Finviz Stock Screener Review

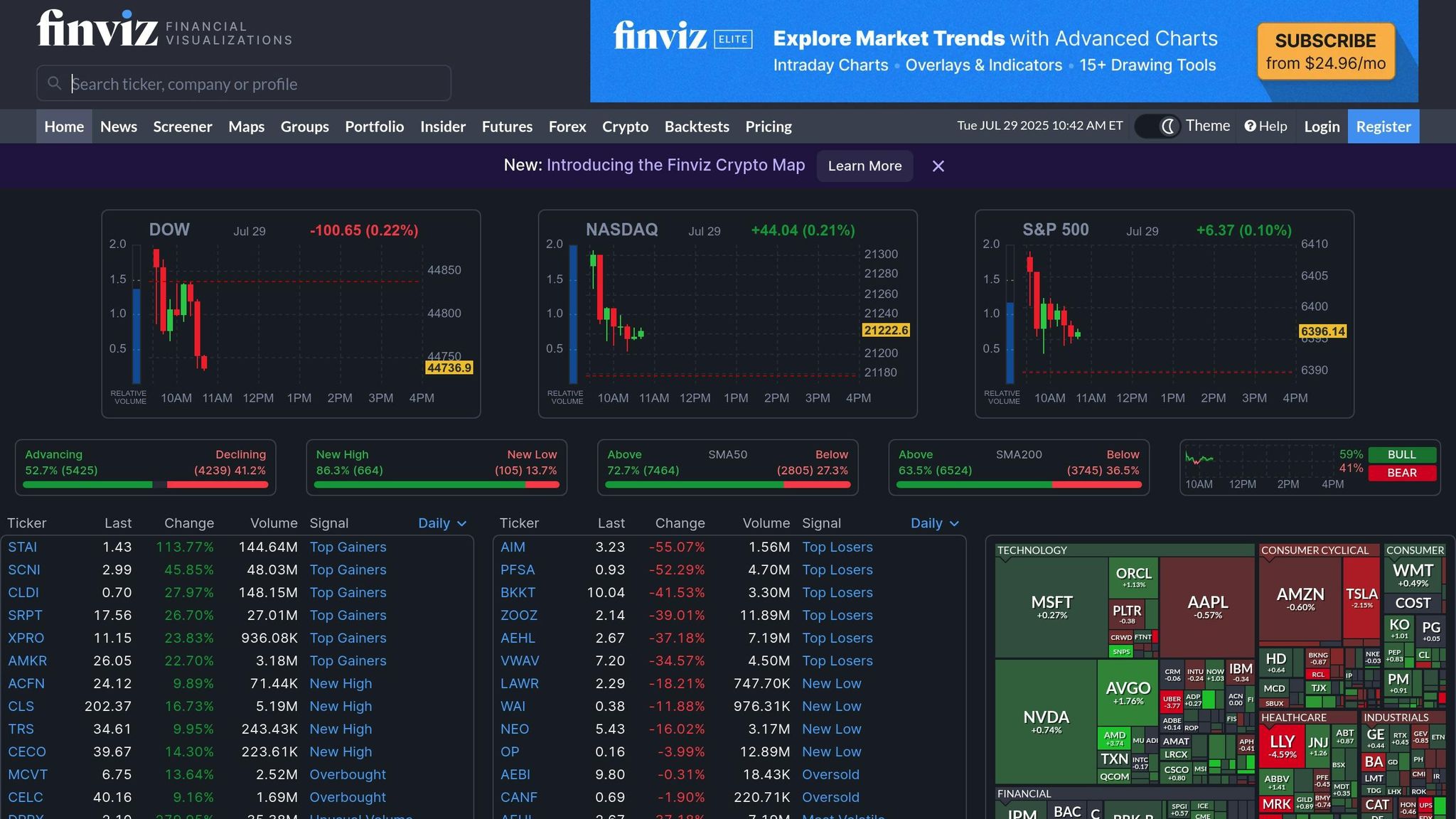

Finviz is a browser-based stock screener tailored to U.S. equities, offering tools for filtering over 8,500 stocks and ETFs using 67 criteria like technical indicators, financial metrics, and insider activity. It’s widely used by individual investors, professional traders, and institutions for its ability to simplify stock analysis with visual tools like heat maps and automated chart pattern recognition.

Key Features:

- Free Version: 15-20 min delayed quotes, basic filters, heat maps, and chart patterns.

- Elite Version ($39.50/month or $299.50/year): Real-time data, intraday charts, backtesting, and alerts.

- Filter Categories: Descriptive (e.g., market cap), Fundamental (e.g., P/E ratio), and Technical (e.g., RSI).

- Customizable Tools: Save presets, adjust layouts, and export data (Elite only).

Who Should Use It:

- Retail Investors: Beginners appreciate free features; advanced users benefit from Elite tools.

- Active Traders: Real-time data and alerts cater to day and swing traders.

- Institutions: Trusted by firms like HSBC and Bank of America for its robust screening.

Pros:

- Free access to essential tools.

- Intuitive interface with clear visuals.

- Real-time and advanced tools in Elite.

Cons:

- Free version has ads and delayed data.

- Limited fundamental data compared to specialized platforms.

- No mobile app.

For traders seeking efficiency, pairing Finviz with a VPS (e.g., QuantVPS) enhances execution speed and reliability. Finviz is a solid choice for screening and visualizing market data, with Elite unlocking advanced features for serious traders.

Main Features and Screening Tools

Stock Screening Options

Finviz offers a stock screener with a robust filtering system that covers more than 8,500 stocks and ETFs using 67 different criteria. These tools are grouped into three main filtering categories:

- Descriptive filters: Focus on basic stock details like market cap, sector, and trading volume.

- Fundamental filters: Include financial metrics such as P/E ratios and earnings growth.

- Technical filters: Highlight price trends, moving averages, and chart patterns.

The platform also features an "All" view, allowing users to combine filters from multiple categories to create highly customized screens. Vincent Nguyen from TradeSearcher explains:

"By filtering a large list of stocks based on technical and fundamental criteria, the screener shows you potential investment opportunities within seconds."

"By filtering a large list of stocks based on technical and fundamental criteria, the screener shows you potential investment opportunities within seconds."

For instance, traders might set up a screen with filters like: market cap > $500M, RSI < 30, price above the 20-day moving average, short float > 20%, and average volume > 500K shares. These combinations can be saved as presets, making it easier to revisit specific strategies.

Charts and Market Visualization

Finviz goes beyond just filtering stocks - it excels at presenting market data visually. Its heat maps provide a quick snapshot of market performance, showcasing sector rotation and individual stock movements with color-coded updates throughout the trading day. Performance charts, which include various timeframes and technical overlays, help traders analyze price action and pinpoint key support or resistance levels.

Barry D. Moore, a Certified Financial Technician, praises Finviz's visual tools:

"My Finviz testing uncovered an impressive free stock screener, speedy market heatmaps, and automated chart pattern recognition! Plus, with Finviz Elite, you gain access to real‑time data, interactive charts, and backtesting - all at a competitive price."

"My Finviz testing uncovered an impressive free stock screener, speedy market heatmaps, and automated chart pattern recognition! Plus, with Finviz Elite, you gain access to real‑time data, interactive charts, and backtesting - all at a competitive price."

The platform’s automated chart pattern recognition identifies formations like triangles, flags, and head-and-shoulders, saving time for technical analysts. Market visualization tools also extend to sector performance displays, offering a broader perspective on which industries are gaining traction and which are experiencing selloffs.

Interface and Usability

Finviz combines powerful features with a user-friendly interface designed for accessibility and customization. Since it’s browser-based, there’s no need to download software - it works on any device with internet access. Intuitive dropdown menus make it easy to select filters, and real-time updates show how each criterion affects the stock universe.

Customization options include adjusting column layouts, sorting results by different metrics, and saving custom screener configurations. These features are especially handy for traders juggling multiple strategies or analyzing different segments of the market. Finviz received an overall rating of 4.4 out of 5.0, with its usability earning a perfect 5-star score. One reviewer notes:

"First-class stock screener that balances power with ease-of-use. The platform is intuitive and fun once users get the hang of it."

"First-class stock screener that balances power with ease-of-use. The platform is intuitive and fun once users get the hang of it."

For beginners, the platform includes a guided tour to help users unlock its full potential. Whether you’re conducting quick scans for opportunities or diving deeper into company research, Finviz makes the process seamless.

| Filter Type | Example Criteria | Purpose |

|---|---|---|

| Descriptive | Market Cap > $500M | Identify liquid stocks |

| Fundamental | P/E < 20 | Spot undervalued companies |

| Technical | Price above 20-day MA | Confirm upward momentum |

Free vs Elite (Premium) Versions

Free Version Features

Finviz's free version gives users access to a solid stock screening platform without any cost. It includes the essential screening tools with a wide range of filter options spanning descriptive, fundamental, and technical categories. Users also get basic heat maps, sector performance displays, and chart pattern recognition. However, ads are part of the interface, which can disrupt workflow, and stock quotes come with a 15-20 minute delay.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

The free plan allows up to 50 screener presets and limits the table view to 20 results per page. Financial data is capped at three years, which might not be enough for detailed fundamental analysis. Additionally, features like intraday charts, advanced technical studies, and alerts for price movements or screening criteria are not included in the free tier.

Elite Version Features

For those needing more, Finviz Elite transforms the platform into a professional-grade tool with real-time quotes, charts, and screening capabilities. The Elite plan costs $39.50 per month or $299.50 annually, which breaks down to $24.96 per month when billed yearly. Elite users gain access to premarket data (4:00 AM to 9:30 AM) and after-hours data (4:00 PM to 8:00 PM), making it particularly appealing for active traders. The subscription removes all ads and provides enhanced features like intraday charts, customizable layouts, and in-depth technical studies.

Lincoln Olson from WallStreetZen describes the audience for this premium tier:

"A subscription to FINVIZ Elite is worth it for an extremely niche group of day traders and swing traders. Keep reading to find out if you're among those who could benefit from it."

"A subscription to FINVIZ Elite is worth it for an extremely niche group of day traders and swing traders. Keep reading to find out if you're among those who could benefit from it."

Elite subscribers also enjoy backtesting tools with over 20 years of historical data, email alerts for price changes and portfolio updates, and the ability to export data to Excel. The Elite plan increases screener preset limits to 200 (compared to 50 in the free version) and allows users to view up to 100 items per page in screener results. Additionally, financial statement access is extended to eight years of historical data, and correlation analysis tools are included for identifying related securities.

For those hesitant to commit, Finviz offers a 30-day money-back guarantee, giving new Elite subscribers a chance to explore the premium features risk-free.

Feature Comparison: Free vs Elite

Here's a side-by-side look at how the free and Elite versions stack up:

| Feature | Free Account | Elite Account |

|---|---|---|

| Data Timing | 15-20 minute delay | Real-time |

| Intraday Charts | Not available | Full access |

| Advertisements | Present | Ad-free experience |

| Email Alerts | None | Price, Insider, Ratings, News, SEC Filings |

| Screener Presets | Max 50 | Max 200 |

| Items Per Page | 20 table rows | Up to 100 table rows |

| Financial Statements | 3 years | 8 years |

| Data Export | Not available | Excel/API export |

| Backtesting | Not available | Full backtesting suite |

| Portfolio Tracking | 50 portfolios, 50 tickers each | 100 portfolios, 500 tickers each |

| Monthly Cost | Free | $39.50/month ($24.96/month when billed annually) |

Most of Finviz's nearly 20 million monthly users stick with the free version, suggesting that it meets the needs of many traders. However, for those who rely on real-time data and advanced tools to inform active trading strategies, the Elite version offers a significant upgrade. These enhanced features set the stage for effectively leveraging Finviz tools, as discussed in the next section on practical trading strategies.

Finviz Review - Full Feature Review + Use Cases

How Traders Use Finviz

Traders turn to Finviz to uncover opportunities across various market conditions. What makes this platform stand out is its ability to combine different types of filters, allowing users to design screening strategies that fit their trading styles and risk levels.

Technical Analysis Filters

For traders who focus on technical analysis, Finviz offers tools like pattern recognition and momentum indicators to identify potential setups. These features, accessible under the "Technical" tab, allow users to filter for criteria such as "Change from Open" and "Candlestick" patterns. The platform organizes chart patterns into three main categories:

| Pattern Category | Key Patterns | Approach |

|---|---|---|

| Trend Patterns | Trendlines, Channels | Enter positions on breakouts confirmed by strong volume. |

| Reversal Signals | Double Tops/Bottoms, Head & Shoulders | Trade at support or resistance level breaks. |

| Continuation Patterns | Triangles, Wedges | Act on pattern completion with significant volume. |

Momentum traders often rely on tools like moving averages and RSI (Relative Strength Index) to measure the strength of trends. For example, filtering for stocks with an RSI below 30 (indicating oversold conditions) while ensuring the price is above the 20-day moving average can help highlight potential opportunities. A notable backtest revealed that a Price Rate of Change strategy achieved a 1,624% profit over 25 years, equating to an annual return of 12.68%, outperforming the S&P 500's 10.44% annual return.

While technical filters focus on price action, Finviz also provides fundamental filters for evaluating a company's financial health.

Fundamental Analysis Filters

Value investors and long-term traders use Finviz's fundamental filters to find undervalued stocks or growth opportunities. These filters cover key metrics like profitability ratios, debt levels, and growth indicators.

For those seeking undervalued stocks, a common approach is to target companies with P/E ratios under 20 and confirm their technical conditions. Growth strategies might focus on metrics such as EPS growth (over various time periods) and sales growth. As Vincent Nguyen from TradeSearcher puts it:

"By filtering a large list of stocks based on technical and fundamental criteria, the screener shows you potential investment opportunities within seconds."

"By filtering a large list of stocks based on technical and fundamental criteria, the screener shows you potential investment opportunities within seconds."

Other fundamental filters track unusual trading volume, analyst ratings, and insider activity. Market trends also play a role in screening effectiveness. For example, on April 30, 2025, data showed that 67.2% of stocks were advancing, 29.1% were declining, 71.3% hit new highs, and 28.7% reached new lows.

By combining technical and fundamental filters, traders can create strategies tailored to their goals.

Combining Multiple Filters

The true strength of Finviz lies in its ability to combine descriptive, technical, and fundamental filters, enabling traders to build highly customized screening strategies. This layered approach not only saves time but also helps narrow the focus to the most promising opportunities.

For instance, a momentum or short squeeze strategy might include filters for liquidity, oversold conditions, momentum confirmation, short interest levels, and trading activity. These combinations can be saved as presets for future use.

On the other hand, a growth-focused strategy could target stocks with earnings growth above 25% quarterly, sales growth above 20% quarterly, return on equity above 15%, and gross margins exceeding 30%. Technical confirmation might involve ensuring the stock price is above the 50-day moving average, an RSI between 40 and 70, and an average volume above 100,000 shares. Additional refinements could include limiting results to stocks priced between $10 and $100, with a market cap over $1 billion, and focusing on US-based securities.

These custom filter combinations can be saved and paired with alerts to streamline the process further. Regularly updating and fine-tuning these criteria based on market trends and personal trading outcomes is crucial for success. This ability to integrate multiple filters highlights why Finviz is such a versatile tool for traders.

Pros, Cons, and Trading Setup Integration

Finviz, like any trading tool, has its strengths and weaknesses. Understanding these can help traders decide whether it fits their needs and trading style.

Pros and Cons

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Finviz stands out as a powerful stock screener that's easy to use, making it a favorite among traders. It simplifies complex market data into visuals that are easy to understand and act on.

| Pros | Cons |

|---|---|

| Free access - Most features are available without registration | Limited educational resources - Few learning materials included |

| Visual data presentation - Combines market news, charts, and financial data into clear visuals | Data overload - The sheer amount of information can overwhelm new users |

| Professional user base - Trusted by professionals from HSBC, UBS, and Bank of America | Free version ads - Includes ads and delayed market data |

| Real-time features - The Elite version provides real-time data, interactive charts, and historical backtesting | Basic charting tools - Charting options are functional but not top-tier |

| User-friendly interface - Easy to navigate once you get the hang of it | Limited fundamental data - Fewer metrics compared to specialized screeners |

| Extensive coverage - Tracks 1,256 global stocks with diverse filtering options | No mobile app - Can only be accessed on desktop |

The platform's 3.8 TrustScore on Trustpilot, based on 16 user reviews, highlights generally positive experiences. However, the $39.50 monthly fee for Finviz Elite ($299.50 annually) might feel steep for individual traders. For active traders who rely on real-time data, though, the paid version is often a must.

Using Finviz with QuantVPS

Finviz offers robust features on its own, but pairing it with QuantVPS can significantly enhance trading performance. This combination addresses Finviz's limitations while boosting its strengths, creating a seamless research-to-trade workflow.

Running Finviz on QuantVPS ensures ultra-low latency (0-1ms), which means your orders hit the market faster than traditional setups. As QuantVPS explains:

"Ultra-low latency connectivity assures that the orders reach the market center before anyone else, and you can execute trades way ahead of anyone else."

"Ultra-low latency connectivity assures that the orders reach the market center before anyone else, and you can execute trades way ahead of anyone else."

For example, a Forex trader saw a 30% improvement in execution speed after switching to QuantVPS, while a cryptocurrency trader reported a 40% rise in profits over three months by using the platform for backtesting.

Reliability is another critical benefit. QuantVPS offers a 100% uptime guarantee, along with DDoS protection and automatic backups. Its multi-platform integration supports popular trading tools like NinjaTrader, MetaTrader, and TradeStation, alongside web-based platforms like Finviz. Plus, its global accessibility allows traders to manage their setup from anywhere with an internet connection.

QuantVPS also optimizes resource allocation, ensuring smooth performance when running multiple applications. Plans range from the VPS Lite ($59/month for 4 cores and 8GB RAM) to the Dedicated Server ($299/month for 16+ cores and 128GB RAM), allowing traders to scale based on their needs.

For those using algorithmic trading, this setup is particularly effective. Finviz helps identify trading opportunities, while QuantVPS enables automated bots to execute strategies 24/7. Even if you're offline, these bots keep your strategies running.

The platform also includes performance monitoring, making it easier to track both your screening and execution efficiency. This allows for regular adjustments to Finviz filters and QuantVPS settings to fine-tune your strategy over time.

Conclusion

Finviz has earned a reputation as one of the top stock screeners available, thanks to its combination of visually appealing data presentation and robust filtering tools. The platform simplifies complex market data, turning it into actionable insights through an easy-to-navigate interface and a wide range of screening options. While the free version offers plenty of features, traders seeking real-time data and advanced tools will find the Elite subscription especially useful.

With millions of monthly users, including professionals from leading financial institutions, Finviz has proven its reliability and effectiveness in catering to a wide variety of trading needs. Its popularity underscores the platform's ability to deliver valuable insights for both novice and experienced traders.

For those aiming to take their trading to the next level, pairing Finviz with QuantVPS can create a seamless research-to-execution workflow. Finviz shines in identifying trading opportunities through its advanced screening features, while QuantVPS addresses execution challenges with ultra-low latency and dependable uptime. Together, they form a well-rounded solution for traders looking to optimize their strategies.

Whether you're diving into fundamental analysis, exploring technical screening, or building algorithmic trading strategies, Finviz equips traders with the tools and clarity needed to make confident decisions in today’s fast-paced markets.

FAQs

What are the main differences between the free and Elite versions of Finviz, and who should consider upgrading?

The free version of Finviz is a solid choice for beginners or casual traders. It includes essential features like delayed data (up to 20 minutes), straightforward charts, and lacks portfolio tracking - perfect for those just starting out or trading occasionally.

On the other hand, the Elite version caters to more active traders and investors. It offers real-time data, advanced charting tools, backtesting options, and access to pre-market and after-hours trading data, making it ideal for those who need detailed and timely market insights.

For anyone who depends on real-time updates or requires advanced tools for deeper market analysis, the Elite version can take your trading to the next level.

How does Finviz's chart pattern recognition help technical analysts, and what are its key benefits?

Finviz's chart pattern recognition feature is designed to automatically detect well-known patterns such as wedges, double tops, and head and shoulders on daily charts. This makes it a handy tool for technical analysts aiming to identify trading opportunities without the hassle of manual analysis.

By automating this process, it not only saves time but also reduces the chances of human error. Plus, it delivers insights that traders can act on, making stock research faster and more focused. It's particularly useful for those who want to zero in on promising trades with greater efficiency.

How can using Finviz with QuantVPS improve trading performance and execution speed?

Combining Finviz with QuantVPS can take your trading game to the next level by speeding up data processing and cutting down on latency. This means trades can be executed faster and more efficiently, giving you an edge when acting on market opportunities uncovered through Finviz's stock screening tools.

On top of that, QuantVPS supports the automation of trading strategies based on Finviz scans. This integration lets traders make quicker, data-driven decisions without the usual delays. By streamlining workflows and boosting efficiency, this pairing becomes a game-changer for both active traders and long-term investors looking to enhance their performance.

The free version of Finviz is a solid choice for beginners or casual traders. It includes essential features like delayed data (up to 20 minutes), straightforward charts, and lacks portfolio tracking - perfect for those just starting out or trading occasionally.

On the other hand, the Elite version caters to more active traders and investors. It offers real-time data, advanced charting tools, backtesting options, and access to pre-market and after-hours trading data, making it ideal for those who need detailed and timely market insights.

For anyone who depends on real-time updates or requires advanced tools for deeper market analysis, the Elite version can take your trading to the next level.

Finviz's chart pattern recognition feature is designed to automatically detect well-known patterns such as wedges, double tops, and head and shoulders on daily charts. This makes it a handy tool for technical analysts aiming to identify trading opportunities without the hassle of manual analysis.

By automating this process, it not only saves time but also reduces the chances of human error. Plus, it delivers insights that traders can act on, making stock research faster and more focused. It's particularly useful for those who want to zero in on promising trades with greater efficiency.

Combining Finviz with QuantVPS can take your trading game to the next level by speeding up data processing and cutting down on latency. This means trades can be executed faster and more efficiently, giving you an edge when acting on market opportunities uncovered through Finviz's stock screening tools.

On top of that, QuantVPS supports the automation of trading strategies based on Finviz scans. This integration lets traders make quicker, data-driven decisions without the usual delays. By streamlining workflows and boosting efficiency, this pairing becomes a game-changer for both active traders and long-term investors looking to enhance their performance.

"}}]}