Tickblaze IgniteCopier Review: Broker-Approved Native Trade Copying Explained

Tickblaze IgniteCopier is a local trade copier designed for traders who prioritize speed, security, and compliance. Unlike cloud-based copiers that rely on external servers, IgniteCopier operates directly on your device, ensuring near-instant trade replication with minimal latency. This approach makes it ideal for scalpers, day traders, and proprietary traders managing multiple accounts across brokers like Interactive Brokers, Rithmic, and CQG.

Key features include:

- Execution Speed: Near-zero latency since trades are processed locally, avoiding delays typical of cloud systems (200ms+).

- Security: Sensitive data stays on your device, reducing risks tied to external servers.

- Compliance: Approved by many brokers and proprietary firms, avoiding issues with unofficial APIs.

- Reliability: No dependency on third-party servers, ensuring stability even during volatile markets.

- Multi-Asset Support: Works across stocks, futures, forex, and crypto with built-in symbol mapping.

While IgniteCopier requires an active platform and specific hardware (e.g., Intel Core i7, 16GB RAM), it provides unmatched performance for traders who value precision and control. Cloud-based copiers offer remote flexibility but come with trade-offs in latency, compliance, and security.

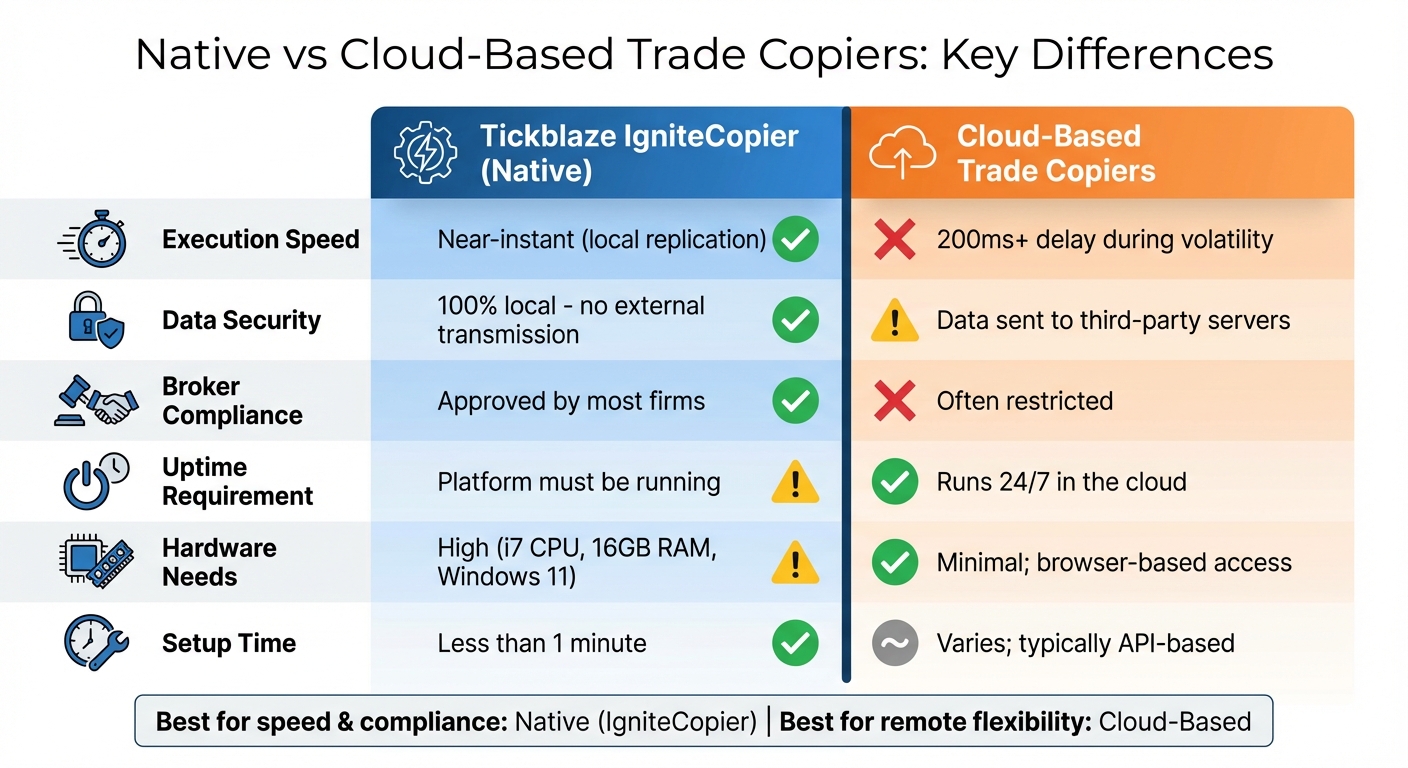

| Criteria | Tickblaze IgniteCopier | Cloud-Based Copiers |

|---|---|---|

| Execution Speed | Near-instant (local replication) | 200ms+ delay during volatility |

| Data Security | 100% local | Data sent to third-party servers |

| Broker Compliance | Approved by many firms | Often restricted |

| Uptime Requirement | Platform must be running | Runs 24/7 in the cloud |

| Hardware Needs | High (i7 CPU, 16GB RAM) | Minimal; browser-based access |

For traders focused on speed, security, and broker compliance, Tickblaze IgniteCopier offers a reliable solution for trade copying without the risks and delays of cloud-based systems.

Tickblaze IgniteCopier vs Cloud-Based Trade Copiers Comparison

Tickblaze IgniteCopier vs Cloud-Based Trade Copiers Comparison

1. Tickblaze IgniteCopier

Execution Model

Tickblaze IgniteCopier works directly on your device, whether you're using a desktop, browser, or mobile app. Unlike systems that rely on external servers to process trades, IgniteCopier replicates every order within the Tickblaze platform itself using native trade replication. This means that as soon as you place a trade on your leader account, it's immediately copied to your follower accounts.

This setup supports multi-asset copying across a range of markets, including stocks, futures, forex/CFDs, and crypto. You can connect to brokers like Rithmic, CQG, Interactive Brokers, and YourBourse - all through a single interface. With its built-in symbol mapping feature, you can easily copy trades between instruments, such as converting trades from Micro contracts (e.g., MES) to Mini contracts (e.g., ES). This is particularly useful when managing accounts with varying capital requirements. By keeping everything local, IgniteCopier ensures a streamlined, lightning-fast trade replication process.

Latency

Speed is critical in fast-moving markets, and IgniteCopier delivers. Its local execution model ensures minimal delay between trades on your leader and follower accounts. Unlike cloud-based systems that often introduce delays of 200 milliseconds or more due to external server routing, IgniteCopier eliminates this bottleneck. During periods of high volatility, this difference can be the key to avoiding missed opportunities.

Futures prop trader Mark A. captured this advantage perfectly:

"Every other copier failed when volatility spiked - Tickblaze hasn't missed a single fill. It's fast, stable, and bulletproof."

"Every other copier failed when volatility spiked - Tickblaze hasn't missed a single fill. It's fast, stable, and bulletproof."

For scalpers and day traders who rely on precise timing, the near-instantaneous execution helps reduce slippage and ensures trades are executed as intended.

Broker Compliance

A major strength of IgniteCopier is its broker-friendly design. Because it operates entirely within Tickblaze's approved infrastructure, it avoids the pitfalls of using unofficial APIs or external automation layers - practices that many brokers and prop firms explicitly prohibit. All trade data remains on your local device, keeping sensitive account credentials and trading information private.

This approach is especially important for prop traders, as many firms have strict policies against cloud-based copiers due to data security concerns. IgniteCopier adheres to approved broker protocols, addressing these concerns head-on and mitigating the risks associated with external systems.

Additionally, the platform maintains detailed audit logs with precise timestamps for every trade and modification. This creates a transparent record for compliance checks or resolving disputes, adding another layer of reliability.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

Security

Beyond speed and compliance, IgniteCopier prioritizes the security of your trade data. Since no trade information is transmitted externally, there’s no risk of leaks or account breaches. Your broker credentials, trading strategies, and account details stay securely on your local machine, unlike cloud-based systems that require sensitive data to be stored on remote servers.

For traders managing multiple funded accounts - often worth $50,000 or more - this local-only approach provides significant peace of mind. By eliminating third-party services or external APIs, the risk of data compromise is drastically reduced.

Reliability

By removing cloud dependencies, IgniteCopier avoids many common failure points. You won’t have to worry about server outages, API disruptions, or connectivity issues between your device and a remote service. As long as the Tickblaze platform is running, your trades will be consistently replicated.

The platform also includes built-in risk management tools, such as daily loss and gain limits for each account, helping you stay within prop firm drawdown rules. Setup is quick and intuitive, taking less than a minute to configure. With IgniteCopier, reliability and ease of use go hand in hand.

2. Cloud-Based Trade Copiers

Execution Model

Cloud-based trade copiers function on remote servers that transmit trade orders from the leader's account to the followers'. While this setup enables accessibility from virtually anywhere, it also introduces an extra layer of complexity. This additional network hop can lead to delays and creates a dependency on external infrastructure, which is outside the trader’s direct control. These factors can have significant implications, especially during fast-moving market conditions.

Latency

One of the most glaring challenges with cloud-based copiers is latency. Since trades must be processed remotely before execution, this delay can often exceed 200 milliseconds during periods of high market volatility. This lag increases the likelihood of missed opportunities and slippage - both of which can eat into profits. As quantitative strategist Julian Vance aptly put it:

"Latency - the delay between copying a master trade and executing it on a slave account - is a silent killer of profitability".

"Latency - the delay between copying a master trade and executing it on a slave account - is a silent killer of profitability".

Broker Compliance

Another hurdle is compliance with broker and proprietary trading firm policies. Many brokers have strict rules against transmitting sensitive credentials or trade data to external servers. Such practices are often flagged as security risks, with some firms explicitly banning the use of cloud-based copiers. Violating these policies can result in serious consequences, including account suspension or termination.

Security

The reliance on external servers to handle trade data raises concerns about security. Even with encryption, transmitting sensitive account details offsite exposes traders to potential risks. For those managing large accounts, this vulnerability becomes even more critical, as compromised data could lead to significant financial and operational consequences.

Reliability

While cloud providers often tout impressive uptime statistics like 99.99%, their systems are not immune to disruptions. Outages, API failures, or unexpected bugs can occur at the worst possible moments, particularly during volatile market conditions. Some traders have reported severe issues, such as trades failing to close properly, resulting in unexpected losses during critical periods. This reliance on third-party infrastructure can undermine trust in the system when it’s needed most.

Advantages and Disadvantages

When deciding between native and cloud-based trade copiers, the right choice often comes down to your trading environment and priorities. Each option has strengths and weaknesses that can directly influence trade execution and risk management.

Let’s start with Tickblaze IgniteCopier, a native trade copier. Its standout feature is instant trade replication. Since it operates entirely on your local machine, trades are executed without routing through external servers. This not only speeds up execution but also eliminates data security concerns - your broker credentials and trade details stay on your device. This level of security is why many proprietary trading firms approve its use.

That said, IgniteCopier does come with requirements. It depends on an active trading platform, meaning your Windows 11 machine must remain online and connected. Additionally, it requires specific hardware - such as an Intel Core i7 (11th Gen or newer) and at least 16GB of RAM - to function smoothly. For traders looking for a hands-off, always-on solution, this can be a drawback unless you set up a low-latency VPS for algorithmic trading.

On the other hand, cloud-based copiers shine in terms of accessibility. You can manage trades from any device with an internet connection, and these systems remain active even when your personal computer is off. They’re also typically easy to set up, often requiring no software installation. However, there are some downsides. Sensitive account data is transmitted to offsite servers, which may raise compliance concerns. Plus, the extra network routing can introduce latency - sometimes exceeding 200 milliseconds during periods of high market volatility.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

| Criteria | Tickblaze IgniteCopier | Cloud-Based Copiers |

|---|---|---|

| Execution Speed | Instant (local replication) | 200ms+ delay during peak volatility |

| Data Security | 100% local; no external transmission | Data sent to third-party servers |

| Broker Compliance | Approved by most firms | Often restricted |

| Uptime Requirement | Platform must be running | Runs 24/7 in the cloud |

| Hardware Needs | High (i7 CPU, 16GB RAM, Windows 11) | Minimal; browser-based access |

| Setup Time | Less than 1 minute within Tickblaze | Varies; typically API-based |

So, how do you decide? If execution speed and strict compliance rules are your top priorities, the native model offers a more reliable solution. But, if you value remote flexibility and the ability to trade from any device without worrying about hardware, a cloud-based copier might be the better fit - though you’ll need to weigh its slower execution and data security trade-offs. This breakdown highlights the key factors to consider as you choose the best option for your trading needs.

Conclusion

Tickblaze IgniteCopier stands out as a powerful tool for traders who prioritize speed, compliance, and reliability. By handling trades locally rather than routing them through external servers, it eliminates the 200ms+ delays often seen in cloud-based systems during high-volatility periods. This level of performance is especially critical for futures traders and scalpers, where even the smallest delay can lead to missed opportunities or slippage.

Its local execution not only boosts performance but also ensures compliance. By operating within a broker-approved framework and avoiding third-party APIs, IgniteCopier meets the stringent requirements set by many proprietary trading firms. This approach keeps data secure and aligns with the compliance standards traders need to follow.

For those juggling multiple funded accounts, IgniteCopier offers built-in risk controls and detailed audit logs, making account management both secure and transparent. Traders have praised its stability during volatile market conditions, and with a setup process that takes under a minute, it’s ready to perform without relying on external infrastructure that could fail at critical moments.

Whether you’re a prop trader, scalper, or risk manager, IgniteCopier’s local execution model provides the precision, security, and firm approval needed in today’s rule-driven trading environments. For traders seeking dependable and precise trade execution, IgniteCopier delivers where it matters most.

FAQs

How does Tickblaze IgniteCopier stay compliant with brokers?

Tickblaze IgniteCopier prioritizes compliance by functioning directly within the Tickblaze platform, utilizing only approved broker connections. Unlike external tools, it eliminates the need for third-party APIs, cloud-based routing, or unapproved trade-injection methods. This ensures all trades are executed securely and locally.

This setup meets the compliance standards set by brokers and proprietary trading firms, making it a dependable option for traders working in regulated settings or under stringent trading guidelines.

What are the hardware requirements for running Tickblaze IgniteCopier?

To use Tickblaze IgniteCopier, your computer needs to meet the basic system requirements set by Tickblaze. This means you’ll need Windows 11 or later, an Intel Core i7 11th-gen or newer processor, and a minimum of 16 GB of RAM. On top of that, make sure the Microsoft .NET Framework 9.0 is installed.

Meeting these requirements is crucial for seamless performance and dependable trade copying on the Tickblaze platform.

Why would a trader choose a local trade copier instead of a cloud-based one?

A local trade copier brings several benefits to traders by integrating directly into the trading platform. One major advantage is faster trade execution, thanks to reduced latency. Since trades don’t rely on external servers, they happen quickly and without unnecessary delays.

This setup also boosts reliability. By avoiding third-party cloud services, there’s less risk of downtime or missed opportunities. On top of that, security is stronger because trade data stays within the platform, eliminating the need to route through external networks.

Another plus is that local trade copiers are often more broker-compliant, as they don’t rely on unofficial APIs or external automation tools. For traders who value speed, security, and staying within compliance guidelines, a local trade copier is an excellent option.

Tickblaze IgniteCopier prioritizes compliance by functioning directly within the Tickblaze platform, utilizing only approved broker connections. Unlike external tools, it eliminates the need for third-party APIs, cloud-based routing, or unapproved trade-injection methods. This ensures all trades are executed securely and locally.

This setup meets the compliance standards set by brokers and proprietary trading firms, making it a dependable option for traders working in regulated settings or under stringent trading guidelines.

To use Tickblaze IgniteCopier, your computer needs to meet the basic system requirements set by Tickblaze. This means you’ll need Windows 11 or later, an Intel Core i7 11th-gen or newer processor, and a minimum of 16 GB of RAM. On top of that, make sure the Microsoft .NET Framework 9.0 is installed.

Meeting these requirements is crucial for seamless performance and dependable trade copying on the Tickblaze platform.

A local trade copier brings several benefits to traders by integrating directly into the trading platform. One major advantage is faster trade execution, thanks to reduced latency. Since trades don’t rely on external servers, they happen quickly and without unnecessary delays.

This setup also boosts reliability. By avoiding third-party cloud services, there’s less risk of downtime or missed opportunities. On top of that, security is stronger because trade data stays within the platform, eliminating the need to route through external networks.

Another plus is that local trade copiers are often more broker-compliant, as they don’t rely on unofficial APIs or external automation tools. For traders who value speed, security, and staying within compliance guidelines, a local trade copier is an excellent option.

"}}]}