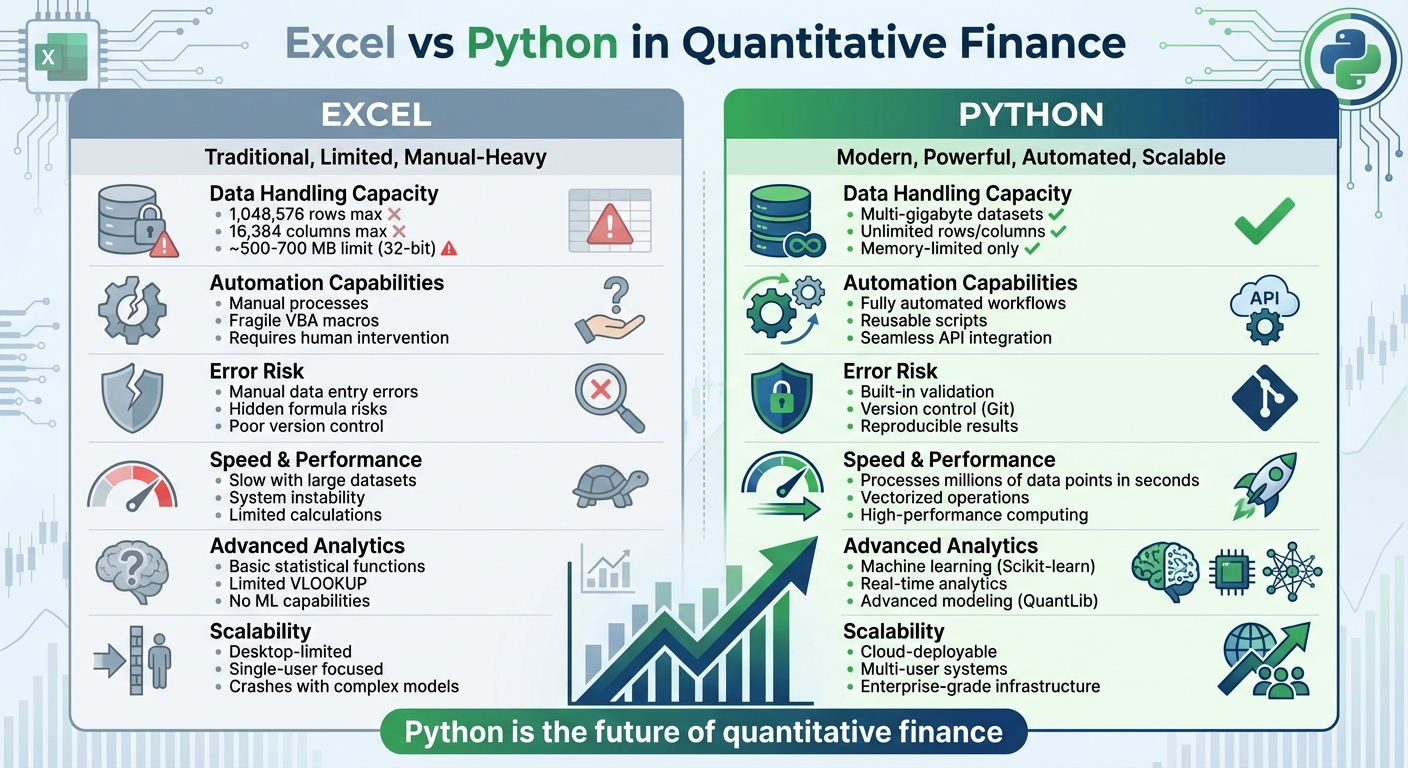

Python is replacing Excel as the go-to tool for quantitative finance. Why? Excel struggles with large datasets, automation, and modern demands like machine learning. Python, on the other hand, handles massive data, integrates with APIs, and automates workflows efficiently. With libraries like Pandas, NumPy, and Scikit-learn, Python offers unmatched flexibility for tasks like portfolio optimization, risk analysis, and backtesting.

Key reasons for Python’s rise:

- Data Handling: Excel has a row limit (1,048,576), while Python processes multi-gigabyte datasets effortlessly.

- Automation: Python scripts eliminate repetitive tasks, unlike Excel’s manual processes and fragile VBA macros.

- Error Reduction: Python ensures reliability with built-in version control and robust data validation tools.

- Scalability: Python supports advanced trading systems, machine learning, and real-time analytics.

Firms are transitioning gradually, using tools like Pandas for data management, Matplotlib for reporting, and QuantLib for financial modeling. Infrastructure upgrades, such as using cloud servers like QuantVPS, further enhance Python’s performance for trading and analytics.

Excel’s limitations are clear: it’s slow, error-prone, and unsuitable for modern finance. Python is the future, offering speed, accuracy, and scalability for today’s fast-paced markets.

Excel vs Python for Quantitative Finance: Feature Comparison

Excel vs Python for Quantitative Finance: Feature Comparison

Excel‘s Limitations in Quantitative Finance

Technical Limits of Excel

Excel has a hard ceiling when it comes to handling large datasets, with a maximum of 1,048,576 rows and 16,384 columns. For professionals in quantitative finance, this can be a significant hurdle. Tasks like analyzing tick-by-tick market data or processing years of historical trades often involve multi-gigabyte datasets, which Excel simply can’t manage. The 32-bit version of Excel compounds the issue, limiting the data model to around 500–700 MB within a 2 GB virtual address space.

These aren’t the only constraints. Excel also caps the number of open workbooks, PivotTable reports, and worksheet arrays you can use at one time. Even common functions like VLOOKUP have their limitations – they can only return values from a single column and struggle with complex conditions. For intricate tasks like portfolio optimization or Monte Carlo simulations requiring millions of iterations, these technical restrictions make Excel far less practical. As a result, users often face higher error rates and even system instability.

Error Risks and Reliability Issues

One of Excel’s biggest weaknesses lies in its reliance on manual data entry and hidden formulas. A single typo, misclassified value, or deleted cell can ripple through an entire financial model, often without being noticed right away. The problem worsens when spreadsheets are linked across multiple files. If a file name changes or a file is moved, dependencies can break, disrupting the entire model.

Another challenge is the lack of robust version control. When multiple team members work on the same spreadsheet, tracking changes or verifying results becomes a daunting task. These reliability issues, paired with Excel’s limited automation capabilities, can slow down workflows and increase the risk of costly errors.

Automation and Integration Shortcomings

Although Excel includes VBA macros for automation, they fall short of meeting the needs of modern quantitative workflows. Connecting Excel to APIs, databases, or real-time trading systems often requires manual intervention or hard-coded solutions. These approaches are fragile and prone to failure whenever data formats or structures change.

This lack of seamless integration makes it difficult to build fully automated workflows. As a result, analysts often spend excessive time on repetitive tasks instead of focusing on high-value activities like strategic analysis or generating alpha. This inefficiency underscores Excel’s limitations in keeping up with the demands of contemporary quantitative finance.

Python‘s Advantages for Quantitative Finance

Python’s Core Strengths for Quant Analysis

When it comes to modern quantitative finance, Python outshines Excel in handling large-scale data and complex operations. Excel struggles with datasets exceeding a million rows, but Python can seamlessly process multi-gigabyte files, making it a perfect choice for tasks like tick data analysis and historical backtesting.

Python’s numerical libraries are the backbone of fast and scalable quant analysis. NumPy supports high-performance mathematical operations on multi-dimensional arrays and matrices, enabling lightning-fast calculations for quantitative strategies. Building on this, Pandas introduces DataFrames and Series, which simplify time-series analysis tasks like resampling, rolling-window calculations, and complex data aggregations – tasks that Excel formulas handle less efficiently. To further extend these capabilities, SciPy offers advanced optimization algorithms and statistical tools that are essential for portfolio optimization and risk management.

Python also shines in automation. By using reusable scripts, analysts can automate entire workflows, eliminating the manual, error-prone steps often associated with Excel. This automation not only saves time but allows analysts to focus on generating actionable insights. These strengths make Python a versatile tool for a wide range of quantitative finance applications.

Typical Quant Finance Applications for Python

Python is a staple in nearly every quantitative workflow on Wall Street. For instance, portfolio optimization benefits from SciPy’s algorithms, enabling the construction of portfolios tailored to specific risk-return profiles. Similarly, backtesting engines built with Pandas can efficiently process years of historical data to validate trading strategies. Risk analytics systems leverage NumPy’s vectorized operations to quickly calculate metrics like Value at Risk (VaR), stress tests, and exposure measures.

Python has also become the top choice for machine learning in alpha generation. Libraries like Scikit-learn allow quants to develop predictive models that extract trading signals from alternative data sources – something far beyond Excel’s capabilities. Additionally, Python’s ability to integrate with real-time data feeds, databases, and trading APIs makes it possible to create fully automated systems that execute strategies without human intervention.

Benefits of Python’s Open-Source Community

Python’s open-source nature adds another layer of value for quants. Its active community of developers and financial professionals continuously enhances libraries like NumPy, Pandas, and SciPy, ensuring they evolve to meet the demands of modern markets.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

This collaborative ecosystem means that bugs are fixed quickly, and new features are introduced regularly. Platforms like GitHub and Stack Overflow enable thousands of quants to share code, strategies, and solutions. Whether it’s options pricing, high-frequency trading, or other specialized tasks, the availability of tailored libraries accelerates development and reduces the need to build tools from the ground up.

Finally, Python’s open-source framework gives quants complete control over their infrastructure, free from licensing fees or vendor restrictions. This flexibility is a game-changer for firms looking to customize their tools without incurring additional costs.

Converting Excel Workflows to Python

Data Management and Reporting in Python

Switching from Excel to a Pandas-driven workflow completely changes how quantitative analysts handle data. Instead of relying on manual copying and pasting between spreadsheets, Python automates tasks like data extraction, validation, and reporting. With Pandas DataFrames, you can load, clean, and merge complex time-series data from various sources – whether it’s databases, APIs, or even Excel files – quickly and efficiently.

When it comes to processing large datasets, tools like NumPy and Pandas can handle millions of data points and perform complex statistical calculations in just seconds. On top of that, Python’s built-in logging and version control make auditing analytical processes much easier, which is especially useful for meeting regulatory requirements.

For reporting, Python offers libraries like Matplotlib and Plotly, which can create interactive and visually appealing charts that go far beyond what Excel can produce. As CodeBun puts it:

If you’re doing anything with financial time series, you’ll live inside

pandas.

If you’re doing anything with financial time series, you’ll live inside pandas.

This streamlined approach also benefits portfolio analytics, where Python outshines traditional spreadsheet methods.

Portfolio Analytics and Risk Models in Python

Python’s ability to handle large-scale data and complex calculations makes it ideal for portfolio analytics and risk modeling. With vectorized operations, Python can easily manage extensive portfolios and run simulations. For instance, Monte Carlo simulations and Value at Risk calculations powered by NumPy are significantly faster than their Excel counterparts. When it comes to advanced tasks like derivatives pricing or portfolio optimization, Python’s QuantLib library provides tools that are on par with institutional-grade systems.

Goldman Sachs has even introduced GS-Quant, a Python library adapted from their own internal quant framework. It offers tools for analyzing risk, managing derivatives, and working with time-series data across various markets. This type of infrastructure simply doesn’t exist in Excel. Moreover, Python’s ability to connect with real-time data feeds and trading APIs ensures that risk models stay updated automatically throughout the trading day – no manual refreshes required. These features make transitioning from Excel to Python a smoother and more efficient process.

Python’s capabilities don’t stop at analytics and risk management; it also transforms how trading strategies are tested and refined.

Backtesting and Strategy Research in Python

Python takes strategy research to the next level by automating and refining processes that Excel handles manually. Libraries like Zipline, PyAlgoTrade, and QSTrader provide event-driven backtesting engines that simulate real-world trading scenarios. These tools can process years of historical data while factoring in fees, slippage, and portfolio-level risk management – areas where Excel often falls short.

For technical analysis, Python’s TA-Lib supports over 150 indicators, including RSI, MACD, and Bollinger Bands, which can be used for both backtesting and live trading analysis. Python scripts simplify the entire workflow, allowing users to test multiple strategies, tweak parameters, and automatically produce performance reports. This level of automation not only saves time but also reduces the risk of errors common in Excel-based updates.

Infrastructure Requirements for Python Trading Systems

Why Desktop Machines Aren’t Enough

While Python is an excellent tool for developing trading systems, the infrastructure supporting it is just as important. Relying on desktop computers introduces serious risks. A power outage, internet disruption, or system crash can instantly halt your trading strategies. And in fast-moving markets, even a few seconds of downtime can lead to missed opportunities or unexpected losses.

Desktop machines also fall short when it comes to handling the heavy computational loads of modern quantitative workflows. Tasks like backtesting years of high-frequency data, running Monte Carlo simulations with millions of iterations, or training machine learning models demand multi-core processors and large amounts of memory – resources that desktops simply can’t provide. Additionally, advanced trading systems require automation and robust scripting capabilities, such as managing data pipelines, connecting to brokers, and implementing continuous integration workflows. For these reasons, Ubuntu/Linux server environments have become the go-to choice for Python quants. They offer powerful command-line tools and seamless compatibility with cutting-edge libraries like TensorFlow and PyTorch. Clearly, robust server environments are a must for anyone serious about Python-based quantitative trading.

Running Python Quant Workflows on QuantVPS

To address these challenges, platforms like QuantVPS provide the infrastructure needed to support modern Python trading systems. QuantVPS offers server-grade resources designed specifically for quant workflows, with plans that scale to suit various needs. For instance, their entry-level plan starts at $59.99/month and includes 4 cores and 8GB of RAM, while their top-tier VPS Ultra plan ($189.99/month) offers 24 cores, 64GB of RAM, and 500GB of NVMe storage – ideal for processing massive datasets and running complex models.

For institutional-level demands, the Dedicated Server option ($299.99/month) steps it up with 16+ dedicated cores, 128GB of RAM, and unparalleled capabilities for tasks like parallel strategy optimization and real-time risk calculations. Every plan includes unmetered bandwidth on 1Gbps+ networks, ensuring your Python scripts can fetch market data and execute trades without any network throttling.

QuantVPS Features for Python Quants

QuantVPS is built with Python quants in mind, offering ultra-low latency (0-1ms) for near-instant market data updates and trade execution. The platform guarantees 100% uptime, eliminating the reliability concerns that make desktop setups impractical for serious trading operations.

Key features include NVMe storage for lightning-fast data access, DDoS protection to keep your trading systems secure, and full root access so you can install any Python libraries or dependencies – whether it’s NumPy, Pandas, QuantLib, or TA-Lib. Automatic backups ensure your data and code are safe, while system monitoring tools notify you of any potential performance issues before they can disrupt your strategies. These capabilities provide the stability and scalability required for successful Python-based quantitative trading, allowing you to focus on developing and refining your strategies without worrying about infrastructure limitations.

Quant Finance with Python and Pandas | 50 Concepts you NEED to Know in 9 Minutes | [Getting Started]

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

How to Transition from Excel to Python

Switching from Excel to Python can unlock a world of efficiency and scalability for quant workflows. Here’s how to make the shift effectively.

Learning Python for Quant Finance

Start by getting a solid grip on Python basics – things like modules, variables, lists, dictionaries, and functions. Once you’re comfortable, dive into financial libraries that can handle tasks Excel might struggle with. Two key libraries to focus on are NumPy and Pandas. NumPy is great for fast mathematical operations, while Pandas excels at data manipulation, offering tools that mimic and often surpass Excel’s functionality. Fun fact: Pandas was created by Wes McKinney at AQR Capital to tackle data analysis challenges Excel couldn’t handle effectively.

To translate your Excel skills into Python, master Pandas operations such as groupby, pivot_table, merge, and concatenate. These will help you clean, wrangle, and manipulate data efficiently. For those in quant finance, adding TA-Lib to your toolkit is a wise move – it’s packed with technical indicators essential for financial analysis.

Gradual Migration Approach

Transitioning to Python doesn’t mean dumping Excel overnight. Instead, take a gradual approach by identifying Excel’s weak spots – like sluggish performance with large datasets or repetitive manual tasks. Start small. For instance, automate tedious processes such as data validation across multiple sheets, generating workbooks programmatically, or pulling data from external sources.

To make the shift smoother, consider tools like xlwings, openpyxl, or Mito. These libraries let you integrate Python functions directly into Excel, combining Python’s power with the familiarity of spreadsheets. This step-by-step transition allows you to refine your workflows without the hassle of rewriting complex VBA setups entirely.

Setting Up Your Python Quant Environment

A solid Python environment is key to a successful transition. Begin by installing MiniConda, which simplifies library management and includes MKL optimization for better performance. Keep things organized by isolating project dependencies in separate Conda environments – this keeps your base setup clean and manageable.

Install essential packages like Pandas, xlsxwriter, xlrd, and JupyterLab using either conda or pip. JupyterLab is particularly handy for exploring datasets and testing strategies interactively. For better organization, establish a consistent project structure with folders for raw data, processed data, and reports. Tools like Cookiecutter can automate this setup for you.

Don’t forget version control. Using Git to track changes in your code ensures reproducibility and avoids the pitfalls of Excel’s VBA. Once your environment is ready, consider deploying it on platforms like QuantVPS for reliable and scalable trading operations. This setup not only enhances performance but also sets the stage for more advanced Python-based workflows.

Conclusion: Python’s Role in the Future of Quant Finance

Python has become the universal language of quantitative trading, empowering traders and analysts with the tools needed to execute advanced strategies in today’s fast-paced markets. Compared to Excel, Python offers clear advantages: it can handle massive datasets with ease, automate repetitive tasks seamlessly, and integrate effortlessly with external data sources and databases. While Excel has been a staple in finance for decades, Python’s vast library ecosystem provides the adaptability required for cutting-edge analytics, machine learning, and AI applications that the modern financial landscape demands.

In an industry driven by data and speed, adopting Python is no longer optional – it’s a necessity. Saeed Amen, Founder of Cuemacro, emphasizes the importance of efficiency in quantitative finance:

Speed is important in quantitative finance, whether it’s in generating a price, creating a risk report, fitting a model etc. Indeed, speed is one of the reasons why the many pricing libraries are written in C++ within banks. If it takes you a week to come up with a risk report, it’s not going to be that useful for a trading desk, and equally making traders wait a massive amount of time for a pricing model to compute, likely means lost business.

Speed is important in quantitative finance, whether it’s in generating a price, creating a risk report, fitting a model etc. Indeed, speed is one of the reasons why the many pricing libraries are written in C++ within banks. If it takes you a week to come up with a risk report, it’s not going to be that useful for a trading desk, and equally making traders wait a massive amount of time for a pricing model to compute, likely means lost business.

For those ready to make the leap, the transition to Python begins with a solid foundation. Start by learning the basics of Python and its essential libraries, such as NumPy, Pandas, and SciPy. Put these skills into action by tackling practical projects – automate routine reports, build a portfolio model from scratch, or backtest a straightforward trading strategy. As you grow more confident, consider deploying your workflows on platforms like QuantVPS, which ensure the speed and reliability needed for serious trading operations.

Embracing Python opens the door to thriving in today’s evolving financial markets. While the shift from legacy tools might seem challenging at first, a step-by-step approach combined with the right infrastructure will quickly highlight Python’s immense value in modern quantitative finance. This transition marks a pivotal step toward building future-ready solutions in an increasingly complex industry.

FAQs

Why is Python a better choice than Excel for analyzing large datasets in finance?

Python is built to manage large datasets with ease, making it a go-to choice for modern financial analysis. While tools like Excel can hit performance bottlenecks and struggle with data size limitations, Python handles millions of rows effortlessly without compromising speed.

What sets Python apart are its powerful libraries, such as Pandas and NumPy, which simplify data manipulation and analysis. Beyond that, Python shines in automating repetitive tasks and integrating seamlessly with other tools, offering a flexible and scalable solution for quantitative finance workflows.

How does Python help automate tasks and reduce errors in quantitative finance?

Python makes automation in quantitative finance straightforward by taking care of repetitive tasks like data collection, processing, and analysis. This not only cuts down on the time spent but also minimizes the chances of human error, offering professionals more accuracy and efficiency.

Thanks to robust libraries like Pandas and NumPy, Python excels at handling complex calculations and manipulating large datasets with ease. Its scripting abilities also make it easy to connect with APIs and databases, ensuring workflows are smoother and less reliant on manual input. By leveraging Python, finance teams can shift their focus from tedious manual tasks to making impactful, strategic decisions.

What kind of infrastructure is needed to run Python-based trading systems?

To successfully run Python-based trading systems, you’ll need a solid infrastructure that prioritizes speed, dependability, and the ability to grow with your needs. At the core, this means having a powerful computer or server equipped with multi-core CPUs, at least 16GB of RAM to manage demanding setups, and fast storage like SSDs for handling large datasets and intensive calculations.

A stable, low-latency internet connection is equally crucial for real-time data processing and executing trades without delays. If your system requires more advanced capabilities – like high-frequency trading or extensive backtesting – you might want to explore cloud-based platforms or dedicated servers that allow for flexible resource scaling. Lastly, don’t overlook security: implement firewalls, encryption, and other safeguards to protect your trading algorithms and sensitive information.