Order matching engines are the invisible engines behind financial markets, connecting buyers and sellers in milliseconds. They organize orders in real-time, execute trades instantly, and ensure fairness through advanced algorithms. Here’s what you need to know:

- What they do: Match buy and sell orders using detailed order books and algorithms like FIFO (First In, First Out) or Pro-Rata.

- Why it matters: Understanding these systems can improve your trading strategy, especially in high-frequency or fast-moving markets.

- Key components: Order books (track market data), matching algorithms (decide trade execution), and trade confirmation systems (finalize transactions).

- Speed and performance: Trades are executed in microseconds; even a 1-millisecond delay can cost millions annually.

- Evolution: From physical trading floors to electronic platforms like NASDAQ and CME Globex, these systems now handle millions of trades daily.

Quick takeaway: Knowing how order matching engines work helps traders optimize order placement, reduce latency, and improve results in today’s fast-paced markets.

How traders orders get matched (exchange matching algorithms)

Main Parts of Order Matching Engines

Order matching engines are built around a few key components that work together to process trades with incredible speed and accuracy. These components handle every stage of a trade, from when the order is placed to when it’s executed. The three main parts are the order book, the matching algorithm, and the trade confirmation system. Modern systems are designed to operate with extremely low latency.

Order Books and Market Data

At the heart of an order matching engine is the order book, which organizes and displays all active buy and sell orders for a specific asset. Think of it as a constantly updating ledger that shows the best available prices (the "top of book") along with deeper market data like price levels, order quantities, and overall liquidity. This live data reflects changes in real-time as new orders are placed or existing ones are modified.

The order book does more than just display the best bid and ask prices – it offers a detailed view of market depth. For instance, you might see 500 shares available at $50.00, with additional orders queued at nearby price points. Advanced tools, such as Nasdaq’s TotalView, go even further by revealing more than 20 times the liquidity compared to standard Level 2 products, giving traders a clearer picture of market conditions.

This continuous flow of data in the order book drives the price discovery process, capturing the real-time interaction of supply and demand.

Matching Logic and Algorithms

Once the orders are organized in the book, the matching algorithm steps in to determine how trades are executed. This is the decision-making core of the engine. One of the most common methods is the Price-Time Priority (also known as FIFO), where orders are sorted by price and, within the same price level, by the time they were submitted . For example, if a buy order for 300 shares at $50.00 is submitted before another buy order for 100 shares at the same price, the 300-share order will be filled first when a matching sell order appears.

Another matching method is Pro-Rata allocation, where orders at the same price level are filled proportionally based on their size rather than submission time. Each approach has its own impact on trading behavior: FIFO often results in tighter spreads, while Pro-Rata encourages larger orders and broader participation at each price level.

Trade Confirmation and Reporting

After a trade is matched, the engine moves to the final step: trade confirmation. This process ensures the transaction is completed smoothly and accurately. The confirmation system verifies the matched orders, updates account balances, records transaction details, and issues trade confirmations – all within microseconds.

Modern confirmation systems are tightly integrated with market data feeds, clearinghouses, regulatory reporting tools, and risk management platforms. This ensures that every trade is properly documented and compliant with regulations. Additionally, these systems maintain audit trails for market surveillance and are designed with redundancies to prevent disruptions. If one part of the system fails, backup systems automatically take over to keep the process running without delays.

How Different Matching Algorithms Work

When it comes to matching orders, exchanges rely on various algorithms to decide which orders are executed first and how trades are distributed. These algorithms play a critical role in shaping market dynamics, influencing liquidity, execution speed, fairness, and even price volatility. By understanding how these matching methods work, traders can better navigate different market environments. Let’s dive into how these algorithms operate and their effects on trading.

Price-Time Priority (FIFO)

Price-Time Priority, often called First-In-First-Out (FIFO), is one of the simplest and most widely used matching algorithms. It works by prioritizing orders based on price first and then by the time they were submitted. Orders with the best price take precedence, and if multiple orders have the same price, the one placed earlier is executed first.

Here’s an example: If you place a buy order for 1,000 shares of Microsoft at $350.00 at 9:30 AM, and another trader places a buy order for 500 shares at the same price at 9:31 AM, your order will be filled first when a matching sell order becomes available. This system rewards traders who act quickly.

FIFO is commonly used in equity markets where speed and fairness are key priorities. It’s particularly effective in fast-moving markets with frequent price changes, making it a favorite in high-frequency trading environments. However, this approach can pose challenges for large orders, as they may get stuck behind smaller orders placed earlier, making it harder for institutional traders to execute large positions fully.

One clear benefit of FIFO is its role in promoting price discovery. By rewarding quick responses to market changes, it helps traders react to new information efficiently.

Pro-Rata Allocation

Pro-Rata Allocation takes a different route by dividing available shares among orders based on their size rather than the time they were placed. When multiple orders share the same price, each gets a portion of the available volume proportional to its size. For instance, imagine three buy orders at $50.00: Order A for 1,000 shares, Order B for 2,000 shares, and Order C for 1,000 shares, totaling 4,000 shares. If a sell order for 800 shares comes in at $50.00, Order A would receive 200 shares (25%), Order B 400 shares (50%), and Order C 200 shares (25%).

This method is widely used in futures markets. By ensuring proportional allocation, it allows consistent access to the market for all orders, regardless of size. This feature makes it appealing to institutional traders and avoids the conflicts that can arise between large and small orders.

A notable example of Pro-Rata Allocation in action occurred in May 2015 when CME Group temporarily switched its 2-Year Treasury Futures market from a hybrid pro-rata/FIFO system to pure FIFO due to a technical glitch. Research from this period revealed that orders placed later were often more profitable under pro-rata, though the process of price discovery became less efficient.

Hybrid Matching Models

Some exchanges use hybrid models that combine elements of FIFO and pro-rata to better suit specific market needs. For example, an exchange might allocate the first portion of an order using FIFO to reward speed, while distributing the remainder using pro-rata to ensure broader participation. This was the standard approach for CME’s 2-Year Treasury Futures before the 2015 technology issue.

Another variation is Size-Time Priority, which factors in both the size of the order and the time it was placed. This ensures that larger orders receive priority while still accounting for speed. Some exchanges even utilize Last-In-First-Out (LIFO) systems, where the most recent orders at a given price level are executed first, reflecting current market sentiment.

The choice of matching algorithm has grown increasingly important, especially as high-frequency trading now accounts for about 55% of trading volume in U.S. equity markets and between 23% and 43% in European equity markets. Modern matching engines must handle these algorithms while processing enormous amounts of data in real time, executing trades in microseconds. To accommodate large institutional orders without disrupting markets, exchanges often employ tools like order slicing or iceberg orders, which split large trades into smaller, more manageable pieces. These methods demonstrate how exchanges balance the need for speed with the desire for fairness in today’s markets.

Speed and Performance Optimization

In electronic trading, speed isn’t just important – it’s everything. While the algorithms behind order matching ensure fair execution, reducing latency is critical to seizing market opportunities. Modern trading systems process transactions in microseconds, and even the tiniest delay can mean the difference between profit and loss. With high-frequency trading making up about 70% of all stock trading volume, every fraction of a second matters.

Just how much does latency cost? A single millisecond delay can result in losses of up to $100 million per year. During major news events, currency pairs can see spikes of up to 50 pips in mere milliseconds. This reality has driven trading firms to pour resources into advanced technology and infrastructure to gain any speed advantage they can.

Colocation and Proximity Hosting

When it comes to trading speed, physical distance isn’t just a detail – it’s a game-changer. Colocation involves placing trading servers as close as possible to exchange data centers, reducing the distance that orders need to travel. For instance, every meter of fiber optic cable adds about 4 nanoseconds of latency.

But colocation doesn’t come cheap. At CME, a 10G connection costs $12,000 per month, while renting an 8-rack unit at the NYSE runs $2,500 per month, plus $1,500 per kilowatt of power. For firms looking for a more affordable option, proximity hosting offers a middle ground. These facilities, often located in the same city as the exchange, provide significant latency reductions at a lower cost – especially if they have established fiber connections to your broker’s pricing servers.

Geography plays a big role, too. For example, the route between Tokyo and Hong Kong is about 2.5 times longer than the path between New York and Chicago, creating unique latency challenges for Asian markets. Beyond physical location, advanced hardware and network tuning are essential for shaving off those precious nanoseconds.

Hardware and Network Optimization

Cutting-edge hardware is a must in high-frequency trading. Take SmartNICs, for example – they can deliver speeds up to 10× faster than standard network cards. Similarly, Field-Programmable Gate Arrays (FPGAs) allow for processing at microsecond levels, far surpassing the capabilities of traditional CPUs.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.9% uptime • Chicago & NY data centers • From $59.99/mo

FUTURES — 60% off first month

The network infrastructure itself also plays a role. Layer 1 switches introduce latency in the double-digit nanosecond range, while Layer 2/3 switches can add several hundred nanoseconds. For the fastest connection, direct market access (DMA) is key. As explained by an expert at OnixS:

"Direct market access is direct interaction with the APIs exposed by the liquidity pool. The key concept here is ‘direct’ – meaning that the API is optimized for interacting with the order book without going through another processing layer or service that adds latency."

– OnixS

"Direct market access is direct interaction with the APIs exposed by the liquidity pool. The key concept here is ‘direct’ – meaning that the API is optimized for interacting with the order book without going through another processing layer or service that adds latency."

– OnixS

Even software tools like Apache Kafka are pushing the boundaries of speed, delivering message processing latencies as low as 2 milliseconds. Notably, over 80% of Fortune 100 companies use Kafka. Cloud solutions are stepping up, too – AWS Local Zones near exchange colocation facilities can achieve latencies as low as 1 millisecond.

High-frequency trading sets a high bar for performance: order execution must happen in under 100 microseconds, market data processing in less than 10 microseconds, and risk checks within 50 microseconds. Achieving these benchmarks demands a complete optimization of every system component.

Clock Synchronization and Timestamping

After optimizing physical and network systems, precise timekeeping becomes critical. Regulations like MiFID II require trading venues to synchronize clocks within 100 microseconds of UTC, using timestamps with 1-microsecond granularity. In the United States, FINRA Rule 4590 mandates clock accuracy within 50 milliseconds of NIST‘s atomic clock.

To meet these stringent standards, many firms have transitioned from Network Time Protocol (NTP) to Precision Time Protocol (PTP). PTP offers far greater accuracy, outperforming NTP’s millisecond-level precision.

| Trading Type | Maximum Divergence from UTC |

|---|---|

| High-frequency algorithmic trading | 100 microseconds |

| Algorithmic trading (non-HFT) | 1 millisecond |

| Human-powered trading | 1 second |

Redundancy is a must. Firms rely on multiple time sources and diverse network paths to maintain synchronization, even during hardware failures or cyberattacks. Poor timekeeping doesn’t just slow down trades – it can result in regulatory fines and compliance issues.

NIST highlights the importance of precision in a notable observation:

"During the year, UTC(NIST) never varied from UTC by more than 20 nanoseconds (0.000000020 s). Thus, while there is technically a difference between UTC(NIST) and UTC, the difference is minuscule and for all practical purposes can be ignored."

– Michael Lombardi, head of the remote time and frequency calibration program at NIST

"During the year, UTC(NIST) never varied from UTC by more than 20 nanoseconds (0.000000020 s). Thus, while there is technically a difference between UTC(NIST) and UTC, the difference is minuscule and for all practical purposes can be ignored."

– Michael Lombardi, head of the remote time and frequency calibration program at NIST

Regulatory oversight is intense. For example, FINRA’s CAT Alert 2020-02 requires participants to self-report deviations over one second and mandates reporting for deviations exceeding 100 milliseconds. This level of scrutiny underscores the need for constant monitoring and accurate time data archiving.

Precise timestamping isn’t just about speed – it’s vital for reconstructing trades, monitoring for market abuse, and ensuring best execution. These practices are fundamental to maintaining the integrity of financial markets.

Examples from Major Exchanges

Looking at how top exchanges operate reveals how their matching engines are fine-tuned to meet various market demands. Each platform has its own way of handling trades, shaped by the specific needs of its users and the trading styles it supports. By understanding how these systems work in practice, traders can better navigate the unique features of different exchanges.

CME Globex

CME Globex stands out as one of the largest electronic trading platforms, managing millions of orders daily. On some days, CME Group processes up to 20 million orders [26], which demands a highly efficient matching system. The platform uses a price-time priority approach to ensure fairness and efficiency.

Bryan Durkin, Managing Director and COO of CME Group, highlights their commitment to transparency:

"We use a central limit order book. It’s a single integrated marketplace, allowing for concentrated liquidity in one transparent location… Our market data is sent to everyone at once. There are no preferential data feeds that are provided exclusively to a particular segment of user base… No one can see orders prior to them hitting our match engine and being made available to the order book." [26]

"We use a central limit order book. It’s a single integrated marketplace, allowing for concentrated liquidity in one transparent location… Our market data is sent to everyone at once. There are no preferential data feeds that are provided exclusively to a particular segment of user base… No one can see orders prior to them hitting our match engine and being made available to the order book." [26]

CME Globex employs algorithms like FIFO (First In, First Out), Pro Rata, and LMM (Lead Market Maker) to allocate trades based on market conditions. This flexibility allows the platform to adapt its methods for different types of contracts.

CME Group also invests heavily in market oversight, spending $40 million annually on monitoring and surveillance [26]. Their detailed audit trails capture every message, order, and trade, tracking down to individual message IDs. This meticulous approach has led to notable enforcement actions, such as the $850,000 fine against Infinium in 2011 for market disruptions and penalties against Panther Energy Trading and Michael J. Coscia in 2013 for illegal layering.

To further maintain integrity, CME Globex includes Self-Match Prevention (SMP) functionality, which stops orders from accounts with shared ownership from matching against each other.

Regarding colocation services, Durkin stresses equal access for all participants:

"Although colocation requires an investment, it is open to all market participants and serves to level the playing field… With the development of our colocation facilities, no one trader may gain an advantage over another due to proximity to that match engine. All customers in our colocation facility are treated equally." [26]

"Although colocation requires an investment, it is open to all market participants and serves to level the playing field… With the development of our colocation facilities, no one trader may gain an advantage over another due to proximity to that match engine. All customers in our colocation facility are treated equally." [26]

This example provides a foundation for understanding how other exchanges approach similar challenges in their own unique ways.

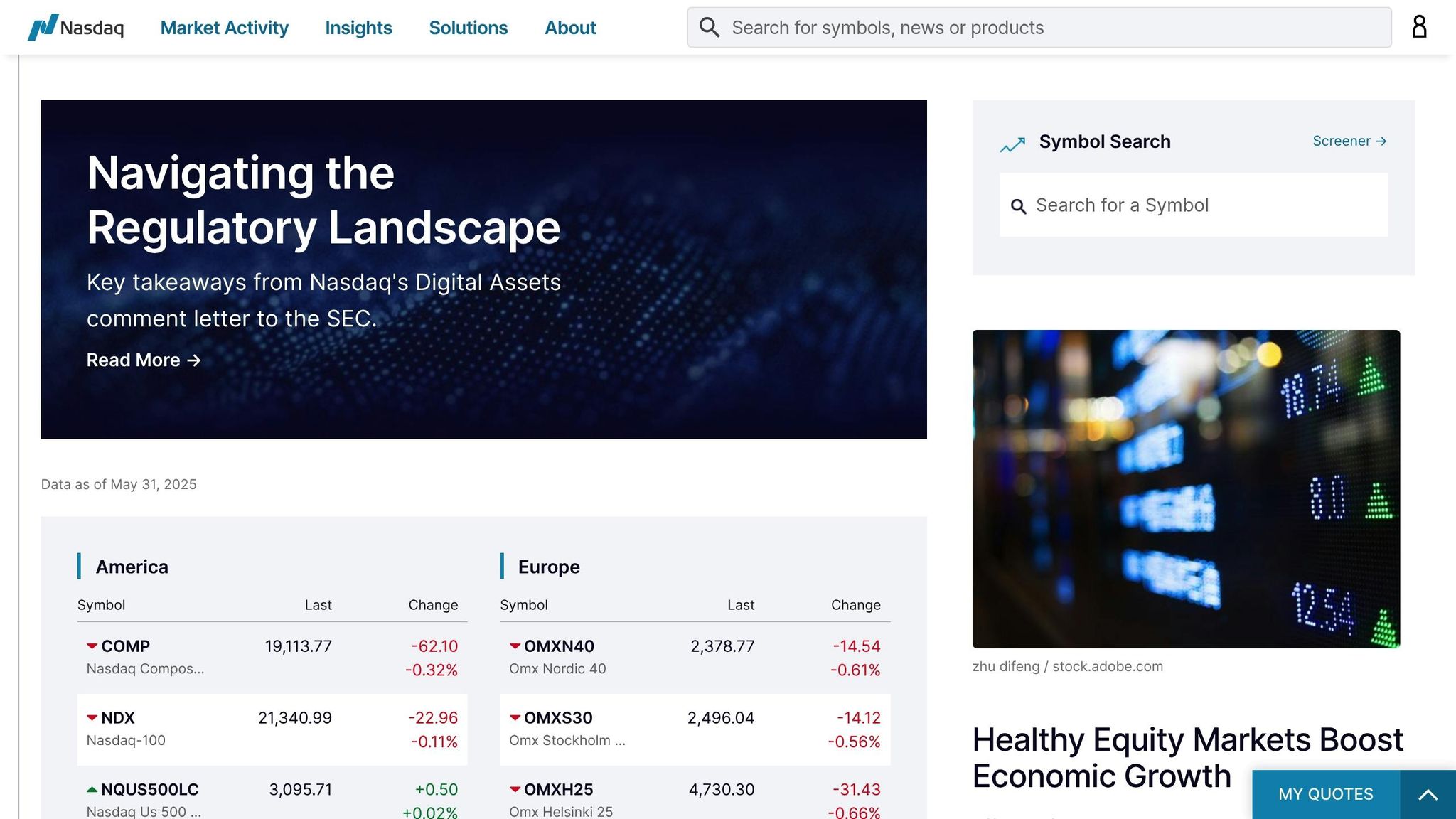

NASDAQ ITCH Protocol

NASDAQ’s ITCH protocol offers a different take on market data distribution, focusing on real-time tracking of orders and reconstructing the order book. Since its launch in January 2000, ITCH has become a standard in the industry for delivering market data.

The protocol enables users to follow individual orders from placement to execution or cancellation. This level of detail supports advanced trading strategies that can’t be achieved with simpler quote-based data.

NASDAQ’s TotalView provides unparalleled order book depth, showing more than 20 times the liquidity of standard Level 2 data. It displays every quote and order at every price level across venues.

| Message Type | Order Book Impact |

|---|---|

| A | New unattributed limit order |

| D | Order canceled |

| U | Order canceled and replaced |

| E | Full or partial execution |

| X | Modified after partial cancellation |

| F | Add attributed order |

| P | Trade Message (non-cross) |

| C | Executed in whole or in part at a price different from the initial display price |

| Q | Cross Trade Message |

The efficiency of ITCH is evident in high-performance setups. For instance, RULEMATCH uses NASDAQ’s matching engine, achieving execution latencies under 80 microseconds through FIX, while collocated participants using the OUCH protocol can execute trades in under 25 microseconds.

The protocol also includes features like the Net Order Imbalance Indicator (NOII), which provides critical data for opening and closing auctions.

IEX’s Speed Bump System

IEX Exchange takes a bold approach with its "speed bump" system, designed to protect investors and counteract latency arbitrage. This system uses 38 miles of coiled fiber-optic cable to introduce a 350-microsecond delay on all orders.

Ronan Ryan, COO and Co-Founder of IEX, explains the rationale behind the speed bump:

"As an exchange, as a referee in the market, you should be faster than your fastest participant."

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

FUTURES — 60% off first month

"As an exchange, as a referee in the market, you should be faster than your fastest participant."

This delay gives IEX time to process data and update prices before executing trades, preventing high-frequency traders from exploiting small timing gaps.

Since its inception, IEX has seen impressive growth, increasing its market share from just 0.1% in October 2013 to 1.64% by October 2015. The exchange also leverages "the Signal", a predictive tool that identifies when stock prices are about to change. Ryan elaborates:

"Why would you buy stock at $10 when less than 2 milliseconds later you could buy it at $9.99? You wouldn’t. Who would do that?"

"Why would you buy stock at $10 when less than 2 milliseconds later you could buy it at $9.99? You wouldn’t. Who would do that?"

Interestingly, about 32% of marketable orders sent to IEX fall within the window when the Signal is active, yet this only accounts for 0.02% of the trading day. The results speak volumes. In Q4 2020, IEX led in stable midpoint volume among the eight largest U.S. equity midpoint exchanges. Additionally, IEX experiences significantly less trading of its midpoint volume during volatile periods compared to other platforms.

Brad Katsuyama, CEO of IEX, sums up their philosophy:

"Creating that safe environment lets buyers and sellers come together without moving the stock, which keeps them coming back."

"Creating that safe environment lets buyers and sellers come together without moving the stock, which keeps them coming back."

IEX’s success has inspired other exchanges to adopt similar measures, such as the NYSE American Stock Exchange speed bump, the Chicago Stock Exchange LEAD program, and NASDAQ’s Extended Life order designation.

Key Points for Traders

To navigate today’s fast-paced electronic markets, traders need more than just intuition – they need a solid grasp of how order matching engines work. This understanding can help you choose the right order types, time your trades effectively, and improve execution outcomes. Below, we break down the essentials of trade execution, the role of technology, and the importance of staying updated with the latest tools.

How Trade Execution Really Works

Order matching engines play a pivotal role in determining both the price and speed of your trades. These systems use algorithms like FIFO (First In, First Out) or pro-rata to decide how orders are filled. Knowing how these algorithms function can help you adjust your order types and timing to secure better fills.

Tyler Corvin, Senior Trader at The Trading Analyst, explains it well:

"Matching orders are the invisible engine behind the seamless execution of trades, pairing buyers and sellers in seconds. These systems are crucial to maintaining the speed, stability, and efficiency of modern markets, ensuring that supply meets demand for assets like stocks, bonds, and options."

"Matching orders are the invisible engine behind the seamless execution of trades, pairing buyers and sellers in seconds. These systems are crucial to maintaining the speed, stability, and efficiency of modern markets, ensuring that supply meets demand for assets like stocks, bonds, and options."

Market conditions also significantly impact execution quality. For instance, high volatility can lead to price slippage, while low liquidity can push prices against you when placing large orders. These factors influence whether you should opt for faster market orders or more controlled limit orders.

Using Technology to Trade Better

In the world of trading, speed is everything. Advanced matching engines like DXmatch, which boast sub-100 microsecond latency and handle up to 30,000 matches per segment, set the benchmark for performance.

Colocation is another game-changer. By placing your trading servers near exchange matching engines, you can drastically reduce order transmission delays. If full colocation isn’t feasible, services like QuantVPS offer low-latency hosting solutions tailored for trading, providing a cost-effective alternative.

Precise timing is equally critical. Synchronizing your systems with exchange timestamps using tools like Precision Time Protocol (PTP) ensures accurate order sequencing and execution priority.

Tony Jones, Head of Low Latency Strategy at BSO, highlights the rapid pace of advancement in trading technology:

"The last five years have seen remarkable changes, primarily driven by hardware improvements such as routers, switches, and advancements in fiber optics."

"The last five years have seen remarkable changes, primarily driven by hardware improvements such as routers, switches, and advancements in fiber optics."

Specialized hardware like SmartNICs can significantly lower latency – up to 10 times faster than standard network cards. When paired with optimized software and Quality of Service (QoS) settings that prioritize trading data, these tools provide a clear edge.

Staying Current with New Technology

The trading landscape is constantly evolving, and keeping up with new technologies is essential for staying competitive. Tools like machine learning and smart order routing are refining trading strategies in real time, improving precision and minimizing market impact.

Regularly reviewing your execution quality and fee structures ensures that your technology investments deliver tangible benefits. The trick is finding the right balance – while not every trader needs the fastest execution, understanding the available options allows you to allocate resources wisely for maximum impact.

FAQs

How do FIFO and Pro-Rata matching algorithms impact trading strategies in high-frequency markets?

Matching algorithms like FIFO (First In, First Out) and Pro-Rata are central to shaping trading strategies, particularly in high-frequency markets. Here’s how they work:

FIFO processes trades in the order they are submitted, with the earliest orders being executed first. This creates a system that’s clear and predictable, but it can put traders who depend on split-second reactions at a disadvantage. If their orders come in after others, they might face delays, even if their strategy is highly time-sensitive.

On the other hand, Pro-Rata distributes trades proportionally based on the size of orders at the same price level. This method tends to favor traders placing larger orders, as they secure a bigger slice of the available liquidity. For high-frequency traders, this can be a game-changer, as it allows them to align execution with order size, making it especially useful for strategies that hinge on volume and speed.

Grasping these algorithms is essential for traders to fine-tune their strategies – whether they aim to capitalize on timing and speed or leverage larger orders to secure liquidity more effectively.

What are the main advantages of using colocation and proximity hosting to reduce latency in electronic trading?

Colocation and Proximity Hosting in Electronic Trading

Colocation and proximity hosting bring major perks when it comes to cutting down latency in electronic trading. By situating your trading servers close to exchange servers, you shrink the physical distance that data has to travel. The result? Faster order execution and quicker access to market data – an absolute game-changer for high-frequency trading, where every millisecond can make a difference.

Another advantage is the reduced risk of slippage. With trades executed closer to the target price, you’re better positioned to lock in the numbers you aim for. Plus, colocation gives traders a leg up in seizing short-lived market opportunities. Many of these facilities also come equipped with high-speed, reliable network connections, further boosting the performance and dependability of trading operations.

How do exchanges maintain fairness and transparency in fast-paced trading environments?

Exchanges play a key role in maintaining fairness and transparency in the fast-moving world of trading through order matching algorithms. These algorithms operate based on clear, predefined rules, ensuring an orderly process. For instance, they might use methods like price-time priority, FIFO (First In, First Out), or pro-rata matching. This setup guarantees that all traders are treated equally, with no room for favoritism or manipulation.

On top of that, exchanges are held to high standards through strict regulatory oversight. This oversight reinforces fairness and protects the integrity of the market. By blending cutting-edge technology with strong compliance practices, exchanges provide a transparent environment for trading – even in the rapid pace of high-frequency trading.