Top 16 Forex Brokers Reviewed (2026): Spreads & Leverage

Looking for the best Forex broker in 2026? Here's what you need to know upfront:

- Speed matters. Execution speeds vary widely, with brokers like Pepperstone and BlackBull Markets leading at 77ms and 72ms, respectively.

- Tight spreads save costs. IC Markets offers spreads as low as 0.02 pips, while Fusion Markets charges the lowest commission at $2.25 per lot.

- Platforms differ. Popular options include MetaTrader 4/5, cTrader, and TradingView. Some brokers, like Axi Global, stick to MT4, while others, like Eightcap, include advanced tools like Capitalise.ai.

- Leverage options vary. Offshore brokers like Exness and Vantage go up to 1:500, while brokers under stricter regulators (e.g., ASIC) cap leverage at 1:30 for retail traders.

- VPS hosting is key for automation. Low-latency VPS solutions, such as QuantVPS, help traders reduce delays, especially for brokers hosting servers in Equinix data centers (e.g., NY4, LD5).

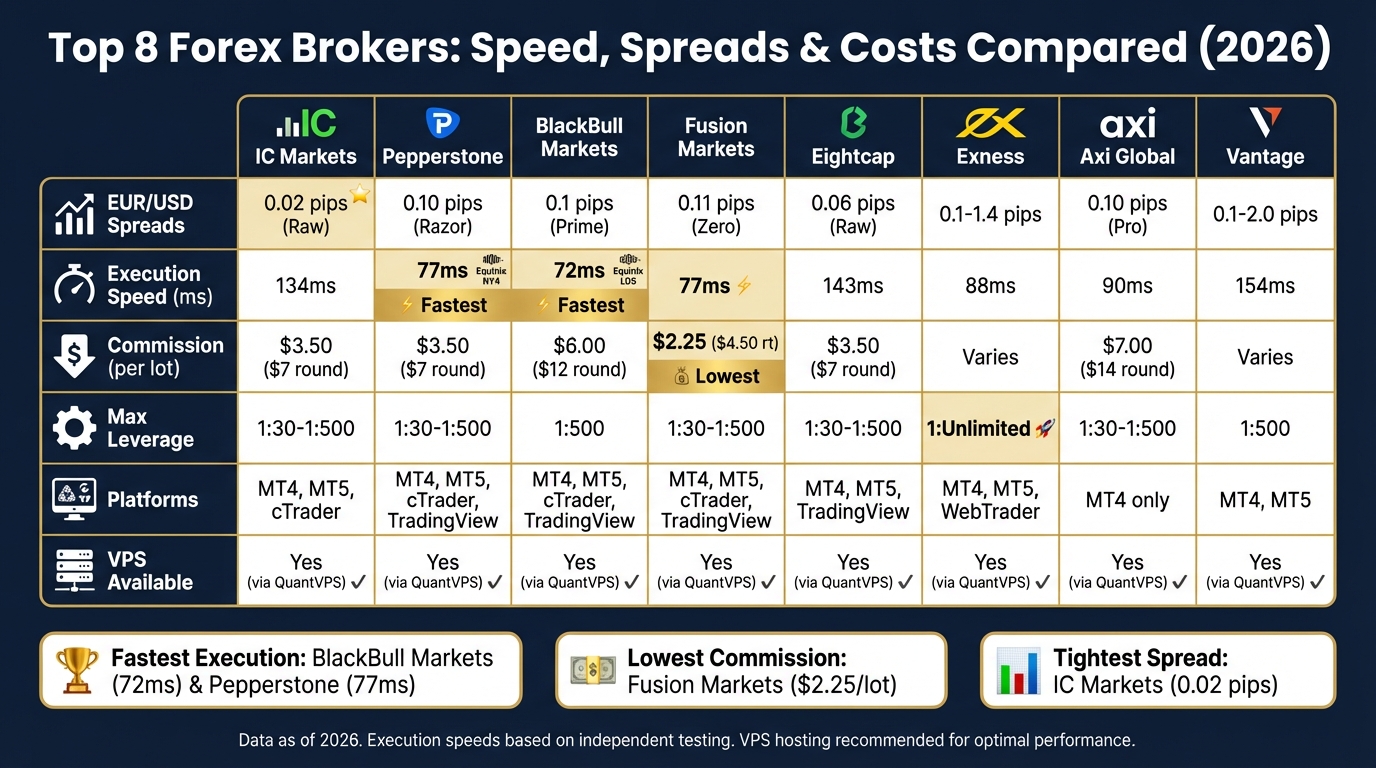

Quick Comparison Table

| Broker | Spreads (EUR/USD) | Execution Speed | Platform Options | Leverage | Commission | VPS Hosting |

|---|---|---|---|---|---|---|

| IC Markets | 0.02 pips (Raw) | 134ms | MT4, MT5, cTrader | 1:30–1:500 | $3.50/lot ($7 round) | Yes (via QuantVPS) |

| Pepperstone | 0.10 pips (Razor) | 77ms | MT4, MT5, cTrader | 1:30–1:500 | $3.50/lot ($7 round) | Yes (via QuantVPS) |

| BlackBull Markets | 0.1 pips (Prime) | 72ms | MT4, MT5, cTrader | 1:500 | $6.00/lot ($12 round) | Yes (via QuantVPS) |

| Axi Global | 0.10 pips (Pro) | 90ms | MT4 only | 1:30–1:500 | $7.00/lot ($14 round) | Yes (via QuantVPS) |

| Fusion Markets | 0.11 pips (Zero) | 77ms | MT4, MT5, cTrader | 1:30–1:500 | $2.25/lot ($4.50 rt) | Yes (via QuantVPS) |

| Eightcap | 0.06 pips (Raw) | 143ms | MT4, MT5, TradingView | 1:30–1:500 | $3.50/lot ($7 round) | Yes (via QuantVPS) |

| Exness | 0.1–1.4 pips | 88ms | MT4, MT5, WebTrader | 1:Unlimited | Varies by account | Yes (via QuantVPS) |

| Vantage | 0.1–2.0 pips | 154ms | MT4, MT5 | 1:500 | Varies by account | Yes (via QuantVPS) |

This guide breaks down the top brokers for scalping, algorithmic trading, and retail investing, helping you match your strategy to the right platform. Dive in for detailed reviews, features, and how to optimize your trading setup.

Top 8 Forex Brokers Comparison: Spreads, Speed & Commissions 2026

Top 8 Forex Brokers Comparison: Spreads, Speed & Commissions 2026

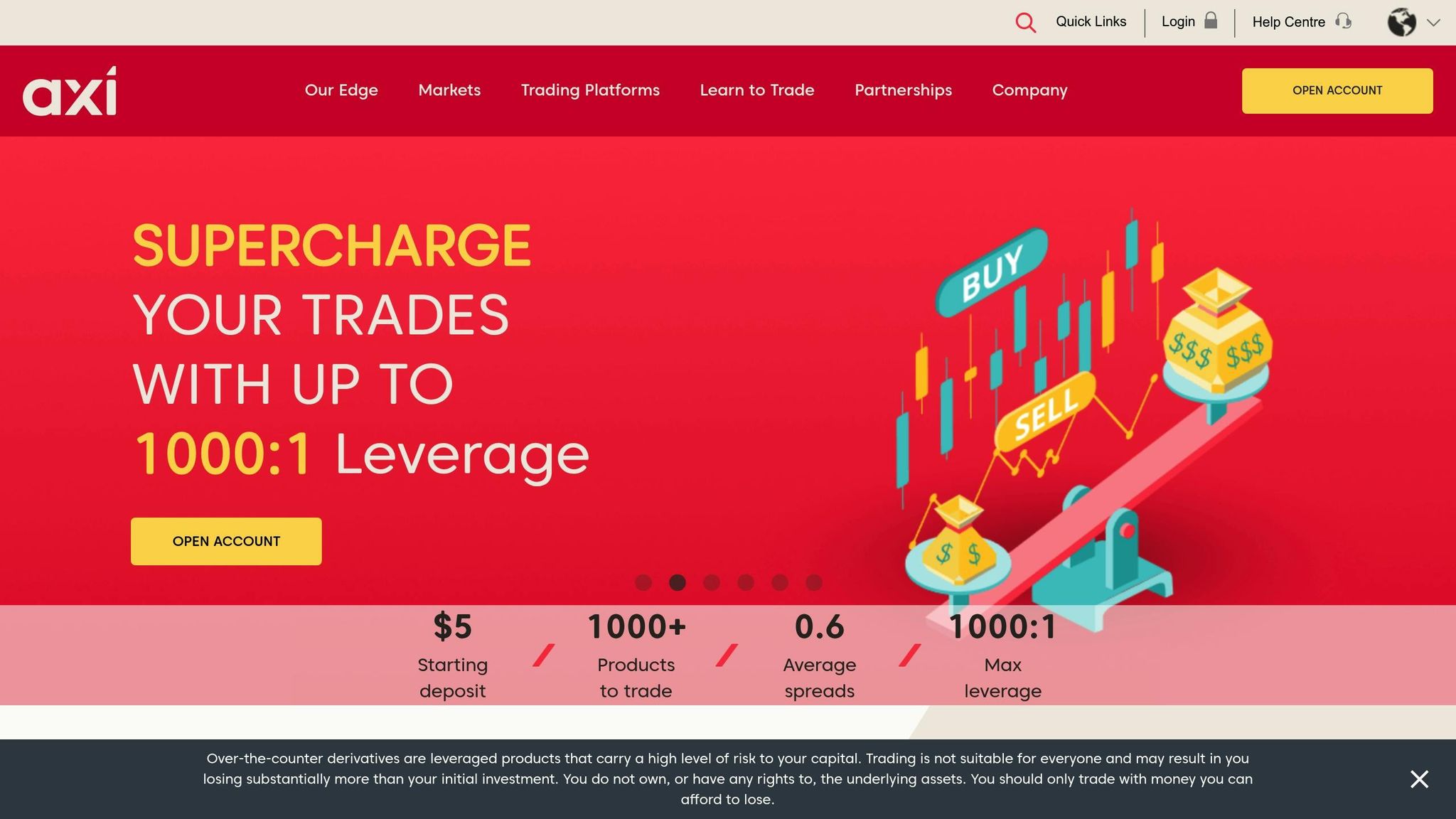

1. Axi Global

Regulation and Reputation

Axi Global operates under the regulation of top-tier authorities, including ASIC in Australia, FCA in the UK, and DFSA in Dubai, ensuring a strong focus on trader protection. The broker has garnered a 4.4/5 rating on Trustpilot, based on over 4,000 reviews, with 74% of users giving it a five-star rating. However, it’s worth noting that Axi’s license was suspended by New Zealand's FMA in November 2019 due to non-compliance with the Financial Markets Conduct Act 2013. As a result, the broker no longer serves retail traders in New Zealand.

Spreads and Commissions

Axi provides two types of accounts to suit different trading styles:

- Standard Account: This account has no commission but offers wider spreads, averaging 1.71 pips on EUR/USD.

- Pro Account: Designed for traders seeking tighter spreads, this account charges $7.00 USD round-trip per standard lot and features spreads starting as low as 0.10 pips.

While the Pro Account delivers raw spreads, it falls behind competitors like IC Markets (0.02 pips) and Eightcap (0.06 pips). For high-volume traders, the Pro Account’s commission-based structure is often more cost-effective compared to the Standard Account's higher spreads.

Available Platforms

Axi is dedicated solely to the MetaTrader 4 platform, enhanced with the MT4 Next Generation suite. This upgrade includes tools like a Sentiment Indicator, Correlation Trader, and Automated Trade Journal. This focus on MT4 appeals to traders who value its reliability and robust features.

Execution Model and Latency

As an ECN/NDD broker, Axi provides direct access to liquidity from 14 global banks. The broker reports an execution latency of approximately 30ms. However, independent tests have measured limit order execution speeds at 90ms, ranking Axi 15th among major brokers. Axi also supports automated trading and hedging without restrictions, making it a suitable choice for algorithmic traders. For optimal performance, VPS hosting is highly recommended to minimize latency.

VPS Hosting

For traders utilizing Expert Advisors or scalping strategies, a low-latency VPS is essential to maintain uninterrupted connections to Axi's servers. This setup ensures smooth execution by directly linking traders to Axi’s liquidity providers and global banking networks. With Axi handling a monthly trading volume exceeding $12 billion, stable platform uptime is critical for strategies where even milliseconds can influence profitability. QuantVPS offers tailored hosting solutions that bring MT4 platforms within milliseconds of Axi’s servers in key financial centers, enabling high-frequency traders to operate efficiently.

2. BlackBull Markets

Regulation and Reputation

BlackBull Markets operates under the regulatory oversight of New Zealand's FMA and Seychelles' FSA. The FMA license is highly regarded in the trading world due to New Zealand's strict conduct standards and transparent regulatory guidelines. The broker markets itself as a "True ECN" provider, offering institutional-grade liquidity and direct market access, which are particularly appealing to professional traders and scalpers. With an impressive overall rating of 4.8 out of 5 stars, BlackBull Markets has built a reputation for reliability and high performance. It stands out for its execution speed, processing limit orders in just 72 milliseconds and market orders in 90 milliseconds.

Spreads and Commissions

BlackBull Markets offers three ECN account tiers tailored to different trading needs:

- Standard: Spreads starting at 0.8 pips with no commission.

- Prime: Spreads beginning at 0.1 pips, accompanied by a $6.00 round-turn commission.

- Institutional: Custom pricing structures available for accounts starting with a $20,000 deposit.

The $6.00 commission for the Prime account strikes a balance, ensuring competitive pricing across the tiers.

Available Platforms

Traders with BlackBull Markets can access a variety of platforms, including MetaTrader 4, MetaTrader 5, cTrader, and TradingView. Additionally, the broker offers proprietary tools like BlackBull CopyTrader for social trading and BlackBull Invest for managing multi-asset portfolios. These platform options underscore the broker's focus on delivering ultra-fast and efficient trade execution.

Execution Model and Latency

BlackBull Markets operates as a True ECN broker, connecting traders directly to institutional liquidity providers. The broker's servers are housed in Equinix data centers located in New York (NY4), London (LD5), and Tokyo (TY3). This infrastructure ensures some of the fastest execution speeds in the ECN category, with limit orders executing in 72 milliseconds and market orders in 90 milliseconds. For those utilizing Forex algorithms, co-located VPS hosting at these Equinix hubs provides sub-millisecond latency. QuantVPS further enhances connectivity to BlackBull's servers, enabling high-frequency trading strategies to perform seamlessly without delays that could affect profits.

Unique Features

BlackBull Markets brings additional perks to its clients beyond competitive pricing and platform variety. Eligible clients can access leverage of up to 1:500, which is significantly higher than what is typically available under ASIC or FCA regulations. The broker also offers access to an extensive selection of over 23,000 tradable shares, though availability may vary depending on the region.

3. Blueberry Markets

Regulation and Reputation

Blueberry Markets operates under the watchful eye of the Australian Securities and Investments Commission (ASIC). Known for its transparency and dependability, the broker has earned a solid reputation in a well-regulated environment. It was even a finalist in Finder's Innovation Awards for "Best Online Customer Service" in both 2020 and 2021. One standout feature is the assignment of dedicated account managers to all clients, whether they use demo or live accounts. On top of that, the broker holds a 4.4 out of 5-star rating on Myfxbook, based on feedback from 40 reviewers.

Spreads and Commissions

Blueberry Markets provides two account types: Standard and RAW. The Standard account offers spreads starting at 1.2 pips on EUR/USD with no additional commissions. Meanwhile, the RAW account is tailored for traders seeking direct market access, with spreads starting as low as 0.3 pips and a commission of AUD $3.50 per lot. The broker has also maintained 0.0 pip spreads on key pairs like EUR/USD, AUD/USD, and USD/CAD. This commission rate is highly competitive in the Australian market, sitting between Fusion Markets' AUD $2.25 and IC Markets' AUD $4.50 per lot.

Available Platforms

Blueberry Markets supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), offering a versatile trading experience for manual and algorithmic traders alike. With access to over 300 tradable instruments - including currencies, indices, commodities, and share CFDs - traders have plenty of options to explore. The broker also provides 24/7 one-on-one customer support to assist with platform setup and technical issues. Additionally, it ensures compatibility with professional VPS hosting solutions, enabling low-latency execution for advanced trading strategies.

Execution Model and Latency

Blueberry Markets operates as an ECN broker, delivering direct market access with lightning-fast execution speeds. Market orders are executed in just 94 milliseconds, making it an attractive choice for traders using high-frequency or algorithmic strategies. For those aiming to reduce latency further, using a VPS located near Blueberry Markets' servers is a smart move. QuantVPS, for instance, offers optimized connectivity to Australian brokers, ensuring minimal delays for automated forex trading systems.

Unique Features

With leverage of up to 1:500 and support for accounts in eight different base currencies, Blueberry Markets is designed to accommodate a global clientele. The broker also places a strong emphasis on trader education and customer support, reflecting its commitment to helping clients succeed in their trading endeavors.

4. Deriv

Regulation and Reputation

Deriv doesn't provide extensive regulatory details, but it has carved a space for itself by offering unique trading products. One of its most notable features is its synthetic indices, which allow traders to engage in 24/7 trading, bypassing the constraints of standard market hours.

Spreads and Commissions

The spreads and commissions at Deriv vary based on the type of account you choose. Some accounts operate on a spread-only pricing model, while others include per-lot fees. For major currency pairs, the broker provides competitive spreads, which differ depending on whether you select a standard or advanced account setup.

Available Platforms

Deriv supports a variety of trading platforms, including DMT5, Deriv X, Deriv EZ, DTrader, SmartTrader, and DBot. These platforms cater to both manual and algorithmic trading preferences. For algorithmic traders, Deriv MT5 supports the use of Expert Advisors (EAs), while DBot offers a web-based tool to create trading bots without requiring any coding knowledge. To further enhance performance, Deriv also provides low-latency VPS hosting.

Latency and VPS Hosting

Fast execution is crucial for successful trading, especially for automated strategies. On Deriv MT5, where speed can make or break high-frequency and scalping strategies, minimizing latency is a priority. Using a VPS located near Deriv's servers can significantly reduce delays. For instance, QuantVPS offers optimized connectivity for MetaTrader 5 users, ensuring consistent uptime and rapid execution speeds, no matter your location.

Unique Features

What sets Deriv apart is its proprietary synthetic indices, which operate independently of traditional market hours and are available 24/7. This, combined with its comprehensive lineup of trading platforms and automation tools, makes it an attractive choice for traders seeking alternatives to standard forex pairs and CFDs. It's especially appealing for those employing high-frequency strategies that benefit from round-the-clock market access.

5. Eightcap

Regulation and Reputation

Eightcap operates under the regulation of the Australian Securities and Investments Commission (ASIC) and the Securities Commission of the Bahamas (SCB). It has secured a Forex Panel Score of 96/100 from expert reviewers, reflecting its strong position in the industry. On Trustpilot, the broker has a 4.4/5 star rating based on feedback from over 3,000 users, placing it in the "Excellent" category. Traders frequently commend the broker for its responsive customer support and the reliability of its trading platforms.

Spreads and Commissions

Eightcap provides two account options tailored to different trading styles. The Standard account features spreads starting at 1.0 pips with no commission, while the Raw account offers spreads as low as 0.0 pips, with a commission of $3.50 per lot ($7.00 for a round-turn). During 24-hour testing, the Raw account maintained a 0.0 pip spread 97.83% of the time outside of rollover periods. For EUR/USD, the average spread on the Raw account is an impressive 0.06 pips, far below the industry average of 0.22 pips. The minimum deposit required to start trading is $100.

Available Platforms

Eightcap complements its regulatory credentials with a range of powerful trading platforms. It supports MT4, MT5, TradingView, and Capitalise.ai. The integration of Capitalise.ai stands out, as it allows traders to automate their strategies without any coding skills. The broker offers access to over 800 tradable instruments, including 56 forex pairs, 586 shares, and 16 indices. Its cryptocurrency offering is particularly notable, with 95+ crypto markets, making it the largest selection among forex brokers reviewed.

Execution Model

Eightcap operates as a No Dealing Desk (NDD) broker, offering ECN-style pricing on its Raw account. Its execution speed for limit orders averages 143 milliseconds, which is competitive but not the fastest available. The broker supports the use of Expert Advisors (EAs) and offers Forex VPS solutions to help algorithmic traders minimize latency.

Latency and VPS Hosting

For traders using automated systems or scalping strategies, reducing latency is crucial. Eightcap's servers are optimized for fast execution, but pairing them with a low-latency VPS can further enhance performance. QuantVPS provides MetaTrader users with optimized server connections, including locations in Singapore, ensuring minimal delays to Eightcap's execution servers. This setup is particularly valuable for high-frequency strategies, where even milliseconds can make a difference.

6. Exness

Regulation and Reputation

Exness operates under the oversight of eight international regulatory bodies, including the FCA, CySEC, and FSCA. As of January 2026, the broker holds an impressive performance rating of 86%, backed by 393 customer reviews across major rating platforms. On top of that, Myfxbook users have rated Exness 4.3 out of 5 stars, reflecting a high level of satisfaction with its reliability and transparency.

Spreads and Commissions

Exness offers four account types: Standard, Pro, Raw Spread, and Zero. The Standard account requires just a $10 deposit and charges no commissions, making it a popular choice for beginners. On the other hand, Raw Spread and Zero accounts cater to more experienced traders, offering spreads starting from 0.0 pips with a commission. Typical spreads range between 0.1 and 1.4 pips. With access to 134 currency pairs, Exness serves a global community of more than 500,000 traders. The broker’s dynamic leverage model adjusts automatically based on account equity, providing leverage from 1:500 to as high as 1:Unlimited, depending on the account type.

Available Platforms

Exness supports a variety of trading platforms, including MetaTrader 4, MetaTrader 5, the Exness Trade App, and WebTrader. These platforms cater to both manual traders and those using Expert Advisors (EAs). For high-frequency strategies and scalping, the Raw Spread and Zero accounts are particularly well-suited. Beyond forex, Exness also offers CFDs on gold, cryptocurrencies, stocks, and indices. This diverse platform lineup ensures fast and dependable trade execution for traders of all styles.

Execution Model

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

As a Market Maker, Exness delivers impressive execution speeds, with market orders averaging 88 ms and limit orders at 92 ms. These speeds outperform competitors like Blueberry Markets (94 ms) and Global Prime (98 ms), though Fusion Markets leads slightly at 77 ms. Additionally, Exness processes withdrawals in seconds, adding to its appeal for traders seeking efficiency.

Latency and VPS Hosting

For traders focused on automated and scalping strategies, even small delays can impact profitability. While Exness’s servers are optimized for quick order processing, using one of the cheapest forex VPS options can further reduce delays. QuantVPS, for instance, offers optimized connections to Exness servers from New York, making it a valuable tool for algorithmic traders and high-frequency strategies. This setup is particularly beneficial during volatile market conditions, where every millisecond can make a difference.

7. FTMO

Regulation and Reputation

FTMO stands out with a model that’s quite different from traditional brokers. Instead of acting as a typical brokerage, FTMO operates as a proprietary trading firm. It funds skilled traders through a two-step evaluation process, giving them the chance to trade larger accounts without putting their own money at risk. This performance-driven approach sets it apart from standard broker accounts.

Unique Features

What makes FTMO particularly interesting is its two-step evaluation process. The first phase, called the FTMO Challenge, is followed by a Verification stage. These steps are designed to assess a trader’s discipline and risk management skills. Those who pass both stages earn the title of FTMO Trader and can trade accounts as large as $200,000. Trades are executed in live markets through FTMO’s liquidity partners, ensuring a real-world trading experience.

Available Platforms

FTMO accommodates traders by supporting both MetaTrader 4 and MetaTrader 5. This means traders can continue using their trusted Expert Advisors and custom indicators without needing to learn a new platform.

Latency and VPS Hosting

For traders relying on forex algorithmic trading strategies or scalping, execution speed matters. FTMO’s liquidity providers deliver dependable performance, but using a low-latency VPS can enhance this even further. Services like QuantVPS, with optimized connections from hubs in New York and London, help reduce delays - an edge that can be especially useful during the evaluation stages.

8. Fusion Markets

Regulation and Reputation

Fusion Markets operates under the regulation of the Australian Securities and Investments Commission (ASIC) and the Financial Services Authority (FSA) of Seychelles. Known for its competitive pricing, the broker stands out with trading costs that are about 36% lower than many competitors. This cost advantage, coupled with its reliable services, has earned it a strong reputation among traders. Fusion Markets boasts an impressive 4.6/5 rating on Myfxbook, based on feedback from 57 reviews. Adding to its credibility, independent tests have confirmed that it is the fastest broker for market order execution, with an average execution speed of just 77 milliseconds.

Spreads and Commissions

Fusion Markets offers two account types to cater to different trading preferences:

- Classic Account: Features commission-free trading but comes with slightly wider spreads.

- ZERO Account: Designed for traders seeking raw spreads, this account charges a commission of $2.25 per side ($4.50 round-turn). For EUR/USD, spreads typically range between 0.11 and 0.14 pips, maintaining a 0-pip spread 100% of the time outside rollover periods.

These options provide flexibility for traders, whether they prioritize lower upfront costs or tighter spreads.

Available Platforms

Fusion Markets supports a wide range of trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, TradingView, and DupliTrade. On top of that, the broker offers its proprietary copy trading tool, Fusion+, which allows clients to either follow top-performing traders or have their own trades replicated. This diverse platform selection aligns with Fusion Markets' focus on delivering fast and transparent trading experiences.

Execution Model

Fusion Markets operates as an ECN/STP broker, meaning it routes orders directly to the market without interference, ensuring quick and transparent execution.

Latency and VPS Hosting

For traders who value speed, Fusion Markets excels with its low-latency infrastructure. Independent testing confirmed an average market order execution speed of 77 milliseconds. To further enhance performance, the broker offers sponsored VPS hosting for clients trading at least 20 lots per month. For those using automated or scalping strategies, pairing Fusion Markets with QuantVPS's Singapore hub can further reduce delays, ensuring optimal execution speeds.

9. Global Prime

Regulation and Reputation

Global Prime is regulated by the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC). This Australian-owned broker has been in operation since 2010, now serving clients across more than 170 countries. Its global reach is supported by a strong focus on transparent trade execution and low-latency performance. Promoting itself as a "True ECN" broker, Global Prime uses a no-dealing-desk model, granting traders direct access to institutional liquidity. On Myfxbook, it holds a 3.9/5 rating from 38 reviews, which is slightly lower than competitors like Pepperstone (4.4) and IC Markets (4.2). However, its customer service and pricing scores stand at 4.1/5 and 3.8/5, respectively.

Spreads and Commissions

Global Prime offers raw spreads starting at 0.0 pips, with the EUR/USD pair averaging 0.16 pips. The broker charges a commission of $7.00 AUD per round-turn lot, which is standard for ECN brokers, though it may be higher than some competitors. There’s no minimum deposit requirement, and traders can choose from several base account currencies, including USD, AUD, GBP, EUR, CAD, JPY, and SGD.

Available Platforms

Traders can access Global Prime through MetaTrader 4, MetaTrader 5, web-based platforms, and mobile apps. Additionally, integration with TradingView is expected soon, expanding its platform offerings.

Execution Model

As a true ECN broker, Global Prime routes orders directly to the market. While the broker advertises execution speeds as fast as 10 milliseconds, independent tests show slightly slower times: 88 milliseconds for limit orders and 98 milliseconds for market orders. In a 2025 ranking of over 35 brokers, Global Prime claimed the 9th spot for execution speed - outperforming IC Markets but falling behind Fusion Markets and Pepperstone.

Latency and VPS Hosting

To address latency concerns, particularly for traders using automated strategies, Global Prime provides sponsored VPS hosting. By leveraging QuantVPS's London hub, the broker minimizes latency during European trading hours, a key reason why traders choose QuantVPS for high-frequency execution, making it a strong choice for scalpers and those employing expert advisors (EAs).

10. IC Markets

Regulation and Reputation

IC Markets operates under the watchful eye of Tier-1 regulators, including the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC). Their international reach extends through oversight by the Financial Services Authority of Seychelles and the Securities Commission of the Bahamas. For clients in the UK and certain EU countries, services are provided via IC Trading, regulated by Mauritius's Financial Services Commission. As one of the largest brokers globally by trading volume, IC Markets processes over 500,000 trades daily, generating an impressive US$1.64 trillion in volume. With a client base exceeding 180,000 active traders, it’s a favorite among algorithmic traders, who contribute to about 60% of its total trade volume. On Trustpilot, IC Markets shines with a 4.8/5 star rating from 46,000 reviews, with 91% of users awarding it five stars. These accolades highlight its strong reputation and set the stage for an in-depth look at its features.

Spreads and Commissions

IC Markets caters to diverse trading needs with two main account types. The commission-free Standard Account offers spreads starting at 0.6 pips (averaging 0.82 pips on EUR/USD). For those seeking tighter spreads, the Raw Account begins at 0.0 pips and includes a US$3.50 per lot commission (US$7.00 round-turn). High-volume traders can benefit from the Raw Trader Plus program, which provides commission rebates, reducing fees to as low as US$1.00–US$2.00 per lot. The Raw Account stands out with an average EUR/USD spread of just 0.02 pips - about 80% lower than many competitors. Additionally, IC Markets charges no fees for deposits, withdrawals, or inactivity, and requires a minimum deposit of US$200.

Available Platforms

Traders using IC Markets have access to a robust selection of platforms, including MetaTrader 4, MetaTrader 5, cTrader, and TradingView. To ensure low latency, the broker hosts its MetaTrader servers in Equinix NY4 (New York) and its cTrader servers in Equinix LD5 (London), both of which are major financial data centers. These platforms connect to interbank price feeds from more than 50 liquidity providers, ensuring reliable and efficient trading.

Execution Model

IC Markets operates using an ECN/No Dealing Desk model, offering direct market access. Independent testing shows limit order execution speeds of 134 ms and market orders at 153 ms, placing it 17th among over 35 brokers. While not the fastest in raw execution speed, IC Markets combines tight spreads and institutional-grade liquidity, making it a strong contender for automated trading strategies. Both account types benefit from this efficient execution model, which prioritizes competitive pricing.

Latency and VPS Hosting

For traders relying on expert advisors or high-frequency strategies, minimizing latency is key. IC Markets enhances this by placing its infrastructure close to Equinix data centers. QuantVPS offers optimized hosting from hubs in New York and London VPS providers, ensuring sub-millisecond connectivity to the broker's servers. High-volume traders enrolled in the Raw Trader Plus program also enjoy complimentary VPS hosting, further supporting their need for speed and reliability. This focus on low-latency execution underscores IC Markets' commitment to meeting the demands of today’s fast-paced trading environment.

11. IC Trading

Regulation and Reputation

IC Trading represents the Mauritius-based branch of IC Markets, catering specifically to clients in the UK and select EU regions. It operates under the Financial Services Commission (FSC) of Mauritius, providing a level of regulatory oversight. However, it’s worth noting that Mauritius regulation doesn’t offer the same level of protection as Tier-1 regulators like ASIC or CySEC. Even so, IC Trading benefits from the robust infrastructure of IC Markets, delivering high-quality execution to these regions. The platform processes more than 500,000 trades daily, with approximately 60% of those trades powered by algorithmic strategies. This focus on execution quality has earned the trust of professional traders, even for those who prioritize performance over regulatory jurisdiction.

Spreads and Commissions

IC Trading offers two distinct pricing models to accommodate a variety of trading styles. The Standard Account features spreads starting at 0.6 pips with no added commission. On the other hand, the Raw Spread Account provides ultra-tight spreads starting at 0.0 pips, paired with a $3.50 commission per lot ($7.00 round-turn). For EUR/USD, the average spread is just 0.02 pips. High-volume traders can benefit from the Raw Trader Plus program, which offers tiered commission rebates. For example, traders handling 2,000 lots or more per month qualify for Tier 3 status, reducing their effective commission to just $1.00 per lot. The platform requires a minimum deposit of $200 and does not charge fees for deposits, withdrawals, or inactivity.

Available Platforms

IC Trading enhances its competitive pricing with a versatile suite of trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, and TradingView. These platforms provide flexibility and cater to a range of trading needs. The broker’s MetaTrader servers are hosted in Equinix NY4 (New York), while cTrader servers are located in Equinix LD5 (London), two major financial hubs that ensure close proximity to liquidity providers. For algorithmic traders, cTrader offers FIX API connectivity and C# integration through cAlgo, enabling advanced automation. With direct access to over 50 banking and institutional liquidity providers, traders benefit from competitive pricing and reliable execution.

Execution Model

IC Trading operates using an ECN-style, No Dealing Desk (NDD) execution model. This means traders have direct market access without any conflict of interest. Independent testing has shown execution speeds of 134 ms for limit orders and 153 ms for market orders. Additionally, MetaTrader 4 users benefit from execution speeds under 30 ms, making the platform ideal for high-frequency and scalping strategies. Tight spreads and deep liquidity further enhance the trading experience.

Latency and VPS Hosting

For traders relying on expert advisors or high-frequency strategies, reducing latency is crucial. IC Trading’s servers, co-located in Equinix data centers, provide a strong foundation for low-latency trading. To optimize performance even further, external VPS hosting is available. QuantVPS offers dedicated hosting from hubs in New York and London, delivering sub-millisecond connectivity to IC Trading’s servers. High-volume traders enrolled in the Raw Trader Plus program can also enjoy complimentary VPS hosting, ensuring ultra-low latency for their trades.

12. Key to Markets

Regulation and Reputation

Key to Markets operates under the watchful eye of the FCA (Financial Conduct Authority) in the United Kingdom and also holds a license from the FSC (Financial Services Commission) in Mauritius. The FCA license places this broker among the most rigorously regulated platforms, ensuring client protection through measures like segregated accounts. This dual regulatory setup provides a balance of global reach and stringent standards. Over time, the broker has earned trust among professional traders who value strong regulatory oversight paired with reliable execution.

Spreads and Commissions

Key to Markets stands out with its competitive pricing, offering raw spreads that start as low as 0.0 pips. For popular currency pairs like EUR/USD, spreads typically range from 0.0 to 0.2 pips during peak market hours. The broker uses a transparent, commission-based pricing model, making trading costs predictable. This setup is particularly appealing to high-frequency and algorithmic traders who rely on consistent and clear cost structures for their trading strategies.

Available Platforms

Traders using Key to Markets can access the widely-used MetaTrader 4 (MT4) platform, enhanced with FIX API connectivity. This setup caters to algorithmic traders and institutional clients who need direct market access and advanced technical capabilities. The FIX API integration supports custom trading applications, automated strategies, and lightning-fast order execution, bypassing the limitations of standard retail platforms. While MT4 serves as the primary interface, the FIX API provides the technical backbone for more sophisticated trading needs, making it an ideal choice for developers and quantitative traders building proprietary systems.

Execution Model

Key to Markets employs a DMA (Direct Market Access) execution model, which connects traders directly to institutional liquidity providers without involving intermediaries. This eliminates conflicts of interest and ensures that orders are executed at the best available market prices. The DMA model offers complete transparency, allowing traders to access deep liquidity pools and experience minimal slippage under normal market conditions. This execution style is particularly advantageous for scalpers and algorithmic traders who depend on precise order fills and tight spreads.

Latency and VPS Hosting

For traders running automated strategies, server location can make or break performance. Key to Markets hosts its trading infrastructure in London, a major global financial hub with direct connections to liquidity providers. To further enhance speed, QuantVPS provides dedicated London-based hosting, offering sub-millisecond connectivity. This setup minimizes network delays, ensuring orders hit the market as quickly as possible - a crucial factor for strategies where every millisecond counts.

13. Pepperstone

Regulation and Reputation

Pepperstone operates under some of the strictest regulatory standards in the trading industry. The broker is licensed by Tier-1 regulators such as ASIC (Australia), FCA (United Kingdom), BaFin (Germany), and CySEC (Cyprus). It also holds Tier-2 oversight from the DFSA (UAE) and Tier-3 licenses from the SCB (Bahamas) and CMA (Kenya). Established in 2010 in Melbourne, Pepperstone has grown to serve 400,000 traders globally. It boasts a 9.0/10 trust score, with client funds kept in segregated accounts and a spotless compliance history. With around 110,000 Google searches per month and a daily trading volume of $9.2 billion, Pepperstone ranks as the 20th most searched forex broker worldwide in 2024. This strong regulatory foundation supports its competitive pricing and market presence.

Spreads and Commissions

Pepperstone’s Razor Account is designed for traders seeking tight spreads, offering spreads from 0.0 pips on major pairs like EUR/USD, with an average of 0.10 pips. Commissions are $3.50 per side ($7.00 round trip) per 100k traded for USD and AUD accounts. Tests conducted in 2025 confirmed a 100% occurrence of 0.0 pip spreads on major currency pairs. Meanwhile, the Standard Account provides commission-free trading with spreads starting from 1.0 pips. For high-volume traders, the Active Trader Program offers rebates that can significantly lower effective commission costs.

"Pepperstone's sweet spot continues to be their Razor Account, which our tests found to have some of the lowest spreads of all brokers." - Justin Grossbard, CEO, CompareForexBrokers

"Pepperstone's sweet spot continues to be their Razor Account, which our tests found to have some of the lowest spreads of all brokers." - Justin Grossbard, CEO, CompareForexBrokers

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Available Platforms

Pepperstone supports a wide range of trading platforms. These include MetaTrader 4, ideal for automated trading using Expert Advisors, and MetaTrader 5, which caters to multi-asset trading, including share CFDs. cTrader offers features like direct market depth and scalping tools, while TradingView provides advanced charting capabilities with over 90 drawing tools. Additionally, the broker has developed a proprietary mobile and web platform tailored for beginners, offering an intuitive way to monitor forex, crypto, and indices markets. For traders interested in social and copy trading, Pepperstone integrates with Signal Start for automated MT4/5 strategy copying, DupliTrade for pre-screened strategies (with a $5,000 minimum deposit), and its dedicated CopyTrading by Pepperstone app for mobile users. These platform options pair seamlessly with Pepperstone's fast execution model, ensuring smooth trading experiences.

Execution Model

Pepperstone operates as a No Dealing Desk (NDD) broker, utilizing a Straight-Through Processing (STP) model. This eliminates requotes and ensures orders are routed directly to liquidity providers. During technical testing in 2025/2026, Pepperstone recorded the fastest limit order execution speed at 77ms, outperforming competitors like IC Markets (134ms) and Eightcap (143ms).

"Pepperstone achieved an outstanding 77 ms limit order execution speed, which ranked as the fastest out of all the brokers we tested." - Ross Collins, Head of Research, CompareForexBrokers

"Pepperstone achieved an outstanding 77 ms limit order execution speed, which ranked as the fastest out of all the brokers we tested." - Ross Collins, Head of Research, CompareForexBrokers

Latency and VPS Hosting

To complement its execution model, Pepperstone minimizes latency by strategically locating its servers. Its trading servers are housed in the Equinix NY4 data center in New York, placing them close to major liquidity providers to reduce network delays. For traders relying on automation or high-frequency strategies, QuantVPS offers hosting in New York with sub-millisecond connectivity. This setup is especially beneficial for algorithmic traders and scalpers who require ultra-low latency to maintain their edge. Combined with Pepperstone's 77ms execution speed, QuantVPS hosting creates an environment optimized for strategies where every millisecond counts.

14. ThinkMarkets

Regulation and Reputation

ThinkMarkets is licensed by several prominent regulatory bodies, including ASIC, FCA, FSCA, FSA-S, CySEC, and DFSA. These licenses ensure that client funds are kept in segregated accounts and retail traders benefit from Negative Balance Protection. In 2026, the broker achieved a Forex Panel Score of 80/100, reflecting its strong reputation as a CFD broker and a cost-effective stockbroker. With access to over 4,000 trading products, including 47 currency pairs and more than 3,000 global markets, ThinkMarkets has established itself as a reliable choice for traders worldwide.

Spreads and Commissions

ThinkMarkets provides two account options tailored to different trading needs. The Standard Account features commission-free trading with EUR/USD spreads starting at 1.1 pips. Meanwhile, the ThinkZero (RAW) Account offers tighter spreads from 0.1 pips, paired with a $3.50 commission per lot. On average, RAW spreads include 0.11 pips for EUR/USD, 0.4 pips for GBP/USD, and 0.3 pips for AUD/USD. Impressively, the broker maintains minimum spreads 97.93% of the time outside rollover periods. For stock trading via the ThinkTrader app, ASX shares cost $8 per trade.

Available Platforms

ThinkMarkets supports a variety of platforms, including MetaTrader 4, MetaTrader 5, TradingView, and its proprietary ThinkTrader app. MT4 and MT5 are ideal for traders using Expert Advisors for forex algorithmic trading, while TradingView offers sophisticated charting tools. The ThinkTrader app provides access to over 3,100 ASX shares and 352 ETFs, though the ThinkZero RAW account is not available on this platform. For scalpers, the ThinkZero account offers tight spreads, but execution speeds are moderate, averaging 161ms for limit orders and 248ms for market orders.

Execution Model and Latency

In execution tests, ThinkMarkets ranked 30th, with average speeds of 161ms for limit orders and 248ms for market orders. These figures highlight the importance of low-latency solutions for traders relying on high-frequency strategies. To address this, QuantVPS provides hosting in London, where ThinkMarkets' servers are located, helping to reduce network delays for automated trading systems.

Unique Features

ThinkMarkets sets itself apart by combining CFD trading with direct stock investing. Through the ThinkTrader app, traders gain access to over 3,100 ASX shares and 352 ETFs. The broker has no minimum deposit requirement for standard accounts, though RAW accounts do require a deposit and are subject to an inactivity fee. It’s worth noting that the ThinkZero account is not compatible with the ThinkTrader platform.

15. Tickmill

Regulation and Reputation

Tickmill operates as a multi-regulated ECN broker, holding licenses from respected authorities like the FCA (UK), CySEC (Cyprus), FSA (Seychelles), and FSCA (South Africa). This regulatory backing ensures a secure and reliable trading environment, particularly for traders using high-frequency strategies. With a 4.2/5 rating on Myfxbook based on 135 reviews, Tickmill has earned a reputation as a go-to broker for scalping and low-spread trading approaches.

Spreads and Commissions

Tickmill offers variable spreads starting as low as 0.0 pips on major currency pairs. Its commission structure is designed to minimize trading expenses, although fees vary depending on the account type. While standard accounts may have wider spreads on pairs like EUR/USD compared to fixed-spread accounts, the ECN model provides direct access to liquidity providers. This setup ensures transparency and high execution quality, making it appealing for traders focused on cost efficiency and precision.

Available Platforms

Traders with Tickmill can access MetaTrader 4, MetaTrader 5, and proprietary platforms tailored to diverse trading styles. Both MT4 and MT5 fully support Expert Advisors, making them ideal for algorithmic trading. Tickmill's platform infrastructure is built to handle high trading volumes across various markets, including Forex, Stocks, Indices, Commodities, Cryptocurrencies, and Bonds.

Execution Model and Latency

Tickmill emphasizes speed through its ECN execution model, delivering strong performance in this area. In 2025 testing, the broker ranked 10th for execution speed, averaging 91 ms for limit orders and 112 ms for market orders. While its limit order speed of 91 ms is competitive, it falls slightly behind the very fastest brokers. Scalpers and automated traders also benefit from low-latency hosting via QuantVPS on MT4 and MT5 platforms.

Unique Features

Tickmill is designed with high-frequency traders and Expert Advisor users in mind, offering ultra-fast execution, razor-thin spreads, and leverage up to 1:1,000. By focusing on speed and transparency, Tickmill provides traders with the tools they need to excel in fast-paced markets.

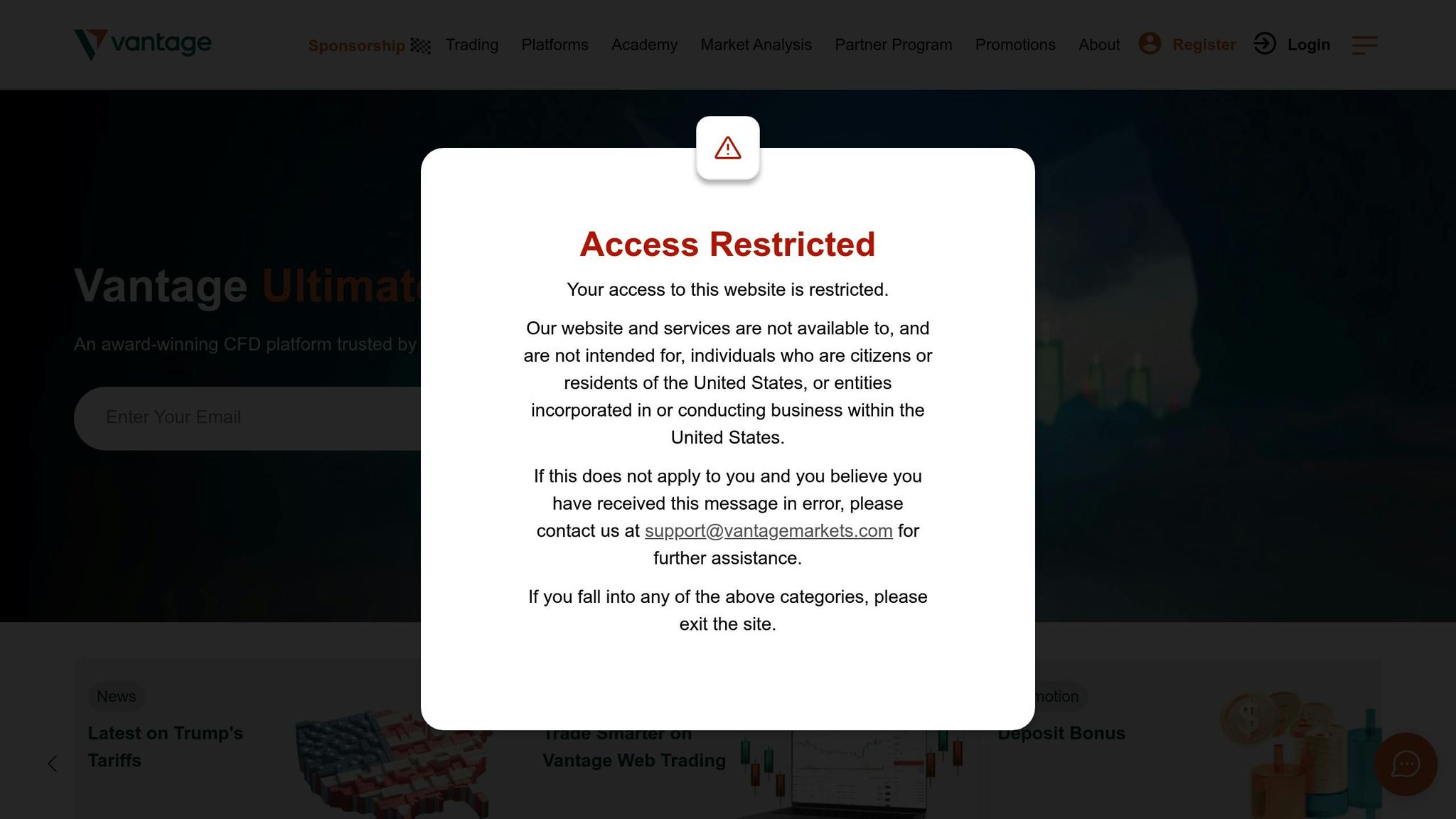

16. Vantage

Regulation and Reputation

Vantage operates under licenses from several well-known regulatory bodies, including the Australian Securities and Investments Commission (ASIC), the Financial Conduct Authority (FCA) in the UK, the Financial Sector Conduct Authority (FSCA) in South Africa, and the Vanuatu Financial Services Commission (VFSC). This multi-region regulatory oversight ensures a secure trading environment for its users.

That said, when it comes to execution speed, Vantage ranks 26th out of 36 brokers. Market orders take an average of 154 milliseconds, while limit orders average 175 milliseconds. While Vantage does offer competitive spreads, its infrastructure falls short compared to high-frequency trading specialists like Fusion Markets (77 ms) and BlackBull Markets (90 ms). This positions Vantage as a solid choice for standard retail traders but less appealing for those focused on ultra-high-frequency trading.

Spreads and Commissions

Vantage balances its regulatory credentials with attractive trading costs. The broker offers variable spreads on major currency pairs ranging from 0.1 to 2 pips and allows high-leverage trading with ratios up to 1:500. These spreads work well for retail traders, but the slower execution speeds may not satisfy scalpers or algorithmic traders who rely on rapid order processing.

Available Platforms and VPS Hosting

For trading platforms, Vantage supports MetaTrader 4, a popular choice for expert advisors and automated strategies. To optimize automated trading, traders can pair Vantage with QuantVPS in New York to help reduce latency. However, despite this setup, the execution speeds remain less competitive compared to brokers with faster infrastructure.

Best Forex Brokers in Australia (2026) – Trusted, Regulated, Ranked

Broker Comparison: Strengths and Weaknesses

The choice of a broker often comes down to your specific trading style, platform preferences, and latency requirements. Here's a closer look at how different brokers cater to various trading strategies, from high-frequency scalping to algorithmic trading. For instance, scalpers often lean toward brokers like BlackBull Markets (72 ms latency) and Pepperstone (77 ms latency) due to their speed, while IC Markets stands out with a raw spread as low as 0.02 pips, making it a cost-effective option. Impressively, during 2025 testing, Pepperstone maintained 0.0 pip spreads on major currency pairs 100% of the time. These figures provide a solid foundation for comparing commission rates and platform features.

Commission Costs

Commission rates can vary widely across brokers, which is an important consideration for traders. Fusion Markets offers some of the lowest rates, charging $2.25 per standard lot - about $1.10 below the industry average. For high-volume traders, IC Markets provides added value through its "Raw Trader Plus" program, which reduces commissions to $1.00 per lot for those trading over 2,000 lots per month. On the other hand, standard commission rates at brokers like IC Markets, Pepperstone, Eightcap, and ThinkMarkets hover around $3.50 per lot.

Platform Flexibility

The trading platform is another critical factor, especially for traders utilizing algorithms or VPS solutions. Brokers such as Pepperstone, IC Markets, BlackBull Markets, and Fusion Markets support a wide array of platforms, including MT4, MT5, cTrader, and TradingView. In comparison, Axi Global focuses exclusively on MT4, while Eightcap and Pepperstone also integrate Capitalise.ai, enabling code-free automation for traders. Notably, IC Markets reports that algorithms drive 60% of its daily trades, supported by access to over 50 institutional liquidity providers.

Latency and VPS Optimization

For traders prioritizing latency, the broker's server location is key. Brokers with servers in major financial hubs, such as Equinix NY4, can achieve latencies as low as 1–2 ms when paired with locally hosted VPS solutions. In Asian markets, brokers with servers in Singapore or Tokyo typically deliver the best latency performance, ensuring smoother execution for traders operating in those regions.

Leverage and Regulation

Leverage options and regulatory oversight also play a significant role in broker selection. Brokers regulated by ASIC, such as IC Markets and Pepperstone, typically offer leverage capped at 30:1 for retail clients. However, offshore brokers operating in jurisdictions like Vanuatu or Seychelles can offer leverage as high as 500:1, appealing to traders seeking higher risk-reward opportunities. Some brokers, including Exness and Vantage, also provide leverage up to 500:1, though this comes with increased risk exposure.

Optimal VPS Server Locations by Broker

The location of your VPS plays a key role in trading performance. The closer your VPS is to your broker's execution servers, the faster your execution speed - something that’s absolutely critical in algorithmic trading, where even milliseconds can make a difference. Most leading brokers host their primary servers in Equinix NY4 (Secaucus, New Jersey), Equinix LD4 (London), or Equinix TY3 (Tokyo). To achieve sub-millisecond latency, your VPS should ideally be in the same facility as your broker’s servers.

For brokers like IC Markets, Pepperstone, BlackBull Markets, Fusion Markets, Eightcap, Axi Global, Vantage, and ThinkMarkets, New York is the go-to location since they operate from Equinix NY4. On the other hand, brokers such as Tickmill and Key to Markets, which focus on European liquidity, perform best with a VPS in London's Equinix LD4. If you’re trading with brokers like Deriv or others targeting Asian markets, VPS infrastructure in Singapore or Tokyo is the most effective choice. These strategic data center locations ensure optimal performance tailored to specific brokers.

As Matthew Hinkle, Lead Writer at NYCServers, explains:

"If you're trading from home on MetaTrader with a 50ms connection, you're not competing. Real HFT operates at speeds measured in microseconds."

- Matthew Hinkle

"If you're trading from home on MetaTrader with a 50ms connection, you're not competing. Real HFT operates at speeds measured in microseconds."

- Matthew Hinkle

QuantVPS offers solutions designed to perfectly align with these brokers, providing dedicated infrastructure in New York, London, and Singapore. This strategic proximity minimizes network hops and reduces jitter - both of which are crucial for algorithmic trading strategies that rely on consistent execution timing.

For example, a VPS with stable 0.8ms latency is far superior to one fluctuating between 0.3ms and 2.1ms. Consistent latency ensures more predictable performance, which is essential for enhancing your trading server performance. When paired with cutting-edge hardware - like NVMe SSDs, AMD Ryzen 7950X3D processors, and fiber cross-connects - these VPS setups keep order round-trip times as low as possible, even during peak trading hours.

Conclusion

Selecting the right broker comes down to aligning with your trading style and priorities. Scalpers and high-volume traders benefit from brokers that offer lightning-fast execution speeds - sub-80ms - and competitive commission structures. For those using the best tools for forex algo traders, IC Markets shines, with 60% of its trades powered by automated strategies and seamless connectivity through Equinix NY4 and LD5 data centers. These factors highlight how crucial it is to choose a broker that complements your trading approach.

Leading brokers consistently deliver ultra-tight spreads and execution speeds under 80ms. As Ross Collins, Chief of Technology Research at CompareForexBrokers, explains:

"Pepperstone achieved an outstanding 77 ms limit order execution speed, which ranked as the fastest out of all the brokers we tested".

"Pepperstone achieved an outstanding 77 ms limit order execution speed, which ranked as the fastest out of all the brokers we tested".

Execution speed isn’t just about milliseconds - it’s also about location. The physical distance between your trading platform and your broker’s execution servers plays a big role in latency. Brokers like IC Markets, Pepperstone, and BlackBull Markets host their servers in Equinix data centers in New York, London, and Singapore. Services like QuantVPS strategically position their infrastructure near these hubs, reducing network hops and ensuring consistent sub-millisecond latency, even during volatile market swings.

For traders relying on automated strategies, uninterrupted uptime is non-negotiable. A VPS ensures your algorithms keep running smoothly, unaffected by local power outages, internet issues, or hardware failures. Combine this with brokers offering institutional-grade execution and deep liquidity, and you’re looking at improved fill rates and reduced slippage. Whether you’re scalping during the London session or running high-frequency strategies across multiple currency pairs, pairing a top-tier broker with optimized VPS hosting gives you a real edge in 2026’s fast-paced forex markets.

FAQs

What should I look for when choosing a forex broker in 2026?

When choosing a forex broker in 2026, the first step is to confirm they’re regulated by reputable authorities like ASIC, FCA, or the CFTC. Brokers with licenses across multiple jurisdictions, such as Axi or IC Markets, can offer an extra layer of protection for your funds.

Next, take a close look at trading costs - this includes spreads, commissions, and any hidden charges. If you’re into scalping or high-frequency trading, brokers with low spreads are a better fit. Also, check the broker’s execution model. ECN/STP brokers often provide more competitive pricing and deeper market access compared to market makers, which can be crucial for strategies like algorithmic or copy trading.

Lastly, consider their platforms, leverage options, and latency support. Brokers that support MT4, MT5, cTrader, or TradingView allow for more advanced and flexible trading approaches. For traders who need fast execution, look for brokers with strong infrastructure and VPS compatibility. Additionally, factors like responsive customer service, quick funding processes, and a broad range of tradable instruments can significantly enhance your trading experience and help align it with your objectives.

How can VPS hosting enhance my forex trading performance?

VPS (Virtual Private Server) hosting offers traders a dedicated, always-on server housed in a data center, often positioned close to the broker's liquidity providers. This strategic placement cuts down the time it takes for trade orders to reach their destination, leading to quicker execution, reduced latency, and minimal slippage. For traders relying on strategies like scalping or algorithmic trading, these enhancements can be game-changing.

Another key advantage of a VPS is its ability to keep your trading platform running 24/7, even during local power outages or internet issues. This level of reliability is essential for automated tools, such as trading bots or copy-trading systems, which require uninterrupted operation to perform effectively. By leveraging a VPS, you can create a stable and efficient trading environment, giving you a competitive edge in the high-speed forex market.

What are the benefits of trading with brokers that offer low latency and tight spreads?

Trading with brokers offering low latency means your orders are executed nearly instantly, allowing you to react swiftly to market changes. This quick response reduces slippage, ensures more accurate pricing, and makes your trading process smoother and more efficient.

On the other hand, tight spreads lower the cost of every trade, making them particularly advantageous for high-frequency traders or those relying on strategies like scalping. When combined, low latency and tight spreads can greatly enhance your trading outcomes and increase your potential for profits.

When choosing a forex broker in 2026, the first step is to confirm they’re regulated by reputable authorities like ASIC, FCA, or the CFTC. Brokers with licenses across multiple jurisdictions, such as Axi or IC Markets, can offer an extra layer of protection for your funds.

Next, take a close look at trading costs - this includes spreads, commissions, and any hidden charges. If you’re into scalping or high-frequency trading, brokers with low spreads are a better fit. Also, check the broker’s execution model. ECN/STP brokers often provide more competitive pricing and deeper market access compared to market makers, which can be crucial for strategies like algorithmic or copy trading.

Lastly, consider their platforms, leverage options, and latency support. Brokers that support MT4, MT5, cTrader, or TradingView allow for more advanced and flexible trading approaches. For traders who need fast execution, look for brokers with strong infrastructure and VPS compatibility. Additionally, factors like responsive customer service, quick funding processes, and a broad range of tradable instruments can significantly enhance your trading experience and help align it with your objectives.

VPS (Virtual Private Server) hosting offers traders a dedicated, always-on server housed in a data center, often positioned close to the broker's liquidity providers. This strategic placement cuts down the time it takes for trade orders to reach their destination, leading to quicker execution, reduced latency, and minimal slippage. For traders relying on strategies like scalping or algorithmic trading, these enhancements can be game-changing.

Another key advantage of a VPS is its ability to keep your trading platform running 24/7, even during local power outages or internet issues. This level of reliability is essential for automated tools, such as trading bots or copy-trading systems, which require uninterrupted operation to perform effectively. By leveraging a VPS, you can create a stable and efficient trading environment, giving you a competitive edge in the high-speed forex market.

Trading with brokers offering low latency means your orders are executed nearly instantly, allowing you to react swiftly to market changes. This quick response reduces slippage, ensures more accurate pricing, and makes your trading process smoother and more efficient.

On the other hand, tight spreads lower the cost of every trade, making them particularly advantageous for high-frequency traders or those relying on strategies like scalping. When combined, low latency and tight spreads can greatly enhance your trading outcomes and increase your potential for profits.

"}}]}