Tickblaze IgniteConnect OMS: Faster, Smarter Order Matching

Tickblaze IgniteConnect OMS offers a streamlined solution for managing trades across multiple brokers and asset classes, including equities, futures, forex, and crypto. This system combines advanced tools like Smart Order Routing (SOR), real-time monitoring, and automation to improve order execution speed and accuracy. Key features include:

- Unified Interface: Manage trades across brokers without switching platforms.

- Smart Order Routing: Finds the best execution path to minimize slippage.

- Real-Time Monitoring: Tracks orders, PnL, and positions with precision.

- Automation: Integrates with Tickblaze's strategy engine for seamless execution.

- Risk Controls: Includes pre-trade filters, daily limits, and compliance tools.

- Broker-Agnostic Flexibility: Connects to major brokers like Interactive Brokers, Rithmic, Binance, and Kraken.

For traders and proprietary firms, IgniteConnect simplifies multi-account management and enhances performance with local execution and low-latency architecture. When paired with QuantVPS hosting, it ensures reliability and speed, critical for high-frequency and automated trading strategies.

Quick Overview:

- Who Benefits: Proprietary firms, algorithmic traders, multi-asset traders.

- Key Tools: CLI for portfolio management, dual-connection architecture, and strategy integration.

- Hosting Recommendation: QuantVPS for ultra-low latency and secure trading environments.

IgniteConnect bridges strategy development and execution, making it a solid choice for modern trading needs.

Tickblaze IgniteConnect OMS: Core Features

Unified Order Entry and Routing

IgniteConnect simplifies trade management with a single interface that supports multiple brokers and asset classes, including equities, futures, forex, and crypto. Through its Trade Pad, users can effortlessly switch between brokers without leaving the interface, making the process seamless and efficient.

The system's Smart Order Routing (SOR) acts like an "air-traffic controller", analyzing real-time price, depth, and latency across all connected liquidity sources to determine the best execution path. For larger orders, the routing engine automatically splits trades across venues to improve weighted average pricing and maximize fill rates. This minimizes slippage, especially in fragmented markets.

"Smart Order Routing (SOR) is the intelligence layer that guarantees a broker's commitment to 'best execution.'" - Spencer Logic

"Smart Order Routing (SOR) is the intelligence layer that guarantees a broker's commitment to 'best execution.'" - Spencer Logic

Additionally, the OMS provides real-time visibility into your trades, ensuring you stay informed every step of the way.

Real-Time Monitoring and Reporting

IgniteConnect keeps a close eye on orders, executions, and fills across all linked accounts in real time. Its Broker Sync feature ensures that profit and loss (PnL) and positions stay perfectly aligned between IgniteConnect and your broker’s platform, eliminating issues like "ghost trades" or reporting discrepancies.

The platform offers segmented reporting tailored to different asset types, whether you're tracking futures spreads, equity positions, or forex trades. For those who need advanced control, the Command Line Interface (CLI) provides powerful tools to access detailed data. With commands like portfolio-get-order-fills and portfolio-get-order-modifications, users can retrieve critical information on order performance and modifications. This level of detail becomes especially valuable during high-volatility periods when every second matters.

Automation and Low-Latency Execution

IgniteConnect seamlessly integrates with Tickblaze's strategy engine, enabling automated strategies and trade copiers to execute directly through the OMS without requiring additional context switching. Its dual-connection architecture separates the data feed from the broker connection, ensuring that latency in one doesn’t interfere with the other.

"Tickblaze uses a dual-connection architecture, which separates: Data Feed – for real-time price data [and] Broker Connection – for account control and order execution." - Tickblaze Team

"Tickblaze uses a dual-connection architecture, which separates: Data Feed – for real-time price data [and] Broker Connection – for account control and order execution." - Tickblaze Team

For proprietary traders using platforms like R Trader Pro, IgniteConnect offers a plugin mode that provides a redundant execution path. This feature is essential for compatibility with firms like TopStep and Apex. Modern SOR systems also deliver low latency vs ultra-low latency for portfolio and trading compliance checks, ensuring speed and risk management go hand in hand.

Risk Controls and Compliance

IgniteConnect includes robust risk management tools, such as pre-trade filters, daily limits, and order size checks. Users can assign specific risk-management-id and commission-id resources to portfolios via the CLI, automating compliance and reducing manual errors during high-speed trading.

Customizable rules allow you to restrict trading in certain assets or accounts, helping to avoid wash sale violations and ensure proper allocation of investments. For proprietary firms managing funded accounts, these features provide audit trails and execution records to demonstrate adherence to trading rules. As noted by one investment counselor:

"The OMS has great ease of use and reliability. It needs to work every time and it does." – Tom Crecelius, Investment Counselor, Joel R. Mogy Investment Counsel Inc.

"The OMS has great ease of use and reliability. It needs to work every time and it does." – Tom Crecelius, Investment Counselor, Joel R. Mogy Investment Counsel Inc.

Broker-Agnostic Flexibility

IgniteConnect connects to a wide range of brokers and low-latency gateways, including Rithmic, CQG, Interactive Brokers, Trading Technologies, Binance, and Kraken. This flexibility eliminates vendor lock-in, allowing users to compare fills across brokers for optimal execution.

The platform also supports institutional-grade gateways like Rithmic, commonly used in commodity markets, Futures Commission Merchants (FCMs), and both retail and institutional proprietary firms. By consolidating fragmented liquidity into a Unified Order Book, the system reduces implicit costs often associated with trading on less liquid exchanges.

IgniteConnect combines these features into a streamlined solution, bridging the gap between strategy development and execution.

| Feature | Description | Benefit |

|---|---|---|

| Dual-Connection | Separates data and execution paths | Increased redundancy |

| Broker Sync | Real-time PnL/position alignment | Eliminates reporting errors |

| Plugin Mode | Synchronized execution with R Trader Pro | Prop firm compatibility |

| Trade Pad | Centralized order entry | Faster multi-broker execution |

| CLI Integration | Command-line portfolio management | Enhanced automation |

Integration in the Tickblaze Trading Ecosystem

Integration with Strategy Engines and IgniteCopier

IgniteConnect brings trading, order management, and CRM together into a single, unified system, eliminating the headaches of juggling multiple vendors. This streamlined setup leads to faster, more precise order execution.

The platform seamlessly integrates with Tickblaze's Strategy Desktop, the go-to hub for developing and testing automated strategies. Whether you're coding in C# 12.0 or Python 3, or using the no-code Strategy Wizard to visually map out entry and exit conditions, IgniteConnect ensures these strategies execute effortlessly - no need to switch between tools or platforms.

Tickblaze also offers IgniteCopier, its in-house trade copier, which connects directly with the Order Management System (OMS). This feature enables leader-to-follower and master-to-sub account setups, allowing automated strategies to run across multiple accounts simultaneously - all within the same local environment. Traders have access to nearly 200 pre-made indicators and 100 pre-made patterns, providing a robust toolkit for strategy development.

"This unified architecture gives prop firms a tightly coupled solution that eliminates compatibility issues, improves operational oversight, and streamlines risk controls - capabilities rarely found in a single vendor offering." – Tickblaze

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

"This unified architecture gives prop firms a tightly coupled solution that eliminates compatibility issues, improves operational oversight, and streamlines risk controls - capabilities rarely found in a single vendor offering." – Tickblaze

IgniteConnect also boasts realistic fill algorithms that mimic live market speed and precision. With over 70 proprietary trading firms already using this system, it has proven to significantly reduce the time it takes new prop firms to get up and running - often within just 30–60 days.

By combining these strategy tools with its execution capabilities, IgniteConnect ensures traders experience heightened performance and efficiency.

Local Execution and Low-Latency Benefits

IgniteConnect enhances performance further with its local execution setup, which minimizes latency and ensures reliability. Its dual-connection architecture separates the data feed from the broker connection, creating a backup execution path that safeguards against trade discrepancies during high-volatility periods.

Operating locally eliminates the delays often associated with cloud-based systems. It also keeps sensitive broker credentials securely stored on the user's machine. The platform leverages multi-core CPUs and optimizes data handling between RAM and disk to handle even the largest datasets efficiently.

Custom strategy scripts, written in C# or Python, embed low-latency order logic directly into the platform. This means automated strategies, risk controls, and order routing all function within a single environment - no reliance on external systems or network delays.

"Tickblaze is not just a trading terminal - it's a complete trading ecosystem built for today's fast-moving prop trading world." – Tickblaze

"Tickblaze is not just a trading terminal - it's a complete trading ecosystem built for today's fast-moving prop trading world." – Tickblaze

For prop traders, these local optimizations ensure that high-frequency strategies and multi-account workflows run smoothly and consistently, even in the most demanding market conditions.

Key Benefits for Traders and Prop Firms

Scalability for Multi-Account Management

managing multiple funded accounts can be a logistical nightmare, but IgniteConnect streamlines the process by offering a single interface for handling numerous accounts. Traders can execute various strategies across different symbols and asset classes, all from one unified portfolio. The platform integrates directly with major providers like Interactive Brokers, Rithmic, and Trading Technologies, giving users access to over 60 FCMs.

For those looking to take scalability to the next level, the Tickblaze CLI allows traders to manage portfolios programmatically using command-line instructions. This eliminates the need to manually configure each account through a graphical interface. Instead, traders can automate deployments and consolidate real-time data from multiple brokers into a single, cohesive reporting stream.

This level of scalability sets the stage perfectly for the automation capabilities discussed next.

Automation and Algorithmic Trading

Automation is at the heart of IgniteConnect, supporting 18 customizable script types in C# 12.0 and Python 3. These scripts can handle everything from event-driven triggers like OnBarUpdate and OnOrderUpdate to position sizing, risk management, and trade execution. This means traders can fully automate their strategies and focus on fine-tuning their systems.

The platform also shines in strategy development, leveraging multi-core CPUs for backtesting and offering advanced optimization techniques like Genetics, Monte Carlo simulations, and Walk-Forward Optimization. With a library of nearly 200 built-in indicators and 100 pre-made patterns, traders have a wealth of tools to design, test, and refine their automated strategies.

Compliance and Risk Oversight

Effective risk management is non-negotiable in trading, and IgniteConnect ensures compliance through its robust risk management scripts. These scripts can automatically adjust or cancel orders based on real-time portfolio analysis, helping traders adhere to critical limits like daily loss caps (typically 3–5%) and drawdown thresholds (8–10%).

"Risk management in prop trading consists of four core elements: position sizing, stop-loss orders, portfolio diversification, and leverage restrictions" – Tradefundrr

"Risk management in prop trading consists of four core elements: position sizing, stop-loss orders, portfolio diversification, and leverage restrictions" – Tradefundrr

The platform also ensures transparency by logging every order, fill, and modification, making it easier to meet regulatory requirements. Firms can assign specific risk-management-id settings to portfolios, aligning them with funding challenge rules or firm-wide mandates. For administrators, CLI commands provide instant access to orders, positions, and performance data across all portfolios, enabling high-level compliance oversight without the need for manual reviews.

| Risk Metric | Prop Firm Limit | IgniteConnect Control |

|---|---|---|

| Daily Loss Limit | 3–5% of account | Automated circuit breakers via risk scripts |

| Maximum Drawdown | 8–10% | Real-time P&L monitoring across all accounts |

| Position Size | 1–5% of capital | Position sizing scripts override order quantities |

| Stop Loss | 1% of account value | Trade management scripts enforce exit rules |

Use Cases and Comparisons

Who Benefits from IgniteConnect

IgniteConnect stands out for its automation and risk management features, catering to specific trader groups with demanding infrastructure needs.

Proprietary trading firms rely on real-time monitoring and lightning-fast execution across various asset classes. For these firms, success rates typically range between 5% and 10%, emphasizing the importance of reliable execution and risk management systems.

Algorithmic traders gain a significant edge with IgniteConnect's integrated C# and Python environment, which supports automated execution and rapid backtesting. By 2009, 60% of all trades in the U.S. were already executed by computers, and that number has only grown since. High-frequency trading firms, such as Hudson River Trading, now handle up to 10% of U.S. stock-trading volume.

"HRT is first and foremost a math and technology company. We are engineers and researchers working as one team to solve difficult problems, and trading millions of shares a day on the world's financial markets." - Hudson River Trading

"HRT is first and foremost a math and technology company. We are engineers and researchers working as one team to solve difficult problems, and trading millions of shares a day on the world's financial markets." - Hudson River Trading

Multi-asset traders benefit from IgniteConnect's ability to unify connections across multiple brokers, eliminating the hassle of fragmented data and siloed accounts. Meanwhile, institutional managers like CTAs and hedge funds use its advanced reporting tools, audit trails, and risk limit enforcement to stay compliant with regulatory standards.

These features demonstrate why IgniteConnect is a step ahead of older systems, meeting the complex demands of modern trading.

Comparison with Legacy OMS Systems

IgniteConnect brings a fresh approach to outdated OMS (Order Management System) practices, offering seamless multi-account, low-latency execution that aligns with its core mission.

| Feature | Legacy OMS Systems | Tickblaze IgniteConnect |

|---|---|---|

| Broker Flexibility | Often limited to a single broker or asset class | Broker-agnostic: supports IB, Rithmic, TT, Binance, Kraken |

| Latency | Slower due to REST APIs | Low-latency execution via FIX API and WebSocket |

| Integration | Separate tools for backtesting, charting, and execution | Unified environment for backtesting, optimization, and live trading |

| Programming | Restricted to proprietary languages | Supports .NET/C# and Python |

| Risk Management | Basic stop-loss/take-profit tools | Advanced risk scripts and portfolio-level analysis |

The difference is clear to professional users. Tom Crecelius, Investment Counselor at Joel R. Mogy Investment Counsel Inc., remarked:

"The OMS has great ease of use and reliability. It needs to work every time and it does."

"The OMS has great ease of use and reliability. It needs to work every time and it does."

Eric Rosel, Managing Member at Morgan Rosel Wealth Management, shared:

"Blaze's trading technology allows us to implement and trade multiple investment strategies within one account type, which dramatically scales our business, freeing up valuable time to focus on our client's needs."

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

"Blaze's trading technology allows us to implement and trade multiple investment strategies within one account type, which dramatically scales our business, freeing up valuable time to focus on our client's needs."

With these advancements, IgniteConnect establishes itself as a robust platform, enabling scalable and high-performance trading across ever-changing market conditions.

OMS Webinar Series: Navigating the Complexities of Modern Trading with OMS Risk Controls

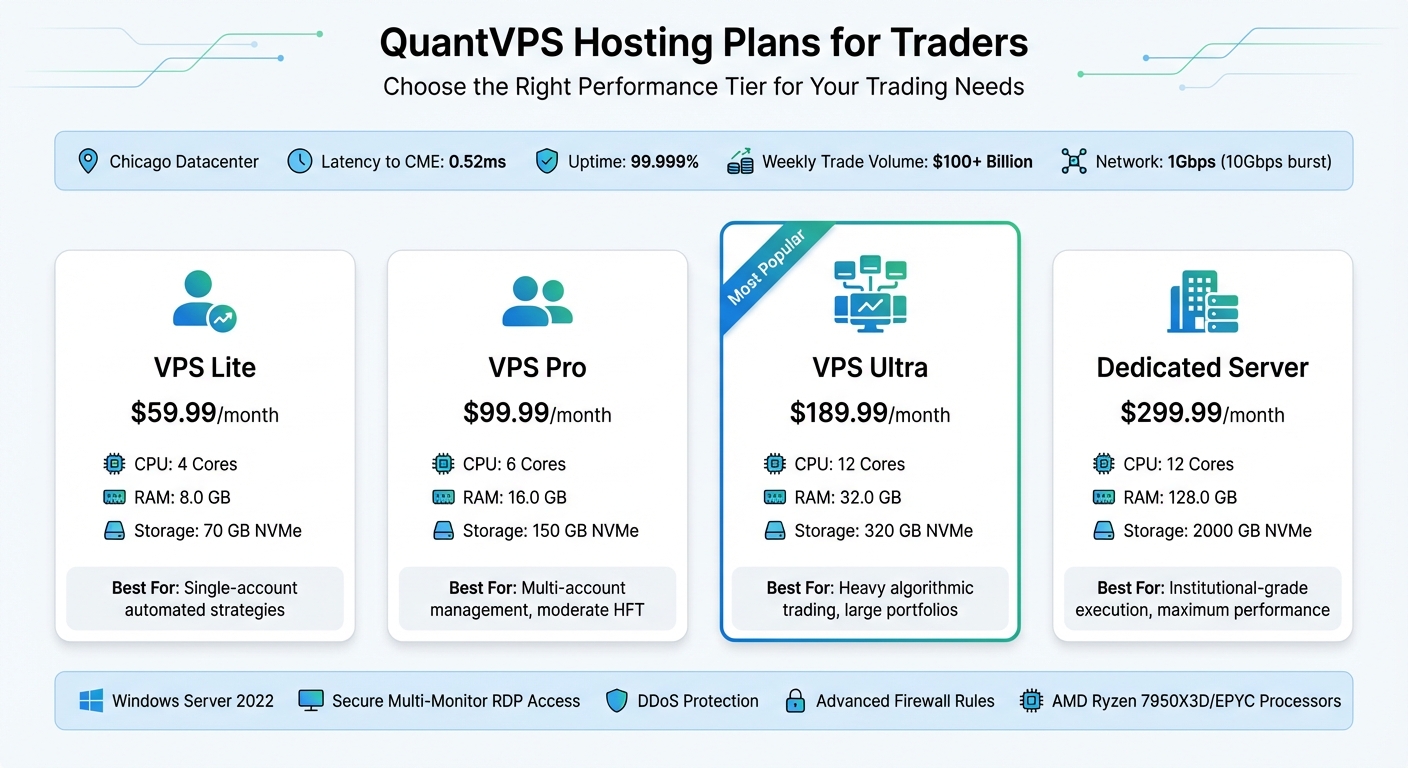

QuantVPS Hosting for Optimal Performance

QuantVPS Hosting Plans Comparison for Algorithmic Trading

QuantVPS Hosting Plans Comparison for Algorithmic Trading

Why Choose QuantVPS for IgniteConnect

To get the most out of IgniteConnect's low-latency execution and powerful automation, a reliable, high-performance hosting solution is a must. Running IgniteConnect on your local computer can expose you to power outages, internet disruptions, and hardware failures - any of which could derail critical trades. QuantVPS eliminates these risks by hosting your trading environment in a Chicago datacenter that's directly cross-connected to CME Group's matching engines. With a lightning-fast 0.52ms latency to CME, QuantVPS ensures your orders are executed almost instantly.

IgniteConnect's performance thrives on robust hardware. QuantVPS uses AMD Ryzen 7950X3D and EPYC processors paired with DDR4/5 RAM and NVMe SSD storage, offering the speed and reliability needed to process multi-asset orders efficiently. With 99.999% uptime, your automated strategies and IgniteConnect's order management system (OMS) operate seamlessly, completely independent of your local setup. Impressively, over $100 billion in trades flows through QuantVPS servers each week, demonstrating its reliability under demanding, real-world trading conditions.

"Our Chicago datacenter provides ultra‐low latency (<0.52ms) directly to the CME exchange, enabling faster futures trade execution and significantly minimizing slippage." – QuantVPS

"Our Chicago datacenter provides ultra‐low latency (<0.52ms) directly to the CME exchange, enabling faster futures trade execution and significantly minimizing slippage." – QuantVPS

The hosting setup includes Windows Server 2022 and secure multi-monitor RDP access, allowing you to manage Tickblaze strategies remotely while keeping order execution anchored in the low-latency Chicago environment. For traders handling multiple proprietary firm accounts, this combination of speed and stability is a game-changer. QuantVPS is perfectly aligned with IgniteConnect's modern, efficient trading architecture.

Recommended VPS Plans for Traders

QuantVPS offers a range of plans designed to meet the needs of different trading workloads. If you're running basic automated strategies with IgniteConnect, the VPS Lite plan is a solid choice. For traders managing multiple accounts or engaging in high-frequency trading (HFT), the VPS Pro or VPS Ultra plans provide the extra resources needed.

| Plan | CPU Cores | RAM | Storage | Monthly Price | Best For |

|---|---|---|---|---|---|

| VPS Lite | 4 Cores | 8.0 GB | 70 GB NVMe | $59.99 | Single-account automated strategies |

| VPS Pro | 6 Cores | 16.0 GB | 150 GB NVMe | $99.99 | Multi-account management, moderate HFT |

| VPS Ultra | 12 Cores | 32.0 GB | 320 GB NVMe | $189.99 | Heavy algorithmic trading, large portfolios |

| Dedicated Server | 12 Cores | 128.0 GB | 2000 GB NVMe | $299.99 | Institutional-grade execution, maximum performance |

Every plan includes 1Gbps connectivity with 10Gbps burst capability, strong DDoS protection, and advanced firewall rules to secure your trading operations. This robust network infrastructure ensures IgniteConnect can handle real-time market data and execute orders rapidly, even during high-volatility market events.

Conclusion

Why IgniteConnect Stands Out

IgniteConnect brings together speed, adaptability, and precision by consolidating multiple asset classes into a single, user-friendly Order Management System (OMS). Designed to be broker-agnostic, it seamlessly supports equities, futures, forex, and crypto trading. With advanced fill algorithms and automated compliance controls, it ensures simulations are highly reflective of live trading while maintaining strict risk management standards.

"The prop industry is fragmented and inefficient. Firms are forced to stitch together multiple vendors and teams, wasting time and inflating costs, all while relying on underpowered tech stacks that limit trader performance... We're changing that." - Sean Kozak, CEO of Tickblaze

"The prop industry is fragmented and inefficient. Firms are forced to stitch together multiple vendors and teams, wasting time and inflating costs, all while relying on underpowered tech stacks that limit trader performance... We're changing that." - Sean Kozak, CEO of Tickblaze

This sophisticated OMS doesn’t just enhance execution - it also integrates effortlessly with powerful hosting solutions.

Final Thoughts on IgniteConnect and QuantVPS

When paired with IgniteConnect, QuantVPS hosting takes performance to the next level by offering ultra-low latency and 100% uptime. This ensures that automated strategies and multi-account workflows run without interruption. Whether you're running a single algorithmic strategy with the VPS Lite plan at $59.99/month or managing institutional-grade operations on a Dedicated Server for $299.99/month, QuantVPS provides the infrastructure needed to unlock IgniteConnect's full potential.

Together, IgniteConnect’s unified OMS and QuantVPS’s Chicago-based datacenter create a streamlined, high-performance setup for traders handling multi-account operations and prop firm workflows.

FAQs

How does IgniteConnect deliver lightning-fast execution for high-frequency trading?

IgniteConnect delivers lightning-fast trade execution by channeling orders directly through broker-grade gateways such as Rithmic. This approach reduces delays and optimizes speed, ensuring trades are processed in mere milliseconds.

Because IgniteConnect operates directly within the Tickblaze platform, it removes the need for extra middleware or unnecessary network steps. This seamless integration makes it a perfect choice for high-frequency trading, where even the tiniest time advantage can make a big difference in seizing opportunities and staying ahead of the competition.

What are the advantages of IgniteConnect's broker-agnostic system?

IgniteConnect's broker-agnostic design lets traders connect with any supported broker or trading venue, offering the freedom to route orders without being locked into a single proprietary network. This approach allows users to manage trades across equities, futures, options, forex, and crypto - all from one streamlined dashboard. Plus, it provides real-time updates on positions, executions, and order statuses across all linked accounts.

Perfect for multi-account setups or proprietary trading firms, IgniteConnect effortlessly scales to handle even the most complex workflows. It supports automated strategies while implementing pre-trade risk checks to maintain strong risk controls. With its low-latency performance, it’s built for high-volatility markets, making it an essential tool for both active and professional traders.

How does IgniteConnect work with Tickblaze’s strategy engine for automated trading?

IgniteConnect works hand-in-hand with Tickblaze’s strategy engine, allowing automated trading strategies written in C# or Python to send orders directly to the OMS. This integration ensures seamless routing, execution, and real-time risk checks - all without needing to toggle between different systems.

With IgniteConnect embedded into the Tickblaze platform, traders can automate their workflows with low latency while retaining complete control over execution. The result? A faster, more efficient trading process.

IgniteConnect delivers lightning-fast trade execution by channeling orders directly through broker-grade gateways such as Rithmic. This approach reduces delays and optimizes speed, ensuring trades are processed in mere milliseconds.

Because IgniteConnect operates directly within the Tickblaze platform, it removes the need for extra middleware or unnecessary network steps. This seamless integration makes it a perfect choice for high-frequency trading, where even the tiniest time advantage can make a big difference in seizing opportunities and staying ahead of the competition.

IgniteConnect's broker-agnostic design lets traders connect with any supported broker or trading venue, offering the freedom to route orders without being locked into a single proprietary network. This approach allows users to manage trades across equities, futures, options, forex, and crypto - all from one streamlined dashboard. Plus, it provides real-time updates on positions, executions, and order statuses across all linked accounts.

Perfect for multi-account setups or proprietary trading firms, IgniteConnect effortlessly scales to handle even the most complex workflows. It supports automated strategies while implementing pre-trade risk checks to maintain strong risk controls. With its low-latency performance, it’s built for high-volatility markets, making it an essential tool for both active and professional traders.

IgniteConnect works hand-in-hand with Tickblaze’s strategy engine, allowing automated trading strategies written in C# or Python to send orders directly to the OMS. This integration ensures seamless routing, execution, and real-time risk checks - all without needing to toggle between different systems.

With IgniteConnect embedded into the Tickblaze platform, traders can automate their workflows with low latency while retaining complete control over execution. The result? A faster, more efficient trading process.

"}}]}