Perpetual futures are gaining traction as a go-to tool for traders looking to speculate or hedge without worrying about contract expiration. Platforms like Hyperliquid are leading the charge by offering high-leverage trading opportunities on a decentralized platform with advanced tools and transparent pricing.

Key Points:

- What are Perpetual Futures? Contracts without expiration dates, kept aligned with market prices via funding rates.

- Why Hyperliquid? Offers up to 100x leverage, on-chain execution, and tools like Funding Comparison and History for better decision-making.

- Infrastructure Matters: Using Virtual Private Server (VPS) hosting minimizes latency, ensures uptime, and supports automated trading strategies.

- Risk Management: High leverage increases potential returns but also magnifies risks. Tools like stop-loss orders and proper position sizing are essential.

For traders navigating fast-paced markets, combining Hyperliquid’s platform with VPS hosting solutions like QuantVPS can make all the difference. These tools ensure speed, reliability, and precision in high-stakes trading environments.

What Are Perpetual Futures Contracts?

Trading Technology Infrastructure: The Role of VPS Hosting

Trading perpetual futures on platforms like Hyperliquid demands split-second decisions and flawless execution. With funding rates updating every 8 hours and leverage reaching up to 100x, even a millisecond delay can make or break a trade. That’s why Virtual Private Server (VPS) hosting has become a game-changer for serious traders. This infrastructure advantage is the foundation of QuantVPS’s specialized trading services.

In today’s fast-paced trading environment, every millisecond matters. Take the XYZ US 100 Index perpetual futures, for instance – its funding rate updates at 0.0331%, creating fleeting opportunities that can vanish before your home internet even catches up. For traders, having a robust and high-speed infrastructure is just as crucial as their market strategies.

How VPS Hosting Enhances Trading

One of the biggest benefits of VPS hosting is ultra-low latency, which is critical for futures traders. A typical home internet connection may experience 50-200ms of latency when connecting to trading servers. By contrast, VPS solutions can achieve near-zero latency, giving traders the speed they need to execute trades on volatile assets like TSLA-USDC perps. In such high-leverage scenarios, even a minor price movement could trigger liquidations in seconds.

Another key advantage is continuous uptime. VPS hosting ensures that your trading operations run smoothly, even during local internet outages, power failures, or computer crashes. This reliability guarantees that stop-loss orders and automated strategies execute without interruption, regardless of external circumstances.

Additionally, dedicated resources make a huge difference during periods of high market activity. Shared hosting can slow down under heavy trading volumes, but VPS hosting provides exclusive CPU cores, RAM, and storage. This ensures consistent performance, even during volatile market spikes. Plus, it allows traders to access their platforms from anywhere with an internet connection, offering flexibility without sacrificing speed.

These features make VPS hosting a vital tool for traders navigating the complexities of high-leverage platforms like Hyperliquid.

QuantVPS Features for Futures Traders

QuantVPS takes these benefits to the next level with solutions tailored specifically for futures traders. Designed for high-frequency and automated trading, QuantVPS offers ultra-low latency connections that are essential for responding to rapid funding rate changes in perpetual futures markets.

QuantVPS provides multiple performance tiers, including VPS Lite ($41.99/month annually) with 4 cores and 8GB RAM for smaller setups, and VPS Ultra ($132.99/month annually) with 24 cores and 64GB RAM, ideal for traders managing multiple charts and strategies simultaneously.

For those juggling multiple contracts, multi-monitor support is a standout feature. The VPS Pro plan supports up to 2 monitors, while the Dedicated Server option allows up to 6 monitors. This setup is perfect for tracking assets like XYZ100-USDC, TSLA-USDC, and other equity perps alongside traditional crypto futures.

Platform compatibility ensures seamless integration with popular trading platforms such as NinjaTrader, MetaTrader, and TradeStation. This means traders can use their preferred tools and automated strategies without running into compatibility issues.

Security is another priority. Advanced security features like DDoS protection safeguard trading operations from malicious attacks, while automatic backups protect configurations and historical data. For advanced users, full root access allows complete customization of the trading environment.

QuantVPS also utilizes NVMe storage technology for lightning-fast data access. This is especially useful for real-time market analysis, such as reviewing funding rate histories across multiple contracts, where quick data retrieval and chart updates can make all the difference.

Finally, the unmetered bandwidth feature supports high-frequency trading strategies without the worry of data limits. Traders running algorithms to monitor dozens of perpetual markets can operate freely, without concerns about throttling or bandwidth caps.

These features highlight the importance of a reliable trading infrastructure in managing the risks and opportunities of perpetual futures trading.

XYZ US 100 Index Perpetual Futures: Key Features and Data

How the XYZ100-USDC Contract Works

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

The XYZ US 100 Index represents the top 100 U.S. companies outside the financial sector, giving traders a chance to zero in on the nation’s biggest nonfinancial players. Unlike broader indices like the S&P 500 or Nasdaq 100, which include banks and insurance companies, this index focuses on industries like technology, healthcare, consumer goods, and industrials. These sectors are often at the forefront of advancements and economic shifts, making the contract particularly appealing for traders interested in dynamic market segments. This narrower focus also influences the contract’s funding mechanics and potential returns.

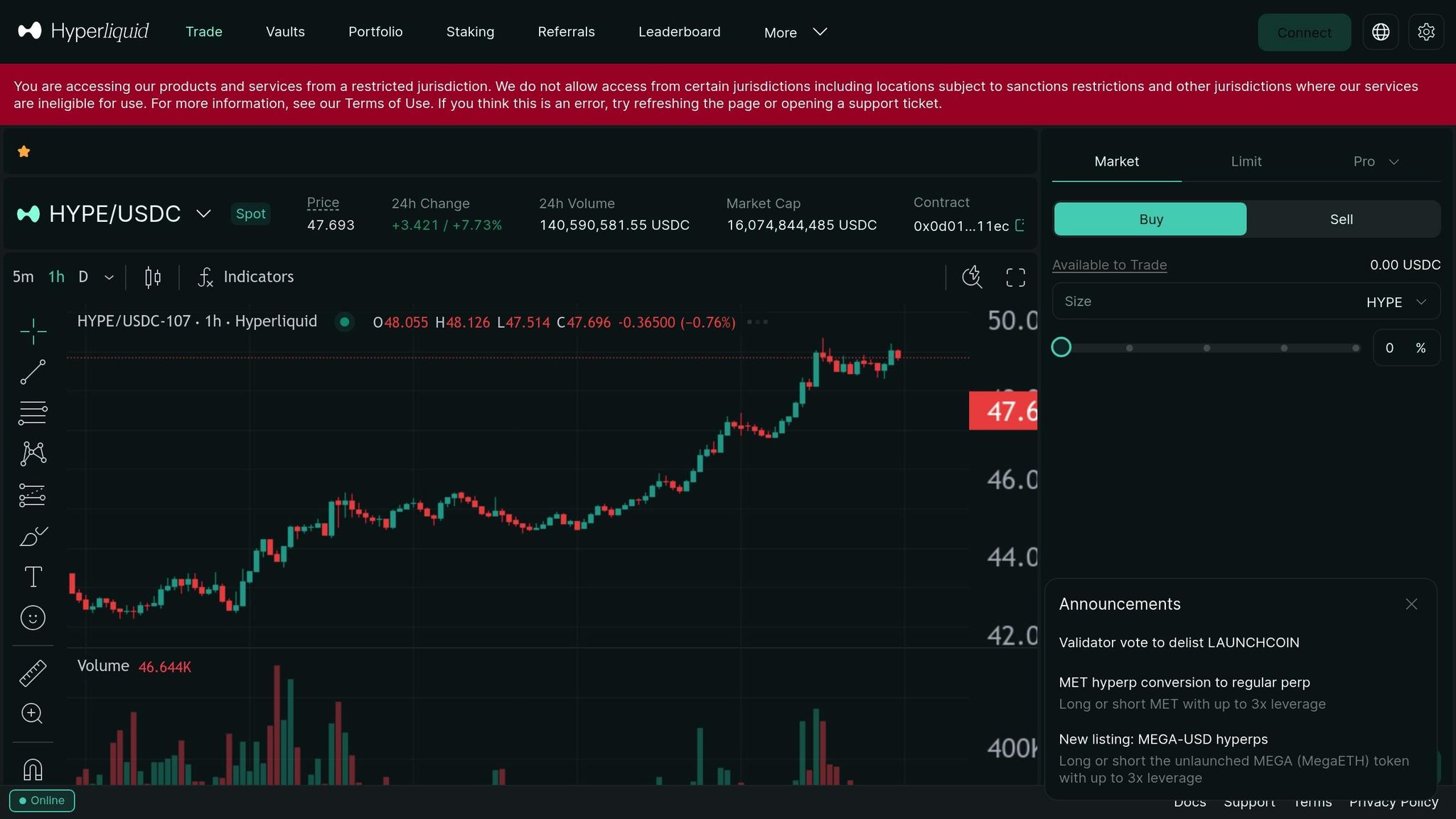

Equity Perpetual Futures on Hyperliquid

Hyperliquid has expanded its perpetual futures model to include equity perps, giving traders another way to engage with the market. These contracts allow users to speculate on price movements directly on-chain, without needing to own the actual asset. Similar to traditional stock futures, equity perps rely on a funding mechanism to track their underlying assets. Let’s dive into some examples that highlight how Hyperliquid’s equity perps work.

Key Equity Perps

One example is the TSLA-USDC contract, which mirrors Tesla’s price movements. Another notable addition is the MEGA-USD hyperps, offering up to 3x leverage. With Hyperliquid’s funding comparison tool, traders can easily spot favorable funding conditions, making it easier to optimize their positions.

Price Discovery and Launch Process

Hyperliquid uses its "hyperps" system to launch equity perps, enabling trading even before the underlying asset is fully established. This early trading mechanism allows participants to position themselves ahead of major market developments or token launches.

The process begins with placeholder pricing, which can be highly volatile – sometimes swinging as much as –100% – as the market transitions from provisional to market-driven values. A great example of this occurred in October 2025, when Hyperliquid launched the MEGA-USD hyperps for the upcoming MEGA (MegaETH) token. This allowed early trading with up to 3x leverage. Another example is the MET hyperp, which started as a hyperps contract and later transitioned into a standard perpetual contract. During the initial price discovery phase, funding rates can vary significantly as the market finds a balance between long and short positions.

To launch a new contract, Hyperliquid requires 500,000 HYPE tokens (valued between $20–$50 million, depending on market conditions). This ensures that only serious market makers initiate contracts while maintaining accessibility for traders. By combining this phased launch approach with early trading opportunities, Hyperliquid provides a platform for traders to engage with emerging market trends.

Trader Strategies for Perpetual Futures

On Hyperliquid, traders often take advantage of differences in funding rates within perpetual futures markets. A popular method is funding rate arbitrage, where traders position themselves to collect periodic funding payments from other market participants.

Funding Yield Strategies

In funding rate arbitrage, the key is keeping a close eye on funding rates at specific intervals. Traders aim to enter and exit positions based on real-time funding conditions, allowing them to earn income from funding payments while potentially benefiting from price movements.

Success with this approach requires a sharp focus on market trends and quick decision-making. At the same time, managing risk effectively is crucial, especially in markets prone to sudden volatility.

Risk Management and Best Practices

Trading perpetual futures with high leverage on platforms like Hyperliquid demands disciplined risk management. Take contracts like XYZ100-USDC and TSLA-USDC as examples – while leverage can amplify profits, it also increases risk significantly. With leverage levels as high as 100x, paired with volatile markets, traders face the possibility of rapid account liquidations if safeguards aren’t in place.

Managing Leverage and Liquidation Risks

When dealing with high-leverage markets, a solid risk management strategy is non-negotiable.

Position sizing is key. For instance, XYZ100-USDC offers 20x leverage, and TSLA-USDC provides 10x leverage. Before entering any trade, it’s crucial to determine the maximum loss you’re willing to accept. A good rule of thumb is to limit risk to 2-3% of your total account value per trade, regardless of how much leverage is available.

Monitoring margins is critical, especially since funding rates can change every 8 hours. Although the funding rate for XYZ100-USDC is only 0.0331% per 8 hours, it adds up over time. For traders holding positions over longer periods, these costs can become substantial, particularly when annualized funding rates exceed 10%.

Stop-loss and trailing stop orders are essential tools for limiting losses, but placement matters. Set stops too close, and you risk being forced out by normal market fluctuations. Set them too far, and they lose their effectiveness. Finding the right balance is crucial in high-leverage trading.

Keep a buffer above liquidation prices. Market gaps can unexpectedly trigger liquidations, so maintaining a cushion can help protect your positions.

Shorter timeframes can reduce exposure to funding costs. Instead of holding large positions through multiple funding periods, many traders opt for shorter-term strategies. This approach allows them to capitalize on price movements while avoiding the compounding costs of extended holding periods.

Using VPS Hosting for Risk Reduction

In addition to sound risk management practices, having reliable VPS hosting can make a significant difference, especially during periods of market volatility.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Consistent connectivity is a must for managing high-leverage trades. Platforms like QuantVPS offer ultra-low latency and a 100% uptime guarantee, ensuring you stay connected during critical moments when the market can move against you in seconds.

Automated risk management tools rely heavily on stable server performance. QuantVPS provides dedicated resources to support real-time monitoring systems and automated stop-loss execution, helping traders stay ahead of sudden market changes.

DDoS protection and automatic backups are invaluable during volatile periods. For instance, if funding rates spike or breaking news impacts equity perpetuals like TSLA-USDC, uninterrupted access to adjust or close positions is essential.

Global VPS access ensures stable connectivity from anywhere in the world. This is particularly useful for international traders using Hyperliquid’s decentralized platform, where execution speed and reduced slippage can directly impact profitability.

Multi-monitor support, available with QuantVPS Pro and higher plans, makes it easier to track multiple contracts, funding rates, and risk metrics simultaneously. With Hyperliquid offering over 100 perpetual markets, having enough screen space to monitor correlations across different positions is a game changer.

Finally, the Windows Server 2022 environment supports popular trading tools and risk management software, making it easier to calculate position sizes and set up automated alerts.

Combining disciplined risk management with dependable VPS hosting creates a solid foundation for success in high-leverage trading. These tools and strategies work together to help traders navigate the challenges of perpetual futures markets effectively.

Key Takeaways for Traders

For traders, several key insights stand out: spotting market opportunities, using leverage wisely, relying on solid technology, embracing automation, and maintaining strict risk management practices.

Hyperliquid’s perpetual futures open doors to unique trading opportunities, especially when combined with strong technology and disciplined risk strategies. The platform offers early access to unlaunched tokens, or "hyperps" (like MEGA-USD), enabling traders to engage in price discovery for up-and-coming assets.

Strategic leverage usage is a must. Hyperliquid provides tools like the Funding Comparison and Funding History features, which help traders manage leverage and keep track of funding costs effectively.

Dependable technology is non-negotiable. With QuantVPS, traders benefit from ultra-low latency and a 100% uptime guarantee, ensuring uninterrupted access to the markets for timely decision-making.

Automation can significantly improve trading efficiency. Hyperliquid’s API and Sub-Accounts simplify algorithmic trading strategies, while QuantVPS enhances this with its Windows Server 2022 environment and multi-monitor support. Together, these features allow traders to handle multiple positions with ease and precision.

Lastly, disciplined position sizing is critical. Tools like QuantVPS’s DDoS protection and automatic backups provide an extra layer of security, helping traders navigate market volatility with confidence.

FAQs

What makes perpetual futures on platforms like Hyperliquid different from traditional futures contracts?

Perpetual futures, often called perps, are a type of derivative contract that allows traders to speculate on asset prices without worrying about an expiration date. Unlike traditional futures, which come with fixed maturity dates, perps remain active indefinitely. To ensure their prices stay aligned with the underlying asset, they use periodic funding rate payments.

Platforms like Hyperliquid enhance the appeal of perpetual futures by offering features such as high leverage – up to 100x – and access to a broad selection of assets, including equities and indices. These advantages make perps a go-to option for traders looking for flexibility and opportunities across both crypto and traditional financial markets.

How does VPS hosting improve trading performance in high-leverage markets like those on Hyperliquid?

VPS hosting can play a key role in improving trading performance, especially in fast-paced, high-leverage markets. It provides low latency connections, which means orders are executed more quickly. This speed can help minimize slippage – an issue that’s particularly critical in volatile trading environments where every millisecond counts.

Another major advantage of VPS hosting is its 24/7 uptime and stability. Traders can keep their strategies running smoothly and ensure automated trading systems operate without interruptions. This is especially valuable in markets like those on Hyperliquid, where opportunities can appear at any moment. With a VPS, traders can stay ahead in dynamic, high-stakes trading landscapes.

What are the best strategies to manage risk when trading high-leverage perpetual futures on Hyperliquid?

Managing risk is an essential part of trading high-leverage perpetual futures on Hyperliquid. Here are some strategies to help you trade smarter and protect your capital:

- Set Stop-Loss Orders: A stop-loss order is your safety net. It automatically closes your position if the market moves against you, helping to cap potential losses before they spiral.

- Be Mindful of Leverage: While high leverage can amplify gains, it also magnifies losses. Stick to lower leverage levels, especially if you’re just starting out, to better manage market swings.

- Diversify Your Trades: Don’t put all your eggs in one basket. Spread your investments across different assets to reduce the risk of being overly reliant on a single market or index.

- Watch Funding Rates: Funding rates can add up, especially for long-term positions. Keep an eye on these trends to avoid letting high costs eat into your profits.

- Trade Within Your Means: Only use funds you can afford to lose. Never risk your entire account balance on a single trade – it’s a recipe for unnecessary stress and potential losses.

By applying these strategies, you’ll be better equipped to handle the challenges of trading high-leverage perpetual futures on Hyperliquid. While risks are inevitable, a thoughtful approach can make the journey much smoother.