Sports Betting Bots on Polymarket: Automated Event Trading

Polymarket is a peer-to-peer prediction platform where users trade event-based contracts using USDC. Unlike traditional sportsbooks, Polymarket operates on a decentralized model with a binary outcome system (YES/NO shares). Automated trading bots dominate this space by exploiting real-time data, reacting to price shifts, and executing trades faster than humans. Here's why bots are essential and how they work:

- Speed: Bots process data and execute trades in milliseconds, leveraging WebSocket feeds with ~100ms latency.

- Efficiency: They monitor hundreds of markets simultaneously, 24/7, removing human error and emotions.

- Strategies: Common bot types include spike detection (reacting to news), market-making (providing liquidity), and arbitrage (exploiting price differences with external sportsbooks).

For success, bots require reliable APIs, real-time data feeds, and robust hosting infrastructure. Risk management tools like the Kelly Criterion and Fill-or-Kill orders ensure precise execution. Hosting on platforms like QuantVPS minimizes latency and ensures uninterrupted operation, critical for trading in Polymarket's dynamic sports markets.

How to Use the Polymarket API with Python (Step by Step)

How Automated Sports Trading Works

Polymarket API Data Feeds Comparison: Latency and Use Cases

Polymarket API Data Feeds Comparison: Latency and Use Cases

Sports trading on Polymarket revolves around events, markets, and outcomes. Shares are traded as decimals ranging from 0 to 1 USDC, with each share paying $1.00 USDC once the event is resolved. The platform operates using a Central Limit Order Book (CLOB), enabling bots to access real-time bids, asks, and order book depth through the CLOB API or WebSocket connections. Event outcomes are finalized using UMA's Optimistic Oracle, which relies on official league websites to determine payouts. Bots can identify active sports markets via the /sports endpoint, while specific events like UFC or F1 can be filtered using tag_id parameters.

How Polymarket Sports Markets Operate

Polymarket sports markets function as peer-to-peer exchanges, where contract prices mirror real-time market sentiment. All trades and payouts are conducted in USDC, utilizing the Polygon blockchain. Positions are tracked through ERC-1155 tokens.

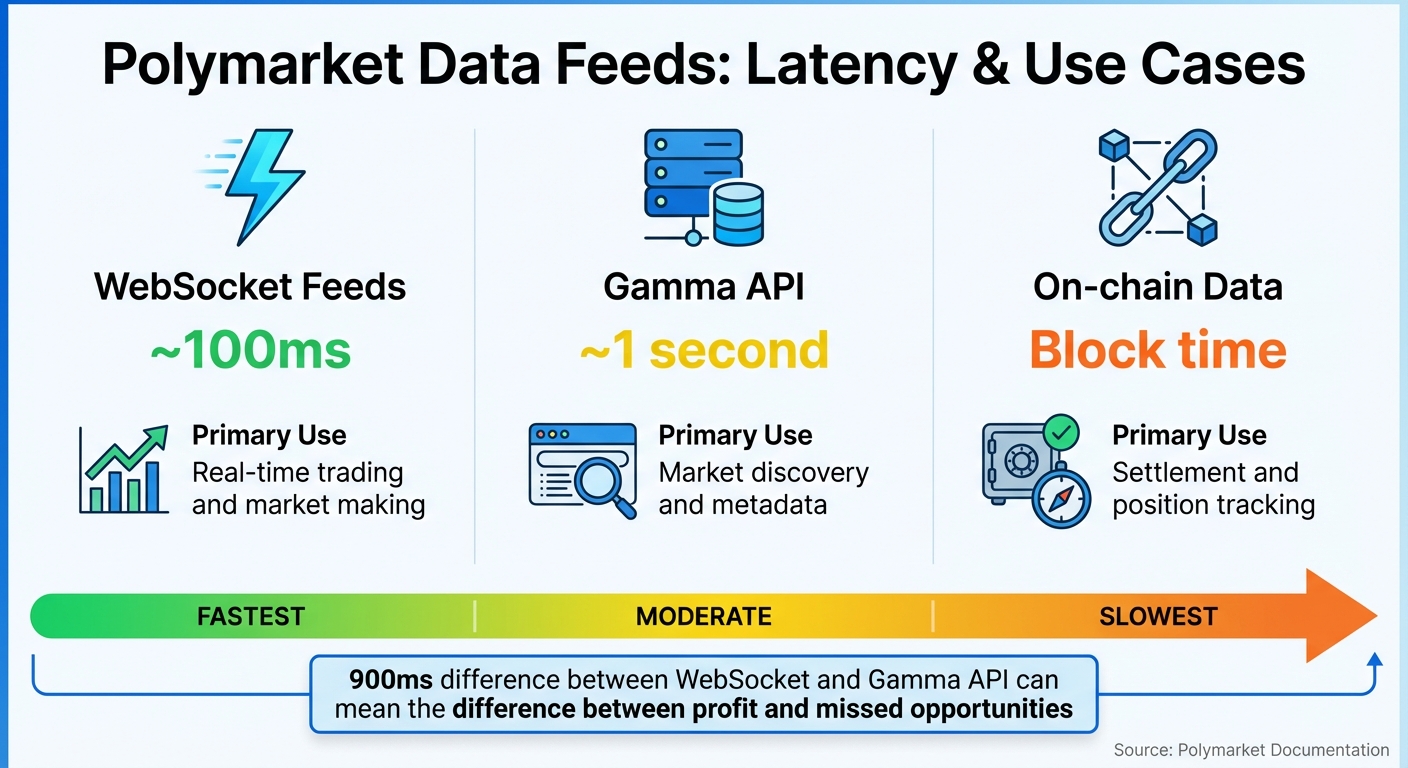

Bots rely on three primary data feeds, each tailored to specific trading tasks:

- WebSocket feeds: Deliver price updates with ~100ms latency, ideal for fast-paced trading.

- Gamma API: Offers market discovery and metadata with ~1-second latency.

- On-chain data: Used for settlement verification, subject to blockchain block times.

| Feed Type | Latency | Primary Use Case |

|---|---|---|

| WebSocket | ~100ms | Real-time trading and market making |

| Gamma API | ~1s | Market discovery and metadata |

| On-chain | Block time | Settlement and position tracking |

Implied Odds and Probability in Sports Markets

Contract prices in sports markets represent implied probabilities, offering bots a chance to spot arbitrage opportunities when external statistics differ from market prices. For instance, if a statistical model predicts a 70% probability for an outcome, but the market prices it at 60%, a bot could step in to exploit the difference.

To ensure bots only interact with active, tradable contracts, filter for live markets using active=true and closed=false parameters. Additionally, the /sports/market-types endpoint can help identify supported betting structures, such as moneylines and spreads.

Why Latency Matters in Event Trading

Speed is everything in automated event trading. The faster a bot can act, the better its chances of capitalizing on mispriced contracts before the market adjusts. Bots using the Gamma API (~1-second latency) are at a disadvantage compared to those leveraging WebSocket feeds (~100ms latency). In fast-moving sports markets, a ~900ms difference can mean the difference between profit and missed opportunities.

"Market makers need fast, reliable data to price markets and manage inventory." - Polymarket Documentation

"Market makers need fast, reliable data to price markets and manage inventory." - Polymarket Documentation

To stay competitive, bots should maintain a local copy of the order book, applying incremental updates from WebSocket streams rather than relying on repeated REST endpoint calls. Tracking sequence numbers in data packets helps bots detect missed messages, ensuring they avoid trading on outdated information. Additionally, implementing automatic reconnection with exponential backoff and responding to heartbeat pings is crucial for maintaining stable connections.

Grasping these technical details is essential for designing effective bot strategies. Latency considerations play a pivotal role in shaping the approaches discussed in the next section.

Bot Strategies for Polymarket Sports Trading

Automated trading bots on Polymarket are designed to exploit various market inefficiencies, falling into three main categories. These bots integrate real-time data and employ disciplined risk management to execute trades in milliseconds, offering a glimpse into the technical and operational intricacies of sports trading.

Spike Detection and Reaction Bots

These bots are tuned to monitor live sports events and react instantly to breaking news, such as a critical player injury or a sudden momentum shift. Using WebSocket feeds, they identify rapid price changes before the broader market catches on. Some advanced bots even incorporate AI to process news and social media updates, enabling faster responses to pivotal events.

When a spike is detected, bots often rely on Fill-or-Kill (FOK) orders to ensure their entire calculated position is executed at the desired price, avoiding partial fills during volatile moments. Many of these bots also compare data from sharp sportsbooks like Pinnacle to determine accurate odds, executing trades only when Polymarket prices lag behind these external benchmarks.

Market Making Bots

Market-making bots focus on providing liquidity by maintaining bid-ask spreads in Polymarket’s sports markets. Leveraging Polymarket’s Real-Time Data Stream (RTDS), these bots adjust their inventory and pricing dynamically as game conditions evolve. Since sports markets can experience dramatic shifts in response to a single play, these bots maintain a local order book that updates incrementally via WebSocket feeds. With profit margins being razor-thin, uptime and execution speed are critical for their success.

Arbitrage and Mispricing Bots

Arbitrage bots capitalize on pricing discrepancies by comparing Polymarket contracts with odds from external sportsbooks. For instance, Gambot pulls odds from Pinnacle, removes the house edge to calculate true probabilities, and executes trades when Polymarket prices deviate significantly. Between April 2024 and April 2025, arbitrage strategies generated over $40 million in profits on Polymarket, with the top three wallets alone earning approximately $4.2 million.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

"By pulling market data from sharp sportsbooks (like Pinnacle), removing the house edge to determine the sportsbook's 'true' view on odds and comparing against Polymarket, Gambot leverages a probabilistic modeling approach." – Chris Gillam

"By pulling market data from sharp sportsbooks (like Pinnacle), removing the house edge to determine the sportsbook's 'true' view on odds and comparing against Polymarket, Gambot leverages a probabilistic modeling approach." – Chris Gillam

These opportunities are fleeting, often lasting only seconds, which is why arbitrage bots are typically hosted on co-located servers near Polygon nodes to minimize execution delays. They also use the Kelly Criterion to dynamically adjust stake sizes based on the perceived edge and current bankroll, aiming to maximize growth while managing risk. However, despite the potential for high returns, only 0.51% of users involved in arbitrage strategies have managed to earn profits exceeding $1,000, underscoring the technical challenges of this approach.

Technical Requirements and Infrastructure

Creating a sports betting bot for Polymarket involves three essential elements: integrating APIs for executing orders, accessing real-time sports data for informed decisions, and using reliable hosting infrastructure. Together, these components enable your bot to identify opportunities and act on them without delay.

Polymarket API and Data Integration

Polymarket’s hybrid system allows for seamless integration of APIs to facilitate quick order execution and market monitoring. To develop a functional bot, you'll need to work with three main APIs - Gamma, CLOB, and Data - along with a WebSocket connection.

The Gamma API (https://gamma-api.polymarket.com) is your go-to for market discovery and sports metadata. Use the /sports endpoint to locate automated leagues, filtering by series_id (e.g., NBA is 10345) or tag_id (e.g., 100639 for game-specific bets). Always include active=true&closed=false to ensure your bot only interacts with tradable markets.

The CLOB API (https://clob.polymarket.com) handles order placement and fetching prices, while the Data API (https://data-api.polymarket.com) tracks positions and trade history. For real-time updates, the CLOB WebSocket (wss://ws-subscriptions-clob.polymarket.com) provides orderbook data with roughly 100ms latency.

| API Component | Base URL | Primary Use Case |

|---|---|---|

| Gamma API | https://gamma-api.polymarket.com | Market discovery, sports metadata |

| CLOB API | https://clob.polymarket.com | Order placement, price fetching, orderbooks |

| Data API | https://data-api.polymarket.com | Position tracking, trade history |

| CLOB WebSocket | wss://ws-subscriptions-clob.polymarket.com | Real-time orderbook updates |

To get started, connect your wallet, enable API trading, and generate API credentials. Use the official Python SDK (py-clob-client) or TypeScript SDK (@polymarket/clob-client) to initialize the ClobClient with your private key and proxy address. All authenticated requests require HMAC-SHA256 signatures with timestamps that expire after 30 seconds.

Rate limits depend on the endpoint type: public endpoints allow 100 requests per minute per IP, authenticated reads support 300 requests per minute, and trading endpoints permit 60 orders per minute. WebSocket connections can handle up to 20 simultaneous subscriptions. To avoid timeouts, send PINGs every 5–10 seconds.

"Polymarket operates a hybrid architecture that combines off-chain order matching with on-chain settlement. This design provides the speed of centralized exchanges while maintaining the security and transparency of blockchain-based systems." – AL, Founder of PolyTrack

"Polymarket operates a hybrid architecture that combines off-chain order matching with on-chain settlement. This design provides the speed of centralized exchanges while maintaining the security and transparency of blockchain-based systems." – AL, Founder of PolyTrack

Once your API connections are in place, the next step is to tap into real-time sports data for responsive decision-making.

Real-Time Sports Data Feeds

For effective sports betting, your bot needs two types of data: pre-game information for initial positioning and in-play updates to adapt to live events. The Gamma API supplies live event details like score, period, elapsed time, and gameStartTime. This data helps your bot track game progress and respond to momentum shifts.

WebSocket feeds provide the fastest updates, with approximately 100ms latency, while the Gamma API operates at around 1-second latency. To maintain data integrity, use sequence numbers in data streams to identify missed messages. If the connection drops, implement reconnection logic with exponential backoff to resume streaming automatically.

The Gamma API also offers a resolution field in its metadata, which links to the official source (e.g., a league website) used for market settlement. This ensures transparency and helps verify outcomes to avoid disputes.

These real-time data feeds are crucial for smooth trading operations, setting the stage for hosting your bot on a reliable platform.

Hosting Bots with QuantVPS

To ensure your bot performs efficiently, hosting on a dependable platform like QuantVPS is essential. Sports events occur around the clock, and opportunities in Polymarket’s markets can vanish in seconds. A VPS ensures 24/7 uptime and minimizes the delay between receiving sports updates and executing trades. QuantVPS is tailored for high-frequency trading, offering features that align perfectly with sports betting bots.

Ultra-low latency is vital for reacting to breaking news or arbitrage opportunities. QuantVPS delivers 0-1ms latency with optimized routing to Polygon nodes, which speeds up transaction broadcasts to the blockchain. Since Polymarket operates on the Polygon mainnet (Chain ID 137), this optimization directly improves execution times.

Reliable WebSocket connectivity is another must-have. Sports bots rely on continuous data streams from wss://ws-subscriptions-clob.polymarket.com for real-time orderbook updates. QuantVPS provides stable, high-bandwidth connections that can handle constant data streams without interruptions. Its VPS plans range from VPS Lite (4 cores, 8GB RAM) to Dedicated Server (16+ cores, 128GB RAM), ensuring scalability as your bot's needs grow.

For strategies requiring Real-Time Data Streams (RTDS), QuantVPS offers NVMe storage and unmetered bandwidth, allowing you to process high-frequency price feeds without performance issues. A 100% uptime guarantee ensures your bot stays operational during critical moments, while automatic backups protect your configurations and historical data. Full root access lets you install custom dependencies for Python or TypeScript SDKs, and built-in DDoS protection shields against network attacks that could disrupt trading.

| Feature | Requirement for Sports Bots | Polymarket Component |

|---|---|---|

| Latency | Ultra-low for quick reactions | CLOB API & RTDS |

| Uptime | 100% during live game windows | Gamma API (Event Start/End) |

| Connectivity | Persistent WebSocket streams | CLOB WebSocket |

| Infrastructure | High-performance compute capacity | Python/TypeScript SDKs |

Risk Management and Best Practices

In automated trading, even a single mistake or a momentary connection loss can erase weeks of hard-earned profits. That’s why having a solid risk management strategy is absolutely essential for maintaining consistent gains.

Capital Allocation and Position Sizing

A golden rule in trading: never risk more than 1–5% of your total capital on a single trade. Gambot enforces this principle by using parameters like MAX_PERCENTAGE_BET and MAX_DOLLAR_BET to keep over-leveraging in check.

For a more dynamic approach, consider the Kelly Criterion. This method adjusts the size of your trades based on your edge and the probability of success. Gambot incorporates this through a kelly_multiplier (ranging from 0 to 1) to balance risk and optimize long-term growth. This strategy helps shield your capital from major losses caused by unexpected data errors or bugs in the system.

Another smart move? Spread your risk. Instead of putting all your capital on a single NBA game, diversify across multiple sports and timeframes. That way, even if an unexpected event - like a star player’s injury - throws off one game, your overall portfolio remains stable.

Managing Latency and Execution Risk

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Slippage, or getting worse prices than expected, can seriously hurt your profits. To minimize this, use Fill-or-Kill (FOK) orders. These orders ensure your trade is either executed immediately at the quoted price or canceled altogether.

Latency is another critical factor. WebSocket feeds offer a latency of about 100ms, which is much faster than the 1-second delay of the Gamma API. To avoid missing critical data, track sequence numbers in data packets and set up reconnection logic with exponential backoff. This ensures your bot automatically resumes streaming after temporary network hiccups.

To identify mispriced odds, compare Polymarket’s implied probabilities with those from top sportsbooks like Pinnacle. Gambot uses the RapidAPI Pinnacle Data API to pull accurate odds, ensuring trades are made only when there’s a real edge - typically aiming for an Expected Value (EV) between 3% and 8%. If your system can’t handle the inherent delays of live betting, it’s better to avoid it altogether. Simply set INCLUDE_LIVE to false to disable trading on ongoing games.

These steps are crucial for maintaining precise executions and supporting a broader risk management strategy.

Maintaining Uptime with VPS Hosting

When it comes to hosting, reliability is non-negotiable. Even brief downtime can take a chunk out of your profits. Opt for the best VPS for algorithmic trading that guarantees 100% uptime and includes DDoS protection to keep your operations running smoothly.

System monitoring is another must-have. It helps you catch performance issues early, preventing missed trades. Make sure your VPS system clock stays in sync with Polymarket’s API server. Since API requests expire after 30 seconds, even a small timestamp mismatch can result in "Unauthorized" errors.

For HTTP 429 or 500 errors, implement exponential backoff retry logic. Also, keep in mind that Polymarket limits trading to 60 orders per minute per API key. Design your bot to respect these limits to avoid temporary IP bans.

Conclusion

Automated sports betting bots on Polymarket offer key benefits: they execute trades in milliseconds, run 24/7, and remove the pitfalls of emotional decision-making by relying on systematic risk management.

To achieve optimal performance, these bots rely on a solid technical foundation. This includes low-latency API connections, real-time data feeds through WebSockets, and risk management tools like the Kelly Criterion and Fill-or-Kill orders. Pairing these tools with reliable VPS hosting ensures uninterrupted operations and lightning-fast execution speeds - both critical for success in fast-moving markets.

The importance of hosting infrastructure cannot be overstated. Using a home PC introduces risks like connectivity drops and latency delays, which can disrupt trading strategies. In contrast, professional VPS hosting offers guaranteed uptime, enterprise-grade DDoS protection, and servers strategically located to reduce network delays. This infrastructure ensures bots can operate seamlessly without interruptions.

QuantVPS, for example, delivers 99.999% uptime and ultra-low latency (less than 0.52 milliseconds) to key trading hubs, ensuring your bots stay ahead in prediction markets where every millisecond matters.

Ultimately, combining well-designed bot strategies with reliable VPS hosting is essential for thriving in Polymarket’s fast-paced sports markets. Whether you're deploying spike detection bots, running market-making algorithms, or seeking arbitrage opportunities, your hosting setup plays a direct role in maximizing profits.

FAQs

How do sports betting bots on Polymarket stay competitive in fast-moving markets?

Sports betting bots on Polymarket excel by leveraging a mix of real-time data analysis, probability modeling, and lightning-fast execution. These bots are constantly at work, analyzing odds from top sportsbooks, comparing them with Polymarket's market probabilities, and applying strategies like the Kelly criterion to pinpoint and act on profitable trades before the market catches up.

Speed is everything in this game, and that’s why these bots depend on low-latency systems. Running the bot on a high-performance VPS ensures trades are executed within milliseconds - a crucial advantage in markets where opportunities can disappear in the blink of an eye.

On top of that, these bots handle risk management and adaptive strategies automatically. They track market volatility, adjust trade sizes on the fly, and even pause operations during unusual data surges or when approaching API limits. By combining rapid decision-making, precision, and strict discipline, these bots are designed to consistently exploit inefficiencies in the market.

What do I need to set up an automated sports betting bot on Polymarket?

To get started with a sports betting bot on Polymarket, the first step is securing programmatic access to the platform. This typically involves obtaining a Polymarket API key or signed wallet credentials. Make sure your bot respects Polymarket's rate limits when fetching market data or placing orders. For easier implementation, consider using the Polymarket Agents SDK for Python. This tool simplifies key tasks like retrieving live odds, submitting trades, and monitoring settlements.

Another essential component is a real-time sports data feed. Look for a JSON API that provides live scores, player stats, and odds. This data is critical for generating trading signals, which are often based on statistical models or strategies like the Kelly criterion to determine optimal bet sizing. Before going live, thoroughly test and back-test your bot to ensure its logic is accurate and dependable.

Your bot also needs a secure and stable environment to handle the fast-paced nature of sports events. A dedicated VPS, such as QuantVPS, is a solid choice. Opt for a server with minimal downtime, sufficient CPU and RAM, and a stable U.S.-based IP address. To safeguard your funds, use secure storage for private keys, like an encrypted vault or hardware wallet. Additionally, implement robust error-handling systems to minimize disruptions during live trading.

How do sports betting bots manage risk and stay profitable on Polymarket?

Sports betting bots play a pivotal role in managing risk and staying profitable on Polymarket by sticking to well-defined strategies and utilizing cutting-edge automation. They rely on position-sizing rules, like the Kelly Criterion, to decide how much capital to allocate to each trade. This approach strikes a balance between maximizing growth and limiting exposure. Additionally, bots set strict loss limits - such as stop-loss thresholds - and spread their trades across various events to reduce the impact of unexpected outcomes.

To stay ahead in a fast-moving market, these bots continuously rebalance positions and keep a close eye on market liquidity, ensuring they don’t get caught off guard by sudden price swings. Advanced bots often use AI-powered algorithms to identify arbitrage opportunities or mispriced markets, allowing them to secure small, consistent profits through quick and accurate execution. By blending these methods with backup systems and strategies inspired by seasoned traders, these bots can navigate Polymarket’s ever-changing sports trading landscape while keeping risks under control.

Sports betting bots on Polymarket excel by leveraging a mix of real-time data analysis, probability modeling, and lightning-fast execution. These bots are constantly at work, analyzing odds from top sportsbooks, comparing them with Polymarket's market probabilities, and applying strategies like the Kelly criterion to pinpoint and act on profitable trades before the market catches up.

Speed is everything in this game, and that’s why these bots depend on low-latency systems. Running the bot on a high-performance VPS ensures trades are executed within milliseconds - a crucial advantage in markets where opportunities can disappear in the blink of an eye.

On top of that, these bots handle risk management and adaptive strategies automatically. They track market volatility, adjust trade sizes on the fly, and even pause operations during unusual data surges or when approaching API limits. By combining rapid decision-making, precision, and strict discipline, these bots are designed to consistently exploit inefficiencies in the market.

To get started with a sports betting bot on Polymarket, the first step is securing programmatic access to the platform. This typically involves obtaining a Polymarket API key or signed wallet credentials. Make sure your bot respects Polymarket's rate limits when fetching market data or placing orders. For easier implementation, consider using the Polymarket Agents SDK for Python. This tool simplifies key tasks like retrieving live odds, submitting trades, and monitoring settlements.

Another essential component is a real-time sports data feed. Look for a JSON API that provides live scores, player stats, and odds. This data is critical for generating trading signals, which are often based on statistical models or strategies like the Kelly criterion to determine optimal bet sizing. Before going live, thoroughly test and back-test your bot to ensure its logic is accurate and dependable.

Your bot also needs a secure and stable environment to handle the fast-paced nature of sports events. A dedicated VPS, such as QuantVPS, is a solid choice. Opt for a server with minimal downtime, sufficient CPU and RAM, and a stable U.S.-based IP address. To safeguard your funds, use secure storage for private keys, like an encrypted vault or hardware wallet. Additionally, implement robust error-handling systems to minimize disruptions during live trading.

Sports betting bots play a pivotal role in managing risk and staying profitable on Polymarket by sticking to well-defined strategies and utilizing cutting-edge automation. They rely on position-sizing rules, like the Kelly Criterion, to decide how much capital to allocate to each trade. This approach strikes a balance between maximizing growth and limiting exposure. Additionally, bots set strict loss limits - such as stop-loss thresholds - and spread their trades across various events to reduce the impact of unexpected outcomes.

To stay ahead in a fast-moving market, these bots continuously rebalance positions and keep a close eye on market liquidity, ensuring they don’t get caught off guard by sudden price swings. Advanced bots often use AI-powered algorithms to identify arbitrage opportunities or mispriced markets, allowing them to secure small, consistent profits through quick and accurate execution. By blending these methods with backup systems and strategies inspired by seasoned traders, these bots can navigate Polymarket’s ever-changing sports trading landscape while keeping risks under control.

"}}]}