How Latency Impacts Polymarket Bot Performance (And How to Reduce It)

Latency is the delay between a bot sending a command and Polymarket responding. Even milliseconds matter in trading - high latency can mean missed profits or losses. Here’s why it’s critical and how to fix it:

- Why Latency Hurts: Delays lead to outdated decisions, slippage, and missed trades. Bots with faster speeds dominate markets by acting on fresh data.

- What Causes Latency: Physical distance from servers, slow internet, poor VPS choices for algorithmic trading, inefficient code (e.g., using REST APIs instead of WebSockets), and shared hosting.

-

How to Fix It:

- Use a high-performance VPS near Polymarket servers (e.g., QuantVPS with <5ms latency).

- Optimize bot code (e.g., switch to WebSockets, batch API calls, use faster programming languages).

- Monitor performance continuously to address new bottlenecks.

- Use a high-performance VPS near Polymarket servers (e.g., QuantVPS with <5ms latency).

- Optimize bot code (e.g., switch to WebSockets, batch API calls, use faster programming languages).

- Monitor performance continuously to address new bottlenecks.

Reducing latency can improve execution speeds, minimize slippage, and make your bot more competitive in fast-moving markets.

How Latency Affects Polymarket Bot Performance

Latency and Market Efficiency

High latency can seriously hinder your bot's ability to respond to market changes. When data takes too long to reach your system, you're essentially making decisions based on outdated information. In prediction markets, where prices can shift in seconds, this lag can be the difference between making a profit or missing out entirely. Professional high-frequency trading systems operate with sub-millisecond performance, while most retail setups experience latencies ranging from 10 to 100 milliseconds. That gap is critical.

When you're working with stale data, your bot is forced to make decisions that are no longer relevant. By the time your order reaches Polymarket's servers, the opportunity may have passed, or the price may have moved against you. This means you either accept less favorable prices or miss the trade altogether. And when these delays pile up, they directly impact your profitability.

How Latency Reduces Trading Profits

Every millisecond counts in trading. If your home internet latency is 150 ms or higher, scalping profits can disappear entirely. Similarly, poor futures trading VPS choices can lead to execution delays, resulting in slippage losses of 2–10 pips. For high-frequency strategies, even an additional 50 ms of latency can make profitable trades unviable.

"Every millisecond of delay between your automated trading strategies and your broker's trading servers can mean the difference between capturing profitable opportunities and watching them slip away." - Finance Monthly

"Every millisecond of delay between your automated trading strategies and your broker's trading servers can mean the difference between capturing profitable opportunities and watching them slip away." - Finance Monthly

It's a simple equation: if your competitors are executing trades in 1–5 ms while your system operates at 20–50 ms, you'll consistently lose out on favorable prices. This delay doesn't just reduce profits - it can render your bot ineffective. Real-world scenarios highlight how latency can make or break a trading strategy.

Examples of Latency Problems in Polymarket Trading

In late 2025, traders using "Esports Parsing" strategies on Polymarket reported profits exceeding $200,000. These bots were directly linked to official game APIs for titles like League of Legends and Dota 2, allowing them to detect in-game events - such as kills or tower losses - seconds before the general public relying on delayed Twitch or YouTube streams. This gave them a 30–40 second advantage in trading.

Another example comes from December 2025, when a developer known as "Efficient Coder" tested a Polymarket bot on the "BTC 15-minute UP/DOWN" market using 6 GB of live data. The bot monitored for a 15% price drop within a 3-second window, achieving an 86% ROI and turning $1,000 into $1,869 in a few days. However, when the strategy was adjusted to act on a more aggressive 1% threshold, it resulted in a 50% loss over two days due to false triggers and execution delays caused by latency.

These cases underline how latency creates a two-tiered trading environment. Bots with ultra-low latency dominate and capture profits, while slower systems consistently fall short - even when using the same strategies. The difference lies not in the trading logic but in the speed of the infrastructure.

What is Latency and Why is it Crucial in High-Frequency Trading?

What Causes Latency in Polymarket Bot Setups

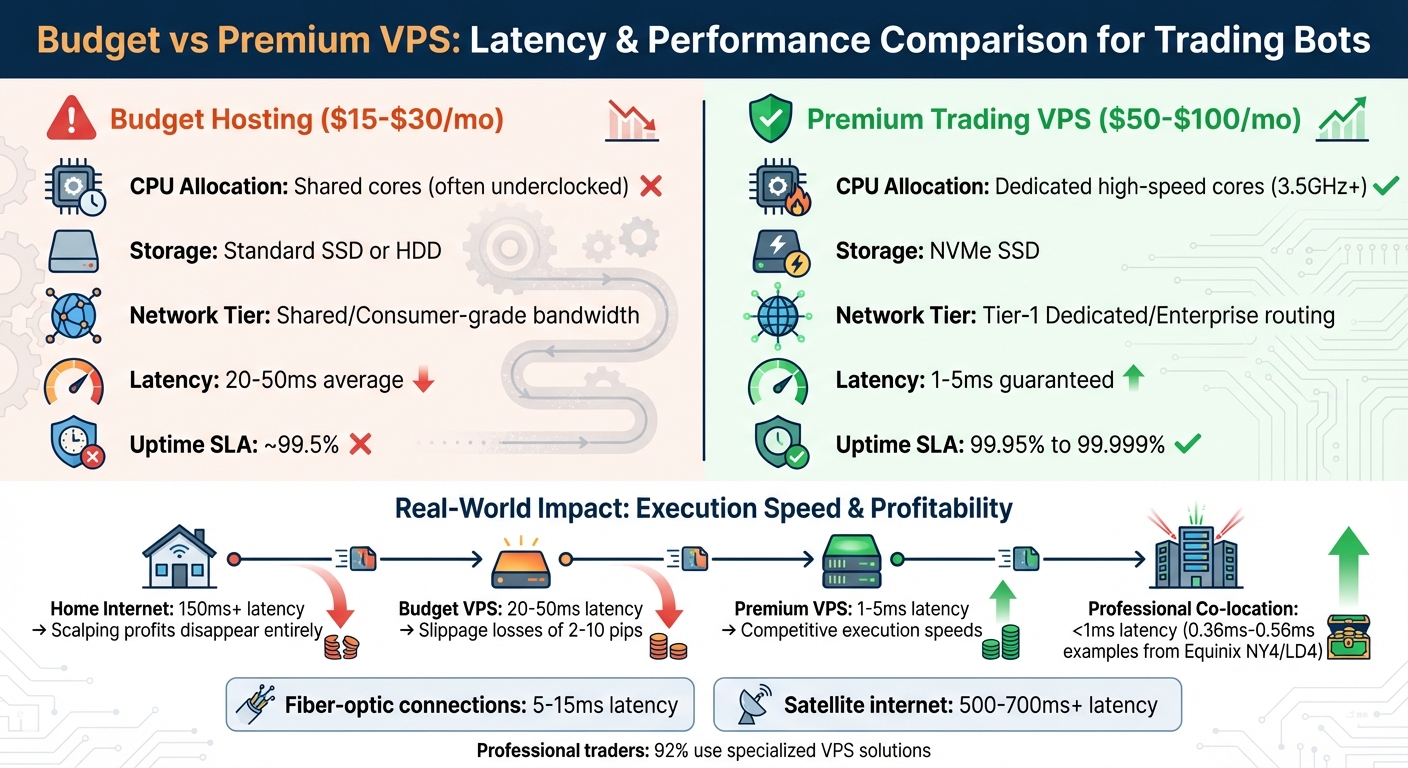

Latency Impact on Trading Performance: Budget vs Premium VPS Comparison

Latency Impact on Trading Performance: Budget vs Premium VPS Comparison

Distance from Polymarket Servers

One of the biggest reasons for latency is physical distance. If your bot is running on a home connection or from a data center far from Polymarket's servers, every request has to travel hundreds or even thousands of miles. This adds precious milliseconds to response times.

"The distance between your trading software and broker servers creates the primary latency bottleneck." - Finance Monthly

"The distance between your trading software and broker servers creates the primary latency bottleneck." - Finance Monthly

For example, typical home internet connections often experience latency of 150ms or more. This makes profitable scalping nearly impossible. Even with a VPS, location matters. A low-cost VPS in the wrong region might still result in 20–50ms latency. On the other hand, a server housed in the same facility as Polymarket’s infrastructure can get latency down to just 1–5ms.

To put this into perspective:

- Fiber-optic connections generally provide latency between 5–15ms.

- Satellite internet can suffer from delays of 500–700ms or more.

Professional traders know the importance of minimizing latency, which is why they often co-locate their servers in major financial hubs. For instance, Equinix's NY4 in New York and LD4 in London have shown real-world latencies as low as 0.36ms and 0.56ms, respectively.

But distance isn’t the only factor. The way your bot is built also plays a critical role.

Poorly Optimized Bot Code

The efficiency of your bot’s code can heavily influence latency. For instance, if your bot relies on REST API polling to fetch market data instead of using WebSocket streams, it has to wait for the next polling cycle instead of receiving updates in real time. This delay can be a dealbreaker in fast-moving markets.

Additionally, inefficient API usage can trigger rate limits. Polymarket caps trading endpoints at 60 orders per minute per API key. If your bot exceeds this limit, it will encounter HTTP 429 "Too Many Requests" errors, forcing it into exponential backoff and temporarily halting trading.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

Another bottleneck arises from Polymarket’s requirement for HMAC-SHA256 signature authentication on every trading request. If your code isn't optimized to handle these calculations efficiently, it can slow down processing.

Other common coding inefficiencies include:

- Sequential processing instead of asynchronous programming, which delays responses to incoming data.

- Failing to cache frequently used information, leading to repeated server queries.

- Sending individual queries instead of batching them, resulting in unnecessary back-and-forth with the servers.

Even with well-optimized code, the hosting environment can still introduce delays.

Low-Performance Hosting Infrastructure

Your server’s hardware and network performance are just as important as your bot’s code and location. Budget hosting solutions often create bottlenecks due to shared resources. For example, low-cost VPS options typically share CPU cores and bandwidth with other users, leading to unpredictable delays - especially during periods of high market activity. Outdated hardware can also struggle to handle the data bursts that occur during market volatility.

Another issue with budget hosting is the reliance on consumer-grade network connections. These connections often introduce variable latency and jitter, particularly during peak trading hours. Premium trading VPS services, by contrast, use Tier-1 enterprise-grade routing, which ensures more stable and predictable performance.

Uptime is another critical factor. Budget hosting solutions usually promise an uptime SLA of around 99.5%, while premium services offer 99.95% or higher. Although the difference might seem minor, it can be the difference between your bot staying online during a critical market event or going offline, leaving trades unmanaged and opportunities lost.

Here’s a quick comparison of budget hosting versus premium trading VPS options:

| Feature | Budget Hosting ($15–$30/mo) | Premium Trading VPS ($50–$100/mo) |

|---|---|---|

| CPU Allocation | Shared cores (often underclocked) | Dedicated high-speed cores (3.5GHz+) |

| Storage | Standard SSD or HDD | NVMe SSD |

| Network Tier | Shared/Consumer-grade bandwidth | Tier-1 Dedicated/Enterprise routing |

| Latency | 20–50ms average | 1–5ms guaranteed |

| Uptime SLA | ~99.5% | 99.95% to 99.999% |

As you can see, investing in better hosting infrastructure and enhancing your trading server performance can make a huge difference in reducing latency and ensuring your bot operates at peak performance.

How to Reduce Latency and Improve Bot Performance

Latency can throw a wrench into your Polymarket bot's performance, but there are ways to regain your competitive edge. By focusing on hosting, code optimization, and careful planning, you can significantly reduce delays and boost efficiency.

Use QuantVPS for Low-Latency Hosting

One of the quickest ways to cut down latency is by hosting your bot on a high-performance VPS close to Polymarket's infrastructure. QuantVPS specializes in ultra-low latency connections - as low as 0.52ms to major exchanges - thanks to servers strategically located in financial hubs like New York, Chicago, and London.

The platform uses AMD Ryzen and EPYC processors with clock speeds of 3.5 GHz or higher, which is ideal for single-threaded trading bots that rely more on high clock speeds than multiple cores. Combine that with NVMe SSD storage, and your bot can load tick data and execute strategies almost instantly.

QuantVPS also features fiber-optic cross-connects and 1Gbps+ network connections (with bursts up to 10Gbps), ensuring minimal network hops and reduced slippage. To keep things stable during peak trading times, it includes enterprise-grade routing with DDoS protection and advanced firewalls. In late 2025, over $100 billion in trading volume flowed through QuantVPS servers in just one week, showcasing its ability to handle real-world trading demands.

Once your hosting is optimized, the next step is to fine-tune your bot's code for maximum performance.

Optimize Your Bot's Code and API Calls

Even the best hosting can’t save a bot weighed down by inefficient code. Start by switching from REST API polling to WebSocket streams. Unlike REST APIs, WebSockets provide real-time updates for price movements, order books, trades, and user data, eliminating delays caused by repeated HTTP requests.

Pay close attention to how your bot handles API calls. Polymarket’s /order endpoint allows bursts of 3,500 requests per 10 seconds (500/s) but caps sustained rates at 60 orders per minute. Exceeding these limits triggers HTTP 429 errors, forcing your bot into exponential backoff. To avoid this, implement smart batching for requests and cache data locally with a suitable Time-To-Live (TTL).

Another critical factor is the HMAC-SHA256 signature authentication required for trading requests. Using high-performance libraries for generating these signatures can shave off precious milliseconds. Additionally, if you’re serious about reducing latency, consider using lower-level languages like C++, which often outperform interpreted languages like Python in time-sensitive operations. If a full rewrite isn’t feasible, focus on optimizing the most delay-prone parts of your code.

Once your code is streamlined, ensure your VPS plan matches your bot’s resource needs.

Select the Right QuantVPS Plan

Choosing the right VPS plan is essential. A basic setup may work for low-volume trading, but high-frequency algorithms often require dedicated resources.

For simpler setups, a plan with 4GB of RAM and shared CPU cores should do the trick. For more complex strategies or running multiple bots, you’ll need at least 8GB of RAM and dedicated CPU cores. Dedicated resources prevent the "noisy neighbor" effect, where other users on the same server slow down your bot during high market activity.

Here’s a quick guide to help you pick the right plan:

| Trading Style | Recommended Plan | Key Features |

|---|---|---|

| Swing Trading / Low Volume | VPS Lite ($59.99/mo) | 4 cores, 8GB RAM, 70GB NVMe, 1Gbps+ network |

| Scalping / Medium Volume | VPS Pro ($99.99/mo) | 6 cores, 16GB RAM, 150GB NVMe, up to 2 monitors |

| High-Frequency / Multiple Bots | VPS Ultra ($189.99/mo) | 24 cores, 64GB RAM, 500GB NVMe, up to 4 monitors |

| Professional / Heavy Workloads | Dedicated Server ($299.99/mo) | 16+ dedicated cores, 128GB RAM, 2TB+ NVMe, 10Gbps+ network |

For traders who need every possible edge, QuantVPS also offers Performance Plans (+) with enhanced routing and guaranteed sub-5ms latency.

Before committing to a plan, test it during peak trading hours - especially during major news events. This ensures your setup can handle CPU load spikes of 300-500% without crashing. When your bot performs under pressure, you’ll know it’s ready for anything.

Step-by-Step Guide to Reducing Latency

Now that you understand what causes latency and how to address it, it’s time to take action. This step-by-step guide will help you measure, improve, and maintain your bot's performance effectively.

Measure Your Current Latency

Start by recording timestamps for key events like signal generation, order submission, and execution confirmation. This will help you identify where delays occur.

Run continuous ping tests for 24–48 hours to monitor latency patterns across different market sessions. Pay close attention to peak trading hours and major news events when network congestion tends to increase. Use traceroute analysis to locate specific network nodes causing slowdowns between your setup and Polymarket's infrastructure.

To supplement these tests, try paper trading to measure real-world execution speeds and account for software-related overhead. Monitor your system's CPU and RAM usage during high-volume periods - hardware limits could be a hidden bottleneck.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Once you’ve established a clear baseline, you’ll have the data needed to make targeted improvements.

Apply Latency Reduction Techniques

One of the most effective steps is relocating your bot to a VPS near Polymarket's infrastructure. Physical proximity significantly reduces latency.

Switch to WebSocket streams for real-time data, which eliminates the delays caused by HTTP overhead. Optimize your bot’s code by using techniques like exponential backoff for rate limits and local caching to cut down on repetitive API calls. For critical processes, consider rewriting key sections of your code in C++ instead of Python to minimize processing time.

Test every change during peak trading hours to ensure it delivers measurable improvements. Keep track of what works and what doesn’t - this documentation will be invaluable for future optimization efforts.

Once you’ve made adjustments, the next step is to ensure your bot continues to perform well over time.

Monitor Performance Over Time

"Latency optimization represents an ongoing process rather than a one-time implementation." - Tom Hartman, TradersPost

"Latency optimization represents an ongoing process rather than a one-time implementation." - Tom Hartman, TradersPost

After implementing latency reduction measures, it’s critical to continuously monitor your bot’s performance. Market conditions shift, network routes change, and without regular checks, performance can degrade unnoticed. Set up continuous monitoring to track latency trends over weeks and months. Regular ping tests and statistical analysis of execution times can help you identify outliers and spot potential issues.

Prepare for CPU load spikes of 300–500% during major news events. If your bot crashes or slows down during these critical moments, it’s a sign you need additional computational resources. Plan for periodic hardware upgrades, such as moving to NVMe SSDs or faster processors, to stay competitive as market demands grow.

Maintain detailed logs of all infrastructure and code changes. This will make it easier to pinpoint the cause of any performance shifts and quickly address them.

The most successful traders aren’t those who optimize just once - they’re the ones who continuously refine their systems to adapt to an ever-changing market.

Conclusion

In fast-paced prediction markets like Polymarket, even a fraction of a second can make all the difference between profit and missed opportunity. Success often hinges on how quickly your bot can detect events, submit orders, and secure fills before the window closes.

The strategies discussed here - such as choosing hosting locations strategically and optimizing your bot's code - can lead to noticeable improvements. For instance, professional traders using optimized VPS setups have reported 42% faster order fills and 58% fewer missed opportunities. These numbers highlight the direct impact of infrastructure on trading performance.

To take advantage of these insights, start by analyzing your system's latency. Identify and resolve bottlenecks, whether that means relocating your bot to a VPS near financial hubs like Chicago or New York (where latency can drop to just 0.52ms) or fine-tuning your bot’s code for peak efficiency during high-demand periods.

It's worth noting that 92% of professional traders utilize specialized VPS solutions, as standard home setups simply can't match their performance. With plans starting at $59.99/month, services like QuantVPS offer the high-performance infrastructure needed to overcome latency challenges and stay competitive.

The key to success lies in constant monitoring and refinement. As market conditions shift, so should your system. By applying these techniques, you'll be better equipped to seize opportunities that others might miss.

FAQs

How does the distance between my server and Polymarket servers affect latency?

The physical distance between your bot's server and Polymarket's servers can heavily influence latency. The farther apart they are, the longer it takes for data to travel back and forth. This delay can slow down trade execution and potentially affect your ability to capitalize on fast-moving market opportunities.

To cut down on latency, think about hosting your bot on a server located closer to Polymarket's data center. This shortens the network round-trip time, allowing your bot to execute trades more quickly and efficiently.

Why are WebSockets better than REST APIs for trading bots?

WebSockets enable real-time market data by keeping a continuous connection open. Unlike REST APIs, which rely on repeated requests to fetch updates, WebSockets eliminate the lag caused by the back-and-forth request-response process. This means trading bots can access crucial information much faster.

Thanks to WebSockets, bots can respond to market shifts almost immediately. This latency advantage plays a big role in improving trade execution speed and, ultimately, profitability. In latency-sensitive platforms like Polymarket, this enhanced speed can significantly impact overall performance.

How do I choose the best VPS plan for my Polymarket trading bot?

To choose the best VPS plan for your Polymarket trading bot, start by assessing what your bot requires in terms of latency, processing power, and storage. If your trading strategy relies on lightning-fast execution, pick a server that's geographically close to Polymarket’s servers. For example, QuantVPS’s New York datacenter is a solid choice, offering incredibly low ping times of 1–2 ms to major exchanges.

Next, think about the workload your bot will handle. If your bot is running light operations, like managing 1–2 charts, a basic setup with 4 CPU cores and 8 GB of RAM should be enough. On the other hand, if you’re running multiple bots or performing extensive backtesting, you’ll need a more advanced plan with greater resources. Also, make sure the storage aligns with your data requirements - larger plans are better suited for storing extended historical price data.

Lastly, double-check that the plan includes unmetered bandwidth to ensure smooth API data streaming without any interruptions. After setting up, test the latency to confirm everything is running as expected. Keep an eye on resource usage over time so you can adjust your plan if necessary, ensuring your bot operates efficiently without overspending.

The physical distance between your bot's server and Polymarket's servers can heavily influence latency. The farther apart they are, the longer it takes for data to travel back and forth. This delay can slow down trade execution and potentially affect your ability to capitalize on fast-moving market opportunities.

To cut down on latency, think about hosting your bot on a server located closer to Polymarket's data center. This shortens the network round-trip time, allowing your bot to execute trades more quickly and efficiently.

WebSockets enable real-time market data by keeping a continuous connection open. Unlike REST APIs, which rely on repeated requests to fetch updates, WebSockets eliminate the lag caused by the back-and-forth request-response process. This means trading bots can access crucial information much faster.

Thanks to WebSockets, bots can respond to market shifts almost immediately. This latency advantage plays a big role in improving trade execution speed and, ultimately, profitability. In latency-sensitive platforms like Polymarket, this enhanced speed can significantly impact overall performance.

To choose the best VPS plan for your Polymarket trading bot, start by assessing what your bot requires in terms of latency, processing power, and storage. If your trading strategy relies on lightning-fast execution, pick a server that's geographically close to Polymarket’s servers. For example, QuantVPS’s New York datacenter is a solid choice, offering incredibly low ping times of 1–2 ms to major exchanges.

Next, think about the workload your bot will handle. If your bot is running light operations, like managing 1–2 charts, a basic setup with 4 CPU cores and 8 GB of RAM should be enough. On the other hand, if you’re running multiple bots or performing extensive backtesting, you’ll need a more advanced plan with greater resources. Also, make sure the storage aligns with your data requirements - larger plans are better suited for storing extended historical price data.

Lastly, double-check that the plan includes unmetered bandwidth to ensure smooth API data streaming without any interruptions. After setting up, test the latency to confirm everything is running as expected. Keep an eye on resource usage over time so you can adjust your plan if necessary, ensuring your bot operates efficiently without overspending.

"}}]}