Automated Trading on Polymarket: Bots, Arbitrage & Execution Strategies

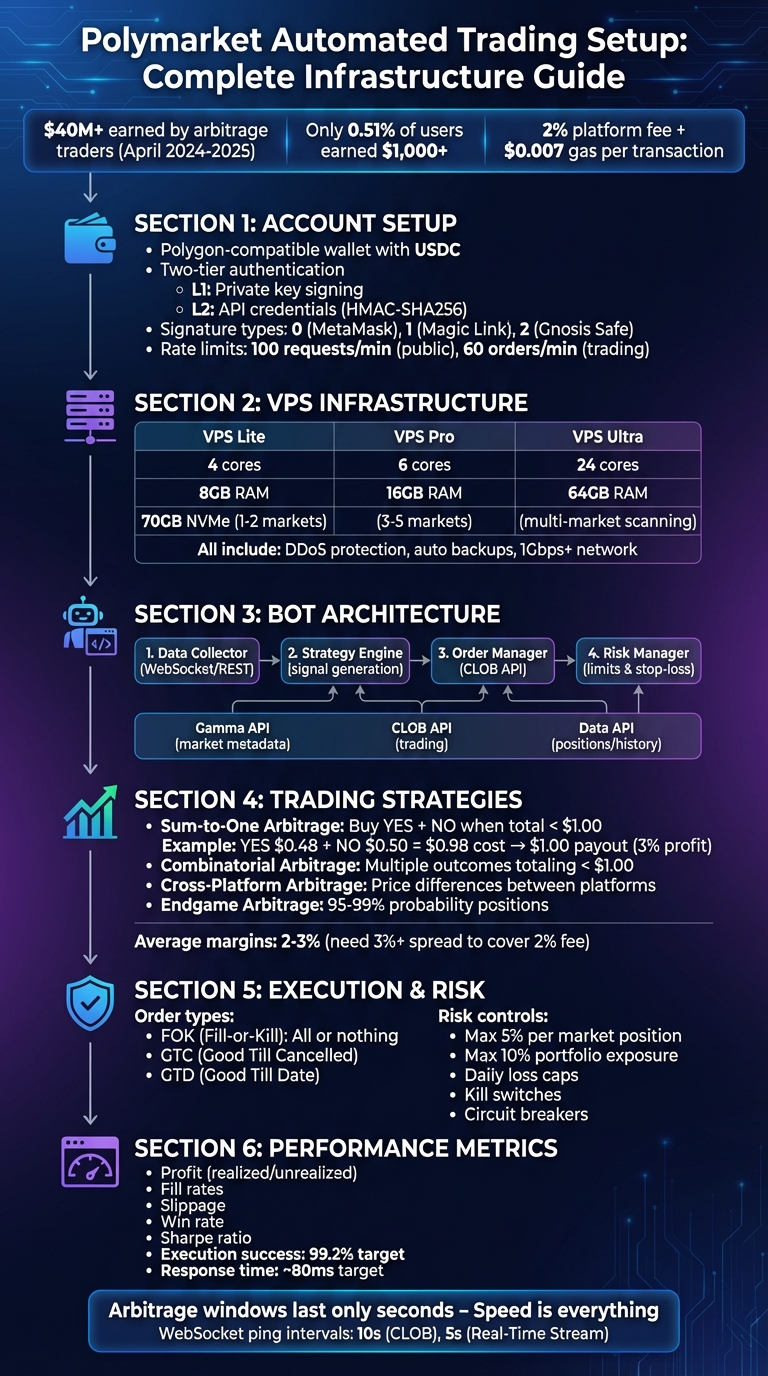

Automated trading on Polymarket is all about speed, precision, and leveraging tools to profit from fleeting opportunities. Polymarket uses a hybrid system combining off-chain order matching and on-chain settlement, making it essential for traders to focus on low-latency infrastructure and efficient bot design. Between April 2024 and April 2025, arbitrage traders earned over $40 million, but only a small percentage of users made significant gains, highlighting the competitive nature of the platform.

Here’s what you need to know:

- Setup: You’ll need a Polygon-compatible wallet with USDC, API credentials, and secure storage for keys. Public API calls are capped at 100 requests/minute, while trading endpoints allow 60 orders/minute.

- Infrastructure: A low-latency VPS, like QuantVPS, is critical for minimizing delays in execution. Plans vary based on the number of markets you monitor, with higher-tier plans offering more computational power.

- Bot Design: Key modules include data collection, strategy execution, order management, and risk controls. WebSocket connections are essential for real-time updates.

- Strategies: Popular methods include intra-market arbitrage (e.g., buying YES/NO shares when their combined price is under $1) and combinatorial arbitrage. Execution relies on precise order types like Fill-or-Kill (FOK).

- Risk Management: Use stop-losses, position limits, and daily loss caps to protect capital. Store credentials securely and implement kill switches for emergencies.

- Performance Monitoring: Track metrics like profit, fill rates, and slippage. Adjust strategies based on live data and test changes with small capital before scaling.

Success hinges on infrastructure, execution speed, and disciplined risk management. With Polymarket’s 2% fee and minimal gas costs (~$0.007/transaction), efficient systems are key to staying competitive.

Polymarket Automated Trading Setup: 6-Step Infrastructure Guide

Polymarket Automated Trading Setup: 6-Step Infrastructure Guide

Setting Up Your Trading Infrastructure

Accounts, Wallets, and API Access

To get started, you'll need an Ethereum-compatible wallet loaded with USDC on Polygon. Polymarket uses a two-tier authentication system that separates ownership verification from trading execution.

The first layer (L1) relies on your wallet's private key to sign messages, while the second layer (L2) uses API credentials (key, secret, passphrase) signed with HMAC-SHA256. You can export your private key directly from Polymarket (navigate to Cash → 3-dot menu → Export Private Key) and use the create_or_derive_api_creds() function to generate L2 credentials.

Your funder address acts as a proxy wallet that holds your USDC and trading positions. You can locate this address in your Polymarket profile settings at polymarket.com/settings. Before trading, you must approve the Exchange contract to access your USDC. This can be done via the Polymarket interface or programmatically with the CTF contract's setApprovalForAll() method.

Pay attention to the signature type when setting up your API credentials. Use the following codes to avoid L2_AUTH_NOT_AVAILABLE errors:

-

0for standard wallets like MetaMask -

1for Magic Link/Email proxy wallets -

2for Gnosis Safe or browser wallets

Keep your private keys and API secrets stored securely, away from version control systems. If you're using Python, pin your web3 library to version 6.14.0 to prevent compatibility issues. Public API endpoints are capped at around 100 requests per minute, while authenticated trading endpoints allow 60 orders per minute per API key.

This setup ensures a secure and efficient foundation for fast, precise trading - critical in Polymarket's fast-paced environment. With your accounts and API access configured, the next step is to choose a VPS that minimizes latency.

Choosing a Trading VPS

In Polymarket trading, latency is everything. Arbitrage opportunities often last just seconds, and profits can be substantial. A reliable trading VPS reduces internet latency and keeps your bot running around the clock.

For trading on Polymarket, look for servers with ultra-low latency connections to Polygon nodes and high uptime guarantees. Your bot needs to analyze market conditions and execute trades within milliseconds to remain competitive.

For single-market bots monitoring one or two prediction markets, the VPS Lite plan from QuantVPS is a good starting point. It includes:

- 4 cores

- 8GB RAM

- 70GB NVMe storage

- 1Gbps+ network speeds

This setup is adequate for basic order placement and WebSocket connections.

If you're running multi-market arbitrage bots that monitor several prediction markets simultaneously, you'll need more power. The VPS Pro plan offers:

- 6 cores

- 16GB RAM

This makes it suitable for monitoring 3–5 markets at once. For even more intensive setups scanning numerous markets, the VPS Ultra plan provides:

- 24 cores

- 64GB RAM

These resources are designed to handle the heavy computational demands of multi-market arbitrage.

All QuantVPS plans come with essential features like DDoS protection, automatic backups, and unmetered bandwidth. These ensure stable connections to Polymarket's WebSocket feed at wss://ws-subscriptions-clob.polymarket.com/ws/. With Polygon gas fees averaging about $0.007 per transaction, your infrastructure costs will likely outweigh transaction fees, making the choice of a VPS critical for profitable automated trading.

Designing and Building Trading Bots for Polymarket

Core Bot Architecture

To build a Polymarket trading bot, you’ll need four key modules working together. First, the Data Collector gathers real-time market data using WebSocket connections or REST API calls. Next, the Strategy Engine processes this data and generates trading signals based on your custom logic. The Order Manager takes care of placing and canceling trades through the CLOB API, while the Risk Manager ensures position limits and stop-loss rules are in place to safeguard your capital.

Your bot will interact with three API layers. The Gamma API (https://gamma-api.polymarket.com) provides essential market metadata and event details. The CLOB API (https://clob.polymarket.com) manages trading actions, including order placement and real-time price updates. Lastly, the Data API (https://data-api.polymarket.com) supplies user-specific details, such as your current positions and trade history.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

For real-time updates, you’ll rely on two WebSocket channels. The Market Channel streams order book updates for the markets you’re monitoring, while the User Channel, which requires authentication, delivers instant notifications about filled orders or position changes. To keep these WebSocket connections alive, send a "PING" signal every 10 seconds for the CLOB WebSocket and every 5 seconds for the Real-Time Data Stream.

With this foundational architecture in place, you can move on to implementing trading strategies.

Implementing Basic Strategies

A straightforward starting point is sum-to-one arbitrage. This strategy involves buying both YES and NO outcomes when their combined price is less than $1.00. Your bot monitors the order book via the WebSocket feed at wss://ws-subscriptions-clob.polymarket.com/ws/. For example, if YES is priced at $0.48 and NO at $0.50, your bot submits simultaneous FOK (Fill or Kill) orders to capitalize on the opportunity.

FOK orders are essential here because they ensure both trades execute together or not at all. This prevents “legged” positions where you might end up holding just one side of the trade, which exposes you to unnecessary risk. These arbitrage opportunities are fleeting, often lasting only seconds, making automation a must.

If you’re looking to diversify, market-making strategies can complement your approach. In market-making, your bot places quotes for both YES and NO outcomes with a spread. Carefully monitor your inventory - if you accumulate too much of one position (e.g., YES), adjust your quotes to favor the opposite side (e.g., NO) to balance your holdings. Establish strict inventory limits, and program your bot to unwind positions automatically if those limits are breached.

Testing and Deployment

Testing is an essential part of the development process. During the first two weeks, focus on exploring the API and understanding rate limits: 100 requests per minute for public endpoints and 60 orders per minute for trading. In weeks three and four, build an alert-only bot that identifies opportunities without executing trades. By weeks five and six, introduce paper trading to simulate real trades without risking actual funds.

When you’re ready to go live, deploy your bot using one of the best VPS for algorithmic trading to ensure continuous 24/7 operation with low latency. Always store your API credentials securely in environment variables - never hardcode them in your codebase. If you’re coding in Python, make sure to pin the web3 library to version 6.14.0 to avoid compatibility issues with the py-clob-client library.

To handle rate limit errors (HTTP 429), implement exponential backoff using a library like tenacity. Set up automated alerts through platforms like Telegram or Discord to notify you instantly if your bot disconnects, breaches risk thresholds, or encounters API issues. Lastly, include an emergency kill switch to manually halt all trading activity if market conditions suddenly shift.

Arbitrage Opportunities and Strategies in Polymarket

Common Arbitrage Patterns

One of the simplest strategies on Polymarket is intra-market arbitrage. This involves buying both YES and NO shares when their combined cost is less than $1. For example, if YES shares trade at $0.48 and NO shares at $0.49, you would spend $0.97 to secure a guaranteed $1 payout when the market resolves - locking in a 3% return before fees.

Another approach is combinatorial arbitrage, which applies to markets with multiple outcomes. Suppose a market offers three mutually exclusive outcomes priced at $0.35, $0.38, and $0.25. Buying all three outcomes would cost $0.98, guaranteeing a $1 payout regardless of the result. Then there’s cross-platform arbitrage, where you exploit price differences for the same event between Polymarket and other platforms like Kalshi or PredictIt. However, make sure both platforms rely on the same resolution source to avoid settlement discrepancies. Lastly, endgame arbitrage involves purchasing shares for near-certain outcomes (95–99% probability) just before resolution. While the gains may be small, they can add up to substantial annualized returns.

"Arbitrage opportunities on Polymarket exist for only a few seconds. Today, they are captured not by people but by bots operating on Polygon nodes." - AL, Founder of PolyTrack

"Arbitrage opportunities on Polymarket exist for only a few seconds. Today, they are captured not by people but by bots operating on Polygon nodes." - AL, Founder of PolyTrack

On average, arbitrage margins hover around 2–3%, but Polymarket charges a 2% fee on net winnings. To calculate profitability, use the formula:

Arbitrage Profit = $1.00 – (YES Ask + NO Ask) – (0.02 × $1.00).

For example, on a $100 position, you’d need at least a 3% spread to cover fees, gas costs, and any execution risks. Larger trades - $1,000 or more - tend to be more efficient, requiring spreads as low as 2.2% to remain profitable. Understanding these strategies is the first step toward building tools like an arbitrage scanner to automate the process.

Building an Arbitrage Scanner

Spotting arbitrage opportunities quickly requires automation. A good arbitrage scanner has three main components:

-

Data Layer: This gathers market data using the Gamma API and connects to real-time price feeds via the WebSocket at

wss://ws-subscriptions-clob.polymarket.com/ws/. - Strategy Layer: Here, the scanner identifies when the combined price of YES and NO shares falls below $1 (after accounting for fees).

-

Execution Layer: This places trades automatically using tools like the

py-clob-client. REST API polling isn’t fast enough to catch fleeting opportunities.

For more advanced functionality, scanners can use tools like Chroma DB paired with embeddings (e.g., e5-large-v2) to group similar markets, such as "Trump wins" and "Donald Trump elected." These groupings can reveal cross-market mispricings. Once opportunities are identified, they’re ranked by expected value after factoring in the 2% fee, Polygon gas costs, and potential slippage. Focus on high-volume markets, such as elections or sports, where emotional trading often leads to temporary pricing errors. Avoid markets with liquidity under $1,000, as slippage could wipe out any theoretical profits.

VPS for Arbitrage Efficiency

Execution speed is vital for successful arbitrage, and a reliable VPS (Virtual Private Server) can provide the edge you need. Arbitrage windows on Polymarket often last just a few seconds, so hosting your scanner on a VPS close to Polygon nodes - such as a QuantVPS instance - can significantly reduce the time between detecting an opportunity and executing a trade.

"Polymarket arbitrage is mechanical. If you execute it correctly and repeatedly, the edge already exists." - DevSphere, Coding Nexus

"Polymarket arbitrage is mechanical. If you execute it correctly and repeatedly, the edge already exists." - DevSphere, Coding Nexus

Using a VPS ensures your scanner operates in a stable, always-on environment, enabling it to monitor multiple markets and maintain consistent WebSocket connections. To safeguard your operations, include emergency kill switches in your code to prevent runaway losses during API failures or extreme market volatility. As competition grows, success will increasingly depend on execution speed and reliable infrastructure rather than simply identifying opportunities.

Execution and Risk Management

Execution Strategies for Prediction Markets

Once your bot is up and running, the next big challenge is executing orders effectively. In Polymarket's thin order books, selecting the right order type can make all the difference. Limit orders let you control the price, but they might not always get filled. On the other hand, market orders execute immediately but can lead to slippage, especially in low-liquidity situations. A middle-ground option is Fill-or-Kill (FOK) orders, which either execute the entire order at your specified price or cancel it completely, avoiding partial fills.

For arbitrage, precise execution is critical. Your bot should aim to simultaneously buy both YES and NO shares when their combined cost drops below $1.00, locking in profits before the market adjusts. To manage risk, limit trades to 1%–5% of available liquidity per position. Adding a small premium, like $0.01, to your limit orders can improve the chances of getting them filled without hurting profitability.

Order timing also plays a role. Good Till Cancelled (GTC) orders stay active until they're filled or manually canceled, while Good Till Date (GTD) orders expire at a specific time, helping to avoid stale orders. Keep in mind, Polymarket’s CLOB API has a rate limit of 60 orders per minute per API key. To work within these limits, implement an exponential backoff strategy for handling rate limit errors and retries, ensuring your bot doesn’t overwhelm the system. These execution techniques lay the groundwork for the next step: managing risk effectively.

Risk Controls and Safeguards

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Efficient trade execution is just one part of the equation - protecting your capital is equally important. A robust risk management layer should include position limits, stop-losses, and daily loss caps, all enforced before your orders are executed. To limit exposure, avoid allocating more than 5% of your portfolio to a single market. Even seemingly safe markets with 99% probabilities can shift dramatically due to unexpected events like political scandals, health emergencies, or disputes over market resolutions.

Between April 2024 and April 2025, arbitrage traders managed to pull in over $40 million in profits on Polymarket. However, only 0.51% of users earned more than $1,000, highlighting the competitive nature of the platform. To protect against extreme volatility, consider implementing circuit breakers to pause trading during chaotic market conditions. A kill switch can also be invaluable, allowing you to manually shut down operations instantly if needed. If your bot hits its daily loss cap, it should automatically cancel any open orders and pause trading, giving you time to review its performance.

For added security, store private keys and API credentials in environment variables rather than hardcoding them. Use IP whitelisting to restrict API access to your VPS, and rotate API keys periodically. Polymarket’s infrastructure combines L1 wallet signing with L2 authentication for faster and safer trading. Make sure to leverage L2 authentication to minimize the risk of exposing private keys.

Performance Monitoring and Iteration

With execution and risk management in place, the next step is to monitor performance continuously. Keep an eye on metrics like realized and unrealized profits, win rates, and the Sharpe ratio. Other key indicators, such as slippage and fill rates, can help fine-tune your execution strategy. If your bot struggles to get orders filled, you might need to adjust the limit order premium or switch to FOK orders for faster execution.

Utilize tools like Parsec for real-time insights into on-chain activity, including flows, open interest, and share distribution. For more advanced analysis, Polysights offers AI-driven momentum metrics, while PolyTrack provides valuable APIs for tracking large traders and analyzing portfolios. Studying market volatility across different timeframes - such as 3 hours, 24 hours, 7 days, and 30 days - can help identify stable environments with better risk-adjusted returns.

Refine your strategy based on live performance data. If your bot’s arbitrage scanner identifies opportunities but fails to act on them due to latency, consider hosting it on a VPS closer to Polygon nodes, such as a QuantVPS instance, to reduce response times. Professional trading platforms report average execution success rates of 99.2% with response times around 80ms. Test any changes with small amounts of capital before scaling up, and maintain detailed logs to troubleshoot and improve your bot’s performance over time.

How to Use the Polymarket API with Python (Step by Step)

Conclusion and Key Takeaways

Automated trading on Polymarket goes beyond just writing code - it's about crafting a system that prioritizes speed, accuracy, and reliability. Data shows that arbitrage traders have achieved notable profits on Polymarket, but the real edge lies in strong infrastructure, precise execution, and careful risk management.

A well-thought-out bot architecture is critical. A solid system uses real-time data and atomic execution strategies to handle trades in fast-moving markets. This foundation is essential to tackling one of the most crucial factors: latency.

Speed is everything in arbitrage. Opportunities on Polymarket are fleeting, often lasting just seconds before being snapped up by high-speed bots. Hosting your trading bot on a VPS located near Polygon nodes can minimize execution delays, providing the speed needed for algorithmic trading. QuantVPS offers infrastructure specifically designed for low-latency performance, making it a strong option for traders.

While speed is vital, the fundamentals are what sustain long-term success. Always account for Polymarket’s 0.01% trading fee and Polygon’s gas costs, which are roughly $0.007 per transaction, when calculating profitability. Use sensible position limits, such as keeping exposure at a maximum of 10% of your portfolio per market, and maintain detailed logs to identify and fix issues. Before scaling up, test any strategy adjustments with small amounts of capital.

FAQs

How can I reduce latency for automated trading on Polymarket?

Reducing latency is crucial for executing trades swiftly and effectively on Polymarket. To make this happen, consider hosting your trading bot on a low-latency VPS positioned close to Polymarket’s servers. This setup minimizes network delays, enabling quicker communication between your bot and the platform.

For real-time market updates, switch to Polymarket's WebSocket connections instead of relying on REST APIs. WebSockets deliver instant data streams, cutting down on delays. When placing orders, stick to the fastest REST endpoints and streamline your requests to reduce processing time.

On the coding side, fine-tune your bot's performance by employing efficient programming practices. Pre-compute essential calculations where possible, and avoid blocking operations that can slow things down. Regularly track and analyze latency metrics to spot and fix any performance issues. These strategies will enhance the speed and reliability of your automated trading on Polymarket.

What are the best strategies to manage risks when using trading bots on Polymarket?

Managing risks is a key part of successfully running trading bots on Polymarket. Start by getting a solid grasp of the market rules and payout conditions - this helps ensure there are no unpleasant surprises when markets settle. Steer clear of thinly traded markets with low liquidity, as they can lead to significant slippage and poor trade execution. Instead, focus on markets with a deeper order book unless you’re confident you have a clear advantage.

Keep your position sizes disciplined by limiting each trade to a small percentage of your total capital - around 1–2% is a good rule of thumb. This approach helps cushion the impact of potential losses. It’s also smart to set up stop-loss mechanisms or trading thresholds. These can automatically pause the bot if losses hit a certain percentage or if unexpected spikes in market volatility occur. To maintain a well-balanced and diversified strategy, cap the bot’s exposure to individual markets.

Make it a habit to regularly check your bot’s performance. Keep an eye on factors like API rate limits and execution speed to ensure everything is running smoothly and without errors. Before deploying your strategy, back-test it using historical data to validate your risk settings and fine-tune them as market conditions shift. By following these steps, you’ll be better positioned to improve your bot’s performance while keeping risks in check.

How can I make sure my trading bot follows Polymarket's API rate limits?

To make sure your trading bot stays within Polymarket's API rate limits, start by checking their official guidelines for the maximum number of requests allowed per endpoint and time frame. Configure your bot to monitor its request count and automatically pause or delay additional calls if it’s approaching the limit. If you encounter a 429 error (Too Many Requests), program your bot to pause briefly and retry once the limit resets.

If your trading strategy demands a higher request capacity, you might want to upgrade to a higher builder tier for increased flexibility. Also, keep an eye on Polymarket’s documentation for any updates to their rate limits. Maintaining a detailed activity log for your bot can help you track compliance and quickly address any issues that arise.

Reducing latency is crucial for executing trades swiftly and effectively on Polymarket. To make this happen, consider hosting your trading bot on a low-latency VPS positioned close to Polymarket’s servers. This setup minimizes network delays, enabling quicker communication between your bot and the platform.

For real-time market updates, switch to Polymarket's WebSocket connections instead of relying on REST APIs. WebSockets deliver instant data streams, cutting down on delays. When placing orders, stick to the fastest REST endpoints and streamline your requests to reduce processing time.

On the coding side, fine-tune your bot's performance by employing efficient programming practices. Pre-compute essential calculations where possible, and avoid blocking operations that can slow things down. Regularly track and analyze latency metrics to spot and fix any performance issues. These strategies will enhance the speed and reliability of your automated trading on Polymarket.

Managing risks is a key part of successfully running trading bots on Polymarket. Start by getting a solid grasp of the market rules and payout conditions - this helps ensure there are no unpleasant surprises when markets settle. Steer clear of thinly traded markets with low liquidity, as they can lead to significant slippage and poor trade execution. Instead, focus on markets with a deeper order book unless you’re confident you have a clear advantage.

Keep your position sizes disciplined by limiting each trade to a small percentage of your total capital - around 1–2% is a good rule of thumb. This approach helps cushion the impact of potential losses. It’s also smart to set up stop-loss mechanisms or trading thresholds. These can automatically pause the bot if losses hit a certain percentage or if unexpected spikes in market volatility occur. To maintain a well-balanced and diversified strategy, cap the bot’s exposure to individual markets.

Make it a habit to regularly check your bot’s performance. Keep an eye on factors like API rate limits and execution speed to ensure everything is running smoothly and without errors. Before deploying your strategy, back-test it using historical data to validate your risk settings and fine-tune them as market conditions shift. By following these steps, you’ll be better positioned to improve your bot’s performance while keeping risks in check.

To make sure your trading bot stays within Polymarket's API rate limits, start by checking their official guidelines for the maximum number of requests allowed per endpoint and time frame. Configure your bot to monitor its request count and automatically pause or delay additional calls if it’s approaching the limit. If you encounter a 429 error (Too Many Requests), program your bot to pause briefly and retry once the limit resets.

If your trading strategy demands a higher request capacity, you might want to upgrade to a higher builder tier for increased flexibility. Also, keep an eye on Polymarket’s documentation for any updates to their rate limits. Maintaining a detailed activity log for your bot can help you track compliance and quickly address any issues that arise.

"}}]}