By 2025, algorithmic trading dominates the forex market, accounting for 92% of trades. To succeed in this fast-paced environment, traders need specialized tools to build, test, and execute strategies efficiently. Here’s a quick breakdown of the top tools:

- QuantVPS: Reliable VPS hosting with ultra-low latency (0-1ms) for uninterrupted trading.

- MetaTrader 5: A popular platform with MQL5 for building and deploying trading algorithms.

- NinjaTrader: Advanced tools for strategy creation, backtesting, and multi-broker integration.

- TradeStation: Offers EasyLanguage programming and robust backtesting for forex strategies.

- QuantConnect: A cloud-based platform supporting Python and C# for complex algorithm development.

- TradingView: Known for Pine Script and powerful charting with community-driven insights.

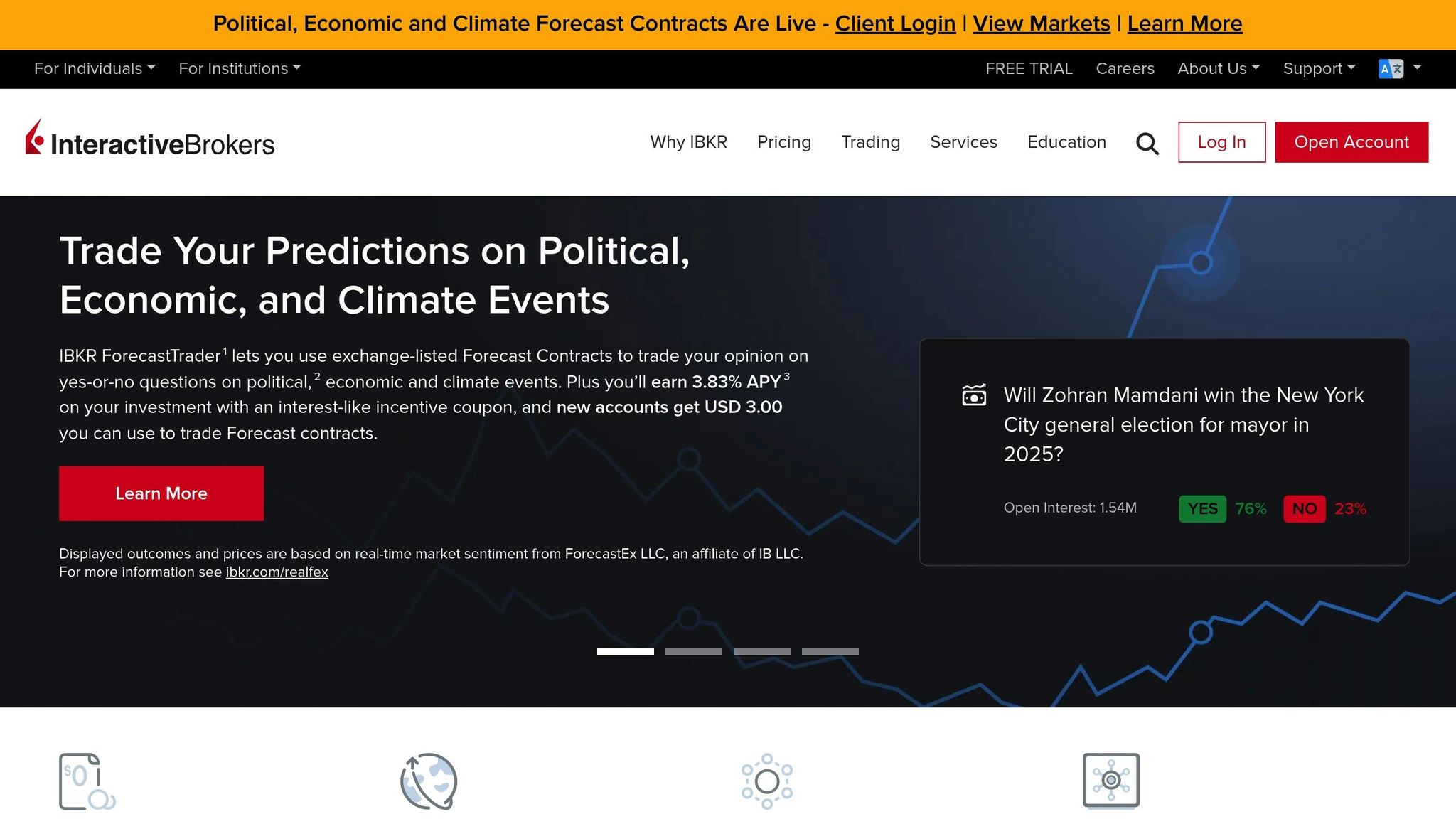

- Interactive Brokers API: Direct access to 160+ global markets with support for multiple programming languages.

Quick Comparison

| Tool | Key Feature | Price | Best For | Programming Needed |

|---|---|---|---|---|

| QuantVPS | Ultra-low latency VPS hosting | $59–$299/month | Reliable algo hosting | No |

| MetaTrader 5 | MQL5 for algorithm creation | Free (broker spreads apply) | Forex algo traders | Yes (MQL5) |

| NinjaTrader | Advanced charting and backtesting | Free to $1,499 lifetime | Futures and forex traders | Yes (C#, NinjaScript) |

| TradeStation | EasyLanguage and strategy reports | Subscription/commissions | U.S. traders and multi-asset strategies | Yes (EasyLanguage) |

| QuantConnect | Cloud-based research and backtesting | Usage-based pricing | Complex multi-asset strategies | Yes (Python, C#) |

| TradingView | Pine Script and charting | Free to premium tiers | Strategy visualization | Yes (Pine Script) |

| Interactive Brokers API | Global market access, multi-language support | Free API + trading fees | Global traders needing extensive access | Yes (Python, Java, etc.) |

Each tool caters to different needs and skill levels. Beginners might prefer MetaTrader 5 or TradingView for their user-friendly scripting, while advanced traders may gravitate toward QuantConnect or the Interactive Brokers API for their flexibility and global reach. For uninterrupted execution, QuantVPS ensures your algorithms perform consistently.

5 Tools Every Forex Algo Trader ABSOLUTELY Needs!

1. QuantVPS

QuantVPS is a VPS hosting service tailored specifically for forex algo trading. Founded by Ethan Brooks, the platform is designed to meet the demanding infrastructure needs of automated trading strategies. With servers strategically located in Chicago and New York, QuantVPS provides the ultra-low latency that forex algo traders rely on to stay competitive.

The standout feature of QuantVPS is its 0-1ms latency performance, which can have a direct impact on trading profitability. For example, John, a scalper based in New York, managed to cut slippage by 0.3 pips after switching to QuantVPS, significantly improving his trading results. For high-frequency traders, even small reductions like this can add up to substantial financial gains over time.

Platform Compatibility

QuantVPS is compatible with top trading platforms, including MetaTrader, NinjaTrader, and TradeStation. It also supports multi-monitor setups, which is ideal for traders managing multiple currency pairs and timeframes simultaneously. Running on Windows Server 2022 with root access, the platform ensures smooth and efficient execution of trading strategies. Whether you’re working with basic setups or advanced multi-chart configurations, QuantVPS has options to suit your needs, offering up to six monitors with its Dedicated Server plan.

Pricing (in USD)

QuantVPS offers four pricing tiers, each tailored to different levels of trading complexity and volume:

| Plan | Monthly Price | CPU Cores | RAM | Storage | Ideal For |

|---|---|---|---|---|---|

| VPS Lite | $59.00 | 4 AMD EPYC | 8GB | 70GB NVMe | 1–2 charts |

| VPS Pro | $99.00 | 6 cores | 16GB | 150GB NVMe | 3–5 charts, up to 2 monitors |

| VPS Ultra | $199.00 | 24 cores | 64GB | 500GB NVMe | 5–7 charts, up to 4 monitors |

| Dedicated Server | $299.00 | 16+ cores | 128GB | 2TB+ NVMe | 7+ charts, up to 6 monitors |

Payments can be made using major credit cards or Google Pay. While QuantVPS does not provide free trials or refunds, new users can often score a 95% discount on their first month by reaching out to the support team. The platform boasts an impressive 4.8/5 rating on Trustpilot, based on 222 reviews.

The VPS Ultra and Dedicated Server plans are particularly suited for traders with complex backtesting needs or those requiring real-time execution. With a 100% uptime guarantee and automatic backups, QuantVPS ensures your trading algorithms run without interruption.

2. MetaTrader 5

MetaTrader 5 is a feature-rich platform designed for forex and CFD trading. It’s particularly popular among algorithmic traders, offering a complete environment to create, test, and deploy automated strategies. Interestingly, its trading volume has even surpassed that of MetaTrader 4 as of April 2025.

Algorithm Development Capabilities

MetaTrader 5 comes equipped with the MQL5 Integrated Development Environment (IDE), which simplifies the entire process of building, debugging, testing, and optimizing trading robots. For beginners, there’s the MQL5 Wizard, while experienced developers can take advantage of advanced tools, including support for object-oriented programming and multithreaded execution. As XS.com highlights, MQL5 is a robust language for creating trading algorithms, custom indicators, and scripts.

The platform supports complex strategies through Expert Advisors (EAs), custom indicators, and scripts tailored to individual trading needs. With more than 80 built-in indicators and 21 timeframes, MT5 provides a detailed framework for market analysis[4]. Additionally, the MetaTrader Market offers thousands of pre-built trading robots and indicators, while the MQL5 Freelance service connects users with expert programmers for custom solutions.

Backtesting Features

The Strategy Tester in MT5 is a powerful tool for validating algorithmic strategies. It supports multi-threaded testing, which significantly cuts down the time needed for backtesting and optimization compared to single-threaded methods[4]. Traders can fine-tune their algorithms using historical data across multiple timeframes and currency pairs, thanks to the platform’s extensive optimization options. This makes MT5 a solid choice for traders who value precision and efficiency.

Platform Compatibility

MetaTrader 5 ensures traders can access the platform from virtually any device. It’s available for Windows, macOS, Android, iOS, and even Linux through its web version. According to FP Markets:

MT5 includes the necessary tools required to conduct fundamental and technical analysis, along with the option of developing custom indicators. The platform is fully equipped for algorithmic trading and copy trading, making it suitable for traders using Expert Advisors (EAs).

MT5 includes the necessary tools required to conduct fundamental and technical analysis, along with the option of developing custom indicators. The platform is fully equipped for algorithmic trading and copy trading, making it suitable for traders using Expert Advisors (EAs).

The MT5 Android app has been downloaded over 10 million times and boasts an impressive 4.5/5 rating, ensuring a reliable experience across all supported platforms.

Pricing (in USD)

MetaTrader 5 is free to download and use, as it generates revenue through broker partnerships rather than charging users directly. However, there are optional costs, including:

- Free applications from the MQL5 Code Base

- Paid tools and robots available on the MetaTrader Market

- Custom development services via MQL5 Freelance

- VPS hosting fees for uninterrupted automated trading (costs vary by provider)

This pricing model makes MT5 accessible to traders of all experience levels, offering flexibility without compromising on functionality.

3. NinjaTrader

NinjaTrader has become a go-to platform in the world of algorithmic trading, especially for forex traders. In March 2025, its reputation soared following a major acquisition. With more than 2 million users and serving 60,000 traders across 150+ countries, NinjaTrader has solidified its position as a trusted choice for forex algorithmic trading. It also integrates effortlessly with other essential tools for algo traders.

Algorithm Development Capabilities

NinjaTrader offers powerful tools for creating and refining trading strategies. It supports NinjaScript strategies, which can be built using open charts or the drag-and-drop Strategy Builder. For those with coding expertise, custom indicators can be developed using C#. The platform also provides APIs, historical data, and advanced charting tools to help traders design, test, and fine-tune their strategies.

Backtesting Features

NinjaTrader shines when it comes to backtesting. The Strategy Analyzer is a standout feature, allowing traders to test, optimize, and evaluate strategies using historical data. Users can tweak strategy parameters to find the most effective combinations under different market conditions. The platform provides access to a wealth of historical data and key performance metrics like ROI, Sharpe Ratio, Maximum Drawdown, and win rate, offering traders a clear picture of a strategy’s effectiveness. Additionally, playback and simulation tools enable users to replay market data and test strategies in a risk-free, controlled environment.

Platform Compatibility

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

One of NinjaTrader‘s strengths is its ability to integrate with other platforms and brokers. It connects seamlessly with major brokers like Interactive Brokers and TD Ameritrade, as well as third-party applications for processing trading signals. The NinjaTrader Ecosystem includes over 1,000 third-party applications and thousands of indicators, all of which can be incorporated into trading strategies. For forex traders, brokers such as FXCM and FOREX.com support NinjaTrader, ensuring reliable execution and real-time data feeds. The platform also fully supports automated forex trading, with users frequently praising its fast performance, intuitive navigation, and compatibility with virtually any data feed or broker.

Pricing (in USD)

NinjaTrader offers a free version with basic charting capabilities. For advanced features, users can opt for premium upgrades. To ensure uninterrupted automated trading, traders can use QuantVPS, which provides optimized VPS hosting starting at $59 per month.

4. TradeStation

TradeStation stands out as a comprehensive platform for forex algorithmic trading, offering advanced tools that cater to both beginners and seasoned traders.

Algorithm Development Capabilities

TradeStation uses its proprietary EasyLanguage® programming language, making it possible for traders to create strategies without needing extensive coding expertise. For those with more technical skills, the platform’s API supports multiple programming languages and advanced order types. This setup simplifies the process of coding, backtesting, and live trading, creating a solid foundation for refining trading strategies.

Backtesting Features

TradeStation shines with its backtesting tools, allowing traders to analyze historical performance using detailed forex data sets. The platform generates in-depth Strategy Performance Reports, helping traders assess the viability of their strategies. Additional features, like Monte Carlo simulation and walk-forward optimization (powered by Build Alpha), provide deeper insights into potential outcomes and strategy robustness.

Platform Compatibility

Flexibility is a key strength of TradeStation, thanks to its robust API and third-party integrations. The platform supports customization through specialized external tools and offers API access for building tailored strategies. For example, TradersPost partners with TradeStation to automate TradingView and TrendSpider strategies directly within the platform. Additionally, integrations with tools like TradingView and QuantConnect’s API make it easier for traders to develop and execute strategies smoothly. These integrations enhance TradeStation’s position as a vital tool for modern forex algo trading.

TradeStation ensures accessibility across devices with its Desktop platform, Web Trading interface, and Mobile Apps, enabling traders to manage their automated strategies from virtually anywhere.

Pricing (in USD)

TradeStation provides a range of pricing options to suit different trading needs. The commission structure varies based on trading type and account size. Traders interested in using TradeStation for algorithmic trading should visit the platform’s website for the most up-to-date pricing information to find an option that fits their requirements.

5. QuantConnect

QuantConnect is a cloud-based platform designed for algorithmic trading, with over 100,000 quant traders worldwide leveraging its tools and resources. The platform processes an impressive $45 billion in monthly notional volume, making it a key player in the forex algo trading landscape.

Algorithm Development Capabilities

QuantConnect supports both Python and C#, and its LEAN engine adds flexibility by accommodating additional programming languages. The platform is tailored to handle various forex trading strategies, offering a cloud-based research environment equipped with extensive financial data and machine learning libraries. One of its standout features is the Algorithm Framework, which encourages modular design and reusable code. For example, the ForexCarryTradeAlgorithm showcases how traders can use predefined interest rates for currency pairs and rebalance monthly to capitalize on inflation rate differences.

"QuantConnect has revolutionized our trading strategies, allowing us to capitalize on multiple asset classes, refine our approach through rapid backtesting, and seize real-time market opportunities."

– Louis Clouatre, Start-Up Co-Founder

"QuantConnect has revolutionized our trading strategies, allowing us to capitalize on multiple asset classes, refine our approach through rapid backtesting, and seize real-time market opportunities."

– Louis Clouatre, Start-Up Co-Founder

In addition to its development tools, QuantConnect provides a strong backtesting system for strategy validation.

Backtesting Features

Once a strategy is developed, QuantConnect’s backtesting framework steps in with institutional-quality datasets and a cloud-powered, open-source engine. The platform handles over 15,000 backtests daily, helping traders evaluate strategies and analyze key metrics such as drawdowns and volatility [42, 46, 47]. Its advanced framework is particularly effective for modeling multi-asset portfolio strategies, including forex, and supports parameter sensitivity testing to fine-tune performance.

"In order to be able to design a viable algorithm, a robust backtesting engine is crucial. After exploring various options, we found QuantConnect to be the most suitable for our needs. Its ease of use, wide range of instruments and asset classes, and an extensive Python library makes it an ideal choice for students."

– David Ye, Professor, Duke University

"In order to be able to design a viable algorithm, a robust backtesting engine is crucial. After exploring various options, we found QuantConnect to be the most suitable for our needs. Its ease of use, wide range of instruments and asset classes, and an extensive Python library makes it an ideal choice for students."

– David Ye, Professor, Duke University

Platform Compatibility

QuantConnect integrates effortlessly with several brokerages, including Interactive Brokers, TradeStation, Alpaca, and OANDA. It also supports FIX connections, broadening its compatibility with additional brokers. The platform’s brokerage-agnostic setup allows users to deploy strategies without needing to adjust code for specific brokerage requirements. QuantConnect has been a trailblazer in live trading, hosting over 150,000 live strategies. For advanced users, the open-source LEAN engine provides the option to customize the system to meet unique trading needs.

Pricing (in USD)

QuantConnect offers free access to forex data and basic backtesting tools. However, deploying live trading algorithms requires a subscription for live trading nodes. Pricing details for live trading and premium features depend on data usage and computational resources. Traders can visit QuantConnect’s website for the most up-to-date subscription information. The platform delivers strong value, particularly for those serious about algorithmic trading.

6. TradingView

TradingView stands out as a popular platform for forex algorithmic trading, combining advanced technology with a thriving community of traders. With 60 million users each month and a 2024 award for its charting capabilities, it continues to set a high standard for both strategy development and testing.

Algorithm Development Capabilities

At the heart of TradingView’s appeal is Pine Script, its proprietary programming language designed for creating custom algorithms. Whether you’re basing strategies on technical indicators, chart patterns, or unique trading conditions, Pine Script makes it possible to tailor strategies specifically for forex trading. For instance, users can program algorithms to execute trades when a 50-day moving average crosses a key threshold.

"Algorithmic trading opens a world of opportunities for all kinds of traders… there has never been a time that the tools and methods are more readily available to you for successful algotrading." – Elysian_Mind

"Algorithmic trading opens a world of opportunities for all kinds of traders… there has never been a time that the tools and methods are more readily available to you for successful algotrading." – Elysian_Mind

Beyond its scripting capabilities, TradingView’s community plays a crucial role. Traders actively share strategies and insights, creating an environment that encourages collaboration and continuous learning. This community-driven approach complements the platform’s tools for developing and refining custom strategies.

Backtesting Features

TradingView provides robust backtesting options to evaluate strategies against historical market data. The Bar Replay feature allows traders to manually simulate trades, reviewing market movements one candle at a time. For those seeking a more automated approach, Pine Script enables systematic backtesting across various market scenarios.

To ensure reliable results, it’s essential to test strategies over a significant number of trades. For users on higher-tier plans, the Deep Backtesting feature offers access to extensive historical data. This allows for a detailed analysis of critical metrics like maximum drawdown, risk-to-reward ratios, and the percentage of profitable trades.

Platform Compatibility

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

TradingView integrates seamlessly with multiple brokers, enabling direct trade execution and management. This is particularly useful for Pine Script users and those leveraging tools like PineConnector to send signals to MetaTrader accounts. Additionally, some brokers provide trading ideas and technical analyses directly within the platform, enriching the overall trading experience.

Pricing (in USD)

TradingView operates on a freemium model. The free plan offers basic features and limited backtesting capabilities, while paid subscriptions unlock advanced tools, deeper historical data, and more comprehensive backtesting options.

7. Interactive Brokers API

Rounding out the toolkit for forex algo trading, the Interactive Brokers API offers direct market access and advanced automation. With connections to over 160 markets across 36 countries, it provides the infrastructure needed for intricate trading strategies and algorithmic development.

Algorithm Development Capabilities

The Interactive Brokers API supports various programming interfaces to suit different technical needs and preferences. These include the TWS API, Web API, and FIX API.

Developers can leverage programming languages like Python 3.11.0+ (alongside libraries such as Pandas, NumPy, and TA-Lib), Java 8+, and C++14+ for both real-time and historical market data analysis. The API facilitates the creation of custom trading applications that can handle tasks like order execution, position tracking, and risk management, all in response to market conditions.

In January 2025, QuantInsti showcased a Python-based setup for algorithmic forex trading using this API. This example included features for executing trades with tailored strategies, as well as documentation for tweaking hyperparameters and adjusting trading logic.

Platform Compatibility

The Interactive Brokers API integrates smoothly with popular trading platforms and third-party tools. For instance, platforms like NinjaTrader and MultiCharts can connect to the Trader Workstation (TWS) to access market data, place orders, and manage account details.

The API supports multiple programming languages, including Python, Java, C++, and C#. On Windows, the C# implementation works with .NET Core 3.1, .NET Framework 4.8, and .NET Standard 2.0. To avoid disruptions from updates, users can opt for the offline version of TWS. Additionally, the platform enforces a global request rate limit of 50 requests per second per authenticated user to ensure system stability.

Pricing (in USD)

The Interactive Brokers API is free for all IBKR clients. However, trading fees still apply under the platform’s commission structure. For spot currency trades, fees are based on a tiered system tied to monthly trading volume. For volumes up to $1 billion, the fee is 0.20 basis points of the trade value, with a $2.00 minimum per order. High-volume traders can access reduced rates, such as 0.08 basis points with a $1.00 minimum per order.

Access to forex market data typically doesn’t require extra subscriptions. That said, clients must maintain a minimum account balance of $500 USD to receive market data through the API, along with any applicable market data fees. An IBKR Pro account is also necessary for market data access, which is allocated on a per-user basis.

Tool Comparison Chart

Choosing the right algorithmic trading tool involves weighing features, costs, and compatibility with your trading needs and technical skills. The table below highlights key aspects of popular platforms to help guide your decision.

| Tool | Primary Strengths | USD Pricing | Platform Compatibility | Best For | Programming Required |

|---|---|---|---|---|---|

| QuantVPS | Ultra-low latency (0–1ms), 100% uptime guarantee, optimized for algo trading | $59–$299/month | Windows Server 2022; supports all major trading platforms | Hosting trading algorithms with maximum reliability | No (hosting service) |

| MetaTrader 5 | Extensive forex market coverage, built-in algorithmic tools, large community | Free platform (broker spreads apply) | Windows, macOS, Linux, iOS, Android, Web | Forex-focused algo traders, beginners to intermediate | Yes (MQL5) |

| NinjaTrader | Advanced charting, comprehensive backtesting, futures specialization | Free to $1,499 lifetime + commissions | Windows; also available on iOS, Android, Web | Futures and forex traders seeking professional tools | Yes (C#, NinjaScript) |

| TradeStation | Integrated brokerage, EasyLanguage coding, institutional-grade analytics | Subscription or commission-based | Windows, macOS, iOS, Android, Web | Active U.S. traders and multi-asset strategies | Yes (EasyLanguage) |

| QuantConnect | Cloud-based research environment, institutional-grade backtesting, multi-asset support | Usage-based, scalable pricing | Cloud-based (accessible on any device with an Internet connection) | Quantitative developers and complex strategies | Yes (Python, C#) |

| TradingView | Superior charting, Pine Script automation, social trading features | Free to premium tiers | Windows, macOS, Linux, iOS, Android, Web | Strategy visualization and manual/semi-automated systems | Yes (Pine Script) |

| Interactive Brokers API | Global market access (over 160 markets), support for multiple programming languages, free API | Free API + trading commissions (0.20 basis points minimum) | Windows, macOS, Linux | Developers needing extensive market access | Yes (Python, Java, C++, C#) |

This comparison highlights how each tool caters to specific trading styles and technical expertise. For traders prioritizing mobility, cloud-based platforms like QuantConnect and TradingView offer flexibility, while locally hosted solutions like MetaTrader 5 and NinjaTrader provide stable and private data access.

Programming skills are another major factor. MetaTrader 5’s MQL5 language is beginner-friendly, with abundant documentation for basic backtesting. On the other hand, Python-based platforms like QuantConnect offer more flexibility for crafting complex strategies, though they require a steeper learning curve. TradingView’s Pine Script offers a balance, ideal for visualization and simpler strategies, although it’s less suited for high-frequency trading.

Market access is another critical consideration. The Interactive Brokers API stands out with connections to over 160 global markets, making it a strong choice for international trading strategies. In contrast, TradeStation focuses heavily on U.S. markets, while MetaTrader 5 excels in forex trading with broad broker support.

Backtesting capabilities also set platforms apart. QuantConnect provides institutional-grade backtesting with access to historical tick data, making it a standout for refining complex strategies.

Lastly, reliable infrastructure is key. QuantVPS ensures your algorithms run seamlessly with features like DDoS protection, automatic backups, and optimized hardware. This kind of reliability is vital, especially as algorithmic systems now account for over 70% of trading volume.

Final Thoughts

The forex algorithmic tools you choose can have a significant impact on your trading outcomes. Each platform we’ve discussed – whether it’s the beginner-friendly MetaTrader 5 or the globally expansive Interactive Brokers API – caters to different trading styles and expertise levels. Let’s break down the key considerations to guide your decision-making.

Latency matters when milliseconds make the difference. In high-frequency trading, ultra-low latency infrastructure is essential to stay ahead of the competition. Ensure your setup can handle the speed demands of your strategies.

Your technical skill level plays a big role in choosing the right platform. For those just starting out, MetaTrader 5 provides an approachable environment with plenty of resources and community support. Developers more comfortable with coding might prefer QuantConnect, which supports Python and C#. If you’re somewhere in the middle, TradingView’s Pine Script offers automation without the steep learning curve of advanced programming.

Costs are another factor to weigh carefully. While MetaTrader 5 is free to use, you’ll need to budget for VPS hosting if you want round-the-clock operation. TradeStation might not charge for its software, but frequent traders could see commissions pile up quickly. QuantVPS plans, ranging from $59 to $299 per month, are an investment that can pay off with better execution reliability and less slippage.

Market access is equally important. If you’re focused solely on forex pairs, MetaTrader 5’s compatibility with a wide range of brokers is a major advantage. On the other hand, traders pursuing broader, multi-asset strategies might find Interactive Brokers API or QuantConnect more suitable, thanks to their access to numerous global markets.

Some traders find success by combining tools to maximize their strengths while minimizing limitations. For example, you could use TradingView for strategy visualization and backtesting, then execute trades on MetaTrader 5 hosted through QuantVPS for enhanced performance.

Before committing your capital, test your chosen tools on demo accounts. A platform that seems ideal in theory might not align with your trading style or technical preferences. Start small, backtest your strategies thoroughly, and only scale up once you’ve confirmed consistent results in live market conditions.

FAQs

What should forex algorithmic traders look for in a VPS, and how does QuantVPS meet these requirements?

When choosing a VPS for forex algorithmic trading, there are a few critical aspects to keep in mind: low latency, reliable uptime, strong security measures, and server locations close to your broker’s data center. These factors are crucial for ensuring trades are executed swiftly and dependably – an absolute must in the fast-moving forex market.

QuantVPS addresses these needs by providing secure, high-performance hosting with servers strategically placed near major forex brokers. This setup minimizes latency, ensures consistent uptime, and creates a stable environment for trading, giving traders the dependability they need to fine-tune their algorithmic strategies.

How does the choice of programming language impact the development and deployment of forex trading algorithms?

The programming language you pick can significantly impact how smoothly you develop, test, and deploy forex trading algorithms. Python stands out for its ease of use and a vast range of libraries, making it a top choice for quickly prototyping and backtesting trading strategies. If speed is your priority, C++ is often the go-to option, especially for tasks like high-frequency trading where performance is critical. Meanwhile, Java offers a middle ground with strong performance and scalability, making it well-suited for building larger, more complex trading systems.

Each language brings something unique to the table, so the right choice depends on your specific needs. Python is great for beginners or those who want to develop strategies rapidly. C++ is ideal for traders who need fast, efficient execution, while Java works well for those managing more intricate, scalable systems. Think about your goals and technical skillset when deciding which language fits your trading strategy best.

What are the benefits of using a cloud-based platform like QuantConnect instead of a locally hosted solution for algorithmic forex trading?

Cloud-based platforms like QuantConnect bring several standout benefits compared to locally hosted solutions. For starters, they offer unmatched scalability. You can easily adjust resources to meet your needs without the hassle or expense of buying extra hardware. This makes them a smart choice for traders aiming to expand their operations efficiently.

Another big plus is accessibility. With a cloud platform, you can manage and monitor your trading strategies from anywhere with an internet connection. Whether you’re at home, in the office, or traveling, staying on top of your trades is simple and convenient. Plus, many cloud platforms are designed to deliver faster trade execution by minimizing latency – a critical factor in the high-speed world of forex trading.

Lastly, cloud-based solutions often come equipped with advanced security features to keep your data and strategies safe. Combined, these advantages make cloud platforms a reliable and effective tool for refining and automating your forex trading strategies.