Step-by-Step: How to Backtest a Strategy in TradeStation

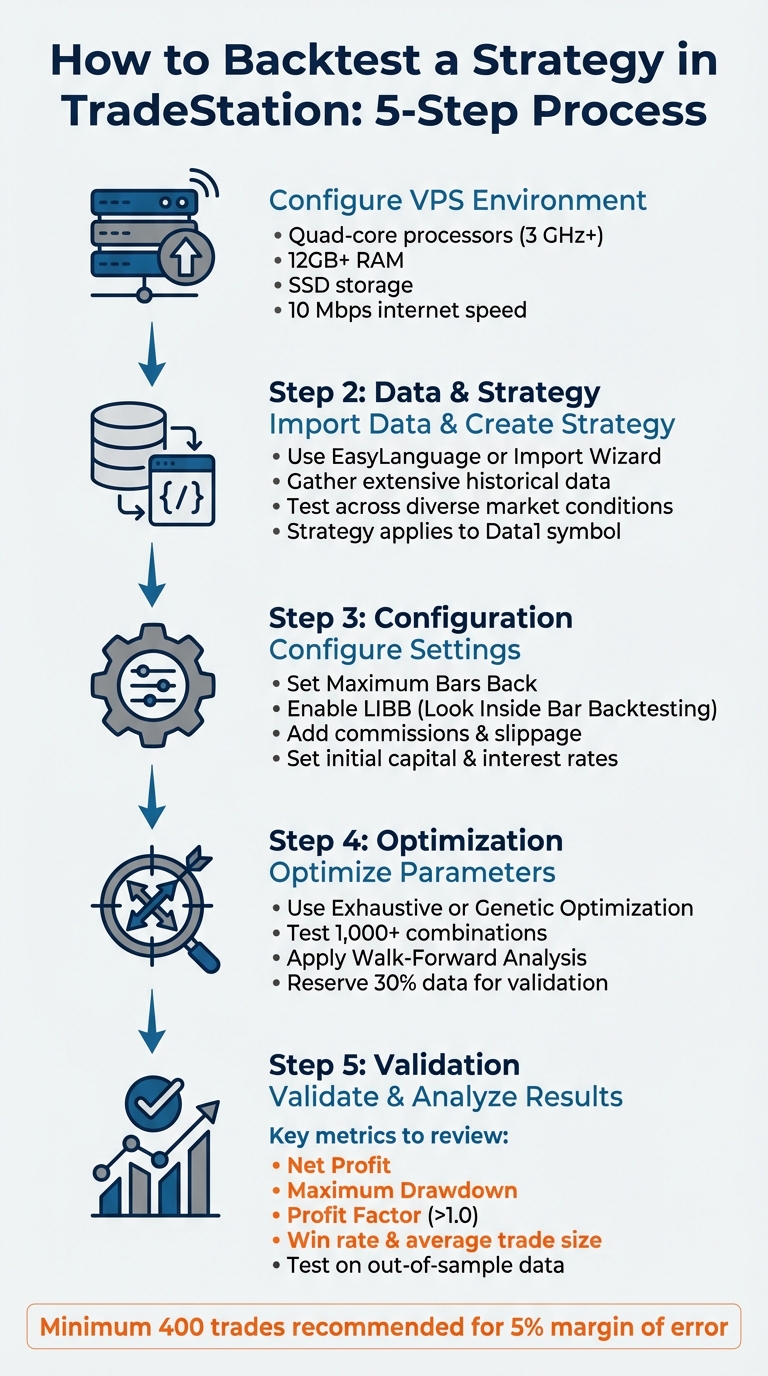

Backtesting in TradeStation helps traders evaluate strategies using historical data to assess performance before risking real money. This guide outlines the process, from setting up TradeStation to analyzing results. Here’s a quick breakdown:

- Setup: Use a VPS for stable performance, especially for resource-intensive tasks. Opt for quad-core processors, 12GB+ RAM, and SSD storage for faster data handling.

- Data & Strategy: Import or create strategies using EasyLanguage. Use extensive, recent data for testing to cover diverse market conditions.

- Configuration: Adjust settings like Maximum Bars Back, commissions, and slippage. Enable Look Inside Bar Backtesting (LIBB) for precise simulations.

- Optimization: Test parameter ranges with TradeStation’s tools (Exhaustive or Genetic Optimization). Use Walk-Forward Analysis to avoid overfitting.

- Validation: Re-test strategies on out-of-sample data to ensure reliability. Check metrics like Net Profit, Maximum Drawdown, and Profit Factor.

5-Step TradeStation Backtesting Process: From Setup to Validation

5-Step TradeStation Backtesting Process: From Setup to Validation

Prerequisites and Setup for Backtesting

Before diving into backtesting, it's crucial to set up your environment correctly. These steps ensure that your backtests in TradeStation run smoothly and deliver reliable results. TradeStation categorizes its users into three groups: Minimum, Standard, and Power Users. Backtesting and strategy optimization typically fall into the Power User category because of the heavy computational demands required to process large datasets and perform complex EasyLanguage calculations.

Installing TradeStation on a VPS

Installing TradeStation on a Virtual Private Server (VPS) helps avoid interruptions caused by local power outages or unstable internet connections. For optimal performance, choose a VPS with quad-core processors (3 GHz or higher) and at least 12 GB of RAM. While TradeStation officially supports Windows 10 (64-bit) for desktop systems, many VPS providers offer Windows Server 2022, which often provides better stability and performance.

Opt for a VPS with SSD storage to eliminate delays in data retrieval during backtesting. SSDs handle the large volumes of data involved in optimization runs much faster than traditional hard drives. Additionally, ensure your VPS has a broadband connection with a download speed of at least 10 Mbps to efficiently process high-volume market data requests.

| Feature | Minimum Requirements | Power User (Recommended for Backtesting) |

|---|---|---|

| Processor | Dual-core 1.5 GHz or faster | Quad-core 3 GHz or faster |

| Memory (RAM) | 8 GB | 12 GB or more |

| Hard Drive | 400 MB free space (5400 RPM) | 1 GB free space (SSD recommended) |

| Operating System | Windows 10 (64-bit or 32-bit) | Windows 10 (64-bit) |

| Internet Speed | 2 Mbps (download) | 10 Mbps or better (download) |

Once your VPS is set up, configure it and your system settings to ensure smooth backtesting operations.

Gathering Historical Data and Strategy Files

TradeStation requires a robust dataset to deliver meaningful backtest results. It's important to test strategies on extensive historical data that spans different market conditions and symbols. This approach helps capture a broad spectrum of market behavior. To maintain accuracy, emphasize using more recent data for your tests.

If you're importing pre-built strategies, use the Import and Export Wizard to transfer studies and strategies into the EasyLanguage document area. This tool supports files from TradeStation version 4 and later. For those developing custom trading logic, the TradeStation Development Environment provides a workspace for EasyLanguage programming. If coding isn't your strong suit, you can still create strategies using the "Custom" feature, which allows you to input formulas and conditions directly.

Strategies are implemented in an active Chart Analysis window and generate orders based on the primary symbol displayed, commonly referred to as Data1. Even if your chart contains multiple symbols, the strategy will only execute trades on the first symbol.

Once your data and strategy files are ready, it's time to fine-tune your TradeStation settings for realistic simulations.

Configuring TradeStation Settings

To simulate real-world trading conditions, you'll need to adjust several key settings. Start with Maximum Bars Back, which determines how many historical bars your strategy references. This ensures there’s enough data for accurate indicator signals.

Enable the LIBB (Look Inside Bar Backtesting) feature in the Strategy Properties for greater precision. This setting examines data at a finer interval - whether tick, second, or minute - than what's plotted on the chart. It reconstructs historical trades as they would have unfolded in real time, rather than relying on simplified assumptions about price movements within a bar. Without LIBB, you risk "perfect" fills that ignore actual price action, leading to unrealistic results.

To further enhance realism, manually input cost assumptions like commissions, position slippage, initial capital, and interest rates. TradeStation’s Bouncing Ticks™ feature, which defaults to a 10% increment, simulates price movement within historical bars where the exact transaction sequence isn’t available. For even greater precision, set the backtesting resolution to tick or intraday, though this will increase the computational demands on your VPS.

How to Backtest a Strategy in TradeStation

Once you've set up your workspace, you're ready to dive into backtesting a strategy in TradeStation. Here's how to get started.

Creating or Importing a Strategy

Begin by opening TradeStation's Development Environment. Navigate to File > New, and choose Strategy as the document type to create a new EasyLanguage file. If you'd like to speed things up, use the "Select Template" dropdown to apply pre-formatted templates that align with your needs.

Your strategy will outline the rules for entering and exiting trades using EasyLanguage. For instance, a moving average crossover strategy might buy when a fast moving average crosses above a slower one and sell when it crosses below. If you already have a strategy file, you can open it by selecting File > Open and filtering by "Strategy."

Once your strategy is ready, set up a chart to visualize how these rules perform.

Setting Up Charts and Applying the Strategy

Open a Chart Analysis window and select the symbol and timeframe you'd like to test. Then, go to Studies > Add Strategy (or Insert > Strategy, depending on your version) and pick your strategy from the list. If needed, customize the input settings before running the test.

TradeStation will automatically apply the strategy to the first symbol on your chart (referred to as Data1), even if you're displaying multiple symbols. The backtest will begin right away, and you'll see visual markers - like arrows and lines - showing historical entry and exit points based on your strategy.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

From here, you can fine-tune the strategy settings to better match real-world trading conditions.

Configuring Strategy Properties

To adjust your strategy settings, click Properties for All in the Strategies tab. Here are the key configurations to focus on:

- Commissions and Initial Capital: Ensure these reflect actual trading costs and your starting balance.

- Interest Rates: Include these for more accurate profit calculations.

- Position Limits: Set these if you allow multiple entries.

In the Backtesting tab, define how orders (like limit and market orders) are filled and include slippage amounts for market orders. If your strategy relies on intrabar price movements, enable Intrabar Order Generation (IOG) or adjust the resolution to tick or minute-level data.

The Automation tab determines whether orders from the strategy appear in TradeManager and if they can be sent directly to your brokerage account. For backtesting purposes, keep automation turned off until you're ready to trade live.

Running the Backtest and Analyzing Results

After applying and configuring your strategy, the backtest will run automatically. To evaluate its performance, go to View > Strategy Performance Report. This report provides a detailed breakdown of how your strategy performed historically.

"The Strategy Performance Report provides detailed information about the strategy. This report may be used to help decide if the trading strategy is right for you." – TradeStation Help

"The Strategy Performance Report provides detailed information about the strategy. This report may be used to help decide if the trading strategy is right for you." – TradeStation Help

Pay close attention to these key metrics:

- Net Profit: The total gains after accounting for costs.

- Maximum Drawdown: The largest loss experienced, which highlights risk exposure.

- Profit Factor: A value above 1.0 indicates profitability.

Also, review the win rate and average trade size to assess the strategy's consistency. To avoid overfitting, test the strategy across various time periods and multiple symbols within the same sector. If the strategy status shows "Not Verified", recompile it in the Development Environment before enabling it for live use.

Optimizing and Refining Your Strategy

Using TradeStation's Optimization Tools

To improve your strategy's performance, you can adjust its parameters using TradeStation's optimization tools. These tools test different input combinations to enhance metrics like Net Profit or the Sharpe ratio.

Getting started is simple: right-click on any numeric input in your strategy and choose Optimize. Define a logical range for the inputs by setting Start, Stop, and Increment values. Avoid overly small increments to keep testing manageable. TradeStation offers two optimization methods:

- Exhaustive Optimization: Tests every possible combination to find the best result.

- Genetic Optimization: Uses an evolutionary algorithm to quickly pinpoint meaningful results.

For strategies requiring more than 10,000 tests, consider increasing the parameter increments or switching to genetic optimization to save time.

However, be cautious of overfitting - this happens when a strategy is tailored too perfectly to past data but fails in live trading. To prevent this, TradeStation recommends Walk-Forward Analysis (WFA). WFA divides your data into "In-Sample" segments (used for optimization) and "Out-of-Sample" segments (used for validation). The Strategy Optimization Report provides tools like the Robustness Index and a WFO suitability indicator to assess whether your strategy is genuinely reliable or just overfit to historical data. A helpful tip: reserve the last 30% of your historical data as an out-of-sample validation window during the initial optimization phase.

Once you've optimized the parameters, it's time to validate those adjustments by re-testing them with fresh data.

Re-testing and Validation

After optimization, re-test your strategy using out-of-sample data to ensure its reliability. Use the Strategy Optimization Report to review different parameter combinations, then perform backtests on the out-of-sample data. This helps determine if the strategy's performance is consistent across both in-sample and out-of-sample data.

Keep an eye on the equity curve during this process. A smooth, steady upward trend suggests a dependable strategy, while erratic spikes or sharp declines may indicate high risk or instability.

If your strategy underperforms on unseen data, it’s a warning sign that the parameters might be overfit. To ensure walk-forward analysis is effective, TradeStation advises conducting at least 1,000 tests, whether you’re using exhaustive or genetic optimization methods.

Best Practices for Accurate Backtesting with QuantVPS

Getting accurate backtesting results depends on setting things up correctly and using high-quality data. Start with tick-level resolution to analyze strategies against real price movements - this approach ensures you're working with the most precise data available. For detailed setup instructions, check out the earlier section on enabling look-inside-bar testing.

Don't skip factoring in realistic costs. Without accurate estimates for broker commissions and slippage, your backtest results won't reflect actual trading conditions. Make sure to input precise slippage and commission values in your strategy properties. This step helps you avoid surprises like an equity curve that looks great in testing but performs poorly in live trading.

Another key to accuracy is ensuring a large enough sample size. For example, a strategy with at least 400 trades reduces the margin of error to 5%, while a smaller sample of 100 trades leaves you with a 10% margin of error. It's also smart to set aside the most recent six months of data as "out-of-sample" data. This allows you to validate your strategy after the initial testing phase. As Perry J. Kaufman puts it:

"Practically speaking, a robust trading strategy is one that produces consistently good results across a broad set of parameter (input) values applied to many different markets tested for many years".

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

"Practically speaking, a robust trading strategy is one that produces consistently good results across a broad set of parameter (input) values applied to many different markets tested for many years".

By following these practices, you'll strengthen your strategy validation process and complement the earlier setup instructions.

Using QuantVPS for Backtesting

QuantVPS offers a powerful setup to support these best practices, ensuring your backtesting environment is both reliable and efficient. With 99.999% uptime, you won't have to worry about server interruptions or connectivity issues disrupting your work. The platform's NVMe storage allows for quick access to historical tick data, while low-latency connections in Chicago and New York keep TradeStation responsive during even the most demanding optimization runs.

If your strategies involve look-inside-bar calculations, you'll need significant CPU power. QuantVPS handles these intensive tasks with ease, letting you run complex optimizations without slowing down. The platform also includes automatic backups to safeguard your strategy files and historical data, plus DDoS protection to keep your testing environment secure.

To get the most out of QuantVPS, choose a plan that matches the complexity of your backtesting needs.

Choosing the Right VPS Plan

QuantVPS offers several plans tailored to different levels of backtesting complexity:

- VPS Lite ($59.99/month or $41.99/month billed annually): Ideal for basic backtesting with 1–2 charts. Includes 4 cores, 8GB RAM, and 70GB NVMe storage.

- VPS Pro ($99.99/month or $69.99/month billed annually): Designed for multi-chart setups with 3–5 charts. Provides 6 cores, 16GB RAM, and 150GB NVMe storage.

- VPS Ultra ($189.99/month or $132.99/month billed annually): Best for heavy workloads, such as portfolio testing or genetic optimization across multiple strategies. Comes with 24 cores, 64GB RAM, and 500GB NVMe storage.

- Dedicated Server ($299.99/month or $209.99/month billed annually): Built for the most demanding tasks, like portfolio testing with 7+ charts. Features 16+ cores, 128GB RAM, and 2TB+ NVMe storage.

| Plan | Monthly Cost | Best For | Key Specs |

|---|---|---|---|

| VPS Lite | $59.99 ($41.99/year) | Basic backtesting, 1–2 charts | 4 cores, 8GB RAM, 70GB NVMe |

| VPS Pro | $99.99 ($69.99/year) | Multi-chart setups, 3–5 charts | 6 cores, 16GB RAM, 150GB NVMe |

| VPS Ultra | $189.99 ($132.99/year) | Heavy workloads, 5–7 charts | 24 cores, 64GB RAM, 500GB NVMe |

| Dedicated Server | $299.99 ($209.99/year) | Portfolio testing, 7+ charts | 16+ cores, 128GB RAM, 2TB+ NVMe |

Every plan includes unmetered bandwidth, 1Gbps+ network speeds, and runs on Windows Server 2022. Pick the plan that aligns with your backtesting needs to ensure smooth performance.

Conclusion

To backtest in TradeStation effectively, start by analyzing historical data and validating your strategies with real-time performance. This guide covered creating or importing strategies using EasyLanguage or no-code tools like Build Alpha, configuring key settings such as Max Bars Back, and evaluating outcomes through the Strategy Performance Report. As David Bergstrom, Founder of Build Alpha, wisely points out:

"Backtest results are not indicative of future results".

"Backtest results are not indicative of future results".

This underscores the importance of forward testing on a simulated account for at least 30 days before risking actual funds.

For the most accurate results, use realistic settings by factoring in commission and slippage, enabling Look-Inside-Bar backtesting, and testing strategies across multiple symbols. Additionally, a dependable QuantVPS setup - whether it's VPS Lite for simpler tasks or a Dedicated Server for heavy workloads - ensures uninterrupted backtesting with 100% uptime and low latency. A stable hosting environment is key to keeping your backtesting process smooth and free from technical hiccups.

FAQs

How much historical data is enough for a reliable backtest?

For a dependable backtest, you should aim to include 200–500 trades that cover various market conditions - bull, bear, and sideways - over a timeframe of 3 to 5 years or more. This broader market exposure ensures your results aren't skewed by a lucky streak or isolated trends. By analyzing enough trades over a significant period, you can gain a clearer, more reliable picture of how your strategy performs under different conditions.

When should I use LIBB or IOG instead of standard backtesting?

LIBB and IOG are perfect for testing strategies that involve intricate order fills or rely on detailed execution assumptions. These modes excel at simulating limit and market order fills with greater precision, factoring in elements like slippage and partial fills. They’re especially useful when standard backtesting methods fall short in capturing these finer details.

How can I tell if my optimized results are overfit?

To spot overfitting, look for strategies that excel on the dataset they were optimized for but stumble when applied to new or out-of-sample data. A good way to test this is by evaluating performance across different time periods or datasets. Key warning signs include:

- Poor performance on out-of-sample data

- Sharp declines in profitability when tested on new data

- Failure to outperform random or baseline strategies

If these issues appear, it’s a strong indication that the strategy might not have real predictive power.

For a dependable backtest, you should aim to include 200–500 trades that cover various market conditions - bull, bear, and sideways - over a timeframe of 3 to 5 years or more. This broader market exposure ensures your results aren't skewed by a lucky streak or isolated trends. By analyzing enough trades over a significant period, you can gain a clearer, more reliable picture of how your strategy performs under different conditions.

LIBB and IOG are perfect for testing strategies that involve intricate order fills or rely on detailed execution assumptions. These modes excel at simulating limit and market order fills with greater precision, factoring in elements like slippage and partial fills. They’re especially useful when standard backtesting methods fall short in capturing these finer details.

To spot overfitting, look for strategies that excel on the dataset they were optimized for but stumble when applied to new or out-of-sample data. A good way to test this is by evaluating performance across different time periods or datasets. Key warning signs include:

- Poor performance on out-of-sample data

- Sharp declines in profitability when tested on new data

- Failure to outperform random or baseline strategies

If these issues appear, it’s a strong indication that the strategy might not have real predictive power.

"}}]}