Best VPS for Polymarket: Low-Latency Servers for Faster Execution

In Polymarket trading, speed matters. Even a slight delay in execution can lead to slippage, costing you profits. Using a low-latency VPS for Polymarket located near major financial hubs like New York can reduce execution delays to as little as 1–30ms. This setup ensures faster trades, minimizes slippage, and keeps your trading bots running 24/7, even during volatile market events.

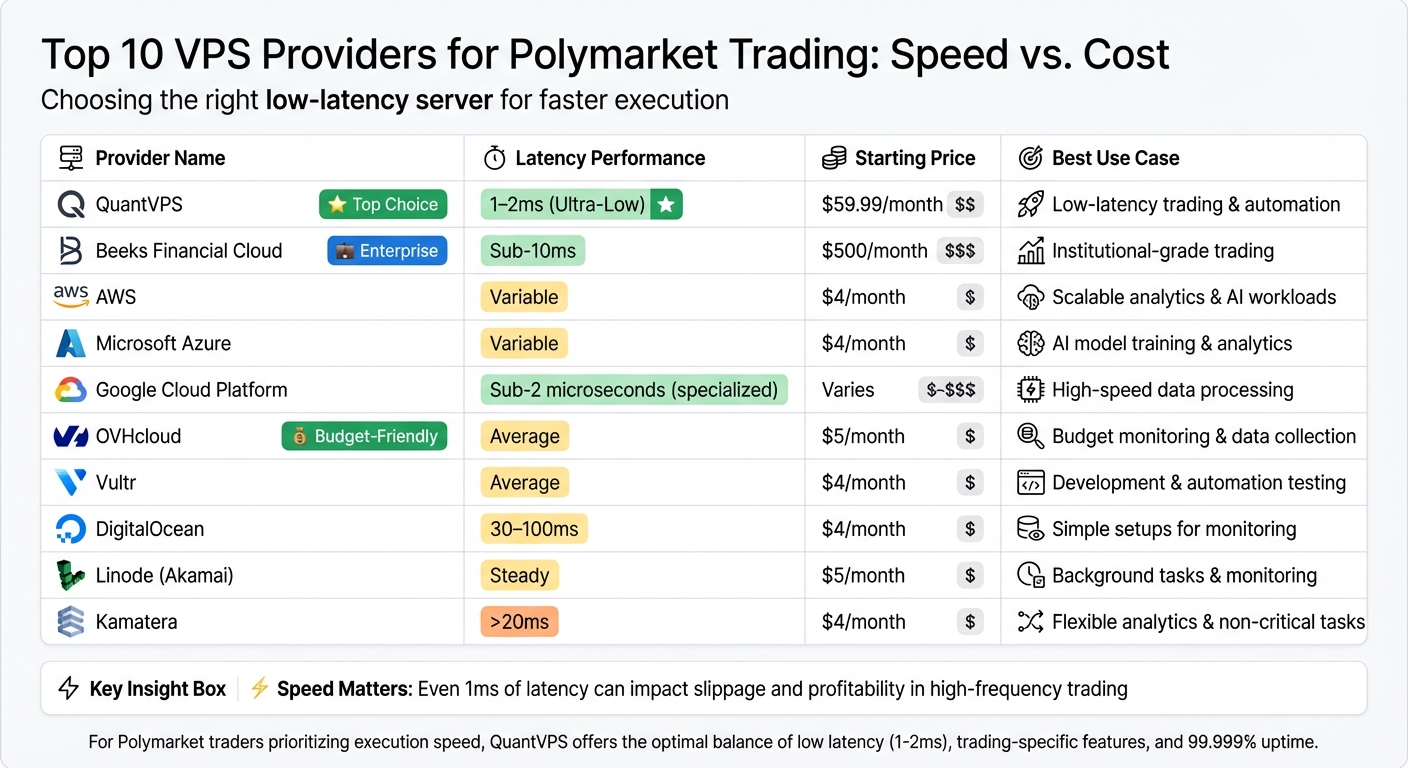

Here are the top VPS providers for Polymarket traders:

- QuantVPS: Ultra-low latency (0–1ms), trading-optimized features, and 99.999% uptime. Plans start at $59.99/month.

- Beeks Financial Cloud: Institutional-grade infrastructure with sub-10ms latency. Pricing ranges from $500 to $2,000/month.

- AWS: Highly scalable with specialized low-latency instances, though extensive configuration may be needed for trading-grade performance.

- Microsoft Azure: Strong scalability but requires optimization for real-time trading. Entry-level plans start at $4/month.

- Google Cloud Platform (GCP): Advanced AI tools and sub-2 microsecond latency on specialized instances. Best for analytics-heavy setups.

- OVHcloud: Affordable VPS options starting at $5/month, but less ideal for ultra-low latency needs.

- Vultr: Developer-friendly with flexible plans, better suited for testing and automation rather than live trading.

- DigitalOcean: Simple setup and budget-friendly plans starting at $4/month, ideal for monitoring and automation.

- Linode (Akamai): Reliable general-purpose VPS with steady connections, starting at $5/month.

- Kamatera: Highly customizable with pay-as-you-go pricing, starting at $4/month, though not designed for ultra-low latency.

Quick Comparison

| Provider | Latency | Starting Price | Best For |

|---|---|---|---|

| QuantVPS | 0-1ms | $59.99/month | Low-latency trading and automation |

| Beeks Financial Cloud | Sub-10ms | $500/month | Institutional-grade trading setups |

| AWS | Variable | $4/month | Scalable analytics and AI workloads |

| Microsoft Azure | Variable | $4/month | AI model training and analytics |

| Google Cloud Platform | Sub-2 microseconds | Varies | High-speed data processing and analysis |

| OVHcloud | Average | $5/month | Budget monitoring and data collection |

| Vultr | Average | $4/month | Development and automation testing |

| DigitalOcean | 30–100ms | $4/month | Simple setups for monitoring |

| Linode (Akamai) | Steady | $5/month | Background tasks and monitoring |

| Kamatera | >20ms | $4/month | Flexible analytics and non-critical tasks |

For Polymarket traders, QuantVPS stands out as the top choice for its low latency, trading-focused features, and reliability. If you prioritize speed and uninterrupted execution, it’s worth the investment.

VPS Provider Comparison for Polymarket Trading: Latency, Pricing, and Features

VPS Provider Comparison for Polymarket Trading: Latency, Pricing, and Features

1. QuantVPS - Trading-Optimized VPS with Low-Latency Routing

Latency Optimization

QuantVPS operates servers strategically located in New York and Chicago, ensuring proximity to major order matching engines with latency as low as 1–2ms. For Polymarket traders, this setup allows execution speeds as fast as 0.52ms to the CME Group exchange. By utilizing direct fiber-optic cross-connects, QuantVPS minimizes network hops, effectively reducing latency and slippage.

The network infrastructure includes a 1Gbps connection with the ability to burst up to 10Gbps, which is critical during high-traffic market events. This burst capacity ensures consistent performance, even when trading activity surges. Designed for reliability, this low-latency network supports seamless automated trading operations.

Trading-Specific Features

QuantVPS provides a "Private Trading Cloud" designed for 24/7 operation of trading bots and AI-driven models. This ensures uninterrupted market monitoring and execution - essential for Polymarket's fast-paced environment. Each server is pre-configured with Windows Server 2022, fine-tuned for trading needs.

The hardware is built for speed and reliability, featuring AMD EPYC and Ryzen processors, high-speed DDR4/5 RAM, and NVMe M.2 SSD storage to handle real-time market data processing. Secure Remote Desktop access with multi-monitor support enables you to manage complex Polymarket dashboards from virtually any device. To protect your strategies during volatile market conditions, QuantVPS includes enterprise-grade DDoS protection and advanced firewall configurations.

Scalability and Customization

QuantVPS offers flexible pricing plans, starting with the VPS Lite plan at $59.99/month and scaling up to Dedicated Server options priced at $299.99/month. A simple 5-question configurator tool helps tailor resources like CPU, RAM, and storage to suit anything from lightweight monitoring setups to resource-heavy AI models. This adaptability ensures your trading setup can evolve alongside shifting market demands.

With a 99.999% uptime guarantee and a service-level agreement (SLA) that compensates for any outages, QuantVPS demonstrates its reliability. Supporting over $100 billion in weekly trading volume as of late 2025, the platform is built to handle high-volume trading. Plus, US-based technical support is available 24/7, ensuring expert assistance is on hand during critical trading periods to support your Polymarket strategies.

2. Beeks Financial Cloud - Institutional Infrastructure

Latency Optimization

Beeks Financial Cloud operates out of top-tier Equinix data centers, strategically placing servers just 1–5 milliseconds away from major financial hubs in the New York/New Jersey area. By using direct fiber-optic connections, the platform ensures trade orders reach primary liquidity sources with minimal delay. Institutional clients report sub–10 millisecond performance, even during periods of high market volatility. The platform’s "Proximity Cloud" is purpose-built for low-latency financial computing, offering a specialized alternative to general-purpose hosting solutions. These high-speed connections are paired with robust security and uptime features, making the infrastructure both fast and reliable.

Trading-Specific Features

Designed with professional traders in mind, Beeks incorporates advanced DDoS protection and enterprise-grade security to safeguard sensitive trading data. The platform promises 99.9% uptime, supported by service level agreements, and ensures server loads never exceed 67%, even during peak trading hours. This setup prevents performance drops when market activity spikes, allowing traders to operate without interruptions during crucial trading moments.

Scalability and Customization

Beeks offers scalable cloud computing tailored to the unique needs of traders. With flexible private connectivity and customizable server configurations, users can easily adjust their infrastructure. For instance, traders can quickly add bandwidth or computing power during prediction market surges, ensuring their systems can handle high-demand, capital-intensive strategies seamlessly.

Pricing and Cost-Effectiveness

Pricing for Beeks’ low-latency trading VPS plans ranges from $500 to $2,000 per month, depending on specifications like CPU, RAM, and connectivity. While this may seem premium, the cost is often offset by reduced slippage, which can save traders hundreds of dollars during volatile trading sessions. For large-scale operations, this balance of cost and performance delivers a compelling return on investment.

3. Amazon Web Services (AWS) - Scalable Cloud Compute

Latency Optimization

AWS employs Cluster Placement Groups (CPGs) to group EC2 instances within the same network spine inside an Availability Zone. This setup minimizes the distance data travels between servers, leading to faster communication. Tests show that CPGs can cut P50 UDP roundtrip latencies by 37% and P90 latencies by 39% compared to standard instance placements. For traders seeking even lower latency, AWS offers specialized network-optimized instances like c7gn, c6in, and c5n, designed to reduce delays further.

"CPGs provide a placement strategy that allows Amazon EC2 instances to share connectivity to the same spine cell, thereby making sure of lower latency on the underlying AWS network." - AWS for Industries

"CPGs provide a placement strategy that allows Amazon EC2 instances to share connectivity to the same spine cell, thereby making sure of lower latency on the underlying AWS network." - AWS for Industries

Choosing the right region and configuring routing correctly are also crucial for minimizing latency when connecting to Polymarket endpoints. AWS Global Accelerator can improve network performance by routing traffic through AWS's private network, offering optimized routes under 50ms. This is a significant improvement compared to standard global routes, which can range from 150–300ms. While AWS's focus on latency pairs well with its scalability, traders may need to fine-tune its execution environment to meet the demands of time-sensitive trading.

Scalability and Customization

AWS is a powerhouse for handling large-scale data pipelines and AI-driven models. Its suite of tools supports machine learning, batch processing, and time-series data analysis, making it a go-to platform for traders working on price prediction or sentiment analysis models.

"Quant trading is a never-ending arms race to extract alpha... fueled by a flywheel of new compute capabilities, data analytics, and AI/ML." - Boris Litvin, Financial Services SA, AWS

"Quant trading is a never-ending arms race to extract alpha... fueled by a flywheel of new compute capabilities, data analytics, and AI/ML." - Boris Litvin, Financial Services SA, AWS

However, AWS's general-purpose cloud design prioritizes research, modeling, and historical analysis over real-time execution. For tasks where milliseconds dictate profitability, AWS may not always deliver the immediacy required without additional adjustments.

Pricing and Cost-Effectiveness

When it comes to execution-sensitive trading, where every millisecond impacts outcomes, AWS's general-purpose design can require extensive configuration to reach optimal performance. While its premium options can deliver better results, they may not always be cost-efficient for traders prioritizing speed over raw compute power.

AWS does provide flexibility through Spot Instances, which are ideal for batch processing and data analysis. However, its complexity and variable latency make it more suited as a backend analytics platform than as a primary choice for real-time execution. For analytics and model training, AWS offers strong value. But for traders focused on execution speed, achieving trading-grade performance often demands significant effort in optimization.

4. Microsoft Azure - Enterprise Cloud & AI Services

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

Latency Optimization

Microsoft Azure tackles latency with features like Accelerated Networking powered by SR-IOV, which improves data transmission efficiency, and Proximity Placement Groups, which position virtual machines closer together to shorten data paths. While these tools help reduce delays, Azure’s design as a general-purpose cloud platform means traders need to carefully select regions and fine-tune network settings to achieve performance suitable for real-time trading. On the plus side, Azure provides strong scalability options, making it adaptable to the growing demands of trading operations.

Scalability and Customization

Azure delivers enterprise-level infrastructure with the ability to scale resources instantly and manage them with precision. Traders can customize CPU power, memory, and storage to align with their evolving strategies, making it a solid choice for tasks like training AI models or handling large-scale data analytics. Whether it’s sentiment analysis or price prediction, Azure supports complex workflows. However, because it’s not specifically designed for time-sensitive trading, achieving the necessary execution speeds may require significant adjustments and optimizations.

Pricing and Cost-Effectiveness

Azure’s flexible pricing model is based on hourly billing, with entry-level plans starting around $4.00 per month, while mid-tier configurations range from $12.99 to $21.59 per month. For smaller traders, Azure’s primary advantage lies in its reliability—though comparing QuantVPS vs ForexVPS reveals how specialized providers often achieve even higher uptime standards - keeping systems online during local internet or power outages - rather than excelling in ultra-low latency performance. Larger-scale operations benefit from uptime guarantees (SLAs) between 99.9% and 99.99%, as well as the ability to handle demanding computational workloads. However, for traders who prioritize fast execution speeds, achieving trading-grade performance on Azure often requires premium setups, which can drive costs higher. This positions Azure as a better fit for analytics and AI model development rather than for executing real-time trades.

5. Google Cloud Platform (GCP) - Data & AI-Focused Infrastructure

Latency Optimization

Google Cloud Platform (GCP) tackles latency issues with its Titanium system, which uses custom silicon to offload network processing from the host CPU. This setup frees up the processor to focus entirely on trading workloads rather than juggling network traffic. GCP's C3 and C4 instance types are equipped with custom IPUs, designed specifically to handle high-throughput messaging, making them ideal for tasks like order matching and data distribution.

In September 2025, 28Stone Consulting conducted a benchmark study on Google Cloud C3 machines for Tick-to-Trade (T2T) latency, measuring the entire cycle from data ingestion to order transmission. The results? Sub-2 microsecond latency, with stable jitter and throughput exceeding 5 Gbps. Rohit Bhat, Managing Director for Financial Services at Google Cloud, emphasized the importance of these findings: "Seeing sub-2 µs best-case results with stable jitter in controlled benchmarks confirms that firms can achieve ultra-low-latency targets on Google Cloud". Using the Aeron messaging framework, the C3 VMs can handle 100,000 messages per second at 18 microseconds P99 latency, marking a 50% latency improvement over the previous C2 generation. Additionally, GCP’s custom IPU is capable of processing 4.7 million messages per second and distributing over 10 Gbps in a single thread. These advancements make GCP a powerful choice for trading platforms requiring ultra-low-latency performance.

Trading-Specific Features

GCP offers Hyperdisk Extreme, a feature capable of delivering up to 500,000 IOPS per compute instance. This level of performance is crucial for managing the data-intensive demands of prediction market order books, ensuring quick logging and retrieval of order book states. The platform also boasts a network capacity of 200 Gbps, far outpacing the capabilities of most on-premise exchange networks.

To further support trading activities, GCP’s C3 instances include Advanced Maintenance and compact placement policies, which help minimize disruptions and reduce inter-node latency during high-stakes trading events.

Scalability and Customization

GCP is well-suited for handling the complex AI models and massive data pipelines that Polymarket traders rely on for pattern recognition and statistical analysis. The platform supports Kubernetes (GKE), enabling seamless autoscaling during periods of high traffic. Additionally, traders can customize CPU, memory, and storage configurations to align with their specific strategies.

The Aeron Cluster implementation enhances reliability with Raft-based consensus, ensuring zero message loss while maintaining deterministic confidence. This system adds just 18 microseconds at P99 latency. Such architecture is perfect for managing multiple markets in real time and executing automated strategies based on live probability changes. With this level of scalability, GCP ensures that trading operations remain stable and responsive, even during rapid market fluctuations.

Pricing and Cost-Effectiveness

Polymarket’s planned U.S. taker fee of 0.01% (1 basis point), combined with Polygon gas fees of less than $0.01, allows traders to invest in premium infrastructure without significantly cutting into their profits. Compared to competitors charging around 1% in fees, Polymarket’s 100x cost advantage gives traders more room to allocate resources toward high-performance computational tools.

GCP’s infrastructure is designed to meet both analytical and high-speed trading needs. Its advanced data and AI tools align perfectly with Polymarket’s vision of becoming an "information infrastructure", where real-time pricing can serve as sentiment indicators for institutional investors. With Polymarket’s trading volume reaching approximately $9 billion in 2024, GCP’s enterprise-grade capabilities provide the robust support needed to process massive datasets and extract meaningful market insights.

6. OVHcloud - Cost-Effective Dedicated & VPS Servers

Latency Optimization

OVHcloud operates a global network of 37 data centers spread across four continents, including U.S. facilities in New Jersey and Virginia. These locations are strategically close to key East Coast financial hubs, which can be beneficial for traders. However, unlike platforms specifically designed for trading with optimized routing, OVHcloud relies on standard internet routing. This results in higher and less predictable latency. On the plus side, its VPS plans feature NVMe SSD storage, which enhances data processing and boot times. According to VPSBenchmarks 2025 testing, OVHcloud delivers competitive raw IOPS performance, though its network latency remains average compared to services fine-tuned for trading. For Polymarket traders, this setup is solid for market monitoring and data collection, but strategies requiring ultra-low latency execution might encounter challenges. These latency factors shape how well the platform aligns with different trading approaches.

Trading-Specific Features

OVHcloud stands out with features like robust anti-DDoS protection, full root access, and compatibility with both Windows and Linux. It also supports one-click installation for popular trading applications. The servers are built for reliability, offering a 99.99% uptime SLA to enhance trading server performance during peak loads. That said, OVHcloud lacks some advanced features like dedicated fiber-optic cross-connects or pre-configured trading environments, which are often essential for traders prioritizing ultra-low latency.

Scalability and Customization

OVHcloud provides a range of scalable hardware options. VPS plans start at just $5 per month (1 vCore, 2 GB RAM, 20 GB NVMe SSD) and go up to over $50 per month for configurations with up to 8 vCores, 32 GB RAM, and 640 GB NVMe SSD. Dedicated servers begin at $50 per month and come with customizable options for CPU, RAM, and SSD storage. Additionally, all plans include unmetered bandwidth, ensuring consistent data connections.

Pricing and Cost-Effectiveness

For traders on a budget, OVHcloud offers an affordable entry point with VPS plans starting at $5 per month. This makes it a practical choice for those focusing on research, backtesting, or market monitoring. However, it may not satisfy the needs of traders requiring ultra-low latency execution. Despite occasional delays in customer support and higher latency from non-U.S. data centers, OVHcloud's affordability, scalability, and reliable uptime have earned it a strong rating on Trustpilot.

7. Vultr - Developer-Friendly VPS

Latency Optimization

Vultr runs a network of global data centers, including several on the U.S. East Coast. However, its infrastructure relies on standard internet routing rather than specialized paths optimized for trading. While this setup is great for development and testing, it’s not ideal for execution-sensitive trading tasks that demand sub-millisecond latency. For many, achieving ultra-low latency is the primary goal. During periods of heavy traffic, this limitation becomes even more noticeable, making Vultr better suited for traders focused on building and refining automation tools rather than live execution.

Trading-Specific Features

Vultr prioritizes simplicity and flexibility for developers. With features like rapid server provisioning and support for custom ISO uploads, it’s easy to configure servers for automation tasks. That said, the platform lacks tools specifically designed for trading, such as advanced monitoring systems or network prioritization - key elements for strategies that depend on precise timing.

Scalability and Customization

Vultr’s flexibility shines in its range of compute options. You can choose from Cloud Compute (shared vCPUs), Optimized Cloud (dedicated vCPUs), or Bare Metal servers, allowing you to scale resources based on the demands of your trading automation. Whether you’re running lightweight market monitoring or resource-heavy data analysis, Vultr has an option to fit your needs. The ability to upload custom ISOs also lets you create secure and tailored environments for proprietary algorithms, adding another layer of customization.

Pricing and Cost-Effectiveness

Vultr’s transparent pricing and competitive rates make it an attractive choice for traders exploring Polymarket automation or handling tasks like data collection and backtesting. Its affordability is ideal for testing and non-critical operations. However, traders focused on live, high-stakes execution may find Vultr less suitable and might need to invest in platforms built for real-time performance.

8. DigitalOcean - Simplicity & Ease of Use

Latency Optimization

DigitalOcean operates data centers in key locations like New York, London, and Singapore, ensuring latency levels that are suitable for dashboards and market monitoring. However, it's important to note that the platform isn't designed with high-frequency trading in mind. DigitalOcean categorizes low latency as under 100 ms and ultra-low latency as under 30 ms. While this performance is excellent for tasks like data collection and monitoring, it doesn't meet the millisecond-level execution demands of high-frequency trading. That said, its quick setup offers a solid foundation for building an agile trading environment.

Trading-Specific Features

With DigitalOcean, you can deploy Droplets in under 60 seconds, and its 1-Click App marketplace simplifies launching pre-configured setups for hosting trading scripts or bots. Whether you're working with Docker, LAMP, or Node.js, the platform minimizes the technical hurdles - perfect for retail traders experimenting with automation on Polymarket. While it’s not tailored for high-frequency trading, its straightforward interface and ease of use make it a practical choice for monitoring and automating trading strategies.

"DigitalOcean was easy to use, and instead of having to focus on correctly configuring everything, we were able to spend our time on writing code." - Patrick Wingo, Head of Product, Kea

"DigitalOcean was easy to use, and instead of having to focus on correctly configuring everything, we were able to spend our time on writing code." - Patrick Wingo, Head of Product, Kea

Scalability and Customization

DigitalOcean’s Infrastructure-as-a-Service model makes scaling simple. You can isolate Polymarket strategies on separate Droplets, ensuring that a failure in one script doesn’t disrupt others. For traders leveraging AI-driven analysis, the platform offers GPU-backed infrastructure through GradientAI, featuring NVIDIA H100 and RTX 4000/6000 Ada GPUs. Its API and robust monitoring tools provide real-time visibility into your trading setup, allowing you to adapt strategies as market conditions change.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Pricing and Cost-Effectiveness

DigitalOcean stands out with its straightforward and budget-friendly pricing, making it a great option for experimentation and non-critical operations. Basic Droplets start at just $4.00 per month, with typical setups costing $6.00 per month - a fraction of the cost of premium alternatives. Additionally, you get 500 GiB of free outbound data per month, with overage rates at a flat $0.01 per GiB, and a $200 introductory credit to get started. A Forrester study revealed that organizations using DigitalOcean see a 186% return on investment over three years, with the initial investment typically paying off in under six months. This affordability allows traders to channel more resources into refining their strategies.

9. Linode (Akamai) - Stable General-Purpose VPS

Latency Optimization

Linode, now integrated into Akamai's Connected Cloud platform, operates data centers in key U.S. cities like Newark, Atlanta, and Dallas. By utilizing Akamai's global network, Linode ensures steady connectivity, which is particularly useful for background monitoring and data collection. For Polymarket traders handling these tasks, this stability often outweighs the need for ultra-low latency. However, it's worth noting that Linode doesn't provide direct fiber-optic cross-connects to exchange matching engines, such as those used by CME Group in Chicago. This reliable network performance serves as a solid base for developer-focused solutions.

Trading-Specific Features

Linode's platform is tailored for developers, offering tools that are especially helpful for automating monitoring or handling light trading activities. With features like StackScripts for automated deployments and a robust API for managing infrastructure, traders can easily set up monitoring dashboards or run lightweight Polymarket bots without the hassle of manual configuration. For many users, the platform's focus on consistent and reliable connections over time is more important than shaving off a few milliseconds of latency.

Scalability and Customization

Linode provides dedicated virtual machines with isolated OS, RAM, and storage, ensuring dependable performance. Its control panel and API make it simple to adjust resources as needed, allowing traders to scale operations seamlessly in response to market activity. This flexibility ensures uninterrupted Polymarket operations, even during periods of high demand.

10. Kamatera - Flexible Cloud Infrastructure

Scalability and Customization

Kamatera offers a highly adjustable setup for cloud resources, letting you fine-tune vCPU, RAM, and SSD storage to match your needs. You can configure servers with up to 104 vCPUs, 512 GB of RAM, and 20 TB of SSD storage, scaling resources instantly to handle changing trading demands. With hourly billing starting at around $0.005 per hour, this model can save you 50–70% compared to fixed monthly plans. The platform also supports over 50 operating system templates, including setups tailored for trading platforms like MetaTrader, making it easy to create custom monitoring systems for Polymarket trading. Whether you're running lightweight monitoring tools or resource-heavy analytics, Kamatera gives you the flexibility to adapt.

Trading-Specific Features

Although Kamatera isn't built for ultra-low latency, it checks many other boxes for trading infrastructure. With 13 global data centers, including key locations like New York and Chicago, it’s a solid choice for U.S.-based Polymarket traders. While it may not be ideal for latency-critical applications, Kamatera shines in running analytics workloads, copy-trading bots, or AI-driven models where millisecond-level speeds aren't essential. Developers often use it to deploy custom instances for monitoring multiple markets or to run high-RAM servers for analyzing historical data. These capabilities make it a cost-effective solution for traders who prioritize scalability over ultra-fast execution.

Pricing and Cost-Effectiveness

Kamatera’s pay-as-you-go model is perfect for traders experimenting with new strategies or operating intermittently. Entry-level VPS plans start at about $4 per month (1 vCPU, 1 GB RAM) and can scale to over $100 per month for high-performance servers (8 vCPUs, 32 GB RAM). A 30-day free trial allows you to test configurations before committing, and the platform guarantees 99.9% uptime with NVMe SSD storage for consistent performance. However, it’s worth noting that Kamatera is better suited for analytics and background tasks rather than low-latency trading scenarios, where slippage risks can exceed 20 ms.

3 Best Forex VPS Providers for 2026 (My Rankings!)

Feature and Pricing Comparison

QuantVPS is built with high-frequency trading in mind, delivering ultra-low latency - less than 0.52 ms to CME and 1–2 ms to crypto matching engines. With plans starting at $59.99 per month, it supports traders with scalable options and has facilitated over $16.50 billion in trades within 24 hours, all while maintaining a 99.999% uptime guarantee. These performance metrics cater directly to the needs of modern traders.

The entry-level plan, priced at $59.99 per month, runs on AMD EPYC processors and NVMe storage, ensuring swift trade execution. For those demanding more power, premium dedicated server plans are available at $399.99 per month, offering 128 GB DDR5 RAM, 2 TB+ NVMe storage, and 10 Gbps+ network burst capabilities.

Every QuantVPS plan includes essential features aimed at optimizing trading performance, such as direct fiber-optic cross-connects, built-in DDoS protection, multi-monitor remote desktop support, and Windows Server 2022 environments. These tools help reduce slippage during volatile market movements, potentially increasing ROI by 20–90%.

Here’s a breakdown of QuantVPS plans, showcasing their key specifications and features:

| Plan | Key Specifications | Price (USD/month) | Trading Features |

|---|---|---|---|

| VPS Lite | 4 cores, 8 GB RAM, 70 GB NVMe, 1Gbps+ network | $59.99 | Ideal for 1–2 charts; runs on Windows Server 2022 |

| VPS Pro | 6 cores, 16 GB RAM, 150 GB NVMe, 1Gbps+ network | $99.99 | Supports up to 2 monitors; optimized for multi-chart use |

| VPS Ultra | 24 cores, 64 GB RAM, 500 GB NVMe, 1Gbps+ network | $189.99 | Handles up to 4 monitors; perfect for advanced strategies |

| Dedicated+ Server | 16+ dedicated cores, 128 GB RAM, 2 TB+ NVMe, 10Gbps+ network | $399.99 | Built for heavy workloads with multi-monitor support |

All plans ensure ultra-low latency and a 99.999% uptime guarantee.

For Polymarket traders, QuantVPS offers a trading environment designed to minimize slippage and support efficient, around-the-clock execution of strategies.

Conclusion

QuantVPS places traders just 1–2 milliseconds away from crypto matching engines and major liquidity providers, cutting down slippage and improving entry and exit prices. This close proximity ensures faster order execution, especially during volatile market events where every millisecond can make a difference in profitability.

Beyond low latency, the platform’s trading-focused VPS infrastructure delivers unmatched stability. A trading-optimized VPS supports 24/7 automation, continuous market monitoring, and seamless arbitrage execution. Unlike general-purpose cloud services designed for analytics, QuantVPS prioritizes low-latency routing, enterprise-level hardware, and 99.999% uptime. This setup guarantees that automated bots and AI models run smoothly, avoiding the interruptions often caused by home internet or consumer-grade equipment.

For traders juggling multiple strategies - whether analyzing probabilities, exploiting mispricings, or running high-frequency algorithms - consistent performance under heavy load is critical. Features like direct fiber-optic cross-connects, DDoS protection, and multi-monitor RDP support ensure that execution speed remains steady, even during high-traffic periods.

QuantVPS is built for time-sensitive trading operations, with plans starting at $59.99 per month and latencies as low as 0.52 milliseconds to key exchanges. With its New York datacenter location, trading-grade routing, and institutional-level uptime, it provides a competitive edge for Polymarket strategies where speed and reliability are essential for maximizing returns.

FAQs

Why is a low-latency VPS important for Polymarket trading?

A low-latency VPS plays a vital role in Polymarket trading by enabling traders to execute orders almost instantly. This rapid execution minimizes delays, which can otherwise result in missed opportunities or price slippage. With faster trades, traders can secure better prices, ultimately boosting their profitability.

Beyond speed, a low-latency VPS ensures stable and always-on connectivity. This is essential for keeping an eye on multiple markets, running automation tools seamlessly, and responding swiftly to price fluctuations. For traders who depend on precision and real-time decisions, this level of reliability is indispensable.

How does QuantVPS deliver faster trade execution with minimal latency?

QuantVPS boosts trade execution speeds by placing its servers in top-tier data centers close to major financial hubs like New York and Chicago. This strategic positioning shortens the physical distance to essential market data sources and liquidity providers, significantly cutting down latency.

With ultra-low-latency network routing and high-performance hardware, QuantVPS delivers lightning-fast round-trip times - ranging from just 0.5 to 0.7 milliseconds. This setup allows traders to respond to market shifts instantly, execute trades faster, and stay ahead in fast-paced trading environments.

What features make QuantVPS ideal for round-the-clock trading operations?

QuantVPS is designed to keep your trading operations running smoothly around the clock, with 100% uptime, always-on servers, and dedicated high-performance CPUs. Its NVMe storage ensures lightning-fast data access, while low-latency networking delivers the reliability and speed essential for real-time trading. To protect against interruptions, DDoS protection is in place. Plus, with 24/7 expert technical support and continuous system monitoring, your trading bots stay operational without a hitch.

A low-latency VPS plays a vital role in Polymarket trading by enabling traders to execute orders almost instantly. This rapid execution minimizes delays, which can otherwise result in missed opportunities or price slippage. With faster trades, traders can secure better prices, ultimately boosting their profitability.

Beyond speed, a low-latency VPS ensures stable and always-on connectivity. This is essential for keeping an eye on multiple markets, running automation tools seamlessly, and responding swiftly to price fluctuations. For traders who depend on precision and real-time decisions, this level of reliability is indispensable.

QuantVPS boosts trade execution speeds by placing its servers in top-tier data centers close to major financial hubs like New York and Chicago. This strategic positioning shortens the physical distance to essential market data sources and liquidity providers, significantly cutting down latency.

With ultra-low-latency network routing and high-performance hardware, QuantVPS delivers lightning-fast round-trip times - ranging from just 0.5 to 0.7 milliseconds. This setup allows traders to respond to market shifts instantly, execute trades faster, and stay ahead in fast-paced trading environments.

QuantVPS is designed to keep your trading operations running smoothly around the clock, with 100% uptime, always-on servers, and dedicated high-performance CPUs. Its NVMe storage ensures lightning-fast data access, while low-latency networking delivers the reliability and speed essential for real-time trading. To protect against interruptions, DDoS protection is in place. Plus, with 24/7 expert technical support and continuous system monitoring, your trading bots stay operational without a hitch.

"}}]}