety of options, allowing them to choose the program that aligns best with their trading approach and risk tolerance.

Trading Platforms, Instruments, and Rules

Platform features and trading rules play a key role in setting these firms apart. Let’s break down how their offerings differ.

Platform Support and Available Instruments

Since July 2025, Topstep has required all new Trading Combines to use its proprietary web-based platform, TopstepX, which includes integrated TradingView charts (though custom indicators aren't supported). Existing accounts on older platforms will remain active until reset.

Meanwhile, Apex Trader Funding and Bulenox both support third-party platforms like Rithmic and Tradovate, offering compatibility with popular tools such as NinjaTrader, Quantower, and Sierra Chart. Apex goes a step further by offering additional options like WealthCharts, Bookmap, ATAS, Jigsaw, and MotiveWave. TopstepX’s web-based design is particularly convenient for Mac and iOS users, while Tradovate ensures cross-platform compatibility for Apex and Bulenox.

When it comes to instruments, all three firms provide access to equity indices (e.g., ES, NQ, YM, RTY), commodities (like gold and oil), and forex futures. Topstep and Apex each support six forex instruments, while Bulenox offers seven. For cryptocurrency futures, Topstep’s access is limited to Micro Bitcoin, whereas Apex and Bulenox provide broader crypto trading options. Apex even treats Micro Cryptocurrency futures (Bitcoin and Ether) as "Mini" contracts for maximum contract allowances. However, Apex discontinued support for ICE US products as of March 13, 2024.

| Feature | Topstep | Apex Trader Funding | Bulenox |

|---|---|---|---|

| Platform | TopstepX (Proprietary) | NinjaTrader / Tradovate | NinjaTrader / Rithmic |

| TradingView Support | Yes (Integrated) | Yes (via Tradovate/API) | Yes (via Rithmic/Tradovate) |

| Mobile App | Yes (TopstepX/Tradovate) | Yes (Tradovate/RTrader) | Yes (RTrader/Tradovate) |

| Mac Compatibility | High (Web-based) | Moderate (via Tradovate) | Moderate (via Tradovate) |

| Crypto Futures | Limited (Micro Bitcoin) | Yes (Bitcoin & Ether) | Yes |

These platform features establish the groundwork for how trading rules and restrictions are applied.

Trading Style Rules and Restrictions

Each firm has its own set of trading rules, shaping how traders can operate within their systems.

Topstep enforces the most restrictive rules, with a strict "day trading only" policy. Traders must close all positions before the market closes each day, meaning no overnight or weekend positions are allowed. Apex Trader Funding offers a bit more flexibility, allowing trading 23 hours a day, including during news events and holidays. However, all positions must still be closed, and pending orders canceled by 4:59 PM ET, with trading resuming at 6:00 PM ET - effectively disallowing cross-session holding.

Bulenox also prohibits overnight positions, focusing on day trading. All three firms allow scalping and news trading. Daily loss limits vary significantly: Topstep enforces limits ranging from $1,000 to $3,000, Bulenox applies stricter limits of $500 to $1,250, and Apex uses a trailing drawdown system without a fixed daily cap. Apex also permits traders to manage up to 20 funded accounts simultaneously, compared to Topstep’s limit of five. All three firms maintain a standard 1:1 leverage ratio for futures trading.

| Rule | Topstep | Apex | Bulenox |

|---|---|---|---|

| Overnight Holding | Not Allowed | Not Allowed (close by 4:59 PM ET) | Not Allowed |

| News Trading | Allowed | Allowed | Allowed |

| Daily Loss Limit | $1,000–$3,000 | None (Trailing only) | $500–$1,250 |

| Scalping | Allowed | Allowed | Allowed |

| Max Funded Accounts | Typically 5 | Up to 20 | Multiple allowed |

Fees, Payouts, and Account Scaling

Understanding fees and payouts is key to figuring out the real return on investment (ROI). Each firm has its own pricing model and profit-sharing approach, which can significantly impact traders' earnings.

Fee Structures and Payout Terms

Topstep uses a subscription-based evaluation model, charging about $165 per month for a $50K account until the Trading Combine is completed. Once funded, there’s a one-time $149 activation fee. Apex Trader Funding charges around $167 monthly for the same account size but frequently offers promotions with discounts ranging from 50% to 80%. After funding, Apex adds a $85 monthly PA fee, though traders can opt for a lifetime fee ranging from $130 to $360. Bulenox falls in the middle, with monthly fees between $145 and $175 for evaluations.

Reset fees also vary. Topstep charges $49 to restart an evaluation, while Apex and Bulenox charge between $78 and $100. Additionally, Topstep requires traders to pay $133 per month for data, whereas Apex and Bulenox include Level 1 CME data in their plans.

Profit-sharing structures reveal more differences. Apex allows traders to keep 100% of their first $25,000 in profits, which is the most generous among the three. In comparison, both Topstep and Bulenox cap this at $10,000. After these thresholds, all three firms shift to a 90/10 profit split.

Payout schedules also vary significantly. Topstep offers daily payouts, giving traders the quickest access to their earnings. Apex processes payouts twice a month after eight trading days, while Bulenox provides payouts on a weekly basis (Wednesdays) after 10 trading days. Apex also enforces a "30% Rule", requiring traders to leave at least 30% of their total profits in the account during withdrawals. Minimum withdrawal amounts are set at $500 for Apex and $1,000 for Bulenox.

| Feature | Topstep | Apex Trader Funding | Bulenox |

|---|---|---|---|

| Monthly Fee (50K) | $165 | $167 (often discounted) | $145-$175 |

| Activation Fee | $149 | $85/mo or lifetime option | Varies by data plan |

| Reset Fee | $49 | $80-$100 | $78 |

| 100% Profit Tier | First $10,000 | First $25,000 | First $10,000 |

| Payout Frequency | Daily | Twice monthly | Weekly |

| Min. Withdrawal | Not specified | $500 | $1,000 |

These differences in fees and profit-sharing models can have a big impact on traders' bottom lines.

Account Scaling Options

Scaling options play a major role in determining how much capital traders can eventually access. Apex stands out with its volume scaling, allowing up to 20 simultaneous accounts through a single login, with a total funding potential of $1.5 million. Individual accounts can scale up to $300,000 each. Bulenox offers up to 11 accounts, with a maximum individual account size of $250,000. Topstep, on the other hand, limits traders to 5 accounts, each capped at $150,000.

Each company approaches scaling differently. Topstep uses a position-based scaling method, requiring traders to build a profit cushion before increasing their position sizes. Apex and Bulenox, however, allow traders to use their full contract limits from the first day of funding in their "Option 1" accounts, with no scaling restrictions.

"Apex gives traders a variety of scaling plans that reward consistency in profits. As long as traders stick to Apex evaluation rules, there's no maximum to what they can earn." - Sarah Edwards, Contributor, Benzinga

"Apex gives traders a variety of scaling plans that reward consistency in profits. As long as traders stick to Apex evaluation rules, there's no maximum to what they can earn." - Sarah Edwards, Contributor, Benzinga

For traders looking to access capital quickly and retain more initial profits, Apex’s $25,000 profit threshold and multiple account options stand out. Topstep’s daily payouts are ideal for those who prefer frequent withdrawals, while Bulenox offers a balanced approach with weekly payouts and straightforward scaling options.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

The combination of fee structures, profit-sharing models, and scaling opportunities gives traders a clear picture of what each firm brings to the table.

Pros, Cons, and VPS Recommendations

Advantages and Disadvantages Summary

Each trading firm offers its own blend of strengths and challenges, catering to different trader needs. Topstep shines for beginners, thanks to its extensive educational resources and structured risk management tools, making it a great starting point for those new to trading. On the downside, it enforces strict daily loss limits and charges separate data fees of about $133 per month. Apex Trader Funding, on the other hand, is a favorite for experienced traders due to its flexibility - no daily drawdown limits (only trailing), the ability to manage up to 20 accounts, and 100% profit retention on the first $25,000. However, its coaching is less robust compared to Topstep. Bulenox offers an affordable middle-ground option with straightforward rules, though it limits traders to three accounts and has stricter requirements after funding.

"Apex is the better choice for traders who want more control, better payouts, and lower costs." – Patrick Wieland

"Apex is the better choice for traders who want more control, better payouts, and lower costs." – Patrick Wieland

| Feature | Topstep | Apex Trader Funding | Bulenox |

|---|---|---|---|

| Best For | Beginners needing structure | Experienced/scaling traders | Budget-conscious traders |

| Max Accounts | 5 | 20 | 3 |

| Daily Loss Limit | Strict ($1,000) | None (trailing only) | $500–$1,250 |

| Data Fees | ~$133/month | Included | Included (Non-Pro) |

| 100% Profit Tier | First $10,000 | First $25,000 | First $10,000 |

| Coaching/Education | Extensive | Limited | Moderate |

For traders who thrive on flexibility and want to avoid daily loss limits, Apex is a solid choice, especially for scalpers handling volatile sessions. Topstep is better suited for those who prefer a structured environment with plenty of educational support. Meanwhile, Bulenox appeals to budget-conscious traders who want a balance between affordability and essential features.

QuantVPS Plans for Prop Firm Traders

When working with these prop firms, having a reliable trading setup is key. A dependable VPS ensures quick execution and precision, which are critical for meeting the strict rules and platform demands of these firms.

QuantVPS is designed to support Topstep, Apex Trader Funding, and Bulenox, offering ultra-low latency with servers located in Chicago. This proximity delivers latency as low as <0.52 ms to CME matching engines, which is crucial for futures trading on instruments like ES and NQ. The servers are equipped with AMD Ryzen 7950X3D processors, DDR5 memory, and NVMe storage to ensure fast execution and minimize slippage.

Here’s a breakdown of the plans:

- VPS Lite: Ideal for entry-level traders, this plan includes 4 vCPU cores and 8GB RAM for $59.99 per month ($41.99 annually). It’s perfect for running multiple trading terminals and trade copiers.

- VPS Pro: Designed for traders managing multiple accounts or using resource-heavy strategies, this plan offers 6 cores and 16GB RAM for $99.99 per month ($69.99 annually).

- VPS Ultra: Built for professional workloads, this plan features 24 cores and 64GB RAM, supporting up to 5–7 charts. It’s priced at $189.99 per month ($132.99 annually).

To get the best performance, traders should select the Chicago datacenter, ensuring maximum proximity to CME servers. QuantVPS also offers pre-optimized setups for popular platforms like NinjaTrader, MetaTrader, and Rithmic, simplifying the initial configuration. Automated risk management tools can help flag evaluation rules, reducing the chance of costly mistakes.

QuantVPS has earned a Trustpilot rating of 4.8/5 from 166 reviews, with users frequently praising its low latency, reliable 24/7 support, and stable infrastructure with 100% uptime.

Conclusion

Deciding between Topstep, Apex Trader Funding, and Bulenox comes down to your trading style, experience, and financial priorities. Each firm offers distinct advantages:

- Topstep provides a structured evaluation process and excellent educational resources, but its strict daily loss limits and additional fees could increase overall costs.

- Apex Trader Funding stands out with flexible rules, no daily loss limits, the ability to manage 20 accounts simultaneously, and keeping 100% of profits up to $25,000. This makes it a strong choice for experienced traders.

- Bulenox strikes a middle ground with a quicker 5-day evaluation period and competitive pricing for accounts like the 50K option.

"Apex offers the most trader-friendly rules, making it the clear winner for those who want to pass quickly and keep more profits." – Patrick Wieland

"Apex offers the most trader-friendly rules, making it the clear winner for those who want to pass quickly and keep more profits." – Patrick Wieland

Another key factor to consider is infrastructure reliability. QuantVPS, with its ultra-low latency from a Chicago datacenter, ensures fast execution - critical during volatile market conditions. Starting at $59.99 per month, it’s a worthwhile investment for minimizing slippage and improving strategy performance.

Before committing, carefully assess each firm's risk management policies, payout structures, and growth opportunities. Take advantage of promotional codes - Apex and Bulenox frequently offer discounts - to lower your initial costs. Pairing the right prop firm with reliable technology like a VPS can play a decisive role in achieving long-term trading success.

FAQs

Which firm is easiest to pass for my trading style?

The easiest firm to pass largely depends on your trading style and what works best for you. Topstep is a great choice if you thrive in a structured environment with clear rules, defined targets, and limits. On the other hand, Apex offers more flexibility, such as no daily drawdown limits, making it a better option for traders who are confident in managing trailing drawdowns. Think about your strengths and preferred trading approach to determine which firm aligns with your needs.

How do drawdowns and daily loss limits affect my strategy?

In prop trading, managing risk is crucial, and two key tools for this are drawdowns and daily loss limits. A drawdown refers to the maximum amount you’re allowed to lose before your account gets suspended. On the other hand, daily loss limits, such as Topstep’s $1,000 cap, set a hard stop on how much you can lose in a single trading session.

These rules aren’t just about limiting losses - they shape how you approach trading. They push traders to stay disciplined, carefully balance their risk, and decide how bold or cautious they can be while staying within the rules.

What fees and payout rules most impact my take-home profit?

Your take-home profit depends heavily on two factors: profit split structures and payout rules. For instance, Apex allows traders to keep 100% of the first $25,000 in profits, then offers a 90% split on anything beyond that. However, they have specific requirements, such as completing 8 trading days and achieving 5 profitable days. On the other hand, firms like Bulenox provide a 90% profit split but charge a $145 monthly payout fee. To accurately gauge your net earnings, it's crucial to understand these splits, fees, and payout conditions.