News-Driven Polymarket Bots: Trading Breaking Events Automatically

Polymarket bots use news to place trades automatically, reacting to breaking events faster than any human could. They scan news outlets, social media, and web feeds to predict event outcomes on Polymarket, a platform for trading on real-world events. These bots rely on AI, APIs, and ultra-low-latency systems to process news, calculate probabilities, and execute trades in milliseconds.

Key Points:

- What They Do: Monitor news, analyze impact, and trade instantly on Polymarket's prediction markets.

- Why They Matter: Automation beats manual trading in speed and consistency, especially during volatile news cycles.

- How They Work: Bots combine Polymarket's APIs, NLP tools for sentiment analysis, and low-latency hosting like QuantVPS for 24/7 operation.

- Setup: Requires Python, Polymarket APIs, and the best VPS for algorithmic trading to ensure low-latency execution.

- Security: Protect API keys, use DDoS-protected servers, and monitor bot performance remotely.

Quick Overview:

Polymarket bots are designed for speed and efficiency, using real-time data and automation to capitalize on market opportunities driven by breaking news. With the right infrastructure and safeguards, these bots can transform how traders approach prediction markets.

Prediction Market Trading Bot in Python (Polymarket API step by step)

Core Components of a News-Driven Polymarket Bot

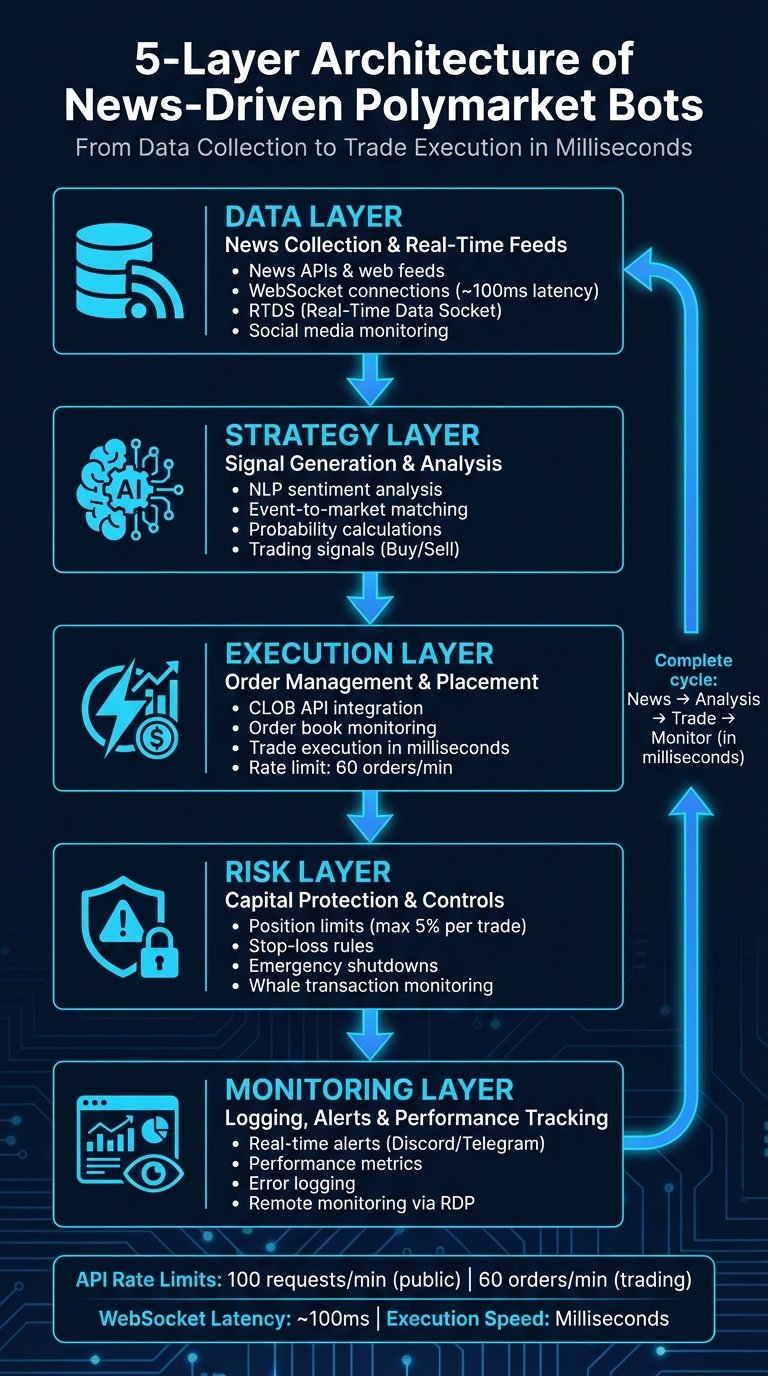

How News-Driven Polymarket Trading Bots Work: 5-Layer Architecture

How News-Driven Polymarket Trading Bots Work: 5-Layer Architecture

Creating a news-driven bot involves five key layers: Data Layer (for data collection), Strategy Layer (to generate actionable signals), Execution Layer (to manage orders), Risk Layer (to control exposure), and Monitoring Layer (to handle logging and alerts). Each layer is crucial for transforming breaking news into profitable trades in mere milliseconds.

Polymarket API: Platform Connection

Polymarket's hybrid system uses specialized interfaces for seamless communication. The Gamma API focuses on market discovery and metadata - helpful for linking news events to specific tradable markets. The CLOB API is the trading engine, offering real-time prices, order book depth, and order placement. For latency-critical tasks, the WebSocket API delivers instant updates on prices and order fills.

Authentication relies on HMAC-SHA256 signatures, requiring an API key, secret, and a timestamp that expires after 30 seconds. Official SDKs are available for TypeScript (@polymarket/clob-client) and Python (py-clob-client) to streamline integration. Be aware of strict rate limits: public endpoints allow 100 requests per minute per IP, while trading endpoints cap at 60 orders per minute per API key. Use the createOrDeriveApiKey() method in the SDK to generate L2 credentials directly from your wallet signer. For real-time data, connect to the CLOB WebSocket for order book updates with ~100ms latency or the Real-Time Data Socket (RTDS) for broader market and sentiment insights.

| API Component | Purpose | Endpoint |

|---|---|---|

| Gamma API | Market discovery & metadata | https://gamma-api.polymarket.com |

| CLOB API | Trading & order book data | https://clob.polymarket.com |

| WebSocket | Real-time data streaming | wss://ws-subscriptions-clob.polymarket.com |

This API setup forms a solid foundation for integrating real-time news feeds.

News Ingestion and Processing

News feeds are the lifeblood of a news-driven bot, providing the signals needed for quick trading decisions. Bots connect to news APIs and web search platforms, often leveraging vector databases to enhance contextual understanding. The RTDS includes a "Comments" topic, streaming user reactions and comments - useful for sentiment analysis and detecting social signals. Natural Language Processing (NLP) tools analyze sentiment or identify specific triggers, like election results or economic data, to create buy/sell signals.

To minimize latency in execution price calculations, keep a local copy of the order book and apply incremental updates using the price_change message type. During periods of low news activity, maintain WebSocket connections with heartbeat messages - send a "PING" every 10 seconds for the CLOB WebSocket and every 5 seconds for the RTDS. If the connection drops, ensure your bot automatically re-subscribes to all relevant market topics to avoid missing critical updates.

Strategy Logic and Risk Management

Effective strategy logic must include strict safeguards to protect capital. For example, limit any single position to no more than 5% of the portfolio. Implement stop-loss rules and emergency shutdowns to pause trading during extreme market volatility or API outages. Keep an eye on order book imbalances - a ratio above 0.6 often signals buying pressure - and monitor large trades ("whale" transactions) to gauge market sentiment.

"A well-designed bot can analyze market conditions, calculate optimal position sizes, and execute trades in milliseconds - far faster than any human trader." - AL, Founder of PolyTrack

"A well-designed bot can analyze market conditions, calculate optimal position sizes, and execute trades in milliseconds - far faster than any human trader." - AL, Founder of PolyTrack

If the API returns a 429 status code (indicating rate limits are exceeded), use exponential backoff to retry requests at progressively longer intervals. Before risking actual USDC, validate your bot's performance with paper trading simulations to test its reaction to news signals. Always store sensitive credentials like POLY_API_KEY and POLY_SIGNATURE securely in environment variables, avoiding hardcoding them into scripts.

How to Build and Deploy a News-Driven Polymarket Bot

Setting Up the Development Environment

To get started, you'll need Python 3.9.10 or later. Install the required libraries using this command: pip install py-clob-client web3==6.14.0 python-dotenv. Be sure to stick with the specific version of web3 (6.14.0) to avoid any compatibility issues.

You'll also need an Ethereum-compatible wallet with USDC on Polygon. To export your private key, log in to Polymarket, go to "Cash", click the three-dot menu, and select "Export Private Key." Remove the '0x' prefix before saving it in your .env file. Use the create_or_derive_api_creds() method from py-clob-client to generate your API Key, Secret, and Passphrase. These credentials are derived from your private key and only need to be created once.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

When setting up the client, you’ll need to choose the signature_type that matches your wallet:

-

0for standard Ethereum wallets like MetaMask -

1for Polymarket email/Magic wallets -

2for wallets like Gnosis Safe or browser-based wallets

The default CLOB host is https://clob.polymarket.com, and the Chain ID for Polygon Mainnet is 137.

| Wallet Type | Signature Type ID | Description |

|---|---|---|

| EOA | 0 | Standard Ethereum wallet (e.g., MetaMask) |

| Custom Proxy | 1 | Polymarket email/Magic Link users |

| Gnosis Safe | 2 | Injected wallets (e.g., Coinbase Wallet) |

Integrating News Feeds and Polymarket APIs

To connect news feeds with Polymarket trading, you'll use three APIs: the Gamma API for finding markets, the CLOB API for placing orders, and WebSockets for real-time updates. Start by querying the Gamma API’s /events or /markets endpoints. Use keywords from news headlines to match them with market "slugs" or "questions." Filter with active=true&closed=false to focus only on live, tradable markets.

Authentication works on two levels:

- L1: Uses your private key to sign EIP-712 messages.

- L2: Uses your API Key, Secret, and Passphrase for faster HMAC-SHA256 signing. These requests expire after 30 seconds for added security.

Each market has two clobTokenIds - one for "Yes" and one for "No." These IDs are critical for retrieving prices and placing trades.

For real-time updates, WebSocket connections are much faster (~100ms latency) compared to REST polling (~1 second). Use the tenacity library for exponential backoff to handle rate limit errors like HTTP 429. Public endpoints allow up to 100 requests per minute per IP, while authenticated endpoints are capped at 60 orders per minute per API key.

| API Component | Latency | Primary Use Case |

|---|---|---|

| WebSocket | ~100ms | Real-time updates, order book changes, trade alerts |

| Gamma API | ~1s | Market discovery, metadata, and resolution info |

| CLOB API | Variable | Core trading operations like placing and managing orders |

Once you've tested the API connections locally and confirmed everything works, you're ready to deploy your bot.

Deploying on QuantVPS for Low-Latency Execution

After testing locally, deploy your bot on a VPS to ensure it runs 24/7 with consistent performance. QuantVPS offers various plans:

- VPS Lite: $59.99/month ($41.99/month billed annually) with 4 cores and 8GB RAM.

- VPS Pro: $99.99/month ($69.99/month billed annually) with 6 cores, 16GB RAM, and 150GB NVMe storage. This plan is ideal for bots handling 3–5 markets.

- Dedicated Server: $299.99/month ($209.99/month billed annually) with 16+ dedicated cores and 128GB RAM.

For instant updates, use WebSocket connections (CLOB WebSocket or RTDS) instead of REST polling. Ensure mandatory heartbeat signals are sent to keep connections alive - CLOB WebSocket requires a "PING" every 10 seconds, and RTDS requires one every 5 seconds. To handle connection drops, implement reconnection logic with exponential backoff and jitter.

Security Tip: Never hardcode sensitive information like API keys or private keys. Use environment variables or a secret management tool on your VPS. Set up real-time alerts via Discord or Telegram to notify you of disconnections, risk breaches, or API errors. Include an emergency shutdown mechanism to stop trading during extreme volatility or technical issues.

Finally, check that your funder address (proxy wallet) has enough USDC for buy orders and sufficient outcome tokens for sell orders to avoid execution rejections.

Optimizing Performance and Reliability

Reducing Latency for Faster Execution

When trading breaking news on Polymarket, speed is everything. QuantVPS hosts its infrastructure in Chicago, strategically close to major financial matching engines. This setup cuts network travel time to an impressive 0.52ms - a huge improvement compared to Polymarket's WebSocket feed (~100ms latency) or Gamma API (~1 second). In trading, every millisecond counts, and this advantage could mean the difference between locking in a favorable price or missing out entirely.

The hardware behind QuantVPS is built for performance. It features AMD EPYC and Ryzen processors, NVMe M.2 SSDs, and DDR4/5 RAM, eliminating internal slowdowns. Network connections are equally robust, with a 1Gbps connection and 10Gbps burst capability, along with direct fiber-optic cross-connects to minimize data transfer delays. For the fastest data access, connect to Polymarket's Real-Time Data Socket (RTDS) at wss://ws-live-data.polymarket.com instead of relying on slower REST API polling.

QuantVPS also boasts a 99.999% uptime rating, ensuring your trading bot runs around the clock - even when your local computer is offline. On January 6, 2026, QuantVPS servers handled over $10.3 billion in futures volume in just 24 hours, showcasing their reliability under high demand.

Security and Stability Best Practices

Once you've optimized for speed, securing your trading setup is the next priority. Protecting your bot and sensitive data requires a multi-layered approach. Start by using environment variables or a secure secret management tool to store credentials safely on your VPS.

QuantVPS includes DDoS protection and advanced firewall rules to defend against external threats. You can further secure your setup by enabling IP whitelisting, allowing API access only from your VPS server. Polymarket's API adds another layer of security with HMAC-SHA256 signature authentication and timestamps that expire after 30 seconds, preventing replay attacks. Regularly rotating your API credentials is a good practice to reduce the likelihood of compromise.

"Protect your trading capital and sensitive data with our multi-layered security protocols... We proactively defend against threats like DDoS attacks and unauthorized access attempts." - QuantVPS

"Protect your trading capital and sensitive data with our multi-layered security protocols... We proactively defend against threats like DDoS attacks and unauthorized access attempts." - QuantVPS

To safeguard your trading algorithms and historical data, set up enterprise-grade backups. For added security, transfer profits from your bot-connected "hot" wallet to a hardware wallet. Monitor your bot's performance remotely using secure Remote Desktop (RDP), allowing you to tweak parameters in real time from anywhere. Additionally, implement rate limit handling with exponential backoff to manage HTTP 429 errors. Keep in mind that Polymarket's API caps authenticated endpoints at 60 orders per minute per API key and public endpoints at 100 requests per minute per IP.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Scaling for Multi-Market or High-Volume Trading

Once speed and security are in place, scaling your trading operations becomes the next focus. Whether you're expanding to multiple markets or handling higher volumes, your infrastructure must keep up. QuantVPS offers tailored solutions for scaling, such as the VPS Pro plan ($99.99/month or $69.99/month annually), which includes 6 cores and 16GB RAM - ideal for managing 3–5 markets. For larger workloads, the Dedicated Server plan ($299.99/month or $209.99/month annually) provides 16+ dedicated cores and 128GB RAM, capable of supporting 7+ markets or intensive strategies.

The 10Gbps burst network ensures smooth handling of data spikes during high-impact news events. Since Polymarket's API limits each WebSocket connection to 20 subscriptions, strategies that monitor dozens of markets simultaneously can use multiple WebSocket connections or scale horizontally by running separate bot instances across various VPS plans.

"A dedicated VPS provides the computational stability and reliable connectivity required for consistent algorithm performance during turbulent market conditions." - QuantVPS

"A dedicated VPS provides the computational stability and reliable connectivity required for consistent algorithm performance during turbulent market conditions." - QuantVPS

Choosing the right VPS plan depends on your trading strategy's computational demands. For example, high-frequency news sentiment analysis needs more CPU power compared to simpler market-making strategies. QuantVPS's automated backup system ensures your code and trading logs are secure as you scale. With its 99.999% uptime, you can confidently operate during 24/7 global news cycles without missing critical opportunities.

Conclusion

Key Takeaways for Automated Polymarket Trading

News-driven Polymarket bots bring speed to the forefront by executing trades within milliseconds. By leveraging WebSocket data and AI-powered natural language processing (NLP), these bots can instantly generate trading signals based on breaking news. This rapid response capability is further supported by Polymarket's hybrid architecture, which combines off-chain order matching for quick execution with on-chain settlement for added security.

Instead of relying on slower REST endpoint polling, bots connect directly to Polymarket's Real-Time Data Socket (RTDS) at wss://ws-live-data.polymarket.com. This approach eliminates rate limits and significantly reduces latency. The result? A fully automated trading system that operates around the clock, taking advantage of global news cycles without the need for human oversight.

The Role of QuantVPS in Automated Trading Success

While speed and automation are essential, a reliable infrastructure is equally critical. QuantVPS provides the backbone for successful news-driven Polymarket trading, offering a 99.999% uptime guarantee to keep your bot active even during high-volatility events. With high-performance hardware and direct fiber-optic cross-connects, QuantVPS ensures low latency and unmatched stability.

Your bot operates independently of your local machine, protected by DDoS safeguards and enterprise-grade firewalls. Meanwhile, you can securely monitor its performance through Remote Desktop access. Whether you're running a small setup or managing complex, multi-market strategies, QuantVPS offers plans tailored to your needs.

In short, a robust infrastructure like QuantVPS is the foundation for efficient and reliable automated Polymarket trading.

FAQs

How do Polymarket bots use AI to trade on breaking news?

Polymarket bots, powered by AI, are designed to process breaking news in real time, pulling data from sources like news APIs, RSS feeds, and social media. By using natural language processing (NLP), these bots can pinpoint crucial details - such as individuals, events, and sentiment - and determine how relevant the news is to specific Polymarket outcomes. This analysis is then paired with additional data like historical price trends and on-chain activity to estimate probabilities for market predictions.

When the bot identifies a significant probability shift with a high level of confidence, it springs into action. It calculates the ideal trade size, prepares the order, and executes it through Polymarket’s API - all within milliseconds. This speed, far beyond human capability, is made possible by sophisticated algorithms that transform rapid insights into precise, actionable trades.

How can I secure my Polymarket trading bot?

To keep your Polymarket trading bot secure, start by encrypting all communications with the platform. Use HTTPS for API requests and WSS (WebSocket Secure) for live market data streams. Instead of hard-coding API keys, store them securely in environment variables or a dedicated vault. Regularly rotate these keys and limit their usage to specific IP addresses to minimize the risk of unauthorized access.

For server security, run the bot on an isolated server. Keep your operating system and software updated to patch vulnerabilities, and enable a firewall to block unnecessary traffic. Before deploying any new code to production, test it thoroughly in a sandbox or test environment. Combining encrypted communication, secure key storage, and a robust server setup will go a long way in protecting your bot from potential threats.

How does a VPS improve the performance of news-driven trading bots on Polymarket?

A Virtual Private Server (VPS) boosts the performance of news-driven Polymarket bots by offering a fast, reliable, and always-on environment. With a VPS, your bot can take advantage of low-latency connections and close proximity to Polymarket’s API endpoints. This setup ensures your bot processes breaking news and executes trades faster than it could with a typical home or office internet connection. And in trading, where every second counts, this speed can mean the difference between profit and loss.

Beyond speed, a VPS guarantees 24/7 uptime and dedicated resources, eliminating interruptions caused by power outages or other programs running on your local machine. This consistent reliability keeps your bot running smoothly without delays or crashes, freeing you to focus on refining your trading strategies. By reducing latency, ensuring constant availability, and delivering stable performance, a VPS equips your trading bot to seize real-time market opportunities with accuracy and efficiency.

Polymarket bots, powered by AI, are designed to process breaking news in real time, pulling data from sources like news APIs, RSS feeds, and social media. By using natural language processing (NLP), these bots can pinpoint crucial details - such as individuals, events, and sentiment - and determine how relevant the news is to specific Polymarket outcomes. This analysis is then paired with additional data like historical price trends and on-chain activity to estimate probabilities for market predictions.

When the bot identifies a significant probability shift with a high level of confidence, it springs into action. It calculates the ideal trade size, prepares the order, and executes it through Polymarket’s API - all within milliseconds. This speed, far beyond human capability, is made possible by sophisticated algorithms that transform rapid insights into precise, actionable trades.

To keep your Polymarket trading bot secure, start by encrypting all communications with the platform. Use HTTPS for API requests and WSS (WebSocket Secure) for live market data streams. Instead of hard-coding API keys, store them securely in environment variables or a dedicated vault. Regularly rotate these keys and limit their usage to specific IP addresses to minimize the risk of unauthorized access.

For server security, run the bot on an isolated server. Keep your operating system and software updated to patch vulnerabilities, and enable a firewall to block unnecessary traffic. Before deploying any new code to production, test it thoroughly in a sandbox or test environment. Combining encrypted communication, secure key storage, and a robust server setup will go a long way in protecting your bot from potential threats.

A Virtual Private Server (VPS) boosts the performance of news-driven Polymarket bots by offering a fast, reliable, and always-on environment. With a VPS, your bot can take advantage of low-latency connections and close proximity to Polymarket’s API endpoints. This setup ensures your bot processes breaking news and executes trades faster than it could with a typical home or office internet connection. And in trading, where every second counts, this speed can mean the difference between profit and loss.

Beyond speed, a VPS guarantees 24/7 uptime and dedicated resources, eliminating interruptions caused by power outages or other programs running on your local machine. This consistent reliability keeps your bot running smoothly without delays or crashes, freeing you to focus on refining your trading strategies. By reducing latency, ensuring constant availability, and delivering stable performance, a VPS equips your trading bot to seize real-time market opportunities with accuracy and efficiency.

"}}]}