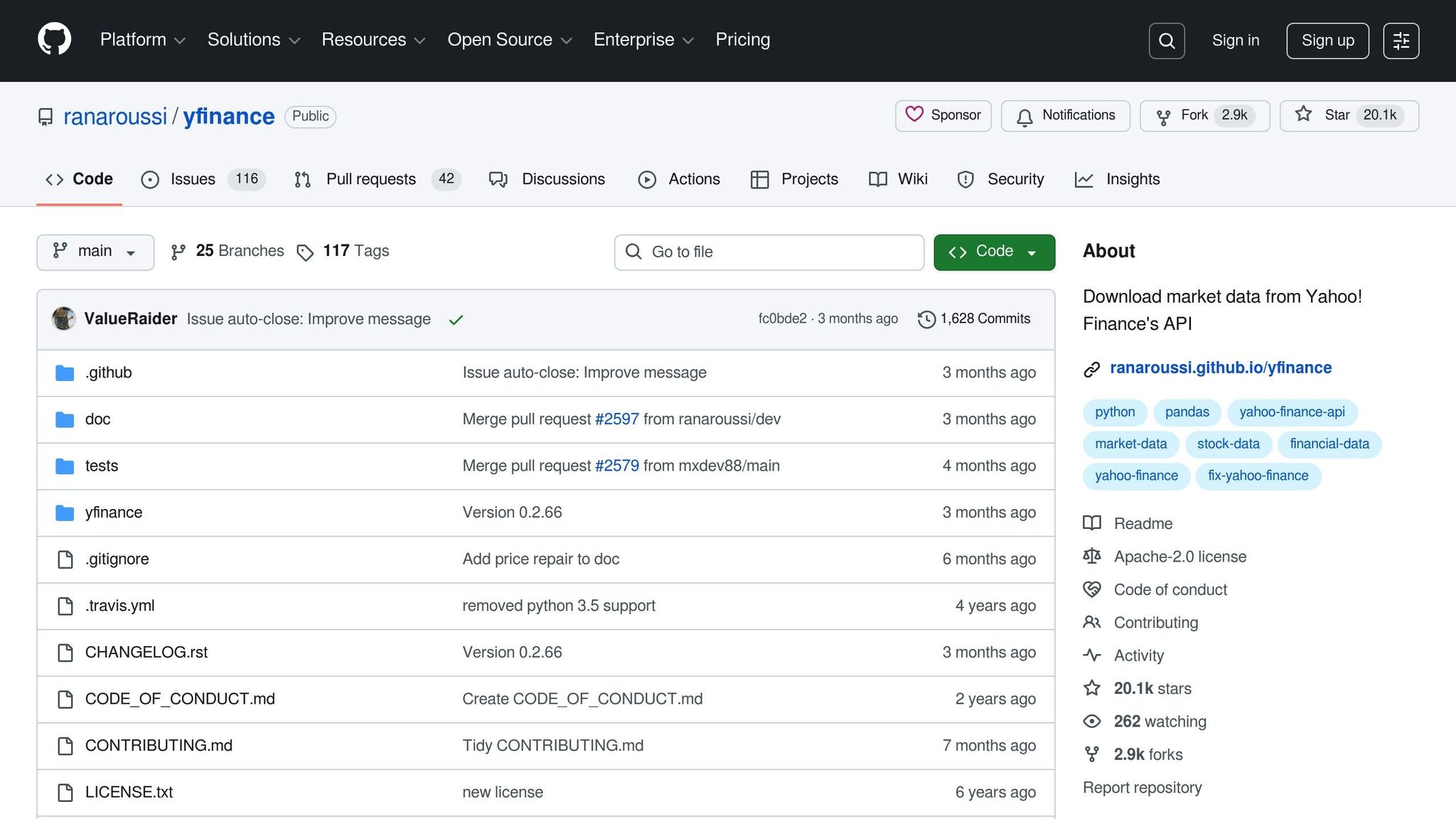

If you’re looking to access Yahoo Finance data for stocks, ETFs, mutual funds, or cryptocurrencies, yfinance is the tool to know. While Yahoo’s official API shut down in 2017, this Python library allows you to programmatically pull historical prices, real-time quotes, company fundamentals, and options data. It’s an efficient way to automate market analysis and build trading workflows.

Here’s what you need to know:

- What is yfinance? An unofficial Python library that retrieves data from Yahoo Finance‘s public endpoints.

- Key Features: Fetch historical prices, financial statements, and options data. Supports automated workflows.

- Setup: Install Python, set up a virtual environment, and use pip to install

yfinancealong withpandasandnumpy. - Best Environment: Use a VPS (like QuantVPS) for 24/7 reliability, low latency, and scalable performance.

- Use Cases: Automate data pulls, backtest strategies, or monitor market conditions in real time.

While yfinance is reliable, it’s unofficial, so occasional disruptions may occur. Pairing it with a robust VPS setup ensures uninterrupted access and smooth operation for your trading systems.

yfinance Python Tutorial: Get Free Market Data

Setting Up yfinance on QuantVPS

To get started with yfinance on QuantVPS, you’ll need to install Python, configure your environment, and select the right plan for your needs.

Installing Python and Required Libraries

QuantVPS instances come with Windows Server 2022 pre-installed, but Python and its libraries must be set up manually. First, open the terminal on your VPS and check if Python is already installed by running:

python --version If Python isn’t installed, download the latest version from the official Python website and follow the installation steps.

Next, ensure that pip, Python’s package manager, is available. Run:

pip --version to confirm its presence. Pip is often bundled with Python, but it’s good to double-check.

For better project management, create a virtual environment. This keeps your project dependencies separate, avoiding conflicts with other projects on the same VPS. Navigate to your project folder in the terminal and run:

python -m venv venv This creates a venv folder containing an isolated Python setup. Activate it using:

venv\Scripts\activate Once the virtual environment is active, you can install the required libraries in one go:

pip install yfinance pandas numpy -

yfinance: Fetches market data. -

pandas: Helps manipulate time series data. -

numpy: Supports numerical computations.

To confirm successful installation, use:

pip show yfinance This command shows details like the version and installation path, ensuring everything is ready to go.

Configuring Your VPS Environment

For accurate financial data analysis, configure your VPS to align with U.S. trading hours. Start by setting the time zone to Eastern Time (ET), as this matches the operating hours of major exchanges like the NYSE and NASDAQ. Access the time zone settings through the Windows Server control panel and adjust accordingly.

Ensure that U.S. regional settings are applied, including currency formatting. Dollar amounts should display with a $ symbol and commas as thousand separators (e.g., $1,234.56). These settings simplify financial data interpretation and analysis.

Organize your workspace by creating dedicated folders for data, logs, and scripts. Suggested structure:

-

C:\trading\data\historical -

C:\trading\logs -

C:\trading\scripts

This organization becomes critical as your data collection grows. Additionally, set up automated backups for your market data and scripts. While QuantVPS offers automatic backup features, having an extra layer of local backups ensures added security. Scheduling regular exports of essential datasets can prevent data loss.

Selecting the Right QuantVPS Plan for Your Needs

The best QuantVPS plan for you depends on the complexity of your workflows and the number of scripts you plan to run simultaneously. Here’s a breakdown of the available plans:

- VPS Lite ($59.99/month or $41.99/month billed annually): Ideal for simple tasks like fetching daily price data for a few stocks or running lightweight monitoring scripts. It includes 4 cores, 8 GB RAM, and 70 GB NVMe storage.

- VPS Pro ($99.99/month or $69.99/month billed annually): Suitable for more demanding workflows, such as pulling data for dozens of securities or running backtests. This plan offers 6 cores, 16 GB RAM, and 150 GB NVMe storage.

- VPS Ultra ($189.99/month or $132.99/month billed annually): Designed for intensive tasks like high-frequency data retrieval across hundreds of securities. It provides 24 cores, 64 GB RAM, and 500 GB NVMe storage.

- Dedicated Server ($299.99/month or $209.99/month billed annually): For professional-grade operations, this option offers 16+ dedicated cores, 128 GB RAM, and 2 TB+ NVMe storage. It’s perfect for real-time data processing and institutional-level workflows.

Choose your plan based on the number of securities you’ll track, the frequency of data retrieval, and the complexity of your scripts. For example, pulling daily prices for 50 stocks requires far fewer resources than fetching minute-by-minute data for 500 securities while performing real-time calculations.

After setup, monitor your VPS’s performance using Windows Server’s Task Manager. Keep an eye on CPU, RAM, and disk usage to ensure your plan meets your needs. If resource usage spikes, QuantVPS makes it simple to upgrade as your workflows evolve and become more complex.

Fetching Market Data with yfinance

Once your VPS is set up and the necessary libraries are installed, you can start pulling market data. The yfinance library is a great tool for this, providing data in Pandas DataFrame format, making it easy to analyze and manipulate.

Getting Historical Price Data

To fetch historical stock prices, yfinance offers two main methods: yf.download() and yf.Ticker().history(). Both return OHLCV data (Open, High, Low, Close, Volume), which is essential for backtesting and strategy development.

For most scenarios, yf.download() is the preferred option. Here’s an example of how to get daily price data for Apple:

import yfinance as yf data = yf.download("AAPL", start="2020-01-01", end="2021-01-01") print(data.head()) This outputs a DataFrame with columns for Open, High, Low, Close, Adjusted Close, and Volume, with dates as the index.

To fetch data for multiple stocks, pass a list of ticker symbols:

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

multi_data = yf.download(["AAPL", "MSFT"], start="2020-01-01", end="2021-01-01") When dealing with multiple tickers, the returned data is a MultiIndex DataFrame. You can access individual stock data like this:

multi_data['Close']['AAPL'] If you’re working with an active Ticker object or need relative time periods, use yf.Ticker().history():

apple = yf.Ticker("AAPL") recent_data = apple.history(period="1d") five_year_data = apple.history(period="5y") This method is convenient for pulling recent trading data without manually defining start and end dates. The period parameter supports values like "1d", "1mo", "1y", "5y", "ytd", and "max".

For intraday data, you can specify intervals such as "1m" for minute-by-minute data (up to 7 days) or "60m" for hourly data (up to 730 days). Keep in mind that Yahoo Finance limits intraday data availability based on the interval selected.

After gathering historical prices, you can dive into financial metrics and statements.

Retrieving Financial Statements and Metrics

Beyond price data, yfinance provides access to a wealth of company fundamentals through the Ticker object’s .info attribute. This returns a dictionary packed with financial metrics and company details.

For example, to analyze Apple:

import yfinance as yf apple = yf.Ticker("AAPL") company_info = apple.info The .info dictionary includes data like market capitalization, P/E ratios, dividend rates, employee counts, and more. Here’s how to extract a specific metric:

forward_pe = apple.info['forwardPE'] print(f"Apple's Forward P/E: {forward_pe}") If you’re interested in dividends, the dividendRate field shows the annual dividend amount. For a detailed dividend history, use the .dividends attribute:

dividends = apple.dividends print(dividends) This returns a Pandas Series with dates as the index and dividend amounts as values.

For financial statements like balance sheets, income statements, and cash flow statements, use these attributes:

financials = apple.financials balance_sheet = apple.balance_sheet cashflow = apple.cashflow These attributes return DataFrames with rows for financial line items and columns for reporting periods.

To analyze multiple companies, loop through ticker symbols and compile the data. For example, you can compare forward P/E ratios like this:

tickers = ["AAPL", "MSFT", "GOOGL"] pe_ratios = {} for ticker in tickers: stock = yf.Ticker(ticker) pe_ratios[ticker] = stock.info.get('forwardPE', 'N/A') print(pe_ratios) These metrics are invaluable when refining automated trading strategies.

Accessing Options Data

For options traders, yfinance provides detailed options chain data, including strike prices, expiration dates, implied volatility, and open interest. Start by using the .options attribute to list all available expiration dates:

import yfinance as yf aapl = yf.Ticker("AAPL") expiration_dates = aapl.options print(expiration_dates) This returns a tuple of expiration dates, ranging from weekly options to long-term LEAPS.

To retrieve the options chain for a specific expiration date, use .option_chain():

opt = aapl.option_chain(date='2020-07-24') calls = opt.calls puts = opt.puts The returned object contains two DataFrames: one for call options and one for puts. Each includes:

- contractSymbol: Unique identifier for the option contract

- strike: Strike price

- lastPrice: Most recent trade price

- bid/ask: Current bid and ask prices

- volume: Number of contracts traded during the session

- openInterest: Total outstanding contracts

- impliedVolatility: Market’s expectation of future price movement

- lastTradeDate: Timestamp of the most recent trade

You can filter this data using Pandas operations. For example, to find call options with strikes between $140 and $150:

filtered_calls = calls[(calls['strike'] >= 140) & (calls['strike'] <= 150)] Or, to identify the strike price with the highest open interest:

max_oi_strike = calls.loc[calls['openInterest'].idxmax(), 'strike'] print(f"Strike with highest open interest: ${max_oi_strike}") Options data can help you analyze market sentiment, identify key price levels, and develop strategies around specific strike prices. To keep your trading strategies updated, consider scheduling regular data pulls on QuantVPS, as options chains are highly dynamic and change throughout the trading day.

Automating Trading Workflows with yfinance on QuantVPS

Once you’ve set up yfinance and configured your VPS, the next logical step is automating your trading workflows. Automating these workflows on QuantVPS ensures smooth data retrieval, processing, and execution of trading strategies without interruptions. This builds on the stable environment discussed earlier, boosting the efficiency of your trading operations.

Scheduling Data Retrieval Scripts

For seamless data collection, you can use Windows Task Scheduler to run Python scripts at specific times, such as 8:00 AM and 5:00 PM EST, to capture pre-market and end-of-day data.

To set this up, open Task Scheduler on your Windows Server 2022 VPS. Click "Create Basic Task" and name it descriptively, like "Pre-Market Data Pull" or "Daily Options Chain Update." Choose a trigger based on your timing needs.

Under the "Action" section, select "Start a program" and point to your Python executable (e.g., C:\Python\python.exe). In the "Add arguments" field, provide the full path to your script, such as C:\TradingScripts\fetch_market_data.py. Make sure the "Start in" directory matches your script’s location to ensure access to required files or dependencies.

For intraday strategies requiring hourly updates between 9:30 AM and 4:00 PM EST, set up a recurring task with an hourly trigger. Remember, Yahoo Finance provides intraday data for recent periods (up to seven days), so pulling minute-by-minute data works best for short-term analysis.

Since yfinance is an unofficial API that mimics browser requests, it’s important to wrap your code in try-except blocks and log errors for troubleshooting. Here’s an example of a Python script for scheduled tasks:

import yfinance as yf import pandas as pd from datetime import datetime import logging # Set up logging logging.basicConfig( filename='C:\\TradingLogs\\data_fetch.log', level=logging.INFO, format='%(asctime)s - %(levelname)s - %(message)s' ) def fetch_premarket_data(): try: tickers = ["AAPL", "MSFT", "TSLA", "SPY"] data = yf.download(tickers, period="5d", interval="1h") # Save data with a timestamp timestamp = datetime.now().strftime("%Y%m%d_%H%M%S") data.to_csv(f"C:\\MarketData\\premarket_{timestamp}.csv") logging.info(f"Successfully fetched data for {len(tickers)} tickers") except Exception as e: logging.error(f"Data fetch failed: {str(e)}") if __name__ == "__main__": fetch_premarket_data() This script logs both successful data pulls and errors, making it easier to identify and resolve issues.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Building Data Pipelines for Trading Strategies

A well-structured data pipeline is key to efficient trading. Break down your pipeline into functions for data retrieval, cleaning, and storage. This modular approach simplifies debugging and allows for smoother integration with trading algorithms.

If your strategies involve calculations like technical indicators or aggregating data across timeframes, here’s an example of a pipeline that fetches and processes data:

import yfinance as yf import pandas as pd from datetime import datetime def fetch_and_process_data(ticker, start_date, end_date): # Fetch raw data raw_data = yf.download(ticker, start=start_date, end=end_date) # Calculate daily returns raw_data['Daily_Return'] = raw_data['Close'].pct_change() # Add moving averages raw_data['SMA_20'] = raw_data['Close'].rolling(window=20).mean() raw_data['SMA_50'] = raw_data['Close'].rolling(window=50).mean() # Calculate volatility raw_data['Volatility'] = raw_data['Daily_Return'].rolling(window=20).std() # Remove NaN values processed_data = raw_data.dropna() return processed_data def save_to_csv(data, ticker): # Save data with a US-formatted timestamp timestamp = datetime.now().strftime("%m_%d_%Y") filename = f"C:\\StrategyData\\{ticker}_{timestamp}.csv" data.to_csv(filename, float_format='%.2f') return filename # Example usage ticker = "AAPL" data = fetch_and_process_data(ticker, "2024-01-01", "2024-12-09") filepath = save_to_csv(data, ticker) print(f"Data saved to {filepath}") For better performance, you can save data in Parquet format instead of CSV:

data.to_parquet(f"C:\\StrategyData\\{ticker}_{timestamp}.parquet") When working with multiple securities, batch your API calls to avoid overwhelming Yahoo’s servers. Fetch data for 10-15 tickers at a time, introduce short delays between batches, and include retry logic for failed requests. Organize your data systematically, such as storing equities data in C:\MarketData\Equities\Daily\ and options data in C:\MarketData\Options\Weekly\, to streamline access and management.

Matching Your VPS Plan to Your Workload

Your QuantVPS plan should align with the intensity of your trading activities. Here’s a breakdown:

- VPS Lite: Suitable for beginners running one or two simple strategies with daily data pulls. This plan can handle fetching end-of-day data for 10–20 tickers and executing basic strategies like moving averages or momentum.

- VPS Pro: Ideal for intermediate traders managing 3–5 concurrent strategies. It supports more frequent data pulls, such as hourly updates during market hours, and allows for backtesting larger datasets.

- VPS Ultra: Designed for advanced traders running 5–7 strategies simultaneously. This plan is capable of handling real-time data processing, complex backtesting with extensive tick data, and parallel execution of Python processes.

- Dedicated Server: Best for professional traders or firms managing 7+ strategies with heavy data demands. This option provides dedicated resources for intensive workloads.

Choosing the right plan ensures your VPS can handle the demands of your trading strategies effectively.

Troubleshooting and Best Practices

Running yfinance on QuantVPS can be a powerful way to access market data, but it comes with its own set of challenges. Since the library isn’t officially maintained by Yahoo Finance, occasional hiccups are inevitable. Tackling these issues promptly can save you hours of debugging and help you avoid data gaps that could disrupt your trading strategies.

Common yfinance Issues and Solutions

Here are some common problems you might encounter with yfinance and how to address them:

-

ModuleNotFoundError: This occurs when the library isn’t installed or the module name is misspelled. Double-check your installation with:pip listMake sure to activate your virtual environment before installing the library.

- Data download failures: Since yfinance scrapes data from Yahoo Finance, changes to their platform can cause errors like empty DataFrames or connection issues. Updating to the latest version often resolves this:

pip install --upgrade yfinance - Time zone mismatches: Yahoo Finance data is returned in UTC, but many trading strategies rely on Eastern Time. Use the

pytzlibrary to convert timestamps:import yfinance as yf import pytz ticker = yf.Ticker("AAPL") data = ticker.history(period="1d", interval="1m") eastern = pytz.timezone('US/Eastern') data.index = data.index.tz_convert(eastern) print(f"Data time zone: {data.index.tz}") - Rate limiting: Yahoo Finance doesn’t publish official limits, but excessive requests can trigger temporary blocks. For large portfolios, batch your requests into smaller groups with short delays:

import yfinance as yf import time tickers = ["AAPL", "MSFT", "GOOGL", "AMZN", "TSLA"] batch_size = 5 for i in range(0, len(tickers), batch_size): batch = tickers[i:i + batch_size] data = yf.download(batch, period="1d", group_by='ticker') time.sleep(2) # Add a delay between batches - Corporate actions: Events like stock splits or dividend payouts can create data discrepancies. Always validate your data for missing entries or NaN values and cross-check the date range with market activity.

pip list Make sure to activate your virtual environment before installing the library.

pip install --upgrade yfinance import yfinance as yf import pytz ticker = yf.Ticker("AAPL") data = ticker.history(period="1d", interval="1m") eastern = pytz.timezone('US/Eastern') data.index = data.index.tz_convert(eastern) print(f"Data time zone: {data.index.tz}") import yfinance as yf import time tickers = ["AAPL", "MSFT", "GOOGL", "AMZN", "TSLA"] batch_size = 5 for i in range(0, len(tickers), batch_size): batch = tickers[i:i + batch_size] data = yf.download(batch, period="1d", group_by='ticker') time.sleep(2) # Add a delay between batches By addressing these issues systematically, you can maintain a reliable data pipeline for your trading strategies.

Maintaining Data Quality

Accurate data is the backbone of any trading system. Even minor errors can compound over time, leading to faulty signals. To ensure data quality, implement validation checks after every data pull. Here’s what to look for:

- Missing values (NaN)

- Logical relationships in OHLC data (e.g., High ≥ Open, Close, and Low)

- Positive volume figures

- Complete trading days, accounting for holidays

Here’s a sample function to validate your data:

import pandas as pd def validate_market_data(data, ticker): issues = [] # Check for NaN values nan_count = data.isna().sum().sum() if nan_count > 0: issues.append(f"Found {nan_count:,} NaN values") # Validate OHLC relationships invalid_high = (data['High'] < data[['Open', 'Close', 'Low']].max(axis=1)).sum() invalid_low = (data['Low'] > data[['Open', 'Close', 'High']].min(axis=1)).sum() if invalid_high > 0: issues.append(f"{invalid_high} rows with invalid High prices") if invalid_low > 0: issues.append(f"{invalid_low} rows with invalid Low prices") # Check for negative volume negative_volume = (data['Volume'] < 0).sum() if negative_volume > 0: issues.append(f"{negative_volume} rows with negative volume") # Check for missing trading days date_range = pd.date_range(start=data.index.min(), end=data.index.max(), freq='B') missing_dates = len(date_range) - len(data) if missing_dates > 5: issues.append(f"Potentially {missing_dates} missing trading days") if issues: print(f"Data quality issues for {ticker}:") for issue in issues: print(f" - {issue}") return False else: print(f"Data validation passed for {ticker}") return True For missing values, use context-specific strategies. Forward-fill prices only for short gaps (1–2 entries) and avoid backward-filling to prevent bias. For missing volume data, filling with zeros may be appropriate, provided the market was open on those dates.

To handle unexpected errors, wrap yfinance calls with retry logic:

import yfinance as yf import time import logging def fetch_with_retry(ticker, max_retries=3): for attempt in range(max_retries): try: data = yf.download(ticker, period="1mo", progress=False) if not data.empty: return data else: logging.warning(f"Empty data for {ticker}, attempt {attempt + 1}") except Exception as e: logging.error(f"Error fetching {ticker}: {str(e)}") if attempt < max_retries - 1: time.sleep(2 ** attempt) # Exponential backoff logging.error(f"Failed to fetch {ticker} after {max_retries} attempts") return None Finally, separate raw and processed data into distinct directories (e.g., C:\\MarketData\\Raw and C:\\MarketData\\Processed) to ensure you can reprocess data without re-downloading it.

Optimizing VPS Performance

High-quality data is only useful if your system can process it efficiently. QuantVPS offers fast NVMe storage and 1Gbps+ network connections, but performance still depends on your setup. To optimize:

- Monitor CPU and RAM usage: Use Task Manager (Ctrl + Shift + Esc) to check for bottlenecks. If CPU usage exceeds 80–90% or memory usage surpasses 75%, consider upgrading your VPS plan.

- Leverage local storage: Store frequently accessed datasets locally to reduce download times.

- Efficient code: Streamline your scripts to minimize unnecessary computations or data handling.

Conclusion

Retrieving market data doesn’t have to be complicated, thanks to yfinance. This library simplifies the process of gathering historical prices, financial statements, and options data with its easy installation and efficient methods. One of its standout features is the automated access to extensive datasets – saving you from the hassle of manual downloads and reducing the risk of errors that often come with traditional approaches.

However, to make the most of yfinance, a dependable execution environment is essential. Accurate data demands a solid, reliable infrastructure. By integrating yfinance with a high-performance QuantVPS setup, you can ensure seamless and consistent trading execution. QuantVPS offers solutions tailored to your needs, whether you’re running lightweight scripts with their VPS Lite plan or handling resource-intensive tasks on Dedicated Servers. With this combination, you can meet the demands of automated trading while maintaining strong performance and reliability.

FAQs

How does the yfinance library retrieve data from Yahoo Finance even though the official API is no longer available?

The yfinance library pulls data directly from Yahoo Finance by utilizing publicly available endpoints. Although Yahoo officially discontinued its Finance API, yfinance steps in to fill the gap by accessing these endpoints to gather market data. This includes stock prices, historical trends, and financial metrics. Its straightforward approach makes it easy for users to incorporate market data into their Python projects without hassle.

Why should I use a VPS like QuantVPS to run yfinance scripts?

Using a VPS like QuantVPS to run yfinance scripts comes with several practical benefits. First and foremost, a VPS ensures your scripts can operate around the clock without interruptions. This is especially crucial for tasks like pulling real-time market data or carrying out automated trading strategies.

QuantVPS offers a setup designed for performance, scalability, and security. This means your scripts can handle high-demand periods smoothly, and your financial data stays secure. Plus, a VPS gives you the freedom to access your trading environment from anywhere, making it an ideal solution for developers and traders who value both flexibility and reliability.

How can I ensure the market data retrieved with yfinance is accurate and reliable?

The yfinance library is a handy resource for accessing market data, but keep in mind that it isn’t officially supported by Yahoo Finance. Because it relies on web scraping, its functionality can sometimes be affected if Yahoo Finance updates its website.

For better accuracy and dependability, it’s a good idea to double-check important data with other reliable financial sources. Also, make sure to validate the data you retrieve, especially if it’s being used for critical trading or analysis. Be aware that occasional service interruptions might happen.